Professional Documents

Culture Documents

Penetration Pricing

Uploaded by

alberto micheliniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Penetration Pricing

Uploaded by

alberto micheliniCopyright:

Available Formats

Penetration pricing

Penetration pricing is a pricing strategy where the price

of a product is initially set low to rapidly reach a wide

fraction of the market and initiate word of mouth.[1]

The strategy works on the expectation that customers

will switch to the new brand because of the lower price.

Penetration pricing is most commonly associated with

marketing objectives of enlarging market share and exploiting economies of scale or experience.[2][3]

Another potential disadvantage is that the low prot margins may not be sustainable long enough for the strategy

to be eective.

Price penetration is most appropriate where:

Product demand is highly price elastic.

Substantial economies of scale are available.

The product is suitable for a mass market (i.e.

enough demand).

Motivation

The product will face sti competition soon after

introduction.

The advantages of penetration pricing to the rm are:[4][5]

It can result in fast diusion and adoption. This can

achieve high market penetration rates quickly. This

can take the competitors by surprise, not giving them

time to react.

There is not enough demand amongst consumers to

make price skimming work.

In industries where standardization is important.

The product that achieves high market penetration

often becomes the industry standard (e.g. Microsoft

Windows) and other products, whatever their merits, become marginalized. Standards carry heavy

momentum.

It can create goodwill among the early adopters

segment. This can create more trade through word

of mouth.

It creates cost control and cost reduction pressures

from the start, leading to greater eciency.

A variant of the price penetration strategy is the bait and

It discourages the entry of competitors. Low prices hook model (also called the razor and blades business

act as a barrier to entry (see Porters 5-forces analy- model), where a starter product is sold at a very low price

sis).

but requires more expensive replacements (such as rells)

It can create high stock turnover throughout the which are sold at a higher price. This is an almost unidistribution channel. This can create critically im- versal tactic in the desktop printer business, with printers

selling in the US for as little as $100 including two ink

portant enthusiasm and support in the channel.

cartridges (often half-full), which themselves cost around

It can be based on marginal cost pricing, which is $30 each to replace. Thus the company makes more

economically ecient.

money from the cartridges than it does for the printer itself.

The main disadvantage with penetration pricing is that it

Taken to the extreme, penetration pricing is known as

establishes long term price expectations for the product,

predatory pricing, when a rm initially sells a product or

and image preconceptions for the brand and company.

service at unsustainably low prices to eliminate competiThis makes it dicult to eventually raise prices. Some

tion and establish a monopoly. In most countries, predacommentators claim that penetration pricing attracts only

tory pricing is illegal, although it can be dicult to difthe switchers (bargain hunters), and that they will switch

ferentiate illegal predatory pricing from legal penetration

away as soon as the price rises. There is much contropricing.

versy over whether it is better to raise prices gradually

over a period of years (so that consumers dont notice),

or employ a single large price increase. A common solution to this problem is to set the initial price at the long 2 Research

term market price, but include an initial discount coupon

(see sales promotion). In this way, the perceived price In an empirical study, Martin Spann, Marc Fischer and

points remain high even though the actual selling price is Gerard Tellis analyze the prevalence and choice of dylow.

namic pricing strategies in a highly complex branded

1

market, consisting of 663 products under 79 brand names

of digital cameras. They nd that, despite numerous recommendations in the literature for skimming or penetration pricing, market pricing dominates in practice. In particular, the authors nd ve patterns: skimming (20% frequency), penetration (20% frequency), and three variants

of market-pricing patterns (60% frequency), where new

products are launched at market prices. Skimming pricing launches the new product 16% above the market price

and subsequently increases the price relative to the market price. Penetration pricing launches the new product

18% below the market price and subsequently lowers the

price relative to the market price. Firms exhibit a mix

of these pricing paths across their portfolios. The specic pricing paths correlate with market, rm, and brand

characteristics such as competitive intensity, market pioneering, brand reputation, and experience eects.[6]

See also

Pricing

Marketing

Microeconomics

Outline of industrial organization

Business model

Price skimming

Sales promotion

References

[1] J Dean (1976). Pricing Policies for New Products. Harvard Business Review 54 (6): 141153.

[2] GJ Tellis (1986). Beyond the Many Faces of Price: An

Integration of Pricing Strategies. Journal of Marketing

50 (October): 146160.

[3] Penetration Pricing

[4] Pricing Strategy Toolkit (with Excel Model)

[5] Penetration Pricing

[6] M Spann, M Fischer, GJ Tellis (2015).

Skimming or Penetration? Strategic Dynamic Pricing for

New Products. Marketing Science 34 (2): 235249.

doi:10.1287/mksc.2014.0891.

REFERENCES

Text and image sources, contributors, and licenses

5.1

Text

Penetration pricing Source: https://en.wikipedia.org/wiki/Penetration_pricing?oldid=668441461 Contributors: Mydogategodshat, Andrewman327, Wik, TexasDex, Khalid hassani, El C, Fgb~enwiki, Maurreen, DG~enwiki, Andrewpmk, SpaceMoose, YurikBot, Joshlk,

Vicarious, KnightRider~enwiki, Bluebot, Deli nk, Dcamp314, Robosh, Jbonneau, Tawkerbot2, Thijs!bot, WinBot, Pan1987, Coin945,

Bobalob, SieBot, SimonTrew, ClueBot, Ideal gas equation, Iohannes Animosus, Addbot, Download, Megaman en m, Daveythedude, Doulos

Christos, PeterEastern, Jakelauer, Zollerriia, Naiveandsilly, F, ClueBot NG, Widr and Anonymous: 31

5.2

Images

5.3

Content license

Creative Commons Attribution-Share Alike 3.0

You might also like

- Functional Leadership ModelDocument3 pagesFunctional Leadership Modelalberto micheliniNo ratings yet

- Elements of Promotional MixDocument2 pagesElements of Promotional MixDominic BulaclacNo ratings yet

- Importance of Pricing in MarketingDocument5 pagesImportance of Pricing in MarketingNasir AlyNo ratings yet

- Consumer Behaviour Case StudyDocument2 pagesConsumer Behaviour Case StudyVivek RokzNo ratings yet

- SWOT AnalysisDocument7 pagesSWOT Analysisalberto micheliniNo ratings yet

- Chapter 8 Pricing StrategyDocument10 pagesChapter 8 Pricing Strategyuser 123No ratings yet

- Chapter+13+Summary MKT MGTDocument12 pagesChapter+13+Summary MKT MGTFerdous MostofaNo ratings yet

- The Major Categories of Pricing Objectives & Pricing Objectives For Nonprofit OrganizationDocument5 pagesThe Major Categories of Pricing Objectives & Pricing Objectives For Nonprofit OrganizationFazrul RosliNo ratings yet

- Product Positioning: Done By, Nidhi SubashDocument11 pagesProduct Positioning: Done By, Nidhi SubashSree LakshmyNo ratings yet

- Evolution To Global MarketingDocument6 pagesEvolution To Global Marketingmohittiwarimahi100% (2)

- Quiz Basic Principles of FinanceDocument22 pagesQuiz Basic Principles of FinanceJosNo ratings yet

- New Product PricingDocument9 pagesNew Product PricingGeorgekutty Saju PooppillilNo ratings yet

- Sample Case StudyDocument1 pageSample Case Studykrako0% (1)

- Principles of Marketing Report On Social Criticism in MarketingDocument29 pagesPrinciples of Marketing Report On Social Criticism in MarketingMara LacsamanaNo ratings yet

- Chapter 11 Pricing StrategiesDocument10 pagesChapter 11 Pricing StrategiesrinmstraNo ratings yet

- Rules or Principles of Business EthicsDocument3 pagesRules or Principles of Business Ethicsutcm77No ratings yet

- A Study On Factors Considered by Consumers For Patronizing A Retail OutletDocument49 pagesA Study On Factors Considered by Consumers For Patronizing A Retail Outletcoolhunkdelhi83% (6)

- FINALconceptG 5Document20 pagesFINALconceptG 5Prime ZibheNo ratings yet

- Crafting The Brand Positioning: Devera, Dianne Lu, Vida Mantos, Charles Valeroso, EuniceDocument19 pagesCrafting The Brand Positioning: Devera, Dianne Lu, Vida Mantos, Charles Valeroso, EuniceEunice ValerosoNo ratings yet

- Service MarketingDocument24 pagesService MarketingacspandayNo ratings yet

- Review QuestionsDocument6 pagesReview QuestionsArjina Arji0% (1)

- Pricing Objectives and MethodsDocument17 pagesPricing Objectives and MethodsRoopesh Kannur83% (6)

- Pricing DecisionDocument3 pagesPricing DecisionRohit RastogiNo ratings yet

- Marketing ManagementDocument12 pagesMarketing Management'Tareque SiddiqueNo ratings yet

- Customers' Roles in Service Delivery: MTG 410 Fall 2000Document13 pagesCustomers' Roles in Service Delivery: MTG 410 Fall 2000Hardik SinghNo ratings yet

- PGP 02 004 - CB Assignment - AjayDocument10 pagesPGP 02 004 - CB Assignment - AjayAjay SundarNo ratings yet

- Market Coverage Strategies-Gaya3Document13 pagesMarket Coverage Strategies-Gaya3Haja Amin100% (1)

- Market SegmentationDocument23 pagesMarket SegmentationRahul AroraNo ratings yet

- Summary Chapter 12: SETTING PRODUCT STRATEGY: Pearson Prentice Hall, 2009Document13 pagesSummary Chapter 12: SETTING PRODUCT STRATEGY: Pearson Prentice Hall, 2009S. M.No ratings yet

- Bon Appetea Review On Related LiteratureDocument6 pagesBon Appetea Review On Related LiteratureDessa VamentaNo ratings yet

- Meaning of MarketingDocument7 pagesMeaning of MarketingkritikanemaNo ratings yet

- Services Marketing-2Document61 pagesServices Marketing-2Harshal Pandav100% (1)

- 17.monopolistic CompetitionDocument36 pages17.monopolistic Competitionsaumya.nanda556780% (5)

- Reflection Paper 1Document5 pagesReflection Paper 1api-556515978No ratings yet

- Workplace DiversityDocument19 pagesWorkplace DiversityLizalyn Dalaodao100% (1)

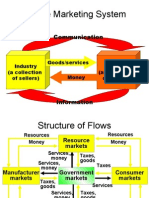

- Simple Marketing System: CommunicationDocument26 pagesSimple Marketing System: CommunicationAshish LallNo ratings yet

- Indifference Curve Analysis PDFDocument24 pagesIndifference Curve Analysis PDFArpita BanerjeeNo ratings yet

- A Market Plan: Unit 2 Marketing EssentialsDocument16 pagesA Market Plan: Unit 2 Marketing EssentialsML FastTrackNo ratings yet

- Made by Divyaneet Kaur Nikita AgrawalDocument16 pagesMade by Divyaneet Kaur Nikita AgrawalKritikaNo ratings yet

- Country Paper: Mang Inasal As A Proposed Business in HongkongDocument35 pagesCountry Paper: Mang Inasal As A Proposed Business in HongkongJerome BadilloNo ratings yet

- Starbucks Price Increase Case StudyDocument3 pagesStarbucks Price Increase Case StudyHyejin LeeNo ratings yet

- Franchise Businesses and Market PerformanceDocument6 pagesFranchise Businesses and Market Performancejmz_12No ratings yet

- Price SegmentationDocument13 pagesPrice SegmentationTerra TuckerNo ratings yet

- Power Organizational BehaviourDocument40 pagesPower Organizational BehaviourRowan RodriguesNo ratings yet

- Managing and Designing ServicesDocument34 pagesManaging and Designing ServicesnithilsajuNo ratings yet

- Department of Management Sciences, University of Gujrat, City CampusDocument6 pagesDepartment of Management Sciences, University of Gujrat, City CampusSabaNo ratings yet

- Entrepreneurial Marketing (Aes 51003) : Prepared For: Prof Madya Noor Hasmini Binti Abd GhaniDocument8 pagesEntrepreneurial Marketing (Aes 51003) : Prepared For: Prof Madya Noor Hasmini Binti Abd GhaniMuhammad Qasim A20D047FNo ratings yet

- BK 1 Cimate ChangeDocument1 pageBK 1 Cimate ChangeAleah Jehan AbuatNo ratings yet

- Introduction To Consumer BehaviourDocument28 pagesIntroduction To Consumer BehaviourShafqat MalikNo ratings yet

- Mark Feasibility StudyDocument1 pageMark Feasibility StudyMark Rivera MediloNo ratings yet

- BAB 7 Market Structure and Output Pricing DecisionsDocument19 pagesBAB 7 Market Structure and Output Pricing DecisionsEunice TzpNo ratings yet

- Service MKTG QuestionsDocument42 pagesService MKTG Questionsjayeshvk80% (5)

- Taguig City University: College of Business ManagementDocument7 pagesTaguig City University: College of Business ManagementDead WalksNo ratings yet

- Reflection 4Document1 pageReflection 4Melen FloresNo ratings yet

- Statement of ObjectivesDocument3 pagesStatement of ObjectivesSarah Hernani DespuesNo ratings yet

- Module 5Document13 pagesModule 5ramya sNo ratings yet

- Group Assignment: QuestionsDocument22 pagesGroup Assignment: Questionssobe2013No ratings yet

- Strama BasicsDocument121 pagesStrama BasicsChristine OrdoñezNo ratings yet

- Foreign Market EntryDocument25 pagesForeign Market EntryShubha Brota RahaNo ratings yet

- Product Line and Product Mix: Hassaan Jamil #14945 Shehroz Adil #10833Document10 pagesProduct Line and Product Mix: Hassaan Jamil #14945 Shehroz Adil #10833Faidz FuadNo ratings yet

- Basics of Strategic and Tactical Pricing: Joy Joseph Collaboration Measurement PricingDocument3 pagesBasics of Strategic and Tactical Pricing: Joy Joseph Collaboration Measurement PricingZe WangNo ratings yet

- Chapter 13 Global Pricing International Marketing 466 Fall 2003Document9 pagesChapter 13 Global Pricing International Marketing 466 Fall 2003tekleyNo ratings yet

- Optimizing Touchpoint ImpactDocument1 pageOptimizing Touchpoint Impactalberto micheliniNo ratings yet

- Family Business Strategies Seminar Series: Fall 2016Document2 pagesFamily Business Strategies Seminar Series: Fall 2016alberto micheliniNo ratings yet

- How Can Food Manufacturers Incentivise Sustainability and Boost GrowthDocument2 pagesHow Can Food Manufacturers Incentivise Sustainability and Boost Growthalberto micheliniNo ratings yet

- Former Royal Dutch Shell Group Planning Coordinator and Author of The Living Company (Growth, Learning and Longevity in Business)Document1 pageFormer Royal Dutch Shell Group Planning Coordinator and Author of The Living Company (Growth, Learning and Longevity in Business)alberto micheliniNo ratings yet

- BC - PRR 9 Month Fy2015 16 en Final 0Document5 pagesBC - PRR 9 Month Fy2015 16 en Final 0alberto micheliniNo ratings yet

- The Institute For Strategy Execution-Strategy Execution CanvasDocument32 pagesThe Institute For Strategy Execution-Strategy Execution Canvasalberto micheliniNo ratings yet

- Situational Leadership TheoryDocument4 pagesSituational Leadership Theoryalberto michelini100% (2)

- Ansoff MatrixDocument3 pagesAnsoff Matrixalberto michelini100% (1)

- Managerial Grid ModelDocument3 pagesManagerial Grid Modelalberto micheliniNo ratings yet

- Specialty FoodsDocument6 pagesSpecialty Foodsalberto micheliniNo ratings yet

- LeadershipDocument19 pagesLeadershipalberto micheliniNo ratings yet

- Crisis ManagementDocument13 pagesCrisis Managementalberto michelini100% (2)

- Change Management: 1 HistoryDocument6 pagesChange Management: 1 Historyalberto micheliniNo ratings yet

- The Kryptonite of Smart DecisionsDocument1 pageThe Kryptonite of Smart Decisionsalberto micheliniNo ratings yet

- News Release: Strong Start To The YearDocument5 pagesNews Release: Strong Start To The Yearalberto micheliniNo ratings yet

- Project ManagementDocument13 pagesProject Managementalberto micheliniNo ratings yet

- Chron - Top 10 Soft Skills For ManagersDocument2 pagesChron - Top 10 Soft Skills For Managersalberto micheliniNo ratings yet

- List of Bean-To-bar Chocolate ManufacturersDocument2 pagesList of Bean-To-bar Chocolate Manufacturersalberto micheliniNo ratings yet

- Barry CallebautDocument4 pagesBarry Callebautalberto micheliniNo ratings yet

- Barry CallebautDocument4 pagesBarry Callebautalberto micheliniNo ratings yet

- Cargill - Guiding PrinciplesDocument1 pageCargill - Guiding Principlesalberto micheliniNo ratings yet

- Marketing Plan OutlineDocument16 pagesMarketing Plan OutlineAttila GárdosNo ratings yet

- Exchange Rates ForecastingDocument25 pagesExchange Rates ForecastingBarrath RamakrishnanNo ratings yet

- Project Planning With Gant Chart TemplateDocument1 pageProject Planning With Gant Chart TemplatePrashant SharmaNo ratings yet

- Bangladesh University of Professionals (BUP) Faculty of Business Studies (FBS)Document71 pagesBangladesh University of Professionals (BUP) Faculty of Business Studies (FBS)শাফায়াতরাব্বিNo ratings yet

- Transitional Housing Business Plan ExampleDocument51 pagesTransitional Housing Business Plan ExampleJoseph QuillNo ratings yet

- Bafin CH01Document5 pagesBafin CH01Sharilyn CasisimanNo ratings yet

- BcgmatrixDocument9 pagesBcgmatrixPenta Anil KumarNo ratings yet

- HBR Case StudyDocument5 pagesHBR Case StudyRahul KumarNo ratings yet

- Penelitian Terdahulu 3Document8 pagesPenelitian Terdahulu 3Muhammad SyahiruddinNo ratings yet

- Final Term Assignment 3 On Cost of Production Report - FIFO CostingDocument2 pagesFinal Term Assignment 3 On Cost of Production Report - FIFO CostingUchiha GokuNo ratings yet

- Black BookDocument50 pagesBlack BookRaj PatelNo ratings yet

- Vaathilil Aa VaathililDocument2 pagesVaathilil Aa VaathililVarghese RyanNo ratings yet

- Internship ReportDocument38 pagesInternship ReportAkshat SharmaNo ratings yet

- Dividend Policy AssignDocument2 pagesDividend Policy AssignAsad RehmanNo ratings yet

- Term Sheet-36Inc-30042018-v2Document3 pagesTerm Sheet-36Inc-30042018-v2harshdeep gumberNo ratings yet

- Carrie Lee The President of Lee Enterprises Was Concerned AbouDocument1 pageCarrie Lee The President of Lee Enterprises Was Concerned AbouAmit PandeyNo ratings yet

- SYDE 262 Assignment 3 Sample SolutionDocument15 pagesSYDE 262 Assignment 3 Sample SolutionRachelNo ratings yet

- Report On CDBLDocument25 pagesReport On CDBLshoumitajNo ratings yet

- Training CatalogueDocument36 pagesTraining CataloguebhavikNo ratings yet

- Interview QuestionsDocument2 pagesInterview Questionsgemrod floranoNo ratings yet

- TAFA Profit SharingDocument5 pagesTAFA Profit SharingRiza D. SiocoNo ratings yet

- Research Proposal PaperDocument8 pagesResearch Proposal Paperunknown name67% (3)

- Unit IV Budgets & Budgetory ControlDocument19 pagesUnit IV Budgets & Budgetory ControlyogeshNo ratings yet

- Karen The SupertraderDocument2 pagesKaren The SupertraderHemant Chaudhari100% (1)

- Income From Business/ProfessionDocument3 pagesIncome From Business/Professionubaid7491No ratings yet

- INI-NSQCS Reg. 10, BuildingDocument1 pageINI-NSQCS Reg. 10, BuildingMark Allen FlorNo ratings yet

- Case StudyDocument3 pagesCase StudyShaikh Ahsan Ali Shabbir HusainNo ratings yet

- Chapter 4 (Salosagcol)Document4 pagesChapter 4 (Salosagcol)Lauren Obrien100% (1)

- 1 Discovery (Director Salonga-Agamata)Document46 pages1 Discovery (Director Salonga-Agamata)TDRO BATANGASNo ratings yet

- Chapter 31 - Multiple ChoiceDocument4 pagesChapter 31 - Multiple ChoiceLorraineMartinNo ratings yet