Professional Documents

Culture Documents

Appendix 1

Uploaded by

Salim Abdulrahim BafadhilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix 1

Uploaded by

Salim Abdulrahim BafadhilCopyright:

Available Formats

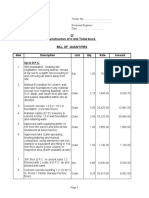

Financial Statements

Consolidated Income Statement

Year ended 30 April 2013

Restated

Year ended 30 April 2014

Note

Underlying* Non-underlying*

millionmillion

Continuing operations

Revenue

2,3

7,217.6

Operating profit

2,3

202.8

0.1

(13.5)

Loss on sale of business

Finance income

Finance costs

Net finance costs

Total

million

Underlying*

million

Non-underlying*

million

Total

million

7,217.7

7,026.6

82.6

7,109.2

189.3

186.4

(35.8)

150.6

(9.6)

3.3

(22.3)

(19.0)

(9.6)

10.5

(64.9)

(54.4)

2.9

(39.5)

(36.6)

(19.8)

(19.8)

166.2

(33.3)

132.9

151.0

(64.4)

86.6

(50.5)

115.7

5.4

(27.9)

(45.1)

87.8

(54.0)

97.0

10.3

(54.1)

(43.7)

42.9

(158.1)

(158.1)

(215.3)

(215.3)

Profit / (loss) after tax for the year

115.7

(186.0)

(70.3)

97.0

(269.4)

(172.4)

Attributable to:

Continuing operations

Equity shareholders of the parent company

Non-controlling interests

Discontinued operations

Equity shareholders of the parent company

Non-controlling interests

115.7

(27.9)

87.8

97.1

(0.1)

(54.1)

43.0

(0.1)

115.7

(157.3)

(0.8)

(186.0)

97.0

(205.5)

(9.8)

(269.4)

(205.5)

(9.8)

(172.4)

2.9

(59.3)

(56.4)

7.2

(42.6)

(35.4)

Profit before tax

Income tax expense

Profit after tax continuing operations

Loss after tax discontinued operations

(Loss) / earnings per share (pence)

Basic total

Diluted total

Basic continuing operations

Diluted continuing operations

Underlying earnings per share (pence)

Basic continuing operations

Diluted continuing operations

27

(157.3)

(0.8)

(70.3)

(1.9)p

(1.9)p

2.4p

2.3p

(4.5)p

(4.5)p

1.2p

1.2p

1,8

3.2p

3.0p

2.7p

2.6p

Underlying figures exclude the trading results of businesses exited, amortisation of acquired intangibles, net restructuring and business impairment charges and other

one off, non-recurring items, profits / losses on sale of businesses, net interest on defined benefit pension schemes, net fair value remeasurements of financial

instruments and, where applicable, discontinued operations. Such excluded items are described as Non-underlying. Further information on these items is shown in

notes 1, 2, 3, 4, 5, 7 and 27.

Businesses exited comprise businesses which have either been sold or closed. Certain businesses meet the criteria of discontinued operations as stipulated by IFRS 5

and are disclosed as such, whereas the remainder do not. Accordingly, despite all of the business exits having similar characteristics, the disclosures within nonunderlying items differ across these businesses. Further information is shown in notes 2, 4 and 27.

Results for the year ended 30 April 2013 have been restated for the impact of the amendment to IAS 19 Employee Benefits, which is described further in note 1.

Underlying figures for the year ended 30 April 2013 have been re-presented to exclude the trading results of businesses exited for which the decisions were made or

executed in 2013/14.

Dixons Retail plc

63

Annual Report and Accounts 2013/14

Financial Statements

Consolidated Statement of Comprehensive Income and Expense

Year ended

30 April 2014

Note

Loss for the year

Items that may be reclassified to the income statement in subsequent years

Cash flow hedges

Fair value remeasurement (losses) / gains

(Gains) / losses transferred to carrying amount of inventories

Losses transferred to income statement (within cost of sales)

Net investment hedges

Fair value remeasurement gains

Reclassification on disposal of overseas subsidiaries

Available for sale investments

Fair value remeasurement gains

Income tax effects

Currency translation movements

Items that will not be reclassified to the income statement in subsequent years:

Actuarial gains / (losses) on defined benefit pension schemes UK

Overseas

Deferred tax on actuarial gains / (losses) on defined benefit pension schemes

Currency translation movements

Other comprehensive expense for the year (taken to equity)

Total comprehensive expense for the year

Attributable to:

Equity shareholders of the parent company

Non-controlling interests

Dixons Retail plc

64

million

Year ended

30 April 2013

Restated

million

(70.3)

(172.4)

10.5

(15.1)

10.1

(12.7)

5.4

3.4

22

22

64.7

21

0.9

0.1

(1.5)

(135.7)

(66.9)

0.4

0.8

32.5

30.7

3.6

0.4

(13.8)

0.4

(9.4)

(151.5)

1.6

31.6

(0.6)

(118.9)

(76.3)

(88.2)

(146.6)

(260.6)

(145.8)

(0.8)

(146.6)

(250.4)

(10.2)

(260.6)

Annual Report and Accounts 2013/14

Financial Statements

Consolidated Balance Sheet

Note

Non-current assets

Goodwill

Intangible assets

Property, plant & equipment

Investments in associates

Trade and other receivables

Deferred tax assets

9

10

11

12

14

30 April 2014

million

30 April 2013

million

607.4

50.9

330.5

0.5

13.6

121.2

1,124.1

704.2

66.4

434.0

0.5

20.6

150.9

1,376.6

684.4

267.1

6.1

1.4

401.2

1,360.2

30.8

2,515.1

895.4

304.5

5.4

2.4

405.3

1,613.0

15.1

3,004.7

(2.0)

(1,382.4)

(51.4)

(24.1)

(1,459.9)

(99.7)

(17.7)

(4.5)

(2.0)

(1,667.7)

(70.4)

(36.8)

(1,799.1)

(186.1)

(246.9)

(91.6)

(401.8)

(239.1)

(15.1)

(16.1)

(1,010.6)

(31.2)

(2,501.7)

13.4

(245.4)

(96.0)

(409.1)

(262.5)

(11.3)

(26.1)

(1,050.4)

(7.9)

(2,857.4)

147.3

91.5

179.3

(450.6)

192.6

12.8

0.6

13.4

90.7

172.7

(520.9)

405.6

148.1

(0.8)

147.3

Current assets

Inventories

Trade and other receivables

Income tax receivable

Short term investments

Cash and cash equivalents

13

14

15

16

Assets held for sale

Total assets

27

Current liabilities

Bank overdrafts

Borrowings

Obligations under finance leases

Trade and other payables

Income tax payable

Provisions

17

17

18

19

20

Net current liabilities

Non-current liabilities

Borrowings

Obligations under finance leases

Retirement benefit obligations

Other payables

Deferred tax liabilities

Provisions

17

18

21

19

7

20

Liabilities directly associated with assets classified as held for sale

Total liabilities

Net assets

27

Capital and reserves

Called up share capital

Share premium account

Other reserves

Retained earnings

Equity attributable to equity holders of the parent company

Equity non-controlling interests

Total equity

23

23

The financial statements were approved by the directors on 25 June 2014 and signed on their behalf by:

Sebastian James

Group Chief Executive

Dixons Retail plc

Humphrey Singer

Group Finance Director

65

Annual Report and Accounts 2013/14

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Planas V Comelec - FinalDocument2 pagesPlanas V Comelec - FinalEdwino Nudo Barbosa Jr.100% (1)

- Prepositions Below by in On To of Above at Between From/toDocument2 pagesPrepositions Below by in On To of Above at Between From/toVille VianNo ratings yet

- Tajima TME, TMEF User ManualDocument5 pagesTajima TME, TMEF User Manualgeorge000023No ratings yet

- SyllabusDocument9 pagesSyllabusrr_rroyal550No ratings yet

- E D K Matokeo F IiDocument2 pagesE D K Matokeo F IiSalim Abdulrahim BafadhilNo ratings yet

- Grade One Test ThreeDocument3 pagesGrade One Test ThreeSalim Abdulrahim BafadhilNo ratings yet

- Biology Results Form Two: Wrong ArrangementDocument1 pageBiology Results Form Two: Wrong ArrangementSalim Abdulrahim BafadhilNo ratings yet

- Carmix Auto Spares (T) LTDDocument7 pagesCarmix Auto Spares (T) LTDSalim Abdulrahim BafadhilNo ratings yet

- Science and Technology Iv Digestive SystemDocument1 pageScience and Technology Iv Digestive SystemSalim Abdulrahim BafadhilNo ratings yet

- Memonpre&Pri Maryschool Engli Shgradei V-2020 Lessoni I-Prefi Xes, I NFI Xesandsuffi XESDocument2 pagesMemonpre&Pri Maryschool Engli Shgradei V-2020 Lessoni I-Prefi Xes, I NFI Xesandsuffi XESSalim Abdulrahim BafadhilNo ratings yet

- SupplierRegistrationCertificate PDFDocument1 pageSupplierRegistrationCertificate PDFSalim Abdulrahim BafadhilNo ratings yet

- STD I Marking Guide: No Developing Sport and Arts B Health Care and EnvironmentDocument2 pagesSTD I Marking Guide: No Developing Sport and Arts B Health Care and EnvironmentSalim Abdulrahim BafadhilNo ratings yet

- Form One NotesDocument2 pagesForm One NotesSalim Abdulrahim Bafadhil50% (2)

- D10 End-User Supplier Manual v2.0 PDFDocument95 pagesD10 End-User Supplier Manual v2.0 PDFSalim Abdulrahim BafadhilNo ratings yet

- Edk FivDocument1 pageEdk FivSalim Abdulrahim BafadhilNo ratings yet

- Management Assignment Qn2Document6 pagesManagement Assignment Qn2Salim Abdulrahim BafadhilNo ratings yet

- Company Account Solution 2Document19 pagesCompany Account Solution 2Salim Abdulrahim BafadhilNo ratings yet

- SupplierRegistrationCertificate PDFDocument1 pageSupplierRegistrationCertificate PDFSalim Abdulrahim BafadhilNo ratings yet

- Five Year Record: Shareholder InformationDocument4 pagesFive Year Record: Shareholder InformationSalim Abdulrahim BafadhilNo ratings yet

- Income StatementDocument1 pageIncome StatementSalim Abdulrahim BafadhilNo ratings yet

- ProjectDocument53 pagesProjectSalim Abdulrahim BafadhilNo ratings yet

- Figures in Millions. Currency Is GBPDocument1 pageFigures in Millions. Currency Is GBPSalim Abdulrahim BafadhilNo ratings yet

- Dixons AnnualReport2011 12 PDFDocument140 pagesDixons AnnualReport2011 12 PDFSalim Abdulrahim BafadhilNo ratings yet

- Downjavedload Annual ReportDocument147 pagesDownjavedload Annual ReportJaved MemonNo ratings yet

- QM Statistic NotesDocument24 pagesQM Statistic NotesSalim Abdulrahim BafadhilNo ratings yet

- Abre Viation SDocument1 pageAbre Viation SSalim Abdulrahim BafadhilNo ratings yet

- The Institute of Finance ManagementDocument4 pagesThe Institute of Finance ManagementSalim Abdulrahim BafadhilNo ratings yet

- Earnings Per Share Net Income Available To Shareholder Number of Shares OutstandingDocument5 pagesEarnings Per Share Net Income Available To Shareholder Number of Shares OutstandingSalim Abdulrahim BafadhilNo ratings yet

- The Website Design Partnership FranchiseDocument5 pagesThe Website Design Partnership FranchiseCheryl MountainclearNo ratings yet

- Fcode 54 en El SytucDocument2 pagesFcode 54 en El SytucAga MenonNo ratings yet

- Ambient Lighting Vol 6 CompressedDocument156 pagesAmbient Lighting Vol 6 Compressedadvait_etcNo ratings yet

- Study of Means End Value Chain ModelDocument19 pagesStudy of Means End Value Chain ModelPiyush Padgil100% (1)

- Drug Study TemplateDocument2 pagesDrug Study TemplateKistlerzane CABALLERONo ratings yet

- bz4x EbrochureDocument21 pagesbz4x EbrochureoswaldcameronNo ratings yet

- Appleyard ResúmenDocument3 pagesAppleyard ResúmenTomás J DCNo ratings yet

- Developments in Prepress Technology (PDFDrive)Document62 pagesDevelopments in Prepress Technology (PDFDrive)Sur VelanNo ratings yet

- Jainithesh - Docx CorrectedDocument54 pagesJainithesh - Docx CorrectedBala MuruganNo ratings yet

- Integrated Building Managemnt SystemDocument8 pagesIntegrated Building Managemnt SystemRitikaNo ratings yet

- National Senior Certificate: Grade 12Document13 pagesNational Senior Certificate: Grade 12Marco Carminé SpidalieriNo ratings yet

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Document6 pagesType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheNo ratings yet

- Standard Cost EstimatesDocument12 pagesStandard Cost EstimatesMasroon ẨśầŕNo ratings yet

- 990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Document25 pages990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Marvin NerioNo ratings yet

- ProAim InstructionsDocument1 pageProAim Instructionsfeli24arias06No ratings yet

- How Can You Achieve Safety and Profitability ?Document32 pagesHow Can You Achieve Safety and Profitability ?Mohamed OmarNo ratings yet

- INTERNATIONAL BUSINESS DYNAMIC (Global Operation MGT)Document7 pagesINTERNATIONAL BUSINESS DYNAMIC (Global Operation MGT)Shashank DurgeNo ratings yet

- Crivit IAN 89192 FlashlightDocument2 pagesCrivit IAN 89192 FlashlightmNo ratings yet

- Management Interface For SFP+: Published SFF-8472 Rev 12.4Document43 pagesManagement Interface For SFP+: Published SFF-8472 Rev 12.4Антон ЛузгинNo ratings yet

- Incoterms 2010 PresentationDocument47 pagesIncoterms 2010 PresentationBiswajit DuttaNo ratings yet

- Project 1. RockCrawlingDocument2 pagesProject 1. RockCrawlingHằng MinhNo ratings yet

- Vylto Seed DeckDocument17 pagesVylto Seed DeckBear MatthewsNo ratings yet

- VB 850Document333 pagesVB 850Laura ValentinaNo ratings yet

- Divider Block Accessory LTR HowdenDocument4 pagesDivider Block Accessory LTR HowdenjasonNo ratings yet

- LISTA Nascar 2014Document42 pagesLISTA Nascar 2014osmarxsNo ratings yet

- Fortigate Fortiwifi 40F Series: Data SheetDocument6 pagesFortigate Fortiwifi 40F Series: Data SheetDiego Carrasco DíazNo ratings yet