Professional Documents

Culture Documents

WSO Resume Nov3

Uploaded by

John MathiasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WSO Resume Nov3

Uploaded by

John MathiasCopyright:

Available Formats

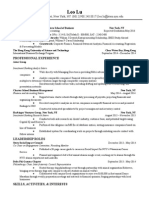

Name

email phone #

linkedin

EDUCATION

Top 50 Non-Target

Bachelor of Arts in Financial Economics, Minor in Computer Science

UK University

Study Abroad Student

City, ST

Anticipated May 2015

London, UK

September 2013 December 2013

GPA: 3.2 / 4.0

Relevant Coursework: Microeconomics, Macroeconomics, Econometrics, Calculus I II & III, Statistics, Behavioral

Economics, International Economics, Financial Accounting

- Financial Management (covered DCF analysis, CAPM, WACC, IRR, Dividend Discount Model, Bond Valuation)

th

SAT Critical Reading & Mathematics: 1420 / 1600 (97 Percentile)

FINANCE EXPERIENCE

Large PE Firm

Fall Intern

London, UK

September 2013 December 2013

FIRM is a private equity firm focused on growth, buy-out, and distressed investments within the global financial

services industry

Case Study Project:

- Drafted 24 case studies of FIRMs investments, from 1994 to present

- Incorporated relevant transaction details from term sheets, equity research, management / internal presentations,

financial statements, and specific information from Bloomberg when necessary

- Assisted with editing FIRMs investor information deck, where select case studies were featured

Learning fundamentals of bank and insurance company valuation / acquisition strategy through industry research

reports, FIRM training materials, and case study work. Internship is ongoing.

Technology Venture Accelerator

Summer Associate

City, ST

May 2013 August 2013

StartFast is a venture capital accelerator program focused on seed stage investment in start-up technology companies

InternetStartup.com:

- Worked directly with the CEO and COO of attending company InternetStartup.com

- Developed customer conversion metrics, return on advertising, and gross profit estimates

- Used findings to create a projected income statement for InternetStartup through FY 2014

- Drafted classified ads targeting over 100 cities, resulting in $3,295 of revenue

- Created a pitch deck for InternetStartup highlighting the companys value proposition, target market, and growth

assumptions. The deck was presented to over 200 individual / institutional investors

University Investment Fund, LLC

Analyst, Financial Institutions and Commodities Group

City, ST

April 2012 Present

University Investment Fund is a student-run investment fund supported by the University

Joined the Financial Institutions and Commodities Group to build off of internship experience at FIRM

Attend bi-weekly meetings covering macro and sector specific information affecting the groups holdings

Researching Nelnet Inc.(a student loan provider and tuition processer) as a possible investment due to:

- Strong 5 year EPS growth, attractive P/E and P/B ratios compared to its peers

- Diverse client base of state / federal agencies, public / private universities, and individuals

TRAINING/SKILLS, ACTIVITIES & INTERESTS

Training/Skills:

Financial Modeling learning fundamentals of applied DCF and comparable analysis through a self-study program

Bloomberg completed 2 hour training session at UK Business School

Python proficient with syntax, Boolean loops, and object-orientated-programming

Activities: Undergraduate Finance and Economics Council, Student DJ, Dodgeball Club

Interests: Guitar, Ping Pong, International Travel, Aviation Simulation

You might also like

- WSO Resume 119861Document1 pageWSO Resume 119861John MathiasNo ratings yet

- WSO Resume 24Document1 pageWSO Resume 24John MathiasNo ratings yet

- WSO ResumeDocument1 pageWSO ResumeJohn MathiasNo ratings yet

- PDP ResumeDocument1 pagePDP Resumeapi-349990269No ratings yet

- Lu Leo ResumeDocument2 pagesLu Leo ResumeLeo LuNo ratings yet

- Yan Zhichao John CVDocument1 pageYan Zhichao John CVJohn MathiasNo ratings yet

- Finance and Math Student Seeking Analyst RoleDocument1 pageFinance and Math Student Seeking Analyst RoleDevin MaaNo ratings yet

- Cover Letter For Stanford - Mutemi-1Document1 pageCover Letter For Stanford - Mutemi-1Sitche ZisoNo ratings yet

- MBA Investment Banking Resume TemplateDocument2 pagesMBA Investment Banking Resume TemplatesensibledeveshNo ratings yet

- Investment Banking ResumeDocument1 pageInvestment Banking Resumekari555No ratings yet

- Expert Financial Analyst Shares Career ExperienceDocument5 pagesExpert Financial Analyst Shares Career ExperienceZolo ZoloNo ratings yet

- Resume of Fengyao LuoDocument1 pageResume of Fengyao Luoapi-340180845No ratings yet

- Resume - Rishabh WadhawanDocument2 pagesResume - Rishabh WadhawanYash WadhawanNo ratings yet

- Resume ExampleDocument1 pageResume ExampleDavid Bonnemort100% (13)

- CHAPTER 5 - Wharton MBA Career Management - University of ...Document13 pagesCHAPTER 5 - Wharton MBA Career Management - University of ...joes100% (1)

- Chris Warley ResumeDocument1 pageChris Warley ResumechriswarleyNo ratings yet

- Mba ResumeDocument2 pagesMba Resumeabhishek2006No ratings yet

- Finance Manager in Atlanta GA Resume Benjamin HughesDocument3 pagesFinance Manager in Atlanta GA Resume Benjamin HughesBenjaminHughesNo ratings yet

- Wharton MBADocument23 pagesWharton MBANur Al AhadNo ratings yet

- Investment Banking Resume II - AfterDocument1 pageInvestment Banking Resume II - AfterbreakintobankingNo ratings yet

- Senior Certified Financial Planner in Charlotte NC Resume Russell HeuchertDocument2 pagesSenior Certified Financial Planner in Charlotte NC Resume Russell HeuchertRussellHeuchertNo ratings yet

- Resume Book: International Class of 2014Document24 pagesResume Book: International Class of 2014aaNo ratings yet

- Investment Banking Cover Letter TemplateDocument2 pagesInvestment Banking Cover Letter TemplateMihnea CraciunescuNo ratings yet

- WSO FT Banking ResumeDocument1 pageWSO FT Banking ResumeJohn MathiasNo ratings yet

- Spring Week GuideDocument32 pagesSpring Week Guidevimanyu.tanejaNo ratings yet

- David Ketelhut Resume 2018Document2 pagesDavid Ketelhut Resume 2018api-385647154No ratings yet

- INDUSTRY INSIDER: PRIVATE EQUITY AND VENTURE CAPITALDocument46 pagesINDUSTRY INSIDER: PRIVATE EQUITY AND VENTURE CAPITALBo LiNo ratings yet

- Joycemengresume PDFDocument2 pagesJoycemengresume PDFDanishevNo ratings yet

- UofMaryland Smith Finance Assoc Resume Book (1Y)Document46 pagesUofMaryland Smith Finance Assoc Resume Book (1Y)Jon CannNo ratings yet

- Cover Letter TemplateDocument2 pagesCover Letter Templatemagicgero100% (4)

- VP Investors Relations in New York City Resume Marlin ReyesDocument1 pageVP Investors Relations in New York City Resume Marlin ReyesMarlin ReyesNo ratings yet

- M&A Course SyllabusDocument8 pagesM&A Course SyllabusMandip LuitelNo ratings yet

- Er. Kishor Kumar Panthi :: CVDocument4 pagesEr. Kishor Kumar Panthi :: CVengineeringwatchNo ratings yet

- Graduate investment banking CV templateDocument1 pageGraduate investment banking CV templateChristopher HoNo ratings yet

- Dardenresume PEDocument36 pagesDardenresume PEkk235197No ratings yet

- Annotated Investment Banking Graduate Job Covering LetterDocument1 pageAnnotated Investment Banking Graduate Job Covering LetterNuttyahNo ratings yet

- Investment Banking Resume III - AfterDocument1 pageInvestment Banking Resume III - AfterbreakintobankingNo ratings yet

- Cover-Letter BCGDocument1 pageCover-Letter BCGVermeireNo ratings yet

- Confluent Inc. (CFLT) - Cloud Momentum Continues As Growth Accelerates - 3Q21 ResultsDocument9 pagesConfluent Inc. (CFLT) - Cloud Momentum Continues As Growth Accelerates - 3Q21 ResultsShingYiuNo ratings yet

- Experienced Investment Banker Resume Template Transaction PageDocument3 pagesExperienced Investment Banker Resume Template Transaction PageMohamed AbdullaNo ratings yet

- Investment Banking Cover Letter TemplateDocument1 pageInvestment Banking Cover Letter Templatetamas-heim-8812No ratings yet

- Internship Offer by GOLDMAN SACHSDocument5 pagesInternship Offer by GOLDMAN SACHSNitesh mishraNo ratings yet

- Cover Letter Goldman SachsDocument1 pageCover Letter Goldman SachsAnonymous GL6svDNo ratings yet

- William CV - BlackRockDocument2 pagesWilliam CV - BlackRockWilliam GameNo ratings yet

- Investment Banking Cover Letter TemplateDocument2 pagesInvestment Banking Cover Letter TemplateBrian OuNo ratings yet

- Primer On Investment BankingDocument2 pagesPrimer On Investment BankingRaul KoolNo ratings yet

- Wharton Resume Advice EntrepreneurshipDocument2 pagesWharton Resume Advice EntrepreneurshipSumant MeherNo ratings yet

- WSO Resume 47Document1 pageWSO Resume 47John MathiasNo ratings yet

- WSO ReviewDocument1 pageWSO ReviewJohn MathiasNo ratings yet

- Maurice Levin Resume CV 2017Document1 pageMaurice Levin Resume CV 2017Maurice LevinNo ratings yet

- EPQ - Ryan G Sharma - Source AnalysisDocument3 pagesEPQ - Ryan G Sharma - Source Analysisryan sharma100% (1)

- VFC Meeting 8.31 Discussion Materials PDFDocument31 pagesVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNo ratings yet

- JChiang ResumeDocument1 pageJChiang Resumemancision100% (1)

- ResumeDocument2 pagesResumeRajat GargNo ratings yet

- Cum Scriu Aplicatia Engleza ResumeDocument54 pagesCum Scriu Aplicatia Engleza ResumePoida ElenaNo ratings yet

- Login to careerclap.com and build your profileDocument9 pagesLogin to careerclap.com and build your profileAnonymous 1aCZDEbMMNo ratings yet

- FAQs Recent College Graduate Job Opportunities Morgan StanleyDocument13 pagesFAQs Recent College Graduate Job Opportunities Morgan StanleydianwenNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Operations Due Diligence: An M&A Guide for Investors and BusinessFrom EverandOperations Due Diligence: An M&A Guide for Investors and BusinessNo ratings yet

- InheritanceDocument17 pagesInheritanceJohn MathiasNo ratings yet

- Garbage CollectionDocument8 pagesGarbage CollectionJohn MathiasNo ratings yet

- FinalProjectPresentationEvaluationForm StudentDocument1 pageFinalProjectPresentationEvaluationForm StudentJohn MathiasNo ratings yet

- FinalProjectPresentationEvaluationForm ProfessorDocument4 pagesFinalProjectPresentationEvaluationForm ProfessorJohn MathiasNo ratings yet

- Generics 2Document18 pagesGenerics 2John MathiasNo ratings yet

- Final Project Presentation Grading RubricDocument3 pagesFinal Project Presentation Grading RubricJohn MathiasNo ratings yet

- Generics 2Document18 pagesGenerics 2John MathiasNo ratings yet

- Final Written Spring2015Document4 pagesFinal Written Spring2015John MathiasNo ratings yet

- CSCI 201L Final Spring 2014 13% of Course GradeDocument6 pagesCSCI 201L Final Spring 2014 13% of Course GradeJohn MathiasNo ratings yet

- Final Written Summer2014Document6 pagesFinal Written Summer2014John MathiasNo ratings yet

- Final Written Spring2017Document7 pagesFinal Written Spring2017John MathiasNo ratings yet

- CSCI 201L Written Exam #2 Spring 2018 15% of Course GradeDocument10 pagesCSCI 201L Written Exam #2 Spring 2018 15% of Course GradeJohn MathiasNo ratings yet

- CSCI 201L - Final Project 30.0% of Course GradeDocument9 pagesCSCI 201L - Final Project 30.0% of Course GradeJohn MathiasNo ratings yet

- CSCI 201L Written Exam #2 Summer 2016 10% of Course GradeDocument6 pagesCSCI 201L Written Exam #2 Summer 2016 10% of Course GradeJohn MathiasNo ratings yet

- Final Programming Summer2016Document4 pagesFinal Programming Summer2016John MathiasNo ratings yet

- CSCI 201L Written Exam #2 Fall 2017 15% of Course GradeDocument10 pagesCSCI 201L Written Exam #2 Fall 2017 15% of Course GradeJohn MathiasNo ratings yet

- Final Written Spring2016Document6 pagesFinal Written Spring2016John MathiasNo ratings yet

- Final Programming Spring2016Document3 pagesFinal Programming Spring2016John MathiasNo ratings yet

- Final Written Fall2016Document6 pagesFinal Written Fall2016John MathiasNo ratings yet

- CSCI 201L Final - Written Fall 2014 12% of Course GradeDocument7 pagesCSCI 201L Final - Written Fall 2014 12% of Course GradeJohn MathiasNo ratings yet

- Final Programming Section2 Spring2014Document4 pagesFinal Programming Section2 Spring2014John MathiasNo ratings yet

- Final Programming Section1 Spring2014Document4 pagesFinal Programming Section1 Spring2014John MathiasNo ratings yet

- Csci 201L Final - Written Fall 2015 13% of Course Grade: SerialversionuidDocument6 pagesCsci 201L Final - Written Fall 2015 13% of Course Grade: SerialversionuidJohn MathiasNo ratings yet

- Programming Exam #2: Submit MoveDocument8 pagesProgramming Exam #2: Submit MoveJohn MathiasNo ratings yet

- Programming Exam #2 Grading Criteria: Part 1 - 4.0%Document3 pagesProgramming Exam #2 Grading Criteria: Part 1 - 4.0%John MathiasNo ratings yet

- File IODocument9 pagesFile IOJohn MathiasNo ratings yet

- Jeffrey Miller, Ph.D. Jeffrey - Miller@usc - Edu: CSCI 201 Principles of Software DevelopmentDocument13 pagesJeffrey Miller, Ph.D. Jeffrey - Miller@usc - Edu: CSCI 201 Principles of Software DevelopmentJohn MathiasNo ratings yet

- Final Programming Fall2014Document3 pagesFinal Programming Fall2014John MathiasNo ratings yet

- Performance of Filler Material in GabionsDocument4 pagesPerformance of Filler Material in GabionsPreetham N KumarNo ratings yet

- Brief History of Gifted and Talented EducationDocument4 pagesBrief History of Gifted and Talented Educationapi-336040000No ratings yet

- Clare Redman Statement of IntentDocument4 pagesClare Redman Statement of Intentapi-309923259No ratings yet

- UI Symphony Orchestra and Choirs Concert Features Mahler's ResurrectionDocument17 pagesUI Symphony Orchestra and Choirs Concert Features Mahler's ResurrectionJilly CookeNo ratings yet

- D5092 - Design and Installation of Ground Water Monitoring Wells in AquifersDocument14 pagesD5092 - Design and Installation of Ground Water Monitoring Wells in Aquifersmaxuelbestete100% (1)

- Forest Ecosystems and EnvironmentsDocument152 pagesForest Ecosystems and EnvironmentsSufyan MaharNo ratings yet

- The Photoconductive CellDocument4 pagesThe Photoconductive Cellfasdasd123No ratings yet

- History of Technical Writing HardDocument4 pagesHistory of Technical Writing HardAllyMae LopezNo ratings yet

- Batangas State University - Testing and Admission OfficeDocument2 pagesBatangas State University - Testing and Admission OfficeDolly Manalo100% (1)

- Chapter #11: Volume #1Document35 pagesChapter #11: Volume #1Mohamed MohamedNo ratings yet

- 4.6.6 Lab View Wired and Wireless Nic InformationDocument4 pages4.6.6 Lab View Wired and Wireless Nic InformationThắng NguyễnNo ratings yet

- Burning Arduino Bootloader With AVR USBASP PDFDocument6 pagesBurning Arduino Bootloader With AVR USBASP PDFxem3No ratings yet

- Galway Music Officer RoleDocument20 pagesGalway Music Officer RoleJohanna KennyNo ratings yet

- 1 - Introducing Your SelfDocument31 pages1 - Introducing Your SelfAbdurrahmanNo ratings yet

- Importance of Decision Tree AnalysisDocument3 pagesImportance of Decision Tree AnalysisJean Grace Agustin BelmonteNo ratings yet

- Lesson 5 The 19th Century PhilippinesDocument5 pagesLesson 5 The 19th Century PhilippinesJoquem PamesaNo ratings yet

- ME 205 - Statics Course Syllabus: Fall 2015Document4 pagesME 205 - Statics Course Syllabus: Fall 2015Dhenil ManubatNo ratings yet

- Complex Vector Model of The Squirrel Cage Induction Machine Including Instantaneous Rotor Bar CurrentsDocument8 pagesComplex Vector Model of The Squirrel Cage Induction Machine Including Instantaneous Rotor Bar CurrentsJorge Luis SotoNo ratings yet

- 1st Activity in ACCA104Document11 pages1st Activity in ACCA104John Rey BonitNo ratings yet

- Instruction Manual for Capacitor Voltage TransformersDocument22 pagesInstruction Manual for Capacitor Voltage Transformerst.o.i.n.gNo ratings yet

- Anselm's Ontological Argument ExplainedDocument8 pagesAnselm's Ontological Argument ExplainedCharles NunezNo ratings yet

- Space Oddity Chords (Ver 2) by David Bowie Tabs at Ultimate Guitar ArchiveDocument3 pagesSpace Oddity Chords (Ver 2) by David Bowie Tabs at Ultimate Guitar ArchiveEMMANUEL ARNOULDNo ratings yet

- QF-16 Security ProceduresDocument55 pagesQF-16 Security Proceduresmaruka33No ratings yet

- Kiribati, Gilbertese BibleDocument973 pagesKiribati, Gilbertese BibleAsia BiblesNo ratings yet

- Justification: Justification: Doctrine of Council of TrentDocument4 pagesJustification: Justification: Doctrine of Council of TrentMihai SarbuNo ratings yet

- A Better Kiln CoatingDocument2 pagesA Better Kiln Coatingamir100% (4)

- Introduction To Wireless Communication - Radio CommunicationDocument21 pagesIntroduction To Wireless Communication - Radio CommunicationYas773No ratings yet

- Indian Standard: Hexagon Head Bolts, Screws and Nuts of Product Grades A and BDocument11 pagesIndian Standard: Hexagon Head Bolts, Screws and Nuts of Product Grades A and BJignesh TrivediNo ratings yet

- Communication Skill ResearchDocument3 pagesCommunication Skill ResearchSunilkumar MSNo ratings yet

- Life and Works or Rizal - EssayDocument2 pagesLife and Works or Rizal - EssayQuince CunananNo ratings yet