Professional Documents

Culture Documents

Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch05

Uploaded by

macseuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch05

Uploaded by

macseuCopyright:

Available Formats

1 of 3

1. The preference for consuming goods today instead of waiting to consume those goods in the future is the basis for the

time-value-of-money.

A. True

B. False

2. The time-value-of-money concept assumes that

A. People accept less money only if they have no other choice.

B. People accept less money to reduce the time they must wait.

C. People accept less money to increase the time they must wait.

D. People accept less money if the time they must wait is unaffected.

3. The future value of money in a savings account for one year with annual compounding will be the same whether the value is

calculated using simple interest or compound interest.

A. True

B. False

4. Continuous compounding captures the effect that increasing the number of periods has on a future value.

A. True

B. False

5. Which of the following is true?

A. The future value of an investment will be larger if the investment earns 5% instead of 10%.

B. The future value of an investment will be larger if the investment is for 12 years instead of 6 years.

C. The future value of an investment does not depend on the rate of return that the investment earns.

D. The future value of a cash-flow does not depend on the length of time that the funds are invested.

6. Generally, the future value of an investment will be greater if

A. The investment is compounded at a lower rate of return

B. The investment is compounded at a higher rate of return

C. The investment is discounted at a lower rate of return

D. The investment is discounted at a higher rate of return

7. Principal may be described as the

A. Average balance in a savings account

B. Beginning balance in a savings account

C. Daily balance in a savings account

D. Ending balance in a savings account

8. Dr. Kilic has $300,000 in a stock fund. The fund pays a 10% return, compounded annually. If he does not make another deposit

into the account, how long will it take for the account to increase to $1 million?

A. 23 .33 years

B. 12.63 years

2 of 3

C. 33.33 years

D. 16.66 years

9. As the discount rate increases, the present value of a future cash-flow increases.

A. True

B. False

10. The present value of a future cash-flow:

A. Increases as the discount rate decreases

B. Decreases as the discount rate decreases

C. Increases as the number of discounting periods increases

D. Decreases as the number of discounting periods decreases

11. Assume that potential projects X, Y and Z will each pay a total of $100,000 over 20 years. X pays $8000 per year for 10 years

and $2000 per year for 10 years. Y pays $2000 per year for 10 years and $8000 per year for 10 years. Z pays $5000 per year

for 20 years. Which project is likely to be most attractive to an investor?

A. The project with large cash flows early is likely to be most attractive.

B. The project with large cash flows later is likely to be most attractive.

C. The project with equal cash flows each year is likely to be most attractive.

D. The projects have equal total cash flows and are likely to be equally attractive.

12. Kathleen just received a bonus from EG. She is excited because her dad started his career with EG. If her bonus of $30,000 is

equivalent to the bonus paid to her dad 25 years ago, how much was her dad's bonus? Assume that the average annual

inflation rate was 3.8%.

A. $11,808

B. $15,385

C. $28,902

D. $76,217

13. The Rule of 72 always yields a precise estimate of the length of time it takes for a sum of money to double.

A. True

B. False

14. At what rate must $400 be compounded annually for it to increase to $1432.80 in 10 years?

A. 11.98%

B. 13.61%

C. 25.82%

D. 35.82%

15. Craig is a weightlifter whose maximum lift is 200 pounds. He believes he can increase his maximum by 4% per month for the

next four months. If Craig achieves his goal, his maximum lift will increase to approximately

A. 230 pounds.

B. 232pounds.

3 of 3

C. 234 pounds.

D. 236 pounds.

16. Money has time value because:

A. People prefer to consume things today rather than at some time in the future.

B. People can earn interest on money that is invested.

C. People require compensation for deferring consumption.

D. All of these.

17. Which of the following statements is true?

A. Timelines help us to correctly identify the size and timing of cash flows.

B. A timeline is a horizontal line that starts out at time 0 and shows cash flows as they occur.

C. Timelines can help us solve problems involving multiple cash flows.

D. All of these.

This is the end of the test. When you have completed all the questions and reviewed your answers, press the button below to

grade the test.

1 of 3

100% (17 out of 17 correct)

1. The preference for consuming goods today instead of waiting to consume those goods in the future is the basis for the

time-value-of-money.

A. True

B. False

2. The time-value-of-money concept assumes that

A. People accept less money only if they have no other choice.

B. People accept less money to reduce the time they must wait.

C. People accept less money to increase the time they must wait.

D. People accept less money if the time they must wait is unaffected.

3. The future value of money in a savings account for one year with annual compounding will be the same whether the

value is calculated using simple interest or compound interest.

A. True

B. False

4. Continuous compounding captures the effect that increasing the number of periods has on a future value.

A. True

B. False

5. Which of the following is true?

A. The future value of an investment will be larger if the investment earns 5% instead of 10%.

B. The future value of an investment will be larger if the investment is for 12 years instead of 6 years.

C. The future value of an investment does not depend on the rate of return that the investment earns.

D. The future value of a cash-flow does not depend on the length of time that the funds are invested.

6. Generally, the future value of an investment will be greater if

A. The investment is compounded at a lower rate of return

B. The investment is compounded at a higher rate of return

C. The investment is discounted at a lower rate of return

D. The investment is discounted at a higher rate of return

7. Principal may be described as the

A. Average balance in a savings account

2 of 3

B. Beginning balance in a savings account

C. Daily balance in a savings account

D. Ending balance in a savings account

8. Dr. Kilic has $300,000 in a stock fund. The fund pays a 10% return, compounded annually. If he does not make another

deposit into the account, how long will it take for the account to increase to $1 million?

A. 23 .33 years

B. 12.63 years

C. 33.33 years

D. 16.66 years

9. As the discount rate increases, the present value of a future cash-flow increases.

A. True

B. False

10. The present value of a future cash-flow:

A. Increases as the discount rate decreases

B. Decreases as the discount rate decreases

C. Increases as the number of discounting periods increases

D. Decreases as the number of discounting periods decreases

11. Assume that potential projects X, Y and Z will each pay a total of $100,000 over 20 years. X pays $8000 per year for

10 years and $2000 per year for 10 years. Y pays $2000 per year for 10 years and $8000 per year for 10 years. Z pays

$5000 per year for 20 years. Which project is likely to be most attractive to an investor?

A. The project with large cash flows early is likely to be most attractive.

B. The project with large cash flows later is likely to be most attractive.

C. The project with equal cash flows each year is likely to be most attractive.

D. The projects have equal total cash flows and are likely to be equally attractive.

12. Kathleen just received a bonus from EG. She is excited because her dad started his career with EG. If her bonus of

$30,000 is equivalent to the bonus paid to her dad 25 years ago, how much was her dad's bonus? Assume that the

average annual inflation rate was 3.8%.

A. $11,808

B. $15,385

C. $28,902

D. $76,217

13. The Rule of 72 always yields a precise estimate of the length of time it takes for a sum of money to double.

3 of 3

A. True

B. False

14. At what rate must $400 be compounded annually for it to increase to $1432.80 in 10 years?

A. 11.98%

B. 13.61%

C. 25.82%

D. 35.82%

15. Craig is a weightlifter whose maximum lift is 200 pounds. He believes he can increase his maximum by 4% per month

for the next four months. If Craig achieves his goal, his maximum lift will increase to approximately

A. 230 pounds.

B. 232pounds.

C. 234 pounds.

D. 236 pounds.

16. Money has time value because:

A. People prefer to consume things today rather than at some time in the future.

B. People can earn interest on money that is invested.

C. People require compensation for deferring consumption.

D. All of these.

17. Which of the following statements is true?

A. Timelines help us to correctly identify the size and timing of cash flows.

B. A timeline is a horizontal line that starts out at time 0 and shows cash flows as they occur.

C. Timelines can help us solve problems involving multiple cash flows.

D. All of these.

Retake Test

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch06 PDFDocument7 pagesFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch06 PDFmacseuNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch07Document7 pagesFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch07macseuNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch04Document7 pagesFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch04macseuNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch03Document7 pagesFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch03macseuNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Banking & Finance QuizDocument6 pagesBanking & Finance QuizmacseuNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch01Document6 pagesFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch01macseuNo ratings yet

- Risks of Derivative Markets in BDDocument3 pagesRisks of Derivative Markets in BDAsadul AlamNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- ProblemDocument8 pagesProblemCORES LYRICSNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Analisis Tingkat Kesehatan Bank Dengan Menggunakan Metode Camel Pada PT - Bank Syariah Mandiri (PERIODE 2001-2010) SkripsiDocument98 pagesAnalisis Tingkat Kesehatan Bank Dengan Menggunakan Metode Camel Pada PT - Bank Syariah Mandiri (PERIODE 2001-2010) SkripsiARYA AZHARI -No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Payment of Tax: (SECTION 49 To 53A)Document36 pagesPayment of Tax: (SECTION 49 To 53A)Mehak KaushikkNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Quiz 2 - ACGN PrelimsDocument8 pagesQuiz 2 - ACGN Prelimsnatalie clyde matesNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Covering Letter To Bank or Building SocietyDocument3 pagesCovering Letter To Bank or Building SocietyNick SiddallNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

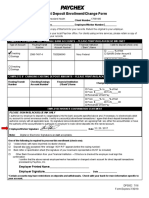

- Paychex DD Form PDFDocument1 pagePaychex DD Form PDFAnonymous 5W3EjvbYNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Asset AccountingDocument52 pagesAsset AccountingVINODREDDY PAGIDINo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- PT-1 Accountancy 2022-23Document3 pagesPT-1 Accountancy 2022-23Ajit HuidromNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sample Form 34 - MOD LOSODocument3 pagesSample Form 34 - MOD LOSOahmad.zakiNo ratings yet

- History of Micro FinanceDocument27 pagesHistory of Micro Financesarkar_12No ratings yet

- Fin0008 Managing Business Finance Formulae Sheet: N I, N 0 I, N N I, N 0 I, N N I, N 0 I, NDocument2 pagesFin0008 Managing Business Finance Formulae Sheet: N I, N 0 I, N N I, N 0 I, N N I, N 0 I, NbnNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Studio Renovations: Barbados Community College Division of Fine Arts - Music MathsDocument10 pagesStudio Renovations: Barbados Community College Division of Fine Arts - Music MathsShanice JohnNo ratings yet

- Chapter 1Document32 pagesChapter 1NthatiNo ratings yet

- IAS 20 and IAS 36 QuestionsDocument6 pagesIAS 20 and IAS 36 QuestionsGonest Gone'stoëriaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Member Statements-04302021Document2 pagesMember Statements-04302021bNo ratings yet

- Kisii UniversityDocument4 pagesKisii Universitystephen maseseNo ratings yet

- A7 Audit of Intangible AssetsDocument4 pagesA7 Audit of Intangible AssetsKezNo ratings yet

- Employees Provident Funds Scheme, 52 Form 20Document3 pagesEmployees Provident Funds Scheme, 52 Form 20AnguchamyNo ratings yet

- AccountStatement-1Document1 pageAccountStatement-1hraza5263No ratings yet

- Subodh Shivtarkar Resume.. 2021Document4 pagesSubodh Shivtarkar Resume.. 2021rm cabsNo ratings yet

- Statement of AccountDocument1 pageStatement of AccountSevuga RajanNo ratings yet

- Statement 1Document6 pagesStatement 1Taliyah GreenNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Solution Manual Investments 11th Edition BodieDocument6 pagesSolution Manual Investments 11th Edition Bodiesunanda mNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- FMAP DirectoryDocument78 pagesFMAP DirectoryZeshan Choudhry100% (1)

- India Infoline Account Opening FormDocument32 pagesIndia Infoline Account Opening FormJuber FarediwalaNo ratings yet

- Iifl Focused Equity Fund: Investment ObjectiveDocument2 pagesIifl Focused Equity Fund: Investment ObjectiveGrishma JainNo ratings yet

- Banking Sector Reforms in IndiaDocument8 pagesBanking Sector Reforms in IndiaAnand KumarNo ratings yet

- CFI - Accounting Fact Sheet PDFDocument1 pageCFI - Accounting Fact Sheet PDFClaudia FilipNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)