Professional Documents

Culture Documents

Calculating "Additional Funds NEEDED" (A.F.N.) : Washington State University & U.S. Department of Agriculture Cooperating

Uploaded by

Shahmir HanifOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculating "Additional Funds NEEDED" (A.F.N.) : Washington State University & U.S. Department of Agriculture Cooperating

Uploaded by

Shahmir HanifCopyright:

Available Formats

cooperative boards of directors, for example,

were sometimes reluctant to ask management for

financial forecasts. Today, directors insist that

such forecasts be prepared and that an

opportunity to review and approve budgets

annually. Unfortunately, while many

agribusiness firms now are convinced of the

need for financial forecasting, not all such firms

are familiar with the way to accomplishing it.

Too often the act of budgeting and financial

forecasting entails little more than a simple

extrapolation of a historical data base. This

simple process fails to recognize the

interdependencies of cash flows and also fails to

accommodate the critical element of calculating

additional funds needed (AFN). As a result,

firms soon discover that working capital

shortages arise and plans for capital expansion

lack the funds required for their completion.

CALCULATING "ADDITIONAL FUNDS

NEEDED" (A.F.N.)

Economic volatility in the agribusiness industry

over the past decade has, in my opinion,

comprised a mixed-bag of hardships and

blessings. Organizational restructuring within

the industry provides ample evidence of the

hardships imposed. As I drive through the rural

areas of eastern Washington, for example, I find

only scant remnants of an agribusiness industry

which existed in the early 1980s. Most notable is

the change in ownership within the farm supply

sector. Dealerships, product labels, company

names and even business locations have changed

as dissolutions, mergers, acquisitions and

consolidations have all served to alter that which

is most visible about the industry. One could

easily argue that this restructuring of business,

this loss of local employment and this increase

in industry concentration have all served poorly

the long-term interests of agriculture. A closer

look suggests that, despite these changes,

agriculture and rural communities are still being

well-served, albeit differently. Productive

resources are still available. Commodities are

still being produced, transported, processed and

marketed, but the agribusiness infrastructure is

different.

My objective here is to review the correct

process of financial forecasting for agribusiness

managers. In particular, I shall address the

differences between those funds which are

generated spontaneously with future increases in

sales, as separate from those funds which must

be generated externa l to budgeted sales. Only in

this manner can management calculate AFN and

thereby make those debt/equity adjustments

required if the firm is going to achieve its

forecasts.

Although not as visible to the casual observer,

some blessings have also emerged from the

decade of the 1980s. Many firms are larger.

However, they are also more operationally

diverse and more efficient. It is also interesting

to note that those agribusiness firms surviving

are no longer complacent about their market

position and long-range future. A decade of

economic volatility has purged the industry of

any sense of long-term permanence. I no longer

need to convince managers that they must plan

for the future if they expect to be a part of it.

Management now recognizes that budgeting and

financial forecasting are prerequisites to shortand long-term survival. Agribusiness

THE SALES-TO-ASSETS RELATIONSHIP

Managers generally understand that sales cannot

be achieved in the absence of supporting assets.

In particular, they are sensitive to the fact that

prior investments in current assets are required

to fuel any growth in sales. However, it is also

true that managers are less sensitive to fixed

asset requirements. If a firm is at, or

approaching, full capacity production, this

oversight can prove critical.

For most businesses, the preferred source of

expansion capital is retained earnings. But if the

WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING

forecasted growth is rapid, or if earnings

retained are limited, even the most profitable

agribusiness firm will have to seek external

capital; i.e., increases in debt or equity. At this

point, it becomes very important to prepare or

calculate reasonably accurate estimates of

forecasted capital requirements. Under normal

conditions, an agribusiness firm only

infrequently would look for substantive

increases in its long-term debt and/or equity.

The timing of debt acquisitions or the issuance

of long-term securities is particularly important

under conditions of economic volatility.

Consider the plight of those agribusiness firms

now struggling under fixed rate long-term loans

initiated in the early 1980s when interest rates

had peaked at record levels. Because investors

are interested in future cash flows, firms

lacking financial forecasts are ill-prepared to

attract equity capital.

the demand for each is probably

interdependent.

2. The next critical step in sales forecasting

includes assessing market share. You must

appraise your firm's current and future

share of current or potential markets. You

need to consider factors such as current

productive capacity, competitor's capacity

and new products you or your competitors

are considering. Your firm's pricing

strategies relative to that of competitors

also becomes an important element in

market share analysis. Advertising

campaigns, promotional discounts, credit

terms and product differentiation may also

alter your projected market share.

Regardless, every manager must recognize

that the act of forecasting future sales does

directly reference market share, whether

considered explicitly or not.

THE SALES FORECAST; THE FIRST

STEP

3. Too often, agribusiness firms developing

sales forecasts often focus on the expected

future demand for products or services.

Equal focus must rest on the supply side;

i.e., your firm's future ability to acquire

supplies or raw products in a timely

manner and at a competitive price. Order

backlogs and/or intermittent supplies can

rapidly destroy the credibility of wellprepared sales forecasts.

Preparing a sales forecast is the critical first step.

In many regards, the sales forecast comprises the

driving force of all planning activity and AFN

calculations. Because each agribusiness firm

confronts a uniquely different set of market and

supply/demand conditions, it's difficult to

generalize regarding the ways such a forecast is

prepared. I will later inject data from a

hypothetical agribusiness firm to provide some

reader guidance. First, I will point out that

almost all viable sales forecasts address the

following basic issues:

4. Finally, remember that a sales forecast is

actually an expected value of a

probability distribution of possible levels

of sales. Because any sales forecast is

subject to a greater or lesser degree of

uncertainty, for sound financial planning

we often are just as interested in this

degree of uncertainty (sales variance) as

we are in a single expected value of sales.

1. Since most agribusiness firms are multiproduct or multi-service entities, each

division within the firm must first be

viewed separately, and their individual

sales potentials assimilated into a total

demand forecast. As historical and future

sales for each division are plotted and

projected, management must pay close

attention to preexisting product-service

interdependencies. For example,

forecasting substantive increases in future

liquid fertilizer sales cannot be completed

separately from the firm's willingness to

expand its inventory of applicators because

ILLUSTRATIVE AGRIBUSINESS FIRM

To illustrate the procedure, I have calculated the

AFN for Agrigrow, a hypothetical agribusiness

firm. (See page 3.)

Agrigrow generated a 4%, profit on sales during

1991 and distributed 40% of 1991 net income to

its stockholders as dividends. Let's further

assume that during 1991 Agrigrow operated its

WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING

fixed assets at full capacity and retained no

underutilized stocks of current assets. If

Agrigrow is going to attain its 1992 sales

forecast of $750,000, what will its 1992 pro

forma balance sheet look like and how much

additional funding will be required during 1992?

AFN must, be calculated for the forecasted sales

period.

The first step in the percentage of sales forecast

is to identify and separate those balance sheet

items expected to vary directly with sales. For

example, since Agrigrow was operating in 1991

at full physical capacity, one would expect that

selected asset items would have to increase to

attain the 1992 sales forecast. Any increase in

assets employed by Agrigrow will have to be

accompanied by an increase in liabilities and/or

equity; i.e., those increases in assets must be

financed by some source. In this regard, we

would expect some financing will be generated

spontaneously; i.e., some sources of funds such

as accounts payable and accruals will rise

spontaneously with sales. While retained

earnings will also increase, they will not respond

in direct proportion to sales. And finally, there is

no reason to expect notes payable, mortgage

debt, or common stock to rise spontaneously

with sales because higher sales do not

automatically trigger increases in these items.

AFN COMPUTATIONAL STEPS

While several methods for developing pro forma

financial statements, I will use the percentage

of sales method. This method provides a simple

and quite practical means for forecasting

financial variables. The method rests on two

basic assumptions. First, it assumes that most

agribusiness balance sheets are linked directly to

sales (i.e., over time, sales impact balance sheet

components). Second, it assumes that the current

complement of assets effectively serves the

current level of sales (i.e., there are no

underutilized assets remaining in the firm's

inventory).

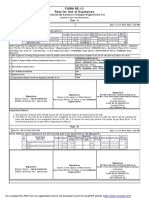

Balance Sheet December 31, 1991 Agrigrow Enterprises, Inc.

Assets

Cash

Liabilities

$10,000

Receivables

Accounts Payable

85,000

$40,000

Notes Payable

10,000

Inventories

Total Current Assets

100,000

$195,000

Accrued Wages/Taxes/Interest

Total Current Liabilities

25,000

$75,000

Fixed Assets (Net)

$150,000

Long-Term Mortgage Debt

Equity

$72,000

Total Assets

$345,000

Common Stock

$150,000

Retained Earnings

Total Liabilities & Equity

$48,000

$345,000

Summary Income Statement December 31, 1991 Agrigrow Enterprises, Inc.

1991 Sales

$500,000

1991 Net Income

1991 Dividends Paid

20,000

8,000

1991 Sales Forecast

$750,000

(4% of Sales)

(40% of Net Income)

(Based on new product introductions and strong

recent growth in market)

WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING

Next, one must express those 1991 Balance

Sheet items which vary directly wit h sales as a

percentage of 1991 sales. Items such as notes

payable which do not automatically vary with

sales are designated not applicable, in Column

1 of the following table. You then multiply these

percentages by the projected 1992 $750,000

sales to obtain the projected amounts as of

12/31/92, in Column 2. Retained earnings for

12/31/92 is obtained by adding to retained

earnings for 1991 those generated in 1992, (see

footnote b). Summing the 1992 asset accounts

shows total projected assets of $518,000 while

summing the projected liabilities and equity

items shows $396,000 in available funds. This

funds shortfall of $122,000 is designated as

AFN.

Having calculated AFN, we must now determine

whether these additional funds are to be raised

by additional bank borrowings and/or by issuing

securities. (Note that for simplicity we have

assumed that cash flows generated by

depreciation are used to replace worn-out fixed

assets.)

SOURCES OF AFN

Up to this point, we have assumed that notes

payable, mortgage debt and common stock have

remained unchanged from 1991 levels (see

footnote a). If we are to generate $122,000 in

AFN, we must use one, or a combination of

these funds sources, to make up the shortfall.

Agrigrow Enterprises Pro Forma Balance Sheet

December 31, 1991

Item

Cash

Receivables

Inventories

TOTAL CURRENT ASSETS

Fixed Assets (net)

TOTAL ASSETS

Accounts Payable

Notes Payable

Accrued Wages/Taxes

(1)

(2)

12/31/91

Balance Sheet Items Expressed as

% of 1991 Sales of $500,000

Pro Forma Balance Sheet

12/31/92

Based on 1992 Projected Sales

($750,000 x Column 1)

2.0%

17.0

20.0

39.0%

30.0

69.0%

8.0%

NA

5.0

$15,000

128,000

150,000

$293,000

225,000

$518,000

60,000

a

10,000

38,000

NA

NA

NA

NA

$108,000

a

72,000

a

150,000

b

66,000

$396,000

c

122,000

$518,000

TOTAL CURRENT LIABILITIES

Mortgage Debt

Common Stock

Retained Earnings

Funds Available

Additional Funds Needed (AFN)

TOTAL LIABILITIES & EQUITY

-----

Initially set at 1991 level, but later financing decisions might change this level.

Balance in 1991 retained earnings ($48,000) plus 1992 projected addition to retained earnings ($75,000

sales x 4% = $30,000; $30,000 net income 40% for dividends paid = $18,000) i.e., $48,000 + 18,000

= $66,000.

c

Residual calculation of $518,000 projected assets less $396,000 in projected funds available = $122,000

AFN.

b

WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING

Ordinarily, agribusiness firms would choose

among funds sources on the basis of relative

costs, subject to certain constraints. For

example, let's assume that Agrigrow has a loan

covenant in its mortgage agreement restricting

the firm from increasing its total debt beyond

50% of total assets. Yet, another covenant

requires that Agrigtow maintain a current ratio

of 2.5 or greater. Given these restrictions,

Agrigrow would evaluate alternative sources of

AFN in the following manner.

financial constraints imposed on the firm by its

lenders, new additions to debt are limited to

$79,000 and only $9,000 of that can be shortterm debt. It must now raise $43,000 from the

sale of additional common stock if 1992 AFN

requirements are to be met.

PROJECTED FINANCIAL STATEMENT

Based largely on the pro forma computations,

AFN calculations and the financial restrictions

noted, Agrigrow can now prepare projected

financial statements for 1992. They would

appear as shown on page 7:

As calculated earlier, Agrigrow requires

$122,000 in AFN for 1992. Because of simple

1. Restriction on additional total debt:

Maximum debt permitted 0.5 (Total Assets

0.5 ($518,000) = $259,000

Total debt already projected for 12/31/91:

Current Liabilities $108,000

Mortgage Debt

+72,000

$108,000

Maximum additional debt permitted = $259,000 - 180,000 = $79,000

2. Restriction on additional current liabilities ( current Ratio 2.5 ):

Maximum current liabilities = Projected current assets 2.5 = $293,000 2.5 = $117,000

Less current liabilities already projected for 1992 =

-108.000

Maximum additional current liabilities

$ 9,000

3. Common equity requirements:

Total AFN

Maximum Additional Debt Permitted

Common equity required

$122,000

- 79,000

$ 43,000

WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING

Arrived at quickly in this manner it can be

shown that for Agrigrow to increase its 1992

sales by $250,000, this agribusiness firm must

increase its assets by $172,500. This $172,500 in

new assets must be financed in some manner. Of

the total amount, $32,500 will come from a

spontaneous increase in liabilities and an

additional $18,000 will result from retained

earnings from 1992 operations. The remaining

$122,000 must be generated from external

sources. Based on Agrigrow's financial

constraints described earlier, $9,000 of AFN will

come from additions to short-term debt (notes

payable), $70,000 will result from an increase in

mortgage debt and the remaining $43,000 will

be generated from the sale of common stock.

AFN CALCULATION SHORTCUT

The most common method to calculate AFN

involves constructing pro forma financial

statements as described above. Under certain

conditions, however, you can use a shortcut

method to calculate AFN. While pro forma

financial statements are not generated, the

following formula -generated AFN highlights the

relationship between sales growth and financial

requirements.

Additional Required Increase

in Sales

Funds Needed

Increase in

Spontaneous Increase

in

Liabilities

Retained Earnings

SUMMARY

Managers of modern agribusiness firms no

longer need to be convinced of the need to

undertake some form of future financial

planning. The practice of preparing sales

forecasts and future operations budgets has

become well-established. Unfortunately, many

agribusiness firms still fail to employ a fully

integrated program of financial planning. Sales

forecasts rest too often on incomplete

projections of historical sales data alone.

Furthermore, those projections too often fail to

adequately consider the capital investments in

assets required to attain those forecasted levels

of sales. And further, the financial planning

process often fails to distinguish between funds

generated spontaneously by sales vs. those

which must be generated externally. Finally, the

process does not identify those sources of

external funds which would best serve the needs

of the firm and/or adhere to pre-existing

financial constraints.

AFN = ( A/ S )VS ( L / S )VS MS1 (1 d ) , where:

AFN = additional funds needed

A/S = assets which must increase if sales

are to increase, expressed as a

percentage of sales (69% for

Agrigrow).

L/S = liabilities that increase

spontaneously with sales, expressed

as a percentage of sales (13% for

Agrigrow)

S1

= total sales projected for next year;

i.e., the year for which AFN is being

calculated ($750,000 for Agrigrow)

DS = change in sales from most recent

year to next year, (S1 S0 =

$250,000 for Agrigrow)

M

= profit margin or rate of profits per

$1 of sales (4% for Agrigrow)

d

= percentage of earnings paid out in

dividends; note that 1 - d is the

percentage of earnings retained (d =

40% for Agrigrow)

This paper addresses the deficiencies noted

above and provides agribusiness managers with

a simple and rational means for calculating

additional funds needed.

Therefore: AFN = .69($250,000) .13($250,000) - .04($750,000)(1

4) = $172,500 - $32,000 - $18,000 =

$122,000

WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING

PROJECTED FINANCIAL STATEMENTS

AGRIGROW, 1992

I. Projected Balance Shed, 12/31!92

Cash

Accounts Receivables

Inventories

TOTAL CURRENT ASSETS

Fixed Assets (Net)

$15,000

128,000

150,000

$293,000

225,000

Accts. Pay.

Notes Payable

Accruals

TOTAL CURRENT LIABILITIES

Mortgage Debt

Common Stock

Retained Earnings

TOTAL ASSETS

II. Projected Income Statement, 1992

Sales

Total Costs

Net Increase Before Taxes

Taxes (40%)

Int. Income After Taxes

Dividends (40% of N.I.)

Addition to Retained Earnings

$518,000

Total Equity

TOTAL LIABILITIES & EQUITY

$750,000

700,000

50,000

20,000

30,000

12,000

$18,000

III. Projected Changes in Financial Position, 1992

Sources of Funds:

Net Income

Increase in Accounts Payable

Increase in Accruals

TOTAL SOURCE OF FUNDS

Uses of Funds:

Increase in Accounts Receivable

Increase in Inventories

Increase in Net Fixed Assets

TOTAL USES OF FUNDS

Net Funds from Operations:

Financing Activities:

Increase in Notes Payable

Increase in Mortgage Debt

Sale of Common Stock

Net Funds From Financing

Less: Dividends .

Increase in Cash

NET FUNDS FOR OPERATIONS

$30,000

20,000

13,000

$63,000

$43,000

50,000

75,000

$168,000

($105,000)

$9,000

70,000

43,000

$122,000

-12,000

-5,000

$105,000

Ken D. Duft

Extension Economist

WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING

$60,000

19,000

38,000

$117,000

142,000

193,000

66,000

$259,000

$518,000

You might also like

- Calculating "Additional Funds NEEDED" (A.F.N.) : Washington State University & U.S. Department of Agriculture CooperatingDocument7 pagesCalculating "Additional Funds NEEDED" (A.F.N.) : Washington State University & U.S. Department of Agriculture CooperatingBardos Ahmad BardosonoNo ratings yet

- Proforma Statement InfoDocument20 pagesProforma Statement InfoGideon FamodimuNo ratings yet

- Value-based financial management: Towards a Systematic Process for Financial Decision - MakingFrom EverandValue-based financial management: Towards a Systematic Process for Financial Decision - MakingNo ratings yet

- Entrepreneurial Finance 6th Edition Leach Solutions Manual Full Chapter PDFDocument45 pagesEntrepreneurial Finance 6th Edition Leach Solutions Manual Full Chapter PDFinverse.zinkthxzut100% (12)

- Planificacion FinancieraDocument14 pagesPlanificacion FinancieraEunice MuñozNo ratings yet

- Chap 9 Solutions-2Document15 pagesChap 9 Solutions-2Miftahudin Miftahudin100% (1)

- Balance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessFrom EverandBalance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessNo ratings yet

- Summary of Case DiscussionDocument2 pagesSummary of Case DiscussionNur 'AtiqahNo ratings yet

- Individual Assignment On Intermediate Financial Accounting Feyissa Taye PDFDocument15 pagesIndividual Assignment On Intermediate Financial Accounting Feyissa Taye PDFEYOB AHMEDNo ratings yet

- Business 7 Habits EffectsDocument6 pagesBusiness 7 Habits Effectssaba4533No ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (16)

- Proforma Income StatementDocument20 pagesProforma Income StatementEnp Gus AgostoNo ratings yet

- FNSACC501 Assessment 2Document6 pagesFNSACC501 Assessment 2Daranee TrakanchanNo ratings yet

- Top 10 Business Plan MistakesDocument4 pagesTop 10 Business Plan Mistakesanon-381371100% (3)

- FM 1 MaterialDocument17 pagesFM 1 MaterialSwati SachdevaNo ratings yet

- Topic 5 Financial Forecasting For Strategic GrowthDocument20 pagesTopic 5 Financial Forecasting For Strategic GrowthIrene KimNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- What Are The Basic Benefits and Purposes of DeveloDocument7 pagesWhat Are The Basic Benefits and Purposes of DeveloHenry L BanaagNo ratings yet

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet

- Equity Valuations MFDocument3 pagesEquity Valuations MFsaket.lakkadNo ratings yet

- babe oyeDocument4 pagesbabe oyejashanvipan1290No ratings yet

- ACC 111 Assessment 2 - Project: Adam MuhammadDocument7 pagesACC 111 Assessment 2 - Project: Adam Muhammadmuhammad raqibNo ratings yet

- Financial Statements Balance Sheets Cash Flow StatementsDocument7 pagesFinancial Statements Balance Sheets Cash Flow StatementsMahima BharathiNo ratings yet

- UNIT-3 Financial Planning and ForecastingDocument33 pagesUNIT-3 Financial Planning and ForecastingAssfaw KebedeNo ratings yet

- Financial Planning Chapter 18 Key ConceptsDocument8 pagesFinancial Planning Chapter 18 Key ConceptsSamantha Marie ArevaloNo ratings yet

- How to Structure a Commission Plan That Works: Sales Optimisation, #1From EverandHow to Structure a Commission Plan That Works: Sales Optimisation, #1No ratings yet

- PA2 Issues Analysis for Business ExpansionDocument10 pagesPA2 Issues Analysis for Business ExpansionrgaeastindianNo ratings yet

- Business Opportunity Thinking: Building a Sustainable, Diversified BusinessFrom EverandBusiness Opportunity Thinking: Building a Sustainable, Diversified BusinessNo ratings yet

- ACFrOgCgcoJoISRbbrvcLJKvrsKDFlrOoxqPHjVsbB7HCekvmttN3J l1UYALVPesFLvfr4aE0aQoayJ9Q17wKwnDXMSw0ekVomnFB4hJkggTuWyne4CT0tzG Zk4ZQDXP0pb2 ZMJzczme1vwcODocument43 pagesACFrOgCgcoJoISRbbrvcLJKvrsKDFlrOoxqPHjVsbB7HCekvmttN3J l1UYALVPesFLvfr4aE0aQoayJ9Q17wKwnDXMSw0ekVomnFB4hJkggTuWyne4CT0tzG Zk4ZQDXP0pb2 ZMJzczme1vwcOManleen KaurNo ratings yet

- Financial Planning and ForecastingDocument15 pagesFinancial Planning and ForecastingGeofrey RiveraNo ratings yet

- Chapter 4Document14 pagesChapter 4maindingjelynNo ratings yet

- FAPDocument12 pagesFAPAnokye AdamNo ratings yet

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingFrom EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingRating: 5 out of 5 stars5/5 (1)

- Annexure Detailed Guideline On Project ReportDocument4 pagesAnnexure Detailed Guideline On Project Reportmohamed firdousNo ratings yet

- Valuations 1Document26 pagesValuations 1nsnhemachenaNo ratings yet

- Seven Habits FSADocument6 pagesSeven Habits FSAWaseem AkhtarNo ratings yet

- Financial TrainingDocument15 pagesFinancial TrainingGismon PereiraNo ratings yet

- Rules For ProspectusDocument3 pagesRules For ProspectusNavid GodilNo ratings yet

- Meaning: Business Concern in An Organized Manner. We Know That All Business TransactionsDocument5 pagesMeaning: Business Concern in An Organized Manner. We Know That All Business TransactionsKunika JaiswalNo ratings yet

- Assessing a Venture's Financial StrengthDocument53 pagesAssessing a Venture's Financial StrengthHtet Pyae ZawNo ratings yet

- Looking For Warning Signs Within The Financial StatementsDocument4 pagesLooking For Warning Signs Within The Financial StatementsShakeel IqbalNo ratings yet

- Financial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter QuestionsDocument24 pagesFinancial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter Questionscostel11100% (1)

- Integrated Planning: Steering Towards ProfitDocument8 pagesIntegrated Planning: Steering Towards ProfitKaizhen JiaNo ratings yet

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- Business Plans that Win $$$ (Review and Analysis of Rich and Gumpert's Book)From EverandBusiness Plans that Win $$$ (Review and Analysis of Rich and Gumpert's Book)No ratings yet

- Manajemen Keuangan - Kevin Brandon Nababan - 1932064Document8 pagesManajemen Keuangan - Kevin Brandon Nababan - 1932064Brandon NababanNo ratings yet

- Financing A New Venture Trough and Initial Public Offering (IPO)Document32 pagesFinancing A New Venture Trough and Initial Public Offering (IPO)Manthan LalanNo ratings yet

- Types of Earnings Management and Manipulation Examples of Earnings ManipulationDocument6 pagesTypes of Earnings Management and Manipulation Examples of Earnings Manipulationkhurram riazNo ratings yet

- Financial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter QuestionsDocument24 pagesFinancial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter QuestionsSam Sep A SixtyoneNo ratings yet

- The Business Owner's Guide to Reading and Understanding Financial Statements: How to Budget, Forecast, and Monitor Cash Flow for Better Decision MakingFrom EverandThe Business Owner's Guide to Reading and Understanding Financial Statements: How to Budget, Forecast, and Monitor Cash Flow for Better Decision MakingRating: 4 out of 5 stars4/5 (4)

- Financial Analysis: Learning ObjectivesDocument39 pagesFinancial Analysis: Learning ObjectivesKeith ChandlerNo ratings yet

- IGNOU MBA MS-04 Solved Assignment December 2012Document10 pagesIGNOU MBA MS-04 Solved Assignment December 2012Amit DungdungNo ratings yet

- Ch5 - Financial Statement AnalysisDocument39 pagesCh5 - Financial Statement AnalysisLaura TurbatuNo ratings yet

- Life Sciences Sales Incentive Compensation: Sales Incentive CompensationFrom EverandLife Sciences Sales Incentive Compensation: Sales Incentive CompensationNo ratings yet

- 12 Things You Need To Know About Financial StatementsDocument7 pages12 Things You Need To Know About Financial StatementsRnaidoo1972100% (1)

- Lecture 01 IntroductionDocument35 pagesLecture 01 IntroductionShahmir HanifNo ratings yet

- Role of CalciumDocument2 pagesRole of CalciumShahmir HanifNo ratings yet

- Planning and ControlDocument12 pagesPlanning and ControlShahmir HanifNo ratings yet

- Procurement Management TemplateDocument3 pagesProcurement Management TemplateShahmir HanifNo ratings yet

- MDADocument4 pagesMDAShahmir HanifNo ratings yet

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDocument22 pagesStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasNo ratings yet

- Polyol polyether+NCO Isupur PDFDocument27 pagesPolyol polyether+NCO Isupur PDFswapon kumar shillNo ratings yet

- Sarvali On DigbalaDocument14 pagesSarvali On DigbalapiyushNo ratings yet

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- Budgetary ControlsDocument2 pagesBudgetary Controlssiva_lordNo ratings yet

- 2014 mlc703 AssignmentDocument6 pages2014 mlc703 AssignmentToral ShahNo ratings yet

- PESO Online Explosives-Returns SystemDocument1 pagePESO Online Explosives-Returns Systemgirinandini0% (1)

- Energy AnalysisDocument30 pagesEnergy Analysisca275000No ratings yet

- DLL - The Firm and Its EnvironmentDocument5 pagesDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- Merchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaDocument29 pagesMerchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaSanghamitra KalitaNo ratings yet

- Report Emerging TechnologiesDocument97 pagesReport Emerging Technologiesa10b11No ratings yet

- всё необходимое для изучения английского языкаDocument9 pagesвсё необходимое для изучения английского языкаNikita Chernyak100% (1)

- Brick TiesDocument15 pagesBrick TiesengrfarhanAAANo ratings yet

- Unit 3 Computer ScienceDocument3 pagesUnit 3 Computer ScienceradNo ratings yet

- En dx300lc 5 Brochure PDFDocument24 pagesEn dx300lc 5 Brochure PDFsaroniNo ratings yet

- 15142800Document16 pages15142800Sanjeev PradhanNo ratings yet

- Innovation Through Passion: Waterjet Cutting SystemsDocument7 pagesInnovation Through Passion: Waterjet Cutting SystemsRomly MechNo ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- Sharp Ar5731 BrochureDocument4 pagesSharp Ar5731 Brochureanakraja11No ratings yet

- International Certificate in WealthDocument388 pagesInternational Certificate in Wealthabhishek210585100% (2)

- Nursing Care Management of a Client with Multiple Medical ConditionsDocument25 pagesNursing Care Management of a Client with Multiple Medical ConditionsDeannNo ratings yet

- Cold Rolled Steel Sections - Specification: Kenya StandardDocument21 pagesCold Rolled Steel Sections - Specification: Kenya StandardPEng. Tech. Alvince KoreroNo ratings yet

- Exercises 6 Workshops 9001 - WBP1Document1 pageExercises 6 Workshops 9001 - WBP1rameshqcNo ratings yet

- Biology Mapping GuideDocument28 pagesBiology Mapping GuideGazar100% (1)

- Estimation of Working CapitalDocument12 pagesEstimation of Working CapitalsnehalgaikwadNo ratings yet

- ERP Complete Cycle of ERP From Order To DispatchDocument316 pagesERP Complete Cycle of ERP From Order To DispatchgynxNo ratings yet

- Ir35 For Freelancers by YunojunoDocument17 pagesIr35 For Freelancers by YunojunoOlaf RazzoliNo ratings yet

- Take This LoveDocument2 pagesTake This LoveRicardo Saul LaRosaNo ratings yet

- The Ultimate Advanced Family PDFDocument39 pagesThe Ultimate Advanced Family PDFWandersonNo ratings yet

- Chennai Metro Rail BoQ for Tunnel WorksDocument6 pagesChennai Metro Rail BoQ for Tunnel WorksDEBASIS BARMANNo ratings yet