Professional Documents

Culture Documents

Monte Carlo Oil and Gas Reserve Estimation 080601

Uploaded by

Shaho Abdulqader MohamedaliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monte Carlo Oil and Gas Reserve Estimation 080601

Uploaded by

Shaho Abdulqader MohamedaliCopyright:

Available Formats

Lumenaut Ltd.

Introduction to Monte Carlo

Simulation

Oil and Gas

Reserve Estimation

2008

Lumenaut Ltd.

Contents

Introduction to Modeling

Monte Carlo Method

An Oil and Gas Example Reserve Estimation

Lumenaut Ltd.

Introduction to Modeling

Lumenaut Ltd.

Numerical Models

All numerical models have input values

Input values can be a discrete number such as

1, 5, 621 or continuous such as 1.234532 or

99.23421

The input value may be absolutely certain or

stochastic (follows a random pattern)

Stochastic input values the norm in models,

absolute certainty is a luxuary

Lumenaut Ltd.

Stochastic Models

The input values will follow any one of the

numerous statistical distributions, for example

the Normal Distribution or the Uniform

Distribution

For example, population height follows the

normal distribution

Selection of distribution depends on scientific

observation of historical data and professional

judgment

Lumenaut Ltd.

Limitation of Stochastic Models

Stochastic models by their very nature cannot be

calculated definitively, unlike say the floor area

of your office (length x breadth = total area)

Stochastic models do provide the average

answer (assuming that all input values represent

the average input value) but tell you nothing of

the range or probability of possible answers.

This can be critical when determining the likely

profitability of a venture, safety of a drug or

building

Lumenaut Ltd.

Monte Carlo Method

Lumenaut Ltd.

The Monte Carlo Method

A method of random sampling the Stochastic

input values to provide a picture of the output

distribution values and probabilities

The quality of the random number generator is

critical, Lumenaut used the Mersenne twister

algorithm

The Monte Carlo Method Details

Lumenaut Ltd.

One iteration random samples each stochastic

input, setting up a new set of input values

The model then takes these inputs and

calculates the outputs

These outputs are recorded

The process is repeated x time until sufficient

repeat samples are collected to provide a

probability breakdown for a range of output

values

Lumenaut Ltd.

An Oil and Gas Example

Lumenaut Ltd.

An Oil and Gas Example

Calculation of potential oil reserves

Limited information available of extent of

reserve, rock type, pressure, gas content, water

content, and percentage recoverable

hydrocarbons

Use Monte Carlo Method to bracket uncertainty

Lumenaut Ltd.

Oil Reserve Equation

Hydrocarbon in Place = GRV x N/G x Porosity x Sh / FVF

Gross Rock volume - amount of rock in the trap above the

hydrocarbon water contact

N/G - net/gross ratio - percentage of the GRV formed by the

reservoir rock ( range is 0 to 1)

Porosity - percentage of the net reservoir rock occupied by

pores (typically 55-35%)

Sh - hydrocarbon saturation - some of the pore space is filled

with water - this must be discounted

FVF - formation volume factor - oil shrinks and gas expands

when brought to the surface. The FVF converts volumes at

reservoir conditions (high pressure and high temperature) to

storage and sale conditions

Lumenaut Ltd.

Recoverable Hydrocarbons

Recoverable Hydrocarbons = Hydrocarbons in Place x

Percentage Recoverable Hydrocarbons

Recoverable hydrocarbons - amount of hydrocarbon

likely to be recovered during production. This is

typically 1010-50% in an oil field and 5050-80% in a gas

field.

Lumenaut Ltd.

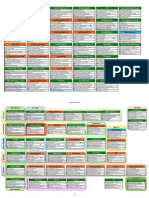

The Lumenaut Excel Monte

Carlo Model

Variables

GRV (cubic kilometers)

N/G

Porosity (%)

Water Saturation (%)

FWF

Values

0.10

50%

15%

25%

1.3

Total Oil Reserves (million cubic meters)

Total Oil Reserves (Million Stock Tank Barrels)

4.327

27.22

Recoverable Hydrocarbons

45%

Total Recoverable Oil (cubic kilometers)

Total Recoverable Oil (Million Barrels)

1.95

12.25

See accompanying Excel Model Oil Reserve Estimation.xls

Lumenaut Ltd.

Explanation

Cells in Green Represent Input Values

Cells in Orange Represent Output Value, in this

case the Total Recoverable Oil in Million Barrels

Lumenaut Ltd.

Inputs Settings

GRV (cubic kilometers)

Cell Name:

Model!$B$6

Cell:

Normal

Distribution:

0.1

Mean:

0.01

SD:

0.06

Min:

0.14

Max:

Cell Name:

Cell:

Distribution:

Mean:

SD:

Min:

Max:

N/G

Model!$B$7

Normal

0.5

0.05

0.23

0.7

Porosity

Model!$B$8

Normal

0.15

0.01

0.11

0.19

Cell Name:

Cell:

Distribution:

Min Point

Mid Point

Max Point

Min:

Water Saturation

Model!$B$9

Triangular

0.184

0.25

0.3

0.184

Cell Name:

Cell:

Distribution:

Mean:

SD:

Min:

Max:

Lumenaut Ltd.

Input Settings

Cell Name:

Cell:

Distribution:

Mean:

SD:

Min:

Max:

FWF

Model!$B$10

Normal

1.3

0.1

1.0

1.7

Cell Name:

Cell:

Distribution:

Mean:

Min:

Max:

Recoverable

Hydrocarbons

Model!$B$15

Uniform

0.45

0.48

Recoverable

Hydrocarbons

Lumenaut Ltd.

Simulation Results

400

0.04

350

0.035

300

0.03

250

0.025

200

0.02

150

0.015

100

0.01

50

0.005

0

5.47

9.88

14.28

18.69

Total Recoverable Oil (Million Barrels)

23.09

Probability

Frequency

Model Run for 10,000 iterations

Lumenaut Ltd.

What Does this Mean?

The distribution of expected possible oil reserves

follows a log normal distribution

Lumenaut Ltd.

Simulation Results

Total Recoverable Oil (Million Barrels)

Mean

Median

Mode

Stand. Deviation

Variance

Mean Std. Error

Range

Range Min

Range Max

Skewness

Kurtosis

12.38

12.15

N/A

2.54

6.45

0.03

20.98

5.26

26.24

0.59

0.74

Lumenaut Ltd.

What Does this Mean?

The average expected oil reserve is 12.4 million

barrels

The minimum expected oil reserve is 5.26 million

barrels and the maximum expected oil reserve is

26.24 million barrels

Lumenaut Ltd.

Simulation Results

Total Recoverable Oil (Million Barrels)

Percentile

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Min to Max

5.26

9.32

10.23

10.94

11.58

12.15

12.77

13.49

14.34

15.70

26.24

Lumenaut Ltd.

What Does this Mean?

10 percent chance that reserves will be between

5.26 and 9.319 million barrels

50 percent chance that reserves will

5.26 and 12.149 million barrels

50 percent chance that reserves will

12.15 and 26.24 million barrels

20 percent chance that reserves will

11.58 and 12.769 million barrels

10 percent chance that reserves will

15.7 and 26.24 million barrels

be between

be between

be between

be between

Lumenaut Ltd.

How can we use the Results?

Can be used to determine whether risks of

extraction outweigh the rewards of extraction

This can be done economically if add cost of

extraction/transportation and expected price of

oil to the model then can calculate range of

revenues and profits together with probabilities

Comparisons can be made with other oil

extraction options company may have to

determine most likely productive field.

You might also like

- Lecture7 Reserve EstimationDocument37 pagesLecture7 Reserve EstimationAkhil GodavarthiNo ratings yet

- Quantifying Uncertainty in Subsurface SystemsFrom EverandQuantifying Uncertainty in Subsurface SystemsCéline ScheidtNo ratings yet

- Hydrocarbon Fluid Inclusions in Petroliferous BasinsFrom EverandHydrocarbon Fluid Inclusions in Petroliferous BasinsNo ratings yet

- How Should I Prepare and Which Books Should I Refer To For Petroleum Engineering in The GATEDocument6 pagesHow Should I Prepare and Which Books Should I Refer To For Petroleum Engineering in The GATEPradyumna Singh RathoreNo ratings yet

- Schedule 03Document70 pagesSchedule 03Tarek HassanNo ratings yet

- Scope of Tight Gas ReservoirDocument26 pagesScope of Tight Gas ReservoirMuhammad Jahangir100% (1)

- Reservoir Simulation StudyDocument143 pagesReservoir Simulation StudyKunal Khandelwal0% (1)

- Exploiting the Digital Oilfield: 15 Requirements for Business ValueFrom EverandExploiting the Digital Oilfield: 15 Requirements for Business ValueRating: 5 out of 5 stars5/5 (1)

- Petroleum EconomicDocument97 pagesPetroleum EconomicAli A.FalihNo ratings yet

- Examples - Heavy Oil Reservoirs Field Development PlanDocument4 pagesExamples - Heavy Oil Reservoirs Field Development PlanChukwunoso NwonyeNo ratings yet

- Reserve Estimation Using Volumetric Method PDFDocument6 pagesReserve Estimation Using Volumetric Method PDFFauji Islami PhasyaNo ratings yet

- EOR Sim - MZA4Document16 pagesEOR Sim - MZA4Tpegteam TrainingNo ratings yet

- Economic CalculationsDocument26 pagesEconomic CalculationsYudis TiraNo ratings yet

- Oil and Gas Reserves and Resource QuantificationDocument21 pagesOil and Gas Reserves and Resource QuantificationKalou Boni100% (1)

- Introduction To Reservoir EngineeringDocument82 pagesIntroduction To Reservoir Engineeringweldsv50% (2)

- Reservoir Simulation FSDocument225 pagesReservoir Simulation FSEl Moustapha Ould CheikhNo ratings yet

- Special Core AnalysisDocument18 pagesSpecial Core AnalysisDorothy Ampomah100% (1)

- Reserves EstimationDocument17 pagesReserves EstimationMcLean McLean McLeanNo ratings yet

- ECLIPSE SimulationDocument34 pagesECLIPSE SimulationKaoru AmaneNo ratings yet

- PERFORM - Nodal Analysis by ExampleDocument2 pagesPERFORM - Nodal Analysis by ExampleAlfonso R. ReyesNo ratings yet

- Deepwater Sedimentary Systems: Science, Discovery, and ApplicationsFrom EverandDeepwater Sedimentary Systems: Science, Discovery, and ApplicationsJon R. RotzienNo ratings yet

- Part 8 - Type Curve AnalysisDocument37 pagesPart 8 - Type Curve AnalysisChai CwsNo ratings yet

- Basic Parameters in Reservoir Simulation For Good Performance MatchingDocument18 pagesBasic Parameters in Reservoir Simulation For Good Performance MatchingkrishNo ratings yet

- Well Test Analysis in Volatile Oil ReservoirsDocument18 pagesWell Test Analysis in Volatile Oil ReservoirsDICKSON TOYO100% (1)

- Lecture 4 - Decline Curve AnalysisDocument41 pagesLecture 4 - Decline Curve Analysisgeber39No ratings yet

- Production PerformanceDocument25 pagesProduction PerformanceBreave HeartNo ratings yet

- Advanced Production Engineering Chapter # 1: Fall 2021Document167 pagesAdvanced Production Engineering Chapter # 1: Fall 2021Ali KiasariNo ratings yet

- InternshipWork RoselbaCanelon ARCS2007Document106 pagesInternshipWork RoselbaCanelon ARCS2007Alejandra AmayaNo ratings yet

- Bourdet vs. Additional Derivatives: In/heshammokhtaraliDocument11 pagesBourdet vs. Additional Derivatives: In/heshammokhtaralimanish.7417No ratings yet

- Upstream Process Engineering Course: 1. Hydrocarbon Phase BehaviourDocument43 pagesUpstream Process Engineering Course: 1. Hydrocarbon Phase BehaviourMohamed Ali100% (1)

- Lecture - 5 - Gas in Place B MBE of Dry and Wet Gas Reservoirs (Compatibility Mode)Document47 pagesLecture - 5 - Gas in Place B MBE of Dry and Wet Gas Reservoirs (Compatibility Mode)Ibrahim_Kocabas100% (1)

- Assignment 1 - ProsperDocument9 pagesAssignment 1 - ProsperMuhammad Amirullah SanadiNo ratings yet

- Reservoir Performance and PredictionDocument33 pagesReservoir Performance and PredictionBishal SarkarNo ratings yet

- Oil Field DevelopmentDocument7 pagesOil Field DevelopmentbaharuNo ratings yet

- 07 CMOST TutorialDocument35 pages07 CMOST TutorialAnonymous Wo8uG3ayNo ratings yet

- Week 2 Dump FloodDocument20 pagesWeek 2 Dump FloodMuhamad HairulNo ratings yet

- Van Dorp - JohanDocument42 pagesVan Dorp - JohanVishakha GaurNo ratings yet

- ARS-Day1 1of 3Document259 pagesARS-Day1 1of 3oilkgas31No ratings yet

- 7 Reserves ClassificationDocument7 pages7 Reserves Classificationzain834No ratings yet

- Class 40-41 (General Material Balance Equation and Application) (Compatibility Mode)Document46 pagesClass 40-41 (General Material Balance Equation and Application) (Compatibility Mode)Sagar DadhichNo ratings yet

- Integrated Field Modeling and OptimizationDocument158 pagesIntegrated Field Modeling and OptimizationMossad Khôi NguyênNo ratings yet

- Gas Well Deliverability I 2018Document33 pagesGas Well Deliverability I 2018Johny Imitaz0% (1)

- 2014 CMOST PresentationDocument86 pages2014 CMOST Presentationc3781794100% (1)

- Pressure Drawdown AnalysisDocument14 pagesPressure Drawdown AnalysisSyed DzafeerNo ratings yet

- Well Test Interpretation: Okafor StanleyDocument30 pagesWell Test Interpretation: Okafor StanleyChukwuebukaNo ratings yet

- BasicPetro 2 PDFDocument157 pagesBasicPetro 2 PDFNamwangala Rashid NatinduNo ratings yet

- Calculation Procedures - Reserve EstimationDocument8 pagesCalculation Procedures - Reserve EstimationSuta VijayaNo ratings yet

- Reserves Certification Report For The Rubiales Field, ColombiaDocument124 pagesReserves Certification Report For The Rubiales Field, Colombiawhales20985No ratings yet

- PIPESIM Fundamentals: Workflow/Solutions TrainingDocument206 pagesPIPESIM Fundamentals: Workflow/Solutions TrainingFco Ignacio CamineroNo ratings yet

- PZ Cum User ManualDocument6 pagesPZ Cum User ManualxielfNo ratings yet

- Scal UgDocument240 pagesScal UgKuanysh ZhassymbekNo ratings yet

- Summary & Schedule SectionDocument33 pagesSummary & Schedule SectionAkmuhammet MammetjanovNo ratings yet

- CH 1 Introduction To Reservoir Modelling SimulationDocument59 pagesCH 1 Introduction To Reservoir Modelling Simulationनाइम दीन100% (2)

- Ecl TDDocument1,018 pagesEcl TDAngel Da SilvaNo ratings yet

- Estimation of Oil & Gas: by DR Anil KumarDocument40 pagesEstimation of Oil & Gas: by DR Anil KumarHemant Srivastava100% (1)

- GRM-chap1-gas Mat BalDocument31 pagesGRM-chap1-gas Mat BalahmedNo ratings yet

- Practical Petroleum Geochemistry for Exploration and ProductionFrom EverandPractical Petroleum Geochemistry for Exploration and ProductionNo ratings yet

- Time Lapse Approach to Monitoring Oil, Gas, and CO2 Storage by Seismic MethodsFrom EverandTime Lapse Approach to Monitoring Oil, Gas, and CO2 Storage by Seismic MethodsNo ratings yet

- عمليات المعالجة الأولية للنفط الخام PDFDocument32 pagesعمليات المعالجة الأولية للنفط الخام PDFShaho Abdulqader Mohamedali100% (3)

- Head Loss ProblemsDocument28 pagesHead Loss ProblemsShaho Abdulqader MohamedaliNo ratings yet

- 16605 نتائج الزمالة الهنغارية 2019-2020 PDFDocument7 pages16605 نتائج الزمالة الهنغارية 2019-2020 PDFShaho Abdulqader MohamedaliNo ratings yet

- EOR Lecture 1 PDFDocument23 pagesEOR Lecture 1 PDFShaho Abdulqader MohamedaliNo ratings yet

- Write There's, There Are, There Isn't, or There Aren't. Look at The Pictures and Circle The Correct Word(s)Document2 pagesWrite There's, There Are, There Isn't, or There Aren't. Look at The Pictures and Circle The Correct Word(s)Shaho Abdulqader MohamedaliNo ratings yet

- EOR Lecture 2Document31 pagesEOR Lecture 2Shaho Abdulqader MohamedaliNo ratings yet

- For Since AgoDocument1 pageFor Since AgoShaho Abdulqader MohamedaliNo ratings yet

- IPM BrochureDocument27 pagesIPM BrochureAli Ahmed PathanNo ratings yet

- Basics of Well CompletionDocument40 pagesBasics of Well CompletionBevin Babu100% (3)

- Can CouldDocument2 pagesCan CouldShaho Abdulqader MohamedaliNo ratings yet

- Formation Prod AcidgbDocument2 pagesFormation Prod AcidgbShaho Abdulqader MohamedaliNo ratings yet

- Sulfur Recovery PDFDocument32 pagesSulfur Recovery PDFShaho Abdulqader Mohamedali0% (1)

- Lectures 1-2 - Natural Gas Production-I (1) - 2Document23 pagesLectures 1-2 - Natural Gas Production-I (1) - 2محمد سعيدNo ratings yet

- 12.1 Matrices: Multiplying A Matrix and A VectorDocument6 pages12.1 Matrices: Multiplying A Matrix and A VectorShaho Abdulqader MohamedaliNo ratings yet

- Lectures 1-2 - Natural Gas Production-I (1) - 2Document23 pagesLectures 1-2 - Natural Gas Production-I (1) - 2محمد سعيدNo ratings yet

- Gas Plant 1Document90 pagesGas Plant 1Murali MuthuNo ratings yet

- Reservoir Stimulation PresentationDocument29 pagesReservoir Stimulation PresentationShaho Abdulqader MohamedaliNo ratings yet

- Mai, A. and Kantzas, A.: Heavy Oil Waterflooding: Effects of Flow Rateand Oil ViscosityDocument12 pagesMai, A. and Kantzas, A.: Heavy Oil Waterflooding: Effects of Flow Rateand Oil ViscositySolenti D'nouNo ratings yet

- Chapter 0 ADocument13 pagesChapter 0 AEarlJaysonAlvaranNo ratings yet

- Electrotech Opps Tr113836Document148 pagesElectrotech Opps Tr113836upesddn2010No ratings yet

- Hydrocarbon Reserves-Estimation, Classification and Importance in Evaluation of Exploration ProjectsDocument6 pagesHydrocarbon Reserves-Estimation, Classification and Importance in Evaluation of Exploration ProjectsShaho Abdulqader MohamedaliNo ratings yet

- Windows 8 - Notice PDFDocument1 pageWindows 8 - Notice PDFSanthosh KumarNo ratings yet

- Pressure Transient Analysis - Houston UniversityDocument68 pagesPressure Transient Analysis - Houston UniversityPuji Lestari100% (3)

- Acp PF4 Pipeline Compressor StationsDocument1 pageAcp PF4 Pipeline Compressor StationsShaho Abdulqader MohamedaliNo ratings yet

- Compressor StationsDocument4 pagesCompressor StationsPierre Alessandro MarcotulliNo ratings yet

- IEICOS Boys Gas Calorimeter Catalog 2011Document1 pageIEICOS Boys Gas Calorimeter Catalog 2011Shaho Abdulqader MohamedaliNo ratings yet

- PGT004 Pressure Reduction STN TrainingDocument9 pagesPGT004 Pressure Reduction STN TrainingShaho Abdulqader MohamedaliNo ratings yet

- Prince Rupert Natural Gas Transmission Compressor Station Basics Factsheet TranscanadaDocument2 pagesPrince Rupert Natural Gas Transmission Compressor Station Basics Factsheet TranscanadaShaho Abdulqader MohamedaliNo ratings yet

- TDW Pipeline Pigging CatalogDocument135 pagesTDW Pipeline Pigging CatalogShaho Abdulqader Mohamedali100% (1)

- Ankit FadiaDocument7 pagesAnkit FadiaavinashnagareNo ratings yet

- CS304 QUIZ 1 SOLVED 2021 by Lon MuskDocument63 pagesCS304 QUIZ 1 SOLVED 2021 by Lon MuskAsif100% (1)

- EMM 3-24DC/500AC/xx-EXM-IFS: DTM DescriptionDocument48 pagesEMM 3-24DC/500AC/xx-EXM-IFS: DTM DescriptionRichard Emmanuel Canche GarcíaNo ratings yet

- h18069 Dell Emc Powerstore Microsoft Hyper V Best PracticesDocument70 pagesh18069 Dell Emc Powerstore Microsoft Hyper V Best PracticesraghuNo ratings yet

- UntitledDocument205 pagesUntitledEdgardo ChavezNo ratings yet

- Name: Sabia Tasleem ENROLLMENT NO: 166756687 Programme Code: Mca 3 SEM Course Code: Mcs042 Data Communication and Computer NetworkDocument51 pagesName: Sabia Tasleem ENROLLMENT NO: 166756687 Programme Code: Mca 3 SEM Course Code: Mcs042 Data Communication and Computer NetworkSunil SharmaNo ratings yet

- x86 Instruction ListingsDocument53 pagesx86 Instruction ListingsHardav RavalNo ratings yet

- How To Build A B-737 300/800 Throttle QuadrantDocument15 pagesHow To Build A B-737 300/800 Throttle QuadrantCristianEnacheNo ratings yet

- CIS 18 Critical Security Controls Checklist: Learn How To Achieve CIS® ComplianceDocument6 pagesCIS 18 Critical Security Controls Checklist: Learn How To Achieve CIS® ComplianceJuan Eduardo ReyesNo ratings yet

- To Computers Information TechnologyDocument675 pagesTo Computers Information TechnologyLin1990No ratings yet

- LRC099-04BT1G: 4-Channel Low Capacitance Esd Protection Diodes ArrayDocument5 pagesLRC099-04BT1G: 4-Channel Low Capacitance Esd Protection Diodes ArrayAndy Díaz MorenoNo ratings yet

- Exercise No 3 Java SwingDocument10 pagesExercise No 3 Java SwingJaysonNo ratings yet

- Saylani Module One OutlineDocument3 pagesSaylani Module One OutlineMaaz AdreesNo ratings yet

- 00 IntroductionDocument14 pages00 IntroductionManishNo ratings yet

- PTV Vision VISUM - Brochure PDFDocument8 pagesPTV Vision VISUM - Brochure PDFSankalp Suman ChandelNo ratings yet

- Policy and ProceduresDocument71 pagesPolicy and ProceduresNadia AfzalNo ratings yet

- Caso Dell 2009Document18 pagesCaso Dell 2009MaSter TopsNo ratings yet

- S7 Service 1 Course (ST-SERV1) : Short DescriptionDocument2 pagesS7 Service 1 Course (ST-SERV1) : Short DescriptionIndustrial ItNo ratings yet

- Digital Signal Processing PROF. S. C. Dutta Roy Department of Electrical Engineering IIT Delhi Discrete Fourier Transform (D F T Cont.) Lecture-10Document15 pagesDigital Signal Processing PROF. S. C. Dutta Roy Department of Electrical Engineering IIT Delhi Discrete Fourier Transform (D F T Cont.) Lecture-10Sudha PatelNo ratings yet

- 23082022Document23 pages23082022Kritika AgrawalNo ratings yet

- Journeys 2012Document76 pagesJourneys 2012Vamsi VirajNo ratings yet

- Std::string Std::wstring Std::basic - String Std::u16string Std::u32stringDocument9 pagesStd::string Std::wstring Std::basic - String Std::u16string Std::u32stringSumegh BelekarNo ratings yet

- CHANGE 2 BY GERD LEONHARD VideoDocument2 pagesCHANGE 2 BY GERD LEONHARD VideoBotany KC Anne Sevilleja-BrionesNo ratings yet

- Audit Preparation - HANADocument5 pagesAudit Preparation - HANAZORRONo ratings yet

- Is Battlefield 2042 Cross-Platform Current Cross-Play Status - Charlie INTELDocument1 pageIs Battlefield 2042 Cross-Platform Current Cross-Play Status - Charlie INTELAustin RussellNo ratings yet

- Curriculam Vitae: Lavanya E Email: Mob: +Document4 pagesCurriculam Vitae: Lavanya E Email: Mob: +Vishal FernandesNo ratings yet

- Fortios v6.4.1 Release NotesDocument46 pagesFortios v6.4.1 Release NotesRafael UlmusNo ratings yet

- Biological Computers: Seminar Report OnDocument23 pagesBiological Computers: Seminar Report OnSeshasai Nandi RajuNo ratings yet

- M29F080DDocument37 pagesM29F080DHELVER GIOVANNI RODRIGUEZ VEGANo ratings yet