Professional Documents

Culture Documents

Accounting Terms

Uploaded by

vintage daisy0 ratings0% found this document useful (0 votes)

153 views2 pagesaccounting info

Original Title

Accounting terms

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaccounting info

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

153 views2 pagesAccounting Terms

Uploaded by

vintage daisyaccounting info

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Accounting - process of identifying, measuring, and reporting financial information of an entity

Accounting Equation - assets = liabilities + equity

Accounts Payable - money owed to creditors, vendors, etc.

Accounts Receivable - money owed to a business, i.e.: credit sales

Accrual Accounting - a method in which income is recorded when it is earned and expenses are

recorded when they are incurred

Asset - property with a cash value that is owned by a business or individual

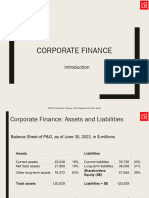

Balance Sheet - summary of a company's financial status, including assets, liabilities, and equity

Bookkeeping - recording financial information

Cash-Basis Accounting - a method in which income and expenses are recorded when they are

paid.

Chart of Accounts - a listing of a company's accounts and their corresponding numbers

Cost Accounting - a type of accounting that focuses on recording, defining, and reporting costs

associated with specific operating functions

Credit - an account entry with a negative value for assets, and positive value for liabilities and

equity.

Debit - an account entry with a positive value for assets, and negative value for liabilities and

equity.

Depreciation - recognizing the decrease in the value of an asset due to age and use

Double-Entry Bookkeeping - system of accounting in which every transaction has a

corresponding positive and negative entry (debits and credits)

Equity - money owed to the owner or owners of a company, also known as "owner's equity"

Financial Accounting - accounting focused on reporting an entity's activities to an external

party; ie: shareholders

Financial Statement - a record containing the balance sheet and the income statement

Fixed Asset - long-term tangible property; building, land, computers, etc.

General Ledger - a record of all financial transactions within an entity

Income Statement - a summary of income and expenses

Job Costing - system of tracking costs associated with a job or project (labor, equipment, etc)

and comparing with forecasted costs

Journal - a record where transactions are recorded, also known as an "account"

Liability - money owed to creditors, vendors, etc

Liquid Asset - cash or other property that can be easily converted to cash

Loan - money borrowed from a lender and usually repaid with interest

Net Income - money remaining after all expenses and taxes have been paid

Non-operating Income - income generated from non-recurring transactions; ie: sale of an old

building

Note - a written agreement to repay borrowed money; sometimes used in place of "loan"

Operating Income - income generated from regular business operations

Payroll - a list of employees and their wages

Profit - see "net income"

Profit/Loss Statement - see "income statement"

Revenue - total income before expenses.

Single-Entry Bookkeeping - system of accounting in which transactions are entered into one

account

You might also like

- AccountingDocument336 pagesAccountingVenkat GV100% (2)

- Accounting McqsDocument90 pagesAccounting McqsFazliAkbar100% (1)

- Accounting AssumptionDocument12 pagesAccounting AssumptionMargerie FrueldaNo ratings yet

- Relic Spotter Inc. CaseDocument9 pagesRelic Spotter Inc. CaseC DonisNo ratings yet

- AccountingDocument46 pagesAccountingshanmugaNo ratings yet

- 1 Accounting Theory and PracticeDocument16 pages1 Accounting Theory and PracticeFirman PrasetyaNo ratings yet

- AccountingDocument7 pagesAccountingGifford NaleNo ratings yet

- TH 425Document1 pageTH 425Jorge Hernandez VilledaNo ratings yet

- Unaccountable AccountingDocument3 pagesUnaccountable Accountingrbala99100% (1)

- Introduction To Accounting Principles: Guidelines-Form The Groundwork On Which More Detailed, Complicated, andDocument9 pagesIntroduction To Accounting Principles: Guidelines-Form The Groundwork On Which More Detailed, Complicated, andCaren Que ViniegraNo ratings yet

- Accounting vs. Auditing: The Origins of AuditingDocument2 pagesAccounting vs. Auditing: The Origins of AuditingAbdu Mohammed100% (2)

- Basic AccountingDocument8 pagesBasic Accountingpurple ailurophileNo ratings yet

- Public AccountingDocument3 pagesPublic Accountingjoliejolie28No ratings yet

- I. Classification of AccountsDocument3 pagesI. Classification of AccountsMarjorie CabilloNo ratings yet

- Managerial Accounting and The Business Environment: Garrison, Noreen, Brewer, Cheng & YuenDocument47 pagesManagerial Accounting and The Business Environment: Garrison, Noreen, Brewer, Cheng & YuenBambang AriwibowoNo ratings yet

- Financial Accounting - Accounting TheoryDocument62 pagesFinancial Accounting - Accounting TheoryKagaba Jean BoscoNo ratings yet

- Depriciation AccountingDocument42 pagesDepriciation Accountingezek1elNo ratings yet

- Corporate AccountingDocument14 pagesCorporate AccountingzainabNo ratings yet

- AccountingDocument57 pagesAccountingReynaldo Jose Alvarado RamosNo ratings yet

- Encumbrance AccountingDocument11 pagesEncumbrance Accountingyramesh77No ratings yet

- Accounting 1Document7 pagesAccounting 1khurramNo ratings yet

- Accounting UsDocument15 pagesAccounting UsFibrin Yang Uelek'sNo ratings yet

- Accounting ApproachesDocument32 pagesAccounting ApproachesHKS75% (4)

- Auditing Theory Testbanks / Reviewers: Decline To Accept or Perform The AuditDocument5 pagesAuditing Theory Testbanks / Reviewers: Decline To Accept or Perform The AuditChryzbryth LorenzoNo ratings yet

- Review AccountingDocument4 pagesReview AccountingDuy ViệtNo ratings yet

- AccountingDocument12 pagesAccountingpearl042008No ratings yet

- The Accounting Process (The Accounting Cycle) : 2. Prepare The Transaction'sDocument3 pagesThe Accounting Process (The Accounting Cycle) : 2. Prepare The Transaction'sGanesh ZopeNo ratings yet

- Activity-Based Costing: Chapter Study ObjectivesDocument11 pagesActivity-Based Costing: Chapter Study ObjectivesThezenwayNo ratings yet

- Paper - 1: Advanced Accounting: Answer All QuestionsDocument22 pagesPaper - 1: Advanced Accounting: Answer All Questionsmakarand8july78100% (1)

- Adjustments (Accounting)Document18 pagesAdjustments (Accounting)MarKhun GabotNo ratings yet

- Accounting - Study Plan (100 Credits) : Pre: BACC 202Document1 pageAccounting - Study Plan (100 Credits) : Pre: BACC 202DuaaaaNo ratings yet

- Accounting PrimerDocument86 pagesAccounting PrimerchandusgNo ratings yet

- May 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeDocument24 pagesMay 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeMartn Carldazo DrogbaNo ratings yet

- AccountingDocument6 pagesAccountingSha SharonNo ratings yet

- Cost AccountingDocument12 pagesCost AccountingrehanNo ratings yet

- History of Debits and CreditsDocument26 pagesHistory of Debits and CreditsPrincess GeminiNo ratings yet

- Accounting TheoryDocument6 pagesAccounting TheoryAPRIL ROSE YOSORESNo ratings yet

- AccountingDocument23 pagesAccountingsekadaraNo ratings yet

- Advanced AccountingDocument304 pagesAdvanced AccountingDeep100% (2)

- Accounting SyllabusDocument67 pagesAccounting SyllabusNaivee Mee100% (1)

- Understanding AccountingDocument20 pagesUnderstanding Accountingrainman54321No ratings yet

- Accounting: NO Judul PengarangDocument14 pagesAccounting: NO Judul Pengarangkartini11No ratings yet

- National University: Department of AccountingDocument8 pagesNational University: Department of AccountingMd MostakNo ratings yet

- AccountingDocument11 pagesAccountingβασιλης παυλος αρακαςNo ratings yet

- Financial Accounting Is The Process of Preparing Financial Statements For A BusinessDocument11 pagesFinancial Accounting Is The Process of Preparing Financial Statements For A Businesshemanth727100% (1)

- Accounting BasicsDocument26 pagesAccounting BasicsAziz MalikNo ratings yet

- Cost AccountingDocument29 pagesCost Accountingsskumar82No ratings yet

- Basic AccountingDocument4 pagesBasic Accountingkanding21No ratings yet

- Accounting StudiesDocument51 pagesAccounting Studieshi2joeyNo ratings yet

- Viva AccountingDocument15 pagesViva Accountingsakib990No ratings yet

- Financial AccountingDocument68 pagesFinancial AccountingAvinash SharmaNo ratings yet

- Telly PDFDocument19 pagesTelly PDFNaushad Ahmad60% (15)

- Accounting MCQDocument15 pagesAccounting MCQsamuelkish50% (2)

- AccountingDocument83 pagesAccountingAsjad Jamshed100% (2)

- 11 ACCTS theoryNOTESDocument6 pages11 ACCTS theoryNOTESDeveshi TewariNo ratings yet

- Basic Accounting TermsDocument2 pagesBasic Accounting TermsajayNo ratings yet

- Basic Accounting TermsDocument2 pagesBasic Accounting TermsSiddhaarth IyerNo ratings yet

- Accounting DictionaryDocument5 pagesAccounting DictionaryShazad HassanNo ratings yet

- Accounting TermsDocument4 pagesAccounting TermsJefferson BriginoNo ratings yet

- Basic Accounting TermsDocument4 pagesBasic Accounting TermsBogdan MirceaNo ratings yet

- The Sherwin-Williams Company Excel Spread Sheet 2010Document6 pagesThe Sherwin-Williams Company Excel Spread Sheet 2010Bitsy627No ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- MGT 101 (100 MCQS)Document20 pagesMGT 101 (100 MCQS)Taimoor Sultan83% (23)

- 3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsDocument3 pages3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsQudsiya KalhoroNo ratings yet

- Prelim 2 Financial ManagementDocument17 pagesPrelim 2 Financial Managementyenyenreyes222No ratings yet

- ICICI Wonderla Holiday 2023Document7 pagesICICI Wonderla Holiday 2023SANDIP MISHRANo ratings yet

- Annual Report Analysis - Oct-14-EDEL PDFDocument259 pagesAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNo ratings yet

- Financial Analysis - Maruti Udyog LimitedDocument100 pagesFinancial Analysis - Maruti Udyog LimitedNithish JainNo ratings yet

- Susquehanna Equipment Rentals (Group D) - PresentationDocument13 pagesSusquehanna Equipment Rentals (Group D) - PresentationNoman ANo ratings yet

- Revenue Recognition and Franchise TestbankDocument43 pagesRevenue Recognition and Franchise TestbankBusiness MatterNo ratings yet

- 12 Accounts ch6 tp1Document11 pages12 Accounts ch6 tp1Pawan TalrejaNo ratings yet

- Chapter 16Document47 pagesChapter 16Irin HaNo ratings yet

- AFAR MIDTERM EXAM REVIEWER - Part 1 (With Answers)Document5 pagesAFAR MIDTERM EXAM REVIEWER - Part 1 (With Answers)AuroraNo ratings yet

- Goodwill Questions and Their SolutionsDocument8 pagesGoodwill Questions and Their SolutionsAMIN BUHARI ABDUL KHADERNo ratings yet

- Written Assignment Unit 4Document9 pagesWritten Assignment Unit 4Mike StevenNo ratings yet

- Measuring Business IncomeDocument3 pagesMeasuring Business Incomeeater PeopleNo ratings yet

- 858 Accounts QPDocument11 pages858 Accounts QPRudra SahaNo ratings yet

- WiproDocument41 pagesWiproPG GuidesNo ratings yet

- Practical Accounting 2 First Pre-Board ExaminationDocument15 pagesPractical Accounting 2 First Pre-Board ExaminationKaren Eloisse89% (9)

- CPX Admin 11122Document198 pagesCPX Admin 11122sen2natNo ratings yet

- Comprehensive Accounting Cycle Review Problem-1Document11 pagesComprehensive Accounting Cycle Review Problem-1api-296886708100% (1)

- Cash Flow - Toa - Valix 2018 PDFDocument13 pagesCash Flow - Toa - Valix 2018 PDFHarvey Dienne QuiambaoNo ratings yet

- ACC2002 Practice 1Document9 pagesACC2002 Practice 1Đan LêNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 3 QuarterDocument4 pagesFundamentals of Accountancy Business and Management 1 11 3 QuarterMarjealyn Portugal100% (2)

- Financial Accounting and Reporting - JA - 2022 - Suggested AnswersDocument8 pagesFinancial Accounting and Reporting - JA - 2022 - Suggested AnswersMonira afrozNo ratings yet

- Financial Management - Financial Statements Analysis NotesDocument24 pagesFinancial Management - Financial Statements Analysis Noteskamdica100% (3)

- Financial Management Chapter 2Document28 pagesFinancial Management Chapter 2beyonce0% (1)

- Akuntansi Keuangan Lanjutan - Baker (10 E)Document1,086 pagesAkuntansi Keuangan Lanjutan - Baker (10 E)Nabila Nur IzzaNo ratings yet

- 2023capital Structure0 FTDocument37 pages2023capital Structure0 FTRonnie KurtzbardNo ratings yet

- CASE STUDY INSTRUCTIONS 2019 T5 NewDocument10 pagesCASE STUDY INSTRUCTIONS 2019 T5 NewSunil SharmaNo ratings yet