Professional Documents

Culture Documents

RPM 061915

Uploaded by

hnepk7587rOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RPM 061915

Uploaded by

hnepk7587rCopyright:

Available Formats

Rhodes Precious Metals Consultancy DMCC

Weekly Precious Metals Market Review

Indications

only|

open

&

closing

prices

are

bids|

data

source

Thomson

Reuters

Eikon|

See

disclaimer

below

|

times

are

GMT

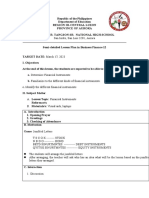

OTC$Market$Data

Week$Ending$19/06/2015

High$Bid

Low$Offer

Weekly$Close

Previous$Week

Weekly$Change$USD

Change$%

YTD$Change$USD

YTD$Change$%

Weekly&High&London&Fix

Weekly&Low&London&Fix

YTD&High&London&Fix&

YTD&Low&London&Fix&

ATM$Option$Vols$.$1m

Forward$Swaps$.$1$m$

Implied$Lease$Rates$.$1$m

CME$Active$Month$Settlement$

Gold

Silver

Platinum

Palladium

CME$Total$Open$Interest

Gold

Silver

Platinum

Palladium

ETF$Holdings

Gold

Silver

Platinum

Palladium

Other$Markets

USD$LIBOR$1$m$

Brent$Crude

USD$Index$(.DXY)

US$Equities$(.DJIA)

Date

Gold

$1,205.50

$1,173.00

$1,200.00$

$1,180.25$

$19.75$

1.67%

$16.50$

1.39%

$1,203.40&

$1,177.75&

$1,298.00&

$1,147.25&

11.41%

0.10000%

0.08700%

Weekly$Close

$1,201.90$

$16.109

$1,086.80$

$707.40$

Silver

$16.440

$15.830

$16.070

$15.920

$0.150$

0.94%

$0.410$

2.62%

$16.120

$15.930

$18.230

$15.470

23.84%

0.35000%

.0.16300%

Previous$Week

$1,179.20$

$15.825

$1,096.80$

$738.15$

Platinum

$1,089.00

$1,070.00

$1,083.00$

$1,094.00$

($11.00)

.1.01%

($117.00)

.9.75%

$1,092.00&

$1,073.00&

$1,285.00&

$1,088.00&

17.84%

0.15000%

0.03700%

Weekly$Change

$22.70$

$0.28$

($10.00)

($30.75)

21.Jun.15

Palladium

$740.00

$707.00

$707.00$

$737.00$

($30.00)

.4.07%

($86.00)

.10.84%

$740.00&

$718.00&

$831.00&

$729.00&

20.65%

.0.10000%

0.28700%

Weekly$Change$%

1.93%

1.79%

.0.91%

.4.17%

419,870

194,591

82,193

35,053

404,169

191,663

77,815

32,942

15,701$

2,928$

4,378$

2,111$

3.88%

1.53%

5.63%

6.41%

43,788,845

531,244,120

2,293,471

2,592,806

43,870,520

531,202,191

2,287,846

2,594,563

.81,675$

41,929$

5,625$

.1,757$

.0.19%

0.01%

0.25%

.0.07%

0.18700%

$63.62$

94.070$

18,105.95

0.18550%

$64.69$

94.910$

17,898.94

0.00150%

($1.07)

(0.840)

207.01

0.81%

.1.65%

.0.89%

1.16%

RPMC does not provide trading or investment advice. The information provided in this report is for indicative information only and RPMC assumes no liability

whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on

futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice. RPMC shall have no liability

whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved 2014.

T: +971 50 6526076

E: jeffrey.rhodes@rpmc.ae

Page 1 of 5

www.rpmc.ae

Rhodes Precious Metals Consultancy DMCC

MARKET NEWS & DATA THOMSON REUTERS EIKON

19-JUN-2015 09:03:12 PM

Indias proposed Sovereign gold bond is a good scheme because gold investors will be able to take this route with returns higher

than gold. Apart from gold price returns, they will also get a per cent or two extra per year, which is proposed to be offered to bond

holders. Nilesh Shah, a strong supporter of gold bonds and managing director of Kotak Mahindra Assets Management Company,

said, Investors will put money in gold sovereign bonds as the scheme proposed by the government is attractive. This scheme

should have come much earlier, but better late than never. He said in the past decade, India sent $280 billion out of the country to

import gold, which otherwise would have been used for development. The amount is similar to foreign institutional investment in

the country during the period. There is one issue in the scheme, which worries some experts. According to a bullion analyst, The

government estimates it will be able to raise $2 billion in the first year but says the gold price risk as well as currency risk need not

be hedged. This could be a big gamble. A banker dealing in gold said: RBI has a natural hedge for currencies and gold with $350

billion in reserves. Unlike the gold monetisation scheme, where the primary objective is to monetise Indias massive stock of

physical gold, the sovereign gold bond scheme intends to convert the investment demand for physical gold into paper demand. In

2014, total investment demand for gold moderated to 180 tonnes from an average annual demand of 345 tonnes during 2010-2013.

If the scheme is fully subscribed in the first year (50 tonnes as estimated by the government), then it will represent 27 per cent of

the 2014 investment demand and result in a saving of $2 billion on gold imports at current gold prices. Additionally, since the bonds

are part of the sovereign borrowing programme, they have to be kept within the fiscal deficit target (3.9 per cent of GDP in FY16).

Regular government borrowing will come down by a similar amount. Overall, this scheme provides a good alternative for gold

investors as these bonds are sovereign backed and also provide a nominal rate of interest, said Sonal Varma, executive director and

India economist at Nomura. Fund managers of gold ETFs, however, need to worry because these bonds can replace ETFs. This is

because ETFs deduct expenses from invested funds, while sovereign bonds will pay additional interest. The government will bear

expenses such as agents commission.

NEW YORK, June 19 (Reuters) - Hedge funds and money managers raised bearish bets on Comex copper futures and options and

slashed bullish bets on silver to the lowest in seven months in the latest week, U.S. Commodity Futures Trading Commission (CFTC)

data showed. In the week ended June 16, speculators increased their net short in copper by 2,651 lots to 6,786, according to Friday's

data as prices sank amid concerns mounted about demand from China, the world's top consumer. They cut net longs in silver by

some 8,140 lots to 2,255 and gold net longs by 1,900 to 42,818 lots.

NEW YORK/LONDON, June 19 (Reuters) - Gold held near a three-week high on Friday and was set for a second weekly gain, bolstered

by the U.S. Federal Reserve's caution on an interest rate rise and worries over Greece, even as a recovering dollar capped gains. Spot

gold was up 0.05 per cent at $1,201.50 an ounce by 2:09 EDT (1809 GMT) in choppy, thin trade after notching its biggest daily

increase since mid-May on Thursday. Prices are up 1.8 per cent this week, the biggest weekly increase in over a month. "We're

sandwiched between resistance at the 200-day moving average and support at the 100-day moving average," said Howard Wen,

precious metals analyst at HSBC Securities in New York. Gold rallied on Thursday on a softer dollar after Fed policymakers said a rate

increase would be appropriate only after further improvement in the labour market and greater confidence that inflation would rise.

"The boost that gold got from a more dovish Fed this week slightly improves the technical picture," ActivTrades chief analyst Carlo

Alberto de Casa said. U.S. gold futures GCcv1 for August delivery settled little changed at $1,201.90 an ounce, near Thursday's

almost four-week high. Noninterest-paying gold has benefited from a record-low rate environment following the 2007-2009 financial

crisis. Higher rates would increase the opportunity cost of holding the metal. Gold in euro terms XAUEUR=R was trading around 9

per cent lower than a near two-year peak hit in January. Bullion has garnered some support from investors worried over a euro zone

crisis. Athens and its international creditors remained deadlocked over a debt deal. Euro zone leaders will hold an emergency

summit on Monday to try to avert a Greek default after bank withdrawals accelerated. Investor positioning remained bearish, with

assets of top gold-backed exchange traded fund SPDR Gold Trust GLD.P at its lowest since 2008 and speculators increasing short

positions. Asian physical demand was also sluggish as a tight price range and higher stock market yields kept consumers away.

In China, prices on the Shanghai Gold Exchange fell to a discount of up to $2 an ounce to the global price from a premium of

between $1 and $2 on Thursday. Silver was down 0.4 per cent at $16.09 an ounce, while palladium lost 1.9 per cent to $705.25 after

hitting a 16-month low. Platinum was up 0.1 per cent at $1,082.24.

2

RPMC does not provide trading or investment advice. The information provided in this report is for indicative information only and RPMC assumes no liability

whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on

futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice. RPMC shall have no liability

whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved 2014.

T: +971 50 6526076

E: jeffrey.rhodes@rpmc.ae www.rpmc.ae

Rhodes Precious Metals Consultancy DMCC

RPMC COMMENTARY

Gold

extended

the

previous

weeks

recovery

from

the

dip

to

$1162

to

reach

a

high

of

$1205.50

before

easing

back

to

end

right

on

the

pivotal

$1200

level,

representing

a

gain

of

$19.75

or

1.67%.

Dovish

comments

on

interest

rates

by

Janet

Yellen

provided

the

spark

that

drove

gold

higher

while

the

on

going

Greek

Sovereign

Debt

Tragedy

added

to

the

new

found

bullishness.

A

3.88%

increase

in

open

interest

on

the

COMEX

last

week

points

to

fresh

speculative

buying

entering

the

market

and

the

yellow

metal

seems

poised

to

make

a

pass

at

the

200

day

moving

average

pegged

at

$1206

with

a

clear

break

likely

to

target

$1225

on

the

charts.

Silver

finally

snapped

its

month

long

losing

streak

as

the

industrial

precious

metal

rose

from

a

low

of

$15.83

to

reach

$16.44

before

falling

back

to

end

the

week

up

15

cents

or

0.94%

at

$16.07

bid.

If

gold

is

able

to

make

a

technical

break

to

the

upside,

silver

should

follow

with

the

100-day

MA

at

$16.47

and

the

200-day

MA

at

$16.62

the

likely

targets

on

the

charts.

3

RPMC does not provide trading or investment advice. The information provided in this report is for indicative information only and RPMC assumes no liability

whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on

futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice. RPMC shall have no liability

whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved 2014.

T: +971 50 6526076

E: jeffrey.rhodes@rpmc.ae www.rpmc.ae

Rhodes Precious Metals Consultancy DMCC

Platinum

traded

between

$1089

and

$1070

before

ending

at

$1083

bid,

a

loss

of

$11

or

1.01%

on

the

week.

A

sharp

5.63%

increase

in

open

interest

on

the

NYMEX

suggests

a

combination

of

ETF

hedging

and

chart

short

selling

with

$1000

on

technical

radar

screens.

However

with

gold

looking

to

move

higher

the

noble

metal

seems

likely

to

reclaim

a

foothold

above

$1100

in

the

week

ahead.

Palladium

recent

fall

from

grace

continued

in

spectacular

fashion

last

week

with

the

junior

precious

metal

falling

from

a

high

of

$740

to

end

on

the

lows

at

$707,

a

loss

of

$30

or

4.07%.

Palladium

has

lost

$100

or

over

12%

over

the

last

month

and

is

now

over

$200

or

22%

below

the

13

year

high

of

$910

posted

in

September

2014.

For

a

precious

metal

that

has

a

chronic

supply

deficit

the

month

long

sell-off

makes

no

fundamental

sense

and

surely

this

short-term

speculative

weakness

provides

a

longer-term

bargain

entry

point.

4

RPMC does not provide trading or investment advice. The information provided in this report is for indicative information only and RPMC assumes no liability

whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on

futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice. RPMC shall have no liability

whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved 2014.

T: +971 50 6526076

E: jeffrey.rhodes@rpmc.ae www.rpmc.ae

Rhodes Precious Metals Consultancy DMCC

ABOUT RPMC

Rhodes Precious Metals Consultancy DMCC was established in December 2013 with a strategy to provide consultancy

and advisory services to prospective clients seeking to establish new business activity in physical precious metals, or to

enhance and improve existing businesses, by providing product knowledge, regional expertise, influence and distribution

capability. The founder and Managing Consultant of RPMC, Jeffrey Rhodes, has a proven track record of having built

successful global gold and silver businesses in a number of different corporate structures, geographies and

environments ranging from major bullion banks to regional precious metals trading companies.

SERVICES

RPMC provides consultancy and advisory services to prospective clients seeking to establish new business activity in

physical precious metals, or to enhance and improve existing businesses, by providing product knowledge, regional

expertise, influence and distribution capability. RPMC offers advice on all aspects of the precious metals business

including hedging and risk management products, logistics, pricing and execution of transactions in precious metals. The

consultancy and advisory services cover:

Physical precious metals, including primary and secondary supply, i.e. bullion bars and scrap.

Paper trading of precious metals on a margin basis, including spot and forwards.

Over-the-counter options and other derivatives relating to the underlying physical precious metals.

Precious metals facilities related to the financing of physical flows, i.e. leases, consignments, L/C backed

transactions etc.

Gold jewellery financing on a fully secured basis.

Compliance, KYC, anti-money laundering and responsible supply chain management procedures.

CLIENTS

RPMCs offers its range of consultancy and advisory services to:

Regional Banks and Financial institutions

Government Agencies

Regional Central Banks

Bullion wholesalers and traders

Jewellery manufacturers, wholesalers, retailers

Producers /Mining Companies

Refiners and smelters

HNWs

5

RPMC does not provide trading or investment advice. The information provided in this report is for indicative information only and RPMC assumes no liability

whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on

futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice. RPMC shall have no liability

whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved 2014.

T: +971 50 6526076

E: jeffrey.rhodes@rpmc.ae www.rpmc.ae

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CHP 2 MCQDocument4 pagesCHP 2 MCQfenaNo ratings yet

- 0 - 3. Time DepositDocument19 pages0 - 3. Time DepositGus CahNo ratings yet

- Sbi Life Midcap Fund PerformanceDocument1 pageSbi Life Midcap Fund PerformanceVishal Vijay SoniNo ratings yet

- A. UNIQLO ProductDocument10 pagesA. UNIQLO ProductHải Đoànnn100% (1)

- Project On Indian Financial MarketDocument44 pagesProject On Indian Financial MarketParag More85% (13)

- Lesson Plan in Financial InstrumentsDocument4 pagesLesson Plan in Financial InstrumentsVanessa AngaraNo ratings yet

- Section3 Pepperfry Group1Document5 pagesSection3 Pepperfry Group1Kenny AlphaNo ratings yet

- Inefficient Markets and The New FinanceDocument18 pagesInefficient Markets and The New FinanceMariam TayyaNo ratings yet

- Santander Volatility Trading Primer Part IDocument118 pagesSantander Volatility Trading Primer Part ISakura2709No ratings yet

- Riskometer - SEBI CircularDocument23 pagesRiskometer - SEBI CircularT SrinivasanNo ratings yet

- Jago Gra Hak JagoDocument6 pagesJago Gra Hak JagoNeeraj KumarNo ratings yet

- Balance Sheet of NHPC: - in Rs. Cr.Document10 pagesBalance Sheet of NHPC: - in Rs. Cr.Priscilla LaraNo ratings yet

- Economic Financial IssuingDocument11 pagesEconomic Financial Issuingdamahoj412No ratings yet

- Example of Swaps On Trading PlatformsDocument40 pagesExample of Swaps On Trading PlatformsgagyNo ratings yet

- Practice Test: 1 Bank Balance Sheet and Ratios Estimation Bank A Bank B Ratios For EstimationDocument12 pagesPractice Test: 1 Bank Balance Sheet and Ratios Estimation Bank A Bank B Ratios For EstimationassassaNo ratings yet

- Performance Evaluation of Sharekhan Ltd. With Other Mutual Fund CompaniesDocument108 pagesPerformance Evaluation of Sharekhan Ltd. With Other Mutual Fund CompaniesVaishakh ChandranNo ratings yet

- Indiabulls Ventures (Dhani Services)Document4 pagesIndiabulls Ventures (Dhani Services)Kushagra KejriwalNo ratings yet

- Coffey V Ripple Labs ComplaintDocument32 pagesCoffey V Ripple Labs ComplaintShaurya MalwaNo ratings yet

- Working 1Document2 pagesWorking 1Hà Lê DuyNo ratings yet

- Sugar MethodologyDocument10 pagesSugar Methodologymekarsari retnoNo ratings yet

- Growth of Mutual Funds in IndiaDocument16 pagesGrowth of Mutual Funds in Indiakaur_sunmeetNo ratings yet

- Assignment On Financial System Operative in BangladeshDocument24 pagesAssignment On Financial System Operative in BangladeshShamsul Arefin67% (6)

- Optimization of Intraday Trading Strategy Based On ACD Rules and Pivot Point System in Chinese MarketDocument6 pagesOptimization of Intraday Trading Strategy Based On ACD Rules and Pivot Point System in Chinese MarketMiMNo ratings yet

- Elliot Wave TheoryDocument60 pagesElliot Wave TheoryMatt Hannan100% (3)

- Fins1613 NotesDocument22 pagesFins1613 Notesasyunmwewert100% (1)

- Mutual Funds in IndiaDocument53 pagesMutual Funds in IndiamummydidoNo ratings yet

- Financial Intermediaries PDFDocument44 pagesFinancial Intermediaries PDFKriztel CuñadoNo ratings yet

- Intacc Questions To AnswerDocument12 pagesIntacc Questions To AnswerMichelle Esternon0% (2)

- Derivatives and Foreign Currency TransactionsDocument10 pagesDerivatives and Foreign Currency TransactionsAthaa ParkNo ratings yet

- Acgl S&DM DSDocument2 pagesAcgl S&DM DSJohnsey RoyNo ratings yet