Professional Documents

Culture Documents

Borrower Qualification

Uploaded by

Trung NguyenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Borrower Qualification

Uploaded by

Trung NguyenCopyright:

Available Formats

Chapter

Borrower Qualification

Key Words and Phrases

Residential loan

Equal Credit Opportunity Act (ECOA)

Loan application

Credit scoring

Production-related income

Assured income

Liabilities

Assets

Willingness to pay

Credit report

Fair Credit Reporting Act

Fair and Accurate Credit Transactions Act

Privacy Act

Percentage guideline method

Effective income

Housing expense

Residual method (VA)

FHA new minimum credit

Cost-of-living expenses (VA)

Income ratio method (VA)

Affordable Housing Programs Conforming

loan

Private mortgage insurance (PMI)

LE ARNING OBJECTIVES

At the conclusion of this chapter, students will be able to:

Understand the difference between a Veterans Administration mortgage

loan and the primary FHA mortgage loan programs

Describe how the components of an FHA loan must be compiled, including

how their unique features of Mortgage Insurance function as part of closing

costs and continuing mortgagor obligations

Understand the development of private mortgage insurance products and

their current features

Describe how a home equity revolving line of credit mortgage works

Explain the function and costs of a reverse annuity mortgage

181

89075_ch09_ptg01_181-214.indd 181

12/12/11 5:08 PM

182 Chapter 9 Borrower Qualification

Introduction

For the purpose of analysis, mortgage loans may be divided into two categories:

those made to individuals and families to buy homes and those made to individuals

and companies to acquire commercial properties. Because the basic source of loan

repayment is not the same, the analysis differs in emphasis. For a home loan, the

analysis focuses first on the applicants income. It is the buyers personal income,

essentially income unrelated to the property itself, that will be used to repay the

loan. For a commercial property loan, the lender normally expects repayment from

income produced by the property, and that source takes priority in the analysis.

This chapter examines, first, the individual as borrower for the purpose of

buying a home. Residential loans comprise over two-thirds of the mortgage loan

market and may be classed in four major categories: (1) insured by a government

agency such as HUD/FHA, (2) having some complete or limited governmentagency guaranty from an entity such as VA or RHS, (3) conventional/conforming,

and (4) other conventional. (A conventional loan is one without government underwriting.) Of the four, both HUD/FHA and VA or RHS offer fairly clear standards

and guidelines for the industry and the consumer.

The third category, conventional/conforming, covers loans made with the

expectation of selling them to either Fannie Mae or Freddie Mac. Both of these

secondary-market purchasers have developed uniform documents and some common

limitations (but not always the same standards) on the loans they can accept.

The fourth category, other conventional, offers few uniform procedures with

many minor variations and includes those residential loans characterized as Alternate

A and subprime. The latter classifications of subprime and Alternate A are a recent

variation of a conventional loan originally designed to better fit the needs of lowerincome families and will be explained later under the umbrella term of affordable

housing loan. In sum, the field of loan qualification does not offer standards used by

everyone. (Some of the variations appear in Table 9-1 later in this chapter.)

We will examine the similarities and the differences between the four major categories of borrower qualification in this chapter. Examples are given for

Major Factors Driving Credit Scores

Recent

Credit

Use

10%

Types of

Credit

Used

10%

Amounts Owed

30%

Length of Credit

History

15%

Payment History

35%

Source: 2013 Cengage Learning

89075_ch09_ptg01_181-214.indd 182

12/12/11 5:08 PM

You might also like

- Study III PDFDocument1 pageStudy III PDFTrung NguyenNo ratings yet

- Chords and GrooveDocument1 pageChords and GrooveTrung NguyenNo ratings yet

- Study IIIDocument1 pageStudy IIITrung NguyenNo ratings yet

- Central and Eastern Europe, Middle East, and Africa Government Bond Index (CEEMEAGBI)Document1 pageCentral and Eastern Europe, Middle East, and Africa Government Bond Index (CEEMEAGBI)Trung NguyenNo ratings yet

- EMUSDDocument2 pagesEMUSDTrung NguyenNo ratings yet

- Euro BigDocument2 pagesEuro BigTrung NguyenNo ratings yet

- Emerging Markets Government Bond Index (EMGBI) : Sovereign - Multi-CurrencyDocument1 pageEmerging Markets Government Bond Index (EMGBI) : Sovereign - Multi-CurrencyTrung NguyenNo ratings yet

- Song For A Stormy NightDocument2 pagesSong For A Stormy NightTrung Nguyen100% (2)

- CR 09110Document68 pagesCR 09110decoandersonNo ratings yet

- Overview of Citi Fixed Income Indices: Total Rate of Return Calculation MethodologyDocument1 pageOverview of Citi Fixed Income Indices: Total Rate of Return Calculation MethodologyTrung NguyenNo ratings yet

- Just Give Me A Reason: P!NK Ft. Nate RuessDocument2 pagesJust Give Me A Reason: P!NK Ft. Nate RuessTrung Nguyen100% (1)

- Song For A Stormy NightDocument2 pagesSong For A Stormy NightTrung Nguyen100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

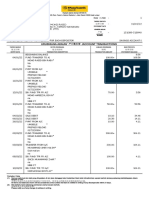

- Wells Fargo Everyday CheckingDocument4 pagesWells Fargo Everyday CheckingSteven LeeNo ratings yet

- g435 Wireless Gaming Headset QSGDocument264 pagesg435 Wireless Gaming Headset QSGElias Sevilla AndujarNo ratings yet

- The Basics of The Foreign Exchange MarketDocument70 pagesThe Basics of The Foreign Exchange MarketSunny MahirchandaniNo ratings yet

- Improve Wimax Performance Using Directional Antennas and Resource Management AlgorithmsDocument14 pagesImprove Wimax Performance Using Directional Antennas and Resource Management Algorithmsabas abdallhaNo ratings yet

- Eie 418 Lecture Notes Interfacing: Interfaces For Simple Computer System and Terminal To TerminalDocument16 pagesEie 418 Lecture Notes Interfacing: Interfaces For Simple Computer System and Terminal To TerminalJames JamessNo ratings yet

- Wildan Kandidat Master DiegoCV FIXDocument1 pageWildan Kandidat Master DiegoCV FIXalberioNo ratings yet

- Findings, Suggestions AND ConclusionDocument16 pagesFindings, Suggestions AND ConclusionPraveen NayakNo ratings yet

- EK-Qatar Current Account: A/C No:19000Document4 pagesEK-Qatar Current Account: A/C No:19000Rashmin MuhammadNo ratings yet

- Frequently Asked Questions About MicrofinanceDocument3 pagesFrequently Asked Questions About MicrofinanceJayakrishnan S KaniyaparambilNo ratings yet

- d2c BrandsDocument20 pagesd2c Brandsch7utiyapa9No ratings yet

- Cash Handling IcqDocument5 pagesCash Handling IcqpalaviyaNo ratings yet

- Benchmarking Matrix: Martha Liliana Muñoz PiambaDocument4 pagesBenchmarking Matrix: Martha Liliana Muñoz PiambaRouss BarreraNo ratings yet

- India Tours - India Tour Packages: HolidayDocument13 pagesIndia Tours - India Tour Packages: HolidayIndia TourismNo ratings yet

- Arin Bank Statement-6 MonthsDocument9 pagesArin Bank Statement-6 MonthsAmit AgarwalNo ratings yet

- Ibs Tangkak 1 31/03/22Document2 pagesIbs Tangkak 1 31/03/22NABIL HAKIMNo ratings yet

- Governmental Accounting-Ch03-ExampleProblemsDocument18 pagesGovernmental Accounting-Ch03-ExampleProblemshala elgedNo ratings yet

- Supply Chain Management For Retailing by Rajesh RayDocument444 pagesSupply Chain Management For Retailing by Rajesh RaySanJana NahataNo ratings yet

- 26-d. Utility Expenses, TelephoneCommunication Services & Advertising Expenses-Jv EstrellaDocument80 pages26-d. Utility Expenses, TelephoneCommunication Services & Advertising Expenses-Jv Estrellajohn vincent estrellaNo ratings yet

- Road Safety Awareness ProgrammeDocument13 pagesRoad Safety Awareness ProgrammeHerradlinNo ratings yet

- Global Bikes IncDocument8 pagesGlobal Bikes Incjai kunwarNo ratings yet

- Zimbabwe Report FNL2012Document56 pagesZimbabwe Report FNL2012Kristi DuranNo ratings yet

- Presentation On Marketing ResearchDocument17 pagesPresentation On Marketing ResearchppoooopopopooopopNo ratings yet

- Axis Bank: Type Industry Founded Headquarters Key PeopleDocument5 pagesAxis Bank: Type Industry Founded Headquarters Key PeopleAlpesh PatelNo ratings yet

- Your August 2022 Bill: $102.30 $84.40 Summary of Current ChargesDocument3 pagesYour August 2022 Bill: $102.30 $84.40 Summary of Current ChargesMarissa RempilloNo ratings yet

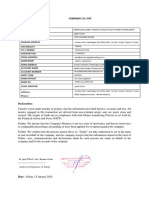

- CIS-KYC-Only-Sierra-Group - PDF 10012024Document2 pagesCIS-KYC-Only-Sierra-Group - PDF 10012024Filipe Emanuel MangueNo ratings yet

- MTCS 202 WMN QBDocument52 pagesMTCS 202 WMN QBArun SharmaNo ratings yet

- Capitec Fees 2023Document4 pagesCapitec Fees 2023bok kopNo ratings yet

- A Guide To The Loan MarketDocument55 pagesA Guide To The Loan MarketAinudeenNo ratings yet

- Purchase Receipt: Canadian Visa ExpertDocument1 pagePurchase Receipt: Canadian Visa Experteddie1011No ratings yet

- Ijeera AcceptedDocument2 pagesIjeera AcceptedRONINo ratings yet