Professional Documents

Culture Documents

Null

Uploaded by

api-25886697Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Null

Uploaded by

api-25886697Copyright:

Available Formats

Philam Asset Management, Inc.

(PAMI) administers, distributes

and provides investment advisory to seven (7) mutual funds.

PAMI gives shareholders superior yields through active

management, diversification and investment expertise only

organizations with extensive financial muscle can provide.

Philam Dollar Bond Fund, Inc. (PDBF)

April 16, 2010

Investment Objective Commentary

The investment objective of the Philam Dollar Bond Fund, Inc. is long- The Dow Jones Industrial Average finally broke through the

term capital preservation with returns and inflows derived out of 11k barrier on the back of positive developments on Greece’s

investments in fixed income instruments. The fund considers medium to deficit problem. Although Greek Finance Minister George

long-term investment horizons for its shareholders. Papaconstantinou said that Greece is not requesting for a

bailout, he welcomed the rescue package being offered by

Historical Performance the other European governments which would come in the

form of three-year loans of as much as EUR 30 billion with

interest rates below current market levels. On top of the EU

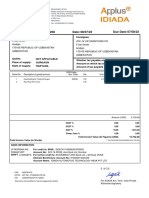

YTD YOY 3 Yrs. 5 Yrs. Since Inception

package, another EUR 15 billion would come from the

2.87% 12.57% 17.98% 39.13% 69.55% International Monetary Fund.

The positive news from the Eurozone, plus better than

NAVPS Graph expected retail sales and earnings report from US

1.7400 corporations including Intel, JPMorgan and UPS, all

contributed to upbeat investor sentiment, which increased

1.6950 demand for riskier assets, including the ROPs. During the

initial rally, locals were seen profit-taking; however, as

1.6500 demand from offshore players seemed non-stop, locals

eventually joined in the buying as well. The “buy Asia” theme

1.6050 of investors was further fueled when South Korea’s credit

rating was upgraded by Moody’s Investor Service from A2 to

1.5600 A1 “prompted by Korea’s demonstration of an exceptional

level of economic resilience to the global crisis, while

1.5150 containing the government’s budget deficit.” As a result,

yields of the ROPs dropped by 15 bps on average compared

1.4700

to the previous week’s level.

1.4250

16-Apr-09 16-Jun-09 16-Aug-09 16-Oct-09 16-Dec-09 16-Feb-10 16-Apr-10

Key Figures

Source: Investment Company of the Philippines published NAVPS Net Asset Value per Share (NAVPS) USD 1.7116

* Past Performance is not indicative of future results

Total Fund Size (in Millions) as of 3/31/10 USD 68.94

PDB YOY return as of 3/31/10 5.59%

Benchmark YOY return as of 3/31/10 6.88%

Top Five Holdings

Inception Date September 13, 2001

Fund Currency US Dollar

ROP 30 9.5% 02FEB30 13.03% Domicile Philippines

ROP 25 10.625% DUE 16MAR25 10.50% Valuation Method Marked-to-Market

Fund Classification Bond Fund

ROP 14 8.25% DUE 15JAN14 9.05%

Risk Profile Low

ROP 15 8.875% DUE 17MAR15 8.92% Minimum Holding Period Six Months

ROP 19N 8.375% DUE 17JUN19 7.94% Redemption Notice Period Three Days

Custodian Bank Citibank N.A.

Transfer Agent Deutsche Bank A.G. (Manila)

Readership: This document is intended solely for the addressee(s). Its content may be legally privileged and/or confidential.

Opinions: Any opinions expressed in this document may be subject to change without notice. We are not soliciting or recommending any action based on this material.

Risk Warning: Past performance is not indicative of future results. Our investment management services relate to a variety of investments, each of which can fluctuate in value. The

value of portfolios we manage may fall as well as rise, and the investor may not get back the full amount originally invested. The investment risks vary between different types of

instruments. For example, for investments involving exposure to a currency other than that in which the portfolio is denominated, changes in the rate of exchange may cause the

value of investments, and consequently the value of the portfolio, to go up or down. In the case of a higher volatility portfolio the loss on realization or cancellation may be very high

(including total loss of investment), as the value of such an investment may fall suddenly and substantially. In making an investment decision, prospective investors must rely on their

own examination of the merits and risks involved.

You might also like

- Tower and Garden VillasDocument11 pagesTower and Garden Villasapi-25886697No ratings yet

- 24K Service, 24 Hours A Day Scope of ServicesDocument1 page24K Service, 24 Hours A Day Scope of Servicesapi-25886697No ratings yet

- NullDocument5 pagesNullapi-25886697No ratings yet

- NullDocument29 pagesNullapi-25886697No ratings yet

- NullDocument20 pagesNullapi-25886697No ratings yet

- GSIS Mutual Fund, Inc. (GMFI) : Historical PerformanceDocument1 pageGSIS Mutual Fund, Inc. (GMFI) : Historical Performanceapi-25886697No ratings yet

- A. Cash PaymentDocument1 pageA. Cash Paymentapi-25886697No ratings yet

- A. Cash PaymentDocument1 pageA. Cash Paymentapi-25886697No ratings yet

- A. Cash PaymentDocument1 pageA. Cash Paymentapi-25886697No ratings yet

- GSIS Mutual Fund, Inc. (GMFI) : Historical PerformanceDocument1 pageGSIS Mutual Fund, Inc. (GMFI) : Historical Performanceapi-25886697No ratings yet

- Bank Account NumbersDocument1 pageBank Account Numbersapi-25886697No ratings yet

- NullDocument20 pagesNullapi-25886697No ratings yet

- Unit Unit Type Floor Area List Price: Light Residences Availability and Pricelist AS OF MAY 9, 2010Document9 pagesUnit Unit Type Floor Area List Price: Light Residences Availability and Pricelist AS OF MAY 9, 2010api-25886697No ratings yet

- Philam Managed Income Fund, Inc. (PMIF) : Investment Objective CommentaryDocument1 pagePhilam Managed Income Fund, Inc. (PMIF) : Investment Objective Commentaryapi-25886697No ratings yet

- Philam Strategic Growth Fund, Inc. (PSGF) : Historical PerformanceDocument1 pagePhilam Strategic Growth Fund, Inc. (PSGF) : Historical Performanceapi-25886697No ratings yet

- Philam Bond Fund, Inc. (PBFI) : Investment Objective CommentaryDocument1 pagePhilam Bond Fund, Inc. (PBFI) : Investment Objective Commentaryapi-25886697No ratings yet

- Chartiss: Your World, InsuredDocument3 pagesChartiss: Your World, Insuredapi-25886697No ratings yet

- NullDocument20 pagesNullapi-25886697No ratings yet

- TF - . - T U, N: Your World, InsuredDocument2 pagesTF - . - T U, N: Your World, Insuredapi-25886697No ratings yet

- Charttsq': Charti, S1)Document2 pagesCharttsq': Charti, S1)api-25886697No ratings yet

- NullDocument22 pagesNullapi-25886697No ratings yet

- NullDocument4 pagesNullapi-25886697No ratings yet

- Chartt S (': Chartis)Document2 pagesChartt S (': Chartis)api-25886697No ratings yet

- C Harti S / ': Chartis+Document2 pagesC Harti S / ': Chartis+api-25886697No ratings yet

- Makati Affiliates: Premium ScheduleDocument2 pagesMakati Affiliates: Premium Scheduleapi-25886697No ratings yet

- Chartis) .: Chartrst''Document2 pagesChartis) .: Chartrst''api-25886697No ratings yet

- Charti56: Your World, InsuredDocument2 pagesCharti56: Your World, Insuredapi-25886697No ratings yet

- .. Carmona ExitDocument42 pages.. Carmona Exitapi-25886697No ratings yet

- .. Carmona ExitDocument42 pages.. Carmona Exitapi-25886697No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cash Cash Equivalents Reviewer2Document9 pagesCash Cash Equivalents Reviewer2anor.aquino.upNo ratings yet

- Indus Motor Company LTD (Ratio Analysis)Document132 pagesIndus Motor Company LTD (Ratio Analysis)mansoor28100% (2)

- Capital Intensive Labor Intensive: Required: Determine The FollowingDocument2 pagesCapital Intensive Labor Intensive: Required: Determine The FollowingMahediNo ratings yet

- Ae Sce Presentation Group 14Document11 pagesAe Sce Presentation Group 14Kisan KhuleNo ratings yet

- This Study Resource WasDocument7 pagesThis Study Resource WasAlexandr VerrellNo ratings yet

- Institutional Framework For Small Business DevelopmentDocument59 pagesInstitutional Framework For Small Business DevelopmentNishantpiyooshNo ratings yet

- Order in The Matter of M/s Kinetic Capital Services Limited & M/s Shubh International LimitedDocument8 pagesOrder in The Matter of M/s Kinetic Capital Services Limited & M/s Shubh International LimitedShyam SunderNo ratings yet

- Banking License ApplicationDocument22 pagesBanking License ApplicationFrancNo ratings yet

- Barriers To Entry: Resilience in The Supply ChainDocument3 pagesBarriers To Entry: Resilience in The Supply ChainAbril GullesNo ratings yet

- Example - Recovery AmountDocument11 pagesExample - Recovery AmountAAKANKSHA BHATIANo ratings yet

- Financial Services CICDocument19 pagesFinancial Services CICAashan Paul100% (1)

- Top Companies in Vapi GujaratDocument9 pagesTop Companies in Vapi GujaratNimesh C VarmaNo ratings yet

- The Contemporary World Activity (Essay)Document2 pagesThe Contemporary World Activity (Essay)rose revillaNo ratings yet

- Organizational Culture in 40 CharactersDocument18 pagesOrganizational Culture in 40 CharactersParva ChandaranaNo ratings yet

- Managing Human Resources, 4th Edition Chapters 1 - 17Document49 pagesManaging Human Resources, 4th Edition Chapters 1 - 17Aamir Akber Ali67% (3)

- Accounting Cycle of A Service Business-Step 3-Posting To LedgerDocument40 pagesAccounting Cycle of A Service Business-Step 3-Posting To LedgerdelgadojudithNo ratings yet

- Sustainability Planning Workshop Budget ProposalDocument7 pagesSustainability Planning Workshop Budget ProposalArnel B. PrestoNo ratings yet

- Micro Credit PresentationDocument33 pagesMicro Credit PresentationHassan AzizNo ratings yet

- IINP222300238 JSC JV Homologation - 220714 - 110521Document1 pageIINP222300238 JSC JV Homologation - 220714 - 110521Gayrat KarimovNo ratings yet

- Estimating Air Travel Demand Elasticities Final ReportDocument58 pagesEstimating Air Travel Demand Elasticities Final Reportch umairNo ratings yet

- AutoDocument11 pagesAutorocky700inrNo ratings yet

- BASIC ACCOUNTING - PARTNERSHIP ADMISSIONSDocument26 pagesBASIC ACCOUNTING - PARTNERSHIP ADMISSIONSVincent Larrie MoldezNo ratings yet

- BVDCDocument22 pagesBVDCErica CruzNo ratings yet

- Genjrl 1Document1 pageGenjrl 1Tiara AjaNo ratings yet

- PPGE&C Payroll 22 022422gDocument1 pagePPGE&C Payroll 22 022422gjadan tupuaNo ratings yet

- ALIGNINGDocument16 pagesALIGNINGgianlucaNo ratings yet

- mgmt09 Tif08Document30 pagesmgmt09 Tif08Sishi WangNo ratings yet

- Indian Securities Market ReviewDocument221 pagesIndian Securities Market ReviewSunil Suppannavar100% (1)

- Report On Non Performing Assets of BankDocument53 pagesReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- Solution Manual For Financial Accounting Information For Decisions 9th Edition John WildDocument41 pagesSolution Manual For Financial Accounting Information For Decisions 9th Edition John WildMadelineShawstdf100% (39)