Professional Documents

Culture Documents

FSA Additional Practices

Uploaded by

Salman Preeom0 ratings0% found this document useful (0 votes)

22 views2 pagesFollowing are the Current Assets and Current Liabilities information of the balance sheet and Sales and COGS information of the income statement. Calculate the current and quick ratio of this company for both years. If the industry average Current Ratio in 2015 was 2. And acid-test ratio was 1.0, comment on the liquidity of this company.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFollowing are the Current Assets and Current Liabilities information of the balance sheet and Sales and COGS information of the income statement. Calculate the current and quick ratio of this company for both years. If the industry average Current Ratio in 2015 was 2. And acid-test ratio was 1.0, comment on the liquidity of this company.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesFSA Additional Practices

Uploaded by

Salman PreeomFollowing are the Current Assets and Current Liabilities information of the balance sheet and Sales and COGS information of the income statement. Calculate the current and quick ratio of this company for both years. If the industry average Current Ratio in 2015 was 2. And acid-test ratio was 1.0, comment on the liquidity of this company.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

1.

Following are the Current assets & current liabilities information of the balance sheet and

Sales & COGS information of the income statement for DEF Manufacturing Company Ltd.

Current Assets:

Year 2015

Year 2014

Amount (Tk.)

Amount (Tk.)

Cash & Cash Equivalents

3,000,000

5,000,000

Marketable Securities

1,000,000

2,000,000

Accounts Receivables

12,000,000

10,000,000

Inventories

20,000,000

15,000,000

Total Current Assets

36,000,000

32,000,000

Current Liabilities:

Accounts Payable

Other S/T liabilities

Total Current Liabilities

Year 1

Year 2

Amount (Tk.)

Amount (Tk.)

10,000,000

9,690,000

5,000,000

7,000,000

15,000,000

Year 1

16,690,000

Year 2

Amount (Tk.)

Amount (Tk.)

Sales*

80,000,000

89,000,000

COGS

50,000,000

65,000,000

*60% of the total sales are credit sales in both years.

Requirements:

Calculate the current and quick ratio of this company for both years. If the industry average

Current ratio in 2015 was 2.0 and acid-test ratio was 1.0. Comment on the liquidity of this

company.

b. Analyze this companys receivables activity and inventories activity by applying relevant

activity ratios and make necessary comment.

The WW Company had the following data extracted from its financial statements for the year

ending June 30, 2014:

Current Ratio = 2, Acid Ratio = 1.5, Current Liabilities = $500,000, Inventory Turnover = 5,

Gross Profit Margin = 20 percent.

What were its sales for the year?

DFG Company had the following information in 2013:

Current ratio = 3.0 times

Quick ratio = 1.4 times

Inventory turnover = 5 times

Current Assets = $810,000 (Cash, inventory & receivables)

Cash = $120,000 COGS = 75% of sales.

Requirements:

a. What is the companys Sales?

b. Assume a 360 day year & all sales are credit. What was the companys Average Collection

Period?

The ZZ Company had the following data extracted from its financial statements for the year

ending June 30, 2015:

Sales = 3.6 million

a.

2.

3.

4.

Average Collection Period = 30 days

Inventory Turnover = 9

Gross Profit Margin = 25 percent

Requirements:

a. What was its accounts receivable balance on June 30, 2015?

b. What was the inventory of the Company on that date?

5. Over the past few years, ABC Company has found that the companys receivable turnover started

to decrease from 50 days to 25 days. The companys credit terms are 1/10, n/30. Comment

whether the company is doing better. 5.

6. The inventory turnover ratio for Agora, a supermarket, is 2.0 times while the same ratio for

Airbus, an aircraft manufacturer, is 1.5 times. Which company is having better inventory turnover

ratio? Explain.

7. Current ratio of XYZ Company is 2 times, Quick Ratio is 1 times and the Current Liability is

$50,000. How much is the value of the inventory? If the industry average of the Quick Ratio is 1.5

times, then comment on the liquidity condition of the company.

8. The ABC Company has annual sales of $1.0 million and a gross profit margin of 10 percent. How

much should be the value of inventory if inventory turnover is 9?

9. WBC Company had $800,000 of debt outstanding and it pays an interest rate of 10% annually. Its

annual sales are $1,000,000 and tax payment is expected to be $40,000. The Net Profit Margin on

sales for this company is 10%. Calculate and interpret the TIE of WBC Company. Suggest some

ways by which WBC can improve its TIE.

10. Assume you are given the following relationships for the WBC Corporation: Total asset turnover

= 1.5 times Earning Power = 3% ROE = 5% Calculate the companys net profit margin and debt to

total asset ratio.

11.

XYZ has an equity multiplier (financial leverage multiplier) of 2.4. The companys assets are

financed with some combination of long term debt and common equity. What is the companys

debt to total asset ratio?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Assignment On THMDocument1 pageAssignment On THMSimantoPreeomNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Fall 2019-20 - Course Outline - Distribution ManagementDocument6 pagesFall 2019-20 - Course Outline - Distribution ManagementSalman PreeomNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- PREM ASSIGNMENT-docsDocument1 pagePREM ASSIGNMENT-docsSalman PreeomNo ratings yet

- Course Outline MKT 4002 Marketing Research - Fall 2018-2019Document5 pagesCourse Outline MKT 4002 Marketing Research - Fall 2018-2019Salman PreeomNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- OBE Course Outline MKT 4002 Marketing Research - Summer 2018-2019Document6 pagesOBE Course Outline MKT 4002 Marketing Research - Summer 2018-2019Salman PreeomNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- VIVA Questions-MGT Acc-MIDDocument7 pagesVIVA Questions-MGT Acc-MIDSalman PreeomNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- CH 11 and 16 TDocument21 pagesCH 11 and 16 TSalman PreeomNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- PGD Prospectus 2018 FinalDocument20 pagesPGD Prospectus 2018 FinalSalman PreeomNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Elementary of A ProposalDocument5 pagesThe Elementary of A ProposalSalman PreeomNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Strategies in Action: Strategic Management: Concepts & Cases 12 Edition Fred DavidDocument27 pagesStrategies in Action: Strategic Management: Concepts & Cases 12 Edition Fred DavidSalman PreeomNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Key Internal Factors Weight Rate Weighted Score StrengthDocument2 pagesKey Internal Factors Weight Rate Weighted Score StrengthSalman PreeomNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Presentation Before SECRETARY (Water Resources,: River Development and Ganga Rejuvenation)Document50 pagesPresentation Before SECRETARY (Water Resources,: River Development and Ganga Rejuvenation)Salman PreeomNo ratings yet

- Revised Mid Term Exam Schedule of Spring19 Feb 19Document6 pagesRevised Mid Term Exam Schedule of Spring19 Feb 19Salman PreeomNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Strategies in Action: Strategic Management: Concepts & Cases 12 Edition Fred DavidDocument27 pagesStrategies in Action: Strategic Management: Concepts & Cases 12 Edition Fred DavidSalman PreeomNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Marketing Plan of Teen ShampooDocument124 pagesMarketing Plan of Teen ShampooSalman PreeomNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Career OutcomeDocument1 pageCareer OutcomeSalman PreeomNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Political Environment: A Critical ConcernDocument12 pagesThe Political Environment: A Critical ConcernSalman PreeomNo ratings yet

- Updated Undergraduate Mid Term Exam Schedule of Spring 2017 18 Feb 26Document6 pagesUpdated Undergraduate Mid Term Exam Schedule of Spring 2017 18 Feb 26didar047No ratings yet

- The Scope and Challenge of International MarketingDocument10 pagesThe Scope and Challenge of International Marketingart galleryNo ratings yet

- David Sm14 Inppt02 GEDocument30 pagesDavid Sm14 Inppt02 GEJue YasinNo ratings yet

- Updated Undergraduate Mid Term Exam Schedule of Spring 2017 18 Feb 26Document6 pagesUpdated Undergraduate Mid Term Exam Schedule of Spring 2017 18 Feb 26didar047No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- ToysDocument1 pageToysSalman PreeomNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BG&a SectionB Achievement ChartDocument10 pagesBG&a SectionB Achievement ChartSalman PreeomNo ratings yet

- All About Presentation SkillsDocument1 pageAll About Presentation SkillsSalman PreeomNo ratings yet

- ("Valstybės Žinios" (Official Gazette), 2004, No. 180-6699 2006, No. 37-1328 2007, No. 1-55)Document8 pages("Valstybės Žinios" (Official Gazette), 2004, No. 180-6699 2006, No. 37-1328 2007, No. 1-55)Jenus KhanNo ratings yet

- Promoting Food Security Following The 2010 Pakistan Floods and Insights From South Asian ExperienceDocument30 pagesPromoting Food Security Following The 2010 Pakistan Floods and Insights From South Asian ExperienceSalman PreeomNo ratings yet

- BCGDocument1 pageBCGSalman PreeomNo ratings yet

- Information Systems in Business TodayDocument24 pagesInformation Systems in Business TodaySalman PreeomNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Report StructureDocument1 pageReport StructureSalman PreeomNo ratings yet

- Chapter 2Document5 pagesChapter 2ERICKA MAE NATONo ratings yet

- Crew Resource Management Phil O'DonnellDocument39 pagesCrew Resource Management Phil O'DonnellMostafaNo ratings yet

- Lord You Know All Things, You Can Do All Things and You Love Me Very MuchDocument4 pagesLord You Know All Things, You Can Do All Things and You Love Me Very Muchal bentulanNo ratings yet

- Phillips LoFloDocument29 pagesPhillips LoFlokawaiiriceNo ratings yet

- Radiation Hazards & Radiation ProtectionDocument62 pagesRadiation Hazards & Radiation ProtectionGurupada JanaNo ratings yet

- Nursing Care of A Family With An InfantDocument26 pagesNursing Care of A Family With An InfantJc GarciaNo ratings yet

- Cen-Tech 63759Document8 pagesCen-Tech 63759GregNo ratings yet

- Philosophy For Management and DisciplineDocument8 pagesPhilosophy For Management and Disciplineapi-300120362No ratings yet

- 2mw Biomass Gasification Gas Power Plant ProposalDocument9 pages2mw Biomass Gasification Gas Power Plant ProposalsabrahimaNo ratings yet

- Kora 3T 09Document1 pageKora 3T 09Vаleriy шефNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cubal Cargo Manual Draft 2 November 2011Document384 pagesCubal Cargo Manual Draft 2 November 2011toma cristian100% (2)

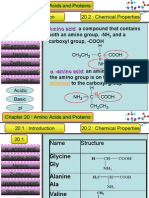

- Matriculation Chemistry Amino Acids-Part-1Document24 pagesMatriculation Chemistry Amino Acids-Part-1iki292No ratings yet

- Answers To Competency Assessment SectionDocument16 pagesAnswers To Competency Assessment Sectionapi-209542414100% (1)

- Registration of Hindu Marriage: A Project On Family Law-IDocument22 pagesRegistration of Hindu Marriage: A Project On Family Law-Iamit dipankarNo ratings yet

- Hematology SOPsDocument99 pagesHematology SOPssalamon2t100% (1)

- LISD LetterDocument2 pagesLISD LetterAnonymous Pb39klJ100% (1)

- Bad Effects of Festivals On The EnvironmentDocument10 pagesBad Effects of Festivals On The EnvironmentSahil Bohra85% (52)

- Jean-Pierre Wybauw - Fine Chocolates 2 - Great Ganache Experience-Lannoo (2008)Document209 pagesJean-Pierre Wybauw - Fine Chocolates 2 - Great Ganache Experience-Lannoo (2008)Mi na100% (1)

- NANOGUARD - Products and ApplicationsDocument2 pagesNANOGUARD - Products and ApplicationsSunrise VenturesNo ratings yet

- HMPE1 (Catering MGT.)Document17 pagesHMPE1 (Catering MGT.)Rysyl Mae MoquerioNo ratings yet

- QuestionnaireDocument2 pagesQuestionnaireMili Gada100% (8)

- 1 PBDocument16 pages1 PBRaffi GigiNo ratings yet

- Nuclear Over Hauser Enhancement (NOE)Document18 pagesNuclear Over Hauser Enhancement (NOE)Fatima AhmedNo ratings yet

- Remote Control RC902V1 ManualDocument3 pagesRemote Control RC902V1 ManualdezdoNo ratings yet

- A Little BookDocument75 pagesA Little Bookfati_cenNo ratings yet

- Fishing Broken Wire: WCP Slickline Europe Learning Centre SchlumbergerDocument23 pagesFishing Broken Wire: WCP Slickline Europe Learning Centre SchlumbergerAli AliNo ratings yet

- Musculoskeletal 20,000 Series CPT Questions With Answers-CpcDocument16 pagesMusculoskeletal 20,000 Series CPT Questions With Answers-Cpcanchalnigam25100% (7)

- Solid Dosage Form Part 1Document48 pagesSolid Dosage Form Part 1Claire Marie AlvaranNo ratings yet

- Switching Power Supply Design: A Concise Practical Handbook: February 2022Document5 pagesSwitching Power Supply Design: A Concise Practical Handbook: February 2022Juan Gil RocaNo ratings yet

- Bachelor of Physiotherapy (BPT) 2nd YearDocument17 pagesBachelor of Physiotherapy (BPT) 2nd YearMOHD TAUSIF0% (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)