Professional Documents

Culture Documents

Short Form Questions

Uploaded by

Khanh Ly Nguyen0 ratings0% found this document useful (0 votes)

28 views3 pagesshort questions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentshort questions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views3 pagesShort Form Questions

Uploaded by

Khanh Ly Nguyenshort questions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Section 1: Legal and other professional regulations,

ethics and current issues

1. Ethical issues and procedures (15

The second opinion may compromise the opinion of the existing

auditor

Client may be opinion shopping which may indicate lack of

management integrity

May be a threat to professional competence and due care if firm is

not in possession of all the facts

Audit firm may be tempted to give the opinion the client desires in

order to obtain future work (Self-interest threat)

Obtaining clients permission to contact the existing auditor and

notifying auditor of the work to be undertaken so that your firm is in

full possession of all the facts

If client refuses permission must normally decline to act

2. Safeguards re fees

To recognise threat: Regularly review situation as client profile changes

To offset threat:

The fact needs to be disclosed to the ethics partner and those

charged with governance at the client and adopt appropriate

safeguards where necessary. For non-listed clients an external hot

review needs to be undertaken.

If total fees regularly exceed 15% of annual fee income (or 10% for

listed company) do not accept the assignment

3. Overdue fees

4. Actions

Report to Money Laundering Reporting Officer (MLRO) within the

firm, which fulfils their responsibility

Report to National Crime Agency (NCA)

Avoid tipping off the client

So as not to prejudice legal proceedings

Recommend repayment to customers

Ensure included as liability not income

Reasons: Representing proceeds of crime or theft; criminal offence if

auditor does not report

26.Audit firms are required, by ES3, to establish procedures and policies to

monitor the length of time that audit engagement partners serve as a long

association with the audit engagement may create threats to auditors

objectivity and independence resulting from: self-interest, self-review and

familiarity.

An engagement partner or other key people should be moved off the job

when they have been involved with an audit engagement for:

10 years for non-listed clients

5 years for listed clients (It may be extended if the clients audit

committee considers that this is necessary to safeguard the quality

of the audit)

A firm need to:

Apply safeguards to reduce any threats to an acceptable level

Resign from the audit if appropriate safeguards cant be applied.

38.Reasons

By ES5, valuation services should not be provided for a listed

company where the valuation would have a material effect on the

financial statements (greater than 2% of total assets).

Self-review threat is too great so that no adequate safeguards can

be applied.

May rely too heavily on valuations in subsequent audit

May be reluctant to identify a misstatement in the valuation

Management threat as may involve subjective judgement/making

assumptions.

Section 2: Accepting and managing engagements

1. Professional enquiry (Relevant matters included in letter from prospective

auditor to existing auditor)

Unlawful acts and defaults by the client

Serious doubts re clients integrity

Differences of opinion between the auditor and the client

Information required by auditor being deliberately withheld by client

Clients reasons for change not in accordance with the facts

Important differences of principle or practice behind the proposed

change

A statement of circumstances to be brought to attention of

members

2. Rights on removal

Receive notice, attend, speak and hear at the meeting where they

would have been appointed, or the proposed new auditor is

appointed

To have a written representation notified to all members to explain

why they should not be removed as auditors

3. Accepting appointment as auditors

Matters to consider

Whether the going concern issue likely to be present for future

accounting periods

Whether the going concern disclosures made were warranted

Whether Meldrew will give permission to contact existing auditors

Whether current auditors agree with reason given by Meldrew for

not wishing to reappoint

Is your firm independent from Meldrew to be able to carry out

objective audit?

Nature of Meldrews business

Timing/resource requirements to be able to perform audit

competently

Procedures to follow

Discuss with directors current going concern status

Review PY account to see whether going concern disclosures were

necessary and to ascertain amount of work likely to be necessary

Request permission to contact current auditors If refused, decline

the appointment

Write to current auditors enquiring if any matters that affect

appointment of your firm as auditors If no response, consider

refusing appointment

Compare estimated time required with current resources to

ascertain whether sufficient staff available at required times

Compare estimated level of fee income with current recurring fee

income to ascertain whether ethical limits likely to be breached

4. Reasons for review

Consider whether work done is in line with strategy

Confirm the work has been performed in accordance with

professional standards and regulatory and legal requirements

Confirm all significant matters have been raised for further

consideration

Assurance work carries duty of care to client

Audit work carries duty of care to third parties/protection against

litigation

Audit is regulated activity and governed by ISAs

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Governance Assignment by JunaidDocument3 pagesCorporate Governance Assignment by JunaidTanzeel HassanNo ratings yet

- CLAS 1510E Checklist 2013Document39 pagesCLAS 1510E Checklist 2013Tam Van LêNo ratings yet

- Om I - SNDocument22 pagesOm I - SNShashwat ChoudharyNo ratings yet

- Introduction To Cost AccountingDocument21 pagesIntroduction To Cost AccountingkakaoNo ratings yet

- Tab 2-2 Module 2 - Revision of 17011 and RiskDocument9 pagesTab 2-2 Module 2 - Revision of 17011 and RiskAlok JainNo ratings yet

- Arvind Sharma - Sustainability Reporting Trends in India - KPMGDocument3 pagesArvind Sharma - Sustainability Reporting Trends in India - KPMGlindareallyNo ratings yet

- Organaizational Performance SMADocument23 pagesOrganaizational Performance SMABassel JaberNo ratings yet

- Nyse Sap 2018Document190 pagesNyse Sap 2018Naveen KumarNo ratings yet

- 35TH Annual Report MRLDocument61 pages35TH Annual Report MRLmayankNo ratings yet

- Assam Professions, Trade, Calling and Employements TaxDocument40 pagesAssam Professions, Trade, Calling and Employements Taxanon_352991738No ratings yet

- Internal Auditing: (Independence, Objectivity, and Due Care)Document26 pagesInternal Auditing: (Independence, Objectivity, and Due Care)BashirNo ratings yet

- Aud TheoryDocument9 pagesAud TheoryYaj CruzadaNo ratings yet

- At WileyDocument9 pagesAt WileyAldonNo ratings yet

- Audit of The Inventory and Warehousing Cycle Business Functions in The Cycle and Related Documents and RecordsDocument3 pagesAudit of The Inventory and Warehousing Cycle Business Functions in The Cycle and Related Documents and RecordsvvNo ratings yet

- Introduccion A ISO 50002Document17 pagesIntroduccion A ISO 50002Pedro Alarcón RetamalNo ratings yet

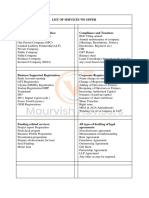

- Admin JobsDocument4 pagesAdmin JobsLakshmann ChettiarNo ratings yet

- Chap. 7 - Flexible Budgeting - Direct Costs VariancesDocument19 pagesChap. 7 - Flexible Budgeting - Direct Costs Variancesrprasad05No ratings yet

- 2009 Compensation & Benefits Survey QuestionnaireDocument18 pages2009 Compensation & Benefits Survey QuestionnaireearendilvorondoNo ratings yet

- PWC LNG Progression CanadaDocument10 pagesPWC LNG Progression CanadaAF Dowell MirinNo ratings yet

- Maurvish AdvisorsDocument2 pagesMaurvish Advisorsmrignagoel.dmpinstituteNo ratings yet

- SUGI Annual Report 2014Document149 pagesSUGI Annual Report 2014Widya HayuNo ratings yet

- SQL Server Security Database and OS Level AuditDocument19 pagesSQL Server Security Database and OS Level AuditKoduriLalNo ratings yet

- As Non Company Entities CA Chintan PatelDocument25 pagesAs Non Company Entities CA Chintan PatelAkshayNo ratings yet

- CFAS ReviewerDocument5 pagesCFAS ReviewerJester BorresNo ratings yet

- Sunshine Inns: Haoyuan ChenDocument14 pagesSunshine Inns: Haoyuan ChenssssNo ratings yet

- Syllabus MBA I II SEM Batch 2022-24Document13 pagesSyllabus MBA I II SEM Batch 2022-24Enosh JOyNo ratings yet

- G.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentDocument39 pagesG.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentMadel PresquitoNo ratings yet

- Public Expenditure PFM handbook-WB-2008 PDFDocument354 pagesPublic Expenditure PFM handbook-WB-2008 PDFThơm TrùnNo ratings yet

- Incorporated Legal Practice & Directors' DutiesDocument6 pagesIncorporated Legal Practice & Directors' DutiesPaddy OliverNo ratings yet

- ACC 103 P1 Long Quiz Set B Answer KeyDocument4 pagesACC 103 P1 Long Quiz Set B Answer KeyAldhy AquinoNo ratings yet