Professional Documents

Culture Documents

MBAA 518 Online Syllabus 0515

Uploaded by

HeatherCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBAA 518 Online Syllabus 0515

Uploaded by

HeatherCopyright:

Available Formats

MBAA 518

Managerial Finance

Online Course Syllabus

Credit Hours: 3

Delivery Method: Online (Internet)

Required Course Materials

Ross, S.A., Westerfield, R.W. and Jaffe, J.F. (2013). Corporate

finance (10th edition). New York, NY: McGraw Hill.

ISBN 978-0-07-803477-0

Suggested Supplemental Materials

American Psychological Association. (2010). Publication manual of the

American Psychological Association (6th ed.). Washington, DC:

Author.

ISBN: 978-1-4338-0561-5

(APA website: http://www.apastyle.org/manual/index.aspx)

Course Description

This course focuses on the theoretical and practical approaches to effective financial

management. Planning, analyzing and controlling investment and short and long term

financing are examined for decision making purposes. Emphasis is placed on the

application of these methods in business settings. Topics include investment (capital

budgeting, risk and diversification), financing (debt and equity), payouts (dividends and

other payouts) and financial derivatives (options and futures).

Prerequisite(s): Satisfactory completion of Business Foundation courses, and/or permission of

the Graduate Program Chair.

This syllabus was developed for online learning by Dr. Ron Mau

MBAA_518_Online_Syllabus_0515.doc

Page 2 of 6

Course Goals

1. Develop an understanding of financial markets and the general environment in which

business operates

2. Develop an understanding of the qualitative and judgmental factors of financial decisionmaking under conditions of uncertainty.

3. Develop the skill to use modern quantitative methods in a structured procedure for

reaching a financial decision.

4. Equip the business manager with the capability of evaluating the financial impact of a

business decision under conditions of risk.

5. Develop economic intuition used in the financial decision making process.

Learning Outcomes

Upon successful completion of this course, the student will be able to:

1.

2.

3.

4.

Evaluate financial ratios.

Apply time value of money

Apply concepts of security valuation to value stocks and bonds.

Apply appropriate analytical techniques to investment opportunities (i.e. discounted cash

flow (DCF), internal rate of return (IRR), net present value(NPV)).

5. Describe the cost of capital and its determinants.

6. Analyze simple portfolios using modern portfolio theory (MFT).

7. Describe the effects of taxes on calculating cash flows and the determination of capital

structure.

8. Evaluate firm payout policies.

9. Discuss the use of financial derivatives to manage risk.

10. Analyze simple applications of financial derivatives.

11. Produce a concise research report of an investment opportunity by applying the various

concepts and analytical techniques from the course.

Grading

These are the major assignments in the course and will be the basis for evaluation according to

the grading scale shown in the table below.

Course Grade Scale

Evaluation Items & Weights

90 100%

Discussion

10%

80 89%

Readings Quizzes

10%

70 79%

Problem Sets

20%

60 69%

Short Papers

20%

59%

Midterm

20%

Final Paper

20%

Page 3 of 6

Discussions: (10 pct.)

Discussions are assigned in activities 1.7, 4.6, 6.5, 7.5, and 9.5. One posting is required and

responses to others are required as well (minimum of two). Your responses should be written

and make a substantive contribution to the discussion.

Readings Quizzes: (10 pct.)

Each module has a timed quiz that covers the material from the readings. These questions are

multiple choice and the quizzes will be timed. The allotted time is dependent upon the number

of questions in a given quiz. There is an option to take these quizzes twice. However, your last

attempt of the quiz is the recorded grade. Be sure to read the Important Quiz Information

located under the Course Specific Resources content in the Modules area of the course.

Problem Sets: (20 pct.)

Each module has a problem set. The problem sets have from 2 to 9 problems. Problems are

assigned various points based on the anticipated work involved in solving the given problem.

The questions apply the concepts from the readings and videos. They will require quantitative

analysis. They are multiple choice so be careful with your analysis and work. There is no

partial credit.

Short Papers: (20 pct.)

There are three short papers that will be completed throughout the course: Activity 2.4, 4.5, and

8.5. Descriptions of each Short Paper assignment are provided in the corresponding activity.

Midterm Exam: (20 pct.)

Module 5 consists of a midterm that covers the course materials presented in Module 1 through

5. Details about the midterm can be found in the Midterm Activity in Module 5.

Final Paper: (20 pct.)

In Activity 8.6, you will submit your final paper. The paper is introduced in Module 3 and will

apply various concepts you will study throughout the course. You may want to work on this

throughout the course and apply the concepts studied as you proceed through the course.

Details can be found in Module 3.

Additional Information

Online Sources

Supplemental sources are provided in the Course Specific Resources.

Library

Embry-Riddle Aeronautical University has one of the most complete library collections of

aviation-related resources in the world.

ERAU Libraries: http://library.erau.edu/

Hunt Library Worldwide: Information, Services, Help

Page 4 of 6

o

o

o

Worldwide Library: Basic Training

Worldwide Library: Ask-a-Librarian

Reference: Research Request

Contact Information

Hours: Monday - Friday 8:00 a.m. - 5:00 p.m. Eastern Time

Telephone: 1-800-678-9428 or 386-226-6947

Email: library@erau.edu

RefWorks

RefWorks is an online database tool that can manage references and citations from almost any

source. It provides specific guidance in how to collect and use references, create

bibliographies, and write research papers.

You may access it through this ERAU organizational login link when signed in to ERNIE or

directly from the RefWorks website (http://www.refworks.com). A different link must be used

for off-campus access (see these instructions). RefWorks requires users to create a

RefWorks-specific username and password. Please contact the Hunt Library if you have any

questions.

Course Policies

Academic Integrity

Embry-Riddle is committed to maintaining and upholding intellectual integrity. All students,

faculty, and staff have obligations to prevent violations of academic integrity and take corrective

action when they occur. The adjudication process will involve imposing sanctions which may

include, but are not limited to, a failing grade on the assignment, a failing grade in a course,

suspension or dismissal from the University, upon students who commit the following academic

violations:

1. Plagiarism: Presenting the ideas, words, or products of another as ones own. Plagiarism

includes use of any source to complete academic assignments without proper

acknowledgement of the source. Reuse or resubmission of a students own coursework if

previously used or submitted in another course, is considered self-plagiarism, and is also

not allowed under University policy.

2. Cheating: A broad term that includes, but is not limited to, the following:

a. Giving or receiving help from unauthorized persons or materials during examinations.

b. The unauthorized communication of examination questions prior to, during, or

following administration of the examination.

c. Collaboration on examinations or assignments expected to be, or presented as,

individual work.

d. Fraud and deceit, that include knowingly furnishing false or misleading information or

failing to furnish appropriate information when requested, such as when applying for

admission to the University.

Page 5 of 6

Note: The Instructor reserves the right to use any form of digital method for checking

plagiarism. Several electronic systems are available and other methods may be used at the

Instructors discretion.

Online Learning

This course is offered through ERAU Worldwide Online and runs nine (9) weeks. The first week

begins the first day of the term and ends at midnight EDT/EST (as applicable) seven days later.

Success in this course requires in-depth study of each module as assigned, timely completion of

assignments, and regular participation in forum discussions.

Late work should be the exception and not the rule and may be downgraded at the discretion of

the Instructor, if accepted at all. Unless all work is submitted, the student could receive a failing

grade for the course. Extensions may be granted for extenuating circumstances at the discretion

of the Instructor and only for the length of time the Instructor deems appropriate. The most

important element of success in an online course is to communicate with your Instructor

throughout the term.

Conventions of online etiquette, which include courtesy to all users, will be observed. Students

should use the Send Email function in Blackboard for private messages to the Instructor and

other students. The class Discussion Board forums are for public messages.

It is highly recommended that students keep electronic copies of all materials submitted as

assignments, discussion board posts and emails, until after the end of the term and a final grade

is received. When posting responses in a discussion forum, please confirm that the responses

have actually been posted after you submit them.

Course Schedule

Modules

Titles / Topics

Introduction to

Corporate Finance

and Financial

Statements

Discounted Cash

Flow and Bond

Valuation

Stock Valuation and

Net Present Value

Activities

*Graded Activities

1.1 - Introduction

1.2 - Readings

1.3 - Videos

1.4 - Reading Quiz 1*

1.5 - Financial Ratios Assignment Preview

1.6 - Problem Set 1*

1.7 - Discussion*

1.8 - Video: Masters of Finance

2.1 - Readings

2.2 - Videos

2.3 - Reading Quiz 2*

2.4 - Assignment: Financial Ratios*

2.5 - Problem Set 2*

3.1 - Readings

3.2 - Videos

3.3 - Reading Quiz 3*

3.4 - Problem Set 3*

3.5 - Valuation using PE ratio preview

3.6 - Final Project Preview

Page 6 of 6

Making Capital

Investment Decisions

Risk and Return

Risk and Cost of

Capital

Capital Structure

Dividend Policy and

Other Payouts

Options, Futures and

Risk Management

4.1 - Readings

4.2 - Videos

4.3 - Reading Quiz 4*

4.4 - Problem Set 4*

4.5 - Assignment: Valuation of stock using PE*

4.6 - Discussion*

5.1 - Readings

5.2 - Videos

5.3 - Reading Quiz 5*

5.4 - Problem Set 5*

5.5 - Midterm*

5.6 - Video: Masters of Finance

6.1 - Readings

6.2 - Notes and Videos

6.3 - Reading Quiz 6*

6.4 - Problem Set 6*

6.5 - Discussion*

7.1 - Readings

7.2 - Videos

7.3 - Reading Quiz 7*

7.4 - Problem Set 7*

7.5 - Discussion*

8.1 - Readings

8.2 - Videos

8.3 - Reading Quiz 8*

8.4 - Problem Set 8*

8.5 - Assignment: Payout Strategy*

8.6 - Final Project*

9.1 - Readings

9.2 - Videos

9.3 - Reading Quiz 9*

9.4 - Problem Set 9*

9.5 - Discussion*

9.6 - Video: Masters of Finance

You might also like

- PMAN635 Course OverviewDocument10 pagesPMAN635 Course OverviewDerrick Antonio GardnerNo ratings yet

- MGMT 3P98 Course Outline S20Document6 pagesMGMT 3P98 Course Outline S20Jeffrey O'LearyNo ratings yet

- MBAA 517 SyllabusDocument7 pagesMBAA 517 SyllabusHeatherNo ratings yet

- Customer Satisfaction in Reliance Jio ProjectDocument97 pagesCustomer Satisfaction in Reliance Jio ProjectHarikrishnan33% (3)

- Ed 508 Sample Syl Lab UsDocument11 pagesEd 508 Sample Syl Lab UsPAUL JOHN ONGCOYNo ratings yet

- Comm 3FH3 - 2021-1-WDocument9 pagesComm 3FH3 - 2021-1-WAlyssa PerzyloNo ratings yet

- FIN3130 Outline 2015 S1Document5 pagesFIN3130 Outline 2015 S1MatthewNo ratings yet

- Lean Production and Lean Construction Brief 2019 20 FinalDocument9 pagesLean Production and Lean Construction Brief 2019 20 Finalsikandar abbasNo ratings yet

- MMI-DL Course SyllabusDocument15 pagesMMI-DL Course Syllabussavvy_as_98-1No ratings yet

- 6NMH0225 Handbook 2012-2013Document21 pages6NMH0225 Handbook 2012-2013shayziaNo ratings yet

- ACCG340Document11 pagesACCG340Dung Tran0% (1)

- EDCI 695.410 Doctoral Research Methodology: Instructor InformationDocument20 pagesEDCI 695.410 Doctoral Research Methodology: Instructor InformationAurangzeb Rashid MasudNo ratings yet

- Accounting Information System SyllabusDocument4 pagesAccounting Information System SyllabusKemas DestiaNo ratings yet

- UT Dallas Syllabus For Fin6301.0g1.09u Taught by Amal El-Ashmawi (Ahe013000)Document10 pagesUT Dallas Syllabus For Fin6301.0g1.09u Taught by Amal El-Ashmawi (Ahe013000)UT Dallas Provost's Technology GroupNo ratings yet

- Course Outline - Summer2020 V1.0Document4 pagesCourse Outline - Summer2020 V1.0Walid Bin Zahid TonmoyNo ratings yet

- FinanceDocument11 pagesFinanceArr ZoneNo ratings yet

- Uos Outline Finc3017 Sem2 2014Document5 pagesUos Outline Finc3017 Sem2 2014suseeexNo ratings yet

- UT Dallas Syllabus For Aim6347.501 06s Taught by Ramachandran Natarajan (Nataraj)Document7 pagesUT Dallas Syllabus For Aim6347.501 06s Taught by Ramachandran Natarajan (Nataraj)UT Dallas Provost's Technology GroupNo ratings yet

- Is 403Document6 pagesIs 403Diana LoNo ratings yet

- Syllabus IT6503 Summer2013Document4 pagesSyllabus IT6503 Summer2013oggokNo ratings yet

- FCWR 101 Syllabus Fall 2014 MisakDocument5 pagesFCWR 101 Syllabus Fall 2014 MisaknyitsucksNo ratings yet

- FIN333 2012 Spring - REVISEDDocument5 pagesFIN333 2012 Spring - REVISEDHa MinhNo ratings yet

- Course Outline F2000TDocument6 pagesCourse Outline F2000Txixi.cz7651No ratings yet

- FINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedDocument7 pagesFINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedYou VeeNo ratings yet

- Syllabus 543Document4 pagesSyllabus 543Venkatesh KaulgudNo ratings yet

- LGMT 683 Online Syllabus 1013Document9 pagesLGMT 683 Online Syllabus 1013HeatherNo ratings yet

- UT Dallas Online Course Syllabus For AIM 6201 - Financial Accounting - 07sDocument10 pagesUT Dallas Online Course Syllabus For AIM 6201 - Financial Accounting - 07sUT Dallas Provost's Technology GroupNo ratings yet

- Master of Business Administration: Assignment (100 Marks)Document5 pagesMaster of Business Administration: Assignment (100 Marks)Vijay SubramaniamNo ratings yet

- Course Outline ACCT 0104 Introduction To Financial Accounting CP-1Document12 pagesCourse Outline ACCT 0104 Introduction To Financial Accounting CP-1thejiannaneptuneNo ratings yet

- ACT4052 Intermediate Accounting IIDocument14 pagesACT4052 Intermediate Accounting IIntloan152No ratings yet

- LGMT 682 Online Syllabus 0811Document6 pagesLGMT 682 Online Syllabus 0811HeatherNo ratings yet

- CIS8080SYLF11Document10 pagesCIS8080SYLF11adityaScribd333No ratings yet

- FIT5057Unit GuideSem.2Document6 pagesFIT5057Unit GuideSem.2gmail.comNo ratings yet

- SyllabusDocument33 pagesSyllabuslsanc308No ratings yet

- MIS5902 Syllabus S2020Document9 pagesMIS5902 Syllabus S2020Elias HarakeNo ratings yet

- 4551 Fall 2020 Course Outline Detailed Sept 29Document20 pages4551 Fall 2020 Course Outline Detailed Sept 29GFGSHSNo ratings yet

- SyllabusDocument7 pagesSyllabusHeatherNo ratings yet

- ASCI 515 Aviation / Aerospace Simulation Systems: Online Course SyllabusDocument8 pagesASCI 515 Aviation / Aerospace Simulation Systems: Online Course SyllabusBob MarleyNo ratings yet

- BA63274 G420 Online Syllabus v5Document16 pagesBA63274 G420 Online Syllabus v5Jayaram KarumuriNo ratings yet

- Applied Data Analytics With PythonDocument14 pagesApplied Data Analytics With PythonhoangtucuagioNo ratings yet

- Updated FIN812 Capital Budgeting - 2015 - SpringDocument6 pagesUpdated FIN812 Capital Budgeting - 2015 - Springnguyen_tridung2No ratings yet

- SyllabusFall2015 20150825Document8 pagesSyllabusFall2015 20150825savvy_as_98-1No ratings yet

- EDTECH 522 Syllabus FA14 ChingDocument7 pagesEDTECH 522 Syllabus FA14 ChingAnonymousNo ratings yet

- Managerial FinanceDocument69 pagesManagerial Financeaimanhassan100% (3)

- B.A. (Hons) Staffordshire UniversityDocument9 pagesB.A. (Hons) Staffordshire UniversityshinimikageNo ratings yet

- Outline 906Document5 pagesOutline 906麦麦庆达No ratings yet

- CIS 101 Introduction To Information Systems Syllabus: 3 Walid - Ghanim@imperial - EduDocument4 pagesCIS 101 Introduction To Information Systems Syllabus: 3 Walid - Ghanim@imperial - EduTantra Nath jhaNo ratings yet

- Investment and Portfolio Management: Dana KikuDocument3 pagesInvestment and Portfolio Management: Dana KikuPlay BoyNo ratings yet

- Accounting Information Systems AC 330 Section A Course Syllabus Spring 2012Document6 pagesAccounting Information Systems AC 330 Section A Course Syllabus Spring 2012FikaCharistaNo ratings yet

- Eco3cce Extended SLG 2014Document14 pagesEco3cce Extended SLG 2014Huong TranNo ratings yet

- MAR6157 International Marketing All Xie, JDocument9 pagesMAR6157 International Marketing All Xie, JMithilesh SinghNo ratings yet

- BIA 652 Syllabus Spring 2017Document5 pagesBIA 652 Syllabus Spring 2017Henry MorenoNo ratings yet

- Department of Interdisciplinary StudiesDocument14 pagesDepartment of Interdisciplinary StudiesBautista OrlNo ratings yet

- Syllabus Acc 711 Gyu Fallb 2017 - On CanvasDocument7 pagesSyllabus Acc 711 Gyu Fallb 2017 - On CanvasHenry MaNo ratings yet

- Finm3401 Ecp 2013Document14 pagesFinm3401 Ecp 2013dmscott10No ratings yet

- Mba 6053 SyllabusDocument8 pagesMba 6053 Syllabusnewlife439No ratings yet

- SyllabusDocument8 pagesSyllabusAntônio DuarteNo ratings yet

- UT Dallas Syllabus For Acct6344.501.11f Taught by (Jad044000)Document10 pagesUT Dallas Syllabus For Acct6344.501.11f Taught by (Jad044000)UT Dallas Provost's Technology GroupNo ratings yet

- Introduction To Cloud TechDocument10 pagesIntroduction To Cloud TechAaron MangalNo ratings yet

- 14 310x Data Analysis For Social ScientistsDocument7 pages14 310x Data Analysis For Social ScientistsGorki FreireNo ratings yet

- Assessment and Feedback in Higher Education: A Guide for TeachersFrom EverandAssessment and Feedback in Higher Education: A Guide for TeachersRating: 5 out of 5 stars5/5 (1)

- Guide to Effective Skills for Online Student Success: Tips and Recommendations for the Concerned, Worried, and Challenged Online StudentFrom EverandGuide to Effective Skills for Online Student Success: Tips and Recommendations for the Concerned, Worried, and Challenged Online StudentNo ratings yet

- MGMT 524 Online Syllabus 0314Document8 pagesMGMT 524 Online Syllabus 0314HeatherNo ratings yet

- A2 Central Bank Guidance DirectionsDocument2 pagesA2 Central Bank Guidance DirectionsHeatherNo ratings yet

- MGMT 651 SyllabusDocument8 pagesMGMT 651 SyllabusHeatherNo ratings yet

- Research Paper Format FinalDocument1 pageResearch Paper Format FinalHeatherNo ratings yet

- MGMT 518 Syllabus Oct 2015 Nesbitt EVHBDocument9 pagesMGMT 518 Syllabus Oct 2015 Nesbitt EVHBHeatherNo ratings yet

- MBAA 523 Online Syllabus 0514Document7 pagesMBAA 523 Online Syllabus 0514HeatherNo ratings yet

- LGMT 683 Online Syllabus 1013Document9 pagesLGMT 683 Online Syllabus 1013HeatherNo ratings yet

- SyllabusDocument7 pagesSyllabusHeatherNo ratings yet

- LGMT 682 Online Syllabus 0811Document6 pagesLGMT 682 Online Syllabus 0811HeatherNo ratings yet

- LGMT 636 Online Syllabus 0311Document9 pagesLGMT 636 Online Syllabus 0311HeatherNo ratings yet

- LGMT 536 Online Syllabus 0812Document9 pagesLGMT 536 Online Syllabus 0812HeatherNo ratings yet

- Internal CommunicationDocument11 pagesInternal Communicationanks0909No ratings yet

- Instagram CourseDocument2 pagesInstagram Courselemeec yopiNo ratings yet

- Online Hybrid Course DefinitionsDocument1 pageOnline Hybrid Course DefinitionsAmanda BrunerNo ratings yet

- Worksheet Titanic Python PDFDocument8 pagesWorksheet Titanic Python PDFrashmimehNo ratings yet

- Learning Multi FrameDocument61 pagesLearning Multi FrameChainun Taidamrong0% (1)

- Jbyers InquiryPaperRevisedDocument5 pagesJbyers InquiryPaperRevisedjbyers16No ratings yet

- Vsphere Distributed Switch Best PracticesDocument30 pagesVsphere Distributed Switch Best PracticesnewbeoneNo ratings yet

- VisitBit - Free Bitcoin! Instant Payments!Document14 pagesVisitBit - Free Bitcoin! Instant Payments!Saf Bes100% (3)

- Ethical HackingDocument19 pagesEthical HackingRenjithNo ratings yet

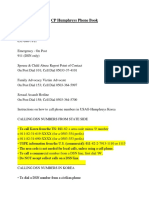

- Camp Humphreys Phone BookDocument50 pagesCamp Humphreys Phone BookJack BondNo ratings yet

- Youtube Ranking Guide 2022Document26 pagesYoutube Ranking Guide 2022Pro NebyuNo ratings yet

- MedOnGo Health Kiosks - BKDocument22 pagesMedOnGo Health Kiosks - BKashkuchiyaNo ratings yet

- Wireless Install Guide English Samsung CLX-9352Document12 pagesWireless Install Guide English Samsung CLX-9352BoxNo ratings yet

- PRST Clp500 enDocument64 pagesPRST Clp500 enLeo MuresanNo ratings yet

- FB Cons-ProsDocument6 pagesFB Cons-Pros黃紘志No ratings yet

- Fabric Path SwitchingDocument1 pageFabric Path SwitchingWalter ValverdeNo ratings yet

- (Toppers Interview) Om Prakash Kasera (AIR 17 - CSE 2011) Working Professional Without Coaching Cracks IAS Exam and Shares His Journey Studyplan and Preparation Tips - Mrunal PDFDocument28 pages(Toppers Interview) Om Prakash Kasera (AIR 17 - CSE 2011) Working Professional Without Coaching Cracks IAS Exam and Shares His Journey Studyplan and Preparation Tips - Mrunal PDFSelvaraj VillyNo ratings yet

- Anaplan Learning Center GuideDocument10 pagesAnaplan Learning Center Guidesrinivasa2No ratings yet

- Questions:: Computer Operator Question Paper of Lok Sewa Exam 2012Document4 pagesQuestions:: Computer Operator Question Paper of Lok Sewa Exam 2012nsktejaNo ratings yet

- Summit Family HW InstallDocument532 pagesSummit Family HW InstallRodrigo F MartinsNo ratings yet

- Information Literacy As A Liberal ArtDocument13 pagesInformation Literacy As A Liberal ArtVenezza GonzalesNo ratings yet

- MIS Report of Fcube CinemasDocument25 pagesMIS Report of Fcube Cinemasginish12No ratings yet

- Digital Marketing Concepts Overview For IIM-ShillongDocument70 pagesDigital Marketing Concepts Overview For IIM-ShillongSrijon MoitraNo ratings yet

- TIS239Document14 pagesTIS239Alejandro V. GarciaNo ratings yet

- Redis Guide How To UseDocument8 pagesRedis Guide How To UseUzuki Campos EcheverríaNo ratings yet

- Articulo JDocument15 pagesArticulo JPercy QuispeNo ratings yet

- NCC Group Annual Report For Year Ended 31 May 2015Document154 pagesNCC Group Annual Report For Year Ended 31 May 2015rayimasterNo ratings yet

- Setting Doc Related FactorDocument6 pagesSetting Doc Related FactorPojangNo ratings yet

- Upload A Document To Access Your Download: Gerard Genette, PalimpsestosDocument3 pagesUpload A Document To Access Your Download: Gerard Genette, PalimpsestosCarlos I. PeñaNo ratings yet