Professional Documents

Culture Documents

Chapter 21 Business Statistic

Uploaded by

Pei XinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 21 Business Statistic

Uploaded by

Pei XinCopyright:

Available Formats

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 1

Chapter 21 : Simple Linear Regression and correlation.

The regression analysis is used to predict the value of one variable(Dependent) on the

basis of other variables(Independent).

This technique may be the most commonly used statistical procedure because, almost all

companies and government institutions forecast variables. Example include weather

forecasting, stock market analyses, sales predictions, crop prediction and sports

prediction and oil price prediction.

Prediction are made in all areas.

Some predictions are more accurate than others due to the strength of the

relationship. That is, the stronger the relationship is between variables, the more

accurate the prediction is. Eg Prediction of temperature in degree F based on

degree C using equation F=32 +

9

C is 100% accurate because this is an area of

5

pure science.

Regression analysis provide a Best Fit mathematical equation for the values of

the two variables using method of least square

21.1

Correlation analysis measures the strength of the relationship

Dependent and independent variables

The Dependent Variable(Y) is the variable being predicted or estimated, It is also

referred to as the Response Variable

The Independent Variable(X) provide the basis for estimation. It is the also

referred to as the predictor variable.

21.2

Regression Analysis model of the Population

The regression equation: Y = 0 + 1X + , where:

Y is the average predicted value of Y for any given X. It is called the dependent

or response variable. It is refers to as the average predicted or Estimated value of

Y for any given value of X.

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 2

X is called the independent or predictor variable. It provides the basis for

estimation.

o 0 is the Y-intercept, or the estimated Y value when X = 0

o 1 is the slope of the line, or the average change in Y for each change of one

unit in X.

o is epsilon or the random error phrase.

Regression equation of the sample:

^

y = b o + b1 x

21.3

where

b1 =

SS xy

SS x

and

b o = y - b1 x

Assumption underlying Simple Linear Regression

The four assumptions of regression(known by

the acronym LINE) are as follows:

Linearity

Independence of Errors

Normality of Errors

Equal Variance(also called homoscedaticity)

21.3.1 Linearity

It states that the relationship between variables is linear

21.3.2 Independence of Errors

The errors variables are independent from one another.

21.3.3 Normality of Errors

The error variable

e is normally distributed at each value of x.

21.3.4 Equal Variance(Homoscedasticity)

The variance of the error variable is a constant(condition of homoscedasticity) for all

values of X.

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 3

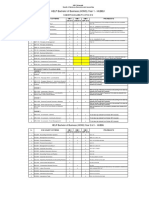

Example 21.1

A consultant was employed to study the relationship between annual sales and annual

advertising expenditure of business firms in order to build a model to predict annual

sales based on annual advertising expenditures.

A simple regression analysis of the relationship between the annual sales($ million) and

annual advertising expenditure($ thousand) of a random sample of 30 firms is shown

below.

Raw Data:

NO

Annual Advertising Expenditures($000)

Annual Sales($million)

22

4.5

28

5.1

31

5.3

31

5.4

35

5.9

43

43

6.5

48

6.6

43

6.6

10

49

6.8

11

56

6.9

12

52

13

57

14

58

7.5

15

61

8.7

16

60

8.9

17

62

9.2

18

66

9.5

19

64

9.6

20

69

10

21

67

10.2

22

72

10.4

23

75

10.5

24

78

10.8

25

77

11

26

82

11.2

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 4

27

81

11.5

28

83

11.7

29

85

12

30

89

12.4

a.

Determine the Least square Regression equation to predict annual sales based

on annual advertising expenditures.

b.

Calculate the standard error of estimate.

c.

Calculate the coefficient of determination

In order to calculate values of a,b and c, need to work out the tables of values below:

X

22

28

31

31

35

43

43

48

43

49

56

52

57

58

61

60

62

66

64

69

67

72

75

78

77

82

81

83

y

4.5

5.1

5.3

5.4

5.9

6

6.5

6.6

6.6

6.8

6.9

7

7

7.5

8.7

8.9

9.2

9.5

9.6

10

10.2

10.4

10.5

10.8

11

11.2

11.5

11.7

x2

y2

484

784

961

961

1225

1849

1849

2304

1849

2401

3136

2704

3249

3364

3721

3600

3844

4356

4096

4761

4489

5184

5625

6084

5929

6724

6561

6889

20.25

26.01

28.09

29.16

34.81

36.00

42.25

43.56

43.56

46.24

47.61

49.00

49.00

56.25

75.69

79.21

84.64

90.25

92.16

100.00

104.04

108.16

110.25

116.64

121.00

125.44

132.25

136.89

Xy

99.00

142.80

164.30

167.40

206.50

258.00

279.50

316.80

283.80

333.20

386.40

364.00

399.00

435.00

530.70

534.00

570.40

627.00

614.40

690.00

683.40

748.80

787.50

842.40

847.00

918.40

931.50

971.10

QBM101 Module 4 - CHAPTER 21(19 Pages)

85

89

1767

12

12.4

254.7

7225

7921

114129

144.00

153.76

2326.17

Page 5

1020.00

1103.60

16255.90

x = 1767 y = 254.7 xy =16255.90

2

x = 114129

2

y = 2326.17

From the above, the following are calculated

( x) 2

1767 2

SS x = x = 114129 = 10052.70

n

30

2

( y ) 2

254.7 2

SS y = y = 2326.17 = 163.767

n

30

2

SS xy = xy -

(1767)(254.7)

x y

= 16255.9 = 1254.07

n

30

^

a.

The required regression equation is

^

Where

b1 =

^

And

SS xy

SS x

^

y = b o + b1 x

1254.07

= 0.124749569 0.12475

10052.7

b o = y - b1 x =

254.7

1767

- 0.124749569

30

30

= 9.49 7.347749614 = 2.142250386

^

Therefore Least square regression equation is

y = 2.1422504 + 0.12475x

Where x is annual advertising expenditure in $000

And y is annual sales in $million.

b.

Standard error of estimate is the measurement of variation of the actual values of

y about the regression line and is written as

Se =

SSE

n-2

QBM101 Module 4 - CHAPTER 21(19 Pages)

Where SSE =

SS y -

2

SS xy

SS x

Page 6

1254.07 2

= 163.767 10052.7

= 163.767 -156.445 = 7.322

Therefore

c.

SS e =

SSE

7.322

=

= 0.5114 $million

n-2

30 - 2

Coefficient of determination (R ) = 1 -

2

SS xy

SS x SS y

1254.07 2

1572691.565

1=

= 0.9553

(10052.70)(163.767) 1646300.521

Unlike the standard error of estimate which is measured by the units of

measurement of y, the coefficient of determination do not have any units of

measurement and it measures the proportion of variation of y which have been

explained by the amount of variation of x.

The values of the coefficient ranges from 0 to 1.

21.4 Interpretation of computer output

You will notice that the above calculations are very tedious. The EXCEL data analysis

program can be used to generate the above outputs in just a split second. Therefore

students are encouraged to learn to use the Data Analysis program although students will

not be tested on using the program.

The emphasis is to test students on the interpretation of the outputs generated by the

EXCEL program

To illustrate the above, the following outputs are generated by the EXCEL program.

1.

Scatter Plot

2.

Summary Output

3.

ANOVA Table

4.

Residual Plot

5.

Histogram of the residual

6.

Residual output

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 7

Example 21.2

A consultant was employed to study the relationship between annual sales and annual

advertising expenditure of business firms in order to build a model to predict annual sales

based on annual advertising expenditure. A simple linear regression analysis of the

relationship between the sales ($ millions) and advertisement expenditure ($ thousands)

of a random sample of 30 firms was performed using EXCEL. The summary output and

charts for this analysis follow.

Annual Sales($millions)

Scatter plot showing Annual Sales($'million) vs sdvertising

expenditures($'000)

14

12

10

8

6

4

2

0

20

30

40

50

60

70

80

90

100

Annual Advertising expenditures($'000)

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.977388491

R Square

0.955288263

Adjusted R Square

0.953691415

Standard Error

0.511381429

Observations

30

ANOVA

Df

Regression

Residual

Total

Intercept

Annual advertising

expenditure($'000)

MS

156.4447

0.261511

F

598.2338

Significance

F

1.94824E-20

1

28

29

SS

156.444693

7.322307042

163.767

Coefficients

1.142250341

Standard

Error

0.314587143

t Stat

3.63095

P-value

0.00112

Lower 95%

0.497847798

Upper 95%

1.786652883

0.12474957

0.005100392

24.45882

1.95E-20

0.11430189

0.13519725

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 8

Annual advertising expenditure($'000)

Residual Plot

Residuals

1

0.5

0

-0.5

20

40

60

80

100

-1

-1.5

Frequency

Annual advertising expenditure($'000)

Histogram of residuals

15

10

5

0

-1.15 -0.85 -0.55 -0.25 0.05

Residuals

0.35

0.65

RESIDUAL OUTPUT

a

Interpret the scatter plot identifying the independent and dependent variables

In the scatter plot, annual advertising expenditures in $000 is the independent variable

and annual sales in $million is the dependent variable.

There is a positive linear relationship between advertising expenditures and sales

meaning that when advertising expenditures increased, sales is expected to increase and

vice versa.

b

Write down the regression equation and interpret the slope coefficient

^

The regression equation is y = 1.14225 + 0.12475x

Where x is the annual advertising expenditures in $000

And y is the annual sales in $million

1.14225 is the y-intercept and

0.12475 is the slope coefficient which means that when annual advertising expenditure

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 9

increase by $1,000, annual sales is expected to increase by $0.12475($million)

c.

Estimate the annual sales with the following annual advertising expenditure and comment

on the reliability of the estimates

i

ii.

annual advertising expenditure of $60,000

annual advertising expenditure of $100,000

^

i.

y = 1.14225 + 0.12475(60) = 8.62725($' million )

The estimate is quite reliable because $60,000 is within the range of the data

^

ii.

y = 1.14225 + 0.12475(100) = 13.61725($' million)

The estimate is not reliable because $100,000 is outside the range of the data.

d.

What is the value of the coefficient of determination and interpret its meaning

The coefficient of determination is the R square(if not given) can be calculated by

either (Multiple R)2 i.e 0.9773884912 = 0.955288262

or

R2 =

SS Re gression 156.444693

=

= .955288262 0.9553

SSTotal

163.767

It means that approximately 95.53% of the variation in annual sales have been

explained variation in annual advertising expenditures. There are still 4.47% of

variation in annual sales that have not been explained by variation in annual advertising

expenditure. Therefore the above regression model to predict sales when given

advertising expenditure is useful.

e.

What is the value of the standard error of estimate and interpret its meaning?

The standard error of estimate, S e is 0.511381429 $million.

It measure the fluctuations of the actual value of y about the regression line.

f.

What is the value of the coefficient of correlation and interpret its meaning:

The coefficient of correlation ranges from -1 to +1. In the above question the coefficient

of correlation is 0.977388491

It means that there is a high degree of positive linear correlation between annual

advertising expenditures and annual sales.

Note; The Multiple R is not the correlation coefficient. We need to decide whether

correlation is positive or negative because the Multiple R is always given as a positive

figure. In the above example, since the slope coefficient is positive, correlation

coefficient is also positive.

QBM101 Module 4 - CHAPTER 21(19 Pages)

g.

Page 10

Test whether there is any significant linear relationship between annual advertising

expenditures and annual sales at the 5% level of significance?

H o : b 1 = 0 There is no sig linear relationship between adv. exp and sales

H 1 : b 1 0 There is sig linear relationship between adv exp and sales

^

Test statistic :

t=

b1 - b1

S^

b1

p-value = 1.95E -20 = 1.95 (10-20 )

Since p-value(0) < 0.05, reject H0

h.

There is significant linear relationship between annual advertising expenditure and

annual sales at the 5% significant level

Set up the 95% confidence interval estimate of the slope coefficient between annual

advertising expenditure and annual sales.

^

CI ( b1 ) = b1 t 0.05

, 28

(S ^ )

b1

= 0.12475

2.048(0.0051)

= 0.12475

0.01044 = 0.114302 , 0.135197

95% CI for population slope is 0.114302 < b1 < 0.13519

i.

Which diagrams can be used to check the assumption of normality of the error

Variable and constant variance of the error variable?

To determine whether the error variable is normally distributed, we have to examine the

histogram of the error variable.

The histogram given indicate that it is not bell shape and therefore the assumption of

normality of the error variable has been violated.

To evaluate the condition of constant variance of the error variable, we have to examine

the residual plot. The residual plot given indicate that with increasing value of x, the

residual follows a pattern of increasing and decreasing values.

Therefore the assumption of constant variance of the error variable(homoscedascity) has

been violated. Or there is condition of heteroscedasticity.

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 11

Example 21.3

A study was conducted to study the relationship between the marks scored in the statistics final

examination and the marks scored in the accounting final examination. Data were collected from a

random sample of 20 students with the following results.

Final examination marks scored in statistics and accounting

Observation

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

Statistics

10

15

18

24

35

38

45

48

50

55

65

68

71

76

82

85

88

89

92

94

Accounting

13

12

22

25

30

36

48

44

54

50

62

66

69

74

85

87

86

92

90

96

a.i.

Calculate the regression coefficients and hence write down the regression equation to predict

accounting marks.

ii.

Calculate the standard error of estimate indicating the units of measurement.

iii.

Calculate the coefficient of correlation.

b.

MS EXCEL was used to generate the following linear regression outputs and appropriate charts.

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 12

SUMMARY OUTPUT

Regression Statistics

Multiple R

A

R Square

0.9874

Adjusted R Square

0.9868

Standard Error

3.1845

Observations

20

ANOVA

Regression

Residual

Total

Intercept

Statistics

Df

1

B

19

SS

14404.41397

182.53603

14586.95

Coefficients

-0.2935

0.9990

MS

14404.41397

10.14089

Standard Error

1.6799

0.0265

RESIDUAL OUTPUT

Observation

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

Predicted Accounting

9.69664

14.69172

17.68876

23.68286

34.67204

D

44.66220

47.65925

49.65728

54.65236

64.64252

67.63957

70.63662

75.63170

81.62580

84.62285

87.61989

88.61891

91.61596

93.61399

Residuals

3.30336

-2.69172

4.31124

1.31714

-4.67204

-1.66909

3.33780

-3.65925

4.34272

E

-2.64252

-1.63957

-1.63662

-1.63170

3.37420

2.37715

-1.61989

3.38109

-1.61596

2.38601

F

1420.429

t Stat

-0.1747

C

Significance F

1.40343E-18

P-value

0.8632

1.40343E-18

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 13

Scatter Diagram Of Marks Of Accounting And Statistics

Accounting Marks

120

100

80

60

40

20

0

0

20

40

60

80

100

Statistics Marks

i. Interpret the scatter diagram, indicating the dependent and the independent variable.

Statistics mark is the independent variable and Accounting mark is the dependent variable.

There is a positive linear relationship between statistics and accounting meaning that when

statistics mark increases, accounting mark will also increase.

ii. Use the output provided to write down the regression equation?

^

y = -0.2935 + 0.999 x

where x is the statistics marks and y is the accounting marks

iii. Interpret the slope coefficient.

0.999 is the slope coefficient which means that when statistics mark increase by 1, accounting

mark will increase by 0.999(approximately 1).

iv. Find the missing values of A, B, C, D and E in the given computer outputs.

A = 0.9874 = 0.9937

B = 19 1 = 18

C=

0.999

= 37.70

0.0265

D=

y = -0.2935 + 0.999(38) = 37.6685

OR

y = y - R = 36 - ( -1.66909) = 36 + 1.66090 = 37.66909

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 14

E=R=

y - y = 50 - 54.65236 = -4.6523

v. What is the value of the coefficient of determination? Interpret its meaning?

Coefficient of determination, R square = 0.9874

It means that approximately 98.74% of the variation in accounting marks have been explained by

variation in statistics marks.

Therefore 1.26% of the variation in accounting mark have not been explained by variation in

statistics mark.

vi. Can we check the assumptions of constant variance of the error variable and normality of the

distribution of the error variable based on the outputs given above and if so, check whether the

assumption(s) is(are) satisfied?

The assumption of normality of the error variable can be checked by looking at the histogram of

the error variable. Since this question did not provide the histogram the assumption of normality

of the error variable cannot be checked.

The other assumption of constant variance of the error variable can be checked by looking at the

residual plot. In the residual plot as statistics mark increase, there is no pattern on the movement

of the residuals. Therefore the assumption of constant variance of the error variable has not been

violated.

vii. At the 1% level of significance, is there evidence of a linear relationship between the final

examination marks of statistics and accounting?

H o : b1 = 0 , There is no sig relationship between statics and accounting marks

H1 : b1 0 , There is sig relationship between statistics and accounting marks

^

Test statistics ,

t=

b1 - b1

S^

b1

p-value (1.40343 E-18) =1.40343(10-18) = 0 < 0.01, reject Ho

Therefore there is sig linear relationship between statistics and accounting marks.

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 15

Exercise 1

In a small fishing town the daily catches were sold locally. Recently, the fishermen have

complained about price fluctuations and reduced catches and hence requested the

government to introduce a minimum fish price. It was suspected that fluctuations in fish

prices were related to fish catches. A statistician was asked to study the relationship

between daily prices and daily catches in the fishing town. A random sample of 30 weeks

were selected and the prices of fish in ($) and the daily catches in kilograms were

recorded.

The prices range from a low of $3.00 to a high of $17.50 per kg.

The daily catches range from a low of 300 kg. to a high of 1,000 kg.

The sample data were analyzed using EXCEL, and the summary output and appropriate

charts were generated and provided below. However because of the printer malfunction,

some of the data values are missing and they are indicated as A, B, C and D.

SUMMARY OUTPUT

Regression Statistics

Multiple R

R Square

Adjusted R Square

Standard Error

Observations

Regression

Residual

Total

Prices($)

Intercept

Average Daily

Catch(kg.)

A

0.9646

0.9634

0.8426

30

df

SS

MS

Significance

F

541.9942

0.7100

7.32626E-22

Coefficients

24.5698

541.9942

19.8808

561.875

Standard

Error

0.5406

t Stat

45.4453

P-value

8.8279E-28

-0.0222

0.0008

7.326E-22

28

29

Scatterplot showing relationship between average

daily catch (kg.) and price ($)

20.00

15.00

10.00

5.00

0.00

0

200

400

600

800

1000

Average Daily Catch (kg.)

1200

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 16

Average daily catch residual Plot

Residuals

2

0

0

500

1000

1500

-2

Average Daily Catch (kg.)

Frequency

Histogram of residuals

8

6

4

2

0

-1.9

-1.5

-1.1

-0.7

-0.3

0.1

0.5

0.9

1.3

Residuals

Use the EXCEL output provided to answer the following questions.

(a)

Find the missing values of A, B, C, and D in the given computer output.

(b)

Interpret the scatter plot and identify the dependent and the independent variables.

Independent variable is average daily catch and price is the dependent cariable.

The scatter plot shows that there is a negative linear relationship between daily

catch and price. It means that when daily catch increase, price will decrease.

(c)

Write down the regression equation?

Where x is daily catch and y is the price

(d)

(e)

Interpret the slope coefficient.

What is the value of the coefficient of determination? Interpret its meaning?

Coefficient of determination is 0.9646.

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 17

It means that 96.46% of variation in price has been explained by variation in daily

catch. Therefore there are still 3.54% of unexplained variation.

(f)

Predict the price for a given day with a daily catch of 850 kg. Is your estimate

reliable?

(g)

Is there any linear relationship between daily catch and price at the 5%

significance level?

(h)

Which graph is used to check the assumption of constant variance of the error

variable? Is there any evidence that this assumption has been violated?

(i)

Which graph is used to check the assumption that the error variable must be

normally distributed? Comment on whether this assumption has been violated.

Exercise 2

A real estate company in a city would like to establish a model to predict the monthly

rent (RM) based on the size of the apartments measured in square feet(sq. ft.) in a

selected city.

A random sample of 15 apartments in the selected city was selected and the information

relating to monthly rent in RM and size in square feet were recorded.

MS EXCEL was used to produce the following charts and diagrams with some missing

figures labeled a to e.

Observation

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Monthly Rent(RM)

1200

1700

1200

1500

850

1700

1500

900

650

1150

1400

1500

2200

1800

1400

Size(square feet)

850

1450

1085

1232

718

1485

1136

500

300

956

1100

1285

1985

1800

1400

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 18

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.9656

R Square

a

Adjusted R Square

0.9271

Standard Error

108.4298

Observations

15

ANOVA

Df

Regression

Residual

Total

Intercept

Size(square. feet)

SS

1 2106492

b 152841.2

14 2259333

Coefficients

390.56

0.8559

Standard

Error

78.81

0.0639

Predicted

Monthly

Rent(RM)

1118.071

1631.61

1319.207

1445.024

1005.093

1661.567

1362.858

818.5066

647.3269

e

1332.046

1490.387

2089.516

1931.175

1588.815

Residuals

81.92885

68.38965

-119.207

54.97556

-155.093

d

137.1418

81.49339

2.67312

-58.7964

67.95418

9.61293

110.4839

-131.175

-188.815

RESIDUAL OUTPUT

Observation

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

MS

2106492

11757.01

F

179.169

Significance F

5.57758E-09

t Stat

4.96

C

P-value

0.0003

5.58E-09

Lower 95%

220.2969

0.7178

Upper 95%

560.8177

0.9940

QBM101 Module 4 - CHAPTER 21(19 Pages)

Page 19

i. Write down the regression equation and interpret the slope coefficient.

ii. What is the value of R square(4 decimal places) marked a in the regression

statistics and explain what it means.

iii. What are the values of the other missing values marked b to e ( 2 decimal places)?

iv. What is the value of the coefficient of correlation and explain what does it

measures?

v. At the 5% level of significance, is there any significant linear relationship between

size of the apartments and rent?

vi. Which chart or diagram can be used to check whether the assumption of

homoscedasticity has been violated and what is your conclusion?

vii. Estimate the monthly rental for the apartments with size of

a)2,000 sq ft and b)2,500 sq ft. and comment on the reliability of your

estimates.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- CH 5 Test BankDocument10 pagesCH 5 Test BankSehrish Atta100% (3)

- 2012 Towers Watson Global Workforce StudyDocument24 pages2012 Towers Watson Global Workforce StudySumit RoyNo ratings yet

- FMEA Training v1.1Document78 pagesFMEA Training v1.1Charles Walton100% (1)

- Six Sigma Control PDFDocument74 pagesSix Sigma Control PDFnaacha457No ratings yet

- NPD Ent600Document26 pagesNPD Ent600Aminah Ibrahm100% (2)

- ACT NO. 2031 February 03, 1911 The Negotiable Instruments LawDocument14 pagesACT NO. 2031 February 03, 1911 The Negotiable Instruments LawRichel Dean SolisNo ratings yet

- Terminal Operators LiabilityDocument30 pagesTerminal Operators LiabilityMurat YilmazNo ratings yet

- How To Use Oracle Account Generator For Project Related TransactionsDocument40 pagesHow To Use Oracle Account Generator For Project Related Transactionsapnambiar88No ratings yet

- Pledge, REM, Antichresis DigestsDocument43 pagesPledge, REM, Antichresis DigestsAnonymous fnlSh4KHIgNo ratings yet

- Business Subject Availability ListsDocument3 pagesBusiness Subject Availability ListsPei XinNo ratings yet

- Chapter 10 QBMDocument38 pagesChapter 10 QBMPei XinNo ratings yet

- CHAPTER 2 Basic Cost Management ConceptsDocument23 pagesCHAPTER 2 Basic Cost Management ConceptsMudassar Hassan100% (1)

- FOD Awareness: Basic Training in Foreign Object Damage PreventionDocument35 pagesFOD Awareness: Basic Training in Foreign Object Damage PreventionHumberto AnguloNo ratings yet

- A Study On Customer Preference Towards Heavy Commercial Vehicle-3145 PDFDocument6 pagesA Study On Customer Preference Towards Heavy Commercial Vehicle-3145 PDFAkash DasNo ratings yet

- Business Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonDocument12 pagesBusiness Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonBhavin GhoniyaNo ratings yet

- Online Shopping PDFDocument4 pagesOnline Shopping PDFkeerthanasubramaniNo ratings yet

- Economics White Goods PresentationDocument12 pagesEconomics White Goods PresentationAbhishek SehgalNo ratings yet

- Gauwelo ProfileDocument9 pagesGauwelo ProfileMONA TECHNo ratings yet

- PARCOR-SIMILARITIESDocument2 pagesPARCOR-SIMILARITIESHoney Lizette SunthornNo ratings yet

- Unit 1 Evolution of Management ThoughtDocument4 pagesUnit 1 Evolution of Management ThoughtParvez SaifNo ratings yet

- Top Multinational Medical Devices CompaniesDocument3 pagesTop Multinational Medical Devices CompaniesakashNo ratings yet

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDocument21 pagesAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriNo ratings yet

- 01 Pengantar SCMDocument46 pages01 Pengantar SCMAdit K. BagaskoroNo ratings yet

- TOGAF An Open Group Standard and Enterprise Architecture RequirementsDocument17 pagesTOGAF An Open Group Standard and Enterprise Architecture RequirementssilvestreolNo ratings yet

- Icici BankDocument99 pagesIcici BankAshutoshSharmaNo ratings yet

- Od-2017 Ed.1.7Document28 pagesOd-2017 Ed.1.7Tung Nguyen AnhNo ratings yet

- Notes - Exploring Labour Market TrendsDocument22 pagesNotes - Exploring Labour Market Trendsapi-263747076100% (1)

- SBI ProjectDocument82 pagesSBI Projectchandan sharmaNo ratings yet

- Coi D00387Document101 pagesCoi D00387Fazila KhanNo ratings yet

- Retail Store Operations Reliance Retail LTD: Summer Project/Internship ReportDocument48 pagesRetail Store Operations Reliance Retail LTD: Summer Project/Internship ReportRaviRamchandaniNo ratings yet

- Report On Financial Market Review by The Hong Kong SAR Government in April 1998Document223 pagesReport On Financial Market Review by The Hong Kong SAR Government in April 1998Tsang Shu-kiNo ratings yet

- Ble Assignment 2019 21 BatchDocument2 pagesBle Assignment 2019 21 BatchRidwan MohsinNo ratings yet

- Talk About ImbalancesDocument1 pageTalk About ImbalancesforbesadminNo ratings yet

- Law Firms List 2Document13 pagesLaw Firms List 2Reena ShauNo ratings yet