Professional Documents

Culture Documents

Accounts Receivable Balances Memo As of June 30, 2009

Uploaded by

fethudinibrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Receivable Balances Memo As of June 30, 2009

Uploaded by

fethudinibrCopyright:

Available Formats

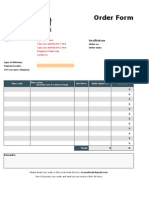

Accounts Receivable Balances Memo

As of June 30, 2009

Date:

To: Accounts Receivable / Inventory Coordinator

Financial Services Office

From:

Department/Unit:

Subject: Accounts Receivable Balances as of June 30, 2009

Summarized below are the total dollar values of the Accounts Receivable by FRS Account

Number and Account Control, by age.

Account # / Days Past Due

Control Current 1 – 30 31 – 60 61 – 90 91 – 365 Over 365 Total

$- $- $- $- $- $- $-

$- $- $- $- $- $- $-

$- $- $- $- $- $- $-

$- $- $- $- $- $- $-

$- $- $- $- $- $- $-

TOTALS $- $- $- $- $- $- $-

The following supporting schedules are attached:

Schedule 1: Accounts Receivable by Customer Name & Age (Required)

Schedule 2: Customers with Credit Balances

Schedule 3: Amounts to be Written Off as of June 30, 2009

Schedule 4: Amounts Written Off During the Fiscal Year

Schedule 5: History of Write-Offs for Prior Fiscal Years (Required)

Contact Person: Please identify a contact person who will be available to answer questions

between July 2 and July 17, 2009:

Contact Person's Name Contact Person E-Mail Phone

Attestation: I confirm that these accurately represent our unit’s accounts receivable as of

June 30, 2009.

Director or Department Head Name & Title Director or Department Head Signature Date

Accounts Receivable Balances Memo Page ___ of ___

Schedule 1: Accounts Receivable by Customer Name & Age as of 6/30/09

Revenue Account / Object Code: S/L

Account Number/Control: G/L

Days Past Due

Customer Current 1 – 30 31 – 60 61 – 90 91 – 365 Over 365 Total

Name

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

Total this Account

Number / Control

0.00 0.00 0.00 0.00 0.00 0.00 $-

Schedule 1: Accounts Receivable by Customer Name and Age Page ___of___

Schedule 2: Customers with Credit Balances as of 6/30/09

Revenue Account /

Object Code: S/L

Account Number/

Control: G/L

Date Customer Name Amount Reason

Code *

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

Total for this Account Number / Control $-

* Credit Balance Reason Codes:

RD Refund Due – may be reclassified as a Miscellaneous Payable

DEP Deposits – may be reclassified as a liability

Schedule 2: Customers with Credit Balances Page___of___

Schedule 3: Amounts to be Written Off as of 6/30/09

Revenue Account / Object Code: S/L

Account Number/Control: G/L

Customer Name Amount Reason

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

Totals this Account # / Control $-

Schedule 3: Amounts to be Written Off Page___of___

Schedule 4: Amounts Written Off During the Fiscal Year Ended 6/30/09

Revenue Account / Object Code: S/L

Account Number/Control: G/L

Customer Name Amount Reason

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

$-

Totals this Account # / Control $-

(1) BD - Journal entry posted to increase Bad Debt Expense and reduce Accounts Receivable

REV - Journal entry posted to reduce Revenues and Accounts Receivable

NP - Receivable never posted to FRS and determined to be uncollectible

Schedule 4: Amounts Written Off During the Fiscal Year Page___of___

Accounting

Treatment *

Schedule 4: Amounts Written Off During the Fiscal Year Page___of___

Schedule 5: Analysis of Accounts Receivable Write-Offs / Proposed Allowance

Accounts Receivable Balance

Fiscal Year Ended as of Fiscal Year End Amount Written Off

$- $-

June 30,2008

$- $-

June 30,2007

$- $-

June 30,2006

Do you believe that all accounts receivable balances are collectible?

YES NO

If “Yes,” explain why you believe amounts over 90 days old are still collectible.

If “No,” determine a proposed allowance for uncollectible accounts receivable, and explain

the basis for the proposed allowance. If Receivables are recorded in more than one

General Ledger (GL) account, should the allowance be recorded in the GL with the largest

balance, or should the allowance be split among the GLs?

Schedule 5: Analysis of Write-Offs/Proposed Allowance Page___of___

You might also like

- Chapter 14Document41 pagesChapter 14wrzmstr2No ratings yet

- IC Simple Cost-Benefit AnalysisDocument8 pagesIC Simple Cost-Benefit AnalysisZairah Ann BorjaNo ratings yet

- MonteBianco-Solution - With Comments and AlternativesDocument27 pagesMonteBianco-Solution - With Comments and AlternativesGiudittaBiancaLuràNo ratings yet

- IC Accounts Receivable Template Updated 8552Document3 pagesIC Accounts Receivable Template Updated 8552Kevzz EspirituNo ratings yet

- Please Kindly Joint With Use For More:: - Facebook Group: Cambodia Accounting and TaxDocument5 pagesPlease Kindly Joint With Use For More:: - Facebook Group: Cambodia Accounting and TaxLay TekchhayNo ratings yet

- Or Click Here To Manage Accounts Receivable Aging in SmartsheetDocument3 pagesOr Click Here To Manage Accounts Receivable Aging in SmartsheetTwins VinesNo ratings yet

- ServicesDocument1 pageServicesoupoiupoiupoiupiuuuuNo ratings yet

- Construction Change Order Log Template: Dates Accounting TimeDocument3 pagesConstruction Change Order Log Template: Dates Accounting TimeMani Falou ÉnigmeNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts Receivablebaby blue2008No ratings yet

- IC Accounts Payable Ledger Template Updated 8552Document2 pagesIC Accounts Payable Ledger Template Updated 8552M Monjur MobinNo ratings yet

- Invoice TemplateDocument1 pageInvoice TemplatehaniNo ratings yet

- Click Here To Create & Manage Your Expense Reports in SmartsheetDocument4 pagesClick Here To Create & Manage Your Expense Reports in SmartsheetM Monjur MobinNo ratings yet

- Or Click Here To Create Your Accounts Payable Ledger in SmartsheetDocument2 pagesOr Click Here To Create Your Accounts Payable Ledger in SmartsheetRahul agarwalNo ratings yet

- Account Payable Excel AqsaDocument2 pagesAccount Payable Excel AqsaAqsa shahNo ratings yet

- IC Accounts Receivable 8852Document3 pagesIC Accounts Receivable 8852moggy giNo ratings yet

- Sales ReceiptDocument1 pageSales ReceiptHEAD OFFICE NelspruitNo ratings yet

- Expense Report: Date Description Lodging Air & TransDocument2 pagesExpense Report: Date Description Lodging Air & TransACYATAN & CO., CPAs 2020No ratings yet

- Expense ReportDocument3 pagesExpense Reportcadayonajamescarlo96No ratings yet

- Shipping TaxesDocument1 pageShipping TaxesoupoiupoiupoiupiuuuuNo ratings yet

- Simple Invoice111111Document1 pageSimple Invoice111111Fazadar RohmanNo ratings yet

- Cash Flow ProjectionsDocument7 pagesCash Flow ProjectionsBrookeNo ratings yet

- Office Supplies RequestDocument1 pageOffice Supplies RequestCang Điện QuangNo ratings yet

- Csot Analysis TemplateDocument6 pagesCsot Analysis TemplateMr SrinivasNo ratings yet

- IC Accounts Payable 8897Document2 pagesIC Accounts Payable 8897jose miguel baezNo ratings yet

- IC Accounts Payable Ledger 9467Document2 pagesIC Accounts Payable Ledger 9467Rahul BadaikNo ratings yet

- Invoice: Bill To Industrial Minera de Colombia Date Invoice #Document1 pageInvoice: Bill To Industrial Minera de Colombia Date Invoice #Juan Carlos GutierrezNo ratings yet

- Excel Expense Report TemplateDocument1 pageExcel Expense Report Templatemalik.a.alghailiNo ratings yet

- OWSD EC Fellowship BudgetDocument10 pagesOWSD EC Fellowship BudgetMendouaNo ratings yet

- IC Painting Estimate 9256Document2 pagesIC Painting Estimate 9256jaquinNo ratings yet

- IC Painting Estimate 9256Document2 pagesIC Painting Estimate 9256jaquinNo ratings yet

- Simple Cost Benefit Analysis Template 8746Document9 pagesSimple Cost Benefit Analysis Template 8746Pia May Torres PablicoNo ratings yet

- Service InvoiceDocument1 pageService Invoiceiraqhero300No ratings yet

- IC Purchase RequisitionDocument1 pageIC Purchase RequisitionMario CungkringNo ratings yet

- PayslipDocument2 pagesPayslipAugie LingaNo ratings yet

- IC Simple Cost Benefit AnalysisDocument8 pagesIC Simple Cost Benefit Analysislord yoloNo ratings yet

- IC Inventory Transfer Form 11311Document2 pagesIC Inventory Transfer Form 11311Arjun SinghNo ratings yet

- Coterra Witherspoon 23 State #4h 4Document1 pageCoterra Witherspoon 23 State #4h 4nevet1985No ratings yet

- Accounts Payable LedgerDocument4 pagesAccounts Payable LedgeredwinjethromoliverosNo ratings yet

- IC Vendor Comparison 10842Document3 pagesIC Vendor Comparison 10842Pushpinder KaurNo ratings yet

- IC Painting Quote 10885Document3 pagesIC Painting Quote 10885engrmgquinol.uecc.phNo ratings yet

- Cost Benefit Analysis 03Document8 pagesCost Benefit Analysis 03Shreepathi AdigaNo ratings yet

- College Spending Tracking Calculator3Document2 pagesCollege Spending Tracking Calculator3prathapsingh1987No ratings yet

- Purchase Order Tracking: Payment Amount Due Amount Paid Balance Due Overvie WDocument2 pagesPurchase Order Tracking: Payment Amount Due Amount Paid Balance Due Overvie WGDS AGENCYNo ratings yet

- IC Painting Estimate 9256Document3 pagesIC Painting Estimate 9256bksinghsNo ratings yet

- Modest Muslimah - Local Order FormDocument1 pageModest Muslimah - Local Order Formapi-3798804No ratings yet

- Requisition - Perkins EngineDocument1 pageRequisition - Perkins EngineAtaa AssaadNo ratings yet

- U.S. Ambassadors Fund For Cultural Preservation: AFCP 2022 Budget Worksheet (In US Dollars)Document3 pagesU.S. Ambassadors Fund For Cultural Preservation: AFCP 2022 Budget Worksheet (In US Dollars)Denisse RiveraNo ratings yet

- Fill Out First: Instructions AttentionDocument31 pagesFill Out First: Instructions AttentionGabrielAlejandroMontalvoQuinterosNo ratings yet

- TP0300004631Document2 pagesTP0300004631San Marcos UMCNo ratings yet

- Cost-Benefit Analysis: (Proposed Product/Initiative/Service) Quantitative Costs Year 1 Year 2Document10 pagesCost-Benefit Analysis: (Proposed Product/Initiative/Service) Quantitative Costs Year 1 Year 2Sunil KambojNo ratings yet

- Excel Invoice TemplateDocument2 pagesExcel Invoice TemplateGolamMostafa100% (1)

- Purchase Order - Material or Equipment SupplierDocument3 pagesPurchase Order - Material or Equipment SupplierAimee RamosNo ratings yet

- Product Expenses Item Name Item Description Units $ / Unit: Combined Total CostDocument5 pagesProduct Expenses Item Name Item Description Units $ / Unit: Combined Total CostDynamic BuildersNo ratings yet

- Dimsum 99: Item # Description Qty Unit Price Discount PriceDocument1 pageDimsum 99: Item # Description Qty Unit Price Discount Priceacak acakNo ratings yet

- 12-Month Operating BudgetDocument2 pages12-Month Operating BudgetJoel SimbiNo ratings yet

- Product Expenses Item Name Item Description Units $ / Unit: Combined Total CostDocument5 pagesProduct Expenses Item Name Item Description Units $ / Unit: Combined Total Costmohamed fathyNo ratings yet

- Lapakcustom: Item # Description Qty Unit Price Discount PriceDocument1 pageLapakcustom: Item # Description Qty Unit Price Discount PriceNaufalhnffNo ratings yet

- Equipment Inventory List Physical Condition Financial StatusDocument2 pagesEquipment Inventory List Physical Condition Financial Statusgafia1123No ratings yet

- Com Happy Birthday: Item # Description Qty Unit Price Discount PriceDocument1 pageCom Happy Birthday: Item # Description Qty Unit Price Discount PricetandinttNo ratings yet

- Afar 1stpb Exam-5.21Document7 pagesAfar 1stpb Exam-5.21NananananaNo ratings yet

- AccountsDocument135 pagesAccountsChinnam LalithaNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- PDF-Afar CompressDocument128 pagesPDF-Afar CompressCharisse VisteNo ratings yet

- Balance Sheet As Per Schedule VI Indian Companies Act, 1956: Liabilities AssetsDocument50 pagesBalance Sheet As Per Schedule VI Indian Companies Act, 1956: Liabilities AssetsSreekumar NarayanaNo ratings yet

- Account Answers Utar TutorialDocument33 pagesAccount Answers Utar Tutorialsadyeh0% (1)

- Techniques of Financial AppraisalDocument35 pagesTechniques of Financial AppraisalUtsav DubeyNo ratings yet

- Famba 8e - SM - Mod 03 - 040320 1Document77 pagesFamba 8e - SM - Mod 03 - 040320 1Shady Mohsen MikhealNo ratings yet

- Tower Bersama Infrastructure TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesTower Bersama Infrastructure TBK.: Company Report: January 2019 As of 31 January 2019Felik KristantoNo ratings yet

- Analyzing Financial Statements: Before You Go On Questions and AnswersDocument52 pagesAnalyzing Financial Statements: Before You Go On Questions and AnswersNguyen Ngoc Minh Chau (K15 HL)No ratings yet

- SRTG Financial Statement December 2021 - ReleaseDocument56 pagesSRTG Financial Statement December 2021 - ReleaseAlbert LudiNo ratings yet

- CH 1 - Business - CombinationsDocument41 pagesCH 1 - Business - CombinationsAzakia 103No ratings yet

- Analisis ProspektifDocument9 pagesAnalisis ProspektifEvelDerizkyNo ratings yet

- Accounting IntroDocument4 pagesAccounting Introozzy75No ratings yet

- Unadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceDocument3 pagesUnadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceCj BarrettoNo ratings yet

- Mindtree BSDocument9 pagesMindtree BSAswini Kumar BhuyanNo ratings yet

- Chapter 9Document46 pagesChapter 9Sita Kusuma NugrahaeniNo ratings yet

- Ey Apply Leases PD December 2019Document68 pagesEy Apply Leases PD December 2019Priya TomarNo ratings yet

- Accounting For Managers ACCT602 MBA Fin Sec B Module 1 (1-42)Document11 pagesAccounting For Managers ACCT602 MBA Fin Sec B Module 1 (1-42)aditi anandNo ratings yet

- Financial Analysis Statement Solution IncompleteDocument9 pagesFinancial Analysis Statement Solution IncompleteJerome BaluseroNo ratings yet

- Directions: Read Carefully Each Item. Use A Separate Sheet For Your Answers, Write Only TheDocument3 pagesDirections: Read Carefully Each Item. Use A Separate Sheet For Your Answers, Write Only Thehector mabantaNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument4 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsBagudu Bilal GamboNo ratings yet

- IBF Assign#2Document4 pagesIBF Assign#2Burhan uddin100% (1)

- Report FSDocument27 pagesReport FSRamHari AdhikariNo ratings yet

- ANNA1Document3 pagesANNA1jeffryNo ratings yet

- Accounting What The Numbers Mean 11th Edition Marshall Test Bank 1Document36 pagesAccounting What The Numbers Mean 11th Edition Marshall Test Bank 1amandawilkinsijckmdtxez100% (24)

- Perpetual BowmanDocument19 pagesPerpetual BowmanEric AntonioNo ratings yet

- 2 Full 5-4a 5-4bDocument82 pages2 Full 5-4a 5-4banurag sonkarNo ratings yet