Professional Documents

Culture Documents

2016 State Sales Tax Rates

Uploaded by

The Council of State GovernmentsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2016 State Sales Tax Rates

Uploaded by

The Council of State GovernmentsCopyright:

Available Formats

MARCH 2016

THE COUNCIL OF STATE GOVERNMENTS

CAPITOL RESEARCH

FISCAL & ECONOMIC DEVELOPMENT

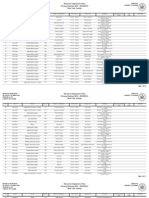

2016 State Sales Tax Rates

In 2016, 45 states plus the District of Columbia have sales taxes in place and five states do not.

Tax rates in 2016 remained relatively unchanged from 2015, but have been creeping slowly upward

over the past decade.1

In 2016, state sales tax rates look a lot like they did

in 2015.

In 2015, 45 states plus the District of Columbia levied

a sales taxthe same was true on Jan. 1, 2016.

In 2015, five states (Alaska, Delaware, Montana,

New Hampshire and Oregon) did not levy a sales

taxthe same five states did not levy a sales tax on

Jan. 1, 2016.

Sales tax rates (or lack thereof) remained the same

as 2015 rates in 49 states and the District of Columbia

on Jan. 1, 2016.

Those rates range from a low of 2.9 percent in

Colorado to a high of 7.5 percent in California,

with an average rate 5.65 percent.

From Jan. 1, 2015 to Jan. 1, 2016, Kansas was the

only state to institute a sales tax rate change.

Kansas legislators passed the tax rate hike in 2015

from 6.15 percent to 6.5 percentto address

budgetary shortfalls. The increase went into effect

on July 1, 2015.

While little has changed since last year, sales tax rates

overall have crept up slowly since 2006.

In 2006, the same five states (Alaska, Delaware,

Montana, New Hampshire and Oregon) did not

levy a sales tax.

Also in 2006, the lowest sales tax rate was 2.9 percent, in Coloradothe same as in 2016.

The highest sales tax rate in 2006 was 7.0 percent

a three way tie in Mississippi, Rhode Island and

Tennessee. Thats relatively similar to the highest

rate in 2016: 7.5 percent in California.

However, in 2006, the average sales tax rate (for

those 45 states plus the District of Columbia that

levied a sales tax) was 5.32 percentmore than 0.3

percentage points lower than the average in 2016.

Thats because from 200616, 19 states increased

their sales tax rates.

Those increases ranged from less than 0.5 percentage

points in six states (Connecticut, Minnesota, Nevada,

New Mexico, North Carolina and Ohio)to the

largest rate increase in Virginia, an increase from

4.0 percent to 5.3 percent.

RESOURCES

2016 and historical sales tax rates are collected and reported by the Federation of Tax Administrators, http://www.taxadmin.org/current-tax-rates.

Jennifer Burnett, Director, The Council of State Governments Fiscal and Economic

Development Policy, jburnett@csg.org

The Council of State Governments

State Sales Tax Rates, Jan. 1, 2016

WA

6.5

OR

No Sales Tax

NV

6.85

CA

7.5

MT

No Sales Tax

ID

6.0

WY

4.0

UT

6.0

ND

5.0

MN

6.875

SD

4.0

KS

6.5

OK

4.5

NM

5.125

TX

6.25

AK

No Sales

Tax

WI

5.0

IA

6.0

NE

5.5

CO

2.9

AZ

5.6

NH

No Sales

VT Tax

ME

6.0

5.5

MO

4.225

AR

6.5

LA

4.0

IL

6.25

NY

4.0

MI

6.0

OH

5.75

IN

7.0

KY

6.0

AL

4.0

WV

6.0

VA

5.3

RI 7.0

CT 6.35

NJ 7.0

DE No Sales Tax

MD 6.0

NC 4.75

TN 7.0

MS

7.0

PA

6.0

MA 6.25

GA

4.0

SC

6.0

FL

6.0

HI

4.0

No Sales Tax

< 4 Percent

4 4.9 Percent

55.9 Percent

6 6.9 Percent

7 Percent +

THE COUNCIL OF STATE GOVERNMENTS

State Sales Tax Rates

Sales Tax Rates (Percent)

Jan. 1, 2006

Alabama

Alaska

Arizona

Arkansas

California (a)

Colorado

Connecticut

Delaware

Dist. of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah (b)

Vermont

Virginia ( c)

Washington (d)

West Virginia

Wisconsin

Wyoming

Jan. 1, 2015

Change in Rate (Percentage Points)

Jan. 1, 2016

201516

200616

4.0

4.0

4.0

......................................................................................................................... No Sales Tax.........................................................................................................................

5.6

5.6

5.6

6.0

6.5

6.5

0.5

6.3

7.5

7.5

1.25

2.9

2.9

2.9

6.00

6.35

6.35

0.35

......................................................................................................................... No Sales Tax.........................................................................................................................

5.75

5.75

5.75

6.0

6.0

6.0

4.0

4.0

4.0

4.0

4.0

4.0

5.0

6.0

6.0

1.0

6.25

6.25

6.25

6.0

7.0

7.0

1.0

5.0

6.0

6.0

1.0

5.30

6.15

6.5

0.35

1.2

6.0

6.0

6.0

4.0

4.0

4.0

5.0

5.5

5.5

0.5

5.0

6.0

6.0

1.0

5.00

6.25

6.25

1.25

6.0

6.0

6.0

6.500

6.875

6.875

0.375

7.0

7.0

7.0

4.225

4.225

4.225

......................................................................................................................... No Sales Tax.........................................................................................................................

5.5

5.5

5.5

6.5

6.9

6.85

0.35

......................................................................................................................... No Sales Tax.........................................................................................................................

6.0

7.0

7.0

1.0

5.000

5.125

5.125

0.125

4.0

4.0

4.0

4.50

4.75

4.75

0.25

5.0

5.0

5.0

5.50

5.75

5.75

0.25

4.5

4.5

4.5

......................................................................................................................... No Sales Tax.........................................................................................................................

6.0

7.0

5.0

4.0

7.0

6.25

4.8

6.0

4.0

6.5

6.0

5.0

4.0

6.0

7.0

6.0

4.0

7.0

6.25

6.0

6.0

5.3

6.5

6.0

5.0

4.0

6.0

7.0

6.0

4.0

7.0

6.25

6.0

6.0

5.3

6.5

6.0

5.0

4.0

1.0

1.2

1.3

Source: Compiled by the Federation of Tax Administrators, reported in CSGs The Book of the States.

(a) Rate is scheduled to decrease to 7.25 percent on 1/1/17.

(b) Includes statewide tax of 1.25 percent levied by local governments in Utah.

(c) Includes statewide 1.0 percent tax levied by local governments in Virginia.

(d) Washington tax rate may fall to 5.5 percent on 4/15/16, if state legislature does not act on Initiative 1366.

THE COUNCIL OF STATE GOVERNMENTS

You might also like

- Sports Betting in The SouthDocument16 pagesSports Betting in The SouthThe Council of State GovernmentsNo ratings yet

- Surprise Medical Billing in The South: A Balancing ActDocument16 pagesSurprise Medical Billing in The South: A Balancing ActThe Council of State GovernmentsNo ratings yet

- Issues To Watch 2020Document8 pagesIssues To Watch 2020The Council of State GovernmentsNo ratings yet

- The Growth of Synthetic Opioids in The SouthDocument8 pagesThe Growth of Synthetic Opioids in The SouthThe Council of State GovernmentsNo ratings yet

- Rural Hospitals: Here Today, Gone TomorrowDocument24 pagesRural Hospitals: Here Today, Gone TomorrowThe Council of State GovernmentsNo ratings yet

- Long-Term Care in The South (Part II)Document16 pagesLong-Term Care in The South (Part II)The Council of State GovernmentsNo ratings yet

- Weathering The Storm: Assessing The Agricultural Impact of Hurricane MichaelDocument8 pagesWeathering The Storm: Assessing The Agricultural Impact of Hurricane MichaelThe Council of State GovernmentsNo ratings yet

- Scoot Over: The Growth of Micromobility in The SouthDocument12 pagesScoot Over: The Growth of Micromobility in The SouthThe Council of State GovernmentsNo ratings yet

- By Roger Moore, Policy AnalystDocument6 pagesBy Roger Moore, Policy AnalystThe Council of State GovernmentsNo ratings yet

- The Netherlands Model: Flood Resilience in Southern StatesDocument16 pagesThe Netherlands Model: Flood Resilience in Southern StatesThe Council of State GovernmentsNo ratings yet

- Blown Away: Wind Energy in The Southern States (Part II)Document16 pagesBlown Away: Wind Energy in The Southern States (Part II)The Council of State GovernmentsNo ratings yet

- Opioids and Organ Donations: A Tale of Two CrisesDocument20 pagesOpioids and Organ Donations: A Tale of Two CrisesThe Council of State GovernmentsNo ratings yet

- By Roger Moore, Policy AnalystDocument16 pagesBy Roger Moore, Policy AnalystThe Council of State GovernmentsNo ratings yet

- 2017 Medicaid Comparative Data ReportDocument125 pages2017 Medicaid Comparative Data ReportThe Council of State GovernmentsNo ratings yet

- By Roger Moore, Policy AnalystDocument16 pagesBy Roger Moore, Policy AnalystThe Council of State GovernmentsNo ratings yet

- Long-Term Care in The South (Part 1)Document20 pagesLong-Term Care in The South (Part 1)The Council of State GovernmentsNo ratings yet

- 2017 Education Comparative Data ReportDocument69 pages2017 Education Comparative Data ReportThe Council of State GovernmentsNo ratings yet

- Emerging State Policies On Youth ApprenticeshipsDocument3 pagesEmerging State Policies On Youth ApprenticeshipsThe Council of State GovernmentsNo ratings yet

- Body-Worn Cameras: Laws and Policies in The SouthDocument24 pagesBody-Worn Cameras: Laws and Policies in The SouthThe Council of State GovernmentsNo ratings yet

- SLC Report: Wind Energy in Southern StatesDocument8 pagesSLC Report: Wind Energy in Southern StatesThe Council of State GovernmentsNo ratings yet

- CSG Capitol Research: Workforce Development Efforts For People With Disabilities: Hiring, Retention and ReentryDocument4 pagesCSG Capitol Research: Workforce Development Efforts For People With Disabilities: Hiring, Retention and ReentryThe Council of State GovernmentsNo ratings yet

- The Case For CubaDocument24 pagesThe Case For CubaThe Council of State GovernmentsNo ratings yet

- Ensuring Federal Consultation With The StatesDocument3 pagesEnsuring Federal Consultation With The StatesThe Council of State GovernmentsNo ratings yet

- Transportation Performance ManagementDocument6 pagesTransportation Performance ManagementThe Council of State GovernmentsNo ratings yet

- Reducing The Number of People With Mental IllnessesDocument16 pagesReducing The Number of People With Mental IllnessesThe Council of State GovernmentsNo ratings yet

- Corrections and Reentry, A Five-Level Risk and Needs System ReportDocument24 pagesCorrections and Reentry, A Five-Level Risk and Needs System ReportThe Council of State GovernmentsNo ratings yet

- 2016 Medicaid Comparative Data ReportDocument185 pages2016 Medicaid Comparative Data ReportThe Council of State GovernmentsNo ratings yet

- CSG Capitol Research: Child Care ConclusionDocument5 pagesCSG Capitol Research: Child Care ConclusionThe Council of State GovernmentsNo ratings yet

- Commuter Rail in The Southern Legislative Conference States: Recent TrendsDocument12 pagesCommuter Rail in The Southern Legislative Conference States: Recent TrendsThe Council of State GovernmentsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Civics Test Study GuideDocument3 pagesCivics Test Study GuideLaura HarrisNo ratings yet

- 554353991583738551Document16 pages554353991583738551api-498674438No ratings yet

- Electoral College Webquest 2020Document4 pagesElectoral College Webquest 2020api-476923692No ratings yet

- Cocktail Reception With Mitt Romney For Romney Victory Inc.Document2 pagesCocktail Reception With Mitt Romney For Romney Victory Inc.Sunlight FoundationNo ratings yet

- 20120523145043619Document106 pages20120523145043619WisconsinOpenRecordsNo ratings yet

- Chapter 22Document5 pagesChapter 22api-235651608No ratings yet

- APUSH Chapter 11 Notes (Up To P. 225)Document4 pagesAPUSH Chapter 11 Notes (Up To P. 225)phthysyllysm100% (1)

- Aas Paper Due FridayDocument7 pagesAas Paper Due FridayTJ BettsNo ratings yet

- Unit 3 Learning Target ChecklistDocument2 pagesUnit 3 Learning Target Checklistapi-116126174No ratings yet

- What The Founders Really Thought About RaceDocument19 pagesWhat The Founders Really Thought About RaceNPI100% (11)

- Commonlit Mccarthyism StudentDocument7 pagesCommonlit Mccarthyism Studentapi-336093393No ratings yet

- Test Bank For Constitutional Law and The Criminal Justice System 6th Edition J Scott Harr DownloadDocument12 pagesTest Bank For Constitutional Law and The Criminal Justice System 6th Edition J Scott Harr DownloadPhilip Yarbrough100% (29)

- Amendments To US ConstitutionDocument2 pagesAmendments To US ConstitutionЛана ШаманаеваNo ratings yet

- Regent University Thesis of Bob McDonnellDocument99 pagesRegent University Thesis of Bob McDonnellDoug MataconisNo ratings yet

- August Leadership Webinar 1Document32 pagesAugust Leadership Webinar 1Joaquin TreeversifeNo ratings yet

- 2008 ATTLEBORO MA Precinct VoteDocument3 pages2008 ATTLEBORO MA Precinct VoteJohn MNo ratings yet

- State of Colorado: Second Regular Session Sixty-Ninth General AssemblyDocument3 pagesState of Colorado: Second Regular Session Sixty-Ninth General AssemblyMichael_Lee_RobertsNo ratings yet

- B Slavery The Civil War and ReconstructionDocument3 pagesB Slavery The Civil War and Reconstructionapi-257246256100% (1)

- The Constitution and The New RepublicDocument6 pagesThe Constitution and The New RepublicTheGreatHelperNo ratings yet

- Donald Trump Personal Financial Disclosure (May 16, 2016)Document104 pagesDonald Trump Personal Financial Disclosure (May 16, 2016)Dank DrizzlerNo ratings yet

- Group Letter To Harris County Commissioners Court - SB 4 LawsuitDocument2 pagesGroup Letter To Harris County Commissioners Court - SB 4 LawsuitKHOUNo ratings yet

- A. Identify The Direct Object and The Indirect Object of The Following SentencesDocument3 pagesA. Identify The Direct Object and The Indirect Object of The Following SentencesDea megaputri0% (1)

- Charters Schools Letter To SchumerDocument2 pagesCharters Schools Letter To SchumerGothamSchools.orgNo ratings yet

- A Dividing NationDocument6 pagesA Dividing Nationapi-252912960No ratings yet

- Dauphin MDJ Primary 2017Document3 pagesDauphin MDJ Primary 2017Hope StephanNo ratings yet

- Objection Ledger Preview 1235Document27 pagesObjection Ledger Preview 1235Celeste KatzNo ratings yet

- Practice Essay Questions - AmericaDocument93 pagesPractice Essay Questions - AmericaGerd KruseNo ratings yet

- Instant Download Anatomy Physiology and Disease Foundations For The Health Professions 1st Edition Roiger Test Bank PDF Full ChapterDocument33 pagesInstant Download Anatomy Physiology and Disease Foundations For The Health Professions 1st Edition Roiger Test Bank PDF Full Chapterlipajdhuruno100% (9)

- Lincoln and The 13th Amendment QuestionsDocument3 pagesLincoln and The 13th Amendment Questionsapi-3318521310% (1)

- Succession Cases - RevisedDocument5 pagesSuccession Cases - RevisedPatrick Santos0% (1)