Professional Documents

Culture Documents

How Latest Version of HB247 Impacts State's Bottom Line

Uploaded by

AustinBairdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Latest Version of HB247 Impacts State's Bottom Line

Uploaded by

AustinBairdCopyright:

Available Formats

HB247\A (ORIGINAL BILL AS INTRODUCED)

Prepared 4-25-16 by Department of Revenue

Provisions in HB 247 and their Estimated Fiscal Impact as compared to Spring 2016 Forecast ($millions) - FORECAST PRICE1

Note: this table attempts to value the impact of each of the items independently, except where noted. In some cases, the total value of several impacts will not equal the sum of the individual impact values.

Brief Description of Provision - Includes only provisions anticipated to have a direct fiscal impact

1. Minimum tax cannot be reduced by net operating loss credit, small producer credit, per-taxable-barrel credits

applicable to GVR-eligible production, or alternative credit for exploration.

2. Minimum tax change from multiple percentages to a flat 5% of GVPP (assuming #1 above)

3. Qualified capital expenditure credits and well lease expenditure credits are repealed

4. No true-up of sliding scale per-taxable-barrel credits on annual return

5. The GVR cannot be used to create or increase a net operating loss

6. Credits expire 10 years after they are earned

7. A tax exempt entity may earn credits applicable to only those lease expenditures subject to tax

8. The gross value at the point of production cannot be less than zero

9. The interest rate on delinquent taxes is changed to 7% above the Fed Res Discount rate, compounded quarterly

Total Revenue Impact

A. The GVR cannot be used to create or increase a net operating loss (provision 5 above)

B. Budget impact of repeal of qualified capital and well lease expenditure credits (provision 3 above)

C. Budget impact of limiting refunds to $25 million per company per year. This provision applies only for credits earned

from activity after 7/1/16.

D. Budget impact of limiting refunds by the percentage of a company's Alaska resident hire

FY 2017

FY 2018

Total Budget Impact

Total Fiscal Impact - does not include revenue impacts from potential changes in

investment3

Non-refundable carry-forward credits balance at fiscal year end - current law4

4

Non-refundable carry-forward credits balance at fiscal year end - proposed

change due to bill

FY 2020

FY 2021

FY 2022

$120-$140 $175-$200 $175-$200 $150-$175 $175-$200 $125-$150

$40-$50

$40-$50

$50-$60

$70-$90

$30-$40

$30-$40

$10-$15

$10-$15

$10-$15

$10-$15

$10-$15

$30-$40

No impact at forecast price - could benefit State under volatile prices

$0

$0

$0

$0

$0

$5-$15

$0

$0

$0

$0

$0

$0

Indeterminate

$0

$0

$0

$0

$0

$0

Indeterminate

$170 to

$225 to

$235 to

$230 to

$215 to

$190 to

$205

$265

$275

$280

$255

$245

$0

$10-$20

$20-$30

$15-$25

$0-$10

$0-$10

$30-$40

$50-$75

$40-$50

$30-$40

$75-$100

$75-$100

$10-$20

$50-$75

$10-$20

$20-$40

$20-$40

$60 to

$100

$40-$60

$150 to

$230

$75-100

$10-$20

Indeterminate

Indeterminate

$40-$60

$40-$60

$175 to

$95 to

$240

$145

$20-$40

$105 to

$170

$20-$40

$115 to

$190

$230 to

$305

$375 to

$495

$410 to

$515

$325 to

$425

$320 to

$425

$305 to

$435

618

751

732

585

265

136

E. Budget impact of limiting refunds to companies with no outstanding liability to the State

F. Budget impact of limiting refunds to companies with annual gross revenues of <$10 billion2

FY 2019

773

1128

1226

1223

1230

1240

155

377

494

638

965

1104

The impacts listed are based on production and prices as forecasted in DOR's Spring 2016 revenue forecast. The forecasted oil prices are between $38.89 and $61.64.

Estimates shown for this provision are incremental to the budget impact of limiting refunds to $25 million per company per year. As a standalone provision, these estimates would be higher.

NOTE: "Total Fiscal Impact" includes best estimates of both revenue and operating budget impacts.

These rows include estimates of carried-forward credits for previous calendar years, plus estimates of credits that will be earned on activity through June 30 of the fiscal year.

NOTE: The fiscal impact of this bill is an estimate based on the final Spring 2016 revenue forecast. Estimates shown here are draft / preliminary based on our

interpretation of possible changes. We reserve the right to make modifications to estimates for any forthcoming fiscal notes.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Cruise Ship Industry Sues Alaska's Capital CityDocument13 pagesCruise Ship Industry Sues Alaska's Capital CityAustinBairdNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Anchorage Proposed Marijuana Business RegulationsDocument30 pagesAnchorage Proposed Marijuana Business RegulationsAustinBairdNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- House Attempts To Appeal Medicaid Expansion LawsuitDocument38 pagesHouse Attempts To Appeal Medicaid Expansion LawsuitAustinBairdNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Audit of Alaska Cruise Ship TaxDocument88 pagesAudit of Alaska Cruise Ship TaxAustinBairdNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Alaska Court System Fee IncreasesDocument11 pagesAlaska Court System Fee IncreasesAustinBairdNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Art Hackney Contract, Invoices With Governor's OfficeDocument14 pagesArt Hackney Contract, Invoices With Governor's OfficeAustinBairdNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Governor's $12,500/month Contract With North Slope Energy ExpertDocument5 pagesGovernor's $12,500/month Contract With North Slope Energy ExpertAustinBairdNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Anchorage School District Letter Opposing Senate BillsDocument2 pagesAnchorage School District Letter Opposing Senate BillsAustinBairdNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Judge Invalidates Anchorage LIO LeaseDocument17 pagesJudge Invalidates Anchorage LIO LeaseAustinBairdNo ratings yet

- 2015-12-29 McLeod PRR Hackney Invoice-2 RecordDocument3 pages2015-12-29 McLeod PRR Hackney Invoice-2 RecordAustinBairdNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 2015 Alaska Legislative Spending ReportDocument23 pages2015 Alaska Legislative Spending ReportAustinBairdNo ratings yet

- Alaska Court System Bracing For Budget CutsDocument10 pagesAlaska Court System Bracing For Budget CutsAustinBairdNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Alaska Legislature Contract With Navigant To Study Value of Controversial OfficeseDocument12 pagesAlaska Legislature Contract With Navigant To Study Value of Controversial OfficeseAustinBairdNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Governor's Business Roundtable AttendeesDocument3 pagesGovernor's Business Roundtable AttendeesAustinBairdNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- State, Feds Investigate North Slope Borough PoliceDocument1 pageState, Feds Investigate North Slope Borough PoliceAustinBairdNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

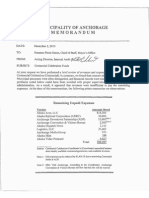

- Auditor: City Mismanaged Funds On Centennial CelebrationDocument7 pagesAuditor: City Mismanaged Funds On Centennial CelebrationAustinBairdNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Governor Has An Idea of Things Legislators Could Work OnDocument2 pagesGovernor Has An Idea of Things Legislators Could Work OnAustinBairdNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Gov. Bill Walker Letter To Legislature On Special SessionDocument3 pagesGov. Bill Walker Letter To Legislature On Special SessionAustinBairdNo ratings yet

- How Much Does Alaska's Overtime Legislative Session Cost?Document3 pagesHow Much Does Alaska's Overtime Legislative Session Cost?AustinBairdNo ratings yet

- A Special Session Is 'Likely'Document2 pagesA Special Session Is 'Likely'AustinBairdNo ratings yet

- Alaska GOP Draft Resolution On Syrian RefugeesDocument1 pageAlaska GOP Draft Resolution On Syrian RefugeesAustinBairdNo ratings yet

- State Legislators File Lawsuit To Block Medicaid ExpansionDocument15 pagesState Legislators File Lawsuit To Block Medicaid ExpansionAustinBairdNo ratings yet

- Could Lawmakers Confirm None of Walker's Appointees?Document6 pagesCould Lawmakers Confirm None of Walker's Appointees?AustinBairdNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- State's Response To Tribe's Pet For RehearingDocument10 pagesState's Response To Tribe's Pet For RehearingAustinBairdNo ratings yet

- An Open Letter To The Leaders of The Islamic Republic of IranDocument4 pagesAn Open Letter To The Leaders of The Islamic Republic of Irankballuck1No ratings yet

- Anchorage Solid Waste Services ResolutionDocument2 pagesAnchorage Solid Waste Services ResolutionAustinBairdNo ratings yet

- Gov. Bill Walker's First Month in OfficeDocument33 pagesGov. Bill Walker's First Month in OfficeAustinBairdNo ratings yet

- Roland Maw Withdraws From Board of Fisheries ConsiderationDocument1 pageRoland Maw Withdraws From Board of Fisheries ConsiderationAustinBairdNo ratings yet

- Marijuana Use Among Pregnant Women in AlaskaDocument1 pageMarijuana Use Among Pregnant Women in AlaskaAustinBairdNo ratings yet

- Problems - Income TaxationDocument4 pagesProblems - Income Taxationpedrosagucio44% (9)

- Knowledge ReportDocument15 pagesKnowledge ReportarsenalmanikandanNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- 7110 w11 Ms 21Document10 pages7110 w11 Ms 21mstudy123456No ratings yet

- Donell ByrdchenCTP 2023-24 Ch05Document92 pagesDonell ByrdchenCTP 2023-24 Ch05juliapaige2000No ratings yet

- Working Capital, Sujala Pipes. 03 FinDocument86 pagesWorking Capital, Sujala Pipes. 03 FinRavi Teja100% (1)

- Main SOCE Forms 1 2 3 SheetsDocument3 pagesMain SOCE Forms 1 2 3 SheetsJohn Rey Villafuerte88% (8)

- Watson Answering ServiceDocument3 pagesWatson Answering Servicemohitgaba1967% (6)

- Chapter 3 Revenue From Contracts With CustomersDocument6 pagesChapter 3 Revenue From Contracts With CustomersClint AbenojaNo ratings yet

- Sage x3 Solution Capabilities Guide 2021Document73 pagesSage x3 Solution Capabilities Guide 2021PDF ImporterNo ratings yet

- Module 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument10 pagesModule 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionApril Ross TalipNo ratings yet

- Chapter - 1: Bescom in BriefDocument6 pagesChapter - 1: Bescom in BriefAshok Kumar ThanikondaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaNo ratings yet

- Asset Management Plan TemplateDocument23 pagesAsset Management Plan TemplateMHD0% (1)

- EC - Lecture 001 - Principles of Engineering EconomicsDocument8 pagesEC - Lecture 001 - Principles of Engineering EconomicsDIANNEMICHELLE PINEDANo ratings yet

- Basic Accounting Crash CourseDocument5 pagesBasic Accounting Crash CourseJolo RomanNo ratings yet

- Payroll QuestionnaireDocument16 pagesPayroll QuestionnaireVengat RamanaNo ratings yet

- School Mooe RevisitedDocument35 pagesSchool Mooe RevisitedKyla Michelle Daguison100% (2)

- Peacewick University - Task Sheet - FinalDocument11 pagesPeacewick University - Task Sheet - FinalPrachi Tripathi100% (1)

- Literature Review On Cash Management SystemDocument8 pagesLiterature Review On Cash Management Systemea98skah100% (1)

- 20180731103842D5760 GNBCY PP Chap14 Differential Analysis The Key To Decision Making With Cover PageDocument91 pages20180731103842D5760 GNBCY PP Chap14 Differential Analysis The Key To Decision Making With Cover PageBENNo ratings yet

- Answer Key - EpfoDocument18 pagesAnswer Key - EpfoVirat rohliNo ratings yet

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Consolidation Notes Consolidated Statement of Cash FlowsDocument10 pagesConsolidation Notes Consolidated Statement of Cash FlowsamitsinghslideshareNo ratings yet

- Mindtree Shareholders Report Q2 FY23Document6 pagesMindtree Shareholders Report Q2 FY23Punith DGNo ratings yet

- TPL D A Tariff For FY 2020 21Document138 pagesTPL D A Tariff For FY 2020 21zarrinNo ratings yet

- A REPORT ON Working Capital Management IDocument78 pagesA REPORT ON Working Capital Management IAriful Islam RonyNo ratings yet

- Rothschild Bank AG Annual Report 2011/2012Document60 pagesRothschild Bank AG Annual Report 2011/2012blyzerNo ratings yet

- Accounting 211 Chapter 5Document46 pagesAccounting 211 Chapter 5Darwin QuintosNo ratings yet

- Financial Statement Analysis First LectureDocument17 pagesFinancial Statement Analysis First LectureDavid Obuobi Offei KwadwoNo ratings yet

- Anandham CaseDocument17 pagesAnandham Casekarthick raj100% (1)