Professional Documents

Culture Documents

AP Macroeconomics - Unit 8 - 8.1 Final Exam Questions

Uploaded by

Jame ChanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AP Macroeconomics - Unit 8 - 8.1 Final Exam Questions

Uploaded by

Jame ChanCopyright:

Available Formats

Graded Assignment

Name:

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Date:

Graded Assignment

Final Exam

Directions

Mark your answers to the multiple-choice questions on the answer sheet at the end of the multiple-choice

section. Use a black or blue pen.

Remember to complete the submission information on every page you turn in.

Multiple-Choice Questions

1. How do gross domestic product and gross national product differ?

A.

B.

C.

D.

E.

Gross national product does not include depreciation.

Gross domestic product does not include intermediate goods.

Gross national product does not include goods produced domestically by foreign companies.

Gross domestic product is specified in real terms; gross national product is specified in nominal terms.

Gross national product includes only final goods and services.

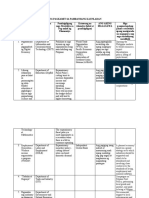

2. Which of the following is (are) true for the period described in the table below?

Year

1990

1991

1992

1993

I.

II.

III.

A.

B.

C.

D.

E.

Price Level

100

110

120

130

Inflation is increasing.

The price level is increasing.

Inflation is decreasing.

Both II and III.

Both I and II.

II and either I or III.

II only.

III only.

3. If real GDP rises and nominal GNP falls, which of the following must be true?

A. The price level has decreased.

B. Production in the country by foreign firms has grown faster than has production outside of the country by

domestic firms.

C. Either A or B, but possibly both A and B.

D. Both A and B.

E. Either A or B, but not both.

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 1 of 19

Graded Assignment

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

4. If the price level rises by 10%, which of the following must be true?

A.

B.

C.

D.

E.

All consumers will increase their spending by 10% if they are to buy the same things they used to buy.

All prices have risen by 10%.

The prices of each of the goods included in the relevant basket of goods have risen by 10%.

All real incomes have fallen by 10%.

None of these must be true.

5. Over the course of the business cycle, which of the following is most often true?

A.

B.

C.

D.

E.

When unemployment is high, inflation will be high.

When unemployment is low, interest rates will be low.

When the economy is in a trough, unemployment will be low.

When inflation is low, economic growth rates are high.

When unemployment is high, economic growth rates are low.

6. Which of the following must be true in an economy with a government but with no foreign trade?

A. Household saving will be equal to investment.

B. The sum of consumption and saving will be equal to the sum of income and taxes.

C. The sum of household income and business profits must be equal to the sum of consumption,

government spending, and investment.

D. An increase in the government deficit will force an increase in investment.

E. If the government has a balanced budget, household consumption will equal the difference between

income and saving.

7. For an economy operating at full employment, which of the following is true?

A. There is no frictional unemployment.

B. Expansionary fiscal policy will result only in higher price levels and will have no effect on output.

C. The classical model will accurately predict the effects of monetary and fiscal policies, both in the short run

and in the long run.

D. The calculated unemployment rate is zero.

E. The Keynesian model will over-estimate the effect of a change in expenditures on GDP.

8. Which of the following will lead to the greatest decrease in a country 's net exports?

A.

B.

C.

D.

E.

An increase in household consumption

Contractionary fiscal policy

Inflation in foreign countries with no change in the exchange rate

A large purchase of foreign currency by the countrys central bank

A large increase in interest rates in the country

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 2 of 19

Graded Assignment

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

9. Assume an economy with lump sum taxes and no international trade. If there is full employment and a

marginal propensity to consume of 0.8, what will be the effect of an $800 increase in autonomous

expenditures?

A.

B.

C.

D.

E.

An increase of less than $4,000 in real output

An increase in real output of $4,000

An increase in real output of at least $4,000

An increase in the price level and in increase in output of approximately $4,000

The answer depends critically on whether the economy is in the Keynesian region of the aggregate

supply curve, and the answer cannot be predicted without knowing this.

10. According to the Keynesian model, equal increases in government spending and taxes will result in

which of the following?

A.

B.

C.

D.

E.

Increases in the price level accompanied by increases in output

Increased imports due to the effects of interest rate changes on exchange rates

Decreased imports due to the effects of tax changes on exchange rates

No change in the price level and a decrease in output

An increase in output and no change in the price level

11. To reduce the possibility of inflation in the U.S. economy, the Fed should:

A.

B.

C.

D.

E.

lower the reserve requirement and buy securities on the open market.

raise the discount rate and buy securities on the open market.

lower the discount rate and sell securities on the open market.

raise the reserve requirement and sell securities on the open market.

raise the reserve requirement and lower the discount rate.

12. The classical model may have contributed to the severity of the Great Depression of the 1930s

because:

A.

B.

C.

D.

E.

it prescribed no fiscal response by the government.

it suggested that the Fed should increase taxes to avoid a deficit.

it failed to recognize the severity of the decrease in the money supply resulting from bank failure.

it failed to recognize that price levels can change when aggregate demand shifts.

it suggested that a contractionary fiscal policy could reduce government budget problems.

13. Expansionary fiscal policy conducted in an economy at full employment will have which combination

of effects in the short run?

A.

B.

C.

D.

E.

An increase in real output and a smaller increase in nominal output

An increase in real output, but a decrease in nominal output

A decrease in real output, but an increase in nominal output

An increase in real output and a larger increase in nominal output

An increase in output, but no decrease in unemployment

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 3 of 19

Graded Assignment

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

14. If the U.S. government conducts contractionary fiscal policy at the same time the Fed conducts

expansionary monetary policy, what will be the most likely effects?

A.

B.

C.

D.

E.

An increase in interest rates and a decrease in unemployment

A decrease in interest rates and an indeterminate change in output

An increase in the price level and a decrease in interest rates

An increase in the value of the dollar in foreign exchange markets and an increase in U.S. imports

An increase in interest rates, an increase in the value of the dollar, and an indeterminate change in

unemployment

15. Which of the following will be an effect of unexpectedly low inflation?

A.

B.

C.

D.

E.

Lenders will benefit at the expense of borrowers.

Workers with long-term wage contracts will suffer a decrease in real income.

The real money supply will increase, and the value of the currency will decrease.

Worker productivity will rise.

None of the above

16. According to the Keynesian model, expansionary fiscal policy will have what effect?

A.

B.

C.

D.

E.

An increase in output and price levels

A decrease in unemployment and inflation

An increase in output and a decrease in the price level

No change in the price level and an increase in output

No change in output and an increase in the price level

17. Which of the following is an important criticism of the consumer price index?

A. It fails to recognize that consumers change their behavior in response to changes in the relative prices of

goods and, as a result, generates an inflation rate that is too high.

B. It calculates the cost of a basket of goods purchased by an average consumer, an individual who doesn t

really exist.

C. It fails to recognize that consumers change their behavior in response to changes in the relative prices of

goods and, as a result, generates an inflation rate that is too low.

D. Because it does not include all goods produced in an economy, it will result in real interest rate

calculations that are too high.

E. Because it includes only consumer goods, it fails to capture what is actually happening in the economy.

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 4 of 19

Graded Assignment

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

18. Which statement correctly describes the relationship between policy actions, interest rates, and bond

prices?

A. If the Fed conducts expansionary monetary policy, the supply of bonds will increase, their price will

decrease, and interest rates will decrease.

B. If the government conducts contractionary fiscal policy, the supply of bonds will increase, their price will

decrease, and interest rates will increase.

C. If the government conducts expansionary fiscal policy, the supply of bonds will increase, their price will

decrease, and interest rates will decrease.

D. If the Fed conducts contractionary monetary policy, the supply of bonds will increase, their price will

decrease, and interest rates will decrease.

E. If the Fed conducts expansionary monetary policy, the demand for bonds will increase, their price will

increase, and interest rates will decrease.

19. An increase in autonomous expenditures will have which of the following effects?

A. An increase in GDP, but no increase in the price level if the economy is in the Keynesian portion of the

aggregate supply curve

B. An increase in both GDP and the price level regardless of the level of unemployment

C. A small increase in GDP and a relatively large increase in the price level if the economy is in the

Keynesian portion of the aggregate supply curve

D. An increase in GDP, but no increase in the price level if the assumptions of the classical model are correct

E. An increase in unemployment and a decrease in the price level if the economy is operating in a region

where the assumptions of the classical model are satisfied

20. Why is stagflation inconsistent with the idea of a Phillips curve?

A. Along a Phillips curve, growth is highest when inflation is low.

B. The Phillips curve suggests a tradeoff between inflation and unemployment.

C. Stagflation forces economists to accept the fact that the Phillips curve is upward rather than downward

sloping.

D. Stagflation is a result of demand shocks rather than supply shocks.

E. Stagflation is inconsistent with the classical model of the economy.

21. According to the Keynesian model, under which conditions will an open market operation by the Fed

have the greatest effect on national income?

A.

B.

C.

D.

E.

When the marginal propensity to save is high

When the marginal propensity to consume is high

When both the marginal propensity to consume and the marginal propensity to save are high

When the economy is at full employment

When the investment demand curve is relatively steep

22. One important difference between adaptive and rational expectations models is that:

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 5 of 19

Graded Assignment

A.

B.

C.

D.

E.

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

rational expectations models use more information.

monetary policy is not effective under adaptive expectations.

fiscal policy wont lead to changes in the price level under adaptive expectations.

rational expectations are formed solely on the basis of past behavior and events.

inflation is impossible under adaptive expectations.

23. In an economy with no foreign trade and a marginal propensity to consume of 0.8, which of the

following will be true?

A.

B.

C.

D.

E.

If taxes are increased by $100M, GDP will decrease by $500M.

If autonomous consumption increases by $50M, GDP will increase by $200M.

If both taxes and government spending increase by $100M, GDP will increase by $250M.

If taxes are decreased by $100M, GDP will increase by $400M.

If autonomous consumption decreases by $100M, GDP will decrease by $800M.

24. Looking at the circular flows model, how can the saving equals investment equation be derived?

A.

B.

C.

D.

E.

By looking at flows into and out of goods markets

By looking at flows into and out of financial markets

By looking at flows into and out of households

By looking at flows into and out of firms

By looking at flows into and out of the government

25. What will be the short-run effect of a 10% increase in the money supply for an economy operating in

the Keynesian portion of the aggregate supply curve?

A.

B.

C.

D.

E.

Real GDP will increase by 10% if velocity doesnt change.

Real GDP and the price level will both increase by 5% if velocity doesnt change.

Real GDP wont change, but the price level will increase by 10% if velocity doesnt change.

Velocity will fall by 5%, the price level will increase by 5%, and real GDP wont change.

According to the quantity theory of money, velocity will fall by 10%, and nothing else will change.

26. Which of the following will make monetary policy more effective in changing nominal GDP?

A.

B.

C.

D.

E.

A fixed velocity of money

A flat investment demand curve

A high marginal propensity to save

A money demand curve that is very flat

An aggregate expenditure curve that is very flat

27. Given the nation has a capital account surplus and a federal budget deficit, which of the following is

an effect of an increase in interest rates?

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 6 of 19

Graded Assignment

A.

B.

C.

D.

E.

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Lower structural unemployment

An increase in the trade deficit

Aggregate demand and aggregate supply will intersect in a steeper section of the aggregate supply curve

An outward shift in the production possibilities frontier

An inward shift of the consumption possibilities frontier

28. Which of the following pairs of actions suggest that fiscal policy and monetary policy are working in

the same direction?

A. Taxes are lowered, and the discount rate is raised.

B. Government spending increases, and the Fed sells bonds on the open market.

C. Government spending and taxes increase by the same amount, and the required reserve ratio is

increased.

D. Taxes are increased, and the Fed buys bonds on the open market.

E. Government spending and taxes decrease by the same amount, and the Fed sells bonds on the open

market.

29. Which of the following is true if cyclical unemployment is high?

A.

B.

C.

D.

E.

Velocity is low.

Monetary policy has little effect on the price level.

The marginal propensity to consume will be particularly high.

The country s currency has a low value in foreign exchange markets.

The Fed could bring the economy back toward full employment by selling bonds on the open market.

30. For the last several years, the money supply in the fictitious nation of Mauritania has been rising by

10% annually, and inflation has been running at 8%. The central bank is going to cut growth of the

money supply back to 3% annually. Which of the following statements regarding the effects of this

action is true, ceteris paribus?

A.

B.

C.

D.

E.

According to the quantity theory of money, inflation will be 1% in the next year.

According to the quantity theory of money, economic growth will slow down.

If the assumption of rational expectations holds, output will fall by 10% in the next year.

If the assumption of adaptive expectations holds, there will be no effect on output in the following year.

None of the above

31. Which of the following is not a component of aggregate demand?

A.

B.

C.

D.

E.

Sales tax receipts

Government spending

Investment

Consumption

Net exports

32. Which of the following is an effect of increased labor productivity?

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 7 of 19

Graded Assignment

A.

B.

C.

D.

E.

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

An increase in aggregated demand

An increase in aggregate supply

A decrease in aggregate demand

An increase in the marginal propensity to save

An indeterminate change in the consumption possibilities frontier

33. Which type(s) of unemployment exist in an economy at full employment?

A.

B.

C.

D.

E.

Frictional

Structural

Cyclical

Frictional and structural

Frictional and cyclical

34. Suppose the Irish economy is at full employment. Suppose in a few months, the exchange rate of the

Irish national currency, the punt, will decline, giving the Irish relatively less purchasing power in

foreign markets. What will happen to the price level and real GDP in Ireland?

A.

B.

C.

D.

E.

The price level will fall, and real GDP will rise.

The price level will fall, and real GDP will not change.

The price level will rise, and real GDP will rise.

The price level will fall, and real GDP will fall.

The price level will not change, and the real GDP will fall.

35. Which of the following statements about an increase in aggregate demand is false?

A. An increase in aggregate demand can be caused by a decrease in other countries interest rates.

B. An increase in aggregate demand can be the result of another countrys central bank selling large

quantities of their government s bonds.

C. An increase in aggregate demand will result in no change in the price level in the Keynesian model.

D. The increase in aggregate demand resulting from an open market operation does not depend on the

slope of the aggregate supply curve.

E. An increase in aggregate demand will have no effect on GDP in the classical model.

36. Which of the following goals of economic policymakers is generally false?

A.

B.

C.

D.

E.

They try to keep unemployment low to avoid leaving productive resources idle.

They find low inflation desirable because it helps to keep unemployment under control.

They want to keep interest rates low to promote long-term economic growth.

They can be persuaded to oppose free trade by small numbers of people.

They may push central banks to buy bonds prior to elections to help insure they remain in power.

37. Japan imports almost all the oil it uses. Which of the following statements about the effects of an

increase in world oil prices is true?

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 8 of 19

Graded Assignment

A.

B.

C.

D.

E.

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

It may cause the Japanese economy to experience stagflation.

It may cause the Japanese central bank to buy bonds to stabilize the value of the yen.

It will cause demand-pull inflation in the Japanese economy.

It will increase the value of the Japanese yen.

It will increase aggregate demand in the Japanese economy.

38. Stagflation may result from which of the following:

A.

B.

C.

D.

E.

Several decreases in the discount rate over the course of a few months.

Large bond sales by the central bank.

A sharp decrease in households marginal propensity to consume.

The expansion of the consumption possibilities frontier due to the opening of international trade.

Rapid deterioration of national infrastructure, such as roads and telephone cable.

39. Which of the following statements about stagflation is correct?

A.

B.

C.

D.

E.

It will result in increased nominal GDP.

It will result in decreased nominal GDP.

It is characterized by high unemployment and low inflation.

It implies an upward shift in the Phillips curve.

It is a problem easily explained and corrected in the Keynesian model.

40. In early 2000, the U.S. was at full employment. Despite this, a number of presidential candidates were

proposing tax cuts and government spending increases. The most likely effect of these actions under

such circumstances would be:

A. an increase in the marginal propensity to consume and a resulting increase in the full-employment level of

GDP.

B. higher price levels and little or no change in GDP.

C. lower interest rates.

D. an increase in the value of the dollar and a resulting increase in exports.

E. a long-run increase in the productive capacity of the U.S.

41. Which of the following is a valid statement about the Keynesian and classical models of the

macroeconomy?

A. Fiscal policy will affect output in the Keynesian model, but only the price level in the classical model.

B. The economy adapts quickly to demand shocks under the Keynesian model, but not under the classical

model.

C. A sharp decrease in the value of a nations currency will lead to higher price levels in the Keynesian

model, but not in the classical model.

D. Increases in autonomous expenditure will increase aggregate demand in the Keynesian model, but not in

the classical model.

E. An increase in the productive capacity of an economy will result in greater output in both the Keynesian

and classical models.

42. Suppose the government spends $500M on a project that has absolutely no value to the country.

Which statement about this project is correct?

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 9 of 19

Graded Assignment

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

A. If taxes were raised $500M to fund this project, the Keynesian model predicts that this will have no net

effect on output in the economy.

B. If the government raised the money for this project by printing $500M in bonds and selling them to the

Fed, the effect is exactly the same as if they sold the bonds to households.

C. The project will increase aggregate supply because it will increase the total quantity of goods and

services supplied in the economy.

D. If the marginal propensity to save in the economy is equal to 0.25, the Keynesian model predicts that this

project will result in a $2000M increase in GDP.

E. Under the assumptions of the classical model, the result of this project will be increases in both the price

level and equilibrium GDP.

43. A particular economy has consumption of $400M, a government deficit of $100M, taxes of $250M, and

income of $800M. Which of the following statements must be true?

A.

B.

C.

D.

E.

If investment is zero, there is no foreign trade imbalance.

If the trade surplus is $50M, investment will be equal to $100M.

If the capital account surplus is $50M, investment will be equal to $100M.

If the trade surplus is $100M, there will be investment.

None of the above statements is necessarily true.

44. Which piece of information would be least useful in trying to predict the effect of a $700M increase in

government spending on equilibrium GDP?

A.

B.

C.

D.

E.

Marginal propensity to save

The slope of the aggregate supply curve

Whether taxes are raised to pay for the spending increase

The current level of structural unemployment

Whether the bonds used to finance the spending were sold to households or to the Fed

45. Which of the statements relating full employment and full capacity is false?

A. At full employment there is no frictional unemployment; at full capacity there is no structural

unemployment.

B. The full-employment level of output is less than the full-capacity level of output.

C. At full employment there is no cyclical unemployment; at full capacity there is no frictional unemployment.

D. A government spending increase will result in increased output and price levels at full employment, but

only increased price levels at full capacity.

E. In the long run, an economy that starts at full capacity will move to full employment.

46. What would be the effect of a law requiring that government spending equal tax revenues in each

year?

A. Fiscal policy would be completely eliminated as a tool to control the macroeconomy.

B. Monetary policy would be completely eliminated as a tool to control the macroeconomy.

C. Fluctuations in GDP would become less severe.

D. The government spending multiplier would be effectively set to 1.0.

E. The marginal propensity to consume would be cut in half.

47. The total value of T-bonds, including T-notes and T-bills, in existence at any point in time is:

A. the federal government spending deficit.

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 10 of 19

Graded Assignment

B.

C.

D.

E.

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

the trade deficit.

less than government spending.

necessarily less than GDP.

the national debt.

48. Which of the following would be a valid statement about a government plan to eliminate a trade

deficit?

A. A decrease in the trade deficit will decrease investment in the country.

B. An effective strategy would be to increase the money supply and increase the value of the national

currency.

C. An effective strategy would be to increase interest rates and increase the value of the national currency.

D. This could be achieved through dramatically increasing aggregate supply.

E. The increase in net exports will result in a decrease in aggregate demand.

49. Crowding out has the effect(s) of:

A. reducing the effectiveness of monetary policy if the crowding out occurs in financial markets.

B. decreasing the value of a nations currency if the crowding out occurs in financial markets.

C. increasing the effectiveness of fiscal policy if the crowding out occurs in financial markets and increasing

the effectiveness of monetary policy if the crowding out occurs in product markets.

D. decreasing the effectiveness of fiscal policy if the crowding out occurs in financial markets and decreasing

the effectiveness of both fiscal and monetary policy if the crowding out occurs in product markets.

E. increasing the price of government bonds if the crowding out occurs in financial markets.

50. Which of the following will make crowding out in credit markets more severe?

A.

B.

C.

D.

E.

A steep investment demand curve

A global credit market

Tax increases

A steep supply curve in the loanable funds market

None of the above

51. The Fed is conducting expansionary monetary policy if it:

A.

B.

C.

D.

E.

increases the discount rate, buys bonds, and sets a lower target for the federal funds rate.

decreases the discount rate and sells bonds.

sets a lower target for the federal funds rate and buys bonds in the open market.

increases reserve requirements and buys bonds in the open market.

buys bonds in the open market and raises the discount rate.

52. If banks become concerned about future conditions and decide to hold larger excess reserves, which

of the following is a likely result?

A. A rise in interest rates

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 11 of 19

Graded Assignment

B.

C.

D.

E.

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

An increase in bond prices

An increase in aggregate demand

An increase in the money supply

Both C and D

53. The Fed is under no obligation to coordinate its actions with fiscal policy. And in fact, the Fed may

take actions specifically designed to counteract some piece of fiscal policy. An example of fiscal and

monetary policies with opposite effects is:

A.

B.

C.

D.

E.

an increase in taxes and increased sales of bonds by the Fed.

a decrease in government spending and an increase in the discount rate.

a decrease in taxes and a decrease in the target for the federal funds rate.

an increase in government spending and an increase in reserve requirements.

a decrease in taxes and increased purchases of bonds by the Fed.

54. In the fictitious nation of Zagora, a worker can produce either 5 books or 10 televisions in an hour. In

neighboring Plovdiv, a worker can produce either 3 books or 5 televisions in an hour. Which

statement about this situation is true?

A.

B.

C.

D.

E.

Zagora has comparative advantage in the production of books.

Zagora has comparative advantage in the production of televisions.

Workers in Plovdiv cant possibly compete against the super-productive workers in Zagora.

Workers in Zagora cant be expected to compete against the low-wage workers in Plovdiv.

None of the above

55. Given the U.S. has a current account deficit, a large increase in the demand for U.S. computer

programs among Japanese residents will have all the following effects except:

A.

B.

C.

D.

E.

an increase in the exchange rate, expressed in yen per dollar.

an increase in the U.S. capital account surplus.

an increase in investment in Japan.

an decrease in the U.S. trade deficit.

It may have all the above effects.

56. Fiscal policy affects exchange rates because:

A. as government spending increases, the government must buy more and more goods and services from

foreign countries.

B. as government debt increases, interest rates rise, and the value of the currency rises.

C. as government debt increases, interest rates rise, and the value of the currency falls.

D. as the money supply increases, interest rates fall, and the value of the currency rises.

E. as the money supply increases, interest rates fall, and the value of the currency falls.

57. There are many kinds of trade restrictions, and trade restrictions are put into place for many reasons.

Which of the following is not a reason to use trade restrictions?

A. To save natural habitats from over-use

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 12 of 19

Graded Assignment

B.

C.

D.

E.

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

To protect the jobs of workers in certain industries

To make a political statement regarding the labor policies of another nation

To compensate for higher taxes placed on domestic producers

To create a lower prices for domestic consumers

58. If the value of the U.S. dollar in foreign exchange markets rises:

A.

B.

C.

D.

E.

U.S. exports will become relatively less expensive.

capital inflows into the United States will increase.

people in the U.S. will purchase fewer imports.

U.S. exports will likely decrease.

All of the above

59. Saying that leakages equal injections give the equation:

A.

B.

C.

D.

E.

T+S+X=G+I+M

Y=C+S+T

Y=C+I+G+X-M

T+S+M=C+G+I+X

T+S+M=G+I+X

60. An economy producing at a level between full employment and full capacity is likely to experience:

A.

B.

C.

D.

E.

zero unemployment.

demand-pull inflation.

cost-push inflation.

a high level of cyclical unemployment.

a high level of seasonal unemployment.

This is the end of the multiple-choice portion of the quiz.

Take a 10-minute break before moving on to Part 2: Free Response.

If your quiz is proctored, ask your proctor for the next section.

If you're taking the unproctored version of the quiz, after your break continue with the next section.

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 13 of 19

Graded Assignment

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Name:

Date:

1.

31.

2.

32.

3.

33.

4.

34.

5.

35.

6.

36.

7.

37.

8.

38.

9.

39.

10.

40.

11.

41.

12.

42.

13.

43.

14.

44.

15.

45.

16.

46.

17.

47.

18.

48.

19.

49.

20.

50.

21.

51.

22.

52.

23.

53.

24.

54.

25.

55.

26.

56.

27.

57.

28.

58.

29.

59.

30.

60.

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 14 of 19

Graded Assignment

Name:

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Date:

Directions

Neatly write your responses in the spaces provided. Use a blue or black pen. Dont write in the margins.

Remember to complete the submission information on every page you turn in.

You have 60 minutes to do this portion of the Final. The first ten minutes are a mandatory reading period. You

may plan or outline your answer, but you may not start writing it. Spend the next 25 minutes on the first

question and the final 25 minutes on the other two questions.

Free-Response Questions

1. Macroeconomics can be a difficult topic to define. For the most part, it can be defined by the specific topics

with which it is concerned. Among these are output, inflation, unemployment, interest rates, and international

trade. At first these topics may seem unrelated, but some thought shows that they are intimately related.

A. The AD/AS model describes changes in the economy by relating real GDP (output) and the price level.

I.

Compare and contrast the Keynesian portion of the AD/AS model with the classical portion of

the AD/AS model, and explain how the level of production is determined in each situation. Use

graphs to explain your answer. (12 points)

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 15 of 19

Graded Assignment

Name:

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Date:

II. Compare and contrast changes in aggregate demand and changes in aggregate supply in the

AD/AS model. Use graphs to explain your answer. (12 points)

B. The Phillips curve relates inflation and unemployment.

I.

Using the AD/AS model, discuss the changes to the economy that the Phillips curve explains well,

and describe under what conditions the Phillips curve fails to explain economic behavior. Include

graphs of the Phillips curve and the AD/AS model in your answer. (12 points)

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 16 of 19

Graded Assignment

Name:

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Date:

II. In the late 1990s, the U.S. economy experienced a period of extremely low inflation and extremely

low unemployment. Use the AD/AS model to explain what sort of change in the economy would

cause this. Include a graphical analysis in your answer, and provide two examples of what might

bring about this event. (12 points)

C. Explain the relationship between interest rates and unemployment. How do changes in the

interest rate affect the level of unemployment in the economy? (10 points)

D. Consider the relationship between interest rates and inflation.

I.

Explain the difference between real and nominal interest rates. (9 points)

II. If the Fed takes actions that will change interest rates, how is this likely to affect inflation? (9

points)

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 17 of 19

Graded Assignment

Name:

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Date:

2. The U.S. economy experienced large trade deficits in the 1980s and 1990s and tremendous economic growth

in the mid- and late-1990s.

A. Trade deficits have an effect on inflation. Explain the relationship between trade deficits and

investment verbally and mathematically using the concept of the balance of payments. (10 points)

B. Explain verbally the relationship between investment and long-term economic growth and

describe the relationship graphically in an AD/AS graph. (10 points)

C. Many people believe trade deficits are a serious problem and need to be eliminated.

I.

Explain the three actions the Fed could take to reduce the trade deficit in the U.S., and explain

carefully how these actions would result in a reduced trade deficit. (10 points)

II. What effect would these three actions from part I of the question have on GDP? Describe the

effects on each of the components of aggregate demand. Include an AD/AS graphical analysis of

your answer. (7 points)

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 18 of 19

Graded Assignment

Name:

HST520: AP Macroeconomics | Unit 8 | 8.1 Final Exam

Date:

3. In Country X, GDP is $400B below the full-employment level of output. Government officials have measured

the marginal propensity to consume at 0.75.

A. The government wants to use fiscal policy to bring the economy back to full employment.

I.

If the government wants to achieve this through a change in spending, what change would be

necessary? (8 points)

II. If the government wants to achieve this through a change in taxes, what change would be

necessary? (8 points)

III. If the government wants to achieve this without creating a budget deficit, what change would be

necessary? (8 points)

B. Say that for a variety of reasons, the government shows that it is not up to the task of conducting

fiscal policy. The central bank steps up and does something about it. If a 1% decrease in interest

rates leads to an increase in investment of $50B, how should the central bank's interest rate

targets change? (13 points)

2009 K12 Inc. All rights reserved.

Copying or distributing without K12s written consent is prohibited.

Page 19 of 19

You might also like

- AP Macroeconomics: Assignment: Apply The Keynesian Model To AD/ASDocument5 pagesAP Macroeconomics: Assignment: Apply The Keynesian Model To AD/ASJaewon Lim33% (3)

- 7 3 6 PDFDocument7 pages7 3 6 PDFAnonymous ICaWn8100% (2)

- (MASTERLIST) MacroeconomicsDoc2Document73 pages(MASTERLIST) MacroeconomicsDoc2Bob Joe93% (15)

- 3.2.4 PracticeDocument2 pages3.2.4 PracticeKyrieSwerving100% (1)

- AP Macroeconomics: Assignment: Apply Knowledge of InflationDocument3 pagesAP Macroeconomics: Assignment: Apply Knowledge of InflationJaewon Lim100% (4)

- (MASTERLIST) MarcoeconomicsDocument350 pages(MASTERLIST) MarcoeconomicsBob Joe100% (16)

- AP Macroeconomics Page 1 of 5 Assignment: Apply The Keynesian Model To AD/ASDocument6 pagesAP Macroeconomics Page 1 of 5 Assignment: Apply The Keynesian Model To AD/ASMadiNo ratings yet

- AP Macroeconomics Test: International Economics: DirectionsDocument7 pagesAP Macroeconomics Test: International Economics: DirectionsOjas Chitnis0% (3)

- AP Macroeconomics Assignment: Apply Concepts of Short-Run EquilibriumDocument7 pagesAP Macroeconomics Assignment: Apply Concepts of Short-Run EquilibriumSixPennyUnicornNo ratings yet

- 6.3.4 PracticeDocument4 pages6.3.4 PracticeKyrieSwerving100% (1)

- AP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingDocument7 pagesAP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingMadiNo ratings yet

- AP Microeconomics Assignment: Apply Concepts of Production and TradeDocument2 pagesAP Microeconomics Assignment: Apply Concepts of Production and TradeJaewon Lim0% (1)

- 2.3.8 PracticeDocument5 pages2.3.8 PracticeKyrieSwerving100% (5)

- 6.2.4 PracticeDocument3 pages6.2.4 PracticeKyrieSwerving100% (1)

- 6.1.6 PracticeDocument2 pages6.1.6 PracticeKyrieSwervingNo ratings yet

- Macroeconomics 1Document25 pagesMacroeconomics 1eunicemaraNo ratings yet

- AP Macroeconomics Assignment: Apply Knowledge of Inflation: .12 .09. For Parts (A-C), The Nominal Rate If 12%Document2 pagesAP Macroeconomics Assignment: Apply Knowledge of Inflation: .12 .09. For Parts (A-C), The Nominal Rate If 12%SixPennyUnicornNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of International TradeDocument5 pagesAP Macroeconomics Assignment: Apply Concepts of International TradeSixPennyUnicornNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingDocument7 pagesAP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingSixPennyUnicornNo ratings yet

- 2.4.5 TestDocument4 pages2.4.5 TestDios TE AmaNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of The Keynesian ModelDocument7 pagesAP Macroeconomics Assignment: Apply Concepts of The Keynesian ModelSixPennyUnicorn0% (2)

- UC Berkeley Poli Sci 1 Midterm FallDocument23 pagesUC Berkeley Poli Sci 1 Midterm Fallsimoneleir100% (1)

- Unit V Fiscal and Phillips IiDocument10 pagesUnit V Fiscal and Phillips IiJonathan NguyenNo ratings yet

- AP Macro Practice TestDocument12 pagesAP Macro Practice TestNathan WongNo ratings yet

- Economics - Question - LanjutanDocument9 pagesEconomics - Question - LanjutanAditya NugrohoNo ratings yet

- Final 2016Document15 pagesFinal 2016Ismail Zahid OzaslanNo ratings yet

- Fiscal PolicyDocument50 pagesFiscal Policysanath77No ratings yet

- TUT Macro Unit 1 (Sept 2016)Document4 pagesTUT Macro Unit 1 (Sept 2016)Shuba ShiniNo ratings yet

- PracticDocument7 pagesPracticyourmaxaluslifeNo ratings yet

- AP Macroeconomics TestDocument10 pagesAP Macroeconomics TestTomMusic100% (1)

- Fiscal Policy TutorialDocument44 pagesFiscal Policy TutorialKing DariusNo ratings yet

- ECON 2123 Quiz 4Document4 pagesECON 2123 Quiz 4Charlie TsuiNo ratings yet

- International Finance-Final ExamDocument5 pagesInternational Finance-Final ExamTrang ĐoànNo ratings yet

- Macroeconomics QuestionsDocument3 pagesMacroeconomics Questionsdongxuan0120No ratings yet

- Economics Final Practice QuestionsDocument9 pagesEconomics Final Practice QuestionsMaranathaNo ratings yet

- ĐỀ SAMPLE MACRO 1Document5 pagesĐỀ SAMPLE MACRO 1nhungo.cucNo ratings yet

- GR12 Economics Exam 24Document7 pagesGR12 Economics Exam 24Abdallah HassanNo ratings yet

- AP Macroeconomics: Unit 4 ReviewDocument4 pagesAP Macroeconomics: Unit 4 ReviewGo TurpinNo ratings yet

- Aqa Econ2 W QP Jun10Document16 pagesAqa Econ2 W QP Jun10wi_hadiNo ratings yet

- Tutorial 1 PresentDocument12 pagesTutorial 1 PresentLi NiniNo ratings yet

- Economics ECN2/1 Unit 2 Part 1 Objective Test - The National EconomyDocument8 pagesEconomics ECN2/1 Unit 2 Part 1 Objective Test - The National EconomyShwan HasanNo ratings yet

- Ugba 101b Test 2 2008Document12 pagesUgba 101b Test 2 2008Minji KimNo ratings yet

- Economics PaperDocument15 pagesEconomics PaperSamad Ashraf MemonNo ratings yet

- Homework 3Document5 pagesHomework 3CHUA JO ENNo ratings yet

- CH 13 Macroeconomics KrugmanDocument6 pagesCH 13 Macroeconomics KrugmanMary Petrova100% (2)

- AP Macroecnomics Practice Exam 1Document20 pagesAP Macroecnomics Practice Exam 1KayNo ratings yet

- AP Macroecnomics Practice Exam 1Document20 pagesAP Macroecnomics Practice Exam 1KayNo ratings yet

- AP Macroeconomics Practice Exam 1Document12 pagesAP Macroeconomics Practice Exam 1Nguyễn Phương LiênNo ratings yet

- ECON 1000 - Final - 2012WDocument8 pagesECON 1000 - Final - 2012WexamkillerNo ratings yet

- Please Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every QuestionDocument12 pagesPlease Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every QuestionRafaelWbNo ratings yet

- ECON 2123 Quiz 5Document4 pagesECON 2123 Quiz 5Charlie TsuiNo ratings yet

- BED1201Document3 pagesBED1201cyrusNo ratings yet

- Aqa Ec0n2 W QP Jun09Document16 pagesAqa Ec0n2 W QP Jun09api-247036342No ratings yet

- EC101 Revision Questions - Graphical Analysis - SolutionsDocument10 pagesEC101 Revision Questions - Graphical Analysis - SolutionsZaffia AliNo ratings yet

- Chapter9 QuizDocument3 pagesChapter9 QuizJoey YUNo ratings yet

- FN 101 All Past PaperDocument107 pagesFN 101 All Past PaperJill MethodNo ratings yet

- Final Econ e PortfolioDocument7 pagesFinal Econ e Portfolioapi-317164511No ratings yet

- Review of Common Exam IIDocument24 pagesReview of Common Exam IIPlatelet SongNo ratings yet

- Chapter 6 For StudentsDocument4 pagesChapter 6 For Studentsdesada testNo ratings yet

- 4.2.2.7 Lab - Building An Ethernet Crossover CableDocument6 pages4.2.2.7 Lab - Building An Ethernet Crossover Cablerezhablo100% (2)

- CCNA A Spring 2016 1.3.1.3 Lab - Mapping The InternetDocument14 pagesCCNA A Spring 2016 1.3.1.3 Lab - Mapping The InternetJame ChanNo ratings yet

- 8.1.2.7 Lab - Using The Windows Calculator With Network AddressesDocument7 pages8.1.2.7 Lab - Using The Windows Calculator With Network Addressesmouzhappy100% (1)

- AP Macroeconomics - Unit 2 - 2.2 Practice Graded Assignment Assignment: Apply Concepts of Production and Trade ANSWERSDocument2 pagesAP Macroeconomics - Unit 2 - 2.2 Practice Graded Assignment Assignment: Apply Concepts of Production and Trade ANSWERSJame Chan100% (1)

- CCNA A Spring 2016 1.2.4.4 Packet Tracer - Representing The Network Instructions IGDocument5 pagesCCNA A Spring 2016 1.2.4.4 Packet Tracer - Representing The Network Instructions IGJame ChanNo ratings yet

- 2.1.4.8 Packet Tracer - Navigating The IOSDocument6 pages2.1.4.8 Packet Tracer - Navigating The IOSClareAustinNo ratings yet

- CCNA A Spring 2016 7.3.1.2 Packet Tracer Simulation - Exploration of TCP and UDP Instructions IGDocument6 pagesCCNA A Spring 2016 7.3.1.2 Packet Tracer Simulation - Exploration of TCP and UDP Instructions IGJame ChanNo ratings yet

- 7.3.2.6 Packet Tracer - Pinging and Tracing To Test The PathDocument4 pages7.3.2.6 Packet Tracer - Pinging and Tracing To Test The PathParthPatelNo ratings yet

- CCNA A Spring 2016 5.1.4.4 Packet Tracer - Identify MAC and IP Addresses Instructions IGDocument3 pagesCCNA A Spring 2016 5.1.4.4 Packet Tracer - Identify MAC and IP Addresses Instructions IGJame ChanNo ratings yet

- 8.1.3.8 Packet Tracer - Investigate Unicast, Broadcast, and Multicast Traffic InstructionsDocument4 pages8.1.3.8 Packet Tracer - Investigate Unicast, Broadcast, and Multicast Traffic InstructionsFaisal0% (1)

- 8.3.2.5 Packet Tracer - Verifying IPv4 and IPv6 Addressing InstructionsDocument4 pages8.3.2.5 Packet Tracer - Verifying IPv4 and IPv6 Addressing InstructionsWinceNo ratings yet

- CCNA A Spring 2016 6.4.3.4 Packet Tracer - Troubleshooting Default Gateway Issues Instructions IGDocument4 pagesCCNA A Spring 2016 6.4.3.4 Packet Tracer - Troubleshooting Default Gateway Issues Instructions IGJame Chan50% (4)

- HST520!2!2 Practice Pg1 AssignmentDocument5 pagesHST520!2!2 Practice Pg1 AssignmentJame Chan100% (1)

- MAECDocument42 pagesMAECsharmakomal20718No ratings yet

- Public ExpenditureDocument6 pagesPublic ExpenditureNaruChoudhary0% (1)

- Principle of Macroeconomics Course Syllabus: Thangbn@neu - Edu.vnDocument4 pagesPrinciple of Macroeconomics Course Syllabus: Thangbn@neu - Edu.vnĐức Anh HồNo ratings yet

- International Finance © Mojmir Mrak: University of LjubljanaDocument30 pagesInternational Finance © Mojmir Mrak: University of LjubljanaGalib HossainNo ratings yet

- Fundamentals of Money and BankingDocument104 pagesFundamentals of Money and BankingSiraajNo ratings yet

- National Development Strategy 1-1Document332 pagesNational Development Strategy 1-1Kelvin Turuka100% (1)

- IHS Global Construction ExecSummary Feb2014 140852110913052132 PDFDocument30 pagesIHS Global Construction ExecSummary Feb2014 140852110913052132 PDFhotschiNo ratings yet

- Economics 2 For IBA Course ManualDocument11 pagesEconomics 2 For IBA Course ManualReinier van DoornNo ratings yet

- Cambridge International AS & A Level: Economics 9708/42 October/November 2022Document15 pagesCambridge International AS & A Level: Economics 9708/42 October/November 2022Poh CarineNo ratings yet

- PNADF350Document47 pagesPNADF350joaozinho fgawNo ratings yet

- Tutorial 5 - MacroDocument2 pagesTutorial 5 - MacroXperiment BeatzNo ratings yet

- Hyperinflation and Stabilization in NicaraguaDocument72 pagesHyperinflation and Stabilization in NicaraguaCaseyDezNo ratings yet

- 4.177 S.Y. B.com Sem 3 4 Under Business EconomicsDocument11 pages4.177 S.Y. B.com Sem 3 4 Under Business EconomicsAkanksha SinghNo ratings yet

- Nomura Report On ChinaDocument104 pagesNomura Report On ChinaSimon LouieNo ratings yet

- Public Financial Management and Its Emerging Architecture: ExcerptDocument34 pagesPublic Financial Management and Its Emerging Architecture: ExcerptYaregal YeshiwasNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument7 pagesInstitute of Actuaries of India: ExaminationsRahul IyerNo ratings yet

- Final Exam Econ 2Document8 pagesFinal Exam Econ 2Ysabel Grace BelenNo ratings yet

- Andhra Pradesh Human Development Report 2007-Chapter5Document11 pagesAndhra Pradesh Human Development Report 2007-Chapter5Vivek GuptaNo ratings yet

- MCR2016Document240 pagesMCR2016Mocanu AndreeaNo ratings yet

- Thailand - PESTLE AnalysisDocument80 pagesThailand - PESTLE Analysisesteban trueba84% (25)

- Business EconomicsDocument519 pagesBusiness Economicsadelineo vlog O67% (3)

- Mock 10 SolnDocument68 pagesMock 10 SolnShaitan MishraNo ratings yet

- Essay Topic 2024 ECO 202Document3 pagesEssay Topic 2024 ECO 202elihlefass0No ratings yet

- ASAL Economics Lang Worksheet 29.1 AnswersDocument2 pagesASAL Economics Lang Worksheet 29.1 AnswersMatej MilosavljevicNo ratings yet

- Peak Oil May Be Imminent (Reynolds 2015)Document4 pagesPeak Oil May Be Imminent (Reynolds 2015)Cliffhanger100% (1)

- W73136 International GCSE Economics 4EC1 An Accessible VersionDocument9 pagesW73136 International GCSE Economics 4EC1 An Accessible VersionS CricketNo ratings yet

- Philippine Public DebtDocument20 pagesPhilippine Public Debtmark genove100% (3)

- Mona Mohamed, Menna Selem, Mariam, ManalDocument8 pagesMona Mohamed, Menna Selem, Mariam, ManalMenna HamoudaNo ratings yet

- 5.1 Demand and Supply-Side PoliciesDocument13 pages5.1 Demand and Supply-Side PoliciesMarisa VetterNo ratings yet

- Pambansang KaunlaranDocument3 pagesPambansang KaunlaranTria LagustanNo ratings yet