Professional Documents

Culture Documents

Letter From Association Lawyer

Uploaded by

Statesman Journal0 ratings0% found this document useful (0 votes)

2K views4 pagesLetter from association lawyer

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLetter from association lawyer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views4 pagesLetter From Association Lawyer

Uploaded by

Statesman JournalLetter from association lawyer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

1.

VIALFOTHERINGHAMur CHRISTOPHER M. 'TINGEY.

ALS) 1.800.684.4111 x211

Fax 503.598.7758

coita@veiawcon

Ado t prt in

Washington

Oregon

Taho

Unb

April 7, 2016

pue722.00

Homeowners

Creekside Homeowners Association Inc.

Re: Legal Opinion Concerning CGC Option 1

Dear Homeowner:

This office represents the Creekside Homeowners Association Inc. (“Association”). In order to

facilitate discussion and to clarify certain issues before next week’s meeting, the Association’s Board of

Directors (“Board”) has asked me to prepare this letter explaining certain legal issues surrounding the

proposed vote(s) scheduled to occur at the May 3, 2016 Owners’ Special Meeting. Please direct any

questions regarding this letter or the meetings to the Association’s community manager, Nancy

LaVoie, via e-mail at naneyl@communitymgt.com.

Background

In February 2016, the owners of the Creekside Golf Club (“CGC”) sent a letter to all homeowners

within the Association informing the homeowners that because of CGC’s financial situation, CGC

might have to close its doors. In that same letter, the owners of CGC presented the homeowners with

three “options,” and asked the homeowners to petition the Board to call a special meeting of the

homeownets to vote on these options. The three options presented were: (1) Have the homeowners

vote to increase Association assessments by $60.00/month per Lot, which the Association would then

tase to pay for a social membership for each homeowner in CGC; (2) have the Association purchase

the golf course from its current owners; ot (3) do nothing and watch as CGC was closed and possibly

sold toa land developer. To be clear, the Board had no part in the preparation or concept of CGC’s

letter and proposed options.

In early March 2016, the Board received a petition from more than thirty percent (30%) of the

homeowners requesting a special meeting of the homeowners to vote on the first option presented by

the owners of CGC (“Option 1”). On March 31, 2016, the Board mailed notice of the 2016 Owners’

Special Meeting (“Special Meeting”) to be held on May 3, 2016, beginning at 7:00 p.m. at Sprague

High School,

Simultaneously, the Board mailed notice of a special Board meeting scheduled for April 12, 2016,

beginning at 7:00 p.m., also at Sprague High School. The sole purpose of the Board meeting is to

provide a forum for answering owners’ questions surrounding the vote to be held at the Meeting,

‘Northwest HOA Law Center, 17355 SW Boones Fersy Road, Suite A, Lake Oswego, OR 97035 503.684.4111

Intermountain West HOA Law Center, 602 Fast 300 South, Salt Lake City, UT’ 84102, 801.355.9594

‘Northwest HOA Law Centet, Boise 12828 LaSalle Street, Suite 101 Boise, ID 83713 208.629.4567

Southwest HOA Law Center, 2333 W University Drive, #C103 Tempe, AZ, 85281 480.448.1331

Website: wos.vElaw.com,

April 7, 2016

Letter to Owners of Creekside Homeowners Association

Page 2

‘The Board understands that the discussion at the Board meeting will likely include questions related to

Option 1, as well as the continued value of the golf course within the confines of the Creekside

Community (“Community”). Homeowners might even tequest to vote on the Option 1 issue that

evening. However, the April 12 meeting is a Board mecting and not an Owners’ meeting, no

vote can or will be called that evening on the CGC’s Option 1 for an increase in the maximum

annual assessment.

Finally, there have been many questions about whether the Special Meeting wil still be held on May 3,

2016, in light of CGC’s announcement that it will close its doots on April 30, 2016. CGC’s

announcement has no beating on the Special Meeting. For the reasons set forth below, the Special

Meeting will proceed as noticed, beginning at 7:00 p.m. on May 3, 2016, at Sprague High

School

sussion

Prior to holding the Special Meeting, the Board has had to determine the parameters of the Special

‘Mecting. In doing so, three fundamental questions presented themselves

(1) Arc homeowners voting on Option 1 as presented by CGC’s owners or are

homeowners simply voting on an inctease in the Association’s maximum annual

assessments?

(2) Does the Board have the authority to spend assessment funds for a social membership

in the CGC for all homeowners?

(3) Ifthe Board lacks the authority to spend assessments on a social membership in the

CGC, what, if anything, can be done to give the Board the authority to spend, allocate

or use such assessments?

‘The Declaration of Covenants, Conditions and Restrictions of Golf Course Estates at Creekside

Declaration”) and Bylaws of Golf Course Estates at Creekside Homeowners Association, Inc.

(“Bylaws”) provide the answers to all three questions.

‘The Declaration provides that the amount of the annual assessment the Association may levy against

any Lot within the Association is capped in any calendar yeat, (Decl, Art. XI, Sect. 4.A). Te further

states that the Board “may each year increase the maximum annual assessments . .. by not mote than

five percent above the maximum assessment for the previous year. . ..”" This five percent (5%)

increase may be done without a vote of the homeowners. (Decl., Att. XT, Sect. 4.B). Lastly, the

Declaration also states that “the maximum annual assessment may be increased above five percent by

avote of 2/3 of... of members voting in petson or by proxy, at an annual meeting or special meeting.

duly called for this purpose.” (Decl, Art. XI, Sect. 4.0).

While the Declaration requires a homeowner vote to exceed the maximum annual assessment above

five percent (5%) above the maximum assessment for the previous year, neither the Declaration, not

the Bylaws endow homeowners with authority to direct how assessments may be used, allocated oF

otherwise spent. Rather, both the Declaration and Bylaws give that authority specifically to the Board.

April 7, 2016

Letter to Ownets of Creekside Homeowners Association

Page 3

“Article V of the Bylaws outline the powers and duties of the Board. The powers assigned to the

Board include determining and setting the annual budget for the Association; fixing assessments for

each Lot and providing homeowners notice of the amount of the assessment; collecting assessments;

suspending voting rights for homeowners who are delinquent in paying their assessments; directing

the financial affairs for the Association; dealing with and paying for maintenance of Association

property, including common property; establishing late charges for non-payment of assessments; and

“exercising all other powers necessary and proper for the administration and operation of the

[Alssociation.”

‘The Declaration limits the purposes for which the Board may levy assessments. "Those purposes ate

to “promote the health, safety and welfare of the owners and occupants, and to enhance the livability

of Golf Course Estates at Creekside and the value of lots and living units therein, and to pay the

‘common expenses of the [Alssociation.” (Decl, Att. XI, Sect. 2).

‘The Declaration specifies what items are considered as “common expenses” of the Association. Id,

‘Common expenses include costs for maintaining common property, insurance, costs for funding

reserves, and administrative expenses. Id. ‘The Declaration also provides that a common expense

includes “aJny other items agreed upon as common expenses by owners.” Id. However, unlike, for

‘example, the two-thirds voting threshold for exceeding the maximum anmual assessment, the

Declaration does not specify any voting thteshold by which homeowners may agree that an item is to

be included as a common expense. Without such a specific voting requirement, by defnult then, a

change in definition of what is a common expense requires a seventy-five percent (75%) vote of

homeowners through an amendment to the Declaration. (Decl, Art. XVI, Sect. 1)

Based on the provisions of the Declaration and Bylaws, it is cleat that the homeownets will not be

voting at the Special Meeting on “Option 1” as presented by CGC. Instead, homeowners will only be

voting on whether to increase the maximum annual assessments of the Association greater than five

percent (5%) above the maximum assessment for 2015.

Likewise, the Declaration and Bylaws make it clear that if the vote to increase assessments

$60.00/month pet Lot passes, as proposed under Option 1, ptesented by CGC, then only the Board

will determine how the assessment inctease is used. ‘The Board does not have the authority to use the

‘money to purchase social memberships for each homeowner because that use of assessment funds

does not satisfy the stated purposes for assessment funds as outlined in the Declaration.

In my legal opinion, a social membership in CGC does not promote the health, safety and welfate of

the owners and occupants of the Community. ‘This level of membership does nothing for the safety

or welfare of the homeowners of other occupants of the Community. Additionally, the exercise

facilities and services being offered under the social membership are too limited to handle use by all

homeowners and occupants of the Community to promote the health of the Community. A social

membership providing limited use in CGC also does not enhance the livability of the Community ot

the value of Lots within the Community. Finally, social membership in CGC also does not cuttently

qualify as a “common expense” of the Association,

In order to make a change to the Declaration authorizing the Board to use, allocate, ot spend

assessments for the purpose requested by CGC would require an amendment to the Declaration, An

April 7, 2016

Letter to Owners of Creekside Homeowners Association

Page 4

amendment would have to be approved by a vote of seventy-five percent (75%) of all homeowners

within the Association,

Conclusion

In summaty, the Board will be conducting an informational meeting at 7:00 p.m. on April 12, 2016, at

Sprague High School. ‘The only purpose of the April 12 meeting is to facilitate discussion within the

Community regarding the golf course issue.

‘On May 3, 2016, at 7:00 p.m., a special meeting of the homeowners will occur. Votes will be taken at

that time on whether to increase the maximum annual assessment allowed. Homeowners will not

have any opportunity to determine how that money is spent; that is a function solely reserved to the

Board.

If, and only if, the $60,00/month per Lot assessment increase is approved at the May 3 Special

Meeting, the Board will send out a proposed amendment to the Declaration to the homeowners for a

vote. ‘The proposed amendment to the Declaration would authorize the Boand to spend assessment

money for social membership ot other similarly negotiated purposes. However, until such a proposed

Declaration amendment is adopted, the Board will not be levying an assessment or spending

assessment money as requested by CGC for the Option 1 purpose because the Board does not have

the legal authority under the Declaration or Bylaws to do so.

‘The Board looks forward to conversation and dialogue with the Community on April 12, and with

resolving angst in the Community over assessments and the relationship with CGC at that time.

Very truly yours,

VIAL FOTHERINGHAM LLP

CMT aja

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

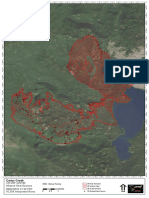

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

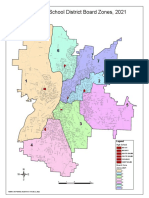

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDocument1 pageSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalNo ratings yet

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

- Cedar Creek Fire Aug. 16Document1 pageCedar Creek Fire Aug. 16Statesman JournalNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

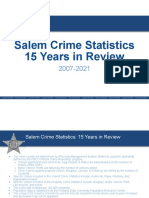

- Salem Police 15-Year Crime Trends 2007 - 2021Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDocument11 pagesSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- BG 7-Governing StyleDocument2 pagesBG 7-Governing StyleStatesman JournalNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- WSD Retention Campaign Resolution - 2022Document1 pageWSD Retention Campaign Resolution - 2022Statesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Salem Police 15-Year Crime Trends 2007 - 2015Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Failed Tax Abatement ProposalDocument8 pagesFailed Tax Abatement ProposalStatesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- Zone Alternates 2Document2 pagesZone Alternates 2Statesman JournalNo ratings yet

- SB Presentation SIA 2020-21 Annual Report 11-9-21Document11 pagesSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

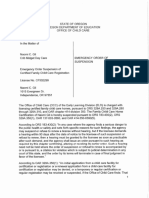

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)