Professional Documents

Culture Documents

Download: Acc 410 Final Exam Part 1

Uploaded by

KevinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Download: Acc 410 Final Exam Part 1

Uploaded by

KevinCopyright:

Available Formats

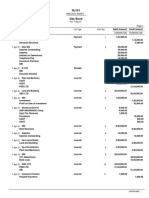

ACC 410 FINAL EXAM PART 1

Download

1.

Voters in Phillips City approved the construction of a new $10 million city hall building and

approved a $10 million bond issue with a stated rate of interest of 6% to fund the construction.

When the bonds were issued, they sold for 101. What are appropriate entries related to the

premium? In the debt service fund

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

A City issued bonds for the purpose of financing a major capital improvement. Which fund is

the most appropriate fund in which to record the receipt of the bond proceeds?

In which fund type would a governmental entitys capital project fund be found?

Voters in Lincoln School District approved the construction of a new high school and

approved a $10 million bond issue with a stated rate of interest of 6% to fund the construction.

Bids were received and the low bid was $10 million. When the bonds were issued, they sold for

face value less bond underwriting fees of $.5 million. The School Board voted to fund the

balance of the construction by a transfer from the general fund. The entry in the capital project

fund to record the receipt of the bond proceeds would be

The capital project fund of a governmental entity is accounted for using which of the following

bases of accounting?

Investments, other than bank balances, must be classified into one of three categories.

Which of the following is NOT one of those categories?

For a government that elects to capitalize its works of art and similar assets, the appropriate

entry when receiving a contribution of a work of art at the government-wide level is

Which of the following is NOT an infrastructure asset?

A governmental entity may record long-term assets in which of the following funds or account

groups?

For a government that elects NOT to capitalize its works of art and similar assets, the

appropriate entry when receiving a contribution of a work of art at the government-wide level is

A City entered into a long-term capital lease for some office equipment. Assuming the city

maintains its books and records in a manner to facilitate preparation of fund financial

statements, what entry would be made in the General Fund to record this event?

A governmental entity that is unable to satisfy claims against it

An obligation issued in the name of a government on behalf of a nongovernmental entity is

called

Southwest City enters into a lease agreement that contains a nonappropriation clause. The

clause

New City entered into a lease agreement for several new dump trucks to be used in general

government activities. Assuming the City maintains its books and records in a manner that

facilitates the preparation of the fund financial statements, acquisition of these dump trucks

would require entries in which of the following funds and/or schedules?

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

1.

The City of Brockton voted to establish an internal service fund to account for its printing

services. The City transferred $500,000 cash from the General Fund to the newly created

internal service fund. The appropriate entry in the General Fund to account for this transfer

would be a credit to cash for $500,000 and a debit for $500,000 to

Cash flows from Operating Activities does NOT include which of the following as cash

outflows?

On the fund financial statements, internal service activities should be presented

Which of the following is NOT a valid reason for governmental entities to engage in businesstype activities?

Franklin County operates a solid waste landfill that is accounted for in an enterprise fund.

The County calculated this years portion of the total closure and post closure costs associated

with the landfill to be $300,000. The entry(ies) to record this cost should be

A plans unfunded actuarially accrued liability is the excess of

Citizens within a defined geographic area of Hill City created a special assessment district to

facilitate the construction of sidewalks. Hill City was responsible for overseeing the entire

construction project. Hill City issued bonds in its own name to pay the contractor for the

construction. However, Hill City was not responsible in any manner for the bonds. The bonds

were secured by the special assessments which would be levied against the property within the

special assessment district. Collections of special assessments would be recorded in which of

the following funds of Hill City?

Previously a city received a $1 million gift, the income from which was restricted to support

maintenance of city-owned parks. During the current year the endowment earned $70,000 of

which $50,000 was transferred to the City Park Special Revenue Fund. On the year-end fund

financial statement, the endowment fund would report the $50,000 transferred to the Special

Revenue Fund as:

The City of Highland Hills receives a federal grant to assist in nutrition (feeding) programs for

senior citizens. The City will select the contractors to provide the feeding and approve the

participants in the program. The proceeds of this grant should be accounted for in which of the

following funds of the City?

A defined contribution pension plan is one in which the employer agrees to which of the

following?

You might also like

- Acc 560 Week 5 Homework (CHPT 7 and 8)Document4 pagesAcc 560 Week 5 Homework (CHPT 7 and 8)KevinNo ratings yet

- Acc 599 Week 10 Assignment 3 Capstone Research ProjectDocument2 pagesAcc 599 Week 10 Assignment 3 Capstone Research ProjectKevin0% (1)

- Download: Acc 499 Week 11 Final Exam Part 2Document2 pagesDownload: Acc 499 Week 11 Final Exam Part 2KevinNo ratings yet

- Download: ACC 410 QUIZ 8Document2 pagesDownload: ACC 410 QUIZ 8KevinNo ratings yet

- Acc 410 Quiz 9Document2 pagesAcc 410 Quiz 9KevinNo ratings yet

- Download: Acc 410 Week 10 Quiz 6Document2 pagesDownload: Acc 410 Week 10 Quiz 6KevinNo ratings yet

- Download: Acc 410 Week 11 Final Exam Part 2Document2 pagesDownload: Acc 410 Week 11 Final Exam Part 2KevinNo ratings yet

- Acc 410 Quiz 8Document2 pagesAcc 410 Quiz 8KevinNo ratings yet

- Acc 410 Quiz 5Document3 pagesAcc 410 Quiz 5KevinNo ratings yet

- Acc 410 Quiz 5Document2 pagesAcc 410 Quiz 5KevinNo ratings yet

- Acc 410 Quiz 6Document2 pagesAcc 410 Quiz 6KevinNo ratings yet

- Acc 410 Quiz 5Document3 pagesAcc 410 Quiz 5KevinNo ratings yet

- Acc 410 Quiz 6Document2 pagesAcc 410 Quiz 6KevinNo ratings yet

- Acc 410 Quiz 7Document2 pagesAcc 410 Quiz 7KevinNo ratings yet

- Acc 410 Quiz 5Document2 pagesAcc 410 Quiz 5KevinNo ratings yet

- Download: ACC 410 QUIZ 5Document2 pagesDownload: ACC 410 QUIZ 5KevinNo ratings yet

- Download: Acc 410 Final Part 1Document2 pagesDownload: Acc 410 Final Part 1KevinNo ratings yet

- Acc 410 Chapter 8 QuizDocument3 pagesAcc 410 Chapter 8 QuizKevinNo ratings yet

- Acc 410 Quiz 4Document2 pagesAcc 410 Quiz 4KevinNo ratings yet

- Acc 410 Quiz 4Document2 pagesAcc 410 Quiz 4KevinNo ratings yet

- Acc 410 Chapter 8 QuizDocument3 pagesAcc 410 Chapter 8 QuizKevinNo ratings yet

- Acc 410 Quiz 3Document3 pagesAcc 410 Quiz 3KevinNo ratings yet

- Acc 410 Quiz 3Document2 pagesAcc 410 Quiz 3KevinNo ratings yet

- Acc 410 Quiz 5Document2 pagesAcc 410 Quiz 5KevinNo ratings yet

- Download: Acc 410 Final Part 2Document2 pagesDownload: Acc 410 Final Part 2KevinNo ratings yet

- Download: Acc 410 Final Exam Part 2Document2 pagesDownload: Acc 410 Final Exam Part 2KevinNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Day Book 2Document2 pagesDay Book 2The ShiningNo ratings yet

- Archon Umipig Resume 2018 CVDocument7 pagesArchon Umipig Resume 2018 CVMaria Archon Dela Cruz UmipigNo ratings yet

- Process Performance Measure Key Performance Indicators - KPIDocument12 pagesProcess Performance Measure Key Performance Indicators - KPIibrahim_semrinNo ratings yet

- Solow Model Exam QuestionsDocument5 pagesSolow Model Exam QuestionsLeaGabrielleAbbyFariolaNo ratings yet

- Neuromarketing and The Perception of Knowledge by Michael Butler PDFDocument5 pagesNeuromarketing and The Perception of Knowledge by Michael Butler PDFcarmldonadoaNo ratings yet

- Alex FINAL BREAKEVENDocument89 pagesAlex FINAL BREAKEVENammi890No ratings yet

- Non-Routine DecisionsDocument5 pagesNon-Routine DecisionsVincent Lazaro0% (1)

- Villar Vs InciongDocument2 pagesVillar Vs InciongManok PhilmusicNo ratings yet

- Ocado Annotated PP 55 and 223Document166 pagesOcado Annotated PP 55 and 223lexie lexieNo ratings yet

- Introduction to malls - What's a mall? Types of malls and their componentsDocument134 pagesIntroduction to malls - What's a mall? Types of malls and their componentsPrince Nornor-Quadzi100% (1)

- Mountain DewDocument8 pagesMountain DewSasquatch0% (1)

- Keycare: Example - Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC) CapmDocument3 pagesKeycare: Example - Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC) CapmekaarinathaNo ratings yet

- Action Coach - Mathew AndersonDocument1 pageAction Coach - Mathew AndersonMathew AndersonNo ratings yet

- Para ImprimirDocument2 pagesPara ImprimirZymafayNo ratings yet

- Dir 3BDocument2 pagesDir 3Banon_260967986No ratings yet

- 2nd September General StrikeDocument15 pages2nd September General StrikeasokababuNo ratings yet

- 11th Commerce 3 Marks Study Material English MediumDocument21 pages11th Commerce 3 Marks Study Material English MediumGANAPATHY.SNo ratings yet

- G.O. 361-I&prDocument3 pagesG.O. 361-I&prBalu Mahendra SusarlaNo ratings yet

- Land Sale Agreement UgDocument3 pagesLand Sale Agreement UgMwesigwa Dani91% (22)

- Fisheries Business Plan - Finley Fisheries PVT LTDDocument44 pagesFisheries Business Plan - Finley Fisheries PVT LTDcrazyaps93% (57)

- Silicon Valley Chapter Strategic Plan, 2011-2014Document2 pagesSilicon Valley Chapter Strategic Plan, 2011-2014Scherraine Khrys CastillonNo ratings yet

- SupermarketsDocument20 pagesSupermarketsVikram Sean RoseNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Nestle - Marketing ProjectDocument24 pagesNestle - Marketing ProjectSarosh AtaNo ratings yet

- Computational Multiple Choice Questions on Cash and ReceivablesDocument18 pagesComputational Multiple Choice Questions on Cash and ReceivablesAndrin LlemosNo ratings yet

- Tribe of TradersDocument6 pagesTribe of TradersdatsnoNo ratings yet

- Accounts Receivables Interview Questions - GeekInterviewDocument20 pagesAccounts Receivables Interview Questions - GeekInterviewManish VermaNo ratings yet

- Competencies Needed in Peb IndustryDocument2 pagesCompetencies Needed in Peb IndustryNishant GauravNo ratings yet

- Apple Vs SamsungDocument10 pagesApple Vs SamsungREEDHEE2210No ratings yet

- Simple InterestDocument4 pagesSimple InterestPuja AgarwalNo ratings yet