Professional Documents

Culture Documents

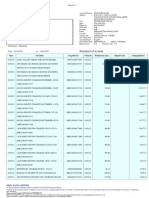

Pricing of Financial Products and Services Offered by Bank

Uploaded by

SmitaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pricing of Financial Products and Services Offered by Bank

Uploaded by

SmitaCopyright:

Available Formats

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

INTRODUCTION OF AXIS BANK

Commercial banking services which includes merchant banking, direct finance infrastructure

finance, venture capital fund, advisory, trusteeship, for ex, treasury and other related financial

services. As on31-Mar-2009, the Group has 827 branches, extension counters and 3,595

automated teller machines (ATMs).Axis Bank was the first of the new private banks to have

begun operations in 1994, after the Government of India allowed new private banks to be

established. The Bank was promoted jointly by the Administrator of the specified undertaking

of the Unit Trust of India (UTI - I), Life Insurance Corporation of India (LIC) and General

Insurance Corporation of India (GIC) and other four PSU insurance companies, i.e. National

Insurance Company Ltd., The New India Assurance Company Ltd., The Oriental Insurance

Company Ltd. and United India Insurance Company Ltd. The Bank today is capitalized to the

extent of Rs. 359.76crores with the public holding (other than promoters) at

57.79%.TheBank's Registered Office is at Ahmadabad and its Central Office is located at

Mumbai. The Bank has a very wide network of more than853 branches and Extension

Counters (as on 30th June 2009). The Bank has a network of over 3723 ATMs (as on 30th

June 2009) providing 24 hrs a day banking convenience to its customers is one of the largest

ATM networks in the country. The Bank has strengths in. This both retail and corporate

banking and is committed to adopting the best industry practices internationally in order to

achieve excellence.

HISTORY OF AXIS BANK

1993 :The Bank was incorporated on 3rd December and Certificate of business on 14th

December. The Bank transacts banking business of all description. UTI Bank Ltd. was

promoted by Unit Trust of India, Life Insurance Corporation of India, General Insurance

Corporation of India and its four subsidiaries. The bank was the first private sector bank to

get a license under the new guidelines issued by the RBI.

1997:The Bank obtained license to act as Depository Participant with NSDL and applied for

registration with SEBI to act as `Trustee to Debenture Holders'. Rupees 100 crores was

Page | 1

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

contributed by UTI, the rest from LIC Rs 7.5 crores, GIC and its four subsidiaries Rs 1.5

crores each.

1998:The Bank has 28 branches in urban and semi urban areas as on 31st July. All the

branches are fully computerized and networked through VSAT. ATM services are available in

27 branches. The Bank came out with a public issue of 1,50,00,000 No. of equity shares of

Rs10 each at a premium of Rs 11 per share aggregating to Rs 31.50crores and Offer for

sale of 2,00,00,000 No. of equity shares for cash at a price of Rs 21 per share. Out of the

public issue 2,20,000 shares were reserved for allotment on preferential basis to employees of

UTI Bank. Balance of 3,47,80,000 shares were offered to the public. The company offers

ATM cards, using which account-holders can withdraw money from any of the bank's ATMs

across the country which is inter-connected by VSAT. UTI Bank has launched a new retail

product with operational flexibility for its customers.

1999:UTI Bank and Citibank have launched an international co-branded Credit card. UTI

Bank and Citibank have come together to launch an international co-branded credit card

under the Master Card umbrella. UTI Bank Ltd has inaugurated an offsite ATM at Ashok

Nagar here, taking the total number of its offsite ATMs to 13.m

2000:The Bank has announced the launch of Tele-Depository Services for Its depository

clients. UTI Bank has launch of `I Connect', its Internet banking Product. UTI Bank has

signed a memorandum of understanding with equitymaster.com for e-broking activities of the

site. Infinity.com financial Securities Ltd., an e-broking outfit is Typing up with UTI Bank for

a banking interface. Geojit Securities Ltd, the first company to start online trading services,

has signed a MoU with UTIBank to enable investors to buy\sell

dematstocks through thecompany's website. India bulls have signed a memorandum of unders

tanding with UTI Bank. UTI Bank has entered into an agreement

with Stock Holding Corporation of India for providing

loans againstshares to SCHCIL's customers and funding investors in public andrights issues.

ICRA has upgraded the rating UTI Bank's Rs 500 crore certificate of deposit programmed to

A1+. UTI Bank has tied up

withL&T Trade.com for providing customized online trading solution for brokers.

2001:UTI Bank launched a private placement of non-convertibledebentures to rise

up to Rs 75 crores. UTI Bank has opened two off site ATMs and one extension counter with

an ATM in Mangalore, taking its total number of ATMs across the country to 355. UTI Bank

has recorded a 62 per cent rise in net profit for the quarter ended September 30, 2001, at Rs

30.95 crore. For the second quarter ended September 30, 2000, the net profit was Rs 19.08

crore. The total income of the bank during the quarter was up 53 per cent at Rs 366.25 crore.

2002:UTI Bank Ltd has informed BSE that Shri B R Barwale has resigned as a Director of

the Bank i.e. January 02, 2002. A C Shah, former chairman of Bank of Baroda, also retired

from the banks board in the third quarter of last year. His place continues to be vacant. MD a

modern took over as the director of the board after taking in the reins of UTI. B S Pandit has

also joined the banks board subsequent to the retirement of K G Vassal. UTI Bank Ltd has

informed that Shri Paul Fletcher has been appointed as an Additional Director Nominee of

CDC Financial Service (Mauritius) Ltd of the Bank. And Shri Donald Peck

hasbeen appointed as an Additional Director (nominee of South AsiaRegional

Page | 2

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Fund) of the Bank. UTI Bank Ltd has informed that on laying down the office of Chairman of

LIC on being appointed as Chairman of SEBI,

Shri G N Bajpai, Nominee Director of LIC has resigned as aDirector of the Bank.

2002:B Paranjpe&AbidHussein cease to be the Directors of UTIBank.UTI Bank Ltd has

informed that in the meeting of the Board

of Directors following decisions were taken: Mr. YashMahajan, Vice Chairman and

Managing Director of Punjab Tractors Ltd wereappointed as an Additional Director with imm

ediate effect. Mr N C Singhal forer Vice Chairmanand Managing Director of SCICI was

appointed as an Additional Director with immediate effect. ABN Amro, UTI Bank in pact to

share ATM. UTI Bank Ltd has informed BSE that a meeting of the Board of Directors of the

Bank is scheduled to be held on October 24, 2002 to consider and take on record the

unaudited half yearly/quarterly financial results of the Bank for the half year/Quarter ended

September 30, 2002. UTI Bank Ltd has informed that Shri J M Trivedi has been appointed as

an alternate director to Shri Donald Peck with effect from November 2, 2002.

2003:UTI Bank Ltd has informed BSE that at the meeting of the Board of Directors of

the company

held on January 16, 2003, Shri R NBharadwaj, Managing Director of LIC has been appointed

as an Additional Director of the Bank with immediate effect.- UTI Bank, the

private sector bank has opened a branch at Nellore. The bank's Chairman and Managing

Director, Dr P.J. Nayak, inaugurating the bank branch at GT Road on May 26. Speaking on

the occasion, DrNayak said. This marks another step towards the extensive customer banking

focus that we are providing across the country and reinforces our

Commitment to bring superior banking services, marked by convenience and closeness to

customers. -UTIBank Ltd. has informed the Exchange that at its meeting held on June 25,

2003 the BOD have decided the following:

1) To appoint Mr. A T Pannir Selvam, formerCMD of Union Bank of India and Prof.

JayanthVarma of the Indian Institute

of Management, Ahmedabad as additional directors of the Bank with immediate effect.

Further, Mr. PannirSelvam will be the nominee director of the Administrator of the specified

undertaking of the Unit Trust of India (UTI-I) and Mr. Jayanth Varma will be an

Independent Director.

2) To issue Non-Convertible Unsecured Redeemable Debentures up to Rs.100 crs, in one or

more tranches as the Bank's Tier - II capital.

-UTI has been authorized to launch 16 ATM son the Western Railway Stations of Mumbai

Division.

-UTI filed suit against financial institutions IFCI Ltd in the debt recovery tribunal at Mumbai

to recover Rs.85cr in dues.

-UTI bank made an entry to the Food Credit Programme; it has made an entry into the 59

cluster whichincludes private sector, public sector, old private sector and co-operative banks.

-ShriAjeet Prasad, Nominee of UTI has resigned as the director of the bank.

-Banks Chairman and MD Dr. P. J. Nayak in augurated a new branch at Nellore.

-UTI bank allots shares under Employee Stock Option Scheme to its employees.

-Unveils pre-paid travel card 'Visa Electron Travel Currency Card'

-Allotment of 58923equity shares of Rs 10 each under ESOP.

-UTI Bank unveils new ATM in Sikkim.

Page | 3

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

2004:Comes out with Rs. 500 mn Unsecured Redeemable Non-Convertible Debenture Issue,

issue fully subscribed -UTI Bank Ltd has informed that ShriAjeet Prasad, Nominee of the

Administrator of the Specified Undertaking of the Unit Trust of India (UTI - I) has been

appointed as an Additional Director of the Bank w. e. f. January 20,2004.-UTI Bank opens

new branch in Udupi-UTI Bank, Geojit in pact for trading platform in Qatar -UTI Bank ties

up with Shri ram Group Cos-Unveils premium payment facility through ATMs applicable to

LIC UTIBank customers Metal junction (MJ)-the online trading andprocurement joint

venture of Tata Steel and Steel Authority of India(SAIL)- has roped in UTI Bank to start

off own equipment for Tata Steel.-DIEBOLD Systems Private Ltd, a wholly owned

subsidiary of Diebold Incorporated, has secured a major contract for the supply of ATMs an

services to UTI Bank -HSBC completes acquisition of 14.6% stake in UTI Bank for .6 m

-UTI Bank installs ATM in Thiruvananthapuram -Launches Remittance Card' in association

with Remit2India, a Web site offering money transfer services.

2005:-UTI Bank enters into a banc assurance partnership with

BajajAllianz General for selling general insurance products through its branch network.

-UTI Bank launches its first Satellite Retail Assets Centre (SRAC) in Karnataka at Mangalore.

2006:

-UBL sets up branch in Jaipur -UTI Bank unveils priority banking lounge.

MANAGEMENT OF AXIS BANK

Promoters:

Axis Bank Ltd. has been promoted by the largest and the best Financial Institution of the

country, UTI. The Bank was set up with a capital of Rs. 115 crore, with UTI contributing Rs.

100 Crore, LIC - Rs.7.5 Crore and GIC and its four subsidiaries contributing Rs. 1.5 Crore

each SUUTI - Shareholding 27.02%Erstwhile Unit Trust of India was

setup as a body corporate under the UTI Act, 1963, with a view to encourage savings and

investment. In December 2002, the UTI Act, 1963 was repealed with the passage of Unit

Trust of India (Transfer of Undertaking and Repeal) Act, 2002 by the Parliament, paving the

way for the bifurcation of UTI into 2 entities, UTI-I and UTI-II with effect from

Page | 4

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

1st February 2003. In accordance with the Act, the Undertakingspecified as UTI I has been

transferred and vested in the Administrator of the Specified Undertaking of the Unit Trust of

India (SUUTI), who manages assured return schemes along with 6.75% US-64 Bonds,6.60%

ARS Bonds with a Unit Capital of over Rs. 14167.59 crores. The Government of India has

currently appointed Shri K. N. Prithviraj as the Administrator of the Specified undertaking of

UTI, to look after and administer the schemes under UTI where Government has continuing

obligations and commitments to the investors, which it will up hold

DEFINITIONS OF BANKING

A bank is a financial institution licensed by a government. Its primary activity is to lend

money. Many other financial

activitieswere allowed over time. For example banks are importantplayers in financial

markets and offer financial services such as investment funds.

Banking can also be defined as engaging in the business of keeping money for

savings and checking accounts or for exchange or for issuing loans and credit.

Transacting business with a bank; depositing or withdrawingfunds or requesting a loan.

Bank - a supply or stock held in reserve for future use (especially in emergencies)

MEANING OF BANKING

An organization, usually a corporation, chartered by a state or federal government, which

does most or all of the following: receives demand deposits and deposits, honors instruments

drawn on them, and pays interest on them; discounts notes, makes loans,and invests

insecurities collects checks, drafts, and notes; certifies depositors checks; and issues drafts

and cashiers.

PRODUCT OF AXIS BANK

Easy Access Saving Account

Saving Account for Women

Prime Saving Account

Senior Citizens Saving Account

Priority Banking

Corporate Salary Account

Trust /NGOs Saving Account

Resident Foreign Currency Account

Online Trading Account

Current Account

Term Deposits

Locker Facilities

NRI Services

Depository Services

Financial Advisory Services

Wealth Management Services

Page | 5

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Insurance Solutions Life and General

Retail Loans

Credit Loans

Travel Currency Cards

Remittance Cards

Gift Cards.

Customer service in Banking Operations

1. Cheque Drop Box Facility:RBI's Committee on Procedures and Performance Audit on

PublicServices has recommended that both the drop box facility and the facility for

acknowledgement of the cheques at the regular collection counters should be available to

customers and no branch should refuse to give an acknowledgement if the customer

tenders the cheques at the counters.

2. Issue of Cheque Books:The Committee has observed that some banks do not allow

depositors to collect their cheque book at the branch but insist on dispatching the cheque

book by courier to the depositor. Further, it is stated by the Committee that the depositor

is forced to sign a declaration that a dispatch by the courier is at the depositor's risk and

consequence and that the depositor shall not hold the bank liable in any manner

whatsoever in respect of such despatch of cheque book. Committee has observed this as

an unfair practice and advised banks to refrain from obtaining such

undertakings from depositors. Banks should also ensure that cheque books are delivered

over the counters on request to the depositors or his authorized representative.

3. Statement of Accounts / Pass Books:The Committee has noted that banks invariably

show the entries in depositors passbooks /statement of accounts as "By Clearing" or "By

Cheque". Further, in the case of Electronic Clearing System (ECS) and

RBI ElectronicFunds Transfer (RBIEFTR) banks invariably do not provide anydetails

even though brief particulars of the remittance are provided to the receiving bank.

In some cases computerized entries use sophisticated codes which just cannot be

deciphered. With a view to avoiding inconvenience to depositors, banks are advised to

avoid such inscrutable entries in passbooks statements of account and ensure that brief,

intelligible particulars are invariably entered in pass books / statements of account. Banks

may also ensure that they adhere to the monthly periodicity prescribed by us while

sending statement of accounts.

Page | 6

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

TRADITIONAL BANKING ACTIVITIES

Banks act as payment agents by conducting checking or current accounts for customers,

paying cheques drawn by customers on the bank, and collecting cheques deposited to

customers' current accounts. Banks also enable customer payments via other payment

methods such as telegraphic transfer, EFTPOS, and ATM. Banks borrow money by accepting

funds deposited on current accounts, by accepting term deposits, and

byissuing debtsecurities such as bank notes and bonds.

Banks lendmoney by makingadvances to customers on current accounts, bymaking installme

nt loans, and by investing in marketable debtsecurities and other forms of money lending.

Banks provide almost all payment services, and a bank account is considered indispensable

by most businesses, individuals and governments. Non-banks that provide

payment services such as remittance companies are not normally

considered an adequate substitute for having a bank account. Banks borrow most funds from

households and non-financial businesses, and lend most funds to households and nonfinancial businesses, but nonbank lenders provide a significant and in many cases adequatesubstitute for bank loans,

and money market funds, cash management trusts and other non-bank financial institutions in

many cases provide an adequate substitute to banks for lending savings.

ECONOMIC FUNCTIONS

1. Issue of money-Inthe form of bank notes and current accounts subject to cheque or

payment at the customer's order. These claims on banks can act as money because they are

negotiable and/or repayable on demand, and hence valued at par. They are effectively

transferable by mere delivery, in the case of banknotes, or by drawing a cheque that the payee

may bank or cash.

2. Netting and settlement of payments Banks act as bothcollection and paying agents for customers, participating ininterbank

clearing and settlement systems to collect, present, be presented with, and pay payment

instruments. This enables banks to economies on reserves held for settlement of payments,

Page | 7

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

since inward and outward payments offset each other. It also enables the offsetting of

payment flows between geographical areas, reducing the cost of settlement between them.

3. Credit intermediation Banks borrow and lend back-to-back on their own account as

middle men.

4. Credit quality improvement

banks lend money to ordinarycommercial and personal borrowers (ordinary credit quality), b

utare high quality borrowers. The improvement comes fromdiversification of the bank's

assets and capital which provides a

buffer to absorb losses without defaulting on its obligations. However, bank notes and

deposits are generally unsecured; if the bank gets into difficulty and pledges assets as

security, to raise the funding it needs to continue to operate, this puts the note holders and

depositors in an economically subordinated position.

5. Maturity Transformation

banks borrow more on demand debt and short term debt, but provide more long term loans. In

otherwords, they borrow short and lend long. With a stronger creditquality than most other bo

rrowers, banks can do this byaggregating issues (e.g. accepting deposits and issuing

banknotes) and redemptions (e.g. withdrawals and redemptions of banknotes), maintaining

reserves of cash, investing in marketable securities that can be readily converted to cash if

needed, and raising replacement funding as needed from various sources (e.g. wholesale cash

markets and securities markets).

BANKING CHANNELS

Banks offer many different channels to access their banking and other services:

A branch, banking centre or financial centre is a retail location where a bank or financial

institution offers a wide array of face-to-face service to its customers.

ATM is a computerized telecommunications device that provides a financial institution's

customers a method of financial transactions in a public space without the need for a human

clerk or bank teller. Most banks now have more ATMs than branches, and ATMs are

providing a wider range of services to a wider range of users. For example in Hong Kong,

most ATMs enable anyone to deposit cash to any customer of the bank's account by

feeding in the notes and entering the account number to be credited. Also, most ATMs enable

card holders from other banks to get their account balance and withdraw cash, even if the

card is issued by a foreign bank.

Mail is part of the postal system which itself is a system where in

written documents typically enclosed in envelopes, and also

small packages containing other matter, are delivered to destinations around the world.

This can be used to deposit cheques and to send orders to the bank to pay money to third

parties. Banks also normally use mail to deliver periodic account statements to customers.

Telephone banking is a service provided by a financial institution

which allows its customers to perform

transactions over thetelephone. This normally includes bill payments for bills from major

billers (e.g. for electricity).

Online bankingis a term used for performing transactions, payments etc. over the Internet

through a bank, credit union or building society's secure website.

Page | 8

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Mobile banking is a method of using one's mobile phone to conduct simple banking

transactions by remotely linking into a banking network.

Video banking is a term used for performing banking transactions or professional banking

consultations via a remote video and audio connection. Video banking can be performed via

purpose built banking transaction machines (similar to an

Automated teller machine),Automated teller machine), or via a video conference enabled

bank branch

MORTGAGE BANKING

Mortgage banking deals primarily with originating mortgage loans and servicing them. Read

more about it here as well as about what a career in mortgage banking involves. Mortgage

banking is meant for a single purpose, to service the real estate finance industry. Mortgage

banking deals specifically with originating mortgage loans as well as servicing them. Usually,

mortgage banks avail funds from the Federal National Mortgage Association, or FNMA, also

known as Fannie Mae, the Federal Home Loan Mortgage Corporation, or FHLMC, also

known as Freddie Mac, or any other large companies that service mortgages, which are

related to the secondary mortgage market. Here are a few pointers about the nitty-gritty

of mortgage banking.

1. Mortgage Banks Specialize in Mortgage Loans:

Unlike a savings bank that is federally chartered, in general mortgage banks specialize in

only providing mortgage loans. Hence, customers do not deposit their money in these banks.

As has been mentioned above, the secondary wholesale market is their primary source of

funds. Freddie Mac and Fannie Mae are examples of the lenders in the secondary market.

2. Mortgage Banks Differ in Size:

While some mortgage banks can be nationwide, others can originate a volume of loan that

can exceed that of a commercial bank that is nationwide. Many of these mortgage banks

utilize specialty servicers like Real Time Resolutions to carry out tasks like fraud detection

work and repurchase.

3. Mortgage Banks have Two Sources of Revenue:

The two main sources of income are from loan servicing fees (if they are into loansevicing0,

and fees from loan origination. Mortgage bankers, by and large, are choosing not to service

the loans they have originated. That is because they are entitled to earn a service-released

premium by selling them soon after the mortgage loans are closed and funded.

4. Different Banking Laws Apply to Mortgage Banks:

Mortgage banks usually operate under banking laws that are quite different, according to the

state they operate in. You will need to check each individual states financial department or

state banking in order to get list of mortgage bankers in each state. While federal laws apply

Page | 9

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

to the operation of a federal bank, in terms of consumer protection, usually consumers have

additional rights, which are applicable according to each state.

5. Mortgage Bankers can be More Competitive:

Since they only specialize in lending and do not have to subsidize any of the losses that other

departments may have incurred, as in regular banking, mortgage bankers have the ability of

being really competitive when lending for mortgage. However, they usually do not have the

advantage of accessing adjustable rate mortgages that are low cost, which federal banks are

typically associated with, and federal money access.

6. Career in Mortgage Banking:

Professionals in mortgage banking in the job market today need to have a college degree in

business or finance, or some specific experience or training related to the field. Skills in good

customer service, an inherent ability with numbers, and computer skills are also essential

requirements for mortgage banking jobs. A mortgage banking professionals job involves

reviewing credit scores, determining the kind of loan that is most beneficial for the customer

and guiding them through the process of application as well as closing. The loan officer has

to be very organized and detail oriented, and need to be able to handle the large amounts

of paperwork and reporting that are required for getting loans approved, up to the closing.

ORGANISATION STRUCTURE OF AXIS BANK

SAVING

ACCOUNT

INFORMATION

Definition: A deposit

account at a bank or

savings and loan which

pays interest, but cannot be

withdrawn by check writing.

TYPES OF SAVING

ACCOUNT IN AXIS

BANKING

1) ZERO BALANCE

SAVINGS ACCOUNT

At Axis Bank it has been c

onstant endeavor to create

productsspecifically catering to your needs. The account while offering a whole range of

services also addresses your latent need of having an account

without the hassle of maintaining an average quarterly balance.

Features: - 1. No Average Quarterly Balance requirement

Page | 10

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

2. Free International Debit Card with an Accidental Insurance cover upto Rs2 lakhs*

(charges for the primary holder are waived)

3. Free mobile banking facility

4. Access through more than 825 branches and more than 3595 ATMs

5. At-Par cheque facility with the clearing limit of Rs 50,000

6. 24x7 Tele banking & Internet banking

7. Free quarterly statements

8. Free monthly e-statement

2) KRISHI SAVING ACCOUNT (Kheti Ho Khushahaliki)

Axis Bank offers a unique savings account which is easy to operate and allows you to transact

immediately. This product has been specially designed keeping in mind the unique

requirements of a farmer and true to its nature has been called the Krishi Savings Account.

Some of the features of our new product are:

Average Balance Requirement :This account is offered with the requirement

of maintaining the half-yearly average balance of Rs 1000 only.

International Master Debit

Card:The Krishi Savings Account entitles you to an International MasterDebit Card with

which you can access your account anytime through the Axis Bank ATM network free of

cost. This card comes with a cash withdrawal limit of Rs 25,000 per day. Free Accident

Insurance cover of Rs 2 lacks.

Anywhere Banking:Being a Krishi account holder, you are entitled to access our wide

network of more than 825 branches and 3595 ATMs across 440 cities. You can now easily

carry out your transactions through any of the branches or ATMs.

At Par ChequeBook:Your Krishi Savings Account comes with the At-Par Cheque

facility. This facility enables you to en cash the cheques as local instruments at any of the

440 centers where the Bank has its presence, at no extra cost. Moreover, you can also

issue cheques at other centers upto the limit of Rs 50,000.

3) EASY ACCESS SAVINGS ACCOUNT (Banking made easy)

A :Accessibility

C :Convenience

C :Comfort

E :Earnings

S :Speed

S :Service

Want a savings account that transcends geographical boundaries? Presenting, Axis Bank's

Easy Access Savings Account. The account is an endeavor by the Bank to understand the

consumers' needs

Page | 11

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

andredefine banking to suit your requirements for a truly comfortablebanking experience.

Easy Access Savings Account gives you instantaccess to your money anywhere, anytime.

Possessing a range of unmatched features, it has been devised to better suit the

convenience of our eclectic client base. You can avail of all these services with a minimum

quarterly average balance of Rs. 5,000 in metro or urban centers, Rs. 2,500 in semi urban

centers and Rs. 1,000in rural centers.

At-par cheque

ATM Network

Anywhere Banking

Telebanking

iConnect

Mobile Banking

Quarterly account statement

Quarterly interest @ 3.5 % per annum

Free monthly e-statement.

You can avail of all these services with a minimum quarterly average balance of Rs. 5,000 in

metro or urban centers, Rs. 2,500 in semi urban centers and Rs. 1,000 in rural centers.

4) CORPORATE SALARY ACCOUNT:

Our Corporate Salary Power Employee Reimbursement accounts as a savings accountvariant.

Preferential pricing on loan products and credit cards and other banking products & services.

Offering is designed to offer payrollsolutions through in a 24 X 7 environment. We leverage o

n ourextensive network of distribution channels spread across 450 centers through a network

of more than 827 branches and 3595 ATMs besides our superior service delivery model and

product features, as a strong differentiator, to provide value to the end user.

Benefit to Employers:

Efficient salary disbursal. Web Upload Transfer salaries/reimbursements directly from

your current account with Axis Bank to your employee's accounts using I Connect from your

office.

Single-instruction salary credit - Same day salary credits for all companies having Corporate

Account with Axis Bank. Dedicated

Relationship Manager at metro locations to understand the financial requirements of your

employees.

Benefit to Employees:

No minimum balance criteria.

Unparalleled Access - Anywhere banking facility through ournetwork of Branches, ATM

and Internet banking facility.

AT Par cheque books payable locally at all Axis Bank locations.

International Debit cum ATM cards with enhanced Cash withdrawal facility and other value

add ones.

Online Banking with funds transfer, online shopping and billpayment options.

Depository services with free online trading accounts.

Meal Cards on a master card platform.

Page | 12

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

5) PRIME SAVING ACCOUNTS:

Want a customized savings account to suit your specific financialrequirements?

At Axis Bank, we have always strived to pace ourproducts with the growing needs of our

customers. The Prime

Savingsaccount has therefore been created with your specific financialrequirements in

mind. Through the 'At Par' cheque facility, you have the unique advantage toencase your

cheques as a local cheque at more than 330

centerswhere the bank has a presence at no extra cost. In addition theaccount enables you

to issue cheques up to Rs. 1 lakh, which will betreated as 'At Par' across these locations. You

can avail of all these services with a minimum average balance of Rs 25,000 in

metro/urban/semi-urban centers and Rs 10,000 in ruralcenters.

6) SMART PRIVILEGE ACCOUNT:(For the woman of today)

In today's busy world it's tough being a working woman. Right from shuttling between a job

and family to taking care of her finances she has to be on her toes all the time. Keeping this in

mind, we at Axis Bank have designed a savings account best suited for the woman of today.

With the Smart Privilege Account, you can manage your

moneyand your life and as well as enjoy a host of lifestyle privileges.Furthermore Axis Bank'

s Smart Privilege Account ensures that youhave enough time for all the important things in life.

Senior Privilege (Because life begins at sixty): Are you seeking a banking style that

compliments your senior status? Axis Bank's Senior Citizen Savings Account has been

designed keeping in mind the fact that a senior citizen's banking requirements are wholly

different and require special consideration.

Special Privilege(A Privilege assures the care you deserve):We have introduced Senior

Citizen ID card for our Senior Privilege patrons. Let us briefly introduce the wide range of

advantages it hold for you.

Avail of Great benefits with Senior Citizen ID card: ID card acts as an age proof.

Enabling you to redeem every advantage that you are eligible for, this card will soon

help you avail of certain never-before Senior-citizen benefits at various stores, service

providers and installation across the nation.

Feel safe Everywhere: Apart from provide you with the power to claim great

benefits, card also act as emergency information medium. In case of emergencies, it

provides the doctors and authorities with vital data like your blood group, allergies,

illnesses, address and emergency contact details. This

ensures that you are well looked after in any situation, no matterwhere you

are.

Always a Privilege: It will help in strengthen the bond with us and to be of

assistance to you at all the times, no matter what your need be. Whether its loan, a

Page | 13

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

savings account or any financial services that you wish to avail of, wewill make sure that

we're always be there by yourside.

7) POWER SALUTE (Salute to the defense forces)

Are you looking for an account that fits with your life in the Defence Forces? Defense Salary

Account from Axis Bank is a product designed keeping in mind how tough a life in the

Defense Forces is. Not only does it come to you absolutely free, no minimum balance is

required either. You can also access the entire Axis Bank network, including more than 2300

ATMs and 550 branch offices (and growing) no matter where you are posted. With the

complete gamut of banking services(including overdrafts, loans and zero-balance

requirements) you can now rest assured about your family and all their financial needs. Its

our way of showing our appreciation to your work.

Banking Privileges: At-par Cheque Facility: Your job involves constant transfers

acrossthe country. With the at-par cheque facility it will no longer be necessary to set up

new bank accounts with each transfer.

Additional Debit Card: Along with a free International Debit Card, you also get

a free card for the joint account holder. This means that your child or spouse also

enjoy the same benefits of banking with Axis Bank.

Financial Advisory Services: Our solutions answer to the twin goals of meeting your

requirements and to diversify and spread the risk of your investment portfolio, so

you can look forward to a comfortable and worry-free life. We first understand your

exact investment needs and then design the perfect investment plan for you.

8) TRUST/NGOSAVING ACCOUNT:

Thoughtful banking for people who spend their lives thinkingof othersNeed special banking

for special causes? Axis Bank's Trust Account is an effort to offer thoughtful banking for

people who spend their

livest h i n k i n g o f o t h e r s . I t i s a c o m p l e t e b a n k i n g s o l u t i o n f o r Tru s t s ,

Associations, Societies, Government Bodies, Section 25 companies andNGOs, so that the

organizations can devote all of their time to their noble motivations.

Features:A Savings Account for your Trust with a concessional AverageQuarterly Balance amulti-city

at-par cheque facility with no limit on clearing payments atcenters across the country wherever

we are present.Free anywhere banking across all our Branches and ExtensionCounters and over

all our ATMs.Free Demand Drafts or Pay Orders as and when required by you to

remitfunds.Free collection of cheques at outstations locationsFree monthly.

Monthly Statement of Account delivered at your doorstep. Facility for collecting donations in

your account through our network

of B r a n c h e s a n d e x t e n s i o n c o u n t e r s a c r o s s t h e c o u n t r y, a s w e l l a s

throughconnects - our Internet Banking facility. Also, Axis Bank canoffer the facility

to donate funds to your Trust through our InternetBanking facility IConnect to its

customers. An Axis Bank customer can donate any amount to your Trust through the Internet.

In such cases,the savings account of the customer gets debited and the

Page | 14

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

savingsaccount of your Trust gets credited with the amount of donation at thesame time. At

the end of every month, the Bank will provide an MISgiving details of the amount of

donations and the name of donor. Thiswill enable the Trust to issue receipts to the donors.Free

Internet Banking facility that enables you to view the status

of yo u r a c c o u n t , t r a n s f e r f u n d s a n d c a r r y o u t a n u m b e r o f b a n k i n g activities

from the comfort of your home or office.

Investment Advice: Our Financial Advisory Desk will provide portfolio management advice

as well as help you undertake investments.

Free De-mat: To facilitate your investments, we offer a free De-mat Account (charges due to NSDL

must still be levied) to our esteemed account holders in the Trust or Society segment.

9)FOREIGN CONTRIBUTION (REGULATION) ACT [FCRA] ACCOUNTS

The FCRA account enables approved organizations to receiveforeign contributions

for utilization in their activities in India. The Bank will provide assistance in the process of

documentation and obtaining necessary approvals from Ministry of Home Affairs at New

Delhi.

CURRENT ACCOUNT INFORMATION

1) CHANNEL ONE: (FOR SUCCESSFUL BUSINESSES)

The Channel One Current Account is an effort in that direction where we take care of your

day to day banking requirements leaving you with more time for your business. Channel One

Current Account is most appropriate choice of successful

businesses. At a monthly Average Balance (MAB ) of Rs. 10 lack.

FEATURES: 1. Relationship Manager

2. Doorstep Banking

3. Anywhere Banking

4. Free Internet Banking

5. Free 24 hour Tele-banking

6. Mobile Banking Service

7. International debit card

8. Cheque Protection Faciltity

9. Free 24 hour cheque deposit facility

10. Payment of Government Taxes/ Dues

11. Foreign exchange services.

2) ZERO Hassle Balance:

Small businesses rising on the growthgraph need the right of nurturing and appropriate

solution for theirgrowing banking requirements. Recognizing these needs, Axis Bankpresent you

the Local Current Account geared to answer all

Page | 15

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

kindsof local business requirements. At a monthlyAverage Balance(MAB) of Rs.

Nil.

FEATURES: 1.Zero Balance facility

2.75 free transactions every month

3.Rebate on Annual Charges

4.Upfrount Annual Fee

5.Mobile Banking

6.ATM cum International Debit Card

7.Free Internet Banking

8 . Tel e b a n k i n g

9.Free Monthly Account Statement

3) BUILDERS AND REAL ESTATE:

Axis Bank understands theincreasing demands on businesses in this segment .Herespresentin

g the Axis Bank Builder & Real Estate Current Account acurrent account with unparalleled

product features built tosuit

Builders & Realtors exclusively. This account offers youunmatched convenience while addin

g financial value to yourbusinesses spread over geographies. . At a monthly AverageBalance

(MAB ) of Rs. 5 Lacs this account comes loaded

withspecial facilities and benefits, most appropriate for your business.

FEATURES:

1.Home Branch Cash Deposit

2.Non Home Branch Cash Withdrawal

3.Free Anywhere Banking

4.Cluster facility

5.Zero Balance account for Vendors and Suppliers

6.Franking Facility

7.Customer cheque printing

8.Internet Banking

9.Free 24-hour Phone banking

10.Mobile Alerts

11.ATM cum Debit Card

12.Free Monthly Account Statement

Page | 16

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

INTRODUCTION TO ORGANISATION

1)BUSINESS DESCRIPTION

The Bank's principal activities are to provide commercial banking services which include

merchant banking, direct finance, infrastructure finance, venture capital fund, advisory,

trusteeship, forex, treasury and other related financial services.

2) CORPORATE PROFILE

Axis Bank is the third largest private sector bank in India. Axis Bank offers the entire

spectrum of financial services to customer segments covering Large and Mid Corporates,

SME, Agriculture and Retail Businesses.The Bank has a large footprint of 1787 domestic

branches (including extension counters) and 10,363 ATMs spread across 1,139 centres in the

country as on 31st December 2012. The Bank also has 7 overseas branches / offices in

Singapore, Hong Kong, Shanghai, Colombo, Dubai, DIFC - Dubai and Abu Dhabi.

Axis Bank is one of the first new generation private sector banks to have begun operations in

1994. The Bank was promoted in 1993, jointly by Specified Undertaking of Unit Trust of

India (SUUTI) (then known as Unit Trust of India),Life Insurance Corporation of India

(LIC), General Insurance Corporation of India (GIC), National Insurance Company Ltd., The

New India Assurance Company Ltd., The Oriental Insurance Company Ltd. and United India

Insurance Company Ltd. The shareholding of Unit Trust of India was subsequently

transferred to SUUTI, an entity established in 2003.With a balance sheet size of Rs.2,85,628

crores as on 31st March 2012, Axis Bank is ranked 9th amongst all Indian scheduled banks.

Axis Bank has achieved consistent growth and stable asset quality with a 5 year CAGR

(2007-12) of 31% in Total Assets, 30% in Total Deposits, 36% in Total Advances and 45% in

Net Profit.

3) SUBSIDIARIES

The Bank has set up six wholly-owned subsidiaries:

Axis Securities and Sales Ltd. (Since renamed Axis Capital Ltd.)

Axis Private Equity Ltd.

Axis Trustee Services Ltd.

Axis Asset Management Company Ltd.

Axis Mutual Fund Trustee Ltd.

Axis U.K. Ltd.

4) PROMOTERS:

UTI Bank Ltd. has been promoted by the largest and the best Financial Institution of the

country,UTI. The Bank was set up IN 1993 with a capital of Rs. 115 crore, with

UTI contributing Rs. 100 crore,

LIC - Rs. 7.5 crore

GIC and its four subsidiaries contributing Rs. 1.5 crore each.

Axis Bank is today one of the most competitive and profitable banking franchise in India.

Which can be clearly seen by an analysis of its comprehensive portfolio of banking services

Page | 17

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

including Corporate Credit, Retail Banking, and Business Banking,Capital Markets, Treasury

and International Banking.

5) CAPITAL STRUCTURE:

The Bank has authorized share capital of Rs. 500 crores comprising 500,000,000 equity

shares of Rs.10/- each. As on 31st March, 2012 the Bank has issued, subscribed and paid-up

equity capital of Rs. 413.20 crores, constituting 413,203,952 shares of Rs. 10/- each. The

Banks shares are listed on the National Stock Exchange and the Bombay Stock Exchange.

The GDRs issued by the Bank are listed on the London Stock Exchange (LSE).

6) DISTRIBUTION NETWORK

The Bank has a network of 1787 domestic branches (including extension counters) and

10,363 ATMs across the country, as on 31st December 2012, the network of Axis Bank

spreads across 1,139 cities and towns, enabling the Bank to reach out to a large cross-section

of customers with an array of products and services. The Banks overseas network consists of

4 branches in Singapore, Hong Kong, DIFC Dubai and Colombo and 3 Representative

offices at Shanghai, Dubai, and Abu Dhabi.

7) BUSINESS OVERVIEW

An overview of various business segment:

A) RETAIL BANKING

Axis Bank has developed a strong retail banking franchise over the years. Retail Banking is

one of the key drivers of the Banks growth strategy and it encompasses a wide range of

products delivered to customers through multiple channels. The Bank offers a complete

suite of products across deposits, loans, investment solutions, payments and cards to help

customers achieve their financial objectives. The Bank focuses on product differentiation as

well as a high level of customer-service to enable it to build its retail business.

The growth areas identified by the Bank are in the areas of residential mortgages and

passenger car loans. Of the total retail loans portfolio, 88.47% is in the form of secured

loans (residential mortgages and auto loans).

The Bank offers a wide range of payment solutions to its customers in the form of debit

cards, prepaid cards and credit cards. As on 31st March 2012, the Bank has a base of

approximately 124.99 lac debit cards, placing it among the leading players in the country. The

Bank is also a dominant player in prepaid cards. Axis Bank has over 2 lakh installed EDC

machines - a highest for any bank in India.

The Bank launched Axis Bank Wealth in 2008-09 targeting customers who have a total

relationship value with the Bank of between Rs.30 lacs and Rs.200 lacs. The value

Page | 18

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

proposition aims at delivering a One Bank experience to such customers and is positioned

as a complete solution involving banking, investment and asset needs.

The Bank also distributes third party products such as mutual funds, Bank assurance products

(life and general insurance), online trading, Gold and Silver coins through its branches.

The retail business of the Bank is supported by innovative services and alternate channels

which provide convenience of transactions to customers. These channels include an

extensive ATM network, internet banking, mobile banking and phone banking.

B) BUSINESS BANKING

Business Banking leverages the Banks strengths a well distributed network of

branches and a strong technology platform to offer the best in transaction banking

services. The Bank offers a range of current account products and cash management

solutions across all business segments covering corporates, institutions, central and

state government ministries and undertakings as well as small and retail customers.

The Bank is one of the top CMS providers in the country. The Bank acts as an agency

bank for transacting government business offering services to various Central

Government Ministries / Departments and other State Governments and Union

Territories.

In order to provide solutions for business to effectively manage their funds flow, the

Bank has introduced liquidity management solution for corporate customers.

Similarly, a single window for all payment requirements was launched with several

advanced features such as setting a daily transaction limit for corporate users, setting

transaction limits for individual beneficiaries, prioritising payment methods, online

stop payment and cancellation facilities.

C) CORPORATE CREDIT

Axis Bank has built a strong corporate banking franchise across corporate, liability

and asset businesses. Axis Bank provides customized structuring and financing

solutions in a timely and comprehensive manner to its corporate customers with a

focus on building out a high quality credit portfolio. The Bank is a market leader in

Debt Capital Markets and loan syndication business across segments, sectors and

geographies.

Banks infrastructure business includes project and bid advisory services, project

lending, debt syndication, project structuring and due diligence, securitisation and

structured finance. During the year the Bank launched its first ever D&B-Axis Bank

Infra Awards 2011 in association with Dun & Bradstreet. The award felicitates

leading infrastructure projects and infrastructure companies. In October 2010, the

Page | 19

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Bank launched the Axis Infra Index (AII) with the primary objective of conveying a

sense of investment conditions in the infrastructure sector.

D) TREASURY

The Bank has an integrated Treasury, covering both domestic and global markets,

which manages the Banks funds across geographies. The Banks treasury business

has grown substantially over the years, gaining market share and continuing to be

among the top five banks in terms of forex revenues. The Treasury plays an important

role in the sovereign debt markets and participates in the primary auctions held by

RBI. It also actively participates in the secondary government securities and corporate

debt market. The foreign exchange and money markets desk is an active participant in

the inter-bank/ FI space. The Bank has been exploring various cross-border markets to

augment resources and support customer cross-border trade. The Bank has emerged as

one of the leading providers of foreign exchange and trade finance services. It

provides a gamut of products for exports and imports as well as retail services. Its

cutting edge technology provides comprehensive and timely customer services.

E) INTERNATIONAL BANKING

The international operations of the Bank form a key enabler in its strategy to partner

with the overseas growth potential of its domestic clientele, who are venturing abroad

or require non-rupee funds for domestic projects. The Bank now has a foreign

network of four branches (Singapore, Hong Kong, DIFC (Dubai) and Colombo (Sri

Lanka)) and three representative offices (Shanghai, Dubai and Abu Dhabi) with

presence in six countries. While corporate banking, trade finance, treasury and risk

management solutions are the primary offerings through the branches at Singapore,

Hong Kong, DIFC (Dubai) and Colombo, the Bank also offers retail liability products

from its branches at Hong Kong and Colombo. Further, the Banks Gulf Co-operation

Council (GCC) initiatives in the form of representative offices in Dubai and Abu

Dhabi, and alliances with banks and exchange houses in the Middle East provide the

support for leveraging the business opportunities emanating from the large NRI

diaspora present in these countries.

F) SMALL AND MEDIUM ENTERPRISES

The Small and Medium Enterprises (SME) segment is a thrust area of the Bank. The

business approach towards this segment, which is expected to contribute significantly

to economic growth in future, is to build relationships and nurture the entrepreneurial

talent available. The relationship based approach enables the Bank to deliver value

through the entire life cycle of SMEs. The Bank has segmented its SME business in

three groups: Small Enterprises, Medium Enterprises and Supply Chain Finance. The

Page | 20

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Bank extends working capital, project finance as well as trade finance facilities to

SMEs. The Bank has launched Business Gaurav SME Awards in association with

Dun & Bradstreet to recognize and award achievers in the SME space.

G) INFORMATION TECHNOLOGY

Technology is one of the key enablers for business and delivery of customized

financial solutions. The Bank continues to focus on introducing innovative banking

services through investments in scalable and robust technology platforms that delivers

efficient and seamless services across multiple channels for customer convenience

and cost reduction. The Bank has also focused on improving the governance process

in IT. The Bank has launched the Business Process Management System, a reusable

system, which helps to build process efficiencies across various areas of operations.

The Bank has undertaken various steps in order to align itself towards RBI guidelines

on security and governance, including setting up of Board and Executive level

committees and working on IT operations and other key areas.

8) AGRICULTURE

The Bank continues to drive and expand the flow of credit to the agricultural sector.

401 branches of the Bank have dedicated officers for providing farm loans. Products

and solutions are created specifically with simple features and offered at affordable

rates to rural customers. The Bank has also adopted a value-chain approach, wherein

end-to-end solutions are being provided for various stakeholders. It also offers various

customized solutions to meet the regional requirements.

9) FINANCIAL INCLUSION

The Bank perceives financial inclusion (FI) not as a corporate social responsibility or

a regulator driven initiative but as a large business opportunity that lies untapped in

the rural and unexplored section of the urban market. Till March 2012, the Bank has

opened over 4.4 million No-Frills accounts in over 7,607 villages through a network

of 15 Business Correspondents and nearly 6,000 customer service points. The Bank

has a strong presence in the Electronic Benefit Transfer (EBT) space and has covered

around 6,800 villages across 19 districts and 9 states till date with over 3.7 million

beneficiaries.

Page | 21

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

In the urban space, the Bank has launched financial inclusion initiatives in Bangalore,

Chennai and Delhi targeting migrant labourers, slum dwellers and other under-banked

sector of the urban population and has opened over 3.5 lac No Frill accounts. The

Banks financial inclusion efforts are not merely restricted to launching of financial

inclusion initiatives and sourcing basic No Frill accounts, but to also promote the

savings habits and enable the customers to obtain customized solutions for their

financial needs.

The Bank also has a range of other customised products for this customer segment

like different variants of Axis Uday No Frills Savings Accounts, Chhota RD, Chhota

FD, and Chhota SIP. The Bank has been one of the first few banks to have tied-up

with telecom companies to offer remittance led financial inclusion services on the

mobile platform.

10)

HUMAN RESOURCES

The Bank aims in creating and developing human capital to realise its vision of

nurturing a mutually beneficial relationship with its employees. Employee

engagement and learning, leadership development, enhancing productivity and

building multiple communication platforms thus occupied centre stage in the Banks

HR objective. The Bank continues to maintain a strong employer brand in the

financial services sector especially on the campuses of the premier business schools of

the country. In a major initiative, the Bank launched Axis Academic Interface

Program (AAIP) with Institutions to offer youngsters an understanding about the

financial services industry, and creating Axis Bankers. So far, the Bank has tied up

with Manipal University, NIIT, IFBI and Guwahati University.

Axis Bank has a young workforce with an average age of 29 years. The equal

opportunity employer policy of the Bank contributes strongly to the Axis Bank brand

Page | 22

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Board of Directors

PERSON

DESIGNATION

Dr. SanjivMisra

Chairman

Shikha Sharma

Managing Director & CEO

Som Mittal

Director

RohitBhagat

Director

IreenaVittal

Director

K. N. Prithviraj

Director

V. R. Kaundinya

Director

S. B. Mathur

Director

Prasad Menon

Director

Rabindranath Bhattacharyya

Director

Prof. Samir K Barua

Director

A.K. Dasgupta

Director

VaradarajanSrinivasan

ED, Corporate Banking

SomnathSengupta

ED, Corporate Center

Mission

Customer service and product innovation tuned to diverse needs of individual and

corporate clientele.

Continuous technology up gradating while maintaining human values.

Progressive globalization and achieving international standards.

Efficiency and effectiveness built on ethical practices.

Customer Satisfaction through providing quality service effectively and efficiently.

VISION AND VALUES

Vision 2015: To be the preferred financial solutions provider excelling in customer delivery

through insight, empowered employees and smart use of technology.

Page | 23

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Core Values

Customer Centricity

Ethics

Transparency

Teamwork

Ownership

Axis bank offers its services majorly in four parts

A.

B.

C.

D.

Personal

Corporate

NRI

Priority banking

A. Personal

Axis bank offers various services for individual domestic customers, which includes services

like

1.

2.

3.

4.

5.

6.

7.

8.

9.

Accounts

Deposits

Loans

Cards

Forex

Invstments

Insurance

Payments

Other services

1. The accounts offered by axis bank for its customers are:

EasyAccess Savings Account

Future Stars Savings Account

Krishi Savings Account

Prime Savings Account

Prime Plus Savings Account

Basic Savings Account

Womens Savings Account (smart privilege account)

Priority banking Account

Demat Account

Senior citizens Account

Defence Salary Account

Trust/NGO Savings Acoount

Page | 24

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Insurance Agent Account

Resident Foreign Currency (Domestic) RFC(D) Account

Pension Savings Bank Account

YOUth Account

3-in-1 Online Investment Account

2. Deposits offered by Axis Bank:

a) Fixed Deposits

Axis Bank offers simple reinvestment Fixed Deposits (at very competitive interest

rates), which can be opened with a minimum investment of Rs 10,000. Customers can

make additions to your deposit in multiples of Rs 1,000 each. The tenure of their

deposit must be a minimum of 6 months.

b) Recurring Deposits

Axis Bank's Recurring Deposit scheme will allow you with an opportunity to build up

your savings through regular monthly deposits of fixed sum over a fixed period of

time.

Features

Recurring deposits are accepted in equal monthly installments of minimum

Rs 1,000 and above in multiples of Rs 500 thereafter.

The fixed numbers of installments for which a depositor can opt are 12, 24, 36, 39,

48, 60, 63, 72, 84, 96, 108 and 120 months.

Transfer of Accounts - a recurring deposit account can be transferred from one

office of the Bank to another branch.

The amount of installment once fixed, cannot be changed.

Installment for any calendar month is to be paid on or before the last working day of

the month. Where there is delay in payment of installment, one can regularise the

account by paying the defaulted installment together with a penalty (at present it is

@ PLR plus 4 % for the period of delay).Fraction of a month will be treated as full

month for the purpose of calculating the penalty.

The total amount repayable to a depositor, inclusive of interest, depends on the

amount of monthly installments and the period of deposit.

c) Encash 24

The Encash 24 (Flexi Deposit) gives the liquidity of a Savings Account coupled with

high earnings of a Fixed Deposit. This is achieved by creating a Fixed Deposit linked

to your Savings Account providing you the following unique facilities:

Maximum Returns:

Customers money is no longer idle. As soon as the balance in your Savings Account crosses

Page | 25

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

over Rs 25,000, the excess, in multiples of Rs 10,000 will be transferred automatically to a

higher interest earning Fixed Deposit Account. The maturity of fixed or term deposits formed

as a result of transfer of money from the Savings Bank account will be for a maximum period

of 181 days and the interest will be calculated on simple interest rate basis.

Maximum Liquidity:

The money parked in Fixed Deposits as a result of the above mentioned sweep out from your

Savings account can be easily accessed by issuing a cheque, withdrawing through ATM etc.

The amount broken form your Fixed Deposit will earn interest rates at the applicable rate for

the period that the deposit was held with the Bank. The remaining amount of Fixed Deposit

will continue to earn the contracted rate of interest.

d) Tax Saver Fixed Deposit

In the Finance Bill of 2006, the government had announced Tax benefits to Bank Term

Deposits which are of over 5 year tenure u/s 80C of IT Act, 1961 vide Notification Number

203/2006 and SO1220 (E) dated 28/07/2006.

The salient points of the scheme notification are; (a) Fixed tenure without premature

withdrawal. (b) Year is defined as a financial year. (c) Amount limited to Rs. 100 minimum

and Rs. 100,000 maximum. (d) Bank will issue a Fixed Deposit Receipt that shall be the basis

of claiming tax benefit. (e) Term deposit under this scheme cannot be pledged to secure a

loan.

3. Loans Offered by Axis :

Home Loan

Car loan

Personal Loan

Loan against Shares

Loan Against Property

Loan Against Securities

Loan against Gold

Education Loan

4. Cards Offered By Axis bank

Credit Cards

Platinum Advantage Credit Card

Page | 26

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Platinum Credit Card

Gold credit card

Silver credit card

Corporate Credit Card

Trust chemists credit card

Shriram credit card

eShop card

Easy credit card

Debit Cards

Priority Platinum Chip Debit Card

Priority Debit Card

Classic Debit Card

Gold Debit Card

Gold Plus Debit Card

Business Gold Debit Card

Prepaid Cards

Travel Currency Card

Payroll Card

Corporate Gift Card

Gift Card

Rewards Card

Remittance Card

Meal Card

Annuity Card

5. Forex offered by Axis bank

Travel Currency Cards :The Travel Currency Card gives its customers a 24-hour

access to money. Withdraw funds in the local currency from any Visa or Visa Plus

ATM's (Automated Teller Machine) as well as pay for all your purchases in any

country you visit, anywhere in the world.

Outward Remittances: Axis Bank offers Outward Remittance facilities enabling its

customers to remit money abroad through reliable and quick transactions. They can

send money abroad for reasons more than one: education, medical purpose, gifting,

maintenance for loved ones or donation for a cause.

Foreign Currency TravellersCheques: American Express Traveler's cheques are

widely accepted globally as a mode of payment in many parts of the world. It is

always worthwhile taking some of your foreign exchange in travelers' cheques as it is

a great backup to cash and cards.

Foreign Currency Cash: Carrying small amount of local currency or internationally

acceptable currency variants in wallet while travelling overseas is reassuring and

Page | 27

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

convenient - especially to make payments for the services you may require on your

arrival at the destination.

6. Investment Services offered by Axis bank

Gold Mohurs

Silver Mohurs

Mutual Funds

Online trading

IPOSmart

Demat Account

8% Saving Bonds

7. Insurance Services offered:

Life Insurance

Home Insurance

Motor Insurance

Health Insurance

Travel Insurance

Business Guard

8. Payments services offered by Axis:

Bill Pay:Axis Bank's Bill Pay service enables you to make secure payments from the

comfort of your home or office. So its time to say goodbye to late payment fines, long

queues, lost bills, and commissions paid to local errand boys.

ECS: It is an electronic clearing system that facilitates paperless credit / debit

transaction directly linked to your account and also provides for a faster method of

effecting periodic and repetitive payments.

Through ECS (Debit), you can pay all your Utility bills (electricity/telephone/Mobile

bills, credit cards, etc), Mutual Fund (SIP), Insurance Premium, Loan Installments,

credit card payments, payments of donations and other bill payments.

Tax ePayments: In this service, Income / Other Direct Taxes, as well as Central

Excise & Service Tax* through iConnect can be paid from account online and can get

on-line acknowledgement of the payment by way of a Cyber Receipt, including

Challan Identification Number (CIN) immediately after making the payment.

Direct tax Payment: The Bank is authorized for Collection of Income or Other

Direct Taxes on behalf of Central Board of Direct Taxes (CBDT) w.e.f 1 October,

2003.

Page | 28

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Pension Disbursement: The Bank is authorized by RBI and Ministry of Defense for

disbursement of Pension to Armed Force (Army, Navy and Air Force) personnel

through its 151 authorized branches across the country.

B. Axis bank offers Corporate services, like:

1. Exclusive Banking Redefined - Club50 Current Account

At a half yearly average balance of Rs. 50 lacs (Rs. 25 lacs at Semi - Urban / Rural

branches), this premium current account smoothly fulfills your daily banking

requirement.

Main Features:

Dedicate relationship manager

Lifestyle benefits/ privileges

Free doorstep banking

Free RTGS / NEFT Facility

Cash Management Services

Free International Business Gold Debit Card

2. Various types of Current Accounts to suit every business requirements like:

The Banks offers a range of current account products to meet the needs of the various

customer segments such as Small Enterprises, Trade, Exproers, Corporate and

intuitions.

Normal Current Account

Business Advantage Account

Business Select Account

Business Classic Account

Business Privilege Account

Channel One Account

Current Account for GovtOrganisations

Current Account for Banks

Current Account for Builders & Real Estate

Capital Market Current Account

Krishi Current Account

Business Global Current Account

Club 50 Current Account

Inland Road Transport Current Account

Travel, Tourism and Hospitality Current Account

Local Current Account Current Account for Pharma

Current Account for Chartered Accountants

Page | 29

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

These products offer flexibility to customers to choose from the above option with

varying minimum average quarterly balance commitments and charges structure. In

addition to conventional banking facilities, these accounts offer Multi-City at Par payable

cheque book facility and anywhere banking facility across offer Multi city At Par

payable cheque book facility and any where banking facility across braches. Customers

can access their account Online through Corporate iConnect, Axis Banks Internet

banking platform as also through Tele-Banking facility and can receive account balance

information on mobile telephones and electronic mail. Customers are subject to

transaction charges including charges for non-maintenance of the committed balances.

FEATURES

Anywhere Banking:Axis Banks Current Account allows an individual to bank

from all Axis Banks branches and Extension counters. An individual can deposit

cash, withdraw cash, deposit cheque, and issue at-par cheques at any of Axis

Banks branches. So bank at an individuals own Convenience.

Instant Fund Transfer:An individual can transfer funds instantly between any of

Axis Banks branches. Funds transfers can be affected online, right from an

individuals through Axis Banks internet banking services.

Internet Banking: Axis Bank presents corporate iConnect a unique net Banking

platform for the current account customers. Available with multiply user IDs,

depending on an individuals needs. Access an individuals account at any time

form anywhere. An individual can transfer funds to his own accounts or to third

party accounts within Axis Bank & Inter Bank covering over 25,000 branches of

various banks. Corporate iConnect also permits transaction initiation by one user

and approval by another. An individual can also excuse bulk payments like salary

and commission across Axis Bank network right form his desktop.

At-Par (Multicity) Chequebook :Enjoy the benefits of Multicity Chequebook

with Axis Banks current Accounts. An individual cans issue cheques payable at

par at all Axis Banks branches across the country. An individuals cheques will be

treated as local cheques at more than 375 locations as on January 31, 2008.

ATM or Debit Card :With every Current Account (For proprietary and

partnership concerns), An individual can avail upto 2 ATM cum Debit cards,

which allow an individual round the clock access to his account from any of all

Axis Banks ATMs all over the country. An individual can withdraw uptoRs

40,000 a day.

Mobile Banking:Mobile Banking will enable an individual to bank with Axis

Bank through his mobile phone irrespective of where an individual are.

Fast track loans for SMEs

Wide range of products for the SME segment

Organised payment and collection solutions

Page | 30

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

Online tax payment or through vast branch network

Mobile Banking services available for Current Account

3.Credit Services by Axis bank:

a) To large Corporates

b) To Agri Business:

For SME unites

Microfinance

4.Besides these services, Axis bank provides services in the areas like:

Capital Market

Treasury

Cash management services

Govt. business

C. Non-Resident (External) NRE Saving Account

Any person resident outside India may open NRE account. This account permits a NRI to

hold and maintain foreign currency earnings in Indian rupees. The Principal and interest

earned on these balances are freely reportable.

Whether an individual are a student, a professional, a salaried employee or an entrepreneur,

this account will meet all an individuals banking need.

Features

Low minimum balance requirement of Rs 5,000

Multicity cheque book which will permit An individual to make payment via cheque

across multiple locations

Mandate or Power of Attorney facility available so that in An individuals absence

from the country An individual can authorize his relative or friend to operate conduct

banking transactions on his behalf.

Free iConnect: 24 X 7 account access through secure internet banking facility from

anywhere and anytime.

Online shopping mall and utility bill payment facility be using Axis Banks Internet

based iConnect banking login.

Free personal accident cover of Indian Rupees 2,00,000 on Axis Banks Debit Card

(The insurance cover will come in force only after An individual make his first

successful payment transaction at any merchant establishment.)*

Tax Advisory Services from Axis Banks empanelled consultants

Page | 31

PRICING OF FINANCIAL PRODUCT & SERVICES OFFERED BY

BANK

D) Priority Banking Resident

In a segmentation study undertaken in 2002, it was found that 2.72 % of Axis Banks retail

customers contribute to nearly 49.05% of Axis Banks total retail deposits. The clients that

bring a larger share of business to the Bank expect a differentiated standard of service. This

also makes business sense, as more often than not, most of the business in a particular branch

flows from a handful of clients. Hence, Priority Banking was launched in order to cater to the

needs of the high net worth customers within the bank.

The product has at its core, the idea of providing a certain bit of differentiation in service and

treatment to a segment of its customers with a view towards customer retention, acquisition

and cross selling.

The nucleus of these services has essentially four important components

Personalized service

Investment advisory Services

Prefential pricing of banking products/services

Lifestyle privileges.

Most of Banks, private as well as foreign, offer a specialized banking service to their elite

customers. The definition of the value of relationship and services offered differs across

banks. In general, MNC banks define the HNI segment taking into account the customers

liability as well as, assail relationship with the bank (Between 20-30 Lakhs and above)

whereas the Indian private banks only take in the savings bank balances and term deposits

(Between 5-10 Lakhs and above).

Features

Priority Banking Lounge: As a Priority banking customer an individual will have

access to an exclusive Priority Banking Lounge at branches. This will allow an

individual to conduct his financial transactions in utmost comfort and confidentiality

through an exclusive Relationship Manager.

Dedicated Relationship Manage:An individual will enjoy access to a dedicated

Relationship Manager who will be his one point contact at branch for all An his

banking transactions thus ensuring that An individual would neither have to move

from one counter to the other nor stand in queues to await his turn.

Home Banking: Experience the convenience of Axis Banks home banking facilities.

Avail of free cash and cheque pick-up delivery at an individuals or residence.

Exclusive Priority Banking International Debit card:This card allows an

individual free access to all VISA ATMs in Idea. The card also comes with higher

ATM withdrawal limits; higher POS transaction limits at merchant establishments,

enhanced insurance over and a host of special discounts and offers. An individual also

get Prefential Interest Rates and lowered Processing Fees on select Retail Loans.