Professional Documents

Culture Documents

Cadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016

Uploaded by

HitechSoft HitsoftOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016

Uploaded by

HitechSoft HitsoftCopyright:

Available Formats

3QFY2016 Result Update | Pharmaceutical

February 24, 2016

Cadila Healthcare

ACCUMULATE

Performance Highlights

CMP

Target Price

Y/E March (` cr)

`330

`352

Investment Period

3QFY2016

2QFY2016

% chg (qoq)

3QFY2015

% chg (yoy)

2,342

2,374

(1.3)

2,160

8.4

112

109

2.5

40

180.7

1542

1567

(1.6)

1400

10.1

Sector

Operating profit

492

536

(8.3)

417

17.9

Market Cap (` cr)

Adj. Net profit

390

391

(0.4)

278

40.0

Net debt (` cr)

Net sales

Other income

Gross profit

Source: Company, Angel Research

Results better than expected at the net profit level: For 3QFY2016, sales came in

at `2,342cr (V/s `2,600cr expected), growing by 8.4% yoy. On the operating

front, the OPM came in at 21.0% V/s 21.4% expected and V/s 19.3% in

3QFY2015. The expansion in the OPM was driven by expansion in the GPM to

65.9% V/s 64.8% in 3QFY2015 and almost flat growth in staff and other

expenditure. R&D expenditure during the quarter came in at 10.1% V/s 8.7% of

sales in 3QFY2015. The net profit came in at `389cr V/s `353cr expected and

V/s `282cr in 3QFY2015, a yoy growth of 38.2%. The Adj. net profit came in at

`390cr V/s `278cr in 3QFY2015, a yoy growth of 40.0%.

Outlook and valuation: We expect Cadilas net sales to post an 18.0% CAGR to

`11,840cr and EPS to report a 24.6% CAGR to `17.6 over FY201517E. We

maintain our Accumulate rating on the stock.

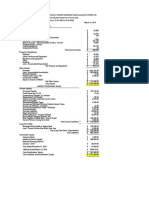

Key financials (Consolidated)

FY2014

FY2015

FY2016E

FY2017E

7,060

8,497

10,224

11,840

% chg

14.7

20.4

20.3

15.8

Net profit

819

1,159

1,496

1,800

% chg

25.0

41.5

29.1

20.3

8.0

11.3

14.6

17.6

EBITDA margin (%)

14.7

18.8

21.0

22.0

P/E (x)

53.1

37.5

29.1

24.1

RoE (%)

25.3

30.1

30.8

29.0

RoCE (%)

13.8

20.2

24.5

25.2

P/BV (x)

2.5

10.2

8.0

6.2

EV/Sales (x)

1.4

5.2

4.3

3.6

EV/EBITDA (x)

9.7

27.8

20.2

16.3

Net sales

EPS

Stock Info

Pharmaceutical

33,748

1,817

Beta

For 3QFY2016, Cadila Healthcare (Cadila) posted a robust performance on the

net profit front while sales came in lower than expected. Sales came in at

`2,342cr (V/s `2,600cr expected), growing by 8.4% yoy. On the operating front,

the OPM came in at 21.0% V/s 21.4% expected and V/s 19.3% in 3QFY2015.

The expansion in the OPM was driven by expansion in the GPM to 65.9% V/s

64.8% in 3QFY2015 and almost flat growth in staff and other expenditure. R&D

expenditure during the quarter came in at 10.1% V/s 8.7% of sales in 3QFY2015.

The net profit came in at `389cr V/s `353cr expected and V/s `282cr in

3QFY2015, a yoy growth of 38.2%. The Adj. net profit came in at `390cr V/s

`278cr in 3QFY2015, a yoy growth of 40.0%. We maintain our Accumulate on

the stock.

Y E March (` cr)

12 Months

Source: Company, Angel Research; Note: CMP as of February 23, 2016

Please refer to important disclosures at the end of this report

0.8

52 Week High / Low

454 / 296

Avg. Daily Volume

95,007

Face Value (`)

BSE Sensex

23,410

Nifty

7,110

Reuters Code

CADI.BO

Bloomberg Code

CDH@IN

Shareholding Pattern (%)

Promoters

74.8

MF / Banks / Indian Fls

9.7

FII / NRIs / OCBs

9.6

Indian Public / Others

6.0

Abs.(%)

3m

1yr

3yr

Sensex

(9.3)

(19.2)

21.2

Cadila

(22.2)

6.8 112.5

3-Year Daily Price Chart

500

450

400

350

300

250

200

150

100

50

0

3

1

b

e

F

3

1

ya

M

3

1

g

u

A

3

1

vo

N

4

1

b

e

F

4

1

ya

M

4

1

g

u

A

4

1

vo

N

5

1

b

e

F

5

1

ya

M

5

1

g

u

A

5

1

vo

N

6

1

b

e

F

Source: Company, Angel Research

Sarabjit Kour Nangra

+91 22 39357600 Ext: 6806

sarabjit@angelbroking.com

Cadila Healthcare |3QFY2016 Result Update

Exhibit 1: 3QFY2016 performance (Consolidated)

Y/E March (` cr)

Net Sales

Other Income

3QFY2016

2QFY2016

% chg (qoq)

3QFY2015

% chg (yoy)

9MFY2016

9MFY2015

% chg

2,342

2,374

(1.3)

2,160

8.4

7,094

6,250

13.5

112

109

2.5

40

180.7

365

143

155.0

Total Income

2,454

2,483

(1.2)

2,199

11.6

7,459

6,393

16.7

Gross profit

1542

1567

(1.6)

1400

10.1

4640

3849

20.5

Gross margin (%)

65.9

66.0

65.4

61.6

1504

1139

21.2

18.2

64.8

Operating profit

492

536

Operating Margin (%)

21.0

22.6

(8.3)

417

17.9

Financial Cost

13

13

(0.5)

16

(22.4)

39

52

Depreciation

77

73

5.1

71

8.9

224

212

5.6

PBT

515

560

(8.1)

370

39.0

1606

1018

57.7

Tax

115

158

(27.3)

79

45.3

445

189

135.6

Adj. PAT before Extra-ordinary item

400

402

(0.6)

291

37.3

1161

829

40.0

Exceptional loss/(gain)

(5)

(3)

(5)

Minority

10

(7.2)

14

27

31

Reported PAT

390

391

(0.3)

282

38.2

1134

800

41.7

Adj. PAT

390

391

(0.4)

278

40.0

1136

796

42.8

EPS (`)

3.8

3.8

11.1

7.8

19.3

2.7

32.0

(25.8)

Source: Company, Angel Research

Exhibit 2: 3QFY2016 Actual vs. Angel estimates

(` cr)

Actual

Estimates

Net Sales

2,342

2,600

Variance

(9.9)

Operating profit

492

556

(11.5)

Tax

115

143

(19.5)

Net profit

390

353

10.3

Source: Company, Angel Research

Revenue up 8.4% yoy; marginally lower than our expectation

For 3QFY2016, the company posted sales of `2,342cr (V/s `2,600cr expected), a

growth of 8.4% yoy. Exports (`1,398.8cr) posted a 10.6% yoy growth during the

quarter while domestic markets (`993.2cr) posted a 6.4% yoy growth.

In exports the key market US (`1071.7cr) posted a yoy growth of 19.6%, while the

other key market Europe (`76.2cr) posted a dip of 10.0%; JVs and alliances

(`100.2cr) posted a dip of 17.7% yoy. In domestic markets, the Indian formulation

markets posted a yoy growth of 11.0%.

February 24, 2016

Cadila Healthcare |3QFY2016 Result Update

Exhibit 3: Sales trend in the US and Europe

1,072

1,004

985

979

896

(` cr)

1,200

1,120

1,040

960

880

800

720

640

560

480

400

320

240

160

80

0

85

3QFY2015

84

74

4QFY2015

76

65

1QFY2016

2QFY2016

US

Europe

3QFY2016

Source: Company, Angel Research

The growth in the domestic market (42% of sales) was 6.4% yoy mainly led by

formulations (`713cr) which grew by 11.1% yoy. API (`83.8cr) on the other hand

de-grew by 12.6% yoy, while Wellness (`117.8cr) grew by 3.3% yoy. Animal

Health and others (`78.5cr) de-grew by 3.8% yoy.

Exhibit 4: Sales trend in Domestic Formulation and Consumer Wellness Divisions

800

700

742

751

713

680

642

600

(` cr)

500

400

300

200

114

111

111

112

118

100

0

3QFY2015

4QFY2015

1QFY2016

Domestic Formulation

2QFY2016

3QFY2016

Consumer division

Source: Company, Angel Research

On the CRAMS front, the company generated sales of `100cr (vs `121.7cr in

3QFY2015), reporting a de-growth of 17.7% yoy.

OPM in line with expectations

On the operating front, the OPM came in at 21.0% V/s 21.4% expected and V/s

19.3% in 3QFY2015. The expansion in the OPM was driven by expansion in the

GPM to 65.9% V/s 64.8% in 3QFY2015 and almost flat growth in staff and other

expenditure. R&D expenditure during the quarter came in at 10.1% V/s 8.7% of

sales in 3QFY2015.

February 24, 2016

Cadila Healthcare |3QFY2016 Result Update

Exhibit 5: OPM trend

23.0

22.5

22.6

22.0

(%)

21.5

21.0

21.0

20.5

20.0

20.2

20.1

19.5

19.0

19.3

18.5

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

Source: Company, Angel Research

Net profit up 40.0% yoy: During the quarter, the company posted a other income

of `112cr V/s `39.9cr in 3QFY2015. This aided the net profit to come in at `389cr

(V/s `353cr expected) V/s `282cr in 3QFY2015, yoy growth of 38.2%. The Adj.

net profit came in at `390cr V/s `278cr in 3QFY2015, a yoy growth of 40.0%.

Exhibit 6: Adjusted Net profit trend

400

391

390

2QFY2016

3QFY2016

390

(` cr)

380

370

368

360

352

352

4QFY2015

1QFY2016

350

340

330

3QFY2015

Source: Company, Angel Research

Concall takeaways

February 24, 2016

Margin improvement during the quarter was primarily driven by higher US

and JV sales.

Currently, the company has transferred 11 products from Moraiya facility to

Ahmedabad based SEZ facility from its existing product portfolio. It is also in

the process of site transferring 4 more key products from future pipeline that

includes Asacol HD and Prevacid ODT.

Currently, Moraiya facility supplies 60% of total US sales. In terms of pending

product approvals, Cadila Healthcare has filed 74 products from Moraiya

facility which includes 40% of total oral solid filings. Cadila Healthcare expects

Cadila Healthcare |3QFY2016 Result Update

the remediation measures at Moraiya facility to get completed over the next 36 months. The Management highlighted that a re-inspection by USFDA might

be required for full resolution. Meanwhile the company has successfully

completed site transfer of 9 existing products and has already initiated site

transfers for four key upcoming launches (including Asacol HD, Toprol XL,

Prevacid ODT, etc).

R&D expenditure is expected to remain at 7-8% of sales in FY2016.

Tax rate as a % of PBT is expected to be around 20% in FY2017.

The Management has guided for higher capex in FY2017 with construction of

few greenfield and brownfield facilities.

Recommendation rationale

Strong domestic portfolio: Cadila is the fifth largest player in the domestic market,

with sales of about `2,677cr in FY2015; the domestic market contributes ~44% to

its top-line. The company enjoys a leadership position in the CVS, GI, women

healthcare and respiratory segments, and has a sales force of 4,500 executives.

The company, on an aggressive front, launched more than 75 new products in

FY2014. During FY2009-14, the company reported a ~13% CAGR in its top-line

in the domestic formulation business.

Further, the company has a strong consumer division through its stake in Zydus

Wellness, which has premium brands such as Sugarfree, Everyuth and Nutralite,

under its umbrella. This segment which contributes ~5.9% of sales, registered a

growth of 3.1% yoy during FY2015.

Going forward, the company expects the segment to grow at an above-industry

rate on the back of new product launches and field force expansion. In FY2014,

sales were lower; however, FY2015 witnessed a rebound. During FY2015-17E, we

expect the domestic segment to grow at a CAGR of 15.0%.

Exports on a strong footing: Cadila has a two-fold focus on exports, wherein it is

targeting developed as well as emerging markets, which contributed around 50%

to its FY2015 top-line. The company has established a formidable presence in the

developed markets of US, Europe (France and Spain) and Japan. In the US, the

company achieved critical scale of `3,393cr on the sales front in FY2015. The

growth in exports to the US along with other regions like Europe would be driven

by new product launches, going forward. Overall, exports are expected to post a

CAGR of 20.0% over FY2015-17E.

Outlook and valuation

We expect Cadilas net sales to post an 18.0% CAGR to `11,840cr and EPS to

report a 24.6% CAGR to `17.6 over FY201517E. We maintain our Accumulate

rating on the stock.

February 24, 2016

Cadila Healthcare |3QFY2016 Result Update

Exhibit 7: Key Assumptions

Key assumptions

FY2016E

FY2017E

15.0

17.0

Domestic growth (%)

Exports growth (%)

20.0

20.0

Growth in employee expenses (%)

24.1

15.8

Operating margins (excl tech. know-how fees) (%)

21.0

22.0

Capex (` cr)

650

650

Source: Company, Angel Research

Exhibit 8: One-year forward PE band

600

500

400

300

200

100

Price

14x

21x

Jan-16

Oct-15

Jul-15

Apr-15

Jan-15

Oct-14

Jul-14

Apr-14

Jan-14

Jul-13

7x

Oct-13

Apr-13

Jan-13

Oct-12

Jul-12

Jan-12

Apr-12

Oct-11

Jul-11

Jan-11

Apr-11

Oct-10

28x

Source: Company

Company background: Cadila Healthcares operations range across API,

formulations, animal health products and cosmeceuticals. The group has global

operations spread across USA, Europe, Japan, Brazil, South Africa and 25 other

emerging markets. Having already achieved the US$1bn sales mark in 2011, the

company believes to be a research-driven pharmaceutical company by 2020.

Exhibit 9: Recommendation Summary

Company

Alembic Pharma

Aurobindo Pharma

Cadila Healthcare

Cipla

Dr Reddy's

Dishman Pharma

GSK Pharma*

Indoco Remedies

Ipca labs

Lupin

Sanofi India*

Sun Pharma

Reco

Neutral

Buy

Accumulate

Buy

Buy

Neutral

Neutral

Neutral

Buy

Neutral

Neutral

Accumulate

CMP Tgt. price

(`)

(`)

618

655

330

523

3,075

295

3,217

251

622

1,777

4,304

871

856

352

605

3,933

900

950

Upside

%

PE (x)

30.7

6.8

15.8

27.8

44.8

9.1

21.5

15.3

18.7

19.0

17.2

14.8

47.1

18.5

22.2

26.0

28.4

32.4

FY2017E

EV/Sales (x)

EV/EBITDA (x)

3.0

2.5

2.8

2.5

2.6

1.6

8.2

2.0

2.2

4.5

3.7

5.8

15.3

10.9

12.8

17.7

11.1

7.5

37.2

11.1

12.1

16.6

17.7

18.7

FY15-17E

CAGR in EPS (%)

38.2

15.6

24.6

18.3

17.2

15.9

6.6

23.0

17.9

13.1

33.1

8.4

FY2017E

RoCE (%) RoE (%)

31.3

23.5

25.2

16.7

19.1

9.4

33.7

19.7

11.8

29.6

27.9

15.8

31.2

30.2

29.0

16.1

20.4

11.0

34.3

19.7

14.0

24.7

25.5

16.6

Source: Company, Angel Research; Note: *December year ending

February 24, 2016

Cadila Healthcare |3QFY2016 Result Update

Profit & Loss statement (Consolidated)

Y/E March (` cr)

Gross sales

Less: Excise duty

5,181

6,285

7,208

8,658

FY2016E

FY2017E

10,417

12,063

91

129

148

161

193

223

5,090

6,155

7,060

8,497

10,224

11,840

173

203

164

154

154

154

5,263

6,358

7,224

8,651

10,379

11,994

13.7

20.8

13.6

19.8

20.0

15.6

Total expenditure

4,179

5,232

6,024

6,896

8,073

9,229

Net raw materials

1,679

2,320

2,714

3,197

3,681

4,262

320

387

443

534

642

744

Net sales

Other operating income

Total operating income

% chg

Other mfg costs

Personnel

751

903

1,071

1,209

1,500

1,737

1,429

1,622

1,796

2,107

2,249

2,486

911

923

1,036

1,601

2,152

2,610

5.8

1.4

12.3

54.6

34.4

21.3

(% of Net Sales)

17.9

15.0

14.7

18.8

21.0

22.0

Depreciation& amortisation

158

183

201

287

304

373

EBIT

753

740

835

1,314

1,848

2,237

Other

EBITDA

% chg

% chg

2.6

(1.7)

12.8

57.4

40.6

21.1

(% of Net Sales)

14.8

12.0

11.8

15.5

18.1

18.9

Interest & other charges

185

169

90

68

93

93

53

37

51

55

55

55

Other income

(% of PBT)

Recurring PBT

% chg

Extraordinary expense/(Inc.)

PBT (reported)

794

811

959

1,456

1,964

2,353

(5.7)

2.1

18.3

51.8

34.9

19.8

17

10

794

811

942

1,445

1,964

2,353

113.0

119.5

106.0

259.4

432.1

517.7

(% of PBT)

14.2

14.7

11.3

17.9

22.0

22.0

PAT (reported)

681

692

836

1,186

1,532

1,836

Less: Minority interest (MI)

28.6

36.4

32.6

35.5

35.5

35.5

PAT after MI (reported)

653

655

804

1,151

1,496

1,800

ADJ. PAT

650

655

819

1,159

1,496

1,800

Tax

% chg

(8.6)

0.8

25.0

41.5

29.1

20.3

(% of Net Sales)

12.8

10.6

11.4

13.5

14.6

15.2

Adj.Basic EPS (`)

6.3

6.4

8.0

11.3

14.6

17.6

6.3

6.4

8.0

11.3

14.6

17.6

(8.6)

0.8

25.0

41.5

29.1

20.3

Adj. Fully Diluted EPS (`)

% chg

February 24, 2016

FY2012 FY2013 FY2014 FY2015

Cadila Healthcare |3QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

102

102

102

102

102

102

Reserves & Surplus

2,471

2,938

3,337

4,149

5,358

6,871

Shareholders funds

2,574

3,040

3,439

4,252

5,460

6,973

Minority interest

90

119

144

169

204

240

2,289

2,681

2,265

2,334

2,334

2,334

Other Long Term Liabilities

43

47

55

43

44

45

Long Term Provisions

79

64

76

110

77

78

Deferred tax liability

119

100

96

59

120

121

5,193

6,053

6,075

6,966

8,118

9,667

Gross block

3,008

4,104

3,756

4,353

5,003

5,653

Less: Acc. depreciation

1,175

1,358

1,540

1,827

2,132

2,504

Net block

1,833

2,746

2,214

2,526

2,871

3,148

Total loans

Total liabilities

APPLICATION OF FUNDS

Capital Work-in-Progress

Goodwill

Investments

Long Term Loans and Adv.

248

892

892

892

892

862

908

733

733

733

24

21

87

154

154

154

263

411

495

637

595

716

2,760

3,191

3,391

4,105

5,642

7,230

Cash

467

582

549

670

1,684

2,699

Loans & advances

275

279

341

334

335

336

Other

2,019

2,330

2,501

3,102

3,623

4,195

Current liabilities

1,186

1,426

1,912

2,081

2,768

3,206

Net Current assets

1,574

1,765

1,480

2,024

2,873

4,024

5,193

6,053

6,075

6,966

8,118

9,667

Current assets

Mis. Exp. not written off

Total assets

February 24, 2016

484

1,015

Cadila Healthcare |3QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

Profit before tax

Depreciation

794

811

942

1,445

1,964

2,353

158

183

201

287

304

373

(427)

(223)

168

(565)

207

(257)

53

37

51

55

55

55

Direct taxes paid

113

119

106

259

432

518

Cash Flow from Operations

359

614

1,154

853

1,988

1,896

(Inc.)/Dec.in Fixed Assets

(743)

(860)

(296)

(597)

(650)

(650)

(Inc.)/Dec. in Investments

(4)

(65)

(68)

Other income

53

37

51

55

55

55

(694)

(820)

(310)

(609)

(595)

(595)

(Inc)/Dec in Working Capital

Less: Other income

Cash Flow from Investing

Issue of Equity

Inc./(Dec.) in loans

February 24, 2016

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

1,238

382

(397)

91

(33)

Dividend Paid (Incl. Tax)

(175)

(175)

(216)

(287)

(287)

(287)

Others

(557)

115

(264)

74

(60)

(1)

Cash Flow from Financing

506

322

(877)

(122)

(380)

(286)

Inc./(Dec.) in Cash

171

116

(33)

121

1,013

1,015

Opening Cash balances

295

467

582

549

670

1,684

Closing Cash balances

467

582

549

670

1,684

2,699

Cadila Healthcare |3QFY2016 Result Update

Key Ratios

Y/E March

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

51.9

51.5

41.2

29.1

22.6

18.7

P/CEPS

41.7

40.2

33.0

23.3

18.7

15.5

P/BV

13.1

11.1

9.8

7.9

6.2

4.8

Dividend yield (%)

2.3

2.3

2.3

2.3

2.3

2.3

EV/Sales

1.7

1.4

1.1

4.1

3.3

2.8

EV/EBITDA

9.2

9.2

7.8

21.8

15.7

12.5

EV / Total Assets

1.6

1.4

1.3

5.0

4.2

3.4

EPS (Basic)

6.3

6.4

8.0

11.3

14.6

17.6

EPS (fully diluted)

6.3

6.4

8.0

11.3

14.6

17.6

Cash EPS

7.9

8.2

10.0

14.2

17.6

21.3

DPS

7.5

7.5

7.5

7.5

7.5

7.5

25.1

29.7

33.6

41.5

53.3

68.1

EBIT margin

14.8

12.0

11.8

15.5

18.1

18.9

Tax retention ratio

85.8

85.3

88.7

82.1

78.0

78.0

Asset turnover (x)

1.3

1.2

1.3

1.5

1.6

1.8

16.8

12.8

13.8

18.6

23.0

26.4

Cost of Debt (Post Tax)

9.4

5.8

3.2

2.4

3.1

3.1

Leverage (x)

0.5

0.7

0.6

0.4

0.3

0.0

20.8

17.7

20.1

25.8

28.1

27.2

ROCE (Pre-tax)

17.3

13.2

13.8

20.2

24.5

25.2

Angel ROIC (Pre-tax)

27.2

19.5

20.6

31.3

39.0

44.1

ROE

27.4

23.3

25.3

30.1

30.8

29.0

Asset Turnover (Gross Block)

2.0

1.8

1.8

2.1

2.2

2.3

Inventory / Sales (days)

66

66

69

61

71

79

Receivables (days)

57

54

57

57

58

64

Payables (days)

49

42

55

46

53

53

WC (ex-cash) (days)

64

66

53

48

45

38

Net debt to equity

0.7

0.7

0.5

0.4

0.1

(0.1)

Net debt to EBITDA

2.0

2.3

1.7

1.0

0.3

(0.1)

Interest Coverage (EBIT / Int.)

4.1

4.4

9.3

19.4

19.8

24.0

Per Share Data (`)

Book Value

Dupont Analysis

ROIC (Post-tax)

Operating ROE

Returns (%)

Turnover ratios (x)

Solvency ratios (x)

February 24, 2016

10

Cadila Healthcare |3QFY2016 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as Angel) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Cadila Healthcare

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

over 12 months investment period):

February 24, 2016

Buy (> 15%)

Accumulate (5% to 15%)

Reduce (-5% to -15%)

Neutral (-5 to 5%)

Sell (< -15)

11

You might also like

- Dr. Reddy's Laboratories 1QFY2017 Result Update | PharmaceuticalDocument11 pagesDr. Reddy's Laboratories 1QFY2017 Result Update | Pharmaceuticalparry0843No ratings yet

- Cadila 4Q FY 2013Document12 pagesCadila 4Q FY 2013Angel BrokingNo ratings yet

- Cipla 4Q FY 2013Document11 pagesCipla 4Q FY 2013Angel BrokingNo ratings yet

- Cadila, 1Q FY 2014Document12 pagesCadila, 1Q FY 2014Angel BrokingNo ratings yet

- Cadila Healthcare: Performance HighlightsDocument12 pagesCadila Healthcare: Performance HighlightsAngel BrokingNo ratings yet

- Ipca Labs: Performance HighlightsDocument11 pagesIpca Labs: Performance HighlightsAngel BrokingNo ratings yet

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument10 pagesAlembic Pharma: Performance HighlightsTirthajit SinhaNo ratings yet

- Cadila Healthcare, 12th February 2013Document12 pagesCadila Healthcare, 12th February 2013Angel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Dishman 4Q FY 2013Document10 pagesDishman 4Q FY 2013Angel BrokingNo ratings yet

- Hul 2qfy2013ruDocument12 pagesHul 2qfy2013ruAngel BrokingNo ratings yet

- Indoco Remedies, 30th January 2013Document11 pagesIndoco Remedies, 30th January 2013Angel BrokingNo ratings yet

- GlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesDocument13 pagesGlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesHitechSoft HitsoftNo ratings yet

- Ipca, 1st February 2013Document11 pagesIpca, 1st February 2013Angel BrokingNo ratings yet

- Dr. Reddy's Laboratories: Performance HighlightsDocument11 pagesDr. Reddy's Laboratories: Performance HighlightsAngel BrokingNo ratings yet

- Lupin: Performance HighlightsDocument12 pagesLupin: Performance HighlightsHitechSoft HitsoftNo ratings yet

- Alembic Pharma, 1Q FY 2014Document10 pagesAlembic Pharma, 1Q FY 2014Angel BrokingNo ratings yet

- Godrej Consumer Products: Performance HighlightsDocument11 pagesGodrej Consumer Products: Performance HighlightsAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- Aurobindo Pharma: Performance HighlightsDocument11 pagesAurobindo Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo Pharma (AURPHA) : in Line Results US Driven Growth ContinuesDocument15 pagesAurobindo Pharma (AURPHA) : in Line Results US Driven Growth Continuesjitendrasutar1975No ratings yet

- Indoco Remedies 4Q FY 2013Document11 pagesIndoco Remedies 4Q FY 2013Angel BrokingNo ratings yet

- Dabur India, 31st January 2013Document10 pagesDabur India, 31st January 2013Angel BrokingNo ratings yet

- Ipca Labs Result UpdatedDocument10 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Dishman 2QFY2013RUDocument10 pagesDishman 2QFY2013RUAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument11 pagesAlembic Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Lupin: Performance HighlightsDocument11 pagesLupin: Performance HighlightsAngel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories: Performance HighlightsDocument10 pagesDr. Reddy's Laboratories: Performance HighlightsAngel BrokingNo ratings yet

- DRL, 22nd February, 2013Document11 pagesDRL, 22nd February, 2013Angel BrokingNo ratings yet

- Ipca Labs Result UpdatedDocument12 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Cipla LTD: Key Financial IndicatorsDocument4 pagesCipla LTD: Key Financial IndicatorsMelwyn MathewNo ratings yet

- UPL, 30th January 2013Document11 pagesUPL, 30th January 2013Angel BrokingNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Britannia: Performance HighlightsDocument11 pagesBritannia: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo 4Q FY 2013Document10 pagesAurobindo 4Q FY 2013Angel BrokingNo ratings yet

- PAGE Industries 4Q FY 2013Document13 pagesPAGE Industries 4Q FY 2013Angel BrokingNo ratings yet

- Britannia: Performance HighlightsDocument10 pagesBritannia: Performance HighlightsajujkNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- HT Media: Performance HighlightsDocument11 pagesHT Media: Performance HighlightsTirthajit SinhaNo ratings yet

- Ajanta Pharma ReportDocument15 pagesAjanta Pharma Reportmayankpant1No ratings yet

- United Spirits 4Q FY 2013Document10 pagesUnited Spirits 4Q FY 2013Angel BrokingNo ratings yet

- Godrej Consumer ProductsDocument12 pagesGodrej Consumer ProductsAngel BrokingNo ratings yet

- Motilal CadilaDocument14 pagesMotilal CadilarohitNo ratings yet

- Dabur India 4Q FY 2013Document11 pagesDabur India 4Q FY 2013Angel BrokingNo ratings yet

- Aurobindo, 1Q FY 2014Document11 pagesAurobindo, 1Q FY 2014Angel BrokingNo ratings yet

- DB Corp.: Performance HighlightsDocument11 pagesDB Corp.: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo, 12th February 2013Document11 pagesAurobindo, 12th February 2013Angel BrokingNo ratings yet

- DB Corp 4Q FY 2013Document11 pagesDB Corp 4Q FY 2013Angel BrokingNo ratings yet

- Relaxo Footwears: Promising FutureDocument13 pagesRelaxo Footwears: Promising FutureIrfan ShaikhNo ratings yet

- GCPL, 4th February, 2013Document11 pagesGCPL, 4th February, 2013Angel BrokingNo ratings yet

- CSL 4Q Fy 2013Document15 pagesCSL 4Q Fy 2013Angel BrokingNo ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- CholaFin AR 20182019Document234 pagesCholaFin AR 20182019HitechSoft HitsoftNo ratings yet

- Company Analysis and Financial Due Diligence: August 2013Document50 pagesCompany Analysis and Financial Due Diligence: August 2013HitechSoft HitsoftNo ratings yet

- HPCotton 5028730316Document72 pagesHPCotton 5028730316HitechSoft HitsoftNo ratings yet

- Gloster 5385950315Document121 pagesGloster 5385950315HitechSoft HitsoftNo ratings yet

- JindalWorldwide 5315430316Document101 pagesJindalWorldwide 5315430316HitechSoft HitsoftNo ratings yet

- Gloster 5385950316Document130 pagesGloster 5385950316HitechSoft HitsoftNo ratings yet

- Sree Rayalseema Alkalies 16 5077530316Document75 pagesSree Rayalseema Alkalies 16 5077530316HitechSoft HitsoftNo ratings yet

- MediaRelease ExtendedWorkOrder MIPDocument3 pagesMediaRelease ExtendedWorkOrder MIPHitechSoft HitsoftNo ratings yet

- Jnac 31mar16Document4 pagesJnac 31mar16HitechSoft HitsoftNo ratings yet

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftNo ratings yet

- Gloster 5385950314Document105 pagesGloster 5385950314HitechSoft HitsoftNo ratings yet

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftNo ratings yet

- IndoAMines Annual Reort 2015-2016 India CorporateDocument120 pagesIndoAMines Annual Reort 2015-2016 India CorporateHitechSoft HitsoftNo ratings yet

- Sankhya 5329720316Document77 pagesSankhya 5329720316HitechSoft HitsoftNo ratings yet

- AngelBrokingResearch NTPC OFSNote 230216Document11 pagesAngelBrokingResearch NTPC OFSNote 230216HitechSoft HitsoftNo ratings yet

- State Bank of India 3Q FY2016 Review IndiaDocument10 pagesState Bank of India 3Q FY2016 Review IndiaHitechSoft HitsoftNo ratings yet

- Lupin: Performance HighlightsDocument12 pagesLupin: Performance HighlightsHitechSoft HitsoftNo ratings yet

- IndTraDeco Annual Report 1516Document49 pagesIndTraDeco Annual Report 1516HitechSoft HitsoftNo ratings yet

- GlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesDocument13 pagesGlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesHitechSoft HitsoftNo ratings yet

- AngelBrokingResearch Cipla 3QFY2016RU 240216Document11 pagesAngelBrokingResearch Cipla 3QFY2016RU 240216HitechSoft HitsoftNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- Bajaj Auto 3Q FY2016Document12 pagesBajaj Auto 3Q FY2016HitechSoft HitsoftNo ratings yet

- Panamapanama Petroleum 2011 Annual Report India CorporateDocument49 pagesPanamapanama Petroleum 2011 Annual Report India CorporateHitechSoft HitsoftNo ratings yet

- Redmi1s Flash Screens 1s Brick CellDocument1 pageRedmi1s Flash Screens 1s Brick CellHitechSoft HitsoftNo ratings yet

- Panama Petro Ar 2010Document40 pagesPanama Petro Ar 2010Inder KalraNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- BulletProofInvesting TakeawaysDocument3 pagesBulletProofInvesting TakeawaysHitechSoft HitsoftNo ratings yet

- Panama Petroleum 2012 Annual Report India CorporateDocument45 pagesPanama Petroleum 2012 Annual Report India CorporateHitechSoft HitsoftNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- Andy Landers - Freeze Zone OffenseDocument6 pagesAndy Landers - Freeze Zone OffenseWinston Brown100% (1)

- Modern Mathematical Statistics With Applications (2nd Edition)Document13 pagesModern Mathematical Statistics With Applications (2nd Edition)Alex Bond11% (28)

- Understanding Deuteronomy On Its Own TermsDocument5 pagesUnderstanding Deuteronomy On Its Own TermsAlberto RodriguesNo ratings yet

- General Ledger Journal Import ProcessDocument13 pagesGeneral Ledger Journal Import ProcessMadhavi SinghNo ratings yet

- Operations Management 2Document15 pagesOperations Management 2karunakar vNo ratings yet

- People v. Cresencia ReyesDocument7 pagesPeople v. Cresencia ReyesAnggling DecolongonNo ratings yet

- CSEC Notes US in The CaribbeanDocument8 pagesCSEC Notes US in The Caribbeanvernon white100% (2)

- 1022-Article Text-2961-1-10-20200120Document10 pages1022-Article Text-2961-1-10-20200120Zuber RokhmanNo ratings yet

- Mr. Honey's Large Business DictionaryEnglish-German by Honig, WinfriedDocument538 pagesMr. Honey's Large Business DictionaryEnglish-German by Honig, WinfriedGutenberg.orgNo ratings yet

- Bombardier CityfloDocument14 pagesBombardier CityfloBiju KmNo ratings yet

- Chapter 5 Quiz Corrections ADocument4 pagesChapter 5 Quiz Corrections Aapi-244140508No ratings yet

- Unpacking of StandardsDocument41 pagesUnpacking of StandardsJealf Zenia Laborada CastroNo ratings yet

- 50 Cool Stories 3000 Hot Words (Master Vocabulary in 50 Days) For GRE Mba Sat Banking SSC DefDocument263 pages50 Cool Stories 3000 Hot Words (Master Vocabulary in 50 Days) For GRE Mba Sat Banking SSC DefaravindNo ratings yet

- Muhammad v. Hall, 10th Cir. (2017)Document12 pagesMuhammad v. Hall, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Adina CFD FsiDocument481 pagesAdina CFD FsiDaniel GasparinNo ratings yet

- Ashe v. Swenson, 397 U.S. 436 (1970)Document25 pagesAshe v. Swenson, 397 U.S. 436 (1970)Scribd Government DocsNo ratings yet

- Neoclassicism: Romanticism Realism ImpressionismDocument16 pagesNeoclassicism: Romanticism Realism ImpressionismErika EludoNo ratings yet

- Test Unit 3Document2 pagesTest Unit 3RAMONA SECUNo ratings yet

- The Perfect Prayer by by Jon Courson - Matthew 6 9-13 The Lords PrayerDocument6 pagesThe Perfect Prayer by by Jon Courson - Matthew 6 9-13 The Lords PrayerRobert Beaupre100% (1)

- 6 Strategies For Effective Financial Management Trends in K12 SchoolsDocument16 pages6 Strategies For Effective Financial Management Trends in K12 SchoolsRainiel Victor M. CrisologoNo ratings yet

- June 2016 - QuestionsDocument8 pagesJune 2016 - Questionsnasir_m68No ratings yet

- Modelling of Induction Motor PDFDocument42 pagesModelling of Induction Motor PDFsureshNo ratings yet

- 4 Reasons To Walk With GodDocument2 pages4 Reasons To Walk With GodNoel Kerr CanedaNo ratings yet

- Due process violation in granting relief beyond what was prayed forDocument2 pagesDue process violation in granting relief beyond what was prayed forSam LeynesNo ratings yet

- Ch.24.2 Animal Evolution and DiversityDocument34 pagesCh.24.2 Animal Evolution and DiversityweldeenytNo ratings yet

- Javier Couso, Alexandra Huneeus, Rachel Sieder Cultures of Legality Judicialization and Political Activism in Latin America Cambridge Studies in Law and SocietyDocument290 pagesJavier Couso, Alexandra Huneeus, Rachel Sieder Cultures of Legality Judicialization and Political Activism in Latin America Cambridge Studies in Law and SocietyLívia de SouzaNo ratings yet

- Communicative Strategy Powerpoint CO With VideoDocument20 pagesCommunicative Strategy Powerpoint CO With VideoGlydel Octaviano-GapoNo ratings yet

- A Case of DrowningDocument16 pagesA Case of DrowningDr. Asheesh B. PatelNo ratings yet

- Introduction To Vitamin C, (Chemistry STPM)Document2 pagesIntroduction To Vitamin C, (Chemistry STPM)NarmeenNirmaNo ratings yet

- Logic Puzzles Freebie: Includes Instructions!Document12 pagesLogic Puzzles Freebie: Includes Instructions!api-507836868No ratings yet