Professional Documents

Culture Documents

Phillip SKS Format

Uploaded by

priyaranjanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Phillip SKS Format

Uploaded by

priyaranjanCopyright:

Available Formats

INSTITUTIONALEQUITYRESEARCH

SKSMicrofinance(SKSMIN)

Favourableoperatingenvironment

13November2014

INDIA|NBFCs|InitiatingCoverage

Marketsharetoriseinthefastgrowingmicrofinanceindustry

ThemicrofinanceindustrywillgrowataCAGRof20%overthenext45yearstotouch

Rs1.83tnfromitscurrentsizeofRs763bn.NBFCMFIsmarketshareshouldriseto60%

from the current 40% over the same period. Since SKS Micro Finance is the largest

NBFCMFI,ittendstogrowatanacceleratedpacewesee35%compoundedannual

growthrateoverthenext45years,translatingintoahighermarketshareof4%from

itscurrent2.25%.

Severalfactorsallayregulatoryandpoliticalrisk

RBI acts as the sole regulator for this segment and issues directives on operational

parameters. Around 90% of the industry players, including SKS, are under RBIs

supervisionthisallaysconcernsaboutanodalregulatoryauthoritybeingpresentand

providesconfidencetostakeholders.Establishmentofcreditbureausaddressconcerns

ofcreditdisciplineandwillensurebetterassetqualitymanagement.Microfinanceisa

sensitivesubjectandwillalwaysbesubjectedtopoliticalriskSKSismanagingthisin

themosteffectivewaybywideningthegeographicalspreadofitsportfolio.

Fastrevenuegrowthandcrosssellingtodriveearnings

Its loan portfolio will see a robust 41% CAGR over FY1417 given the favourable

operatingenvironmentanditstoplinegrowthwillmirrorthisgrowthbecausemargins

are regulated. However, crossselling of various products and services will aid return

ratios.

Scalablemodel+technologytoprovideoperatingleverage

SKSintendstoimplementitsgrowthobjectiveswithoutaddingtoomanynewbranches

orincurringadditionalcapitalexpenditure.Freshadditionswillbemostlyintheformof

loan officer (will add 1,500 such loan officers annually). It continues to focus on

optimisingitscoststructurebyenhancingtheproductivityofitsemployees,introducing

technologyforexpedientreporting,andreengineeringitsinternalprocesses.Thecost

toAUMratioshoulddeclinefurtherto7%byFY17fromthecurrent9%.

Riskmanagementtools:businessmodel,geography,monitoring

UnderitsJLGmodel,peerpressureactsasabiggestdeterrentagainstgroupmembers

defaulting.Additionally,theestablishmentofcreditbureaushasenabledSKStocheck

the credit history of microcredit borrowers. The wider geographical spread of its

portfolioswillalsokeeppoliticalrisklow.

Politicalriskandnaturaldisasterposeabiggestrisktothesector

WehavenotfactoredanAndhraPradeshlikecrisis(Annexure:3AndhraPradeshCrisis)

intoourestimates,consideringvariousdevelopmentssuchasastrongregulator,self

imposed credit discipline, efficient credit monitoring, and geographically diversified

loanportfolio.EmpoweringstatelegislationtooverridetheRBIdirectivetoNBFCMFIs

mayimpactbusinessprospects.

ValuationandRecommendation

SKSMicrofinanceisexpectedtodeliverstrongearningsataCAGRof42%overFY14

17e with superior return on asset of ~5% and return on equity of +20%. At current

market price of Rs360 the stock trades at 3.4x FY16 ABVPS of Rs107.5 & 2.8x FY17

ABVPSofRs132.WeinitiatecoveragewithaBUYratingwithapricetargetofRs503

pershare.

Page|1|PHILLIPCAPITALINDIARESEARCH

BUY

CMPRS360

TARGETRS503(+40%)

COMPANYDATA

O/SSHARES(MN):

MARKETCAP(RSBN):

MARKETCAP(USDBN):

52WKHI/LO(RS):

LIQUIDITY3M(USDMN):

PARVALUE(RS):

126

46

0.8

373/141

11.9

10

SHAREHOLDINGPATTERN,%

PROMOTERS:

FII/NRI:

FI/MF:

NONPROMOTERCORP.HOLDINGS:

PUBLIC&OTHERS:

9.3

57.5

15.3

4.2

13.8

PRICEPERFORMANCE,%

ABS

RELTOBSE

1MTH

25.1

18.7

3MTH

34.8

26.6

1YR

157.5

119.6

PRICEVS.SENSEX

160

140

120

100

80

60

40

20

0

Apr11 Apr12 Apr13 Apr14

SKSFinance

BSESensex

Source:PhillipCapitalIndiaResearch

KEYFINANCIALS

PreprovROE(%)

PreprovROA(%)

NetProfit(Rsmn)

%growth

EPS(Rs)

AdjBVPS(Rs)

ROE(%)

P/E(x)

Adj.P/BV(x)

FY14 FY15E

19.9

22.1

3.4

5.5

701 1587

123.6 126.3

6.5

12.6

42.3

78.9

16.5

21.5

56.3

29.0

8.6

4.6

FY16E

24.4

6.8

1923

21.2

17.8

107.5

17.4

20.5

3.4

Source:PhillipCapitalIndiaResearchEst.

ManishAgarwalla(+912266679962)

magarwalla@phillipcapital.in

SKSMICROFINANCE INITIATINGCOVERAGE

InvestmentThesis

Our investment thesis for SKS Microfinance is based on stable regulatory scenario;

favorable industry outlook and improvement in credit underwriting and monitoring

standards.ToplinegrowthofSKStomirrorloanportfoliogrowth,whichweexpectto

grow at a CAGR of 41% CAGR over FY1417. Because of regulated margin in micro

finance business, net interest income growth will reflect the growth in asset under

management (AUM). However, initiatives like cross sell, cost optimization and

contained credit cost will translate into a robust 55% compounded annual growth

rate in profit before tax. Profit after tax is expected to witness 42% compounded

annualgrowthrate(asthecompanywillhavetopayMATfromFY16onwards).We

expect SKS to maintain return on asset of +5% and return on equity of +20% on a

sustainable basis. At current market price of Rs365 the stock trades at 3.4x FY16

ABVPSofRs107.5&2.8xFY17ABVPSofRs132.

A favourable operating environment, strong business and earnings, and a superior

returnratiowarrantsapremiumvaluation.Webelievethathighoperatingcostand

regulated margin will restrict new entrants. Due to the unsecured nature of the

business, only a diversified portfolio only can sustain any credit risk.As SKS is an

establishedplayerwithawelldiversifiedpresence,sizeableloanportfolio,andisthe

largestNBFCMFI(Bandhan,thelargestMFI,receivedabankinglicense),itstandsina

sweetspottoridethemicrofinancegrowthcycle.WeinitiatecoveragewithaBUY

ratingwithapricetargetofRs503pershare.

ValuationMethodology

DCFExcessReturnValuation

ReturnonEquity=

RetentionRatio=

Expectedgrowthrate=

Costofequity=

sss

Year

NetIncome(Rsbn)

EquityCost(Rsbn)

ExcessEquityReturn(Rsbn)

TerminalValueofExcessReturn(Rsbn)

CumulatedCostofEquity

PresentValue(Rsbn)

Sss

BeginningBVofEquity(Rsbn)

CostofEquity(%)

EquityCost(Rsbn)

sss

ReturnonEquity(%)

NetIncome(Rsbn)

DividendPayoutRatio(%)

RetainedEarnings(Rsbn)

sss

EquityInvested(Rsbn)=

PVofEquityExcessReturn(Rsbn)=

ValueofEquity(Rsbn)=

Numberofshares(Inbn)=

ValuePerShare=

Highgrowth Stablegrowth

stage

Phase

22.00%

20.00%

100.00%

50.00%

22.00%

10.00%

13.40%

13.00%

1

1.9

1.1

0.7

1.1

0.7

2

2.3

1.4

0.9

3

2.8

1.7

1.1

4

3.4

2.1

1.3

5

4.1

2.5

1.6

6

5.0

3.1

2.0

2.0

1.0

7

6.2

3.8

2.4

2.3

1.1

8

7.5

4.6

2.9

2.6

1.1

1.2

0.7

1.4

0.8

1.6

0.8

1.8

0.9

9

10 TerminalYear

9.2 11.2

12.2

5.6

6.8

7.9

3.6

4.3

4.3

149.4

2.9

3.3

1.2 46.8

8.5

10.4

12.6

15.4

18.8

23.0

28.0

34.2

41.7

50.8

55.9

13.4

13.4

13.4

13.4

13.4

13.4

13.4

13.4

13.4

13.4

1.1

1.4

1.7

2.1

2.5

3.1

3.8

4.6

5.6

6.8

13.0

7.1

22.0

1.9

0.0

1.9

22.0

2.3

0.0

22.0

2.8

0.0

22.0

3.4

0.0

22.0

4.1

0.0

22.0

5.0

0.0

3.4

4.1

5.0

22.0

9.2

0.0

9.2

20.0

11.2

0.1

2.8

22.0

7.5

0.0

7.5

22.0

11.2

0.0

2.3

22.0

6.2

0.0

6.2

11.2

8.5

54.9

63.4

0.1

503

Source:Company,PhillipCapitalIndiaResearch

PHILLIPCAPITALINDIARESEARCH|2|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

Marketsharetoriseinthefastgrowingmicrofinanceindustry

ThemicrofinanceindustrywillgrowataCAGRof20%overthenext45yearsto

touchRs1,828bnfromthecurrentRs763bn.

NBFCMFIswillgainmarketsharetotouch60%fromcurrent40%.

SKSMicroFinance,beingthelargestNBFCMFI,tendstogrowatanaccelerated

pace we see 35% compounded annual growth rate over next 45 years,

translatingintoanenhancedmarketshareof4%fromthecurrent2.25%.

Microfinance in India started evolving in the early 1980s when informal selfhelp

groups (SHG) were formed for providing access to financial services to people who

weredeprivedofcreditfacilities.Currently,NationalBankforAgricultureandRural

Development(NABARD)andSmallIndustriesDevelopmentBankofIndia(SIDBI)are

devoting their financial resources and time towards the development of

microfinance.TheIndianmicrofinancesectorshouldgrowataCAGRof20%over45

yearstotouchasizeofaboutRs1.8trnfromthecurrentmarketsizeofRs0.8trn.It

hasenormousgrowthpotentialas41%ofIndianhouseholdsstilldonothaveaccess

toformalbankingservices.

These institutions are organised under three models: Self Help Group (SHG),

Grameen model/jointliability groups, and individual banking groups as in

cooperatives. As of March 2014, both SHGbank linkages (bank provided micro

financecreditthroughselfhelpgroup)andMFIscollectivelyhaveoutstandingloans

ofRs763billion.

Marketshare:Basedongrossloanportfolio

Basedondisbursement

Bandhan

SKS

22%

24%

23%

Spandana

26%

Janalakshmi

Share

Ujjivan

3%

11%

4%

4%

Equitas

Satin

8%

5%

6%

7%

7%

3%

Asmitha

4%

4%

14%

4%

4%

Muthoot(Panchratna)

Others

5%

6%

7%

Source:Company,PhillipCapitalIndiaResearch,Sadhan

As per the 2011 census, the total number of households under formal banking

services in India is 145mn (59%) of which rural are 91mn (54% of total rural

households) and 53mn are urban (68% of total urban households). The untapped

78mnruralhouseholdsprovideabigopportunityformicrofinancelenders.Assuming

allruralhouseholdsarepotentialcustomers(onecustomerperhousehold),theclient

baseforthemicrofinancesegmentcanincreasefromthecurrent110mnhouseholds

to190mnhouseholds.

Considering a credit outstanding of only Rs 9,700 per customer (current loan per

customeratRs6,900+factoringanannualinflationof7%),themicrofinancemarket

canreachasizeofRs1.8trnfromthecurrentlevelofRs0.8trninnext45years.

PHILLIPCAPITALINDIARESEARCH|3|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

Microfinanceindustry

Clientoutreach,mn

SHG

NBFCMFIs

Total

188

200

110

80

40

86

77

96

92

103

85

77

69

66

63

60

54

94

CAGR6%

CAGR21%

120

CAGR11%

160

23

27

32

27

28

33

FY09

FY10

FY11

FY12

FY13

FY14

0

FY19e

Source:Company,PhillipCapitalIndiaResearchEstimates,Sadhan

Microfinanceindustry

Grossloanportfolio,Rsbn

NBFCMFIs

Total

1828

SHG

2000

763

462

302

608

385

223

556

FY10

347

209

FY09

312

216

280

183

464

400

227

173

400

800

528

1200

731

CAGR10%

CAGR29%

1097

CAGR19%

1600

0

FY11

FY12

FY13

FY14

FY19e

Source:Company,PhillipCapitalIndiaResearchEstimates,Sadhan

The NBFCMFI sector in India has gone through two phases in its lifecycle so far.

Phase 1 was high growth (20062010) and phase2 was the Andhra Pradesh crisis

(Annexure: 3 Andhra Pradesh Crisis) and consolidation (201013). The sector has

gained momentum in its 3rd phase (current) and is expected to see accelerated

growth.Thisphaseischaracterisedbyamorestableregulatoryenvironment,steady

availability of funds, improving profitability with comfortable asset quality, and

capitaladequacyandrelativelylesserimpactofconcentrationrisk.

Hence, we expect that NBFCMFIs will gain 60% market share in thenext 45years

(from the current 40%) to due to favourable operating environment and superior

model(Annexure:2SHGModelvs.jointliabilitymodel).SinceSKSisthelargestNBFC

MFI, it should see accelerated growth, thus gaining market share in a fastgrowing

industry. We expect SKS market share to increase from 2.25% (% of overall

microfinanceloanoutstandingincludingthatofSHG)to4%inthenext45years.

PHILLIPCAPITALINDIARESEARCH|4|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

SKSMicrofinanceclientoutreachandloanportfolio

Clientoutreach,mn

SKSMicrofinancemarketshare

Loanoutstanding,Rsbn

7%

78

80

70

6%

CAGR15%

CAGR35%

5%

60

50

40

35

29

30

17

15

14

20

10

7%

6%

90

5 8

FY10

FY11

FY12

FY13

FY14

4%

4%

4%

3%

2.5%

2%

12

2.3%

1.4%

1%

0%

FY09

FY19e

FY09

FY10

FY11

FY12

FY13

FY14

FY19e

Source:Company,PhillipCapitalIndiaResearchEstimates

PHILLIPCAPITALINDIARESEARCH|5|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

Severalfactorsallayregulatoryandpoliticalrisk

RBInowactsasasoleregulatorandissuesdirectivesonoperationalparameters.

Around90%ofindustryplayers,includingSKS,areunderRBIssupervisionthis

allaysconcernsabouttheexistenceofanodalregulatoryauthorityandprovides

confidencetovariousstakeholders.

Establishment of credit bureaus addresses the concern surrounding credit

disciplineandensuresbetterassetqualitymanagement.

Microfinance(beingasensitivesubject)willalwaysbesubjectedtopoliticalrisk.

A wider geographical spread of portfolio is the most effective way to manage

this.

RBIactsasasoleregulatorformicrofinancelendersanditissuedaseparatesetof

directives for MFIs categorising the segment as nonbanking finance company

microfinanceinstitute(NBFCMFIs).NBFCMFIsaretightlyregulatedbytheRBIwith

Micro Finance Institutions Network (MFIN) acting as the SRO (selfregulatory

organisation). SKS satisfies the conditions mentioned under the RBIs directive

including qualifying asset criteria, asset classification and provisioning, pricing of

credit,andcapitalrequirementetc.therefore,itwasalsoreclassifiedasaNBFC

MFI.

The advent of the central regulator has allayed various stakeholders (banks, equity

investors,borrowers)concerns,whichhasresultedinrestorationofbankfundingto

the segment and flow of capital from various equity investors. The Government of

IndiahadpresentedtheMicrofinanceInstitutions(DevelopmentandRegulation)Bill,

2012 (MFIBill 2012) before the Parliamentof India in May2012. TheMFI Bill 2012

provided for the development and regulation of microfinance institutions and

envisaged empowering the RBI to issue directions to MFIs in connection with

prudential norms, corporate governance norms, and operations. The bill was

introduced in theLok Sabhain May, 2012 and was later referred to the standing

committee (headed by former finance minister Mr. Yashwant Sinha) for perusal.

However,thestandingcommitteedidnotapprovethedraftlegislationandreturned

theMFIBill2012statingthatthecurrentBillwasunacceptableinthepresentform;

the Standing Committee suggested that Centre must have wider consultations with

theStateGovernmentsandstakeholdersandarriveataconsensusonvitalissues.

The standing committee also recommended the setting up of a unified and

independent regulator Micro Finance Development and Regulatory Council

(MFDRC)fortheentiremicrofinancesector.Undernewgovernment,revisedMicro

FinanceBillwillbeintroducedintheparliament.

KeyhighlightsofRBIsdirectiveforNBFCMFIs

Parameters

Capital

requirement

Qualifying asset

criteria

PSL Norms for

NBFCMFI

Regulation

Capital adequacy ratio consisting of tier1 and tier2. Capital which shall not be less

than15%ofitsaggregateriskweightedassets.

Thetotaloftier2capitalatanypointoftimeshallnotexceed100%oftier1capital.

Income of borrowers P.A. Rural <= Rs 60,000; Urban <= Rs 120,000. Ticket size Rs

35,000(1stcycle)&Rs50,000(subsequent).

TotalindebtednessofborrowertobelessthanRs50,000.Tenure>=24monthsifloan

sizeinmorethanRs15,000.

Collateralfreeloanwithrepaymentmodelofweekly,fortnightly,ormonthlycollection.

Nopenaltyfordelayedpayment.

Qualifyingassetstoconstitutenotlessthan85%ofitstotalassets(excludingcashand

bankbalances).

Atleast70%ofloansforincomegenerationactivities.

ThecaponmarginsasdefinedbyMalegamCommitteemaynotexceed10%forlarge

MFIs(loansportfoliosexceedingRs1bn)and12%fortheothers.

The funding for loans fulfilling the above mentioned criteria qualifies for indirect

PHILLIPCAPITALINDIARESEARCH|6|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

agricultureexposureunderPSL.

Loanprocessingfee<=1%

Standardasset(090days);substandardasset(91180days);lossasset(>180days)

Asset

classification

Provision

norms

Standard asset (1% of overall portfolio); substandard asset (50% of instalment

overdue);lossasset(100%ofinstalmentoverdue).Note:Theaggregateloanprovision

willbemaintainedathigherof1%ofoverallportfolioorsumofprovisioningforsub

standardandlossassets

Source:Company,RBI,PhillipCapitalIndiaResearch

Theneedtoavoidmultiplelendingtopreventoverindebtednesshasbeenkeenlyfelt

by MFIs after the Andhra Pradesh microfinance situation and especially after RBIs

subsequentlegislationprohibitingmultiplelending.MFIsarealsorequiredtobecome

a member of at least one credit bureau through which they will share client data

periodically and generate client reports before making decisions on loan

disbursements.

ThenumberofMFIsthathavejoinedcreditbureaushasbeenincreasing,andthereis

a significant initiative to check the credit history of microcredit borrowers and

understand their credit behaviour, repayment patterns, existence of multiple

borrowings,andriskofoverindebtedness.Currently,almostallMFIsarereportingto

creditbureaus,whichhaveover100mnclientrecords,andgeneratemorethan1mn

reportseverymonthforMFIsbeforetheyapproveloanstoborrowers.SKS,beingone

of the pioneer members, adopted the practice of credit check with credit bureaus

suchasEquifaxorHighmarkforeachdisbursement.

Microfinanceisasensitivesubjectandwillalwaysbesubjectedtopoliticalrisk.Wider

geographicalspreadofportfolioisthemosteffectivewaytomanagethis.SKShasa

welldiversified portfolio, spread over 16 states. Learning from the Andhra Pradesh

crisis, SKS has diversified its portfolio it has no more than 15% exposure to any

particular state. At the time of the Andhra Pradesh crisis, its exposure to the

erstwhilestatewas30%.

Geographicaldistributionofloanportfolio

1.8

1.2

1.1

3.9

15.8

4.3

5.5

5.7

15.7

8.4

13.7

10

11.7

Orissa

karnataka

westBengal

Bihar

Maharashtra

Uttarpradesh

Madhyapradesh

kerela

Rajashthan

Jharkhand

Punjab

Haryana

Chattisgarh

Uttranchal

Source:Company,PhillipCapitalIndiaResearch

SKSloandisbursementpolicy

Metric

state

District

Branch

NPA

Collectionefficiency

Capondisbursement

<15%

<3%

<1

NodisbursementtoabranchwithNPA>1%

Nodisbursementtoabranchwithontimecollectionefficiencyof<95%

Source:Company,PhillipCapitalIndiaResearch

PHILLIPCAPITALINDIARESEARCH|7|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

Fastrevenuegrowthandcrosssellingtodriveearnings

SKS loan portfolio will see robust 41% CAGR, given the favourable operating

environment.

Toplinegrowthwillmirrorloanportfoliogrowthduetoregulatedmargin.

Improved financial parameters and well capitalised balance sheet enabled a

ratingupgrade,resultingineasyavailabilityoffundsatcompetitivecosts.

Crosssellingofvariousproductsandserviceswillaidthereturnratio.

Robustgrowthintheloanportfolio:SKSprovidessmallvalueloansandcertainother

basic financial services to its members (Annexure: 1 SKS operating model). Its

members are predominantly located in rural areas in India, and loans extended to

themaremainlyforuseinsmallbusinessesorforotherincomegeneratingactivities

andnotforpersonalconsumption.

SKS:Portfoliodistributionbasedonactivities

livestock

Tailoring&clothweaving

Grocerystoreandotherretailoutlet

16%

25%

Masonry,painting,plumbing,electrician,ca

rpenterandrelated

Tradingofvegitable&fruits

3%

4%

Tradingofagricommodity

5%

vehiclerepair

11%

6%

Eateries

Agriculture

6%

9%

8%

Garment&Footwearretailing

8%

Otherincomegeneratingactivities

Source:Company,PhillipCapitalIndiaResearch

SKS revenue growth is directly linked to its loan portfolio growth, given a cap on

margin (cost plus 10%). Being one of the largest microfinance institutions, the

company should benefit from the favourable operating environment. Its

disbursementsshouldseerobustCAGRof35%andloanportfolioshouldseeaCAGR

of41%overFY1417,drivenbynewclientadditions.

Trendinloanportfolioandnetinterestincome

GrossloanPortfolio,Rsbn

Grwth%(rhs)

Grwth%(rhs)

150%

50

100%

40%

20%

40

0%

20

50%

10

0

0%

4.0

20%

40%

2.0

60%

1.0

80%

0.0

100%

FY17e

FY16e

FY14

FY15e

FY13

FY12

FY11

100%

FY10

FY17e

FY16e

FY15e

FY14

FY13

FY12

80%

FY11

0

FY10

60%

20%

5.0

3.0

40%

20

40%

6.0

FY17e

60

30

60%

FY16e

0%

50%

7.0

FY14

80

40

80%

FY15e

20%

100%

8.0

FY13

100

Grwth%(rhs)

9.0

FY12

60%

120

60

FY11

80%

NetInterestIncome,Rsbn

FY10

140

Disbursement,Rsbn

Source:Company,PhillipCapitalIndiaResearchEstimates

PHILLIPCAPITALINDIARESEARCH|8|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

SKSnewclientadditionsareexpectedtobearound4mn,takingthetotalclientbase

to 9.8mn in the next three years, driven by factors such as new branch/centre and

increased client base in existing centres. The branch and centre network should

increase to 1,435 (1,255 at the end of FY14) and 289,913 (228,188 at the end of

FY14),respectively,byFY17.

SKSclientbasetouched7.3mninFY11,i.e.,beforetheAndhraPradeshcrisis.Non

availabilityoffunds(bankslimitedcreditlinesaftertheAPcrisis)reducedSKSability

toserviceitsclientsanditsclientbasedeclinedto5mnbyFY13.Availabilityoffunds

fromthebankingsystemandstrongdemandforitssecuritisedpaperwillprovidethe

necessary resources to reach out to more clients, which were not serviced so far.

EfficientuseoftechnologywillenableSKStoaddmoreclientstoexistingcentresthus

improvingtheoperationalefficiencies.

Clientoutreach

(nos)

FY10

FY11

Branches

2,029

2,379

Centres

226,017 274,782

No.ofMembers(mn)

6.8

7.3

FY12

FY13

1,461

1,261

229,600 216,234

5.4

5.0

FY14

1,255

228,188

5.78

FY15e

1,285

239,597

6.0

FY16e

1,335

263,557

7.8

FY17e

1,435

289,913

9.8

Source:Company,PhillipCapitalIndiaResearchEstimates

Exploring multiple funding avenues: Primary sources of funding for NBFCMFIs are

bank loans and securitisation. After the crisis, scheduled commercial banks limited

their funding to the MFI sector due to the latters high delinquency. Even

securitisationdealsdeclined,giventhefragilestateoftheindustry.

Gradually,themarketstabilised,therewasclarityontheregulatoryfront,fairpricing

practiceswereadopted,andcreditbureauswereestablished.AllthisallowedNBFC

MFIs to recapitalise their balance sheets, which helped their performance, in turn

resulting in better availability of funds and a rating upgrade. The cost of bank

borrowingsdeclinedwithdiminishingcreditrisk.Borrowingcosts,whichwereatbase

rate +400bps immediately after the Andhra Pradesh crisis, declined to base rate

+250bps. Securitisation regained its ground with improved business fundamentals

(because securitisation deals are usually done in Q4, its share in overall funding

appears very high at the end of fiscal we expect yearend securitised funding

sourcetoremainhigh,upwardsof45%).

FundingSource

Bank

Financialinstitution

NBFC

Securitisation

FY09

48%

17%

0%

35%

FY10

44%

16%

2%

38%

FY11

64%

12%

2%

23%

FY12

44%

8%

1%

47%

FY13

58%

7%

0%

35%

FY14

45%

6%

2%

48%

Source:Company,PhillipCapitalIndiaResearch

SKSisexploringvariousfundingoptionssuchascommercialpapermarket,external

commercialborrowing,andnonconvertibledebenturestoreduceitsfundingcosts.It

recentlyissuedRs300mnworthofcommercialpaper.Thedeclineinfundingcostwill

be passed on to the borrower due to regulated margins. However, we believe that

thedeclineinthelendingratewillbeseenasamanifestationoffairpricingpractice

andenablesSKStowardoffanynegativepublicperceptionagainstMFIs.

Crossselling of various products and services to enhance RoA: SKS leverages its

networktodistributefinancialandnonfinancialproductsofotherinstitutionstoits

members (customers) at a cost that is lower than competition. Its network also

allows such distributors to access a segment of the market to which many do not

otherwise have access. While the focus continues on its core business of providing

microcredit services, it continues to diversify into other businesses involving fee

basedservicesandsecuredlending(suchasgoldloans).Itsobjectiveintheseother

PHILLIPCAPITALINDIARESEARCH|9|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

businesses is to focus on lending that will allow it to maintain repayment rates,

increase member loyalty, and also provide economic benefits to its members and

their families. Such other products and services offering fee income will allow it to

increaseitsoverallRoA.

Financialproductsandservicesotherthanmicrocreditinclude:providingloanstoits

members for the purchase of mobile handsets in association withNokia IndiaSales

PrivateLimited,securedloanstoitsmembersagainstgoldascollateral,andloansto

its members to facilitate the purchase of solar lamps in association with D.Light

Energy Private Limited. Another product in the pilot phase is loans for sewing

machines.SKSearnsacommissionfromthemanufacturersforfacilitatingthesaleof

theseproducts.Apartfromgoldloans,alltheseloansareunsecuredandforproducts

thatenhancesmemberproductivityinitseconomicactivities.

Creditbreakup

Solarlamp

1%

Nonmicro

credit

5%

Microcredit

95%

Mobile

0%

Gold

4%

Source:Company,PhillipCapitalIndiaResearch

Tax liability to remain low in medium term: SKS had carried forward deferred tax

assets (DTA) worth Rs 5.58bn by the end of FY14. As the DTA gets utilised against

future profit, the tax rate in normal circumstances will be NIL (until the entire DTA

provisionisutilised).Whilethecompanywillbesubjectedtominimumalternatetax,

for FY15, theeffective tax shouldbenil as SKS will continue to writeoff its Andhra

Pradesh loan portfolio (completely provided) in order to avoid MAT. As per our

estimate,SKStaxincidencewillbenilforFY15andat20%inFY1621.

Rsmn

Deferredtaxasset(DTA)

MATcredit

OutstandingProvisiononAPportfolio

PBT

Taxliability(innormalcase)

DTAutilised

Writeoff

Effectivetax(MAT)

Effectivetaxrate

FY15e

5038

0

202

1588

540

540

1588

0

0%

FY16e

4227

416

0

2386

811

811

202

416

17%

FY17e

3108

1043

0

3291

1119

1119

0

658

20%

Source:Company,PhillipCapitalIndiaResearchEstimates

PHILLIPCAPITALINDIARESEARCH|10|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

DuPontAnalysis

Interestonloan

Incomeonsecuritisation

Loanprocessingfee

Incomefromoperations

financialexpenses

Netinterestincome

Otherincome

Totalincome

Operatingexpenses

Operatingprofit

provisionandcontingencies

Profitbeforetax

Tax

Profitaftertax

leverage

Returnonequity

FY10

21.5

2.7

0.4

24.6

8.1

16.5

2.4

18.9

9.9

9.0

1.4

7.6

2.6

4.9

4.4

21.5

FY11

24.7

2.9

0.2

27.8

8.3

19.5

2.6

22.1

12.3

9.8

5.7

4.1

1.5

2.7

3.1

8.2

FY12

11.9

1.2

0.3

13.4

6.7

6.7

2.3

9.0

14.0

5.0

39.0

44.0

1.2

45.2

2.7

122.8

FY13

10.4

2.8

1.1

14.3

6.8

7.5

2.4

9.9

12.4

2.5

11.6

14.1

0.0

14.1

5.1

72.0

FY14

15.7

2.2

1.3

19.3

8.6

10.7

2.5

13.2

9.8

3.4

0.6

2.8

0.0

2.8

5.9

16.5

FY15e

17.4

2.1

1.5

21.0

8.0

13.0

3.1

16.1

10.7

5.5

0.1

5.3

0.0

5.3

4.0

21.5

FY16e

17.9

1.9

1.4

21.2

8.0

13.2

3.1

16.3

9.8

6.5

0.7

5.8

1.1

4.7

3.7

17.4

FY17e

18.3

1.7

1.4

21.5

8.1

13.4

2.3

15.7

9.1

6.6

0.7

5.9

1.1

4.8

4.2

20.2

Source:Company,PhillipCapitalIndiaResearchEstimates

PHILLIPCAPITALINDIARESEARCH|11|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

Scalablemodel+technologytoprovideoperatingleverage

SKS intends to implement its growth objectives without adding a significant

numberofnewbranchesorincurringadditionalcapitalexpenditure.

FreshadditionofheadcountwillbeinSangammanagers(loanofficers),withan

annualrunrateof1,500loanofficer.

SKS will continue to focus on optimising its cost structure, which includes

enhancing employee productivity, introducing technology for expedient

reporting,andreengineeringtheinternalprocesses.

ThecosttoAUMratioshoulddeclinefurtherfrom9%to7%byFY17.

SKS provides collateralfree credit to most of its members in their own

neighbourhoods,anditsSangamManagers(loanofficers)assistwiththeprocessesof

credit verification. While this helps its borrowers save on travel costs, it results in

high operating expenses, particularly personnel and administrative costs. Personnel

costs were 67% of its operating expenses in FY14. It has embarked on cost

optimisation initiatives by improving its ratio of borrowersperSangamManager,

while realising the benefits of economies of scale. The borrowersperSangam

Managerratiowas411asof31stMarch2012,andhasimprovedto944by2014.

SKS merged its branches, both in undivided Andhra Pradesh and other states. It

intends to implement its growth objectives without adding a significant number of

newbranchesorincurringadditionalcapitalexpenditure.Therewasanetreduction

ofapproximately200branchesinFY13andsixbranchesinFY14.Itstotalheadcount

was reduced from 16,194 as of 31st March 2012 to 8,932 as of 31st March 2014.

Though thecapital expenditure may notbe at a rapidpacecompared withbalance

sheetgrowth,SKSdoesnotwanttoholdbackinanenvironmentwhichisfavourable

for growth. Considering the huge potential for client addition and expansion of

centresunderway,thefreshadditionofheadcountwouldbeSangammanagers(loan

officers)withanannualrunrateof1,500loanofficers.

Otherfactorsthatthecompanycontinuestofocusonisoptimisingcoststructure

including enhancing employee productivity, introducing technology for expedient

reporting, and reengineering internal processes. SKS has completed all branch

connectivitywithdailyMISflowtotheheadoffice.Thishasenabledbettertreasury

and cash management, reduced the need of maintaining high cash balances at

branches,andreducedoperatingcost(costofmanagingcashishigh).Theresultsof

cost optimisation are seen in a 42% fall in operating expenses between FY12 and

FY14. The costtoassetundermanagement ratio declined over the last few years

andshouldkeepfalling.

SKS other technology initiatives are refactoring of its inhouse lending system for

effective monitoring and control, enabling loan officers with handheld devices to

improveproductivity,andmobilebankinginordertomakedisbursementscashless.

These initiatives will lead to an improvement in the clientperloanofficer ratio as

wellasafallinthecashbalanceinitsbalancesheet.

Improvingoperatingefficiency

Clientperloanofficer

Cashaspercenttototalasset(rhs)

CosttoAUMratio

16%

1200

14%

12%

1000

10%

800

8%

600

6%

400

4%

2%

200

0%

FY09 FY10 FY11 FY12 FY13 FY14 FY15e FY16e FY17e

0

FY11

FY12

FY13

FY14

FY15e FY16e FY17e

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Source:Company,PhillipCapitalIndiaResearchEstimates

PHILLIPCAPITALINDIARESEARCH|12|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

Riskmanagementtools:businessmodel,geography,monitoring

Underthejointliabilitygroupmodel,peerpressureactsasabiggestdeterrentto

groupmembersdefaulting.

Theestablishmentofcreditbureausenablesthelendertocheckcredithistoryof

microcreditborrowers.

Wider geographical spread of portfolio is the most effective way to manage

politicalrisk.

SKS has an advantage over banks because of its strong Joint Liability Group (JLG)

model. It has been rigorous in its approach towards customer education and

monitoringofitscustomerbehaviour,whichmakesitstandoutfrombanks.

Under its jointliability grouplending model, SKS lends solely to women borrowers

(similartotheGrameenBankmodel)inthismodel,womenguaranteeeachothers

loans.TherearethreereasonswhySKSlendsonlytowomen:1)womentendtouse

resourcesmoreproductivelythanmen;2)theyaremorelikelytoinvestmostoftheir

incomebackintothehousehold;3)theyaremorelikelytoavoidriskyventuresand

insteaduseloanstoundertakesmall,manageableactivities.

SinceallthemembersinthegroupareliabletorepayanyloansundertheJLGmodel,

peer pressure acts as a biggest deterrent for the group members to default. The

collection efficiency has been very encouraging under the JLG model. The

establishment of credit bureaus enables the lender to check the credit history of

microcredit borrowers andunderstandtheir credit behaviour, repayment patterns,

existenceofmultipleborrowings,andriskofoverindebtedness.

Microfinanceisasensitivesubjectandwillalwaysbesubjectedtopoliticalrisk.Awider

(geographic)portfoliospreadisthemosteffectivewaytomanagethis.SKShasawell

diversifiedportfoliospreadover16states.LearningfromtheAndhraPradeshcrisis,SKS

doesnothavemorethan15%exposuretoanyparticularstate.Similarly,ithasputina

disbursement cap per district and per branch. It also follows a stringent NPA

recognitionpolicy>60daysoverduevs.the>90daysprescribedbytheregulator.

Having completely provided for its Andhra Pradesh exposure, any improvement in the

operating environment could be value accretive for SKS. It has obtained interim relief

fromtheSupremeCourttorestartlendingandcollectionactivitiesinthestate.Theapex

courthasrelaxedsomeofthecriterialaiddownintheAndhraPradeshMicrofinanceAct,

2010.Whilethisispositive,andSKShasrestartedoperations,ithasdonesoinalimited

way. The company has preferred to wait for the parliaments sanction of the MFI Bill,

2012,soastoavoidanypossibleconfrontationwiththestategovernment.

Trendinassetquality

NNPA,%

101

98

FY13

FY14

95.1

95

1.6%

0.8%

1.0%

1.2%

0.7%

1.0%

94

4.8%

0.9%

0.2%

FY11

10.9%

2.4%

1.3%

7.2%

FY10

97.3

96

0.1%

0.9%

0.3%

0.2%

2.3%

FY09

0.4%

0.3%

0.2%

1.0%

20%

99.9

97

17.7%

30%

99.9

99

20.1%

40%

Collectionefficiency(%)

100

37.2%

33.7%

50%

10%

Creditcost,%loanportfolio

52.1%

GNPA,%

60%

FY15e

FY16e

FY17e

93

0%

92

FY12

FY13

FY14

FY11

FY12

Source:Company,PhillipCapitalIndiaResearchEstimates

PHILLIPCAPITALINDIARESEARCH|13|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

KeyRisk

Politicalriskandnaturaldisasterposeabiggestrisktothesector

WehavenotfactoredAndhraPradeshlikecrisisinourestimatesconsideringvarious

developments like strong regulator; selfimposed credit disciple; efficient credit

monitoringandgeographicallydiversifiedloanportfolio.Empoweringstatelegislation

tooverridetheRBIdirectivetoNBFCMFImayimpactthebusinessprospects.

Nonavailabilityoffundmayimpactbusinessgrowth

Banks are primary funding source for SKS Microfinance. Around 86% of on book

fundingrequirementissourcedfrombanks.Anydisruptioninflowoffundstoimpact

thebusinessgrowthandourassumptionofrobust41%CAGRinloanbookoverFY14

17e.MostofthebankshaverestoredfundingtoSKSgivenitsimprovedfinancialsand

strongcapitalbase.

Highattritionrate

Employee strength of the SKS Microfinance was 8,932 as on March 31, 2014. The

manpower distribution shows that the field staff in branch offices is 7,731 (86.6%)

and Head Office & Regional Office staff is 1,201 (13.4%). Voluntary attrition rate

duringFY14was26.1%.StudydonebyMFII(MicrofinanceInstituteofIndia)suggest

high attrition for the industry ranges between 6% 53%. The high attrition is in the

fieldofficersegment,whichmayimpactbusinessgrowthandreduceproductivity.

PHILLIPCAPITALINDIARESEARCH|14|P a g e

COMPANYNAME INITIATINGCOVERAGE

Annexure:1

SKSBusinessmodel

The company is primarily engaged in providing microfinance to lowincome

individuals in India. SKS Microfinances core business is providing small value loans

and certain other basic financial services to its members (customers), who are

predominantlylocatedinruralareasinIndia.ThesemembersuseSKSloansmainly

for small businesses or for other incomegenerating activities; they are not usually

used for personal consumption. These individuals often have no access (or very

limitedaccess)toloansfrominstitutionalsourcesoffinancing.

In its core business, SKS uses a villagecantered, grouplending model to provide

unsecuredloanstoitsmembers.Thismodelreliesonaformofsocialcollateraland

ensures credit discipline through peer support within the group. SKS believes this

model makes members prudent in conducting their financial affairs and prompt in

repayingtheirloans.Ifanindividualborrowerfailstomaketimelyrepayments,other

members in the group will not be able to borrow from SKS in the future. In such a

situation, the group usually uses peer pressure to encourage the delinquent

borrowertomaketimelyrepaymentsorwilloftenmakearepaymentonbehalfofa

defaulting borrower, effectively providing an informal joint guarantee on the

borrowersloan.

Under its jointliability grouplending model, SKS lends solely to women borrowers

(similartotheGrameenBankmodel)inthismodel,womenguaranteeeachothers

loans.TherearethreereasonswhySKSlendsonlytowomen:1)Womentendtouse

resourcesmoreproductivelythanmen;2)Theyaremorelikelytoinvestmostoftheir

incomebackintothehousehold;3)Theyaremorelikelytoavoidriskyventuresand

insteaduseloanstoundertakesmall,manageableactivities.

SKSsapproachistoprovidefinancialservicesatthedoorstepofmembersinvillages

and urban colonies. This allows its customers convenience and savings in terms of

cost and time associated with travelling to mainstream banks. It also enables SKS

staff to promptly and fully collect repayments. SKS loans are designed for

convenience with small weekly repayments corresponding to cash flows. Small first

loansinculcatecreditdisciplineandcollectiveresponsibility.

SKSusesafivememberJointLiabilityGroup(JLG)lendingmethodologybasedonthe

Grameen Bank model, where each member of the group serves as the ultimate

guarantorforeachofitsmembers.Further,multiplegroups(4to10)ofmembersina

singlevillagearecombinedtogetherasaSangam(centre).TheSangamisresponsible

for the repayment of all groups, creating a dual jointliability system, where the

Sangampaysincaseanyofthegroupdefaultsonpayment.Thecentremeetsevery

week, where the Sangam Manager (Loan Officer) collects loan application forms,

disbursesloans,andcollectsloaninstalments.

PHILLIPCAPITALINDIARESEARCH|15|P a g e

COMPANYNAME INITIATINGCOVERAGE

ThewayMFIsoperateinIndia

Selectionofvillages

Beforestartingoperations,staffconductsvillagesurveystoevaluatelocalconditions

like population, poverty level, road accessibility, political stability, and means of

livelihood.

GroupFormation

Womenformselfselectedfivemembergroupstoserveasguarantorsforeachother.

Experience has shown that a fivemember group is small enough to effectively

enforcegrouppeerpressureand,ifnecessary,largeenoughtocoverrepaymentsin

caseamemberneedsassistance.

CompulsoryGroupTraining

CGTisafourdayprocessconsistingofhourlongsessionsdesignedtoeducateclients

onSKSprocessesandproceduresandtoalsobuildacultureofcreditdiscipline.Using

innovativevisualandparticipatoryteachingmethods,SKSstaffintroducesclientsto

itsfinancialproductsanddeliverymethods.CGTalsoteachesclientstheimportance

ofcollectiveresponsibility,howtoelectgroupleaders,howtoaffixsignatures,anda

pledge that serves as a verbal contract between SKS and its members. During this

training period, SKS staff collects quantitative data on each client to ensure

qualification requirements are met, as well as to record baseline information for

futureanalysis.Onthefourthday,clientstakeaGroupRecognitionTestconducted

by a different staff member than the one who trained them. If they pass, they are

officiallyacceptedasSKSmembers.

CentreMeetings

DuringCentreFormation,groupsarecombinedtoformacentreof3to10groupsor

15 to 50 members. Weekly Centre meetings serve as a time to conduct financial

transactions. Meetings are held early in the morning, so as to not interfere with

clientsdailyactivities.Aleaderanddeputyleaderareselectedtofacilitatemeetings

and ensure compliance with SKS procedures. In addition to financial transactions,

membersusetheweeklymeetingstodiscussnewloanapplicationsandcommunity

issues. Centre meetings are conducted with rigid discipline in order to sustain the

environmentofcreditdisciplinecreatedinCGT.

KeyfeaturesofJLGModel

Fivemembersgroupsarethebasicunits

58suchgroupsconstituteabranch(Centre)

Centresmeetonceaweek

Disbursementsandcollectionsaremadeincentremeetings

GroupsandCentresappraisetheloansandundertakejointliability

AllCentremeetingsareattendedbythestaffofMFI

Flatrateofinterestcalculation

StartedbyGrameenBankofBangladesh

Highlystandardisedprocesses

Manyadoptersallovertheworld

PHILLIPCAPITALINDIARESEARCH|16|P a g e

COMPANYNAME INITIATINGCOVERAGE

Annexure:2

SKSsJLGmodelversusthebanksSHGlinkagemodel

SelfHelpGroupModel

InitiatedinIndiainthe1980s

Clientsmaybemenorwomen

Agroupof1020individuals

Isanindependententity

IsusuallypromotedbySelfHelpPromotingInstitutions(SHPIs)orMFIs

Havetheirownbankaccountsandbooksofaccounts

SHGscollectsavingsandgiveloanstotheirmembers

Canborrowontheirownaccount

SHGscanexecutedocuments

Arerecognisedbygovernment

Alsotakeupsocialissues

SHGhasitsrootinsocialdevelopment

Banksprovideloansonlyafter6monthsofgroupformation

JLGModel

Agroupcomprising5members

410suchgroupsconstituting2050membersformingacentre

UsuallypromotedbyanMFI

Mainlypromotedforloans,notinternaltransactions

Nobankaccounts

NobooksofaccountsaremaintainedbyJLGs

HavetodependonMFIforalltheirloanrequirement

Arenotrecognisedbythegovernment

Cannotexecutedocuments

JLGhasitsrootsinmicrofinance

LoansprovidedimmediatelybytheMFIsafterthegroupisformed

WhyistheJLGmodelmoresuccessfulthanbanksSHGmodel?

EventhoughSHG(selfhelpgroup)linkageprogrammemadeimpressiveprogressin

thelasttwodecades,thelastfewyearshaveseenstagnationintheircreditgrowth.

Themainreasonswere:1)inSHG,groupformationisperceivedasameanstoavailof

governmentsubsidiesandentitlements,whichalsoledtoanincreaseinthenumber

of multiple memberships, and 2) the financing banks were also ill prepared for the

sudden spurt in SHG loans and their monitoring and supervision of such loans

becamelessregular(andeventotallyabsentattimes!).

FreshloanstoSHGshavebeennearstagnantforlastfewyears,thoughitshoweda

marginalrisein201213.However,aregionwiseanalysisshowsadisturbingfeature

Southern and Central regions show an increase of nearly 20% and 10% in the

numberofSHGsthatextendedfreshloans;theNorthernregion,too,sawamarginal

increase of 1.74%. All other regions points to negative growth in the numbers.

BackwardstatessuchasBihar,ChhattisgarhandJharkhandreportedadeclineofover

20%whileNorthEasternStatesrecordedahigh50%decline.

PHILLIPCAPITALINDIARESEARCH|17|P a g e

COMPANYNAME INITIATINGCOVERAGE

SHGlendingbybanksishighlyconcentratedinSouthernIndia

Source:Company,PhillipCapitalIndiaResearch

MountingNPAsinSHGlending

From an envious record of almost 100% recovery, the NPAs of SHG loans by banks

havereachedanalarminghighofover7%ofloansoutstandingagainstthem.More

painfulisthefactthatloanstoSHGsinthemostresourcepoorregionsinthecountry

reportedNPAsofover10%.GNPAsinSHGstoodat7.08%in201213thisfigure

wasjust2.9%in200910.Thisexplainswhybankshavebeenwaryoflendinginthe

SHG segment. Southern region with an NPA of 5.11% was the lowest while Central

regionwithanalarming17.3%wasthehighest.OfgraveconcernarethehighNPAsin

major states like Madhya Pradesh (21.16%), Uttar Pradesh (18.22%), Odisha

(18.27%),TamilNadu(10.81%)andKerala(12.38%)

Alarmed by the steady increase in the NPAs of loans to SHGs, NABARD undertook

studies in two important states Uttar Pradesh and Odisha to understand the

underlyingreasonsforthespurt.

Thestudieshighlightedthefollowingreasons:

Focus on group formation for availing subsidy from the government, not self

helporgroupdynamics.

Some groups were not functioning at all no regular meetings, no records of

transactions, not trained / exposed to SHG functioning, no regular internal

savingsorlendingandmembersnotevenawareofthedefaultofloans.

Self Help Promoting Institutions (SHPIs) do not provide the escort services

necessary to nurture the SHGs, rather more target oriented and confined to

linkingthegroupswithbanksfordisbursementofloanandsubsidy.

Banks have largely left the issue of monitoring / supervising the group

functioning to the SHPIs, and there were no regular postdisbursement follow

ups.

Widespread prevalence of middlemen / agents for SHGbank linkage, even for

depositingthesavingsamountthisledtopilferages.

NopropercreditappraisalorratingofSHGswasdonebeforeextendingtheloans

No proper training to the bank staff or to SHPIs/SHG members before groups

werelinkedtobanks.

Wilful default and external environment was not conducive to regular loan

repayment.

PHILLIPCAPITALINDIARESEARCH|18|P a g e

COMPANYNAME INITIATINGCOVERAGE

Annexure3:

AndhraPradeshMicrofinanceCrisis

AndhraPradeshhasthehighestconcentrationofmicrofinanceoperationswith17.31

million SHG members and 6.24 million MFI clients. The total microfinance loans in

AndhraPradeshincludingbothSHGsandMFIsstoodatRs157,692mnwithaverage

loanoutstandingperpoorhouseholdatRs62,527,whichisthehighestamongallthe

statesinIndia.

Thisdataimpliesthatthestateishighlypenetratedbymicrofinance(bothMFIsand

SHGs) giving rise to multiple borrowing. The average household debt in Andhra

PradeshwasRs65,000vs.nationalaverageofRs7,700.Thishighpenetrationofboth

SHGsandMFIsalsoledtostiffercompetitionforclientoutreachbetweenthestate

and private financial providers resulting in wider conflict of interest. To arrest the

growthofMFIsandtostemtheallegedabusivepracticesadoptedbytheMFIs,the

state government promulgated an ordinance on October 16, 2010. In December

2010,theOrdinancewasenactedintoTheAndhraPradeshMicrofinanceInstitutions

(RegulationofMoneylending)Act,2010.

The ordinance was a result of a series of suicides attributed to the alleged abusive

practices of MFIs such as charging high interest rates, adopting coercive collection

practices,andlendingaggressivelybeyondtherepaymentcapacityoftheborrowers

ratherthanhelpingthepoorgetoutofpoverty.Accordingtoonereportmorethan

77ruralpeoplehavebeendriventosuicidesunabletobearthecoercionunleashed

bytheirrecoveryagents.Oneofthekeystepstheordinancehasproposedissetting

upoffasttrackcourtsineverydistrictforMFIrelatedissues.

AsofJanuary,2011,theMFIrepaymentratesfellfrom99%rightbeforetheissuance

of the ordinance to less than 20%. The stringent regulations set by the state

government(suchasmonthlyrepayments,allMFIbranchestoberegisteredwiththe

government, no door to door collection of repayments etc.) coupled with active

encouragementbythelocalpoliticians,ledtothefallinrepaymentlevels.SomeMFIs

suchasStarMicroFinSociety,asmallNGOMFI,faced0%repaymentrateinurban

operationareasand2%inruralareasvs.100%beforetheMFIOrdinance.

This, along with other reasons, led to what is commonly termed as the AP crisis.

Thecrisisunderminedthegrowthandindeedtheveryexistenceofcommercialised

microfinanceinstitutions.ThecrisishadanimpactnotonlyinthestateofAPbutalso

throughout India with many MFIs facing issues raising funds, expanding operations,

etc.

MultipleBorrowing

A key findingof the CMF study onAccess to Finance in Andhra Pradesh was that

multipleborrowingisextremelycommonamongruralpoor,withanestimated84%

ofhouseholdshavingtwoormoreloansfromanysource.Thefindingsalsoimplied

thatmanycasesofmultipleborrowingappeartobedrivenbyaninabilitytoobtain

sufficient credit from a single source as suggested by data collected on timing and

purposesofloans.

Thestudyfurtherbroughtoutthathouseholdshadtakenmorethanoneloanwithin

twosuccessivemonthsinthepastyear36%of428households(153households)

reported taking more than one loan within two successive months mostly from

informalsourcesinthepastyear.

PHILLIPCAPITALINDIARESEARCH|19|P a g e

COMPANYNAME INITIATINGCOVERAGE

Distributionoftotalloans

60%

DistributionofTotalLoans

50%

40%

30%

20%

10%

0%

2Loans

3Loans

4Loans

5Loans

6Loans

Source:Company,PhillipCapitalIndiaResearch

SourcesofCredit

CMFs study highlighted that respondentsdid not borrow from banks because they

did not have enough savings to open bank accounts; they perceived opening bank

accountswasexpensiveandamajorityofthemhadnoideaabouttheprocess.

MajorSource

AnyBank

SHGs

MFIs

Informal

PercentageofHouseholdswithLoanOutstanding

2009

2012

34%

33%

55%

57%

9%

6%

67%

64%

Source:Company,PhillipCapitalIndiaResearch

Accordingtomicrosave,inmorethan80%ofthefocusgroupsessions,respondents

listed SHGs, moneylenders, andMFIsas the most popular options in order to meet

theircreditrequirements.Mostrespondentsdidnotpreferbankingservicesdespite

the presence of banking network in the study areas. Respondents cited inordinate

delays,cumbersomeprocedures,andcomplexdocumentationrequirementsofbanks

asthemajorreasonsfornotpreferringbanksasasourceofcredit.

AftertheAPMFIcrisis

After the Andhra Pradesh Microfinance crisis, certain large MFIs with their

headquarters and substantial portion of their businesses located within the state

weremoresignificantlyandadverselyaffected.IntheyearfromAugust2012,several

of the big commercially oriented NBFCMFIs had recovered their confidence as the

banksbegantosupplyfundsagaintoMFIs.InvestorsregainedtheirinterestinMFIs,

primarilythoselocatedoutsideAndhraPradesh,resultinginariseinthenumberof

investments in MFIs. The guidelines issued by the RBI also brought about a more

orderly manner of operation for MFIs, which improved the credibility of the MFI

sectorasanindustrywithgreatertransparencyandlessrisk.

The situation for the NGOMFI sector also referred to as the nonprofit or

communitybasedmicrofinancesectorappearstobedifferent.Manysectorleaders

believethatinthecurrentscenario,theseMFIs,majorityofwhicharesmallandlocal

in terms of their operational focus, will not fare as well. As the focus is almost

completely concentrated on the regulated NBFC sector, NGOMFIs are generally

strugglingtorecover.

PHILLIPCAPITALINDIARESEARCH|20|P a g e

COMPANYNAME INITIATINGCOVERAGE

Several prominent Andhra Pradeshbased MFIs other than SKS Microfinance have

continuedtoexperiencenegativeornegligiblebusinessgrowth,despiteexpirationin

June2013ofthemoratoriumforloanrepaymentgrantedbythebanksaspartofan

earlierloanrestructuringdeal.InJuly2013,fivetroubledMFIsBhartiyaSamruddhi

Finance Limited (BASIX), Spandana, Share, Asmitha Microfin Limited and Trident

Microfin Private Limited, sought RBIs permission for a second round of loan

restructuring,whichwassubsequentlyturneddown.

BackgroundoftheAPMFIAct

Andhra Pradesh had a unique position of leadership within the Indian microfinance

industry up until 2010, evidenced by the presence of the four largest MFIs in India

withinthestate.InMarch2010,AndhraPradeshaccountedformorethan30%ofall

borroweraccountsandoutstandingloanportfoliosofMFIs.

Even though the Andhra Pradesh Government made significant investments in

subsidising financial inclusion through SBL programs, MFIs continued to increase

financingtotheircustomers.AnaddedfeatureofthishighlevelofMFIlendinginthe

statewaslowdefaultrateswithportfolioatriskbeinglessthan1.0%formostofthe

MFIs.Incontrast,theSBLprogramsreportedmuchhigherdefaultrates.

ImpactoftheAPMFIAct

The APMFI Ordinance and the APMFI Act had an immediate impact on the

recoveriesbyMFIs.ThestringentregulationssetbytheAPMFIAct,particularlythe

inability to hold centre meetings for repayment of loans, led to a significant fall in

repaymentlevels.Recoveryratesthatwereashighas99.0%plummetedtoaslowas

10.0% in Andhra Pradesh. There was no effective way by which the MFIs could

enforcerepaymentsandthisbecameamajorconcernfortheMFIsectorinAndhra

Pradesh.

AccordingtotheStateoftheSectorReport2011,theamountoftotalunpaidloans

extendedbyMFIstoaroundfivemillionborrowerswasapproximatelyRs70bn.Inthe

short run, this dampened credit supply and encouraged a lack of credit discipline.

Given the consequences of restrictive regulatory changes and surge in non

repayments by clients, MFIs in Andhra Pradesh greatly reduced or stopped lending

operationsafterNovember2010.

PHILLIPCAPITALINDIARESEARCH|21|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

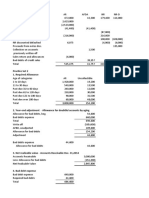

Financials

ValuationRatios

IncomeStatement

Y/EMar,Rsmn

Interestincomeonportfolioloans

Incomefromassignedloans

loanprocessingfee

IncomefromOperations

OtherIncome

Totalrevenue

Financialexpenses

NetInterestIncome

Personnelexpenses

Operatingandotherexpenses

Depreciationandammort

Totaloperatingcost

Preprovisionprofit

Provisionandwriteoffs

Profitbeforetax

Taxexpense

Profitaftertax

FY14

3930

557

338

4828

623

5451

2142

2686

1656

766

41

2462

847

146

701

0

701

FY15e

5188

632

452

6275

937

7212

2399

3876

2241

903

42

3185

1627

40

1587

0

1587

FY16e

7367

823

570

8763

1251

10014

3287

5476

2926

1066

42

4034

2693

300

2393

470

1923

FY17e

10314

1057

769

12142

1222

13365

4536

7606

3766

1279

43

5089

3740

420

3320

620

2700

BalanceSheet

Y/EMar,Rsmn

LIABILITIES

Equitysharecapital

Reservesandsurplus

Networth

Borrowingfrombanks

Borrowingfromfinancialinstitution

BorrowingfromNBFCs

TotalBorrowings

CurrentLiabilities&Provisions

TotalLiabilities

FY14

FY15e

FY16e

FY17e

1082

3313

4592

13212

1646

455

15313

5068

24973

1260

8699

10156

17175

2370

667

20213

3652

34020

1082

10623

11902

24217

3318

965

28500

4799

45200

1082

13323

14612

33904

4645

780

39330

6270

60212

ASSETS

TotalFixedassets

Portfolioloans

Advances

Otherassets

Cashandbankbalances

TotalAssets

112

17207

321

563

6710

24966

124

24486

325

682

8360

34020

138

34371

330

843

9484

45200

153

47843

334

1023

10830

60212

Source:Company,PhillipCapitalIndiaResearchEstimates

PreprovisionOperatingRoAE(%)

RoAE(%)

PreprovisionOperatingROA(%)

RoAA(%)

EPS(Rs.)

Dividendpershare(Rs.)

BookValue(Rs.)

AdjBV(Rs.)

FY14 FY15e

19.9

22.1

16.5

21.5

3.4

5.5

2.8

5.4

6.5

12.6

0.0

0.0

42.4

80.6

42.3

78.9

RevenueAnalysis:

InterestincomeonIBA(%)

InterestcostonIBL(%)

NIMonIBA/AWF(%)

NetinterestincometoAUM(%)

Otherincome/AWF(%)

Op.Exp/TI(%)

Op.Exp/AWF(%)

Op.Exp/AUM(%)

Employeeexps/Opexps(%)

Tax/Pretaxearnings(%)

29.7

13.6

11.0

7.5

2.6

74.4

15.1

9.0

67.3

0.0

AssetQuality:

GNPAs/GrAdv(%)

NNPAs/NetAdv(%)

Provision&contingencies/GrAdv(%)

GrowthRatio:

Advances(%)

Borrowings(%)

Networth(%)

NetIntIncome(%)

Otherincome(%)

NonIntExp(%)

ProfitBeforeTax(%)

Netprofit(%)

Asset/LiabilityProfile

AvgAdv/AvgBorrowing(%)

Avgcash/Avgasset(%)

Incrnetworth/asset(%)

Leverage(x)

CapitalAdequacyRatio:

CRAR(%)

TierI(%)

NNPAstoEquity(%)

FY16e

24.4

17.4

6.8

4.9

17.8

0.0

110.0

107.5

FY17e

28.2

20.4

7.1

5.1

25.0

0.0

135.0

132.0

30.1

13.5

13.5

8.6

3.3

66.2

15.3

8.6

70.3

0.0

29.8

13.5

14.2

9.0

3.2

60.0

13.7

7.9

72.5

19.6

29.5

13.4

14.7

9.4

2.4

57.6

12.4

7.2

74.0

18.7

17.7

0.1

0.9

10.9

0.9

0.2

1.8

0.8

1.0

2.3

0.7

1.0

12.4

5.4

17.6

69.2

21.4

6.2

123.6

123.6

42.3

32.0

121.2

44.3

50.4

29.4

126.3

126.3

40.4

41.0

17.2

41.3

33.5

26.6

50.8

21.2

39.2

38.0

22.8

38.9

2.3

26.1

38.7

40.4

103.2

31.3

2.7

4.4

117.4

25.5

18.9

2.3

120.8

22.5

4.4

2.8

121.2

19.3

5.1

3.1

27.2

27.2

0.3

35.8

35.8

2.2

28.2

28.2

2.2

24.2

24.2

2.2

PHILLIPCAPITALINDIARESEARCH|22|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

Management

VineetBhatnagar(ManagingDirector)

JigneshShah(HeadEquityDerivatives)

(9122)23002999

(9122)66679735

Research

Automobiles

DhawalDoshi

PriyaRanjan

Banking,NBFCs

ManishAgarwalla

PradeepAgrawal

PareshJain

(9122)66679769

(9122)66679965

(9122)66679962

(9122)66679953

(9122)66679948

Consumer,Media,Telecom

NaveenKulkarni,CFA,FRM (9122)66679947

VivekanandSubbaraman

(9122)66679766

ManishPushkar,CFA

(9122)66679764

Cement

VaibhavAgarwal

Economics

AnjaliVerma

(9122)66679967

Engineering,CapitalGoods

AnkurSharma

(9122)66679759

HrishikeshBhagat

(9122)66679986

Infrastructure&ITServices

VibhorSinghal

(9122)66679949

VarunVijayan

(9122)66679992

Midcap

VikramSuryavanshi

Metals

DhawalDoshi

Oil&Gas,AgriInputs

GauriAnand

DeepakPareek

(9122)66679768

Retail,RealEstate

AbhishekRanganathan,CFA (9122)66679952

NehaGarg

(9122)66679996

Technicals

SubodhGupta,CMT

(9122)66679762

ProductionManager

GaneshDeorukhkar

(9122)66679966

DatabaseManager

VishalRandive

(9122)66679944

(9122)66679951

(9122)66679769

(9122)66679943

(9122)66679950

Sr.ManagerEquitiesSupport

RosieFerns

(9122)66679971

(9122)66679969

Sales&Distribution

KinshukBhartiTiwari

AshvinPatil

ShubhangiAgrawal

KishorBinwal

SidharthAgrawal

BhavinShah

Pharma

SuryaPatra

CorporateCommunications

(9122)66679946

(9122)66679991

(9122)66679964

(9122)66679989

(9122)66679934

(9122)66679974

DipeshSohani

SalesTrader

DileshDoshi

SuniilPandit

Execution

MayurShah

(9122)66679756

ZarineDamania

(9122)66679976

(9122)66679747

(9122)66679745

(9122)66679945

ContactInformation(RegionalMemberCompanies)

SINGAPORE

PhillipSecuritiesPteLtd

250NorthBridgeRoad,#0600RafflesCityTower,

Singapore179101

Tel:(65)65336001Fax:(65)65353834

www.phillip.com.sg

MALAYSIA

PhillipCapitalManagementSdnBhd

B36BlockBLevel3,MeganAvenueII,

No.12,JalanYapKwanSeng,50450KualaLumpur

Tel(60)321628841Fax(60)321665099

www.poems.com.my

HONGKONG

PhillipSecurities(HK)Ltd

11/FUnitedCentre95QueenswayHongKong

Tel(852)22776600Fax:(852)28685307

www.phillip.com.hk

JAPAN

PhillipSecuritiesJapan,Ltd

42NihonbashiKabutocho,Chuoku

Tokyo1030026

Tel:(81)336662101Fax:(81)336640141

www.phillip.co.jp

INDONESIA

PTPhillipSecuritiesIndonesia

ANZTowerLevel23B,JlJendSudirmanKav33A,

Jakarta10220,Indonesia

Tel(62)2157900800Fax:(62)2157900809

www.phillip.co.id

CHINA

PhillipFinancialAdvisory(Shanghai)Co.Ltd.

No550YanAnEastRoad,OceanTowerUnit2318

Shanghai200001

Tel(86)2151699200Fax:(86)2163512940

www.phillip.com.cn

THAILAND

PhillipSecurities(Thailand)PublicCo.Ltd.

15thFloor,VorawatBuilding,849SilomRoad,

Silom,Bangrak,Bangkok10500Thailand

Tel(66)222680999Fax:(66)222680921

www.phillip.co.th

FRANCE

King&ShaxsonCapitalLtd.

3rdFloor,35RuedelaBienfaisance

75008ParisFrance

Tel(33)145633100Fax:(33)145636017

www.kingandshaxson.com

UNITEDKINGDOM

King&ShaxsonLtd.

6thFloor,CandlewickHouse,120CannonStreet

London,EC4N6AS

Tel(44)2079295300Fax:(44)2072836835

www.kingandshaxson.com

UNITEDSTATES

PhillipFuturesInc.

141WJacksonBlvdSte3050

TheChicagoBoardofTradeBuilding

Chicago,IL60604USA

Tel(1)3123569000Fax:(1)3123569005

AUSTRALIA

PhillipCapitalAustralia

Level37,530CollinsStreet

Melbourne,Victoria3000,Australia

Tel:(61)396298380Fax:(61)396148309

www.phillipcapital.com.au

SRILANKA

AshaPhillipSecuritiesLimited

Level4,MillenniumHouse,46/58NavamMawatha,

Colombo2,SriLanka

Tel:(94)112429100Fax:(94)112429199

www.ashaphillip.net/home.htm

INDIA

PhillipCapital(India)PrivateLimited

No.1,18thFloor,UrmiEstate,95GanpatraoKadamMarg,LowerParelWest,Mumbai400013

Tel:(9122)23002999Fax:(9122)66679955www.phillipcapital.in

PHILLIPCAPITALINDIARESEARCH|23|P a g e

SKSMICROFINANCE INITIATINGCOVERAGE

DisclosuresandDisclaimers

PhillipCapital (India) Pvt. Ltd. has three independent equity research groups: Institutional Equities, Institutional Equity Derivatives and Private Client Group. This report has been

preparedbyInstitutionalEquitiesGroup.Theviewsandopinionsexpressedinthisdocumentmayormaynotmatchormaybecontraryattimeswiththeviews,estimates,rating,

targetpriceoftheotherequityresearchgroupsofPhillipCapital(India)Pvt.Ltd.

ThisreportisissuedbyPhillipCapital(India)Pvt.Ltd.whichisregulatedbySEBI.PhillipCapital(India)Pvt.Ltd.isasubsidiaryofPhillip(Mauritius)Pvt.Ltd.Referencesto"PCIPL"inthis

reportshallmeanPhillipCapital(India)Pvt.Ltdunlessotherwisestated.ThisreportispreparedanddistributedbyPCIPLforinformationpurposesonlyandneithertheinformation

containedhereinnoranyopinionexpressedshouldbeconstruedordeemedtobeconstruedassolicitationorasofferingadviceforthepurposesofthepurchaseorsaleofany

security,investmentorderivatives.TheinformationandopinionscontainedintheReportwereconsideredbyPCIPLtobevalidwhenpublished.Thereportalsocontainsinformation

providedtoPCIPLbythirdparties.Thesourceofsuchinformationwillusuallybedisclosedinthereport.WhilstPCIPLhastakenallreasonablestepstoensurethatthisinformationis

correct,PCIPLdoesnotofferanywarrantyastotheaccuracyorcompletenessofsuchinformation.Anypersonplacingrelianceonthereporttoundertaketradingdoessoentirelyat

his or her own risk and PCIPL does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements and past

performanceisnotnecessarilyanindicationtofutureperformance.

Thisreportdoesnothaveregardtothespecificinvestmentobjectives,financialsituationandtheparticularneedsofanyspecificpersonwhomayreceivethisreport.Investorsmust

undertake independent analysis with their own legal, tax and financial advisors and reach their own regarding the appropriateness of investing in any securities or investment

strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. In no circumstances it be used or

consideredasanoffertosellorasolicitationofanyoffertobuyorselltheSecuritiesmentionedinit.Theinformationcontainedintheresearchreportsmayhavebeentakenfrom

tradeandstatisticalservicesandothersources,whichwebelievearereliable.PhillipCapital(India)Pvt.Ltd.oranyofitsgroup/associate/affiliatecompaniesdonotguaranteethat

suchinformationisaccurateorcompleteanditshouldnotberelieduponassuch.Anyopinionsexpressedreflectjudgmentsatthisdateandaresubjecttochangewithoutnotice

Important:Thesedisclosuresanddisclaimersmustbereadinconjunctionwiththeresearchreportofwhichitformspart.Receiptanduseoftheresearchreportissubjecttoall

aspectsofthesedisclosuresanddisclaimers.Additionalinformationabouttheissuersandsecuritiesdiscussedinthisresearchreportisavailableonrequest.

Certifications:Theresearchanalyst(s)whopreparedthisresearchreportherebycertifiesthattheviewsexpressedinthisresearchreportaccuratelyreflecttheresearchanalysts

personalviewsaboutallofthesubjectissuersand/orsecurities,thattheanalysthavenoknownconflictofinterestandnopartoftheresearchanalystscompensationwas,isorwill

be,directlyorindirectly,relatedtothespecificviewsorrecommendationscontainedinthisresearchreport.TheResearchAnalystcertifiesthathe/sheorhis/herfamilymembers

doesnotownthestock(s)coveredinthisresearchreport.

Independence/Conflict:PhillipCapital(India)Pvt.Ltd.hasnothadaninvestmentbankingrelationshipwith,andhasnotreceivedanycompensationforinvestmentbankingservices

from, the subject issuers in the past twelve (12) months, and PhillipCapital (India) Pvt. Ltd does not anticipate receiving or intend to seek compensation for investment banking

servicesfromthesubjectissuersinthenextthree(3)months.PhillipCapital(India)Pvt.Ltdisnotamarketmakerinthesecuritiesmentionedinthisresearchreport,althoughitorits

employees, directors, or affiliates may hold either long or short positions in such securities. PhillipCapital (India) Pvt. Ltd may not hold more than 1% of the shares of the

company(ies)coveredinthisreport.

SuitabilityandRisks:Thisresearchreportisforinformationalpurposesonlyandisnottailoredtothespecificinvestmentobjectives,financialsituationorparticularrequirementsof

anyindividualrecipienthereof.Certainsecuritiesmaygiverisetosubstantialrisksandmaynotbesuitableforcertaininvestors.Eachinvestormustmakeitsowndeterminationasto

theappropriatenessofanysecuritiesreferredtointhisresearchreportbaseduponthelegal,taxandaccountingconsiderationsapplicabletosuchinvestoranditsowninvestment

objectivesorstrategy,itsfinancialsituationanditsinvestingexperience.Thevalueofanysecuritymaybepositivelyoradverselyaffectedbychangesinforeignexchangeorinterest

rates,aswellasbyotherfinancial,economicorpoliticalfactors.Pastperformanceisnotnecessarilyindicativeoffutureperformanceorresults.

Sources,CompletenessandAccuracy:ThematerialhereinisbaseduponinformationobtainedfromsourcesthatPCIPLandtheresearchanalystbelievetobereliable,butneither

PCIPLnortheresearchanalystrepresentsorguaranteesthattheinformationcontainedhereinisaccurateorcompleteanditshouldnotberelieduponassuch.Opinionsexpressed

hereinarecurrentopinionsasofthedateappearingonthismaterialandaresubjecttochangewithoutnotice.Furthermore,PCIPLisundernoobligationtoupdateorkeepthe

informationcurrent.

Copyright:ThecopyrightinthisresearchreportbelongsexclusivelytoPCIPL.Allrightsarereserved.Anyunauthorizeduseordisclosureisprohibited.Noreprintingorreproduction,

inwholeorinpart,ispermittedwithoutthePCIPLspriorconsent,exceptthatarecipientmayreprintitforinternalcirculationonlyandonlyifitisreprintedinitsentirety.

Caution:Riskoflossintradingincanbesubstantial.Youshouldcarefullyconsiderwhethertradingisappropriateforyouinlightofyourexperience,objectives,financialresources

andotherrelevantcircumstances.

ForU.S.personsonly:ThisresearchreportisaproductofPhillipCapital(India)PvtLtd.whichistheemployeroftheresearchanalyst(s)whohaspreparedtheresearchreport.The

researchanalyst(s)preparingtheresearchreportis/areresidentoutsidetheUnitedStates(U.S.)andarenotassociatedpersonsofanyU.S.regulatedbrokerdealerandthereforethe

analyst(s)is/arenotsubjecttosupervisionbyaU.S.brokerdealer,andis/arenotrequiredtosatisfytheregulatorylicensingrequirementsofFINRAorrequiredtootherwisecomply

withU.S.rulesorregulationsregarding,amongotherthings,communicationswithasubjectcompany,publicappearancesandtradingsecuritiesheldbyaresearchanalystaccount.

ThisreportisintendedfordistributionbyPhillipCapital(India)PvtLtd.onlyto"MajorInstitutionalInvestors"asdefinedbyRule15a6(b)(4)oftheU.S.SecuritiesandExchangeAct,

1934(theExchangeAct)andinterpretationsthereofbyU.S.SecuritiesandExchangeCommission(SEC)inrelianceonRule15a6(a)(2).IftherecipientofthisreportisnotaMajor

Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied, duplicated and/or

transmittedonwardtoanyU.S.person,whichisnottheMajorInstitutionalInvestor.

InrelianceontheexemptionfromregistrationprovidedbyRule15a6oftheExchangeActandinterpretationsthereofbytheSECinordertoconductcertainbusinesswithMajor

InstitutionalInvestors,PhillipCapital(India)PvtLtd.hasenteredintoanagreementwithaU.S.registeredbrokerdealer,MarcoPoloSecuritiesInc.("MarcoPolo").Transactionsin

securitiesdiscussedinthisresearchreportshouldbeeffectedthroughMarcoPolooranotherU.S.registeredbrokerdealer.

PhillipCapital(India)Pvt.Ltd.

Registeredoffice:No.1,18thFloor,UrmiEstate,95GanpatraoKadamMarg,LowerParelWest,Mumbai400013

PHILLIPCAPITALINDIARESEARCH|24|P a g e

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)