Professional Documents

Culture Documents

PT Gajah Tunggal TBK GJTL

Uploaded by

Daniel Hanry SitompulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PT Gajah Tunggal TBK GJTL

Uploaded by

Daniel Hanry SitompulCopyright:

Available Formats

Page 1 of 3

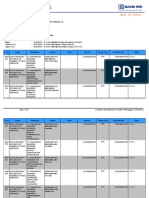

Quantitative Equity Report | Release: 09 Apr 2016, 09:22, GMT-05:00 | Reporting Currency: IDR | Trading Currency: IDR

PT Gajah Tunggal Tbk GJTL

Last Close 08 Apr 2016

Quantitative Fair Value Est 08 Apr 2016

Market Cap 08 Apr 2016

Sector

Industry

745.00

991.38

2,595.9 Bil

t Consumer Cyclical

Rubber & Plastics

PT Gajah Tunggal Tbk is a integrated tire manufacturer in

Southeast Asia and produces and markets tires and inner

tubes for motorcycle, passenger cars, commercial and heavy

equipment vehicles.

Country of Domicile

IDN Indonesia

Price Versus Quantitative Fair Value

2012

2013

2014

2015

2016

2017

Sales/Share

Forecast Range

Forcasted Price

Dividend

Split

Quantitative Fair Value Estimate

4,130

Total Return

Quantitative Scores

3,304

Scores

Momentum:

Standard Deviation: 53.48

Liquidity: High

All Rel Sector Rel Country

Quantitative Moat

None

Valuation

Undervalued

Quantitative Uncertainty Very High

Financial Health

Moderate

1

97

38

21

1

92

29

10

2,478

1

97

32

9

1,652

418.00

52-Wk

1,300.00

418.00

5-Yr

3,675.00

826

GJTL

t

IDN

Undervalued

Fairly Valued

Overvalued

Source: Morningstar Equity Research

Valuation

Sector

Median

Country

Median

0.84

16.4

10.5

19.5

1.01

1.5

0.6

0.87

17.7

13.7

10.1

16.9

2.41

1.7

0.9

0.95

15.4

13.9

8.5

11.2

2.20

1.2

1.3

Current 5-Yr Avg

Sector

Median

Country

Median

11.8

5.3

0.5

Current 5-Yr Avg

Price/Quant Fair Value

Price/Earnings

Forward P/E

Price/Cash Flow

Price/Free Cash Flow

Trailing Dividend Yield %

Price/Book

Price/Sales

0.75

2.0

1.34

0.5

0.2

Profitability

Return on Equity %

Return on Assets %

Revenue/Employee (Mil)

-13.1

-4.4

858.4

14.6

5.3

906.1

Quantitative Moat

-26.3

-45.4

-22.4

-42.8

-14.6

-11.3

-62.1

-61.5

40.6

41.1

0.45

8.9

0.6

1.61

10.4

0.5

0.70

35.6

0.4

1.89

-2.6

0.1

1.34

-3.6

0.2

Total Return %

+/ Market (Morningstar World

Index)

Trailing Dividend Yield %

Forward Dividend Yield %

Price/Earnings

Price/Revenue

Morningstar RatingQ

QQQQQ

QQQQ

QQQ

QQ

Q

2010

2011

2012

2013

2014

TTM

9,854

24.2

11,841

20.2

12,579

6.2

12,353

-1.8

13,071

5.8

12,931

-1.1

Financials (Fiscal Year in Bil)

Revenue

% Change

1,287

12.4

831

1,010

-21.6

684

1,677

66.1

1,132

166

-90.1

120

394

136.7

270

-874

-321.8

-716

Operating Income

% Change

Net Income

12.0

4.3

900.3

-749

262

2.7

-800

-496

-4.2

-1,872

-165

-1.3

-868

431

3.5

-1,433

-1,281

-9.8

-1,468

-153

-1.2

Operating Cash Flow

Capital Spending

Free Cash Flow

% Sales

Score

100

238.00

-8.5

230.09

196.00

-17.6

-44.89

325.00

65.8

-86.06

35.00

-89.2

131.54

77.00

120.0

-398.21

-205.46

-366.8

-43.91

EPS

% Change

Free Cash Flow/Share

80

12.75

766.37

3,485

12.00

1,241.29

3,485

10.00

1,456.70

3,485

27.00

1,652.79

3,484

10.00

1,698.71

10.00

1,445.73

3,484

26.8

8.6

8.4

1.02

2.9

17.2

6.2

5.8

1.08

2.6

22.9

9.3

9.0

1.03

2.3

2.2

0.9

1.0

0.88

2.7

4.6

1.7

2.1

0.83

2.7

-13.1

-4.4

-5.5

0.79

3.4

Profitability

Return on Equity %

Return on Assets %

Net Margin %

Asset Turnover

Financial Leverage

19.7

13.1

14.1

8.5

3,722

19.4

13.3

3,769

18.4

1.4

5,961

18.7

3.0

6,124

19.5

-6.8

7,259

Gross Margin %

Operating Margin %

Long-Term Debt

3,527

2.6

4,431

2.7

5,478

2.3

5,724

2.0

5,983

1.9

5,038

1.6

Total Equity

Fixed Asset Turns

Sep

3,347.2

3,120.7

2,979.8

3,015.6

Dec

Total

3,388.3 13,070.7

3,244.0 12,352.9

3,197.2 12,578.6

60

40

20

0

2009

2010

2011

2012

2013

2014

2015

Financial Health

Current 5-Yr Avg

Distance to Default

Solvency Score

Assets/Equity

Long-Term Debt/Equity

2016

Sector

Median

Country

Median

0.6

492.5

1.8

0.2

0.6

546.5

2.1

0.3

0.3

2.7

1.0

0.4

2.6

0.9

1-Year

3-Year

5-Year

10-Year

5.8

136.7

124.3

-63.0

4.5

-40.6

3.4

-26.9

-26.7

-5.9

10.1

-33.1

10.5

-19.2

-21.5

17.5

-19.3

2.3

Growth Per Share

Revenue %

Operating Income %

Earnings %

Dividends %

Book Value %

Stock Total Return %

Quarterly Revenue & EPS

Revenue (Bil)

Mar

Jun

2015

3,075.3 3,120.5

2014

3,199.7 3,362.1

2013

3,038.0 3,091.1

2012

3,145.8 3,220.0

Earnings Per Share ()

2015

-83.00

-17.52

2014

96.00

-30.72

2013

99.00

33.01

2012

73.00

78.03

Dividends/Share

Book Value/Share

Shares Outstanding (Mil)

Revenue Growth Year On Year %

8.8

5.3

7.3

4.7

4.4

1.5

-1.2

-114.36

-0.94

-72.85

72.19

12.87

-24.48

101.72

77.00

35.00

325.00

-3.9

-7.2

2013

2014

Morningstar 2016. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and

are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data,

analyses or opinions or their use. The information herein may not be reproduced, in any manner without the prior written consent of Morningstar. Please see important disclosures at the end of this report.

2015

Page 2 of 3

Quantitative Equity Report | Release: 09 Apr 2016, 09:22, GMT-05:00 | Reporting Currency: IDR | Trading Currency: IDR

Quantitative Equity Report Disclosure

a security or securities they cover.

Morningstar was not paid by the issuer of the security to produce a Report.

The Quantitative Equity Report (Report) is derived from data, statistics and

information within Morningstar, Inc.s database as of the date of the Report and

is subject to change without notice. The Report is for informational purposes

only, intended for financial professionals and/or sophisticated investors

(Users) and should not be the sole piece of information used by such Users or

their clients in making an investment decision. While Morningstar has obtained

data, statistics and information from sources it believes to be reliable,

Morningstar does not perform an audit or seeks independent verification of any

of the data, statistics, and information it receives.

This Report has not been made available to the issuer of the security prior to

publication.

Unless otherwise provided in a separate agreement, Users and Users clients

accessing this Report may only use it in the country in which the Morningstar

distributor is based. Unless stated otherwise, the original producer and

distributor of the Report is Morningstar Inc., a U.S.A. domiciled financial

institution. Redistribution, in any capacity, is prohibited without permission.

The data, statistics and information presented herein do not constitute

investment advice; are not to be construed as an offer to buy or sell the security

noted; and are not warranted to be correct, complete or accurate. Unless

otherwise provided in a separate agreement, Morningstar makes no

representation that the Report contents meets all of the presentation and/or

disclosure standards applicable in the Users jurisdiction or the jurisdiction(s)

the Users clients are located.

Except as otherwise required by law, Morningstar and its officers, directors and

employees shall not be responsible or liable for any trading decisions, damages

or other losses resulting from, or related to, the information, data, analyses or

opinions within the Report. Morningstar encourages Users and Users Clients to

read all relevant issue documents (e.g., prospectus) pertaining to the security

concerned, including without limitation, its investment objectives, risks, charges

and expenses before making an investment decision and when deemed

necessary, to seek the advice of a legal, tax, and/or accounting professional.

Please note that investments in securities are subject to market and other risks.

Foreign currency rates of exchange may adversely affect the value, price or

income of any security or related investment mentioned in these reports. In

addition, investors in securities such as ADRs, whose value are influenced by

the currency of the underlying security, effectively assume currency risk. A

security investment return and an investors principal value will fluctuate so

that, when redeemed, an investors shares may be worth more or less than their

original cost. A securitys current investment performance may be lower or

higher than the investment performance noted within the Report. Past

performance is not necessarily a guide to future performance.

Indexes noted within the report are unmanaged, their returns do not include

payment of any sales charges or fees an investor would pay to purchase

securities, and cannot be invested in directly.

Conflicts of Interest:

No material interests are held by Morningstar or an equity analyst in the

security that is the subject of the Report.

Morningstar is not a liquidity provider or marker maker for any security nor

does it offer investment banking services.

Equity analysts do not have authority over Morningstar's investment

management group's business arrangements nor are to allow employees from

the investment management group to participate or influence the analysis or

opinion prepared by them.

Morningstar and equity analysts use publicly available information.

Morningstar may provide issuers of a security or its related entities with

services or products for a fee on an arms-length basis including software

products and licenses, research and consulting services, data services, licenses

to republish our ratings and research in their promotional material, event

sponsorship and website advertising.

Equity analysts are to comply with the CFA Institute's Code of Ethics and

Standards of Professional Conduct as well as internal Morningstar, Inc. policies

that are intended to mitigate conflicts of interests and to maintain the integrity

of the research produced by Morningstars equity analysts. Users wishing to

obtain further information about these policies should contact their local

Morningstar office.

Quantitative Equity Ratings

Morningstars quantitative equity ratings consist of: (i) Morningstar Rating (Q),

Quantitative (ii) Quantitative Fair Value Estimate, (iii) Quantitative Valuation, (iv)

Quantitative Uncertainty, (v) Quantitative Economic Moat, and (vi) Quantitative

Financial Health (collectively the Quantitative Ratings).

The Quantitative Ratings are forward-looking and are generated by a statistical

model that is based on analyst-driven ratings, including Morningstars Fair

Value Estimate, Morningstar Economic Moat Rating, and Uncertainty Rating

as well as financial data points such as earnings yield, average daily volume,

and total return volatility, among others.

The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a companys peers as determined by statistical algorithms.

Morningstar calculates Quantitative Ratings for companies whether or not it

already provides analyst ratings and qualitative coverage. In some cases, the

Quantitative Ratings may differ from the analyst ratings because a companys

analyst-driven ratings can significantly differ from other companies in its peer

group.

i. Morningstar Rating (Q): Intended to represent the ratio of a stocks

Quantitative Fair Value Estimate to its most recent close price.The rating is

calculated daily based on the discount or premium in the last close

price of the stock compared to the Quantitative Fair Value Estimate. It is

expressed as one through five stars, denoted with a superscript Q, with 5 stars

representing a stock trading at the most significant discount to the Quantitative

Fair Value Estimate and 1 star representing a stock trading at the biggest

premium to the Quantitative Fair Value Estimate.

Equity analysts compensation is derived from Morningstar, Inc.s overall

earnings and consists of salary, bonus and in some cases restricted stock.

ii. Quantitative Fair Value Estimate: Intended to represent Morningstars

estimate of the per share dollar amount that a companys equity is worth today.

Morningstar calculates the Quantitative Fair Value Estimate using a statistical

model derived from the Fair Value Estimate Morningstars equity analysts

assign to companies.

Equity analysts compensation is not tied to the investment performance of

iii. Quantitative Economic Moat: Intended to describe the strength of a

Morningstar 2016. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and

are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data,

analyses or opinions or their use. The information herein may not be reproduced, in any manner without the prior written consent of Morningstar. Please see important disclosures at the end of this report.

Quantitative Equity Report | Release: 09 Apr 2016, 09:22, GMT-05:00 | Reporting Currency: IDR | Trading Currency: IDR

firms competitive position. It is calculated using an algorithm designed to

predict the Economic Moat rating a Morningstar analyst would assign to the

stock. The rating is expressed as None, Narrow, and Wide.

iv. Quantitative Valuation: Intended to represent the ratio of a stocks

Quantitative Fair Value Estimate to its most recent close price and is similar to

the analyst-driven Fair Value Estimate to last market close price ratio. The rating

is expressed as Overvalued, Fairly Valued, and Undervalued.

v. Quantitative Uncertainty: Intended to represent Morningstars level of

uncertainty about the accuracy of the Quantitative Fair Value Estimate.

Generally, the lower the Quantitative Uncertainty, the narrower the potential

range of outcomes for that particular company. The rating is expressed as Low,

Medium, High, Very High, and Extreme.

vi. Quantitative Financial Health: Intended to reflect the probability that a

firm will face financial distress in the near future. The calculation uses a

predictive model designed to anticipate when a company may default on its

financial obligations. The rating is expressed as Weak, Moderate, and Strong.

The Quantitative Ratings are not statements of fact. Morningstar does not

guarantee the completeness or accuracy of the assumptions or models used in

determining the Quantitative Ratings. In addition, there is the risk that the price

target will not be met due to such things as unforeseen changes in demand for

the companys products, changes in management, technology, economic

development, interest rate development, operating and/or material costs,

competitive pressure, supervisory law, exchange rate, and tax rate. For

investments in foreign markets there are further risks, generally based on

exchange rate changes or changes in political and social conditions. A change in

the fundamental factors underlying the Quantitative Ratings can mean that the

valuation is subsequently no longer accurate.

Prices noted with the Report are the closing prices on the last stock-market

trading day before the publication date stated, unless another point in time is

explicitly stated.

The Quantitative Ratings noted the Report are provided in good faith, are as of

the date of the Report and are subject to change. While Morningstar has

obtained data, statistics and information from sources it believes to be reliable,

Morningstar does not perform an audit or seeks independent verification of any

of the data, statistics, and information it receives.

The Quantitative Ratings are not a market call, and do not replace the User or

Users clients from conducting their own due-diligence on the security. The

Quantitative Ratings (either individually or collectively) are not a suitability

assessment; such assessments take into account may factors including a

persons investment objective, personal and financial situation, and risk

tolerance all of which are factors the Quantitative Ratings do not consider.

For more information about Morningstars quantitative methodology, please

visit corporate.morningstar.com.

Morningstars Quantitative methodology was developed and it is maintained by

Lee Davidson, Head of the Quantitative Research.

For Recipients in Australia: This report has been authorized by the Head of

Equity and Credit Research, Asia Pacific, Morningstar Australasia Pty Limited

and is circulated pursuant to RG 79.26(f) as a full restatement of an original

report (by the named Morningstar analyst) which has already been broadly

distributed. The information in the Report has not been prepared for use by

retail investors. To the extent the Report contains general advice it has been

prepared without reference to an investors objectives, financial situation or

needs. Investors should consider the advice in light of these matters and, if

Page 3 of 3

applicable, the relevant Product Disclosure Statement before making any

decision to invest. Refer to our Financial Services Guide (FSG) for more

information at www.morningstar.com.au/fsg.pdf. The Report is for

informational purposes and should not be the sole piece of information used by

such financial professionals or sophisticated investors in making an investment

decision.

For Recipients in Hong Kong: The Report is distributed by Morningstar

Investment Management Asia Limited, which is regulated by the Hong Kong

Securities and Futures Commission to provide services to professional investors

only. Neither Morningstar Investment Management Asia Limited, nor its

representatives, are acting or will be deemed to be acting as an investment

advisor to any recipients of this information unless expressly agreed to by

Morningstar Investment Management Asia Limited. For enquiries regarding this

research, please contact a Morningstar Investment Management Asia Limited

Licensed Representative at http://global.morningstar.com/equitydisclosures.

For Recipients in India: Research on securities [as defined in clause (h) of

Section 2 of the Securities Contracts (Regulation) Act, 1956], and being referred

to for the purpose of this document as Investment Research, is issued by

Morningstar Investment Adviser India Private Limited.

Morningstar Investment Adviser India Private Limited is registered with the

Securities and Exchange Board of India under the SEBI (Investment Advisers)

Regulations, 2013, vide Registration number INA000001357, dated March 27,

2014, and in compliance of the aforesaid regulations and Chapter III of the SEBI

(Research Analysts) Regulations, 2014, it carries on the business activities of

investment advice and research. Morningstar Investment Adviser India Private

Limited has not been the subject of any disciplinary action by SEBI or any other

legal/regulatory body. Morningstar Investment Adviser India Private Limited is a

wholly owned subsidiary of Morningstar Associates LLC, which is a part of the

Morningstar Investment Management group of Morningstar, Inc. In India,

Morningstar Investment Adviser India Private Limited has only one associate,

viz., Morningstar India Private Limited, and this company predominantly carries

on the business activities of providing data input, data transmission and other

data related services, financial data analysis, software development etc.

The author/creator of this Investment Research (Research Analyst) or his/her

associates or immediate family may have (i) a financial interest in the subject

security or (ii) an actual/beneficial ownership of one per cent or more securities

of the subject security, at the end of the month immediately preceding the date

of publication of this Investment Research. The Research Analyst, his/her

associates and immediate family do not have any other material conflict of

interest at the time of publication of this Investment Research.

The Research Analyst or his/her associates or his/her immediate family

has/have not received any (i) compensation from the relevant issuer of the

security in the past twelve months; (ii) compensation for products or services

from the relevant issuer of the security in the past twelve months; and (iii)

compensation or other material benefits from the relevant issuer of the security

or third party in connection with this Investment Research. Also, the Research

Analyst has not served as an officer, director or employee of the relevant issuer

of the security, nor has it or its associates been engaged in market making

activity for the subject security.

The terms and conditions on which Morningstar Investment Adviser India

Private Limited offers Investment Research to clients, varies from client to

client, and is spelt out in detail in the respective client agreement.

Morningstar 2016. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and

are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data,

analyses or opinions or their use. The information herein may not be reproduced, in any manner without the prior written consent of Morningstar. Please see important disclosures at the end of this report.

You might also like

- Economic Outlook 2021Document198 pagesEconomic Outlook 2021Die EwigkeitNo ratings yet

- Warren Buffett 2002 BRK Annual Letter To ShareholdersDocument22 pagesWarren Buffett 2002 BRK Annual Letter To ShareholdersBrian McMorris100% (2)

- Fundamental Analysis of ACCDocument10 pagesFundamental Analysis of ACCmandeep_hs7698100% (2)

- NREEC Investment Guide Book (Print Ver) (ENG) (7447)Document120 pagesNREEC Investment Guide Book (Print Ver) (ENG) (7447)Shobri MulyonoNo ratings yet

- Philosophy For Old AgeDocument20 pagesPhilosophy For Old Ageajitesh13No ratings yet

- How To Read Your MT4 Trading StatementDocument7 pagesHow To Read Your MT4 Trading StatementwanfaroukNo ratings yet

- Digital Skills Frameworks and ProgramsDocument43 pagesDigital Skills Frameworks and ProgramsrenicaryadiNo ratings yet

- Letters 2013-2019Document166 pagesLetters 2013-2019Devansh GargNo ratings yet

- Outlook Ekonomi (Economic Outlook) Indonesia 2017Document41 pagesOutlook Ekonomi (Economic Outlook) Indonesia 2017Eddy Satriya100% (2)

- PAGD X Grab Pharmacies Store - Kimia Farma PDFDocument16 pagesPAGD X Grab Pharmacies Store - Kimia Farma PDFluthfi hidrathul HamidiNo ratings yet

- Materi Logistik ManagementDocument73 pagesMateri Logistik ManagementsaridewiaNo ratings yet

- JUMPSTARTER 2021 Intro Deck 20200716 PDFDocument33 pagesJUMPSTARTER 2021 Intro Deck 20200716 PDFCindy ZhangNo ratings yet

- Capital Profile Weekly Report - 10.october.2014Document7 pagesCapital Profile Weekly Report - 10.october.2014Anita KarlinaNo ratings yet

- RAM A Study On Equity Research Analysis at India Bulls LimitedDocument44 pagesRAM A Study On Equity Research Analysis at India Bulls Limitedalapati173768No ratings yet

- Equity Research - DanoneDocument5 pagesEquity Research - DanoneFEPFinanceClub100% (1)

- Competitiveness Metrics: Competitiveness of Economic SystemsDocument51 pagesCompetitiveness Metrics: Competitiveness of Economic SystemsHristomir KutsarovNo ratings yet

- Analysis of Financial Statement - GSKDocument36 pagesAnalysis of Financial Statement - GSKImran Sarwar100% (3)

- Endeavor Insiaght Partnership For NYC Tech EntrepreneursDocument32 pagesEndeavor Insiaght Partnership For NYC Tech EntrepreneurscrainsnewyorkNo ratings yet

- Cerulli Report - Targeting The Affluent and The Emerging AffluentDocument25 pagesCerulli Report - Targeting The Affluent and The Emerging AffluentJoin RiotNo ratings yet

- Corporate Investment Decisions: Principles and PracticeDocument18 pagesCorporate Investment Decisions: Principles and PracticeBusiness Expert Press67% (3)

- Ecommerce Dev. PackageDocument19 pagesEcommerce Dev. PackageSiti SarahNo ratings yet

- Pemberton Asian Opportunities Fund Emerges As Substantial Shareholder of SGX-Listed JukenDocument2 pagesPemberton Asian Opportunities Fund Emerges As Substantial Shareholder of SGX-Listed JukenWeR1 Consultants Pte LtdNo ratings yet

- Tesla Income Statement and Financial Ratios 2016Document5 pagesTesla Income Statement and Financial Ratios 2016Mary JoyNo ratings yet

- Deck Creation Checklist: Presentation EssentialsDocument29 pagesDeck Creation Checklist: Presentation EssentialsMuhammad Nico PermanaNo ratings yet

- Patricia's PM PortfolioDocument13 pagesPatricia's PM PortfolioEvaNo ratings yet

- Investing Is An Art Not A ScienceDocument4 pagesInvesting Is An Art Not A SciencemeetwithsanjayNo ratings yet

- Ipo ProcessDocument19 pagesIpo ProcessDeepa KawaraniNo ratings yet

- Understanding The Drivers of ReturnsDocument2 pagesUnderstanding The Drivers of ReturnsSamir JainNo ratings yet

- Stock Pitch GuideDocument25 pagesStock Pitch GuideXie NiyunNo ratings yet

- Unilever Business Analysis BriefDocument21 pagesUnilever Business Analysis Briefshariqanis1500No ratings yet

- GIC Stock PitchDocument9 pagesGIC Stock Pitchbenjim123No ratings yet

- Retail MGMT M4 - Merchandising ManagementDocument37 pagesRetail MGMT M4 - Merchandising Managementvinodpandey100100% (1)

- Research ProjectDocument28 pagesResearch ProjectArchita KoolwalNo ratings yet

- CFA Research Challenge Report on ACB BankDocument21 pagesCFA Research Challenge Report on ACB BankNguyễnVũHoàngTấnNo ratings yet

- Finance 101 Insead Lec 2Document18 pagesFinance 101 Insead Lec 2Dwijesh RajwadeNo ratings yet

- Study Id42540 Digital-Advertising-ReportDocument130 pagesStudy Id42540 Digital-Advertising-ReportpazuzuNo ratings yet

- Cost Estimation Using CocomoDocument3 pagesCost Estimation Using Cocomotanmoy_249120195No ratings yet

- Basics of Stock Market-S1Document36 pagesBasics of Stock Market-S1shivam4822No ratings yet

- Chapter 10: Equity Valuation & AnalysisDocument22 pagesChapter 10: Equity Valuation & AnalysisMumbo JumboNo ratings yet

- Report File - 1Document11 pagesReport File - 1Prachi GargNo ratings yet

- FIL Stock MarketDocument41 pagesFIL Stock Marketrekha_kumariNo ratings yet

- Equity: MarketsDocument113 pagesEquity: MarketsBurhanudin BurhanudinNo ratings yet

- Glossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDSDocument11 pagesGlossary: Edit Ok: D: K03 Edit Pass SRL/TKB 102 Score 13 CDSFUCKYOU21170% (1)

- Ey Private Equity Briefing Southeast Asia June 2018Document24 pagesEy Private Equity Briefing Southeast Asia June 2018soumyarm942No ratings yet

- UKFF4024: Nike vs. Adidas Financial AnalysisDocument24 pagesUKFF4024: Nike vs. Adidas Financial AnalysisCharlie M JCNo ratings yet

- Alibaba, Cainiao, and Ehub StrategyDocument26 pagesAlibaba, Cainiao, and Ehub StrategyMNo ratings yet

- BTC Options: Dissecting Volatility TrendsDocument38 pagesBTC Options: Dissecting Volatility TrendsVishvendra SinghNo ratings yet

- Quick Company Analysis PVR Limited: ShikshaDocument10 pagesQuick Company Analysis PVR Limited: ShikshaSuresh PandaNo ratings yet

- Introduction About Lazada IndonesiaDocument14 pagesIntroduction About Lazada IndonesiaErinNo ratings yet

- PhD-Technical Analysis in Financial Markets, Gerwin A. W. Griffioen University of AmsterdamDocument322 pagesPhD-Technical Analysis in Financial Markets, Gerwin A. W. Griffioen University of AmsterdamDeepika KaurNo ratings yet

- Understanding the VC ProcessDocument13 pagesUnderstanding the VC ProcessStXvrNo ratings yet

- The B2B E-Marketplace: All About Smes!Document5 pagesThe B2B E-Marketplace: All About Smes!Phương IvyNo ratings yet

- Hong Kong Stock Market for Beginners: Hang Seng Index Basics GuideFrom EverandHong Kong Stock Market for Beginners: Hang Seng Index Basics GuideRating: 1 out of 5 stars1/5 (1)

- CFA Society Uruguay - ESG in Sovereign Bond PortfoliosDocument44 pagesCFA Society Uruguay - ESG in Sovereign Bond PortfoliosFabian IbarburuNo ratings yet

- Sharkhan Valueguide 2016Document68 pagesSharkhan Valueguide 2016Nitesh BajajNo ratings yet

- SG Trend Monthly ReportDocument2 pagesSG Trend Monthly Reportanalyst_anil14No ratings yet

- Auto Sales Up 6.5% in 6MFY14Document2 pagesAuto Sales Up 6.5% in 6MFY14jibranqqNo ratings yet

- HRSP Non US Equity StrategyDocument2 pagesHRSP Non US Equity StrategyLoganBohannonNo ratings yet

- Investools IntroductionToTradingStocks Slides PDFDocument268 pagesInvestools IntroductionToTradingStocks Slides PDFstejoh100% (1)

- UNTRDocument3 pagesUNTRDaniel Hanry SitompulNo ratings yet

- ANTMDocument3 pagesANTMDaniel Hanry SitompulNo ratings yet

- UNTRDocument3 pagesUNTRDaniel Hanry SitompulNo ratings yet

- PT Bank Mandiri (Persero) TBK BMRIDocument3 pagesPT Bank Mandiri (Persero) TBK BMRIDaniel Hanry SitompulNo ratings yet

- PT Bank Mandiri (Persero) TBK BMRIDocument3 pagesPT Bank Mandiri (Persero) TBK BMRIDaniel Hanry SitompulNo ratings yet

- UNTRDocument3 pagesUNTRDaniel Hanry SitompulNo ratings yet

- UNTRDocument3 pagesUNTRDaniel Hanry SitompulNo ratings yet

- ANTMDocument3 pagesANTMDaniel Hanry SitompulNo ratings yet

- Financial Statements2014 Lotte ChemicalDocument95 pagesFinancial Statements2014 Lotte ChemicalDaniel Hanry SitompulNo ratings yet

- Chapter 12 AppDocument3 pagesChapter 12 AppDaniel Hanry SitompulNo ratings yet

- UNTRDocument3 pagesUNTRDaniel Hanry SitompulNo ratings yet

- Swap PDFDocument23 pagesSwap PDFshivam_dubey4004No ratings yet

- MergedDocument22 pagesMergedDaniel Hanry SitompulNo ratings yet

- Economic Value Added Versus Profit-Based Measures of PerformanceDocument7 pagesEconomic Value Added Versus Profit-Based Measures of PerformanceRoju ShresthaNo ratings yet

- UNTRDocument3 pagesUNTRDaniel Hanry SitompulNo ratings yet

- Clique Pens: The Writing Implements Division of Us HomeDocument6 pagesClique Pens: The Writing Implements Division of Us HomeDaniel Hanry SitompulNo ratings yet

- Ten Ideas To Reshape Indonesias Energy SectorDocument9 pagesTen Ideas To Reshape Indonesias Energy SectorDaniel Hanry SitompulNo ratings yet

- KFC Performance ManagementDocument36 pagesKFC Performance ManagementMuhammad Emmad87% (15)

- Clocky 120508133109 Phpapp01Document10 pagesClocky 120508133109 Phpapp01Daniel Hanry SitompulNo ratings yet

- Business Plan ReportDocument38 pagesBusiness Plan ReportTống Ngọc Mai100% (1)

- Chapter 1Document3 pagesChapter 1Daniel Hanry SitompulNo ratings yet

- Tgs 0108075Document3 pagesTgs 0108075Daniel Hanry SitompulNo ratings yet

- Metabical Pricing Packaging Analysis ROI ProjectionsDocument11 pagesMetabical Pricing Packaging Analysis ROI Projectionsn_modi100% (2)

- Ohio Art Advertising ExperimentsDocument4 pagesOhio Art Advertising ExperimentsDaniel Hanry Sitompul33% (3)

- ObjectiveDocument2 pagesObjectiveDaniel Hanry SitompulNo ratings yet

- ImpairmentDocument9 pagesImpairmentDaniel Hanry SitompulNo ratings yet

- Clockycasestudy 131214110007 Phpapp01Document11 pagesClockycasestudy 131214110007 Phpapp01Daniel Hanry SitompulNo ratings yet

- V 7 I 32013020493470037Document10 pagesV 7 I 32013020493470037Daniel Hanry SitompulNo ratings yet

- Clocky 120508133109 Phpapp01Document10 pagesClocky 120508133109 Phpapp01Daniel Hanry SitompulNo ratings yet

- Prasenjit Interview WCCLG PDFDocument4 pagesPrasenjit Interview WCCLG PDFAbhishek VermaNo ratings yet

- Transcript of Charlie Rose's Interview With John J. MackDocument27 pagesTranscript of Charlie Rose's Interview With John J. MackDealBook100% (2)

- Defibering UnitDocument3 pagesDefibering UnitArie MambangNo ratings yet

- Transportation, Investment, and Staffing OptimizationDocument3 pagesTransportation, Investment, and Staffing Optimizationjuice0% (1)

- Plastic MoneyDocument13 pagesPlastic MoneyMaliha IrshadNo ratings yet

- Religare Securities ProjectDocument54 pagesReligare Securities ProjectKartikeya Mittal100% (1)

- Sanjay Industries Ltd financial statements preparationDocument2 pagesSanjay Industries Ltd financial statements preparationMittal Kirti MukeshNo ratings yet

- Case Study 1 Assesment of Housing KAHEDocument65 pagesCase Study 1 Assesment of Housing KAHEAnuja Jadhav100% (1)

- HP Court Fees ActDocument58 pagesHP Court Fees ActKaran AggarwalNo ratings yet

- The National Stock ExchangeDocument4 pagesThe National Stock ExchangeChintan VoraNo ratings yet

- MOD HDB TirumalaDocument4 pagesMOD HDB Tirumalajafer patanNo ratings yet

- Company OverviewDocument9 pagesCompany OverviewMj Nazario100% (1)

- Esr 2008 09 enDocument379 pagesEsr 2008 09 enrssonnetNo ratings yet

- Report 1 Si 3656 Belmawa PPK Ormawa 2023 t1 10 Juli 2023Document21 pagesReport 1 Si 3656 Belmawa PPK Ormawa 2023 t1 10 Juli 2023Dhea AnandaNo ratings yet

- DMAS Financial Statement 31 Mar 2022Document82 pagesDMAS Financial Statement 31 Mar 2022Fendy HendrawanNo ratings yet

- Charles Schwab Stock - Consider SCHW For Market-Beating Returns - Seeking AlphaDocument3 pagesCharles Schwab Stock - Consider SCHW For Market-Beating Returns - Seeking AlphateppeiNo ratings yet

- UST Golden Notes Negotiable InstrumentsDocument72 pagesUST Golden Notes Negotiable InstrumentsJoannaNo ratings yet

- Economic Development Through Entrepreneurship - Government, University and Busin PDFDocument265 pagesEconomic Development Through Entrepreneurship - Government, University and Busin PDFDESY SURYANINo ratings yet

- National Sugar Policy - 2010 PDFDocument27 pagesNational Sugar Policy - 2010 PDFJames KisaaleNo ratings yet

- Success in Business StudiesDocument114 pagesSuccess in Business StudiessamuelsamahongoNo ratings yet

- Rights and Liabilities of SuretyDocument22 pagesRights and Liabilities of SuretyPAYAL SINGHNo ratings yet

- NY Quarterly ST-100 Sales Tax FilingDocument4 pagesNY Quarterly ST-100 Sales Tax FilingzilchhourNo ratings yet

- Remedies and Prescriptive Periods: Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods: Prepared By: Dr. Jeannie P. LimMaria Emma Gille Mercado100% (1)

- Different Areas of Frauds in BanksDocument4 pagesDifferent Areas of Frauds in BanksKush SinghNo ratings yet

- Kisan Vikas Patra & Public Provident FundDocument17 pagesKisan Vikas Patra & Public Provident FundDhruvil ShahNo ratings yet

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSManishNo ratings yet

- eBay Order Tracking for Finance BookDocument3 pageseBay Order Tracking for Finance BookGuillermo Esteban Gómez MachucaNo ratings yet

- Anmol Biscuits Financial AnalysisDocument34 pagesAnmol Biscuits Financial AnalysisRachit KhareNo ratings yet

- Reyes Vs CA 5Document6 pagesReyes Vs CA 5Lester TanNo ratings yet