Professional Documents

Culture Documents

Europe Flashwire Quarterly PDF

Uploaded by

Fattyschippy1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Europe Flashwire Quarterly PDF

Uploaded by

Fattyschippy1Copyright:

Available Formats

Media Questions/Requests

media_request@factset.com

FLASHWIRE EUROPE QUARTERLY

2nd QUARTER 2015

This Issue:

Europe M&A News and Trends

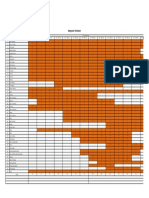

In 2q15, M&A deal spending leaped by 121.8% with an

aggregate value of 430.8 billion compared to a mere 194.2

billion in 1q15. M&A deal-making remained flat posting 3,359

deals this quarter compared to 3,339 deals in the prior

quarter. The sharp rise in deal value reflects mega-deal

trends which took place in 2q15. In April 2015, aggregate deal

value was recorded at 233.9 billion which is at its peak in

the past 16 months. Overall, deal volume remained

consistent over the 1,000 deal mark.

In an extension from 1q2015, the European private equity

market continued its trend and posted increases in both deal

spending and deal volume this quarter. Deal volume in the

private equity market increased by 9% in2q15, recording 594

deals compared to 545 deals in 1q15. Private equity spending

increased by 34.1% with an aggregate deal value of 61.5

billion in the current quarter, up from 45.8 billion in the last

quarter. Private equity spending recorded its highest level at

27.5 billion in April 2015 in comparison to the last twelve

months period.

biggest increases in M&A deal activity, relative to the same

three month period one year ago, have been: Finance (425

vs. 396), Consumer Services (278 vs. 264), and Retail Trade

(152 vs. 138). Of the 21 sectors tracked by FactSet

Mergerstat, only 9 sectors posted relative gains in deal flow

the last three months compared to the same three months

period one year prior.

Overall deal volume in Europes largest economies posted a

marginal increase of 3.5% in 2q15. The UK market recorded a

significant 10.2% increase in deal making, with 1,144 deals in

2q15 compared to 1,038 deals in 1q15. By contrast, Germany

recorded a 7% decrease this quarter with 439 deals, down

from 472 deals in 1q15. Deal volume in the French market

remained flat in 2q15.

Over the past 3 months, the sectors that have seen the

largest declines in M&A deal volume, relative to the same

three month period one year ago have been: Producer

Manufacturing (224 vs. 258), Consumer Durables (70 vs. 91),

and Electric Technology (146 vs. 165). 12 out of the 21

sectors tracked by FactSet Mergerstat posted negative

relative losses in deal flow over the last three months

compared to the same three months one year prior, for a

combined loss of 160 deals.

The top five financial advisors through the second quarter of

2015 based on deal announcements were: Rothschild, KPMG,

Ernst & Young, Goldman Sachs, and

PricewaterhouseCoopers. The top five financial advisors

based on the aggregate transaction value of the deals worked

on, were: Goldman Sachs, JPMorgan Chase & Co, Morgan

Stanley, Bank of America Merrill Lynch, and Lazard.

Europe

MergerMetrics

Europe Sector

Activity & Value

Europe Strategic

Buyer Report

Over the past 3 months, the sectors that have seen the

Europe Private

Equity Report

Top Europe

Advisors

Top Europe

Deals

Scoreboard

Topping the list of the largest deals announced in 2q15

were: Royal Dutch Shells record 74.6 billion scheme of

arrangement for BG Group Plc Ltd; Teva Pharmaceutical

Industries Ltds cash and stock offer to acquire Mylan NV for

44.9 billion; Monsanto Cos unsolicited offer for Syngenta

AG for 42.1 billion; Mylan NVs offer to acquire Perrigo Plc

for 32.3 billion; and the private equity exit of Freescale

Semiconductor to NXP Semiconductors NV for 14.2 billion in

cash and stock.

The top five legal advisors through the second quarter of

2015 based on deal announcements were: Allen & Overy,

Clifford Chance, Linklaters, Jones Day, and Skadden, Arps,

Slate, Meagher & Flom. The top five legal advisors, based on

the aggregate transaction value of the deals worked on,

were: De Brauw Blackstone Westbroek NV, Allen & Overy,

Cravath, Swaine & Moore, Slaughter & May, and Stikeman

Elliott.

The European Mergers & Acquisitions Market Index

250.0

1400

233.9

1200

200.0

1000

139.3

150.0

800

103.6

97.1

95.0

93.3

100.0

79.6

78.5

74.8

64.7

57.6

600

84.9

400

49.7

46.5

55.7

50.0

53.6

200

1,062

1,185

1,070

1,171

1,253

912

1,222

1,167

1,152

1,235

1,076

1,097

1,166

1,107

1,030

1,222

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

0.0

0

Deal Volume

FactSet.com

Aggregate Deal Value

Copyright 2015 FactSet Research Systems Inc. All rights reserved.

Europe MergerMetrics

2nd Quarter 2015

Merger Stats

Number of Deals

Agg. Base Equity (Bil)

12 Months Ended

12 Months Ended

30/06/15

30/06/14

Change

Average

P/E

34.3%

402.8

505.7

-20.4%

28.0

139

4.3%

71.6

97.5

-26.6%

22.0

226

212

6.6%

55.7

73.9

-24.6%

26.7

100M to 249.9M

383

400

-4.3%

42.9

64.1

-33.1%

26.0

50M to 99.9M

352

312

12.8%

17.9

22.0

-19.0%

28.5

25M to 49.9M

391

359

8.9%

9.6

13.0

-26.2%

23.6

10M to 24.9M

525

534

-1.7%

6.4

8.5

-24.3%

20.7

Under 10M

1,388

1,411

-1.6%

3.0

4.3

-31.0%

15.3

Undisclosed

10,037

9,082

10.5%

N/A

N/A

N/A

N/A

Total

13,639

12,592

8.3%

609.9

789.1

-22.7%

22.9

Deal Size

30/06/15

30/06/14

1 Billion +

192

143

500M to 999.9M

145

250M to 499.9M

Change

M&A at a Glance

AVERAGE P/E

AVERAGE PREMIUM

30.0x

50.0%

45.0%

25.0x

20.0x

40.0%

23.5x

35.0%

22.1x

21.4x

37.9%

30.0%

30.5%

29.2%

25.0%

15.0x

20.0%

10.0x

15.0%

10.0%

5.0x

5.0%

0.0%

0.0x

2q13

3q13

4q13

1q14

2q14

3q14

4q14

1q15

2q13

2q15

3q13

4q13

1q14

2q14

3q14

4q14

1q15

2q15

DEAL VOLUME BY COUNTRY

1,400

1,200

1138

1110

1,000

996

956

901

800

1144

1108

1038

1009

600

565

400

499

473

391

522

446

437

3q13

4q13

567

486

488

1q14

2q14

519

548

480

593

593

532

472

439

200

0

2q13

France

Germany

3q14

4q14

1q15

2q15

United Kingdom

FactSet Flashwire Europe Quarterly: Senior QA Analyst Anita Abbas (aabbas@factset.com). Media: Media quotation with source attribution is encouraged. Reporters requesting

additional information or editorial comment should contact Anita Abbas at +1.415.645.9811. Mergerstat gathers its data from sources it considers reliable; however, it does not

guarantee the accuracy or completeness of the information provided in this publication. Copyright 2015 FactSet Research Systems Inc. All rights reserved. It is illegal under federal

copyright law to reproduce or redistribute this publication or any portion of its contents without written authorization of the publisher.

FactSet.com

Copyright 2015 FactSet Research Systems Inc. All rights reserved.

Europe Sector Activity & Value

2nd Quarter 2015

SECTOR BY ACTIVITY

Target Sector

Finance

Consumer Services

Retail Trade

Technology Services

Government

Process Industries

Communications

Health Services

Distribution Services

Miscellaneous

Commercial Services

Transportation

Industrial Services

Energy Minerals

Health Technology

Non-Energy Minerals

Utilities

Consumer Non-Durables

Electronic Technology

Consumer Durables

Producer Manufacturing

Total

L3M 06/30/15

Deal Count

425

278

152

350

8

164

56

76

185

2

446

119

161

25

75

64

78

131

146

70

224

3,235

L3M 06/30/14

Deal Count

396

264

138

339

1

157

52

72

185

4

451

124

169

37

88

77

91

146

165

91

258

3,305

Difference

29

14

14

11

7

7

4

4

0

(2)

(5)

(5)

(8)

(12)

(13)

(13)

(13)

(15)

(19)

(21)

(34)

(70)

SECTOR BY VALUE

Target Sector

Energy Minerals

Finance

Process Industries

Electronic Technology

Retail Trade

Technology Services

Utilities

Transportation

Consumer Services

Communications

Industrial Services

Commercial Services

Government

Health Services

Miscellaneous

Consumer Non-Durables

Distribution Services

Consumer Durables

Health Technology

Non-Energy Minerals

Producer Manufacturing

Total

FactSet.com

L3M 06/30/15

Value

67,557.7

99,047.9

62,959.2

35,948.3

24,764.0

28,919.3

18,169.6

17,437.5

32,204.1

40,320.3

20,711.7

17,806.8

5,765.5

207.1

14,502.4

8,971.9

8,880.2

89,277.4

11,320.7

20,153.4

624,924.9

L3M 06/30/14

Value

13,171.6

44,920.1

12,179.2

8,564.5

7,183.1

16,616.8

7,229.2

6,953.1

23,118.0

36,194.6

17,976.3

15,665.6

5,884.2

363.4

16,223.1

12,222.8

13,046.8

98,779.2

26,110.2

40,772.5

423,174.4

Copyright 2015 FactSet Research Systems Inc. All rights reserved.

Difference

54,386.1

54,127.8

50,780.0

27,383.8

17,580.9

12,302.5

10,940.4

10,484.4

9,086.1

4,125.7

2,735.5

2,141.2

0

(118.7)

(156.4)

(1,720.8)

(3,251.0)

(4,166.7)

(9,501.8)

(14,789.5)

(20,619.1)

201,750.5

Europe Strategic Buyer Report

2nd Quarter 2015

Merger Stats

Number of Deals

Agg. Base Equity (Bil)

12 Months Ended

Deal Size

12 Months Ended

30/06/15

30/06/14

1 Billion +

84

71

500M to 999.9M

60

63

250M to 499.9M

77

100M to 249.9M

50M to 99.9M

Change

Average

P/E

30/06/15

30/06/14

Change

18.3%

425.0

222.2

91.3%

31.7

-4.8%

41.1

44.3

-7.3%

23.8

77

0.0%

27.1

26.3

3.0%

28.5

150

136

10.3%

23.8

22.5

5.8%

24.1

153

127

20.5%

10.7

9.1

17.1%

34.0

25M to 49.9M

168

152

10.5%

6.0

5.6

6.2%

24.7

10M to 24.9M

228

215

6.0%

3.8

3.4

10.3%

15.2

Under 10M

579

575

0.7%

1.9

2.0

-5.2%

15.0

Undisclosed

2,087

1,969

6.0%

N/A

N/A

N/A

N/A

Total

3,586

3,385

5.9%

539.4

335.5

60.8%

24.3

PUBLIC BUYER INDEX LTM 30/06/15

140

400

118.0

350

120

91.8

100

300

250

80

200

60

43.9

38.7

40

30.5

22.2

20

15.6

333

233

299

280

263

339

9.2

217

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

41.2

37.6

36.5

150

100

16.3

275

301

260

270

336

Feb-15

Mar-15

Apr-15

May-15

Jun-15

50

-

Europe Private Equity Report

Indices

Top Private Equity: YTD 2015

PE BUYER INDEX LTM 30/06/15

30

22.2

25

22.9

150

12.7

11.9

10.0

10

4.4

4.7

165

222

100

6.6

Value (Mil)

12-Jun-15

7,559.0

Coller International Partners Fund VII

(Coller Capital Ltd.)

Fund (Private Equity Sponsor)

09-Jan-15

4,900.9

Lone Star Real Estate Fund IV

(Lone Star Americas Acquisitions LLC)

30-Mar-15

4,616.8

Alinda Infrastructure Fund III

(Alinda Capital Partners Ltd.)

06-Mar-15

3,682.7

TA XII Fund

(TA Associates Management LP)

03-Apr-15

3,216.2

Cerberus Institutional Partners VI LP

(Cerberus Capital Management LP)

13-Jan-15

2,673.7

New Enterprise Associates 15 Fund

(New Enterprise Associate LLC)

10-Feb-15

2,649.2

TMA/Pathway Private Equity Fund IV LP

(Pathway Capital Management LP)

01-Jan-15

1,550.0

Waterland Private Equity Fund VI

(Waterland Private Equity Investments BV)

08-Jun-15

1,338.8

Searchlight Capital Fund II

(Searchlight Capital Partners LLC)

06-Feb-15

1,322.2

Castlelake IV LP

(Castlelake LP)

50

223

211

219

229

158

192

195

190

176

228

Jul-14

Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15

GOING PRIVATE INDEX LTM 30/06/15

12.0

10.4

10.0

6.8

8.0

6

5

6.0

4.0

2.0

Open Date

21.2 200

16.3

20

15

250

27.5

23.5

0.7

0.1 0.4

1

1.4 1.7

8

2

6

0.2

2

0.4 0.4

2

0.0

0.0

1

-

Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15

FactSet.com

Copyright 2015 FactSet Research Systems Inc. All rights reserved.

Top Europe Advisors

2nd Quarter 2015

BASED ON EUROPE ANNOUNCED DEALS - RANKED BY TRANSACTION VALUE: YTD 2015

Transaction

Value (Mil)*

Financial Advisor

Total

Deals**

Transaction

Value (Mil)*

Legal Advisor

Total

Deals**

1.

Goldman Sachs & Co.

321,287.3

74

1.

De Brauw Blackstone Westbroek NV

135,119.8

2.

JPMorgan Chase & Co

263,924.9

68

2.

Allen & Overy LLP

127,928.4

94

3.

Morgan Stanley

262,658.2

53

3.

Cravath, Swaine & Moore LLP

123,926.1

10

4.

Bank of America Merrill Lynch

175,849.4

47

4.

Slaughter & May Ltd.

109,339.1

28

5.

Lazard

141,166.5

67

5.

Stikeman Elliott LLP

107,117.5

19

6.

UBS Group AG

92,850.7

36

6.

Skadden, Arps, Slate, Meagher & Flom LLP

106,784.4

43

7.

Deutsche Bank AG

80,873.2

40

7.

Wachtell, Lipton, Rosen & Katz

100,226.2

10

8.

Barclays Plc

77,521.7

26

8.

Freshfields Bruckhaus Deringer LLP

93,913.5

13

9.

Robey Warshaw LLP

74,670.9

9.

Sullivan & Cromwell LLP

93,842.7

19

10.

Citigroup

68,145.8

45

10.

Kirkland & Ellis LLP

62,323.0

28

11.

Greenhill & Co., Inc.

62,880.2

10

11.

Simpson Thacher & Bartlett LLP

51,084.2

16

12.

Rothschild

59,334.8

112

12.

Linklaters LLP

50,425.4

50

13.

Credit Suisse

58,054.2

29

13.

Loyens & Loeff NV

45,336.7

14.

BNP Paribas SA

28,726.9

26

14.

Tulchinsky Stern Marciano Cohen Levitski & Co.

44,916.7

15.

Moelis & Co.

25,075.8

12

15.

Clifford Chance LLP

40,626.1

63

16.

Macquarie Group

18,565.1

12

16.

Davis Polk & Wardwell LLP

35,144.7

21

17.

Ernst & Young Global Ltd.

16,787.4

89

17.

Arthur Cox & Co.

34,415.6

18.

HSBC Holdings Plc

16,533.0

19

18.

A&L Goodbody

32,337.6

19.

Centerview Partners LLC

13,266.6

19.

Weil, Gotshal & Manges LLP

26,594.3

34

20.

Zaoui & Co. LLP

11,954.6

20.

Herbert Smith Freehills LLP

26,308.1

34

21.

RBC Capital Markets

10,862.5

12

21.

Latham & Watkins LLP

25,871.2

31

22.

KPMG International

10,401.2

109

22.

Fried, Frank, Harris, Shriver & Jacobson LLP

24,983.7

11

23.

Intesa Sanpaolo SpA

10,292.1

13

23.

Cleary Gottlieb Steen & Hamilton LLP

22,879.8

20

24.

PricewaterhouseCoopers

9,743.8

70

24.

Wilson Sonsini Goodrich & Rosati

18,741.8

25.

UniCredit SpA

9,587.4

17

25.

Blake, Cassels & Graydon LLP

15,568.3

10

26.

Houlihan Lokey

8,952.6

26.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

15,341.9

11

27.

William Blair & Co. LLC

8,389.9

13

27.

Ropes & Gray LLP

15,083.5

28.

China National Chemical Corp.

8,270.3

28.

Pedersoli e Associati

14,463.7

29.

Perella Weinberg Partners Group LP

7,249.5

29.

Brunswick SCP

14,075.6

30.

Danske Bank A/S

6,991.2

30.

Shearman & Sterling LLP

14,039.0

32

31.

Deloitte LLP

6,535.1

41

31.

Roschier

13,306.6

22

32.

Mediobanca SpA

6,532.4

12

32.

Debevoise & Plimpton LLP

11,990.1

11

33.

FEXCO Group

6,517.2

33.

Chiomenti Studio Legale

10,270.3

34.

Davy Corporate Finance Ltd.

6,503.5

34.

Hogan Lovells

9,454.0

29

35.

Nomura Securities Co., Ltd.

6,424.1

13

35.

Mayer Brown LLP

8,991.1

15

36.

Van Lanschot NV

6,094.0

36.

Gibson, Dunn & Crutcher LLP

8,906.2

12

37.

Evercore Partners, Inc.

5,924.9

14

37.

Lombardi Molinari Segni e Associati

8,348.1

38.

BDT & Co. LLC

5,834.5

38.

Jun He Law Offices

8,270.3

39.

Valuetrust Financial Advisors SE

5,740.2

39.

Baker & McKenzie LLP

8,220.6

17

40.

LionTree LLC

5,724.6

40.

Covington & Burling LLP

7,808.2

41.

PJT Partners LP

5,724.6

41.

Axinn, Veltrop & Harkrider LLP

7,449.1

42.

Jefferies LLC

5,167.6

23

42.

King & Wood Mallesons Ltd.

7,288.6

16

43.

Cenkos Securities Plc

5,049.0

13

43.

Matheson Ormsby Prentice

7,249.5

44.

Banco Santander SA

4,553.5

44.

Proskauer Rose LLP

7,041.2

10

45.

Qatalyst Group LP

4,355.4

45.

Morgan, Lewis & Bockius LLP

6,908.7

46.

FirstRand Ltd.

4,185.3

46.

Jones Day LP

6,738.4

50

47.

Leerink Partners LLC

4,166.2

47.

Arthur Cox & Co. (UK)

6,500.0

48.

Union Square Advisors LLC

4,156.8

48.

Khaitan & Co. LLP

6,416.2

49.

Oakley Capital Ltd.

3,797.1

49.

Ligerion CJSC

6,400.7

50.

Canaccord Genuity Group, Inc.

3,795.5

19

50.

Bredin Prat & Associes

6,205.5

If you would like to participate in our league table rankings or have questions about league table criteria, please contact advisors@factset.com or:

North America: Tayo Olatoyan

E-Mail: tolatoyan@factset.com

FactSet.com

Global

Tel: +1.212.849.4189

Anita Abbas

E-Mail: aabbas@factset.com

Copyright 2015 FactSet Research Systems Inc. All rights reserved.

Tel: +1.415.645.9811

Top Europe Deals Scoreboard

Rank

Seller (Unit Sold)

Financial Advisor

Legal Advisor

Buyer

Financial Advisor

Legal Advisor

Transaction

Value**

(Mil)

Seller Sector

BG Group Plc

Royal Dutch Shell Plc

74,670.9

Energy Minerals

44,916.7

Health Technology

42,121.3

Process Industries

32,337.6

Health Technology

14,216.2

Electric Technology

13,371.5

Communications

11,954.6

Electric Technology

10,057.2

Retail Trade

Goldman Sachs & Co.

JPMorgan Chase & Co.

Morgan Stanley

Robey Warshaw LLP

Freshfields Bruckhaus Deringer LLP

Bank of America Merrill Lynch

Allen & Overy LLP

Cravath, Swaine & Moore LLP

De Brauw Blackstone Westbroek NV

Slaughter & May Ltd.

Mylan NV

Teva Pharmaceutical Ltd.

Goldman Sachs & Co

Lazard

Stikeman Elliott LLP

Barclays Plc

Greenhill & Co.

De Brauw Blackstone Westbroek NV

Kirkland & Ellis LLP

Loyens & Loeff NV

Sullivan & Cromwell LLP

Tulchinsky Stern Marciano Cohen Levitski & Co.

Syngenta AG

Monsanto Co.

Goldman Sachs & Co.

JPMorgan Chase & Co

UBS

Morgan Stanley

Wachtell, Lipton, Rosen & Katz

Perrigo Co. Plc

Mylan NV

JPMorgan Chase & Co.

Morgan Stanley

A&L Goodbody

Wachtell, Lipton, Rosen & Katz

Goldman Sachs & Co.

Lazard

Arthur Cox & Co.

Cravath, Swaine & Moore LLP

Skadden, Arps, Slate, Meagher & Flom LLP

Stikeman Elliott LLP

Freescale Semiconductor Ltd.

NXP Semiconductors NV

Morgan Stanley

Skadden, Arps, Slate, Meagher & Flom LLP

Wilson Sonsini Goodrich & Rosati PC

Telefnica SA (Telefnica Europe Plc)

UBS

Herbert Smith Freehills LLP

Hutchison Whampoa Ltd.

Nokia Oyj

Bank of America Merrill Lynch

Goldman Sachs & Co.

Morgan Stanley

Zaoui & Co. LLP

Sullivan & Cromwell LLP

Wachtell, Lipton, Rosen & Katz

JPMorgan Chase & Co.

Brunswick SCP

Roschier

Skadden, Arps, Slate, Meagher & Flom LLP

Stikeman Elliott LLP

Delhaize Group SA

Credit Suisse

De Brauw Blackstone Westbroek NV

Simpson Thacher & Bartlett LLP

Moelis & Co.

Linklaters LLP

Alcatel-Lucent SA

2nd Quarter 2015

Royal Ahold NV

Bank of America Merrill Lynch

Deutsche Bank

Lazard

Cravath, Swaine & Moore LLP

Fried, Frank, Harris, Shriver & Jacobson LLP

Linklaters LLP

Goldman Sachs & Co.

JPMorgan Chase & Co.

Allen & Overy LLP

Simpson Thacher & Bartlett LLP

Sullivan & Cromwell LLP

Bouygues SA (Bouygues Telecom SA)

Altice SA

10,000.0

Communications

K+S AG

Potash Corp of Saskatchewan, Inc.

8,373.4

Process Industries

10

Deutsche Bank

Morgan Stanley

Total Market Value of Top 10 Deals YTD

FactSet.com

262,019.3

Copyright 2015 FactSet Research Systems Inc. All rights reserved.

You might also like

- City Legal Index 2015Document17 pagesCity Legal Index 2015Legal CheekNo ratings yet

- International Statistical Release 2015 Q2Document7 pagesInternational Statistical Release 2015 Q2Corcaci April-DianaNo ratings yet

- Dow Jones VentureSource EU 4Q 2015Document18 pagesDow Jones VentureSource EU 4Q 2015CrowdfundInsiderNo ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument6 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- Corporate FinanceDocument39 pagesCorporate FinanceAbhishek BiswasNo ratings yet

- Single Market News - Financial and Economic Crisis: Interview With David Wright - 2009 2Document24 pagesSingle Market News - Financial and Economic Crisis: Interview With David Wright - 2009 2dmaproiectNo ratings yet

- UK Gross Domestic Expenditure On Research and Development 2015 - ONSDocument21 pagesUK Gross Domestic Expenditure On Research and Development 2015 - ONSsrowbothamNo ratings yet

- Analysing Mergers and Acquisitions in European Financial Services: An Application of Real OptionsDocument18 pagesAnalysing Mergers and Acquisitions in European Financial Services: An Application of Real Optionskashif salmanNo ratings yet

- Power Cut?: How the EU Is Pulling the Plug on Electricity MarketsFrom EverandPower Cut?: How the EU Is Pulling the Plug on Electricity MarketsNo ratings yet

- IFA39 LoresDocument68 pagesIFA39 LoresMarkus MilliganNo ratings yet

- Globalization German1Document4 pagesGlobalization German1ismadinNo ratings yet

- Catalyst Tic PDFDocument12 pagesCatalyst Tic PDF66apenlullenNo ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument6 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- Disclaimer enDocument146 pagesDisclaimer ennikubeNo ratings yet

- EIB Investment Survey 2023 - European Union overviewFrom EverandEIB Investment Survey 2023 - European Union overviewNo ratings yet

- 2005 San Antonio - TF C5-2 2ID45VER59Document8 pages2005 San Antonio - TF C5-2 2ID45VER59KandlakuntaBhargavaNo ratings yet

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeFrom EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeNo ratings yet

- News Idea Sept 2011Document15 pagesNews Idea Sept 2011Consorzio TecnoimpreseNo ratings yet

- ITRK IMS 19 Nov 13Document2 pagesITRK IMS 19 Nov 13Saulat AliNo ratings yet

- Current Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16From EverandCurrent Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- 2018 05 28 Group Performance For The Year Ended March 31 2018Document8 pages2018 05 28 Group Performance For The Year Ended March 31 2018Priyanka KumariNo ratings yet

- The UK Strategic Investment Fund: Interim ReportDocument28 pagesThe UK Strategic Investment Fund: Interim ReportamvecNo ratings yet

- Economia Subterana in Europa PDFDocument112 pagesEconomia Subterana in Europa PDFFlorin Marius PopaNo ratings yet

- UK Distribution Dynamics 2Q 2012Document20 pagesUK Distribution Dynamics 2Q 2012g_simpson1160No ratings yet

- Trading Economics: A Guide to Economic Statistics for Practitioners and StudentsFrom EverandTrading Economics: A Guide to Economic Statistics for Practitioners and StudentsNo ratings yet

- Mergermarket PDFDocument5 pagesMergermarket PDFAnonymous Feglbx5No ratings yet

- The 2018 EU Industrial R&D Investment ScoreboardDocument110 pagesThe 2018 EU Industrial R&D Investment Scoreboardhalid dazkiriNo ratings yet

- M&A Review Newsletter 2014Document28 pagesM&A Review Newsletter 2014Michael WangNo ratings yet

- Asset Management Report 2015Document40 pagesAsset Management Report 2015tco_99No ratings yet

- PWC Deals Retail Consumer Insights q2 2016Document5 pagesPWC Deals Retail Consumer Insights q2 2016Peter ShiNo ratings yet

- Communique CA Et Resultat FY 2013 VADocument7 pagesCommunique CA Et Resultat FY 2013 VAΠεριοδικό "ΑΣΦΑΛΙΣΤΙΚΗ ΑΓΟΡΑ"No ratings yet

- Mergermarket League Tables of Legal Advisers To Global M&A For Q1 2012Document53 pagesMergermarket League Tables of Legal Advisers To Global M&A For Q1 2012Pallavi SawhneyNo ratings yet

- CE Delft - Calculation of Additional Profits of Sectors and Firms From The EU ETSDocument82 pagesCE Delft - Calculation of Additional Profits of Sectors and Firms From The EU ETSAnitaSamardžijaNo ratings yet

- The EVCA Yearbook 2011Document7 pagesThe EVCA Yearbook 2011Justyna GudaszewskaNo ratings yet

- Capex Report Q1 2013Document21 pagesCapex Report Q1 2013Laurent LequienNo ratings yet

- UntitledDocument53 pagesUntitledapi-228714775No ratings yet

- Global Innovation: Developing Your Business for a Global MarketFrom EverandGlobal Innovation: Developing Your Business for a Global MarketNo ratings yet

- PWC 10 CentralDocument8 pagesPWC 10 CentralCozma BogdanNo ratings yet

- I Securities Markets and Their Agents: Situation and OutlookDocument51 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroNo ratings yet

- PHPV Iwg QMDocument5 pagesPHPV Iwg QMfred607No ratings yet

- Swiss Entertainment Media Outlook 2011-2015 FinalDocument136 pagesSwiss Entertainment Media Outlook 2011-2015 Finalgeopan88No ratings yet

- SME Trade Finance Research FinalDocument70 pagesSME Trade Finance Research FinalMikeNo ratings yet

- Global TobaccoDocument35 pagesGlobal TobaccoTimothée Muller ScientexNo ratings yet

- Manchester United Plots Singapore Float: Club Could Raise $1BnDocument24 pagesManchester United Plots Singapore Float: Club Could Raise $1BnCity A.M.No ratings yet

- The Balance of Payments Provides Us With Important Information About Whether or Not A Country Is "Paying Its Way" in The International EconomyDocument6 pagesThe Balance of Payments Provides Us With Important Information About Whether or Not A Country Is "Paying Its Way" in The International EconomyankitaiimNo ratings yet

- 9708 Y16 SP 4Document4 pages9708 Y16 SP 4jihyunbae925No ratings yet

- DHL/BCC Quarterly International Trade OutlookDocument28 pagesDHL/BCC Quarterly International Trade OutlookDHL Express UKNo ratings yet

- Investor News: Bayer Significantly Improves EarningsDocument8 pagesInvestor News: Bayer Significantly Improves EarningsAnonymous Y9PhqR4YEQNo ratings yet

- Brexit: What the Hell Happens Now?: Your Quick GuideFrom EverandBrexit: What the Hell Happens Now?: Your Quick GuideRating: 4 out of 5 stars4/5 (10)

- q210 IrreleaseDocument4 pagesq210 Irreleaset0k100No ratings yet

- MACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhDocument14 pagesMACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhCabaas XasanNo ratings yet

- 2Q14 Roadmap To ValuationDocument24 pages2Q14 Roadmap To ValuationRyan BrookmanNo ratings yet

- Mills 2Q16 ResultsDocument17 pagesMills 2Q16 ResultsMillsRINo ratings yet

- E.On Ag: Company ProfileDocument11 pagesE.On Ag: Company Profilenewcastle74No ratings yet

- CMS & EMIS Emerging Europe M&a Report 2018-19Document78 pagesCMS & EMIS Emerging Europe M&a Report 2018-19bhaskkarNo ratings yet

- European Economy: The Second Economi C Adj Ust Ment PR Ogr Amme F or GR Eece Mar CH 2012Document195 pagesEuropean Economy: The Second Economi C Adj Ust Ment PR Ogr Amme F or GR Eece Mar CH 2012Emmanuel PassasNo ratings yet

- UK National Accounts, The Blue Book 2021Document79 pagesUK National Accounts, The Blue Book 2021Tri Juli OmbiengNo ratings yet

- Comparison of Pharmaceuticals On Belgium, France and United KingdomDocument8 pagesComparison of Pharmaceuticals On Belgium, France and United KingdomhadiNo ratings yet

- Core Real Estate What It Is and How To Explain It in Real Estate Interviews PDFDocument9 pagesCore Real Estate What It Is and How To Explain It in Real Estate Interviews PDFFattyschippy1No ratings yet

- High Storrs Sixth Form Prospectus PDFDocument40 pagesHigh Storrs Sixth Form Prospectus PDFFattyschippy1No ratings yet

- Wetherspoon Standard Drink Menu Subject To Availability PDFDocument2 pagesWetherspoon Standard Drink Menu Subject To Availability PDFFattyschippy1No ratings yet

- Core Real Estate What It Is and How To Explain It in Real Estate Interviews PDFDocument9 pagesCore Real Estate What It Is and How To Explain It in Real Estate Interviews PDFFattyschippy1No ratings yet

- Stand by Me - Can't Buy Me LoveDocument1 pageStand by Me - Can't Buy Me LoveFattyschippy1No ratings yet

- GCSE Music For Film 2Document1 pageGCSE Music For Film 2Fattyschippy1No ratings yet

- Produce A Project About The Beatles For Weds. 19 SeptDocument1 pageProduce A Project About The Beatles For Weds. 19 SeptFattyschippy1No ratings yet

- Freshers Societies BookletDocument43 pagesFreshers Societies BookletFattyschippy1No ratings yet

- Critical Evaluation of FriedmanDocument3 pagesCritical Evaluation of FriedmanFattyschippy1No ratings yet

- Functional Harmony Made SimpleDocument1 pageFunctional Harmony Made SimpleFattyschippy1No ratings yet

- Royal Dutch Shell and BG Group Case StudyDocument7 pagesRoyal Dutch Shell and BG Group Case StudyFattyschippy1No ratings yet

- Chapel Easter Term 2015Document8 pagesChapel Easter Term 2015Fattyschippy1No ratings yet

- Mathematics Homework - Exam Questions (M)Document2 pagesMathematics Homework - Exam Questions (M)Fattyschippy1No ratings yet

- Supervision 3 Essay NOTESDocument2 pagesSupervision 3 Essay NOTESFattyschippy1No ratings yet

- PartIIA Mich TimetableDocument1 pagePartIIA Mich TimetableFattyschippy1No ratings yet

- National Minimum WageDocument7 pagesNational Minimum WageFattyschippy1No ratings yet

- Lecture 2 Suerpvision Paper 4 Part 1A EconomicsDocument2 pagesLecture 2 Suerpvision Paper 4 Part 1A EconomicsFattyschippy1No ratings yet

- AQA Economics Unit 3 Chapter 1 Exam QsDocument2 pagesAQA Economics Unit 3 Chapter 1 Exam QsFattyschippy1No ratings yet

- Essay 4Document3 pagesEssay 4Fattyschippy1No ratings yet

- 3.1.2 The Allocation of Resources in Competitive MarketsDocument5 pages3.1.2 The Allocation of Resources in Competitive MarketsFattyschippy1No ratings yet

- FP1 Revision With Obscure PartsDocument1 pageFP1 Revision With Obscure PartsFattyschippy1No ratings yet

- Economic ProblemDocument2 pagesEconomic ProblemFattyschippy1No ratings yet

- Banilit Coating PDFDocument76 pagesBanilit Coating PDFFernando Tapia GibsonNo ratings yet

- Bhutan Solid Waste ManagementDocument7 pagesBhutan Solid Waste ManagementSherub PhuntshoNo ratings yet

- Cargo Operations Manual CHAPTER 4 Track and Trace: ContentDocument16 pagesCargo Operations Manual CHAPTER 4 Track and Trace: ContentPankaj TiwariNo ratings yet

- AISI1040Document2 pagesAISI1040Anonymous qRbPsLpuNNo ratings yet

- Technical Data Sheet DECODALLEDocument2 pagesTechnical Data Sheet DECODALLEMaría Isabel CevallosNo ratings yet

- SEDA Study - Region's Economic OpportunitiesDocument60 pagesSEDA Study - Region's Economic Opportunitiessavannahnow.comNo ratings yet

- WNT Catalogue 2016 - 07 Thread Turning PDFDocument47 pagesWNT Catalogue 2016 - 07 Thread Turning PDFMani StoqnovaNo ratings yet

- Vijay Chemsol: R.S.No.110/5, HM Road, Industrial Area, Sedharapet, Pondicherry-605 111. IndiaDocument16 pagesVijay Chemsol: R.S.No.110/5, HM Road, Industrial Area, Sedharapet, Pondicherry-605 111. IndiaSundara MoorthyNo ratings yet

- Bleaching and Dyeing of Cotton Knitted Fabric Project ReportDocument9 pagesBleaching and Dyeing of Cotton Knitted Fabric Project ReportRajesh Kumar PandeyNo ratings yet

- The Procurement Perspectives of Fruits and Vegetables Supply Chain PlanningDocument21 pagesThe Procurement Perspectives of Fruits and Vegetables Supply Chain PlanningnarenisursNo ratings yet

- Simple Line Balancing Exercise: Workstation Manual Time (Min) Machine Time (Min)Document2 pagesSimple Line Balancing Exercise: Workstation Manual Time (Min) Machine Time (Min)Estudiante INGNo ratings yet

- Wholesale Botox Supplier UKDocument1 pageWholesale Botox Supplier UKreliablemedicareNo ratings yet

- Manpower & Equipment ScheduleDocument1 pageManpower & Equipment ScheduleColitz D. KhenNo ratings yet

- World - Class CompaniesDocument19 pagesWorld - Class CompaniesAzinev Yamzky RekcapNo ratings yet

- Thermolatent Curing Agents For Low Temperature 1K Epoxy Adhesive ApplicationsDocument27 pagesThermolatent Curing Agents For Low Temperature 1K Epoxy Adhesive Applicationss0n1907No ratings yet

- Mia Report JkshimDocument17 pagesMia Report JkshimHavish P D SulliaNo ratings yet

- List of Industry Association in Various SectorsDocument2 pagesList of Industry Association in Various SectorsAbhishekNo ratings yet

- Seminar On Drug Master FileDocument23 pagesSeminar On Drug Master FileKuldeep SaikiaNo ratings yet

- 2017 CMP - Alex DollDocument11 pages2017 CMP - Alex DollrodrigoalcainoNo ratings yet

- Daftar Pustaka: Efisiensi Produksi Dengan Menggunakan Metode OEE (Skripsi) - Medan: UniversitasDocument2 pagesDaftar Pustaka: Efisiensi Produksi Dengan Menggunakan Metode OEE (Skripsi) - Medan: UniversitascahyaindrarNo ratings yet

- WMBD Background of VoltasDocument2 pagesWMBD Background of VoltaschetnagawadeNo ratings yet

- Steel Making Prof. Deepak Mazumdar Prof. S. C. Koria Department of Materials Science and Engineering Indian Institute of Technology, KanpurDocument16 pagesSteel Making Prof. Deepak Mazumdar Prof. S. C. Koria Department of Materials Science and Engineering Indian Institute of Technology, KanpurSyed HasniNo ratings yet

- PosterDocument1 pagePosterSaad Ullah100% (2)

- Abhishek Singh Review or Research PaperDocument5 pagesAbhishek Singh Review or Research PaperAnonymous V9S84lNo ratings yet

- Kotler Pom CW PPT Exp Ch13Document15 pagesKotler Pom CW PPT Exp Ch13uldsNo ratings yet

- Production Operation Management SCDL AssignmentDocument26 pagesProduction Operation Management SCDL Assignmentsaurabh303100% (3)

- Question 1 of 20 Accounting For ManagersDocument8 pagesQuestion 1 of 20 Accounting For ManagersgghhsdNo ratings yet

- Application of Whittle Multi Mine at Geita Gold Mine T.Joukoff Et Al PDFDocument6 pagesApplication of Whittle Multi Mine at Geita Gold Mine T.Joukoff Et Al PDFjaja_543No ratings yet

- Costco Packaging Specs AddendumsDocument16 pagesCostco Packaging Specs Addendumssaravanan_c1No ratings yet

- Wps PQR Aws d11 FormDocument2 pagesWps PQR Aws d11 Formflakosisas100% (1)