Professional Documents

Culture Documents

Financial Services Industry Evolution

Uploaded by

Petson ChirangaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Services Industry Evolution

Uploaded by

Petson ChirangaraCopyright:

Available Formats

Chapter 1

Financial Services

Summary

Financial Services, as the name suggest it is a service industry.

But it came into its actual swing since liberalization in economic policy

after 1990. Before that, it was dominated by commercial banks &

other financial institutions & having dominance on Indian financial

service sector. It was characterized by number of factors which

impediments the growth of this sector, viz.

Excessive control in the form of regulation of interest & money

rate, prices of securities.

Unavailability of financial instruments on large scale.

Absence of independent credit rating agencies.

Lack of information about international developments.

One might think, why to study this? But considering present

scenario, we are witnessing the emergence of new financial products &

services almost everyday. This chapter throws light on all-important

points regarding money, scope, activities, financial instruments &

challenges.

The meaning of financial services in broad sense is nothing but

mobilizing & allocating savings. It includes all activities involved in the

transformation of saving into investments.

The classification of this industry can be made into two, Capital

market & Money market. The former consist of institutions, which

provide long-term funds & later consist of commercial banks & other

agencies, which supply short-term funds. Though the scope of the

services is wide, but we can classify them into two again, those are

Traditional & Modern.

The traditional activities combined both capital & money market,

which are grouped as fund based & non-fund based.

As we mentioned above that, this is service industry, the income

source of this industry is fund based & fee based. Fund based means

interest spread & fees based income has its source in merchant

banking, advisory service etc. The less risk involved in fees based than

that of fund based.

There are number of reasons for financial innovations as we

stated earlier that, since liberalization of economy - this sector has

gone through a metamorphosis. Some of the important causes are low

profitability, keen competition, customer service, global impact, and

investors awareness. All this leads to financial innovation to meet the

dynamically changing needs of economy & help to investors.

Financial service comprises of traditional & modern activities. In

now a days investor expect financial service provider to play dynamic

role as not only to provide finance but also as a departmental store of

finance. The activities comes under modern activities are merchant

banking, loan syndication, leasing, mutual fund, venture capital,

custody services, corporate advisory services, derivative security.

With globalization the Forex Market is one of the key area for financial

services providers. The services rendered in connection with forex

markets are forward contracts, options Swaps, futures etc. The LOC is

also an important product. It means the line of credit, which help in

import of goods. It acts as conduct of financing which is for ascertain

period & on certain terms for the required goods to be imported.

The financial service is mainly depends on instruments i.e. a

financial instrument due to keep in tune with changing time; the world

innovation has became key word in modern era. To cope up with

changing time & customers many innovative financial instruments

came into market viz. Commercial Paper, Treasury Bill, Certificate of

deposit, Inter- Bank Participation, various Bonds & Debentures,

Shares, ECU Bonds (European Currency Unit Bonds). In short to

provide more & reliable service to customer the innovation is must.

The financial instruments consist of debentures & shares. There

are different names of shares depend upon the nature of industry to

which they belong. For e.g.

Blue Chip Shares- are shares of those companies, which are well

established & showing consistent growth.

Defensive Shares- as the name suggests they provide a safe

return for the investors money.

Growth Sharesrepresents fast growing companies.

Cyclical Shares- are those, which rise & falls in price.

Non-Cyclical Shares- those whos price is not affected by

any such changes.

The other types are Turn around shares, Active Shares, Alpha

Shares. The Sweet share is an interesting type of share which

normally given to employees or workers for their value addition to

the company for the development of company.

All this leads to, from being a conservative industry to a

dynamic one. To enable the financial service industry to play

dynamic role, the government of India recently taken some steps

viz. Privatization of public sector undertaking, fully convertibility of

Rupee on current A/c, permitting Private sector to participate in

banking & mutual funds. Allow corporate sector to raise debt/equity

in international markets.

Although all above facilities provided by government, there

are lots of challenges ahead in this sectors. Some of these

important challenges are:

Lack of qualified personal investor awareness

Lack of transparency

Specialization recent data

These challenges are likely to grow in number with growing

requirement of customers. The financial service sector has to come

up with new instruments & innovativeness to meet these

challenges.

The current scenario of financial service sector is in

transformation stage from conservatism to dynamism. We are now

witnessing the many private sector financial services. The number

of stock exchange gone up by 3 times in just 14 years. The number

of companies listed on stock exchange in 1980 was just 2265 have

gone over 7000 in 1993. So the primary equity market is getting

stronger. The credit rating plays important role in financial service

sector. Now CRISIL, CARE, ICRA are the leading institutions who

are mainly related to rate the provider & give the rating on the

basis of that the companys standing in the market is decided.

And now it is become compulsory for every non-banking financial

institution or companies to get the credit rating for their debit

instrument. The process of Globalization & liberalization gave rise to

all this. By the globalization, the world become very small & it

becomes a market place & at the same time by liberalization, the

interest rate has been deregulated which is a backbone of this

industry.

You might also like

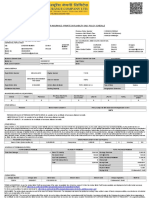

- Car Insurance Oct 20 2019 To Oct 19 2020Document3 pagesCar Insurance Oct 20 2019 To Oct 19 2020Petson ChirangaraNo ratings yet

- Car Insurance Oct 20 2021 To Oct 19 2022Document3 pagesCar Insurance Oct 20 2021 To Oct 19 2022Petson ChirangaraNo ratings yet

- Yellow Indica Policy - 20 Sep 2017 To 19 Sep 2018Document2 pagesYellow Indica Policy - 20 Sep 2017 To 19 Sep 2018Petson ChirangaraNo ratings yet

- 19-Mar-18 To 19-Mar-19 - 920221823120520989Document6 pages19-Mar-18 To 19-Mar-19 - 920221823120520989Petson ChirangaraNo ratings yet

- Car Insurance-Vista-MH43X9890 - Expiry - 19-Oct 2015Document4 pagesCar Insurance-Vista-MH43X9890 - Expiry - 19-Oct 2015Petson ChirangaraNo ratings yet

- JEEVES Terms and ConditionsDocument6 pagesJEEVES Terms and ConditionsPetson ChirangaraNo ratings yet

- Yellow Indica Policy - 20 Sep 2017 To 19 Sep 2018Document2 pagesYellow Indica Policy - 20 Sep 2017 To 19 Sep 2018Petson ChirangaraNo ratings yet

- HDFC ERGO General Insurance Policy ScheduleDocument3 pagesHDFC ERGO General Insurance Policy SchedulePetson ChirangaraNo ratings yet

- Car Insurance-Vista-MH43X9890Document1 pageCar Insurance-Vista-MH43X9890Petson ChirangaraNo ratings yet

- 19-Mar-18 To 19-Mar-19 - 920221823120520989Document6 pages19-Mar-18 To 19-Mar-19 - 920221823120520989Petson ChirangaraNo ratings yet

- Car Insurance Oct 20 2016 To Oct 19 2017Document4 pagesCar Insurance Oct 20 2016 To Oct 19 2017Petson ChirangaraNo ratings yet

- HDFC ERGO General Insurance Policy ScheduleDocument3 pagesHDFC ERGO General Insurance Policy SchedulePetson ChirangaraNo ratings yet

- S. No Domain Activity Name Feature/Para Meter Name Feature/Param Eter Pre Value Feature/Para Meter Post Value Node Count Service ImpactDocument4 pagesS. No Domain Activity Name Feature/Para Meter Name Feature/Param Eter Pre Value Feature/Para Meter Post Value Node Count Service ImpactPetson ChirangaraNo ratings yet

- MOD CELLALGOSWITCH LocalCellId=0 TD20 ScriptDocument14 pagesMOD CELLALGOSWITCH LocalCellId=0 TD20 ScriptPetson ChirangaraNo ratings yet

- DSCP and IPPATH Knowledge For GSM IP NetworkDocument3 pagesDSCP and IPPATH Knowledge For GSM IP NetworkPetson ChirangaraNo ratings yet

- GSM Call Flow (GSM Originating CallDocument6 pagesGSM Call Flow (GSM Originating Callpanha_qbNo ratings yet

- Chapter 09Document72 pagesChapter 09divyapillai0201_No ratings yet

- Alarms Combining MacroDocument2 pagesAlarms Combining MacroPetson ChirangaraNo ratings yet

- International Business OverviewDocument51 pagesInternational Business OverviewPetson ChirangaraNo ratings yet

- Portion - Finance FRM April 12 BatchDocument1 pagePortion - Finance FRM April 12 BatchPetson ChirangaraNo ratings yet

- International Business OverviewDocument51 pagesInternational Business OverviewPetson ChirangaraNo ratings yet

- Guidelines For Giving Online End SEMESTER EXAMINATION Through Aptech CentersDocument2 pagesGuidelines For Giving Online End SEMESTER EXAMINATION Through Aptech CentersPetson ChirangaraNo ratings yet

- Guide For Configuring WB-AMR - RanDocument2 pagesGuide For Configuring WB-AMR - RanPetson ChirangaraNo ratings yet

- E Queue Usage Increases When The RL Reestablishment, MBDR, or AMR Anti-Static Function Is Enabled On The RNCDocument4 pagesE Queue Usage Increases When The RL Reestablishment, MBDR, or AMR Anti-Static Function Is Enabled On The RNCPetson ChirangaraNo ratings yet

- BSC6900 (UO) OMU Commissioning GuideDocument9 pagesBSC6900 (UO) OMU Commissioning GuidePetson ChirangaraNo ratings yet

- Daily RAN Maintenance GuidelinesDocument12 pagesDaily RAN Maintenance GuidelinesPetson Chirangara0% (1)

- MOM For Meeting 'Alarms Missing in TTI' With TAC, Operations Support, Front Office, Server SupportDocument5 pagesMOM For Meeting 'Alarms Missing in TTI' With TAC, Operations Support, Front Office, Server SupportPetson ChirangaraNo ratings yet

- Daily RAN Maintenance GuidelinesDocument12 pagesDaily RAN Maintenance GuidelinesPetson Chirangara0% (1)

- 3GPP TR 25.815 V7.0.0 Signalling Enhancements For CS and PS Release 7Document43 pages3GPP TR 25.815 V7.0.0 Signalling Enhancements For CS and PS Release 7scribdninjaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bajaj Case StudyDocument24 pagesBajaj Case StudyvishvanathtNo ratings yet

- Takafulink Series Product FeaturesDocument6 pagesTakafulink Series Product FeaturesdikirNo ratings yet

- Optimal Capital Structure AnalysisDocument35 pagesOptimal Capital Structure AnalysismelakuNo ratings yet

- BDO UITFs 2017 PDFDocument4 pagesBDO UITFs 2017 PDFfheruNo ratings yet

- Unit 5Document13 pagesUnit 5Sharine ReyesNo ratings yet

- Managing Commodity Price Risk: A Supply Chain PerspectiveDocument9 pagesManaging Commodity Price Risk: A Supply Chain PerspectiveBusiness Expert Press50% (2)

- Market Research 1 PDFDocument6 pagesMarket Research 1 PDFArslanNo ratings yet

- M1a PDFDocument80 pagesM1a PDFTabish KhanNo ratings yet

- Applied Economics - Demand and SupplyDocument11 pagesApplied Economics - Demand and SupplyJowjie TV100% (1)

- Interest Rate Swaptions: DefinitionDocument2 pagesInterest Rate Swaptions: DefinitionAnurag ChaturvediNo ratings yet

- Qualifying Exam - FAR - 1st YearDocument11 pagesQualifying Exam - FAR - 1st YearKristina Angelina ReyesNo ratings yet

- ) Presenting The Contribution As A Group of Assets 2: Does Not Equal Pay Receive Is Not DeterminedDocument20 pages) Presenting The Contribution As A Group of Assets 2: Does Not Equal Pay Receive Is Not Determinedايهاب غزالةNo ratings yet

- Ee Case Study Smart MetersDocument77 pagesEe Case Study Smart MeterstagliiNo ratings yet

- Qatar Review Q1 2016 enDocument6 pagesQatar Review Q1 2016 enahmedh_98No ratings yet

- Chettinad Cement Corporation LTD 2008Document10 pagesChettinad Cement Corporation LTD 2008joosuganya8542No ratings yet

- PEST Analysis of IOCDocument4 pagesPEST Analysis of IOCArpkin_love100% (3)

- Business Models On The Web PDFDocument6 pagesBusiness Models On The Web PDFFerdinand DalisayNo ratings yet

- Jetta A5 January 2010Document10 pagesJetta A5 January 2010billydump100% (1)

- Tally Journal EntriesDocument11 pagesTally Journal Entriessainimeenu92% (24)

- Principles Ofengineehng Economy and Present Economy Studies: 1.1 Ofenginæing EmnomyDocument16 pagesPrinciples Ofengineehng Economy and Present Economy Studies: 1.1 Ofenginæing Emnomy다나No ratings yet

- Multi-Level Trading-Recovery Trading: ND RDDocument11 pagesMulti-Level Trading-Recovery Trading: ND RDAkram BoushabaNo ratings yet

- Fyqs-Dx190715a Quotation Sheet (Fuyu)Document1 pageFyqs-Dx190715a Quotation Sheet (Fuyu)Ronald SalloNo ratings yet

- Athena Chhattisgarh Power - Vedanta To Buy Athena Chhattisgarh Power For Rs 564 Crore - The Economic TimesDocument2 pagesAthena Chhattisgarh Power - Vedanta To Buy Athena Chhattisgarh Power For Rs 564 Crore - The Economic TimesstarNo ratings yet

- Packers & Movers ProjectDocument57 pagesPackers & Movers ProjectMuhammad Kamran Haider71% (14)

- 3.zara Home Product Assorment. Final EssayDocument9 pages3.zara Home Product Assorment. Final EssayEugenio Pavon GutierrezNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Securities Analysis & Portfolio Management For BSEC Investor EducationDocument37 pagesSecurities Analysis & Portfolio Management For BSEC Investor EducationHole StudioNo ratings yet

- Ey - Report - Ipo Q1 2019Document37 pagesEy - Report - Ipo Q1 2019JimmyNo ratings yet

- 100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryDocument6 pages100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryKristina Phillpotts-BrownNo ratings yet