Professional Documents

Culture Documents

Lupin: Performance Highlights

Uploaded by

HitechSoft HitsoftOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lupin: Performance Highlights

Uploaded by

HitechSoft HitsoftCopyright:

Available Formats

3QFY2016 Result Update | Pharmaceutical

February 18, 2016

Lupin

NEUTRAL

Performance Highlights

CMP

Target Price

Y/E March (` cr)

Investment Period

3QFY2016

2QFY2016

% chg qoq

3QFY2015

% chg yoy

3,358

3,178

5.6

3,145

6.8

Other income

263

184

42.8

116

126.9

Stock Info

Operating profit

679

529

28.4

850

(20.1)

Sector

10

(9.6)

253.1

Market Cap (` cr)

530

409

29.6

601

(11.9)

Net Debt (` cr)

Net sales

Interest

Net profit

`1,731

-

Source: Company, Angel Research

Beta

For 3QFY2016, Lupin posted results more or less in line with our expectations on

sales front. A higher than expected other income aided the net profit to come in

higher than our expectation. The company posted sales of `3,358cr (V/s

`3,400cr expected), a growth of 6.8% yoy. On the operating front, the OPM

came in at 20.2% (V/s 20.5% expected) V/s 27.0% in 3QFY2015. R&D

expenditure during the quarter was 11.7% of sales V/s 8.3% of sales in

3QFY2015. The net profit came in at `530cr (V/s `469cr expected) and V/s

`601cr in 3QFY2015, a yoy dip of 11.9%. The higher than expected PAT is on

back of higher other income yoy, which came in at `263cr V/s `116.1cr in

3QFY2015. Overall, we are Neutral on the stock.

52 Week High / Low

Pharmaceutical

77,974

(629)

0.7

2,127 / 1,589

Avg. Daily Volume

96,520

Face Value (`)

BSE Sensex

23,382

Nifty

7,108

Reuters Code

LUPN.BO

LPC@IN

Bloomberg Code

Shareholding Pattern (%)

Promoters

46.5

Results below expectations on net profit: For 3QFY2016, a higher than

MF / Banks / Indian Fls

expected other income aided the net profit to come in higher than our

expectation. The company posted sales of `3,358cr (V/s `3,400cr expected), a

growth of 6.8% yoy. On the operating front, the OPM came in at 20.2% (V/s

20.5% expected) V/s 27.0% in 3QFY2015. R&D expenditure during the quarter

was 11.7% of sales V/s 8.3% of sales in 3QFY2015. The net profit came in at

`530cr (V/s `469cr expected) and V/s `601cr in 3QFY2015, a yoy dip of 11.9%.

The higher than expected PAT is on back of higher other income yoy, which

came in at `263cr V/s `116.1cr in 3QFY2015.

FII / NRIs / OCBs

37.0

Indian Public / Others

10.0

Outlook and valuation: We expect Lupin to post a CAGR of 14.6% in net sales

6.5

Abs. (%)

3m

1yr

3yr

Sensex

(9.6)

(19.7)

20.1

Lupin

(3.8)

4.3

195.0

3-year price chart

to `16,561cr. We expect an earnings CAGR of 13.1% over FY2015-17 to

`68.3/share. Currently, the stock is trading at 34.3x and 25.3x its FY2016E and

FY2017E earnings, respectively. We remain Neutral on the stock.

Key financials (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Net sales

11,087

12,600

13,092

16,561

17.2

13.6

3.9

26.5

1,836

2,403

2,266

3,072

% chg

39.7

30.9

(5.7)

35.5

EPS (`)

41.0

53.5

50.4

68.3

EBITDA margin (%)

25.3

27.4

25.0

27.0

P/E (x)

42.3

32.4

34.3

25.3

RoE (%)

30.3

30.4

22.8

24.7

RoCE (%)

34.7

34.3

26.1

29.6

P/BV (x)

11.2

8.8

7.1

5.6

7.0

6.1

5.8

4.4

27.5

22.3

23.0

16.4

% chg

Net profit

EV/sales (x)

EV/EBITDA (x)

Source: Company, Angel Research; Note: CMP as of February 17, 2016

Please refer to important disclosures at the end of this report

Source: Company, Angel Research

Sarabjit Kour Nangra

+91 22 3935 7600 Ext: 6806

sarabjit@angelbroking.com

Lupin | 3QFY2016 Result Update

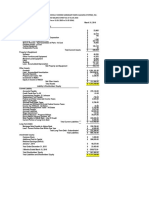

Exhibit 1: 3QFY2016 Consolidated performance

Y/E March (` cr)

3QFY2016

2QFY2016

% chg (qoq)

3QFY2015

% chg (yoy)

9MFY2016

9MFY2015

% chg (yoy)

3,358

3,178

5.6

3,145

6.8

9,610

9,546

0.7

Net sales

Other income

263

184

42.8

116

126.9

579

368

57.4

Total income

3,621

3,363

7.7

3,261

11.0

10,190

9,914

2.8

Gross profit

2,235

2,049

9.1

2,135

6,375

6,345

0.5

Gross margin

66.6

64.5

679.1

528.8

20.2

16.6

10

(9.6)

253.1

Dep. & amortization

114

107

6.6

110

PBT

819

596

37.4

Provision for taxation

290

185

56.7

Reported net profit

28.8

Operating profit

OPM (%)

Interest

67.9

28.4

66.3

66.5

1,969

2,684.0

20.5

28.1

22

210.6

3.3

319

328

(2.8)

853

(4.0)

2,208

2,717

(18.7)

239

21.6

740

834

(11.2)

615

(13.9)

1,467

1,883

(22.1)

850

(20.1)

27.0

529

411

Less : exceptional items

MI & share in associates

(52.7)

PAT after exceptional items

530

409

29.6

EPS (`)

11.8

9.1

(26.6)

13

(90.6)

28

(87.0)

601

(11.9)

1,464

1,856

(21.2)

32.6

41.5

13.4

Source: Company, Angel Research

Exhibit 2: 3QFY2016 Actual vs Angel estimates

` cr

Actual

Estimates

Variation

Net Sales

Other Income

Operating Profit

Deprecation

Tax

Net Profit

3,358

263

679

114

290

530

3,400

116

696

110

220

469

(1.2)

126.9

(2.5)

3.3

31.9

12.9

Source: Company, Angel Research

Revenue grows 6.8% yoy: For 3QFY2016, the company posted sales of `3,358cr

(V/s `3,400cr expected) a yoy growth of 6.8%. Among key geographies, the US

(`1,405cr) posted a flat growth, India (`871.2cr) posted a 17.1% yoy growth,

Japan (`373.9cr) posted a 9.2% yoy growth and ROW (`225.9cr) posted an

18.1% yoy growth. Overall, formulations posted a growth of 7.4% yoy (~92% of

sales), while API grew by 0.1% yoy (~10% of sales).

The company launched 4 products in the US during the period. The company

expects US sales to get normalized by 4QFY2016. It has 87 products in the

market.

Another export destination Japan, posted a yoy growth of 9.2% to `373.9cr,

mainly on back of the currency impact. Sales in JPY terms grew 13.4% yoy to

JPY6,890mn during the quarter. Lupins sales in Europe (`101cr) and India

(`871.2cr) posted a yoy growth of 25.4% and 17.1% yoy, respectively. ROW

(`225.9cr) posted a strong growth of 18.1% yoy in 3QFY2016.

Pharma Dynamics clocked in revenues of `104.8cr during 3QFY2016, a growth

of 5.6% yoy, while growing by 16.5% in ZAR terms to end the quarter at

ZAR223mn. The company remains the fastest growing and the 4th largest generic

February 18, 2016

Lupin | 3QFY2016 Result Update

company in the South African market with clear leadership in the cardiovascular

space.

On the regulatory front, Lupin received 9 approvals from the USFDA during the

quarter. Cumulative ANDA filings with the USFDA as of December 31, 2015 stood

at 225 (37 FTFs) with the company having received 133 approvals to date.

Exhibit 3: Advanced markets Sales trend

2,200

2,000

1,827

1,800

1,880

1,761

1,600

1,599

1,594

1QFY2016

2QFY2016

1,400

1,200

1,000

800

600

400

200

0

3QFY2015

4QFY2015

3QFY2016

Source: Company, Angel Research

Exhibit 4: Domestic Formulation Market

1000

900

800

885

874

871

1QFY2016

2QFY2016

3QFY2016

744

664

700

(` cr)

600

500

400

300

200

100

0

3QFY2015

4QFY2015

Source: Company

OPM lower than expected at 20.2%: On the operating front, the Gross margin

came in at 66.6% (V/s 64.5% expected). Further, a 27.0% and 50.3% yoy rise in

Staff cost and R&D expenditure, respectively, led the OPM to come in at 20.2%

V/s 20.5% expected and V/s 27.0% in 3QFY2015.

February 18, 2016

Lupin | 3QFY2016 Result Update

Exhibit 5: OPM trend

29.0

27.0

27.0

24.2

(%)

25.0

23.0

20.2

21.0

19.0

16.6

17.0

16.6

15.0

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

Source: Company, Angel Research

Net profit growth lower than our estimate: Thus, the net profit came in at `530cr

V/s `469cr expected and V/s `601cr in 3QFY2015, a yoy dip of 11.9%.

(` cr)

Exhibit 6: Net profit trends

700

650

600

550

500

450

400

350

300

250

200

150

100

50

-

601

547

530

525

409

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

Source: Company, Angel Research

Conference call takeaways

February 18, 2016

The Management expects to post 17% yoy growth in the domestic formulation

business in FY2016E.

The Management has guided for higher growth in 4QFY2016 in US and

expects 15-20 approvals every year from FY2017.

Goa and Aurangabad facilities are yet to receive EIR from USFDA clearances

whereas the Indore facility has already received EIR for its 483 observations.

However, Lupin has been receiving ANDA approvals from all three facilities.

Over the last 15 months, the USFDA has inspected 12 facilities for Lupin. 9

out of 12 facilities have been cleared by the USFDA without any 483

observations. Other three include Goa, Indore and Aurangabad.

Lupin | 3QFY2016 Result Update

Recommendation rationale

US market the key driver: The high-margin branded generic business has

been the key differentiator for Lupin in the Indian pharmaceuticals space. On

the generic turf, Lupin is currently the fifth largest generic player in the US,

with 5.3% market share in prescription. Lupin is now the market leader in 33

products marketed in the US generics market and is amongst the Top 3 by

market share in 61 products.

Currently, the companys cumulative filings stand at 220, of which 124 have

been approved, with 35 FTFs valued at more than US$13bn. Lupin plans to

launch 15-20 products in the US in FY2017. Another driver, the OC segment,

is expected to contribute US$100mn to the companys top-line over the next

2-3 years. Another significant portion of the companys US business, Branded

segment which is around ~10% of its US sales (FY2015), is expected to

increase to 30% of sales by FY2018, through acquisitions. We expect the

region to post a CAGR of 15.0% during FY2015-17.

February 18, 2016

Domestic formulations on a strong footing: Lupin continues to make strides in

the Indian market. Currently, Lupin ranks No 3, and is the fastest growing

company among the top five companies in the domestic formulation space,

registering a strong CAGR of 20.0% over the last few years. Six of Lupin's

products are among the top 300 brands in the country. Lupin introduced

54 new products in the Indian market in FY2014 and has a strong field force

of ~5,400MRs (as of FY2015). We expect the domestic formulation market to

grow at a CAGR of 16.0% over FY2015-17E.

First-mover advantage in Japan: Lupin figures among the few Indian

companies with a formidable presence in the worlds second largest pharma

market (ranked as the 8th largest as per IMS MAT March 2014). The

Management believes there will be patent expiries (US$14-16bn) in the next

two years in the Japanese market, which along with increased generic

penetration, would drive growth in the market. For FY2015, the market posted

a moderate growth after a dip in FY2014; however going forward the

company expects a healthy growth, with double digit growth (15% in constant

currency) in the Kyowa business and a single digit growth in the Irom

business. The Management expects improvement in growth in the next 3-4

years. On a conservative basis, we expect the market to post a CAGR of 9.5%

over FY2015-17E.

Lupin | 3QFY2016 Result Update

Valuation

We expect Lupin to post a CAGR of 14.6% in net sales to

`16,561cr and earnings to report a 13.1% CAGR to `68.3/share over

FY201517E. Currently, the stock is trading at 34.3x and 25.3x its FY2016E and

FY2017E earnings, respectively. We remain Neutral on the stock.

Exhibit 7: Key Assumptions

FY2016E

FY2017E

3.9

26.5

16.0

16.0

Sales growth (%)

Domestic growth (%)

Exports growth (%)

Operating margins (%)

1.0

30.2

25.0

27.0

R&D Exp ( % of sales)

10.0

10.0

Capex (` cr)

1000

1000

Source: Company, Angel Research

Exhibit 8: One-year forward PE

3,000

2,500

(` cr)

2,000

1,500

1,000

500

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

15x

20x

25x

30x

Source: Company, Angel Research

Exhibit 9: Recommendation summary

Company

Reco

CMP Tgt. price

Upside

FY2017E

FY15-17E

(`)

(`)

(%)

PE (x)

Alembic Pharma

Neutral

609

21.2

Aurobindo Pharma

Buy

663

856

29.1

Cadila Healthcare

Accumulate

314

352

Cipla

Buy

520

636

Dr Reddy's

Buy

2,961

Dishman Pharma

Neutral

313

GSK Pharma*

Neutral

Indoco Remedies

Neutral

Ipca labs

Buy

Lupin

Sanofi India*

Sun Pharma

Accumulate

FY2017E

EV/Sales (x)

EV/EBITDA (x)

CAGR in EPS (%)

RoCE (%)

RoE (%)

2.9

15.0

38.2

31.3

31.2

15.5

2.5

11.0

15.6

23.5

30.2

12.1

17.8

2.7

12.2

24.6

25.2

29.0

22.3

18.0

2.4

12.8

21.4

17.1

16.8

3,933

32.8

16.6

2.5

10.7

17.2

19.1

20.4

15.7

1.7

7.8

15.9

9.4

11.0

3,195

46.8

8.2

36.9

6.6

33.7

34.3

260

19.1

2.1

11.4

23.0

19.7

19.7

599

900

50.3

21.4

2.2

11.7

17.9

11.8

14.0

Neutral

1,731

25.3

4.4

16.4

13.1

29.6

24.7

Neutral

4,176

27.6

3.6

17.1

33.1

27.9

25.5

855

950

11.2

31.8

5.6

18.3

8.4

15.8

16.6

Source: Company, Angel Research; Note: * December year ending

February 18, 2016

Lupin | 3QFY2016 Result Update

Company Background

Lupin, established in 1968, is primarily engaged in the manufacture and global

distribution of active pharmaceutical ingredients (APIs) and finished dosages. Over

the years, the company forayed into the US markets through a differentiated export

strategy of tapping branded generics and consequently gaining a large share of

the US prescription market. Further, to expand its foot-print in the global market,

Lupin has prudently adopted the inorganic growth route. In line with this, over the

last two years, the company made small acquisitions across geographies,

prominent among these being the acquisition of Kyowa in the growing Japanese

market. In the US, the company has acquired privately held GAVIS

Pharmaceuticals LLC and Novel Laboratories Inc. The acquisition enhances Lupins

scale in the US generic market and also broadens Lupins pipeline in dermatology,

controlled substance products and other high-value and niche generics.

February 18, 2016

Lupin | 3QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

Gross sales

Less: Excise duty

Net sales

Other operating income

Total operating income

7,002

42

6,960

123

62

16,661

84

79

100

9,462 11,087 12,600

13,092

16,561

170

170

170

9,641 11,287 12,770

180

80

13,171

200

13,262

16,731

36.1

17.1

13.1

3.9

26.2

Total expenditure

5,638

7,371

8,284

9,150

9,819

12,089

Net raw materials

2,604

3,548

3,817

4,157

4,189

5,299

906

757

887

1,008

1,047

1,325

Other mfg costs

Personnel

7,083

9,524 11,167 12,684

21.4

% chg

970

1,249

1,465

1,747

2,053

2,153

Other

1,159

1,818

2,115

2,238

2,529

3,312

EBITDA

1,322

2,090

2,803

3,449

3,273

4,471

% chg

24.0

58.2

34.1

23.1

-5.1

36.6

(% of Net Sales)

19.0

22.1

25.3

27.4

25.0

27.0

Depreciation& amortisation

228

332

261

435

468

548

1,094

1,758

2,542

3,015

2,805

3,923

% chg

22.3

60.7

44.6

18.6

-7.0

39.9

(% of Net Sales)

15.7

18.6

22.9

23.9

21.4

23.7

Interest & other charges

35

41

27

10

10

10

Other Income

14

28

116

240

240

240

EBIT

(% of PBT)

Share in profit of associates

Recurring PBT

% chg

Extraordinary expense/(Inc.)

PBT (reported)

1,196

1,925

2,832

3,415

3,205

4,323

20.0

60.9

47.1

20.6

-6.1

34.9

1,196

1,925

2,832

3,415

3,205

4,323

Tax

309

584

962

970

897

1,211

(% of PBT)

25.8

30.4

34.0

28.4

28.0

28.0

PAT (reported)

888

1,340

1,870

2,444

2,307

3,113

Add: Share of earnings of asso.

Less: Minority interest (MI)

Prior period items

20

26

33

41

41

41

PAT after MI (reported)

868

1,314

1,836

2,403

2,266

3,072

ADJ. PAT

868

1,314

1,836

2,403

2,266

3,072

% chg

0.6

51.5

39.7

30.9

(5.7)

35.5

(% of Net Sales)

12.5

13.9

16.6

19.1

17.3

18.5

Basic EPS (`)

19.4

29.4

41.0

53.5

50.4

68.3

Fully Diluted EPS (`)

19.4

29.4

41.0

53.5

50.4

68.3

0.6

51.0

39.5

30.5

(5.7)

35.5

% chg

February 18, 2016

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

Lupin | 3QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

89

90

90

90

90

90

Reserves & surplus

3,924

5,115

6,842

8,784

10,882

13,785

Shareholders funds

4,013

5,204

6,932

8,874

10,972

13,875

Minority interest

Total loans

72

59

67

24

65

106

1,640

1,164

553

471

471

471

Other Long-Term Liabilities

73

50

46

74

75

76

Long-Term Provisions

67

112

132

132

69

70

Deferred tax liability

144

163

178

118

118

118

6,010

6,754

7,908

9,693

11,771

14,717

Gross block

3,627

4,114

4,564

5,355

6,355

7,355

Less: Acc. depreciation

1,442

1,684

1,928

2,363

2,831

3,380

Net block

2,185

2,430

2,635

2,992

3,524

3,975

Capital work-in-progress

444

311

304

304

304

304

Goodwill

564

570

720

1,648

1,648

1,648

178

1,658

1,658

1,658

Total liabilities

APPLICATION OF FUNDS

Investments

Long-Term Loans and Adv.

394

387

373

275

284

359

4,297

5,143

5,924

6,176

7,844

11,189

Cash

402

435

798

1,306

2,783

4,787

Loans & advances

309

340

302

671

697

882

Other

3,586

3,154

4,825

4,199

4,364

5,520

Current liabilities

1,878

2,089

2,227

3,360

3,491

4,416

Net current assets

2,420

3,054

3,697

2,816

4,352

6,772

6,010

6,754

7,908

9,693

11,771

14,717

Current assets

Mis. Exp. not written off

Total assets

February 18, 2016

Lupin | 3QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2012

Profit before tax

1,196

1,925

Depreciation

2,832

FY2015

FY2016E

FY2017E

3,415

3,205

4,323

228

332

261

435

468

548

(Inc)/Dec in working capital

(724)

620

(1,481)

1,487

(69)

(491)

Direct taxes paid

(309)

(584)

(962)

(970)

(897)

(1,211)

391

2,293

649

4,367

2,707

3,170

(997)

(353)

(443)

(791)

(1,000)

(1,000)

Cash Flow from Operations

(Inc.)/Dec.in Fixed Assets

(Inc.)/Dec. in Investments

Cash Flow from Investing

(997)

(353)

(443)

(791)

(1,000)

(1,000)

550

(476)

(611)

(82)

(165)

(209)

(157)

(168)

(168)

(168)

Issue of equity

Inc./(Dec.) in loans

Dividend Paid (Incl. Tax)

February 18, 2016

FY2013 FY2014

Others

204

499

(795)

(2,816)

(62)

Cash Flow from Financing

589

(186)

(1,564)

(3,067)

(230)

(166)

Inc./(Dec.) in Cash

(18)

1,753

(1,358)

509

1,477

2,004

Opening Cash balances

420

402

435

798

1,306

2,783

Closing Cash balances

402

435

798

1,306

2,783

4,787

10

Lupin | 3QFY2016 Result Update

Key Ratios

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

89.0

58.9

42.3

32.4

34.3

25.3

P/CEPS

70.5

47.0

37.0

27.4

28.4

21.5

P/BV

19.2

14.9

11.2

8.8

7.1

5.6

Dividend yield (%)

0.2

0.2

0.2

0.2

0.2

0.2

EV/Sales

11.2

8.2

7.0

6.1

5.8

4.4

EV/EBITDA

59.2

37.3

27.5

22.3

23.0

16.4

EV / Total Assets

13.0

11.5

9.8

7.9

6.4

5.0

EPS (Basic)

19.4

29.4

41.0

53.5

50.4

68.3

EPS (fully diluted)

19.4

29.4

41.0

53.5

50.4

68.3

Cash EPS

24.5

36.8

46.8

63.1

60.8

80.5

3.4

4.0

4.0

4.0

4.0

4.0

89.9

116.3

154.6

197.4

244.1

308.7

EBIT margin

15.7

18.6

22.9

23.9

21.4

23.7

Tax retention ratio

74.2

69.6

66.0

71.6

72.0

72.0

Asset turnover (x)

1.4

1.6

1.7

1.6

1.5

1.8

16.8

20.9

25.4

28.2

23.5

30.2

Cost of Debt (Post Tax)

1.9

2.0

2.0

1.4

1.5

1.5

Leverage (x)

0.3

0.0

0.0

0.0

0.0

0.0

20.6

20.9

25.4

28.2

23.5

30.2

ROCE (Pre-tax)

20.5

27.5

34.7

34.3

26.1

29.6

Angel ROIC (Pre-tax)

27.5

35.0

44.1

48.2

41.6

52.3

ROE

23.8

28.5

30.3

30.4

22.8

24.7

Asset Turnover (Gross Block)

2.3

2.5

2.6

2.6

2.3

2.4

Inventory / Sales (days)

76

70

66

62

69

75

Per Share Data (`)

DPS

Book Value

Dupont Analysis

ROIC (Post-tax)

Operating ROE

Returns (%)

Turnover ratios (x)

Receivables (days)

Payables (days)

WC cycle (ex-cash) (days)

77

75

75

66

74

80

156

72

84

78

89

84

87

88

89

63

42

39

0.3

0.1

(0.0)

(0.1)

(0.2)

(0.3)

Solvency ratios (x)

Net debt to equity

Net debt to EBITDA

Interest Coverage

February 18, 2016

0.9

0.3

(0.1)

(0.2)

(0.7)

(1.0)

30.8

42.9

95.4

307.3

285.9

399.9

11

Lupin | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as Angel) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Lupin

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

over 12 months investment period):

February 18, 2016

Buy (> 15%)

Accumulate (5% to 15%)

Reduce (-5% to -15%)

Neutral (-5 to 5%)

Sell (< -15)

12

You might also like

- General Merchandise (Nondurable Goods) Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Merchandise (Nondurable Goods) Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Lupin: Performance HighlightsDocument11 pagesLupin: Performance HighlightsAngel BrokingNo ratings yet

- Lupin, 4th February, 2013Document11 pagesLupin, 4th February, 2013Angel BrokingNo ratings yet

- Dr. Reddy's Laboratories 1QFY2017 Result Update | PharmaceuticalDocument11 pagesDr. Reddy's Laboratories 1QFY2017 Result Update | Pharmaceuticalparry0843No ratings yet

- Lupin Result UpdatedDocument11 pagesLupin Result UpdatedAngel BrokingNo ratings yet

- Lupin Result UpdatedDocument11 pagesLupin Result UpdatedAngel BrokingNo ratings yet

- Cadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016Document11 pagesCadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016HitechSoft HitsoftNo ratings yet

- Cipla 4Q FY 2013Document11 pagesCipla 4Q FY 2013Angel BrokingNo ratings yet

- Aurobindo Pharma (AURPHA) : in Line Results US Driven Growth ContinuesDocument15 pagesAurobindo Pharma (AURPHA) : in Line Results US Driven Growth Continuesjitendrasutar1975No ratings yet

- Lupin: Performance HighlightsDocument11 pagesLupin: Performance HighlightsAngel BrokingNo ratings yet

- Alembic Pharma, 1Q FY 2014Document10 pagesAlembic Pharma, 1Q FY 2014Angel BrokingNo ratings yet

- UPL, 30th January 2013Document11 pagesUPL, 30th January 2013Angel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument10 pagesAlembic Pharma: Performance HighlightsTirthajit SinhaNo ratings yet

- Aurobindo, 1Q FY 2014Document11 pagesAurobindo, 1Q FY 2014Angel BrokingNo ratings yet

- Cadila, 1Q FY 2014Document12 pagesCadila, 1Q FY 2014Angel BrokingNo ratings yet

- Cadila 4Q FY 2013Document12 pagesCadila 4Q FY 2013Angel BrokingNo ratings yet

- Sintex Industries 3QFY15 EBITDA in line; lower tax boosts PATDocument12 pagesSintex Industries 3QFY15 EBITDA in line; lower tax boosts PATMLastTryNo ratings yet

- Dabur India 4Q FY 2013Document11 pagesDabur India 4Q FY 2013Angel BrokingNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsHitechSoft HitsoftNo ratings yet

- Indian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinDocument17 pagesIndian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinNarnolia Securities LimitedNo ratings yet

- Target: Rs.185. Alembic Pharmaceuticals LTDDocument8 pagesTarget: Rs.185. Alembic Pharmaceuticals LTDnikunjNo ratings yet

- GlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesDocument13 pagesGlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesHitechSoft HitsoftNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Dishman 4Q FY 2013Document10 pagesDishman 4Q FY 2013Angel BrokingNo ratings yet

- Kanpur Plastipack (KANPLA: Stable, Sound Business Model..Document5 pagesKanpur Plastipack (KANPLA: Stable, Sound Business Model..Dinesh ChoudharyNo ratings yet

- Ipca, 1st February 2013Document11 pagesIpca, 1st February 2013Angel BrokingNo ratings yet

- Cadila Healthcare, 12th February 2013Document12 pagesCadila Healthcare, 12th February 2013Angel BrokingNo ratings yet

- Radico Khaitan 1QFY15 Results Update: Earnings Cut 20-25% on Weak VolumesDocument6 pagesRadico Khaitan 1QFY15 Results Update: Earnings Cut 20-25% on Weak VolumesDeepak GuptaNo ratings yet

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Document5 pagesFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarNo ratings yet

- Transcirpt of Earnings Call (Company Update)Document26 pagesTranscirpt of Earnings Call (Company Update)Shyam SunderNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument9 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo, 12th February 2013Document11 pagesAurobindo, 12th February 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument19 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Aurobindo Pharma Result UpdatedDocument10 pagesAurobindo Pharma Result UpdatedAngel BrokingNo ratings yet

- Market Outlook June 2, 2014 RecapDocument13 pagesMarket Outlook June 2, 2014 RecapArun ShekharNo ratings yet

- Market Outlook 19th April 2012Document7 pagesMarket Outlook 19th April 2012Angel BrokingNo ratings yet

- Jain Irrigation Motilal Oswal Aug 16Document12 pagesJain Irrigation Motilal Oswal Aug 16Kedar ChoksiNo ratings yet

- Alembic Pharma LTD (APL) Stock Update: Retail ResearchDocument5 pagesAlembic Pharma LTD (APL) Stock Update: Retail ResearchShashi KapoorNo ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- Jubilant Life Sciences target raised to Rs. 405 on margin expansionDocument13 pagesJubilant Life Sciences target raised to Rs. 405 on margin expansionumaganNo ratings yet

- HDFC Securities Pharma UpdateDocument3 pagesHDFC Securities Pharma UpdateVijayNo ratings yet

- Ranbaxy, 2Q CY 2013Document11 pagesRanbaxy, 2Q CY 2013Angel BrokingNo ratings yet

- Vivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A BuyDocument20 pagesVivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A Buyapi-234474152No ratings yet

- Aurobindo 4Q FY 2013Document10 pagesAurobindo 4Q FY 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument17 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- United Phosphorus: Performance HighlightsDocument12 pagesUnited Phosphorus: Performance HighlightsAngel BrokingNo ratings yet

- Lupin: Performance HighlightsDocument12 pagesLupin: Performance HighlightsAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Bharat Forge LTD - GlobalizationDocument8 pagesBharat Forge LTD - GlobalizationAnny MonuNo ratings yet

- Cadila Healthcare: Performance HighlightsDocument12 pagesCadila Healthcare: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo Pharma: Performance HighlightsDocument11 pagesAurobindo Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Samp Softlogic 2016 Q1Document4 pagesSamp Softlogic 2016 Q1SupunDNo ratings yet

- United Phosphorus Result UpdatedDocument11 pagesUnited Phosphorus Result UpdatedAngel BrokingNo ratings yet

- PAGE Industries 4Q FY 2013Document13 pagesPAGE Industries 4Q FY 2013Angel BrokingNo ratings yet

- Indoco Remedies 4Q FY 2013Document11 pagesIndoco Remedies 4Q FY 2013Angel BrokingNo ratings yet

- Market Outlook 2nd August 2011Document6 pagesMarket Outlook 2nd August 2011Angel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- MediaRelease ExtendedWorkOrder MIPDocument3 pagesMediaRelease ExtendedWorkOrder MIPHitechSoft HitsoftNo ratings yet

- IndoAMines Annual Reort 2015-2016 India CorporateDocument120 pagesIndoAMines Annual Reort 2015-2016 India CorporateHitechSoft HitsoftNo ratings yet

- CholaFin AR 20182019Document234 pagesCholaFin AR 20182019HitechSoft HitsoftNo ratings yet

- Company Analysis and Financial Due Diligence: August 2013Document50 pagesCompany Analysis and Financial Due Diligence: August 2013HitechSoft HitsoftNo ratings yet

- State Bank of India 3Q FY2016 Review IndiaDocument10 pagesState Bank of India 3Q FY2016 Review IndiaHitechSoft HitsoftNo ratings yet

- Gloster 5385950314Document105 pagesGloster 5385950314HitechSoft HitsoftNo ratings yet

- Sree Rayalseema Alkalies 16 5077530316Document75 pagesSree Rayalseema Alkalies 16 5077530316HitechSoft HitsoftNo ratings yet

- JindalWorldwide 5315430316Document101 pagesJindalWorldwide 5315430316HitechSoft HitsoftNo ratings yet

- Jnac 31mar16Document4 pagesJnac 31mar16HitechSoft HitsoftNo ratings yet

- Gloster 5385950315Document121 pagesGloster 5385950315HitechSoft HitsoftNo ratings yet

- HPCotton 5028730316Document72 pagesHPCotton 5028730316HitechSoft HitsoftNo ratings yet

- AngelBrokingResearch NTPC OFSNote 230216Document11 pagesAngelBrokingResearch NTPC OFSNote 230216HitechSoft HitsoftNo ratings yet

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftNo ratings yet

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftNo ratings yet

- Gloster 5385950316Document130 pagesGloster 5385950316HitechSoft HitsoftNo ratings yet

- Sankhya 5329720316Document77 pagesSankhya 5329720316HitechSoft HitsoftNo ratings yet

- Bajaj Auto 3Q FY2016Document12 pagesBajaj Auto 3Q FY2016HitechSoft HitsoftNo ratings yet

- GlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesDocument13 pagesGlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesHitechSoft HitsoftNo ratings yet

- Cadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016Document11 pagesCadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016HitechSoft HitsoftNo ratings yet

- Redmi1s Flash Screens 1s Brick CellDocument1 pageRedmi1s Flash Screens 1s Brick CellHitechSoft HitsoftNo ratings yet

- IndTraDeco Annual Report 1516Document49 pagesIndTraDeco Annual Report 1516HitechSoft HitsoftNo ratings yet

- AngelBrokingResearch Cipla 3QFY2016RU 240216Document11 pagesAngelBrokingResearch Cipla 3QFY2016RU 240216HitechSoft HitsoftNo ratings yet

- BulletProofInvesting TakeawaysDocument3 pagesBulletProofInvesting TakeawaysHitechSoft HitsoftNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- Panama Petro Ar 2010Document40 pagesPanama Petro Ar 2010Inder KalraNo ratings yet

- Panamapanama Petroleum 2011 Annual Report India CorporateDocument49 pagesPanamapanama Petroleum 2011 Annual Report India CorporateHitechSoft HitsoftNo ratings yet

- Panama Petroleum 2012 Annual Report India CorporateDocument45 pagesPanama Petroleum 2012 Annual Report India CorporateHitechSoft HitsoftNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- ENT300 - Module10 - ORGANIZATIONAL PLANDocument34 pagesENT300 - Module10 - ORGANIZATIONAL PLANnaurahimanNo ratings yet

- EDCA Publishing & Distributing Corp. vs. Santos PDFDocument8 pagesEDCA Publishing & Distributing Corp. vs. Santos PDFRaine VerdanNo ratings yet

- CV B Sahoo (AGM) 101121Document4 pagesCV B Sahoo (AGM) 101121Benudhar SahooNo ratings yet

- 05 - E. Articles 1828 To 1842Document14 pages05 - E. Articles 1828 To 1842Noemi MejiaNo ratings yet

- Ong v. Tiu Case DigestDocument3 pagesOng v. Tiu Case DigestNa-eehs Noicpecnoc Namzug0% (1)

- Distributor Agreement CleanDocument16 pagesDistributor Agreement CleanMd. Akmal HossainNo ratings yet

- HP DeskJet Printer Supply Chain IssuesDocument26 pagesHP DeskJet Printer Supply Chain IssuesKaren VillafuerteNo ratings yet

- B Plan Mobile SalonDocument4 pagesB Plan Mobile SalonShristi Gupta100% (1)

- Supply Chain ChecklistDocument2 pagesSupply Chain ChecklistAli Aliakbari100% (4)

- Analyzing Operating ActivitiesDocument38 pagesAnalyzing Operating ActivitiesindahmuliasariNo ratings yet

- How Organizations Change Over TimeDocument36 pagesHow Organizations Change Over TimeTareq Abu Shreehah100% (1)

- Performance Review and GoalsDocument3 pagesPerformance Review and GoalsTaha NabilNo ratings yet

- MTAP Saturday Math Grade 4Document2 pagesMTAP Saturday Math Grade 4Luis SalengaNo ratings yet

- Etr - Siti Zubaidah Azizan M at 14 - 5Document5 pagesEtr - Siti Zubaidah Azizan M at 14 - 5Aziful AiemanNo ratings yet

- Using A Payoff Matrix To Determine The Equilibr...Document2 pagesUsing A Payoff Matrix To Determine The Equilibr...BLESSEDNo ratings yet

- COA 018 Audit Checklist For Coal Operation Health and Safety Management Systems Field Audit2Document42 pagesCOA 018 Audit Checklist For Coal Operation Health and Safety Management Systems Field Audit2sjarvis5No ratings yet

- SKI employee dismissed after resignation from India projectDocument4 pagesSKI employee dismissed after resignation from India projectJB GuevarraNo ratings yet

- Pioneering Portfolio ManagementDocument6 pagesPioneering Portfolio ManagementGeorge KyriakoulisNo ratings yet

- DECISION MAKING TECHNIQUES AND PROCESSESDocument11 pagesDECISION MAKING TECHNIQUES AND PROCESSESMishe MeeNo ratings yet

- Urban DesignDocument22 pagesUrban DesignAbegail CaisedoNo ratings yet

- Business Case ROI Workbook For IT Initiatives: On This WorksheetDocument33 pagesBusiness Case ROI Workbook For IT Initiatives: On This WorksheetMrMaui100% (1)

- QuestionsDocument3 pagesQuestionsLayla RamirezNo ratings yet

- Find the perfect candidate for Wakil Kepala Klinik Utama GR Setra CMIDocument2 pagesFind the perfect candidate for Wakil Kepala Klinik Utama GR Setra CMIRscmi Dan LaboratoriumNo ratings yet

- Recommendations For TOWSDocument9 pagesRecommendations For TOWSShahzad KhanNo ratings yet

- Group8 - Swatch Case RevisedDocument15 pagesGroup8 - Swatch Case RevisedAnand ShankarNo ratings yet

- MQP For MBA I Semester Students of SPPUDocument2 pagesMQP For MBA I Semester Students of SPPUfxn fndNo ratings yet

- Australian Government Data Centre Strategy Strategy 2010-2025Document8 pagesAustralian Government Data Centre Strategy Strategy 2010-2025HarumNo ratings yet

- Factors - Influencing Implementation of A Dry Port PDFDocument17 pagesFactors - Influencing Implementation of A Dry Port PDFIwan Puja RiyadiNo ratings yet

- Average Due Date and Account CurrentDocument80 pagesAverage Due Date and Account CurrentShynaNo ratings yet

- Thermo-020H Decanter DownLoadLy - IrDocument6 pagesThermo-020H Decanter DownLoadLy - IrLuis Rodriguez GonzalesNo ratings yet