Professional Documents

Culture Documents

Determinatns of Dividend

Uploaded by

Nikhil AggarwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Determinatns of Dividend

Uploaded by

Nikhil AggarwalCopyright:

Available Formats

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

Journal of Contemporary Issues in Business Research

ISSN 2305-8277 (Online), 2012, Vol. 1, No. 1, 20-27.

Copyright of the Academic Journals JCIBR

All rights reserved.

DETERMINANTS OF DIVIDEND PAYOUT RATIO: EVIDENCE

FROM KARACHI STOCK EXCHANGE (KSE)*

ABDUL REHMAN

University of Central Punjab

HARUTO TAKUMI

The University of Tokyo, Japan

ABSTRACT

This study examines the determinants of dividend payout ratio in the largest

stock exchange of Pakistan i.e. Karachi Stock Exchange (KSE). The effect of

Debt to equity ratio, Operating cash flow per share, profitability, market to

book value ratio, current ratio and corporate tax on dividend payout ratio was

analyzed for the year 2009 for 50 companies that announced dividend in 2009.

Relation of debt to equity ratio, profitability, current ratio and corporate tax

was found to be positive with dividend payout ratio while Operating cash flow

per share and market to book value ratio has a negative relationship with

dividend payout ratio. Profitability, debt to equity and market to book value

ratios were found to be the significant determinants of dividend payout ratio in

Pakistan.

Keyword: Dividend Payout Ratio; Debt to Equity Ratio; KSE; Determinants.

INTRODUCTION

Dividend payout has always been a debatable subject in corporate finance. Many

researchers in past have come up with theoretical models explaining what factors managers

should consider while making a dividend decision. Dividend decision is important for both

the investors and corporations. It is the decision of companys management that what

proportion of the earnings should be invested and what proportion should be distributed to

shareholders as dividends. While making this decision the management considers available

investment opportunities that would increase future earnings and if such opportunities are not

available the management should distribute the earnings to shareholders. (Miller &

Modigliani, 1961)

The traditional view of the dividend decision states that at a particular time the

amount of cash paid today as dividend is more valuable than the retained cash. The traditional

view argues that paying early dividends may not change the corporation risk level but it will

change the perception of the investor about the corporations risk level thus dividends are

more valuable than retained earnings.

The views or opinions expressed in this manuscript are those of the author(s) and do not necessarily reflect the

position, views or opinions of the editor(s), the editorial board or the publisher.

Corresponding author Email: arehmanlion@hotmail.com

20

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

In imperfect market investors prefer companies with a dividend pattern similar to their

consumption pattern. That is the reason many companies follow a consistent dividend policy

and their management consider reduction in dividend as a weakness signal and thus a higher

dividend would only be announced if the company can sustain it in future.

Investors have incomplete information in imperfect market. Less amount of

information is available so whatever is available is considered as important one by the

investors. Announcement of dividend is taken as signal of future growth of the company. All

these factors prove the importance of dividend and its relevance.

Companys earnings can be used to buy securities or to retire debt or it can be

invested in operating assets or these earnings can be distributed in shareholders in the form of

dividends. There are many reasons for paying or not paying dividends. Dividends are

important for investors as dividends are considered to be a signal of companys financial

wellbeing. Dividends also help in maintaining the market price of the corporations share.

Companies with a history of paying stable dividends would be negatively affected by

decreasing or discontinuing dividends. Similarly companies that have never paid dividends

would be viewed favorably when they would pay dividends.

In this study the researcher extended Amidu & Abor (2006), Anil & Kapoor (2008)

and Gill, Biger, & Tibrewala (2010) findings regarding the dividend payout ratio by

investigating with almost the same variables for the Karachi Stock Exchange.

Objective of the Study

Main objectives are as under:

To examine the factors that determines the dividend payout ratio in Pakistans capital

market.

To analyze the impact of leverage, liquidity, corporate tax to net profit ratio and

market to book value ratio on dividend payout ratio

Significance of this Study

This study is different from all other studies conducted in Pakistan on dividend payout

ratio as all previous studies follow time series while this study is based on cross sectional

data. No study in the past has taken the variables used in this study. This research would help

both investors and corporation to understand about significant factors that determine the

dividend payout ratio in Pakistan.

LITERATURE REVIEW

Lintner (1956) explained that the dividends patterns are subjective to the profitability

of the company. Those companies that are more profitable are expected to pay more

dividends compared to those that are less profitable. Black (1996) concluded in his article

that the companies dont know which dividend policy they must use as they are not aware of

how many irrational investors are there in the market but a rational investor can maximize his

profit by choosing the right dividend policy. The harder we look at dividend the more it

seems like a puzzle with pieces that just dont fit together. Kanwer (2002) in his study

analyzed the factors that explain the dividend payout in companies listed on Karachi Stock

Exchange using data from 1992-98. The author explained that the signaling theory works in

Chemicals, cement and fuel & Energy sectors of Pakistan. Amidu & Abor (2006) studied the

determinants of dividend payout ratio in Ghana. Authors examined the data of six years of

companies listed on stock exchange. Variables such as profitability, cash flow, Corporate

Tax, Sales Growth and Market to Book value were used. Results indicated positive

relationships between dividend payout ratios and profitability, cash flow, and tax while the

relationship was negative with growth and market to book value. Naeem & Nasr (2007)

21

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

studied the dividend policy of the firms listed on the Karachi stock exchange for the period of

1999-2004. Authors collected the data of 108 companies and concluded that there was an

discrepancy in dividends payments of Pakistani companies. Authors found a decline in

dividend payment ratio in 2004. Relation between profitability and dividends payout ratio

suggested that companies with higher profit are more likely to pay dividends. Liquidity

although being an important determinant of dividend payout found to be insignificant in this

study.

Mohamed, et al. (2008) in their study of 200 companies with highest market

capitalization in Malaysian capital market examined the profitability and liquidity as

determinants of dividend payout and concluded that profitability and liquidity are significant

variables in determining the dividend payout and companies which are more profitable and

liquid have more chances of declaring dividends. Anil & Kapoor (2008) observed the

determinants of dividend payout in information technology sector of India. Authors explained

that there are many other variables except the profitability that determine the dividend payout

e.g. cash flow, corporate tax, sales growth and market to book value ratio. Authors examined

that the variables mentioned literature influence the dividend payout in information

technology sector of India or not. Ahmed & Javid (2009) examined if the firms listed at

Karachi stock exchange follow a stable dividend pattern and concluded that the companies

listed at Karachi Stock Exchange are not smooth in their dividends payments. Profitability

and cash flow found to be significant factors in determining the dividends payout in Pakistan.

Gill, Biger, & Tibrewala (2010) examined the determinants of dividend payout ratios using

the data of American service and manufacturing firms. The data of 2007 was used in this

study and different variables such as profitability, cash flow, Corporate Tax, Sales Growth,

Market to Book value and Debt to Equity ratio were used to determine the dividend payout

ratio. Results indicated that in manufacturing industry, corporate tax and profitability were

significant and in service industry the sales growth was significant.

Mistry (2010) in study of determinants of dividend payout ratio in the pharmacy

sector of India used variable like profitability, turnover, liquidity and concluded that the

payments of dividends in dependent more upon the decision of the management as the

relation between dividend payout ratio and profitability of more companies was negative. The

relationship of cash flow with dividend came out to be positive which suggest that companies

have enough cash from operating activities to pay dividend but the relation of dividend

payout with liquidity was negative that showed that even having cash to pay dividends it is

the decision of the management to pay or not to pay the dividends. Ahmad & Javid (2010)

studied the association between dividend payout and ownership structure and concluded that

there is association between ownership structure and dividend payouts in the non financial

sector companies listed in Karachi stock exchange 100 Index. Okpara & Chigozie (2010) in

their research examined the determinants of dividend payouts in Nigeria. The authors used

factor analysis and econometrics techniques to determine those factors that influence

dividend payout in Nigeria. Authors concluded that the current ratio, profitability and

dividends for last year are very important determinants of dividend payout.

Corporate Profitability

Baker, Farrelly, & Edelman (1985) explained that current years earning and previous

years dividend affect the dividend payment pattern of the firms. The projected future profits

of corporations determine the dividend payment ratio of the firm. Pruitt & Gitman (1991)

studied separation principle by surveying the financial managers of top 1000 US firms.

Results indicated a positive relation between dividend payment and profitability. Dividend

decisions were determined by the yearly earnings and previous years dividends. Brook,

Charlton, & Hendershott (1998) concluded that stock returns and dividends sends a positive

22

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

signal about the future financial position of the company but the role of signaling in

dividends determination is very small. Goergen, Silva, & Renneboog (2005) concluded that

the net profit was the main reason of dicidend changes. Authors explained that firms in

Germany that faced loss ommited dividend in the year they faced loss. Mohamed, et al.

(2008) explained that profitability is an important determinant of dividend payout and

concluded that firms that are more frofitable and liquid have higher chances of announcing

dividends. Gill, Biger, & Tibrewala (2010) in their research paper found a positive

relationship between profitability and dividend payout. Authors concluded that profitability is

a significant determinant of dividend payout ratio in US capital market.

Cash Flow

Alli, Khan, Ramirez, & G (1993) explained that cash flow is more important

determinant of dividend than profitability as cash flow determine the ability of the company

to pay dividend. Authors argue that profitability do not reflect the companys ability to pay

dividend. Brook, Charlton, & Hendershott (1998) examined the relationship of cash flow and

dividend payout. Authors explained that increasing cash flows are significant determinants of

dividends. The firms with increasing cashflow have a higher tendency of announcing

dividends. Mohamed, et al. (2008) found a positive relationship between dividend payout and

operating cash flow per share in Malasia. Operating cash flow per share was a significant

determinant of dividend payout in their study. Gill, Biger, & Tibrewala (2010) in their study

of US capital market concluded that the relationship between cash flow and dividend payout

ratio is negative for both manufacturing and service industry. Cash flow was an insignificant

determinant of dividend payout ratio in their research.

Corporate Tax

Masulis & Trueman (1998) explained that there is a positive relation between

corporate tax and dividend payout. Those firms that have an increasing trend in tax liability,

their preference for dividend payment will also increase. Amidu & Abor (2006) in their study

of determinants of dividend payout ratio found that corporate tax and dividend payout ratio

and positively related. Increasing tax leads to increasing dividends. Gill, Biger, & Tibrewala

(2010) found a positive relation between corporate Tax and dividend payout ratio in

manufacturing sector of US capital market but the relation of corporate tax with dividend

payout ratio was negative in service sector. Authors concluded that in manufacturing sector

the Corporate Tax is insignificant determinant of dividend payout ratio but in service sector,

corporate tax was significant determinant of dividend payout ratio.

Market to Book Value Ratio

Omran & Pointon (2004) in their study explains that market to book value is a

significant determinant of dividend payout. Author studied that the relation of dividend

payout is positive with profitability and liquidity. Amidu & Abor (2006) found in their study

that the relation of market to book value ratio is negative with dividend payout. Gill, Biger, &

Tibrewala (2010) found a positive relation of market to book value ratio with dividend payout

ratio in manufacturing sector but in service sector the relation was positive.

Debt to Equity Ratio

Pruitt & Gitman (1991) showed that the firms having a high groth and dividend

payout rate use more debt financing in comparison to those with less dividend payout.

Authors also explained that firms dividend policy is affected by risk. DSouza & Saxena

(1999) found a negative relationship between risk and dividend payout ratio. Authors

concluded that risk is a significant factor in determining the dividend payout ratio. Gill,

23

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

Biger, & Tibrewala (2010) showed a positive relation between debt to equity ratio and

dividend payout ratio in case of service sector but in manufacturing sector of US the relation

of debt to equity ratio with dividend payout ratio was negative. Authors concluded that debt

to equity ratio is insignificant determinant of dividend payout ratio in both manufacturing and

service sectors of US.

RESEARCH METHODOLOGY

To analyze the determinants of dividend payout ratio the author selected the about

110 companies from Karachi stock exchange 100 Index for the year 2009. Total 50

companys dividend was paid in 2009 so only these 50 companies from 110 total companies

were usable. Numerical and financial data were collected to test the hypothesis. For this

purpose financial statements of these companies were used.

Measurement

For the purpose of being consistent with the past studies the variables i.e. profitability,

cash flow operating ratio, corporate tax, market-to-book value ratio, current ratio and debt to

equity ratio were selected. Operating cash flow and current ratio are used for liquidity. Debt

to equity ratio is used for leverage and Profitability is the used for profit margin.

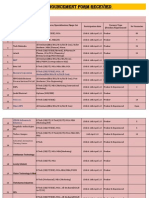

TABLE 1

Variables Definition

Variables

Definitions

Profitability (PROF)

Earnings before interest and taxes/Total assets

Operating cash flow per share (CFPS)

Operating Cash Flow/ No. of Shares outstanding

Corporate Tax (TAX)

Corporate tax/Net profit before tax

Current Ratio (CR)

Current Assets/Current Liabilities

Share price beginning of the year/Net asset value per

Market-to-Book Value (MTBV)

share-basic

Debt to Equity Ratio (D/E)

Total liabilities/Shareholders equity

Dividend Payout Ratio

Yearly dividends/Net income after tax

Hypotheses

Following are the hypotheses of the study:

HO1. The profitability does not affect the Dividend payout ratio significantly.

HO2.The operating cash flow per share does not affect the Dividend payout ratio

significantly.

HO. The corporate tax does not affect the Dividend payout ratio significantly

HO4.The Market to Book value Ratio does not affect the Dividend payout ratio

significantly.

HO5. The Current Ratio does not affect the Dividend payout ratio significantly.

HO6. The Debt to Equity Ratio does not affect the Dividend payout ratio significantly.

H1. These variables affect the dividend payout ratio significantly.

RESULTS AND DATA ANALYSIS

Table 2 provides the descriptive statistics for the variables of the regression Model.

This shows the mean and standard deviation of all the variables. Table 2 shows that the mean

of dividend payout is 1.665 and standard deviation is 7.61. The mean of debt to equity ratio is

0.27 and standard deviation is 0.440. The mean of operating cash flow per share is 2.17 and

standard deviation is 11.17. The mean of profitability is 0.04 and standard deviation is 0.06.

The mean of market to book value ratio is 1.26 and standard deviation is 4.77. The mean of

24

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

current ratio is 9.79 and standard deviation is 24.24. The mean of corporate tax is 0.10 and

standard deviation is 0.12.

TABLE 2

Descriptive Statistics

Mean

1.6550

.2752

2.1728

.0410

1.2641

9.7877

.1011

Variables

Dividend Payout

D/E

CFPS

PROF

MTBV

CR

TAX

Standard Deviation

7.61363

.44036

11.17602

.05915

4.76532

24.23991

.12432

TABLE 3

OLS Regression Estimates

Standard Dividend Payout (N = 50) R2 = 0.48; F = 6.604 F sig.= 0.000; Durbin-Watson

= 2.095

Un-Standardized

Standardized

Co linearity

Coefficients

Coefficients

Statistics

(Cons.)

D/E

CFPS

PROF

MTBV

CR

TAX

B

-3.300

7.944

-.097

72.976

-.485

.061

.056

Std. Error

1.482

2.008

.143

17.245

.213

.067

6.924

Beta

.459

-.142

.567

-.303

.194

.001

t

-2.227

3.957

-.677

4.232

-2.275

.907

.008

Sig.

.031

.000

.502

.000

.028

.370

.994

Tolerance

VIF

.898

.276

.674

.681

.265

.947

1.114

3.620

1.483

1.468

3.774

1.056

Table 3 shows that R2= 0.48 which means that these variables (debt to equity ratio,

Operating cash flow per share, profitability, market to book value ratio, current ratio and

corporate tax) are explaining 48% of the variation in dividend payout ratio. The Value of F is

6.604 which indicate that the model is good fit. The value of F significance i.e. 0.000 also

shows that the model is significant. All variance inflation factors (VIF) are less than 4 and

tolerance coefficients are greater than 0.2.

Dividend Payout = b0+ b1 D/E+ b2 CFPS +b3 PROF +b4 MTBV+b5 CR+b6 TAX+

Dividend Payout = -3.30+7.944D/E+72.976PROF -0.485MTBV+

(Eq. 2)

(Eq. 2)

Where, D/E is the Debt to Equity Ratio; CFPS is the Operating cash flow per share; PROF is

the profitability; MTBV is the Market to Book Value Ratio; CR is the Current Ratio and

TAX is the Corporate Tax.

The above equation explains that debt to equity ratio, profitability; current ratio and

corporate tax have a positive relationship with dividend payout ratio. Operating cash flow per

share and market to book value ratio has a negative relationship with dividend payout ratio.

In this study debt to equity ratio, profitability and market to book value ratio are significant

25

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

variables and Operating cash flow per share, current ratio and corporate tax are insignificant

variables.

CONCLUSION

This study examined the determinants of dividend payout ratio of the companies of

Karachi Stock exchange 100 index for the year 2009. Author found that in Pakistan

profitability, debt to equity and market to book value ratios are the significant determinants of

dividend payout ratio. Relation of debt to equity ratio, profitability, current ratio and

corporate tax was found to be positive with dividend payout ratio while Operating cash flow

per share and market to book value ratio has a negative relationship with dividend payout

ratio. The study has contributed to existing literature about dividend payouts. Interested

researchers may identify and examine more variables that influence the dividend payout ratio.

Limitations of the Study

This study used the data of listed companies for 1 year i.e. 2009. Therefore future

researchers can conduct study with same variables for more than 1 year. Also, the results of

this research can only be generalized to firms that are similar to those that were included in

the study.

BIBLIOGRAPHY

Ahmad, H., & Javid, D. A. (2010). The Ownership Structure and Dividend Payout Policy in

Pakistan (Evidence from Karachi stock Exchange 100 Index). journal of Business

Management and Economic Research , I (1), 58-69.

Ahmed, H., & Javid, A. (2009). Dynamics and Determinants of Dividend Policy in Pakistan

(Evidence from Karachi Stock Exchange Non-Financial Listed Firms). International

Research Journal of Finance and Economics (XXV), 148-171.

Alli, Khan, K. L., Ramirez, A. Q., & G, G. (1993). Determinants of Dividend Policy: a

Factorial Analysis. Journal of Financial Reviews , XXVIII, 523-47.

Amidu, M., & Abor, J. (2006). Determinants of Dividend Payout Ratios in Ghana. Journal of

Risk and Finance , VII, 136-145.

Anil, K., & Kapoor, S. (2008). Determinants of Dividend Payout Ratios - a Study of Indian

Information Technology Sector. International Research Journal of Finance and

Economics (15).

Baker, H. K., Farrelly, G. E., & Edelman, R. B. (1985). A Survey of Management Views on

Dividend Policy. Financial Management , XIV (3), 78-84.

Black, F. (1996). Dividends: the Puzzle. Journal of Portfolio Management , 05-08.

Brook, Y., Charlton, W. T., & Hendershott, R. J. (1998). Do Firms Use Dividends to Signal

Large Future Cash Flow Increases? Financial Management , XXVII (3), 46-57.

DSouza, J., & Saxena, A. K. (1999). Agency Cost, Market Risk, Investment Opportunities

and Dividend Policy an International Perspective. Journal of Managerial Finance ,

XXV (6), 35 - 43.

Gill, A., Biger, N., & Tibrewala, R. (2010). Determinants of Dividend Payout Ratios:

Evidence from United States. The Open Business Journal , III, 08-14.

Goergen, M., Silva, L. C., & Renneboog, L. (2005). When do German Firms Change Their

Dividends? Journal of Corporate Finance , XI (2), 375-399.

26

Journal of Contemporary Issues in Business Research

Volume 1, Issue No. 1, 2012

Jones, S. L. (1991). Corporate Finance Theory and Practice. London: International

Thompson Business Press.

Kanwer, A. (2002). The Determinants of Corporate Dividend Policies in Pakistan: an

Empirical Analysis.

Lintner, J. (1956). Distribution of Incomes of Corporations Among Dividens, Retained

Earnings, and Taxes. The American Economic Review , XXXXVI (2), 97-113.

Masulis, R. W., & Trueman, B. (1998). Corporate Investment and Dividend Decisions under

Differential Personal Taxation. Journal of Financial and Quantitative Analysis , XXIII

(4), 369-86.

Miller, M. H., & Modigliani, F. (1961). Dividend Policy, Growth, and the Valuation of

Shares. The Journal of Business , XXXIV (4), 411-433.

Mistry, D. S. (2010). Determinants of Dividend Payout Ratio: A firm Level Study of Major

Pharma Players in India. The NEHU Journal , VIII (2).

Mohamed, N., Hui, W. S., Omar, N. H., Rahman, R. A., Mastuki, N., Azis, M. A., et al.

(2008). Empirical Analysis of Determinants of Dividend Payment: Profitability and

Liquidity.

Naeem, S., & Nasr, M. (2007). Dividend Policy Of Pakistani Firms :Trends and

Determinants. International Review of Business Research Papers , III (3), 242-254.

Okpara, & Chigozie, G. (2010). A Diagnosis of the Determinant of Dividend Pay-Out Policy

in Nigeria: A Factor Analytical Approach. American Journal of Scientific Research

(8), 57-67.

Omran, M., & Pointon, J. (2004). Dividend Policy, Trading Characteristics, and Share Prices:

Empirical Evidence from Egyptian Firms. International Journal of Theoretical and

Applied Finance , VII (2), 121-133.

Pruitt, S. W., & Gitman, L. J. (1991). The Interactions between the Investment, Financing,

and Dividend Decisions of Major U.S. Firms. Financial Review , XXVI (3), 409-430.

Data sources: KSE website and Annual reports of Companies.

27

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The LEAPDocument3 pagesThe LEAPNikhil AggarwalNo ratings yet

- RelationshipDocument10 pagesRelationshipNikhil AggarwalNo ratings yet

- DividendDocument7 pagesDividendNikhil AggarwalNo ratings yet

- FactoringDocument12 pagesFactoringNikhil AggarwalNo ratings yet

- The LEAPDocument3 pagesThe LEAPNikhil AggarwalNo ratings yet

- 11113013Document34 pages11113013Nikhil AggarwalNo ratings yet

- Panjab University: B.C P - 1 (G)Document2 pagesPanjab University: B.C P - 1 (G)Nikhil AggarwalNo ratings yet

- NSE Settlement CycleDocument9 pagesNSE Settlement CycleAastha GroverNo ratings yet

- Guidelines and Formats For Capstone ProjectsDocument12 pagesGuidelines and Formats For Capstone ProjectsNikhil AggarwalNo ratings yet

- Customer Buying BehaviorDocument17 pagesCustomer Buying BehaviorJohn J. Kundi100% (28)

- Colgate Case AnalysisDocument11 pagesColgate Case AnalysisPopal Zai100% (1)

- Export Exchange Rate CommunicationDocument12 pagesExport Exchange Rate CommunicationNikhil AggarwalNo ratings yet

- Chap 20Document26 pagesChap 20Pardeep KumarNo ratings yet

- Summer Training Handbo Ok: Vivek ChaturvediDocument48 pagesSummer Training Handbo Ok: Vivek ChaturvediNikhil AggarwalNo ratings yet

- Daywise Information (Document5 pagesDaywise Information (Nikhil AggarwalNo ratings yet

- Case Analysis Strategic Management Brighter Smiles For The Masses - Colgate vs. P&G (Download To View Full Presentation)Document13 pagesCase Analysis Strategic Management Brighter Smiles For The Masses - Colgate vs. P&G (Download To View Full Presentation)mahtaabk82% (11)

- Research FileDocument24 pagesResearch FileNikhil AggarwalNo ratings yet

- Nikhil Final Hard WorkDocument27 pagesNikhil Final Hard WorkNikhil AggarwalNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- What Is The Difference Between P & L Ac and Income & Expenditure Statement?Document22 pagesWhat Is The Difference Between P & L Ac and Income & Expenditure Statement?pranjali shindeNo ratings yet

- Exchange Rate RegimesDocument17 pagesExchange Rate Regimesnimmy celin mariyaNo ratings yet

- A Step-by-Step Guide To Real-Time Pricing.Document11 pagesA Step-by-Step Guide To Real-Time Pricing.nora.tuyinNo ratings yet

- BCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMEDocument5 pagesBCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMERukshani RefaiNo ratings yet

- Downloads Cheat Sheets Trading CorrectionsDocument1 pageDownloads Cheat Sheets Trading CorrectionsShiraz ChunaraNo ratings yet

- Global Arbitrage Fund - Factsheet - 2023 - 05 MayDocument2 pagesGlobal Arbitrage Fund - Factsheet - 2023 - 05 MayPranab PattanaikNo ratings yet

- Marketing-Mix: Apr 3, 2023 Dr. Charu Wadhwa/Marketing Management/MBADocument18 pagesMarketing-Mix: Apr 3, 2023 Dr. Charu Wadhwa/Marketing Management/MBAPayel DuttaNo ratings yet

- The Fed and Monetary PolicyDocument27 pagesThe Fed and Monetary PolicyAnonymous taCBG1AKaNo ratings yet

- CIMA F3 2020 NotesDocument118 pagesCIMA F3 2020 NotesJonathan GillNo ratings yet

- Fin358 Individual Assignment Nur Hazani 2020818012Document12 pagesFin358 Individual Assignment Nur Hazani 2020818012nur hazaniNo ratings yet

- Abhishek Rai DissertationDocument120 pagesAbhishek Rai DissertationAnurag MohantyNo ratings yet

- Corporation PDFDocument28 pagesCorporation PDFJorufel PapasinNo ratings yet

- FN2191 Commentary 2020Document13 pagesFN2191 Commentary 2020slimshadyNo ratings yet

- No. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountDocument3 pagesNo. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountMond NaNo ratings yet

- Topi C 7: Corporate RestructuringDocument28 pagesTopi C 7: Corporate Restructuringnira_110No ratings yet

- Ratio Analysis Questions & AnswersDocument10 pagesRatio Analysis Questions & AnswersNaveen ReddyNo ratings yet

- CFA Level 3 2012 Guideline AnswersDocument42 pagesCFA Level 3 2012 Guideline AnswersmerrylmorleyNo ratings yet

- Statement: February 2023Document13 pagesStatement: February 2023Fiona FiaseuNo ratings yet

- Maitra Commodities Pvt. LTD: Introduction To Investing in StocksDocument26 pagesMaitra Commodities Pvt. LTD: Introduction To Investing in StocksAkash JadhavNo ratings yet

- See Securities Industry and Financial Markets Association, "2021 SIFMA Capital Markets Fact Book," Available IbidDocument10 pagesSee Securities Industry and Financial Markets Association, "2021 SIFMA Capital Markets Fact Book," Available IbidForkLogNo ratings yet

- List of Qualified/Eligible Applicants/Bidder For Eauction On 21-11-2023 ofDocument1 pageList of Qualified/Eligible Applicants/Bidder For Eauction On 21-11-2023 ofsorabh vohraNo ratings yet

- Actg 431 Quiz Week 4 Theory of Accounts (Part IV) Notes Payable QuizDocument4 pagesActg 431 Quiz Week 4 Theory of Accounts (Part IV) Notes Payable QuizMarilou Arcillas PanisalesNo ratings yet

- Banking Sector Yes Bank Under A Moratorium. SBI Investing CapitalDocument5 pagesBanking Sector Yes Bank Under A Moratorium. SBI Investing CapitalSingh JagdishNo ratings yet

- ICT For Business - 1Document24 pagesICT For Business - 1AhmadhNo ratings yet

- Joel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationDocument28 pagesJoel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationSun ZhishengNo ratings yet

- ICB Mutual FundDocument10 pagesICB Mutual FundDipock MondalNo ratings yet

- Review Questions - CH 3Document2 pagesReview Questions - CH 3bigbadbear30% (2)

- Entrep Week 3 Q3 Recognize A Potential MarketDocument32 pagesEntrep Week 3 Q3 Recognize A Potential MarketEsperanza DisepedaNo ratings yet

- 2023 - Tutorial 7 Risk - Return - CAPMDocument4 pages2023 - Tutorial 7 Risk - Return - CAPMVanh QuáchNo ratings yet

- Risk and Return Hand OutDocument4 pagesRisk and Return Hand OutAsad ur rahmanNo ratings yet