Professional Documents

Culture Documents

6 Leverages

Uploaded by

MumtazAhmadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 Leverages

Uploaded by

MumtazAhmadCopyright:

Available Formats

Ph:

98851 25025/26

www.mastermindsindia.com

6. LEVERAGES

SOLUTIONS TO ASSIGNMENT PROBLEMS

Problem No. 1

Calculation of Operating and Financial Leverage:

Rs.

Sales

40,00,000

Less: Variable cost

25,00,000

Contribution (C)

15,00,000

Less: Fixed cost

6,00,000

EBIT

9,00,000

Less: Interest

3,00,000

EBT

6,00,000

Operating leverage =

Contributi on

EBIT

15,00,000

9,00,000

= 1.67

Financial leverage =

EBIT

EBT

9,00,000

6,00,000

= 1.50

Problem No. 2

Contribution

= Sales Variable Cost and

EBIT

= Contribution Fixed Cost

10,00,000

= Contribution 20,00,000

Contribution

= 30,00,000

Operating leverage = C / EBIT = 30,00,000/10,00,000 = 3 times

Financial leverage = EBIT/EBT = 10,00,000/8,00,000

= 1.25 times

Combined leverage = OL x FL = 3 x 1.25

= 3.75 times

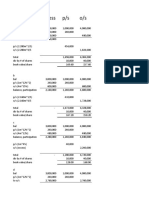

Problem No:3

Preparation of Income Statement of Company A & B

a.

b.

c.

d.

e.

f.

g.

h.

i.

Particulars

Sales Volume (units)

S.P / unit

Less: V.C / unit

Contribution / unit (b-c)

Total Contribution (a x d)

Less: Fixed Cost

EBIT (e-f)

Less: Interest 12% Debt

EBT (g-h)

Company A

60,000

30

10

20

12,00,000

7,00,000

5,00,000

48,000

4,52,000

Company B

15,000

250

75

175

26,25,000

14,00,000

12,25,000

78,000

11,47,000

IPCC_34e_F.M_Leverages_Assignment Solutions_______________________40

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

j.

DOL =

k. DFL =

l.

Contributi on

EBIT

12,00,000

5,00,000

26,25,000

12,25,000

= 2.4

= 2.14

5,00,000

4,52,000

EBIT

EBT

12,25,000

11,47,000

= 1.11

2.4 x 1.11 = 2.664

DCL = DOL X DFL

= 1.07

2.4 x 1.07 = 2.568

Problem No. 4

Estimation of Degree of Operating Leverage (DOL), Degree of Financial Leverage (DFL) and

Degree of Combined Leverage (DCL):

Output (in units)

Selling Price (per unit)

Sales Revenues

Less: Variable Cost

Contribution Margin

Less: Fixed Cost

EBIT

Less: Interest Expense

EBT

DOL =

Contributi on

EBIT

EBIT

EBT

DCL = DOL x DFL

DFL =

Comment

P

2,50,000

7.50

18,75,000

12,50,000

6,25,000

5,00,000

1,25,000

75,000

50,000

Q

1,25,000

7

8,75,000

2,50,000

6,25,000

2,50,000

3,75,000

25,000

3,50,000

5x

1.67 x

2.14 x

2.5 x

1.07 x

12.5 x

Aggressive

Policy

1.79 x

Moderate

Policy

2.14 x

Moderate Policy with no

financial leverage

7,50,000

10

75,00,000

56,25,000

18,75,000

10,00,000

8,75,000

8,75,000

Problem No. 5

Income Statement (Backward Calculation)

Particulars

Sale revenue

Less: Variable Cost

Contribution

Less: Fixed Cost

EBIT

Less: Interest

EBT

Less: Tax @ 45%

EAT

Degree of Operating Leverage =

Contribution

EBIT

EBIT

EBT

Degree of Financial Leverage =

Firm A

Firm B

Firm C

3,600

(2/3) 2,400

(1/3) 1,200

900

300

200

100

45

55

8,000

(3/4) 6,000

(1/4) 2,000

1,600

400

300

100

45

55

12,000

(1/2) 6,000

(1/2) 6,000

4,000

2,000

1,000

1,000

450

550

_Assignment Solutions_______________________41

IPCC_34e_F.M_Leverages

Ph:

98851 25025/26

www.mastermindsindia.com

Problem No. 6

Computation of Operating and Financial Leverage

Actual Production and Sales: 60% of 10,000 = 6,000 units

Contribution per unit: Rs. 30 Rs. 20 = Rs. 10

Total Contribution: 6,000 Rs. 10 = Rs. 60,000

Financial Plan

XY

Situation

XM

Rs.

Rs.

Rs.

Rs.

Contribution (C)

60,000

60,000

60,000

60,000

Less: Fixed Cost

20,000

25,000

20,000

25,000

Operating Profit or EBIT

40,000

35,000

40,000

35,000

4,800

4,800

1,200

1,200

35,200

30,200

38,800

33,800

60,000

40,000

= 1.5

60,000

35,000

= 1.71

60,000

40,000

= 1.5

60,000

35,000

= 1.71

40,000

35,200

= 1.14

35,000

30,200

= 1.16

40,000

38,800

= 1.03

35,000

33,800

= 1.04

Less: Interest

Earnings before tax (EBT)

Operating Leverage =

Financial Leverage =

Contributi on

EBIT

EBIT

EBT

Problem No. 7

Step 1: Finding of Sales Revenue

Turnover / sales

Given total Asset turnover ratio =

Total Assets

=3

Sales

=3

2,00,000

Sales

= 6,00,000

Step 2: Profit Statement

Particulars

Sales revenue

Less: Variable Cost ( 6,00,000 X 40%)

Contribution

Less: Fixed Cost

EBIT

Less: Interest (80,000 X 10%)

EBT

Less: Tax @ 50%

EAT / EAESH

No. of Equity Shares

EPS

EAESH

No.of Shares

6,000

10

Amount (Rs.)

6,00,000

2,40,000

3,60,000

1,00,000

2,60,000

8,000

2,52,000

1,26,000

1,26,000

6,000 Shares

21

IPCC_34e_F.M_Leverages_Assignment Solutions_______________________42

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Step 3: Calculation of Leverages

Degree of Operating Leverage

Degree of Financial Leverage

Degree of Combined Leverage

Contributi on

3,60,000

=

= 1.38

EBIT

2,60,000

2,60,000

EBIT

=

=

= 1.03

EBT

2,52,000

= 1.42

Problem No. 8

a)

Step 1: Finding of Sales Revenue:

Given total Asset turnover ratio

Sales

2,00,000

Sales

Turnover / sales

Total Assets

=3

=3

= 6,00,000

Step 2: Profit Statement:

Particulars

Amount (Rs.)

6,00,000

2,40,000

3,60,000

1,00,000

2,60,000

8,000

2,52,000

88,200

1,63,800

Sales revenue

Less: Variable Cost ( 6,00,000 X 40%)

Contribution

Less: Fixed Cost

EBIT

Less: Interest (80,000 X 10%)

EBT

Less: Tax @ 35%

EAT / EAESH

6,000

10

No. of Equity Shares

EPS

6,000 Shares

EAESH

No.of Shares

27.3

Step 3: Calculation of Leverages:

Degree of Operating Leverage

3,60,000

Contributi on

=

= 1.38

EBIT

2,60,000

Degree of Financial Leverage

EBIT

EBT

Degree of Combined Leverage

= 1.42

2,60,000

= 1.031

2,52,000

b)

EPS is Rs. 1:

We know that EPS

1

(EBIT Int ) (1 t )

n

(EBIT 8,000 ) (1 0.35 )

6,000

IPCC_34e_F.M_Leverages_Assignment Solutions_______________________43

Ph:

98851 25025/26

6,000

EBIT 8,000

EBIT

www.mastermindsindia.com

(EBIT 8,000) (0.65)

6,000

= 9,230.76

0.65

17,230.76

If the level of EBIT is 17,231 then EPS will be equal to Rs. 1

EPS is Rs. 3:

We know that EPS

=

3

EBIT 8,000

EBIT

(EBIT Int ) (1 t )

n

(EBIT 8,000 ) (1 0.35 )

6,000

18,000

0.65

35,692

EPS is Rs. 0:

We know that EPS

=

0

EBIT

=

=

(EBIT Int ) (1 t )

n

(EBIT 8,000 ) (1 0.35 )

6,000

8,000

Problem No. 9

Total Assets = Rs. 48,00,000

Total Assets Turnover Ratio = 2.5

Total Sales = 48,00,000 2.5 = Rs. 1,20,00,000

Computation of Profit after Tax (PAT)

Particulars

Amount

Sales

1,20,00,000

Less: Variable Cost ( 60% of Sales Contribution)

72,00,000

Contribution

48,00,000

Less: Fixed Cost (other than Interest)

28,00,000

20,00,000

Less: Interest on Debentures (15% of 28,00,000)

4,20,000

15,80,000

PBT

Less: Tax @ 30%

4,74,000

11,06,000

PAT

(i)

EPS

PAT

No.of Equity Shares

11,06,000

= Rs. 11.06

1,00,000

(ii)

DCL

Contributi on EBIT

X

EBIT

PBT

Contributi on

PBT

48,00,000

=

15,80,000

3.04

IPCC_34e_F.M_Leverages_Assignment Solutions_______________________44

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Problem No. 10

Income Statement:

Particulars

Rs.

75,00,000

42,00,000

33,00,000

6,00,000

27,00,000

4,05,000

22,95,000

Sales

Less: Variable cost

Contribution (C)

Less: Fixed cost

EBIT

Less: Interest

EBT

i)

ROI

EBIT

Capital Employed

27,00,000

=

1,00,00,000

0.27

27%

ii) Interest on Debt = 9%

Since ROI is greater than Interest on Debt it is favorable financial leverage.

75,00,000

Sales

=

= 0.75

Total assets

1,00,00,000

The firms asset turnover ratio is less than the Industry ratio.

iii) Asset Turnover =

iv) Degree of Operating Leverage

Degree of Financial Leverage

33,00,000

Contributi on

=

= 1.222

EBIT

27,00,000

EBIT

EBT

= 1.438

Degree of Combined Leverage

v) Firms Operating Leverage = 1.222

27,00,000

= 1.1764

22,95,000

Therefore If 1 % Change in Sales then EBIT change by 1.22%

25,00,000

=

75,00,000

% Change in sales =

33.33%

Therefore EBIT will decrease by 40.73% (33.33 X 1.22)

EBIT = Rs. 16,00,290

vi)

Particulars

Sales

Less: Variable cost

Contribution (C)

Less: Fixed cost

EBIT

Less: Interest

EBT

Rs.

22,84,091

12,79,091

10,05,000

6,00,000

4,05,000

4,05,000

0

(100%)

(56%)

(44%)

Problem No.11

(i) Net Sales

EBIT @ 12% on sales

: 30 Crores

: 3.6 crores

IPCC_34e_F.M_Leverages_Assignment Solutions_______________________45

Ph:

98851 25025/26

ROI

www.mastermindsindia.com

EBIT

Capital Employed

= 3.6 x 100

10+2+6

Particulars

EBIT

Interest on debt

EBT

Less:tax @40%

EAT

Less:Preference Dividend

Earnings available for Equity Share Holders

Return of Equity = 1.36/10 x 100 = 13.6%

= 20%

Rs (In crores)

3.60

0.90

2.70

1.08

1.62

0.26

1.36

Segments due to presence of Preference Share capital and Borrowing (Debentures)

Segment of ROE due to presence of Preference Share capital: (0.2(1-0.4)-0.13) x 0.2 =-0.002

Segment of ROE due to presence of Debentures

or -2% +1.8% = 1.6%

(0.2(1-0.4)-0.15(1-0.4)) x 0.2 =0.018

Since segment due to presence of Debt/ Preference = {ROI(1-Tax) Rd(1-Tax) } D/E

Or

{ROI(1-Tax) Rp } P/E

The Weighted average cost of capital is as follows

Source

Proportion

(i)

Equity

Cost (%)

WACC (%)

10/18

13.60

7.56

(ii) Preference Shares

2/18

13.00

1.44

(iii) Debt

6/18

9.00

3.00

12.00

Total

ii) Computation of Operating Leverage

Given Combined Leverage

Financial Leverage

=

=

=

=

Operating Leverage

3

EBIT/ EBT

3.60/2.70

1.33

= Combined Leverage / Financial Leverage

= 3/1.33

= 2.25

THE END

IPCC_34e_F.M_Leverages_Assignment Solutions_______________________46

You might also like

- Assign3 Module6Document3 pagesAssign3 Module6finn mertensNo ratings yet

- LeverageDocument16 pagesLeverageanshuldceNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Chapter 2 - Income Statement QuestionsDocument3 pagesChapter 2 - Income Statement QuestionsMuntasir Ahmmed0% (1)

- IPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamDocument12 pagesIPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamSushant Saxena100% (1)

- Fsa Solved ProblemsDocument27 pagesFsa Solved ProblemsKumarVelivela100% (1)

- Case Study On LeveragesDocument5 pagesCase Study On LeveragesSantosh Kumar Roul100% (3)

- Everage: Sales (S) 90,000 90,000 3000 Units at Rs. 30/-Per Unit 15 Per Unit 45,000 45,000Document20 pagesEverage: Sales (S) 90,000 90,000 3000 Units at Rs. 30/-Per Unit 15 Per Unit 45,000 45,000anon_67206536260% (5)

- New LeveragesDocument16 pagesNew Leveragesmackm87No ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- Return of InvestmentDocument3 pagesReturn of InvestmentAngela FergusonNo ratings yet

- 02 Financing Decisions - Leverages - Practice SheetDocument22 pages02 Financing Decisions - Leverages - Practice SheetPatrick LoboNo ratings yet

- LEVERAGESDocument96 pagesLEVERAGESNaman LadhaNo ratings yet

- Chapter 13Document11 pagesChapter 13Christine GorospeNo ratings yet

- Financial Numericals RatiosDocument27 pagesFinancial Numericals Ratiosanks0909100% (2)

- Ch8 LongDocument14 pagesCh8 LongratikdayalNo ratings yet

- FM Problem SolvingDocument31 pagesFM Problem SolvingAbhishek Jaiswal100% (1)

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315arman_277276271No ratings yet

- Module-5 Valuation Concepts (EVA, MVA)Document19 pagesModule-5 Valuation Concepts (EVA, MVA)vinit PatidarNo ratings yet

- Chapter 8: Leverage and CVP Analysis: 2001 Dec 2bDocument4 pagesChapter 8: Leverage and CVP Analysis: 2001 Dec 2bShubham ParabNo ratings yet

- Compre Quiz No. 6Document10 pagesCompre Quiz No. 6Bea LadaoNo ratings yet

- Castillo Antonio Act1Document5 pagesCastillo Antonio Act1Antonio Castillo MiguelNo ratings yet

- 0976 Module 10 RossFCF9ce SM Ch10 FINALDocument21 pages0976 Module 10 RossFCF9ce SM Ch10 FINALYuk SimNo ratings yet

- ExploreDocument4 pagesExploreNorlyn RunesNo ratings yet

- Marginal CostingDocument9 pagesMarginal CostingprataikNo ratings yet

- Topics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructureDocument5 pagesTopics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructuremagoimoiNo ratings yet

- UNSW Business School School of Accounting ACCT1501 Accounting and Financial Management 1A Session 1 2017Document2 pagesUNSW Business School School of Accounting ACCT1501 Accounting and Financial Management 1A Session 1 2017Kelly ChuNo ratings yet

- Chapter 5 LectureDocument6 pagesChapter 5 LectureSaadNo ratings yet

- 17 Answers To All ProblemsDocument25 pages17 Answers To All ProblemsAarti J100% (1)

- 17 Answers To All ProblemsDocument25 pages17 Answers To All ProblemsRaşitÖnerNo ratings yet

- Assignment Answer Sheet: Name: Subject: Assignment IiDocument6 pagesAssignment Answer Sheet: Name: Subject: Assignment IiAravindh ArulNo ratings yet

- Assignment Leverage Analysis: Financial ManagementDocument2 pagesAssignment Leverage Analysis: Financial ManagementVishal ChandakNo ratings yet

- 17 Answers To All ProblemsDocument25 pages17 Answers To All ProblemsRaşitÖnerNo ratings yet

- CH 8 Answers 2008Document5 pagesCH 8 Answers 2008ergiesonaNo ratings yet

- Problems & Solutions On Fundamental AnalysisDocument8 pagesProblems & Solutions On Fundamental AnalysisAnonymous sTsnRsYlnkNo ratings yet

- Bep AccountsDocument10 pagesBep AccountskamsjaganNo ratings yet

- ACCTG 115 Lecture (01-27-2022)Document3 pagesACCTG 115 Lecture (01-27-2022)Janna Mari FriasNo ratings yet

- Financial and Management and Accouting MBA0041 Assingment FALL 2014 LC-02009 Name: Nandeshwar Singh ROLL NO.1408001255Document7 pagesFinancial and Management and Accouting MBA0041 Assingment FALL 2014 LC-02009 Name: Nandeshwar Singh ROLL NO.1408001255Nageshwar singhNo ratings yet

- Corp Val - Non-DCF Approach (Cir.17.10.2023)Document118 pagesCorp Val - Non-DCF Approach (Cir.17.10.2023)Sonali MoreNo ratings yet

- Paper: Cost Accounting and Financial Management: Raveendranath Kaushik & Associates Cost AccountantDocument13 pagesPaper: Cost Accounting and Financial Management: Raveendranath Kaushik & Associates Cost Accountantrk_rkaushikNo ratings yet

- Corporate Strategic Financial DecisionDocument22 pagesCorporate Strategic Financial Decisionsaloni jainNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- FCF 9th Edition Chapter 02Document45 pagesFCF 9th Edition Chapter 02Omer FareedNo ratings yet

- Abfm CH 8 Part 4Document5 pagesAbfm CH 8 Part 4leelavishnupriyaNo ratings yet

- Chapter 3 (12e) Financial Statements, Cash Flow, and Taxes: Solutions To End-of-Chapter ProblemsDocument2 pagesChapter 3 (12e) Financial Statements, Cash Flow, and Taxes: Solutions To End-of-Chapter ProblemstakesomethingNo ratings yet

- OLC Chap 20Document5 pagesOLC Chap 20NeelNo ratings yet

- 1244 - Roshan Kumar Sahoo - Assignment 2Document3 pages1244 - Roshan Kumar Sahoo - Assignment 2ROSHAN KUMAR SAHOONo ratings yet

- Chapter 9Document18 pagesChapter 9Kate RamirezNo ratings yet

- Chapter 5 (2) CVPDocument11 pagesChapter 5 (2) CVPInocencio TiburcioNo ratings yet

- Eva ProblemsDocument10 pagesEva Problemsazam4989% (9)

- Chapter 4Document10 pagesChapter 4SThomas070884No ratings yet

- Assignment 3 SolutionDocument7 pagesAssignment 3 SolutionAaryaAustNo ratings yet

- Tugas Week 1 - Bagus SeptiawanDocument3 pagesTugas Week 1 - Bagus SeptiawanBagus SeptiawanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 5 out of 5 stars5/5 (5)

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Awareness of Dengue Fever Among School Children: A Comparison Between Private and Government SchoolsDocument5 pagesAwareness of Dengue Fever Among School Children: A Comparison Between Private and Government SchoolsMumtazAhmadNo ratings yet

- Ghulam Ali Hum Tere Shahar Mein Aaye Hain Lyrics - OfficialDocument1 pageGhulam Ali Hum Tere Shahar Mein Aaye Hain Lyrics - OfficialMumtazAhmadNo ratings yet

- Minar-e-Pakistan - Re-Living History - Pakistan TodayDocument3 pagesMinar-e-Pakistan - Re-Living History - Pakistan TodayMumtazAhmad0% (1)

- Upload A Document For Free: AnafesiaDocument1 pageUpload A Document For Free: AnafesiaMumtazAhmadNo ratings yet

- Upload A Document For Free Download Access.: Select Files From Your Computer or Choose Other Ways To Upload BelowDocument1 pageUpload A Document For Free Download Access.: Select Files From Your Computer or Choose Other Ways To Upload BelowMumtazAhmadNo ratings yet

- Single Entry and Incomplete Records MCQS: Debtor Account Credit Account Cash Payments Journal Cash BookDocument3 pagesSingle Entry and Incomplete Records MCQS: Debtor Account Credit Account Cash Payments Journal Cash BookMumtazAhmadNo ratings yet

- My Watchlist - Value ResearchDocument1 pageMy Watchlist - Value ResearchpksNo ratings yet

- Tutorial-Valuation of Bond and SharesDocument1 pageTutorial-Valuation of Bond and SharesAnkush PatialNo ratings yet

- Rates, Rotation, and Re Ation: Taking Stock of 1Q 2021: US Quarterly ChartbookDocument51 pagesRates, Rotation, and Re Ation: Taking Stock of 1Q 2021: US Quarterly ChartbookShivam GuptaNo ratings yet

- Week 11 PDFDocument3 pagesWeek 11 PDFyogeshgharpureNo ratings yet

- ABC LTD Walter ModelDocument5 pagesABC LTD Walter ModelJeeshan IdrisiNo ratings yet

- REVIEWERDocument8 pagesREVIEWERagent purpleNo ratings yet

- CV Session 6 & 7 - NumericalsDocument3 pagesCV Session 6 & 7 - NumericalsSomnath KhandagaleNo ratings yet

- Stock Market - The Place Where The Shares or Stocks of Publicly Listed Companies Are TradedDocument21 pagesStock Market - The Place Where The Shares or Stocks of Publicly Listed Companies Are TradedCarl ReyNo ratings yet

- Ebit Eps AnalysisDocument4 pagesEbit Eps Analysispranajaya2010No ratings yet

- Praedico Company ReportDocument31 pagesPraedico Company ReportShubham SarafNo ratings yet

- Ross 12e PPT Ch17Document25 pagesRoss 12e PPT Ch17sa albaloshiNo ratings yet

- Definition of DividendsDocument7 pagesDefinition of DividendsAdrian ColemanNo ratings yet

- Requirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)Document2 pagesRequirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)happy240823No ratings yet

- 5 Stages of Startup FundingDocument1 page5 Stages of Startup FundingSachin Khurana0% (1)

- INTACCDocument6 pagesINTACCAeliey AceNo ratings yet

- April 2023Document68 pagesApril 2023Daniel Pratama SimbolonNo ratings yet

- Audit of EquityDocument5 pagesAudit of EquityKarlo Jude Acidera0% (1)

- Chapter 10 Discounted DividendDocument5 pagesChapter 10 Discounted Dividendmahnoor javaidNo ratings yet

- Corporation: Issuance: JPIA Mentor's CircleDocument18 pagesCorporation: Issuance: JPIA Mentor's CircleartNo ratings yet

- InvestmentsDocument7 pagesInvestmentsIvan LandaosNo ratings yet

- In Venture Growth & Securities Ltd.Document424 pagesIn Venture Growth & Securities Ltd.adhavvikasNo ratings yet

- Required:: 2014 Beg. Balance 0Document4 pagesRequired:: 2014 Beg. Balance 0arif budi hermansah100% (1)

- 31 - Term Sheets For Private Equity InvestmentsDocument3 pages31 - Term Sheets For Private Equity InvestmentsshakibalamNo ratings yet

- Valuation of Common Stocks and CorporationsDocument79 pagesValuation of Common Stocks and CorporationsAnonymous f7wV1lQKRNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- Kosdaq 150 Methodology Guide: November 2020Document13 pagesKosdaq 150 Methodology Guide: November 2020Edwin ChanNo ratings yet

- Preference SharesDocument7 pagesPreference Sharesmayuresh bariNo ratings yet

- Forex Courses ListDocument9 pagesForex Courses ListTaKo TaKoNo ratings yet

- HW On Statement of Changes in EquityDocument2 pagesHW On Statement of Changes in EquityCharles TuazonNo ratings yet

- Spring Exam 1 KeyDocument10 pagesSpring Exam 1 KeysufyanjeewaNo ratings yet