Professional Documents

Culture Documents

FinMan 11e TM Ch04

Uploaded by

Cooper89Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FinMan 11e TM Ch04

Uploaded by

Cooper89Copyright:

Available Formats

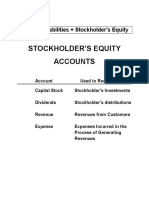

Transparency Master 4-1

STEPS IN THE ACCOUNTING CYCLE

Instructions: List the following steps in the correct order.

Financial statements prepared.

Adjusted trial balance prepared.

Adjustment data assembled and analyzed.

Transactions posted to the ledger.

Closing entries journalized and posted to ledger.

Transactions analyzed and recorded in journal.

Unadjusted trial balance prepared.

Optional end-ofperiod spreadsheet prepared.

Post-closing trial balance prepared.

Adjusting entries journalized and posted to ledger.

Transparency Master 4-2

PURPOSE OF WORK SHEET

1. Tool to assist with end-of-accounting-period

work

2. Information to prepare adjusting entries and

financial statements on one continuous form

3. Format that is easily adapted to a computer

spreadsheet program

Transparency Master 4-3

WORK SHEET

To complete the columns of a work sheet:

1. List all account balances from the ledger in the

Trial Balance columns. Total the Debit and Credit columns; they should be equal.

2. Record the adjusting entries in the Adjustments

columns. Total the Debit and Credit columns;

they should be equal.

3. Enter the balance of each account, after computing any changes due to adjusting entries, in the

Adjusted Trial Balance columns. Total the Debit

and Credit columns; they should be equal.

4. Enter the balance of all revenue and expense

accounts in the Income Statement columns. Total the Debit and Credit columns; the difference

between these columns is Net Income.

5. Enter the balance of assets, liabilities, capital

stock, and dividends in the Balance Sheet columns. Total the Debit and Credit columns. Net

income must be added to the Credit column to

make the Balance Sheet columns balance.

Transparency Master 4-4

END-OF-PERIOD

SPREADSHEET (WORK SHEET)

Enter the following adjusting entries on the endof-period spreadsheet (work sheet) for Dixie Machinery:

1. $375 of the prepaid insurance has expired.

3. Depreciation to be recorded on the office

equipment is $400.

4. $350 of salaries are owed to Dixie Machinerys employees.

Transparency Master 4-5

A

1

2

3

4

5

6 Account Title

7 Cash

8 Accounts Receivable

9 Prepaid Insurance

10 Office Equipment

11 Acc. Depr.Office Equip.

12 Accounts Payable

13 Salaries Payable

14 Capital stock

15 Dividends

16 Repair Revenue

17 Salaries Expense

18 Rent Expense

19 Utilities Expense

20 Insurance Expense

21 Depr. Exp.Office Equip.

22

23

24

25

26

27

E

F

G

Dixie Machinery

End-of-Period Spreadsheet (Work Sheet)

For the Year Ended December 31, 20-Unadjusted

Adjusted

Trial Balance

Adjustments

Trial Balance

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

825

825

300

300

500

375

125

5,050

5,050

180

400

580

250

250

350

350

2,370

2,370

1,100

1,100

15,140

15,140

8,025

350

8,375

1,500

1,500

640

640

375

375

375

400

400

400

17,940

17,940

1,125

1,125

18,690

18,690

Transparency Master 4-6

A

1

2

3

4

5

6 Account Title

7 Cash

8 Accounts Receivable

9 Prepaid Insurance

10 Office Equipment

11 Acc. Depr.Office Equip.

12 Accounts Payable

13 Salaries Payable

14 Capital Stock

15 Dividends

16 Repair Revenue

17 Salaries Expense

18 Rent Expense

19 Utilities Expense

20 Insurance Expense

21 Depr. Exp.Office Equip.

22

23 Net Income

24

25

26

27

I

J

K

Dixie Machinery

End-of-Period Spreadsheet (Work Sheet)

For the Year Ended December 31, 20-Adjusted

Income

Balance

Trial Balance

Statement

Sheet

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

825

825

300

300

125

125

5,050

5,050

580

580

250

250

350

350

2,370

2,370

1,100

1,100

15,140

15,140

8,025

8,375

1,500

1,500

640

640

375

375

400

400

18,690

18,690

11,290

15,140

7,400

7,400

Transparency Master 4-7

FINANCIAL STATEMENTS

Income Statement

Revenues

Expenses

(from the work sheet)

(from the work sheet)

Net Income

Retained Earnings Statement

Beginning Retained

Earnings Balance

+ Net Income

Dividends

(from the work sheet or Retained

Earnings account in the ledger)

(from the income statement)

(from the work sheet)

Ending Retained Earnings Balance

Balance Sheet

Current Assets

(from the work sheet)

+ Property, Plant & Equip. (from the work sheet)

Total Assets

Current Liabilities

+ Long-Term Liabilities

(from the work sheet)

(from the work sheet)

Total Liabilities

+ Capital Stock (from the worksheet)

+ Retained Earnings (from Retained Earnings statement)

Total Liabilities and

Stockholder's Equity

Transparency Master 4-8

FINANCIAL STATEMENTS

Dixie Machinery

Income Statement

For the Year Ended December 31, 20-Revenues:

Repair revenue .............................

Expenses:

Salaries expense ..........................

Rent expense ...............................

Utilities expense ..........................

Depreciation expenseoffice

equipment .................................

Insurance expense.......................

$15,140

$8,375

1,500

640

400

375

Total expenses .....................

11,290

Net income .......................................

$ 3,850

Dixie Machinery

Retained Earnings Statement

For the Year Ended December 31, 20-Retained Earnings, January 1 .............

Net income ............................................

Less dividends .....................................

Increase in Retained Earnings ............

Retained Earnings, December 31 ........

$3,850

1,100

2,750

$2,750

Transparency Master 4-9

FINANCIAL STATEMENTS

Dixie Machinery

Balance Sheet

December 31, 20-Assets

Current assets:

Cash ............................ $ 825

Accounts receivable .. 300

Prepaid insurance ...... 125

Total current assets

$1,250

Liabilities

Current liabilities:

Accounts payable ............. $ 250

Salaries payable ...............

350

Total liabilities ......................

$ 600

Stockholders Equity

Property, plant , and equipment:

Office equipment ........ $5,050

Less accumulated

depreciation ......

580

Total property, plant,

and equipment

4,470

Total assets.....................

$5,720

Capital stock .........................

Retained Earnings ...............

2,370

2,750

Total liabilities and

Stockholders equity ........

$5,720

Transparency Master 4-10

WRITING EXERCISE

Keith Martin is the controller for Daniels Printing Service. Keith has been putting in a lot of overtime; therefore, Mr. Daniels has allowed Keith to hire an assistant.

Keith's assistant is a bright high school graduate, but

he has never taken an accounting class. Keith is trying

to decide which accounting activities could be delegated to his assistant. Keith is willing to give the assistant a few simple instructions on how to complete each

task, but he doesn't have time to teach the assistant to

be an accountant.

For each task listed, state whether Keith should continue to do the work or delegate the task to his assistant.

Explain each answer.

1. List the account balances from the general ledger in

the Trial Balance columns of the end-of-period

spreadsheet.

2. Add the Debit and Credit columns of the trial balance.

3. Make the adjusting entries on the spreadsheet.

4. Complete the spreadsheet.

5. Type the formal financial statements using the data

from the Income Statement and Balance Sheet columns of the spreadsheet.

6. Journalize and post the adjusting entries.

Transparency Master 4-11

CLOSING ENTRIES

Part A

Service Revenue

3,500 Bal.

3,500

Bal.

Bal.

Bal.

Bal.

Bal.

Salaries Expense

1,400

1,400

0

Dividends

1,200

Bal.

Bal.

1,200

Rent Expense

600

600

0

Retained Earnings

1,400

600

3,500

1,200

Bal.

300

Transparency Master 4-12

J. Jones Company

Income Statement

For the Year Ended December 31, 20-Service revenue .................................

$3,500

Expenses:

Salaries expense ............................

$1,400

Rent expense .................................

600

Total expenses ...........................

2,000

Net income .........................................

$1,500

J. Jones Company

Retained Earnings Statement

For the Year Ended December 31, 20-Retained Earnings January 1 .......

$00

Net income .....................................

$1,500

Less dividends ..............................

1,200

Increase in Retained Earnings .....

300

Retained Earnings, December 31 .

$300

Transparency Master 4-13

CLOSING ENTRIES

Part B

a.

Service Revenue

Bal.

3,500

3,500

Bal.

Bal.

Bal.

b.

c.

Rent Expense

600

b.

Salaries Expense

Bal.

1,400

b.

1,400

Bal.

Bal.

600

Bal.

Income Summary

a.

3,500

2,000

Bal. 1,500*

1,500

Bal.

*$1,500 Balance = Net Income

Dividends

1,200

d.

1,200

0

Retained Earnings

c.

d.

1,500

1,200

Bal.

300

Transparency Master 4-14

WRITING EXERCISE

1. Why are closing entries prepared?

2. Why do we use Income Summary when preparing closing entries?

3. Why are closing entries prepared after financial statements?

4. What are some examples of temporary accounts that would be closed for a physician?

Transparency Master 4-15

STEPS IN THE ACCOUNTING CYCLE

Transactions analyzed and recorded in journal.

Transactions posted to the ledger.

Unadjusted trial balance prepared.

Adjustment data assembled and analyzed.

Optional end-ofperiod spreadsheet prepared.

Adjusting entries journalized and posted to ledger.

Adjusted trial balance prepared.

Financial statements prepared.

Closing entries journalized and posted to ledger.

Post-closing trial balance prepared.

You might also like

- Completing The Accounting CycleDocument47 pagesCompleting The Accounting CycleMeagan NelsonNo ratings yet

- The Accounting Cycle Completed: HE IG IctureDocument63 pagesThe Accounting Cycle Completed: HE IG IctureBandar Allehyani100% (1)

- Complete the Accounting Cycle Case StudyDocument16 pagesComplete the Accounting Cycle Case Studydeepak.agarwal.caNo ratings yet

- Financial Accounting Cycle StepsDocument102 pagesFinancial Accounting Cycle StepsstarwarzyodaNo ratings yet

- WorksheetDocument54 pagesWorksheetSayed Farrukh AhmedNo ratings yet

- Chapter 04 SMDocument86 pagesChapter 04 SMAthena LauNo ratings yet

- Accounting Cycle FlowDocument78 pagesAccounting Cycle Flowbrenda septianaNo ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNo ratings yet

- Comprehensive Problem Assignment - PDFDocument20 pagesComprehensive Problem Assignment - PDFJunior RobinsonNo ratings yet

- p4012 (2018)Document349 pagesp4012 (2018)Center for Economic ProgressNo ratings yet

- CH # 4 Financial StatementsDocument4 pagesCH # 4 Financial StatementsAbubakar AliNo ratings yet

- Week 3Document14 pagesWeek 3John PerkinsNo ratings yet

- Completing The Accounting Cycle: QuestionsDocument90 pagesCompleting The Accounting Cycle: QuestionsAmna Tahir100% (1)

- ACCT504 Case Study 1Document15 pagesACCT504 Case Study 1sinbad97100% (1)

- 4012 For 2017 ReturnsDocument349 pages4012 For 2017 ReturnsSarah EunJu LeeNo ratings yet

- ch03 Part1Document6 pagesch03 Part1Sergio HoffmanNo ratings yet

- Scientific Research and Experimental Development (SR&ED) Expenditures ClaimDocument37 pagesScientific Research and Experimental Development (SR&ED) Expenditures ClaimShannon HutchinsonNo ratings yet

- ACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoDocument16 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoRegina Lee FordNo ratings yet

- Xacc280 Week3 Reading2Document56 pagesXacc280 Week3 Reading2osharpening9402No ratings yet

- NotesDocument40 pagesNotesTicktactoe100% (1)

- Chap 004Document84 pagesChap 004MubasherAkramNo ratings yet

- Answer KeyDocument27 pagesAnswer KeycarlosNo ratings yet

- Intermediate Accounting Solutions Chapter 3Document27 pagesIntermediate Accounting Solutions Chapter 3jharris1063% (8)

- Solution Manual For Financial Accounting 9th Edition by WeygandtDocument22 pagesSolution Manual For Financial Accounting 9th Edition by Weygandta540142314100% (3)

- DSR Billing ReportDocument13 pagesDSR Billing ReportisskumarNo ratings yet

- Financial Accounting Ch04Document57 pagesFinancial Accounting Ch04b2dm2k100% (1)

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartNo ratings yet

- Solution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelDocument18 pagesSolution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelKristine AstilleroNo ratings yet

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- Management PresentationDocument61 pagesManagement Presentationiffat.stu2018No ratings yet

- Ac101 ch3Document21 pagesAc101 ch3Alex ChewNo ratings yet

- Sample Questions Chapters 1 2 3 5Document11 pagesSample Questions Chapters 1 2 3 5Anbang XiaoNo ratings yet

- NCERT Class 11 Accountancy Part 2Document296 pagesNCERT Class 11 Accountancy Part 2AnoojxNo ratings yet

- S A Ipcc Nov 2011 - GR IDocument97 pagesS A Ipcc Nov 2011 - GR ISaibhumi100% (1)

- Basics of Accounting Cycle, Adjusting Enteries, Closing Process, Net Profit Margin Ratio.Document28 pagesBasics of Accounting Cycle, Adjusting Enteries, Closing Process, Net Profit Margin Ratio.AccountjinNo ratings yet

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- Module 5 Completion of The Accounting Process For ServiceDocument14 pagesModule 5 Completion of The Accounting Process For ServiceavimalditaNo ratings yet

- CH 04 SMDocument127 pagesCH 04 SMapi-234680678100% (1)

- Chaper 4 Completing The Accounting CycleDocument41 pagesChaper 4 Completing The Accounting CycleAssassin ClassroomNo ratings yet

- CCD Opening SolutionDocument14 pagesCCD Opening Solutionspectrum_4820% (5)

- Test Bank Ques - 4Document6 pagesTest Bank Ques - 4MahfuzulNo ratings yet

- 6e Brewer CH09 B EOCDocument10 pages6e Brewer CH09 B EOCJonathan Altamirano BurgosNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument33 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- CH 04Document4 pagesCH 04vivien33% (3)

- Dr. M. D. Chase Long Beach State University Accounting 300A-10A The Operating Cycle: Worksheet/Closing EntriesDocument20 pagesDr. M. D. Chase Long Beach State University Accounting 300A-10A The Operating Cycle: Worksheet/Closing EntriesDanilo QuinsayNo ratings yet

- Exercise 1-12Document2 pagesExercise 1-12Thalia SandersNo ratings yet

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- Staff Guidance on Form AP and Audit Report DisclosureDocument25 pagesStaff Guidance on Form AP and Audit Report Disclosurebelkahla.rafik9015No ratings yet

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1No ratings yet

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocument10 pagesFinancial and Managerial Accounting 11th Edition Warren Solutions Manualcharlesdrakejth100% (13)

- ACCT504 Case Study 1 The Complete Accounting Cycle-13Document12 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13Mohammad Islam100% (1)

- Pub 4012 VITA Volunteer Resource Guide 2019 ReturnsDocument312 pagesPub 4012 VITA Volunteer Resource Guide 2019 ReturnsmjokNo ratings yet

- Homeworks 1 and 2Document4 pagesHomeworks 1 and 2danterozaNo ratings yet

- 04 Altprob 7eDocument8 pages04 Altprob 7eHNo ratings yet

- 6.prep of Trial BalanceDocument20 pages6.prep of Trial BalanceLouie De La TorreNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionFrom EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionRating: 4.5 out of 5 stars4.5/5 (2)

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- The Controller's Function: The Work of the Managerial AccountantFrom EverandThe Controller's Function: The Work of the Managerial AccountantNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Tax 12. HWDocument4 pagesTax 12. HWCooper89No ratings yet

- Chapter 4 - Completing The Accounting CycleDocument142 pagesChapter 4 - Completing The Accounting CycleCooper89100% (3)

- Tax Case CompiledDocument14 pagesTax Case CompiledCooper89No ratings yet

- TAX 13.hwDocument9 pagesTAX 13.hwCooper89No ratings yet

- Accounting Records Help Business Owners Track Financial ActivityDocument14 pagesAccounting Records Help Business Owners Track Financial ActivityCooper89No ratings yet

- Balance Sheet: Current Assets Current LiabilitiesDocument3 pagesBalance Sheet: Current Assets Current LiabilitiesCooper89No ratings yet

- FinMan11e SecTest 01Document21 pagesFinMan11e SecTest 01Cooper89No ratings yet

- Problem 5-3B Boomer Demolition Company Financial StatementsDocument4 pagesProblem 5-3B Boomer Demolition Company Financial StatementsCooper89No ratings yet

- FinMan11e SecTest 01Document21 pagesFinMan11e SecTest 01Cooper89No ratings yet

- Achivmt Test Answ1Document18 pagesAchivmt Test Answ1Cooper89No ratings yet

- FinMan 11e TM Ch01Document21 pagesFinMan 11e TM Ch01Cooper89No ratings yet

- Basic Accounting SampleDocument37 pagesBasic Accounting SampleJihadah HayatiNo ratings yet

- Charlie Chaplin Quote HelperDocument8 pagesCharlie Chaplin Quote HelperCooper89No ratings yet

- Achivmt Test Answ2Document18 pagesAchivmt Test Answ2Cooper89No ratings yet

- Completing the Accounting CycleDocument31 pagesCompleting the Accounting CycleCooper89No ratings yet

- Cultural Component DraftDocument3 pagesCultural Component DraftCooper89No ratings yet

- Achivmt Test Answ3Document22 pagesAchivmt Test Answ3Cooper89No ratings yet

- Chapter 03Document11 pagesChapter 03Cooper89No ratings yet

- Chapter 15Document15 pagesChapter 15Cooper89No ratings yet

- Chapter 12Document15 pagesChapter 12Cooper89No ratings yet

- Calling For The BanDocument5 pagesCalling For The BanCooper89No ratings yet

- Calling For The Ban On Porn Text Base EssayDocument4 pagesCalling For The Ban On Porn Text Base EssayCooper89No ratings yet

- Homework CH 2Document15 pagesHomework CH 2Cooper89No ratings yet

- Homework CH 3Document12 pagesHomework CH 3Cooper89No ratings yet

- Integrative Lesson Plan Assignment 2Document34 pagesIntegrative Lesson Plan Assignment 2Cooper89No ratings yet

- Case Problem Chapter 3 63Document3 pagesCase Problem Chapter 3 63Cooper89No ratings yet

- Tax Case Problem Chapter 3 62Document2 pagesTax Case Problem Chapter 3 62Cooper89No ratings yet

- Homework CH 1Document12 pagesHomework CH 1Cooper89No ratings yet

- Aleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5Document5 pagesAleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5Cooper89No ratings yet

- Octane Service Station PPT - HODocument48 pagesOctane Service Station PPT - HOJanmejay MinaNo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- Cash Disbursements JournalDocument1 pageCash Disbursements JournalEdwin Siruno LopezNo ratings yet

- Audit Charles Corporation FinancialsDocument20 pagesAudit Charles Corporation FinancialsMa. Hazel Donita DiazNo ratings yet

- FEBTC not liable despite dishonored remittance draftDocument2 pagesFEBTC not liable despite dishonored remittance draft001nooneNo ratings yet

- 291 A-Financial AccountDocument21 pages291 A-Financial AccountK GanesanNo ratings yet

- AGICL AXIS BANK Statement MO NOV 2016 PDFDocument4 pagesAGICL AXIS BANK Statement MO NOV 2016 PDFSagar Asati67% (6)

- Chapter-12 Job and Contract CostingDocument15 pagesChapter-12 Job and Contract CostingAdi PrajapatiNo ratings yet

- Chapter 5: Adjustment at The End of Accounting PeriodDocument9 pagesChapter 5: Adjustment at The End of Accounting PeriodIna NaaNo ratings yet

- Master Direction DNBR - PD.007 - 03.10.119 - 2016-17 Updated 31 - 05 - 2018Document246 pagesMaster Direction DNBR - PD.007 - 03.10.119 - 2016-17 Updated 31 - 05 - 2018rahulsingh89No ratings yet

- Marcelo Transport Services Income Statement and Balance SheetDocument3 pagesMarcelo Transport Services Income Statement and Balance SheetPaulene Abegail MatiasNo ratings yet

- American Express File SpecificationsDocument62 pagesAmerican Express File SpecificationsMag MarinaNo ratings yet

- 11th Accountancy EM Half Yearly Exam 2023 Question Paper With Answer Keys Madurai District English Medium PDF DownloadDocument13 pages11th Accountancy EM Half Yearly Exam 2023 Question Paper With Answer Keys Madurai District English Medium PDF DownloadDr.ManogaranNo ratings yet

- Create Accounting 290816Document9 pagesCreate Accounting 290816SAlah MOhammedNo ratings yet

- PT Aldenio: Memorial Journal (ADJUSTMENT)Document7 pagesPT Aldenio: Memorial Journal (ADJUSTMENT)Laela LitaNo ratings yet

- Part CDocument558 pagesPart CRK KNo ratings yet

- Japan's Balance of Payments For 2009: This Is An English Translation of The Japanese Original Released On March 5, 2010Document56 pagesJapan's Balance of Payments For 2009: This Is An English Translation of The Japanese Original Released On March 5, 2010keziavalenniNo ratings yet

- Week 4 Discussion ProblemsDocument10 pagesWeek 4 Discussion ProblemsGokul Kumar100% (1)

- ENTREP10 MODULES-Quarter2-Week5-9Document16 pagesENTREP10 MODULES-Quarter2-Week5-9Kristel AcordonNo ratings yet

- AFM - Answers of IMP QuestionsDocument6 pagesAFM - Answers of IMP QuestionsShiva JohriNo ratings yet

- Tally Accounting Book by Ca MD ImranDocument6 pagesTally Accounting Book by Ca MD ImranMd ImranNo ratings yet

- AP Preweek B94 - QuestionnaireDocument7 pagesAP Preweek B94 - QuestionnaireSilver LilyNo ratings yet

- Using Accounts Receivable 9.01Document177 pagesUsing Accounts Receivable 9.01Nguyen Quang HungNo ratings yet

- Leases: Key Accounting ConceptsDocument5 pagesLeases: Key Accounting ConceptsJeffer Jay GubalaneNo ratings yet

- Audit Cash Equivalents ProblemsDocument4 pagesAudit Cash Equivalents ProblemsElaine Antonio100% (1)

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probNo ratings yet

- FAR16 Share Capital Transactions - For PrintDocument9 pagesFAR16 Share Capital Transactions - For PrintAJ CresmundoNo ratings yet

- Day 5 - QuizizzDocument3 pagesDay 5 - QuizizzcassiopieabNo ratings yet

- Golden Rules For Types of AccountsDocument4 pagesGolden Rules For Types of AccountsABDUL FAHEEMNo ratings yet

- Sap Real Time TicketsDocument3 pagesSap Real Time TicketsBrijesh KumarNo ratings yet