Professional Documents

Culture Documents

Joint Committee On Taxation Letter To Bill Archer On George W. Bush's Tax Plan

Uploaded by

Dylan MatthewsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joint Committee On Taxation Letter To Bill Archer On George W. Bush's Tax Plan

Uploaded by

Dylan MatthewsCopyright:

Available Formats

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl...

Page 1 of 16

Tax Notes Today

MAY 2, 2000

Paull Letter to Archer With Revenue Estimates

of Bush Tax Reduction Plan [Complete Full

Text in this issue]

A letter from Joint Committee on Taxation Chief of Staff Lindy Paull to Ways and Means

Chair Bill Archer, R-Texas, included 10-year revenue table and distributional tables relating

to the tax reduction proposal by Gov. George W. Bush, R-Texas.

=============== FULL TEXT ===============

May 2, 2000

Honorable Bill Archer

U.S. House of Representatives

1236 Longworth HOB

Washington, D.C. 20515

Dear Mr. Archer:

[1] We are providing the enclosed 10-year revenue table and distributional tables for 2002

through 2005 as backup information to supplement our response of May, 12000, relating go

the various provisions you described as the "George W. Bush Tax Reduction Proposal."

[2] I hope this information is helpful to you. If we can be of further assistance in this matter,

please let me know.

Sincerely,

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 2 of 16

Lindy L. Paull

Congress of United States

Washington, D.C.

Enclosures: Tables #D-00-20 and #00-1 075

* * * * *

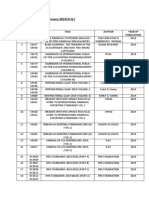

#00-1-075

VERY PRELIMINARY

2-May-00

-- Chairman Archer -ESTIMATED REVENUE EFFECTS OF VARIOUS PROVISIONS DESCRIBED AS THE

"GEORGE W. BUSH TAX REDUCTION PROPOSAL"

Fiscal Years 2001-2010

[Billions of Dollars]

______________________________________________________________________

Provision

[Effective]

2001

2002

2003

2004

______________________________________________________________________

1. Increase the child tax credit

to $600 in 2002, $700 in 2003,

$800 in 2004, $900 in 2005,

and $1,000 in 2006; apply child

credit to AMT in 2002; increase

starting point for phase-out for

singles (by $25,000 per year)

and joint filers (by $18,000 per

year) until it reaches $200,000

in 2008; no indexing for inflation; and change phase-out rate

from 5% to 2% in 2008

[tyba 12/31/01]

---

-1.1

-6.7

-11.3

2. Create new bracket for first

$6,000 of taxable income for

singles, first $10,000 for heads

of households, and first $12,000

for married couples; no indexing

bracket for inflation until 2007;

rate set at 14% in 2002, 13% in

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 3 of 16

2003, 12% in 2004, 11% in 2005,

and 10% in 2006

[tyba 12/31/01]

---

-5.8

-14.1

-22.5

3. Reduce the various income tax

rates (39.6% rate reduced to 38%

in 2002, 37% in 2003, 35% in 2004,

35% in 2005, and 33% in 2006; 36%

rate reduced to 35% in 2002 and

2003, 34% in 2004 and 2005, and

33% in 2006; 31% rate reduced to

30% in 2002, 29% in 2003, 28% in

2004, 27% in 2005, and 25% in

2006; and 28% rate reduced to 27%

in 2002 and 2003, 26% in 2004 and

2005, and 25% in 2006)

[tyba 12/31/01]

---

-12.5

-22.0

-34.8

4. 10% deduction for two-earner

families, up to $6,000 of lower

spouse's income; income cap raised

to $12,000 in 2003, $18,000 in

2004, $24,000 in 2005, and $30,000

in 2006; no indexing for inflation

[tyba 12/31/01]

---

-1.1

-4.5

-7.3

5. Allow taxpayers who do not itemize

to deduct charitable contributions

in addition to their standard deduction (subject to present-law

limitations including 50% of AGI

for cash and 30% of AGI for property; limit deduction for contributions up to the amount of the taxpayer's standard deduction to 20%

in 2002, 40% in 2003, 60% in

2004, 80% in 2005, and 100% in

2006 and thereafter)

[ca 12/31/01]

---

-0.2

-1.7

-3.6

6. Allow individuals 55 and over

tax-free and penalty-free withdrawals from IRAs for charitable

donations

[tyba 12/31/01]

---

-0.2

-0.3

-0.3

7. Raise the cap on corporate chari-

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 4 of 16

table contributions from 10% to

15% of taxable income

[cml tyba 12/31/01]

---

-0.2

8. Expand Education IRAs to allow

elementary, secondary, and afterschool programs, increase the

annual contribution limit to

$1,000 in 2002; $2002 in 2003,

$3,000 in 2004, $4,000 in 2005

and $5,000 in 2006

[1/1/02]

---

9. Permanent extension of R&E tax

credit

[7/1/04]

---

---

-0.2

-0.1

---

-0.2

-0.2

-0.4

10. Reduce all estate tax

rates by 5% in 2002, 10% in

2004, 15% in 2005, 20% in 2006,

30% in 2007, 40% in 2008; and

eliminate estate tax in 2009

[dda 12/31/01]

-----7.8

-8.3

______________________________________________________________________

NET TOTAL

---21.1

-57.4

-88.9

______________________________________________________________________

[table continued]

______________________________________________________________________

Provision

[Effective]

2005

2006

2007

2008

______________________________________________________________________

1. Increase the child tax credit

to $600 in 2002, $700 in 2003,

$800 in 2004, $900 in 2005,

and $1,000 in 2006; apply child

credit to AMT in 2002; increase

starting point for phase-out for

singles (by $25,000 per year)

and joint filers (by $18,000 per

year) until it reaches $200,000

in 2008; no indexing for inflation; and change phase-out rate

from 5% to 2% in 2008

[tyba 12/31/01]

15.9

-20.8

-24.9

-25.9

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 5 of 16

2. Create new bracket for first

$6,000 of taxable income for

singles, first $10,000 for heads

of households, and first $12,000

for married couples; no indexing

bracket for inflation until 2007;

rate set at 14% in 2002, 13% in

2003, 12% in 2004, 11% in 2005,

and 10% in 2006

[tyba 12/31/01]

-31.0

-39.3

-42.5

-43.4

3. Reduce the various income tax

rates (39.6% rate reduced to 38%

in 2002, 37% in 2003, 35% in 2004,

35% in 2005, and 33% in 2006; 36%

rate reduced to 35% in 2002 and

2003, 34% in 2004 and 2005, and

33% in 2006; 31% rate reduced to

30% in 2002, 29% in 2003, 28% in

2004, 27% in 2005, and 25% in

2006; and 28% rate reduced to 27%

in 2002 and 2003, 26% in 2004 and

2005, and 25% in 2006)

[tyba 12/31/01]

-43.6

-58.5

-64.8

-68.1

4. 10% deduction for two-earner

families, up to $6,000 of lower

spouse's income; income cap raised

to $12,000 in 2003, $18,000 in

2004, $24,000 in 2005, and $30,000

in 2006; no indexing for inflation

[tyba 12/31/01]

-9.6

-11.6

-12.9

-13.2

5. Allow taxpayers who do not itemize

to deduct charitable contributions

in addition to their standard deduction (subject to present-law

limitations including 50% of AGI

for cash and 30% of AGI for property; limit deduction for contributions up to the amount of the taxpayer's standard deduction to 20%

in 2002, 40% in 2003, 60% in

2004, 80% in 2005, and 100% in

2006 and thereafter)

[ca 12/31/01]

-8.3

-9.5

-12.7

-13.3

6. Allow individuals 55 and over

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 6 of 16

tax-free and penalty-free withdrawals from IRAs for charitable

donations

[tyba 12/31/01]

-0.2

-0.2

-0.2

-0.2

7. Raise the cap on corporate charitable contributions from 10% to

15% of taxable income

[cml tyba 12/31/01]

-0.2

-0.2

-0.2

-0.2

8. Expand Education IRAs to allow

elementary, secondary, and afterschool programs; increase the

annual contribution limit to

$1,000 in 2002, $2002 in 2003,

$3,000 in 2004, $4,000 in 2005

and $5,000 in 2006

[1/1/02]

-0.3

-0.4

-0.5

-0.5

9. Permanent extension of R&E tax

credit

[7/1/04]

-2.5

-3.2

-3.8

-4.3

10. Reduce all estate tax

rates by 5% in 2002, 10% in

2004, 15% in 2005, 20% in 2006,

30% in 2007, 40% in 2008; and

eliminate estate tax in 2009

[dda 12/31/01]

-15.9

-23.4

-30.7

-42.8

______________________________________________________________________

NET TOTAL

-125.5 -167.1

-193.2

-210.0

______________________________________________________________________

[table continued]

______________________________________________________________________

Provision

20012001[Effective]

2009

2010

2005

2010

______________________________________________________________________

1. Increase the child tax credit

to $600 in 2002, $700 in 2003,

$800 in 2004, $900 in 2005,

and $1,000 in 2006; apply child

credit to AMT in 2002; increase

starting point for phase-out for

singles (by $25,000 per year)

and joint filers (by $18,000 per

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 7 of 16

year) until it reaches $200,000

in 2008; no indexing for inflation; and change phase-out rate

from 5% to 2% in 2008

[tyba 12/31/01]

-27.2

-28.5

-35.0

-162.3

2. Create new bracket for first

$6,000 of taxable income for

singles, first $10,000 for heads

of households, and first $12,000

for married couples; no indexing

bracket for inflation until 2007;

rate set at 14% in 2002, 13% in

2003, 12% in 2004, 11% in 2005,

and 10% in 2006

[tyba 12/31/01]

-44.4

-45.4

-73.4

-288.4

3. Reduce the various income tax

rates (39.6% rate reduced to 38%

in 2002, 37% in 2003, 35% in 2004,

35% in 2005, and 33% in 2006; 36%

rate reduced to 35% in 2002 and

2003, 34% in 2004 and 2005, and

33% in 2006; 31% rate reduced to

30% in 2002, 29% in 2003, 28% in

2004, 27% in 2005, and 25% in

2006; and 28% rate reduced to 27%

in 2002 and 2003, 26% in 2004 and

2005, and 25% in 2006)

[tyba 12/31/01]

-67.5

-69.1

-112.9

-439.0

4. 10% deduction for two-earner

families, up to $6,000 of lower

spouse's income; income cap raised

to $12,000 in 2003, $18,000 in

2004, $24,000 in 2005, and $30,000

in 2006; no indexing for inflation

[tyba 12/31/01]

-13.6

-13.9

-22.5

-87.7

5. Allow taxpayers who do not itemize

to deduct charitable contributions

in addition to their standard deduction (subject to present-law

limitations including 50% of AGI

for cash and 30% of AGI for property; limit deduction for contributions up to the amount of the taxpayer's standard deduction to 20%

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 8 of 16

in 2002, 40% in 2003, 60% in

2004, 80% in 2005, and 100% in

2006 and thereafter)

[ca 12/31/01]

-13.9

-14.6

-11.8

-75.8

6. Allow individuals 55 and over

tax-free and penalty-free withdrawals from IRAs for charitable

donations

[tyba 12/31/01]

-0.2

-0.2

-1.1

-2.1

7. Raise the cap on corporate charitable contributions from 10% to

15% of taxable income

[cml tyba 12/31/01]

-0.2

-0.2

-0.7

-1.7

8. Expand Education IRAs to allow

elementary, secondary, and afterschool programs; increase the

annual contribution limit to

$1,000 in 2002, $2002 in 2003,

$3,000 in 2004, $4,000 in 2005

and $5,000 in 2006

[1/1/02]

-0.7

-0.8

-0.5

-3.5

9. Permanent extension of R&E tax

credit

[7/1/04]

-4.7

-4.9

-2.9

-23.8

10. Reduce all estate tax

rates by 5% in 2002, 10% in

2004, 15% in 2005, 20% in 2006,

30% in 2007, 40% in 2008; and

eliminate estate tax in 2009

[dda 12/31/01]

-52.0

-55.3

-32.0

-236.2

______________________________________________________________________

NET TOTAL

-224.5 -232.9

-292.8 -1,320.5

______________________________________________________________________

Joint Committee on Taxation

NOTE: Details may not add to totals due to rounding.

Legend for "Effective" column:

ca = contribution after

cml = contributions made after

dda = decedents dying after

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction Pl... Page 9 of 16

tyba = taxable years beginning after

FOOTNOTE TO TABLE

1 Loss of less than $50 million.

END OF FOOTNOTE TO TABLE

* * * * *

#D-00-20

2-May-00

DISTRIBUTIONAL EFFECTS OF VARIOUS PROVISIONS

DESCRIBED AS THE "GEORGE W. BUSH TAX REDUCTION PROPOSAL" 1

Calendar Year 2002

_____________________________________________________________________

CHANGE IN

FEDERAL TAXES 3

FEDERAL

UNDER

3

INCOME

TAXES

PRESENT LAW

2

CATEGORY

____________________ _______________________

Millions

Percent

Billions

Percent

_____________________________________________________________________

Less than $10,000

-$19

-0.3%

$7

0.4%

10,000 to 20,000

-428

-1.6%

26

1.5%

20,000 to 30,000

1,082

-1.7%

63

3.6%

30,000 to 40,000

-1,726

-1.8%

97

5.6%

40,000 to 50,000

-2,173

-2.0%

109

6.3%

50,000 to 75,000

-5,669

-2.0%

287

16.5%

75,000 to 100,000

-5,275

-2.1%

257

14.8%

100,000 to 200,000

-9,871

-2.4%

417

24.8%

200,000 and over

-11,204

-2.4%

474

27.3%

_____________________________________________________________________

TOTAL, ALL TAXPAYERS

-$37,446

-2.2%

$1,738

100.0%

_____________________________________________________________________

[table continued]

_____________________________________________________________________

Effective Tax Rate 4

FEDERAL TAXES 3

______________________

INCOME

UNDER

Present

2

CATEGORY

PROPOSAL

Law

Proposal

____________________

______________________

Billions

Percent

Percent

Percent

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction... Page 10 of 16

_____________________________________________________________________

Less than $10,000

$7

0.4%

9.0%

9.0%

10,000 to 20,000

26

1.5%

7.3%

7.1%

20,000 to 30,000

62

3.7%

12.4%

12.2%

30,000 to 40,000

95

5.6%

16.1%

15.8%

40,000 to 50,000

107

6.3%

17.6%

17.2%

50,000 to 75,000

281

16.5%

20.0%

19.6%

75,000 to 100,000

252

14.6%

22.5%

22.0%

100,000 to 200,000

407

23.9%

25.1%

24.5%

200,000 and over

463

27.2%

28.5%

27.8%

______________________________________________________________________

TOTAL, ALL TAXPAYERS

$1,700

100.0%

21.5%

21.0%

______________________________________________________________________

Source: Joint Committee on Taxation

Detail may not add to total due to rounding.

FOOTNOTES TO TABLE

1 Includes a phased-in increase in the child credit, reduction

in individual marginal rates, the creation of a 10% bracket, a second

earner deduction, and a charitable deduction for non-itemizers.

2 The income concept used to place tax returns into income

categories is adjusted gross income (AGI) plus: [1] tax-exempt

interest, [2] employer contributions for health plans and life

insurance, [3] employer share of FICA tax, [4] worker's compensation,

[5] nontaxable social security benefits, [6] insurance value of

Medicare benefits, [7] alternative minimum tax preference items, and

[8] excluded income of U.S. citizens living abroad. Categories are

measured at 2000 levels.

3 Federal taxes are equal to individual income tax (including

the outlay portion of the EIC), employment tax (attributed to

employees), and excise taxes (attributed to consumers). Corporate

income tax is not included due to uncertainty concerning the

incidence of the tax. Individuals who are dependents of other

taxpayers with negative income are excluded from the analysis. Does

not include indirect effects.

4 The effective tax rate is equal to Federal taxes described

in footnote 3 divided by: income described in footnote 2 plus

additional income attributable to the proposal.

END OF FOOTNOTES TO TABLE

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction... Page 11 of 16

* * * * *

DISTRIBUTIONAL EFFECTS OF VARIOUS PROVISIONS

DESCRIBED AS THE "GEORGE W. BUSH TAX REDUCTION PROPOSAL" 1

Calendar Year 2003

_____________________________________________________________________

CHANGE IN

FEDERAL TAXES 3

FEDERAL

UNDER

3

INCOME

TAXES

PRESENT LAW

2

CATEGORY

____________________ _______________________

Millions

Percent

Billions

Percent

_____________________________________________________________________

Less than $10,000

-$36

-0.5%

$7

0.4%

10,000 to 20,000

-851

-3.2%

27

1.5%

20,000 to 30,000

-2,098

-3.2%

65

3.6%

30,000 to 40,000

-3,331

-3.3%

100

5.5%

40,000 to 50,000

-4,062

-3.7%

111

6.1%

50,000 to 75,000

-10,146

-3.4%

299

16.5%

75,000 to 100,000

-8,868

-3.3%

270

14.9%

100,000 to 200,000

-14,822

-3.4%

441

24.3%

200,000 and over

-17,261

-3.5%

493

27.2%

_____________________________________________________________________

TOTAL, ALL TAXPAYERS

-$61,477

-3.4%

$1,813

100.0%

_____________________________________________________________________

[table continued]

_____________________________________________________________________

Effective Tax Rate 4

FEDERAL TAXES 3

______________________

INCOME

UNDER

Present

2

CATEGORY

PROPOSAL

Law

Proposal

____________________

______________________

Billions

Percent

Percent

Percent

_____________________________________________________________________

Less than $10,000

10,000 to 20,000

20,000 to 30,000

30,000 to 40,000

40,000 to 50,000

50,000 to 75,000

75,000 to 100,000

100,000 to 200,000

$7

26

63

97

107

289

261

426

0.4%

1.5%

3.6%

5.5%

6.1%

16.5%

14.9%

24.3%

9.3%

7.4%

12.4%

16.0%

17.4%

19.9%

22.4%

25.1%

9.2%

7.1%

12.0%

15.5%

16.7%

19.3%

21.6%

24.2%

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction... Page 12 of 16

200,000 and over

475

27.2%

28.6%

27.6%

______________________________________________________________________

TOTAL, ALL TAXPAYERS

$1,752

100.0%

21.5%

20.8%

______________________________________________________________________

Source: Joint Committee on Taxation

Detail may not add to total due to rounding.

FOOTNOTES TO TABLE

1 Includes a phased-in increase in the child credit, reduction

in individual marginal rates, the creation of a 10% bracket, a second

earner deduction, and a charitable deduction for non-itemizers.

2 The income concept used to place tax returns into income

categories is adjusted gross income (AGI) plus: [1] tax-exempt

interest, [2] employer contributions for health plans and life

insurance, [3] employer share of FICA tax, [4] worker's compensation,

[5] nontaxable social security benefits, [6] insurance value of

Medicare benefits, [7] alternative minimum tax preference items, and

[8] excluded income of U.S. citizens living abroad. Categories are

measured at 2000 levels.

3 Federal taxes are equal to individual income tax (including

the outlay portion of the EIC), employment tax (attributed to

employees), and excise taxes (attributed to consumers). Corporate

income tax is not included due to uncertainty concerning the

incidence of the tax. Individuals who are dependents of other

taxpayers with negative income are excluded from the analysis. Does

not include indirect effects.

4 The effective tax rate is equal to Federal taxes described

in footnote 3 divided by: income described in footnote 2 plus

additional income attributable to the proposal.

END OF FOOTNOTES TO TABLE

* * * * *

DISTRIBUTIONAL EFFECT OF VARIOUS PROVISIONS

DESCRIBED AS THE "GEORGE W. BUSH TAX REDUCTION PROPOSAL" 1

Calendar Year 2004

_____________________________________________________________________

CHANGE IN

FEDERAL TAXES 3

FEDERAL

UNDER

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction... Page 13 of 16

TAXES 3

PRESENT LAW

____________________ _______________________

Millions

Percent

Billions

Percent

_____________________________________________________________________

INCOME

CATEGORY 2

Less than $10,000

-$57

-0.7%

$8

0.4%

10,000 to 20,000

-1,260

-4.7%

27

1.4%

20,000 to 30,000

-3,139

-4.7%

67

3.5%

30,000 to 40,000

-4,915

-4.8%

102

5.4%

40,000 to 50,000

-6,035

-5.3%

113

6.0%

50,000 to 75,000

-16,076

-5.1%

312

16.5%

75,000 to 100,000

-14,048

-5.0%

280

14.8%

100,000 to 200,000

-24,068

-5.1%

468

24.7%

200,000 and over

-26,029

-5.0%

517

27.3%

_____________________________________________________________________

TOTAL, ALL TAXPAYERS

-$95,627

-5.1%

$1,893

100.0%

_____________________________________________________________________

[table continued]

_____________________________________________________________________

Effective Tax Rate 4

FEDERAL TAXES 3

______________________

INCOME

UNDER

Present

2

CATEGORY

PROPOSAL

Law

Proposal

____________________

______________________

Billions

Percent

Percent

Percent

_____________________________________________________________________

Less than $10,000

$8

0.4%

9.5%

9.4%

10,000 to 20,000

26

1.4%

7.3%

7.0%

20,000 to 30,000

54

3.5%

12.4%

11.9%

30,000 to 40,000

97

5.4%

15.9%

15.2%

40,000 to 50,000

107

6.0%

17.3%

16.4%

50,000 to 75,000

296

16.5%

19.8%

18.8%

75,000 to 100,000

266

14.8%

22.2%

21.1%

100,000 to 200,000

444

24.7%

25.1%

23.8%

200,000 and over

491

27.3%

28.8%

27.3%

______________________________________________________________________

TOTAL, ALL TAXPAYERS

$1,798

100.0%

21.5%

20.5%

______________________________________________________________________

Source: Joint committee on Taxation

Detail may not add to total due to rounding

FOOTNOTES TO TABLE

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction... Page 14 of 16

1 Includes a phased-in increase in the child credit, reduction

in individual marginal rates, the creation of a 10% bracket, a second

earner deduction, and a charitable deduction for non-itemizers.

2 The income concept used to place tax returns into income

categories is adjusted gross income (AGI) plus: [1] tax-exempt

interest, [2] employer contributions for health plans and life

insurance, [3] employer share of FICA tax, [4] worker's compensation,

[5] nontaxable social security benefits, [6] insurance value of

Medicare benefits, [7] alternative minimum tax preference items, and

[8] excluded income of U.S. citizens living abroad. Categories are

measured at 2000 levels.

3 Federal taxes are equal to individual income tax (including

the outlay portion of the EIC), employment tax (attributed to

employees), and excise taxes (attributed to consumers). Corporate

income tax is not included due to uncertainty concerning the

incidence of the tax. Individuals who are dependents of other

taxpayers with negative income are excluded from the analysis. Does

not include indirect effects.

4 The effective tax rate is equal to Federal taxes described

in footnote 3 divided by: income described in footnote 2 plus

additional income attributable to the proposal.

END OF FOOTNOTES TO TABLE

* * * * *

DISTRIBUTIONALS EFFECT OF VARIOUS PROVISIONS

DESCRIBED AS THE "GEORGE W. BUSH TAX REDUCTION PROPOSAL" 1

Calendar Year 2005

_____________________________________________________________________

CHANGE IN

FEDERAL TAXES 3

FEDERAL

UNDER

3

INCOME

TAXES

PRESENT LAW

2

CATEGORY

____________________ _______________________

Millions

Percent

Billions

Percent

_____________________________________________________________________

Less than

10,000 to

20,000 to

30,000 to

$10,000

20,000

30,000

40,000

-$78

-1,672

-4,104

-6,492

-1.0%

-6.2%

-6.1%

-6.2%

$8

27

67

105

0.4%

1.4%

3.4%

5.3%

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction... Page 15 of 16

40,000 to 50,000

-7,973

-6.7%

119

6.0%

50,000 to 75,000

-20,647

-6.4%

320

16.2%

75,000 to 100,000

-17,897

-6.1%

294

14.8%

100,000 to 200,000

-28,970

-5.8%

497

25.1%

200,000 and over

-32,245

-5.9%

543

27.4%

_____________________________________________________________________

TOTAL, ALL TAXPAYERS

-$120,079

-6.1%

$1,980

100.0%

_____________________________________________________________________

[table continued]

_____________________________________________________________________

Effective Tax Rate 4

FEDERAL TAXES 3

______________________

INCOME

UNDER

Present

2

CATEGORY

PROPOSAL

Law

Proposal

____________________

______________________

Billions

Percent

Percent

Percent

_____________________________________________________________________

Less than $10,000

$8

0.4%

9.8%

9.7%

10,000 to 20,000

26

1.4%

7.4%

7.0%

20,000 to 30,000

63

3.4%

12.2%

11.4%

30,000 to 40,000

99

5.3%

15.9%

14.9%

40,000 to 50,000

111

6.0%

17.3%

16.2%

50,000 to 75,000

300

16.1%

19.7%

18.4%

75,000 to 100,000

276

14.8%

22.1%

20.8%

100,000 to 200,000

468

25.2%

25.0%

23.6%

200,000 and over

510

27.4%

28.9%

27.1%

______________________________________________________________________

TOTAL, ALL TAXPAYERS

$1,860

100.0%

21.6%

20.3%

______________________________________________________________________

Source: Joint Committee on Taxation

Detail may not add to total due to rounding.

FOOTNOTES TO TABLE

1 Includes a phased-in increase in the child credit, reduction

in individual marginal rates, the creation of a 10% bracket, a second

earner deduction, and a charitable deduction for non-itemizers.

2 The income concept used to place tax returns into income

categories is adjusted gross income (AGI) plus: [1] tax-exempt

interest, [2] employer contributions for health plans and life

insurance, [3] employer share of FICA tax, [4] worker's compensation,

[5] nontaxable social security benefits, [6] insurance value of

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

Tax Analysts -- Paull Letter to Archer With Revenue Estimates of Bush Tax Reduction... Page 16 of 16

Medicare benefits, [7] alternative minimum tax preference items, and

[8] excluded income of U.S. citizens living abroad. Categories are

measured at 2000 levels.

3 Federal taxes are equal to individual income tax (including

the outlay portion of the EIC), employment tax (attributed to

employees), and excise taxes (attributed to consumers). Corporate

income tax is not included due to uncertainty concerning the

incidence of the tax. Individuals who are dependents of other

taxpayers with negative income are excluded from the analysis. Does

not include indirect effects.

4

The effective tax rate is equal to Federal taxes described

in footnote 3 divided by: income described in footnote 2 plus

additional income attributable to the proposal.

END OF FOOTNOTES

Tax Analysts Information

Jurisdiction: United States

Subject Areas: Legislation and lawmaking

Budgets

Index Terms: legislation, tax

tax relief

budget, federal, revenue estimates

Author: Lindy L. Paull

Institutional Author: Joint Committee on Taxation; House of Representatives; Senate

Tax Analysts Document Number: Doc 2000-12557 (7 original pages)

Tax Analysts Electronic Citation: 2000 TNT 90-14

Tax Analysts (2016)

http://services.taxanalysts.com/taxbase/archive/tnt2000.nsf/dockey/4CDE5AB5829910618... 2/23/2016

You might also like

- Porcellian Club Manual, 2000Document53 pagesPorcellian Club Manual, 2000Dylan Matthews100% (1)

- Healthy California Act AnalysisDocument8 pagesHealthy California Act AnalysisDylan MatthewsNo ratings yet

- Johannes Haushofer's CV of FailuresDocument2 pagesJohannes Haushofer's CV of FailuresDylan Matthews100% (2)

- Kenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Document7 pagesKenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Dylan Matthews57% (7)

- President Obama's 2017 Budget RequestDocument182 pagesPresident Obama's 2017 Budget RequestDylan MatthewsNo ratings yet

- Joint Committee On Taxation Letter To Charlie Rangel On George W. Bush's Tax PlanDocument8 pagesJoint Committee On Taxation Letter To Charlie Rangel On George W. Bush's Tax PlanDylan MatthewsNo ratings yet

- Bernie Sanders' "Medicare For All" PlanDocument8 pagesBernie Sanders' "Medicare For All" PlanDylan Matthews100% (2)

- Grover Cleveland - "Does A College Education Pay?"Document2 pagesGrover Cleveland - "Does A College Education Pay?"Dylan MatthewsNo ratings yet

- Jones v. Chappell - Cormac Carney OpinionDocument29 pagesJones v. Chappell - Cormac Carney OpinionDylan MatthewsNo ratings yet

- Hastert IndictmentDocument7 pagesHastert IndictmentAndrew JordanNo ratings yet

- Dennis Hastert Plea AgreementDocument15 pagesDennis Hastert Plea AgreementSteve WarmbirNo ratings yet

- The Crisis in AntitrustDocument8 pagesThe Crisis in AntitrustDylan MatthewsNo ratings yet

- Mansfield Tipping MapDocument1 pageMansfield Tipping MapDylan MatthewsNo ratings yet

- Final Language GOP Platform 2012Document62 pagesFinal Language GOP Platform 2012Shane Vander Hart100% (1)

- Grassroots Democracy ActDocument1 pageGrassroots Democracy ActDylan MatthewsNo ratings yet

- Get Happy: A Defense of Act UtilitarianismDocument84 pagesGet Happy: A Defense of Act UtilitarianismDylan MatthewsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 704 (B) Allocations KPMGDocument72 pages704 (B) Allocations KPMGturbinetimeNo ratings yet

- ACC124 - Assignment On Income StatementDocument6 pagesACC124 - Assignment On Income StatementRuzuiNo ratings yet

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimNo ratings yet

- US Military Budget Through The YearsDocument1 pageUS Military Budget Through The YearsMatthew HanzelNo ratings yet

- A Guide To UK Oil and Gas TaxationDocument172 pagesA Guide To UK Oil and Gas Taxationkalite123No ratings yet

- CIR vs. Arnoldus Carpentry Shop, Inc., G.R. No. 71122, March 25, 1988 Tax AmnestyDocument2 pagesCIR vs. Arnoldus Carpentry Shop, Inc., G.R. No. 71122, March 25, 1988 Tax AmnestyEim Balt MacmodNo ratings yet

- Tax Reviewer: General Principles: BY: Rene CallantaDocument91 pagesTax Reviewer: General Principles: BY: Rene CallantaDaryl HollandNo ratings yet

- RR No. 5-2021Document7 pagesRR No. 5-2021Scion RaguindinNo ratings yet

- An Analysis of Government Tax Revenue in IndiaDocument4 pagesAn Analysis of Government Tax Revenue in IndiaMohammad MiyanNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961senthil kumarNo ratings yet

- Supporting Industry 311-EnGDocument4 pagesSupporting Industry 311-EnGHong PisethNo ratings yet

- CTA Case Phil Am Life V CTA and CommissionerDocument4 pagesCTA Case Phil Am Life V CTA and Commissionersaintkarri100% (3)

- Tax Information SlipsDocument5 pagesTax Information SlipsTarynNo ratings yet

- Taxation Law Mock BarDocument8 pagesTaxation Law Mock BarKC ManglapusNo ratings yet

- Invoice 1Document1 pageInvoice 1PritNo ratings yet

- Module 3 - Deductions On Gross Estate - v.3Document7 pagesModule 3 - Deductions On Gross Estate - v.3John Vincent ManuelNo ratings yet

- Smietanka v. First Trust & Savings BankDocument3 pagesSmietanka v. First Trust & Savings BankPaul Joshua SubaNo ratings yet

- Dr-Ayanlade-Tutorial - QuestionsDocument4 pagesDr-Ayanlade-Tutorial - QuestionsAkunwa GideonNo ratings yet

- Final Requirement Ba 315 - YanoyanDocument21 pagesFinal Requirement Ba 315 - YanoyanDan Andrei BongoNo ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- EY Doing Business Slipsheet Booklet 7 Sept 2015Document32 pagesEY Doing Business Slipsheet Booklet 7 Sept 2015davidwijaya1986No ratings yet

- CIR v. Bank of CommerceDocument6 pagesCIR v. Bank of Commerceamareia yapNo ratings yet

- Reliance Industries Working Capital ManagementDocument21 pagesReliance Industries Working Capital ManagementSalkar NilamNo ratings yet

- PJP BC Registered Bond - Word97Document2 pagesPJP BC Registered Bond - Word97Osei Tutu Agyarko100% (5)

- Capital gains group transfer and rollover reliefDocument2 pagesCapital gains group transfer and rollover reliefWajih RehmanNo ratings yet

- What Is A Fiscal Deficit?: and Why You Should Care About It..Document1 pageWhat Is A Fiscal Deficit?: and Why You Should Care About It..Sulav SheeNo ratings yet

- Register of Cash in Bank and Other Related Financial TransactionsDocument1 pageRegister of Cash in Bank and Other Related Financial TransactionsCabudol Angel BaldivisoNo ratings yet

- BIR Ruling No. 206-90Document1 pageBIR Ruling No. 206-90Peggy SalazarNo ratings yet

- Indian Customs Edi System: Part - I - Shipping Bill SummaryDocument6 pagesIndian Customs Edi System: Part - I - Shipping Bill SummaryLevina LaurentNo ratings yet

- Notes Dalton Case StudyDocument1 pageNotes Dalton Case StudyAMNo ratings yet