Professional Documents

Culture Documents

Indian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)

Uploaded by

maimslapOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)

Uploaded by

maimslapCopyright:

Available Formats

I

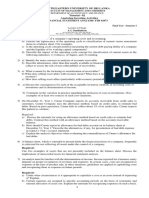

Indian Institute of Technology Kharagpur

Date: _ _FN/AN

Time: 3 hrs

Spring End-Sem. Exam, 2013

Full Marks: 50

Subject: Economics

No. of Students: 398

Subject No: HS2000 1

1. a) Define production and differentiate fixed input from variable input. Discuss the law of

diminishing marginal returns in the context of a production function with one variable

input. Prove that the exponents a and j3 in a Cobb-Douglas Production Function

represent the elasticities of output relating to respective inputs.

2+2+2

b) Show the relationship between Short-run Average Cost (SAC) and Short-run Marginal

Cost (SMC) and prove that SMC curve passes through the SAC curve at its minimum

point. If the total cost function of an inkjet printer is Cij = 5000 + 1.8q and the total

cost function of a laser printer is C1 = 8000 + 1.5q, where q represents the total number

of pages printed, which one should a firm buy and why?

2+2

c) Write short notes on (any three) of the following:

2x3

i. Determinants of price-elasticity of demand

ii. Ridge line and Economic region of production

iii. Laws ofretums to scale

iv. Private and Social costs

2. a) How is investment multiplier derived? An economy has the following consumption and

investment demand functions respectively:

C=25 +0.6Y

1=5 +0.2Y

Find the equilibrium incotne and the value of the multiplier (Treat multiplier as the

reciprocal of marginal demand propensities). If autonomous investment increases by 20,

present the operation of multiplier under the assumption that (i) investment is once-over type

and (ii) investment is permanent. Present the multiplier process with the help of tables and

algebraic expressions.

6

b) A company is planning to undertake a capital project and it has made the following

estimates. The total capital requirement is Rs 25 crore of which Rs 7 crore goes towards

working capital, Rs 8 crore towards reorganization of the activities and the remaining amount

is spent on the plant and machinery. The life ofthe project is five years. Its first year's gross

revenue is Rs 12 crore. It is expected to increase by 25% annually over the previous year's

revenues during second. and third years, and then will decrease by 10% annually over the

previous year's revenues for the last two years. The company will spend 25% of the revenue

on variable factors and Rs 5 crore annually on land, administration and rent. The company is

expected to pay a profit tax of 30% annually. It uses a flat depreciation rate. The salvage

value is estimated to be Rs 2.5 Cr and there is no recovery of working capital. Derive the net

cash flows over the life of the project. Also derive the present value of the net cash flows

5

assuming that the interest rate is 10%. Is the project worth-considering?

I

c) Compare perfect competition with monopoly according to (ii) Entry conditions, (iii) Price

and Quantity, (iv) Shut down point, (v) Demand curves of the firms, (vi) Equilibrium

situations in long-run. Draw the appropriate diagrams and interpret the companson

algebraically wherever necessary.

A perfectly competitive firm has the following average variable cost function:

AVC=4-2Q

It is found that the total fixed cost incurred by the firm is $200. The price per unit of the

output produced by the firm is fixed at $24. What will be the profit maximising output of the

firm in the short-run? How much profit/loss will the firm earn/incur?

6

3. a) Have we radically transformed ourselves from a protective regime to a liberal State?

Examine in detail the policy reforms in the context of New Economic Policy of 1991

onwards, and compare briefly with the pre-reform period.

Or

Define National Income and state the different methods of its estimation. Also state the

problems and fallacies of such estimation. Is it true that National Income can estimate the

growth, welfare and sustainability of a country? Also describe the trend in National Income

10

in India.

b) Distinguish between any seven of the following:

i)

GNP and GDP

ii) . GDP and NDP

iii)

NI (at mp) and NI (at fc)

iv)

NI (at fc) and PI

v)

PI and DPI

vi)

PI and per capita Income

vii) BoT and BoP

viii) IPR 1948 and IPR 1956

ix)

Real Income and Nominal Income

x)

Direct and Indirect taxes

) X

You might also like

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- EconomicsDocument2 pagesEconomicsAvinash BillaNo ratings yet

- Developing Airport Systems in Asian Cities: Spatial Characteristics, Economic Effects, and Policy ImplicationsFrom EverandDeveloping Airport Systems in Asian Cities: Spatial Characteristics, Economic Effects, and Policy ImplicationsNo ratings yet

- OL L K: Indian Institute of Technology KharagpurDocument2 pagesOL L K: Indian Institute of Technology KharagpurmaimslapNo ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- Tutorial QuestionsDocument19 pagesTutorial QuestionsTan Ngoc TranNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument8 pagesInstitute of Actuaries of India: ExaminationsVijaya AgrawalNo ratings yet

- Capital Budgeting SumsDocument6 pagesCapital Budgeting SumsDeep DebnathNo ratings yet

- Capital Budgeting Illustrative NumericalsDocument6 pagesCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- Answer All The Questions:: Discuss Briefly Explain The Steps of Value EngineeringDocument2 pagesAnswer All The Questions:: Discuss Briefly Explain The Steps of Value EngineeringSanjivee SachinNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- Financial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMDocument6 pagesFinancial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMMatthew HughesNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementgundapola100% (2)

- Model Questions of Managerial Economics, 2015 Paper: CS-54Document3 pagesModel Questions of Managerial Economics, 2015 Paper: CS-54JuliusNeelyNo ratings yet

- FIN639 Spring 2021 Final AssignmentDocument5 pagesFIN639 Spring 2021 Final AssignmentMd. Sazzad KhanNo ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Hirushika BandaraNo ratings yet

- Question Paper of FM (1) - 1637643755Document3 pagesQuestion Paper of FM (1) - 1637643755srijana pathakNo ratings yet

- Assignment 2Document2 pagesAssignment 2Parth ShahNo ratings yet

- Question Paper of FMDocument3 pagesQuestion Paper of FMsrijana pathakNo ratings yet

- Mba 108 CDocument5 pagesMba 108 CRohit TushirNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Assessment 1 October 2021 POCFDocument2 pagesAssessment 1 October 2021 POCFAakanksha ChughNo ratings yet

- Bba - 17ubn05 - 01.02.2022 - FN PDFDocument3 pagesBba - 17ubn05 - 01.02.2022 - FN PDFBdhs HdhdNo ratings yet

- Chemical Plant Design and Economics - R2009 - 29!05!2014Document2 pagesChemical Plant Design and Economics - R2009 - 29!05!2014rahulNo ratings yet

- MG2451 ModelDocument2 pagesMG2451 ModelchandrasekarcncetNo ratings yet

- ADL 13 Ver2+Document9 pagesADL 13 Ver2+DistPub eLearning Solution100% (1)

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Annual Worth IRR Capital Recovery CostDocument30 pagesAnnual Worth IRR Capital Recovery CostadvikapriyaNo ratings yet

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- FinancialManagement MB013 QuestionDocument31 pagesFinancialManagement MB013 QuestionAiDLo50% (2)

- Iii Semester Endterm Examination November 2016Document3 pagesIii Semester Endterm Examination November 2016Gautam KumarNo ratings yet

- Siddharth Education Services LTD: Tel:2443455 TelDocument3 pagesSiddharth Education Services LTD: Tel:2443455 TelBasanta K SahuNo ratings yet

- Master of Commerce Term-End Examination December, 2OO8Document4 pagesMaster of Commerce Term-End Examination December, 2OO8Smriti SoniNo ratings yet

- Adfm Iii 2015-17Document3 pagesAdfm Iii 2015-17Nithyananda PatelNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- MEFA Most Important QuestionsDocument15 pagesMEFA Most Important Questionsapi-26548538100% (5)

- Instructions To CandidatesDocument19 pagesInstructions To CandidatesCLIVENo ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- Assig5 2010Document4 pagesAssig5 2010WK LamNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- Q and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Document95 pagesQ and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Samuel Dwumfour100% (1)

- Tutorial I, II, III, IV QuestionsDocument15 pagesTutorial I, II, III, IV QuestionsAninda DuttaNo ratings yet

- Management Accountant Paper 2.2 Dec 2023Document19 pagesManagement Accountant Paper 2.2 Dec 2023MEYVIELYKERNo ratings yet

- Accounting For Managers Sample PaperDocument10 pagesAccounting For Managers Sample Paperghogharivipul0% (1)

- Uhu081 PDFDocument2 pagesUhu081 PDFsahibjotNo ratings yet

- FM MITSoB Capital - Budgeting Exercises)Document3 pagesFM MITSoB Capital - Budgeting Exercises)Saket SumanNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Mbac 2001Document6 pagesMbac 2001sujithNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Capital Budgeting Practice Questions QueDocument9 pagesCapital Budgeting Practice Questions QuemawandeNo ratings yet

- EconomicsDocument2 pagesEconomicsPradeep ChandrasekaranNo ratings yet

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmaleNo ratings yet

- Assignment MT1-2015-5: Section 1 (Based On Lecture Notes)Document5 pagesAssignment MT1-2015-5: Section 1 (Based On Lecture Notes)maimslapNo ratings yet

- Plot Showing The Variation of Log Pressure Gradient Vs Mass VelocityDocument1 pagePlot Showing The Variation of Log Pressure Gradient Vs Mass VelocitymaimslapNo ratings yet

- ReadmeDocument3 pagesReadmemaimslapNo ratings yet

- Cooling Tower PDFDocument3 pagesCooling Tower PDFmaimslapNo ratings yet

- Probability and Statistics Hints/Solutions To Assignment No. 1Document2 pagesProbability and Statistics Hints/Solutions To Assignment No. 1maimslapNo ratings yet

- Probability and Statistics Hints/Solutions To Assignment 7Document1 pageProbability and Statistics Hints/Solutions To Assignment 7maimslapNo ratings yet

- PS Ass 4 2012Document1 pagePS Ass 4 2012yashNo ratings yet

- Sci. Living Sys - Trascription Unit I SCK - 21.01.15Document87 pagesSci. Living Sys - Trascription Unit I SCK - 21.01.15maimslapNo ratings yet

- 2 F (Y) Y, 0 Y1, 9 1 (1 Y), 1 y 4, 9 0, Elsewhere. +Document1 page2 F (Y) Y, 0 Y1, 9 1 (1 Y), 1 y 4, 9 0, Elsewhere. +maimslapNo ratings yet

- PS Ass 4 2012Document1 pagePS Ass 4 2012yashNo ratings yet

- Assessment Case StudyDocument3 pagesAssessment Case StudyqrdpresadoNo ratings yet

- MBA Finance & Accounts With 14 Years of Experiance - Chandra Sekhar DoraDocument4 pagesMBA Finance & Accounts With 14 Years of Experiance - Chandra Sekhar DoraYamini SharmaNo ratings yet

- OIIC BenettonDocument1 pageOIIC BenettonJakaPutranto100% (1)

- West Chemical Company Produces Three Products The Operating ResDocument1 pageWest Chemical Company Produces Three Products The Operating ResAmit PandeyNo ratings yet

- Elite Club PresentationDocument8 pagesElite Club PresentationHiba YousefNo ratings yet

- Shawn Lacrouts - ResumeDocument1 pageShawn Lacrouts - Resumeapi-265317186No ratings yet

- 02 - LTCC WorkbookDocument12 pages02 - LTCC Workbookfaye margNo ratings yet

- Timber Sell Business PlanDocument34 pagesTimber Sell Business PlanNaomi NyongesaNo ratings yet

- Bank Statements AY 2020-21Document21 pagesBank Statements AY 2020-21rohit madeshiyaNo ratings yet

- Sales and Marketing ProfessionalDocument3 pagesSales and Marketing Professionalapi-78851785No ratings yet

- ShopeeDocument5 pagesShopeeDjustize GaboniNo ratings yet

- AI-X-S7-G5-Arief Budi NugrohoDocument9 pagesAI-X-S7-G5-Arief Budi Nugrohoariefmatani73No ratings yet

- Business Ethics ReviewerDocument2 pagesBusiness Ethics ReviewerClamonte, Marnie ShynneNo ratings yet

- Proposal GoyemDocument11 pagesProposal GoyemChukwu SolomonNo ratings yet

- Overview SAPMDocument11 pagesOverview SAPManirbanccim8493No ratings yet

- FAR Review Course Pre-Board - Answer KeyDocument17 pagesFAR Review Course Pre-Board - Answer KeyROMAR A. PIGANo ratings yet

- Ubi 4Document1 pageUbi 4boomtechNo ratings yet

- Artikel Faktoryang Mempengaruhi Transfer PricingDocument14 pagesArtikel Faktoryang Mempengaruhi Transfer PricingAnna altahea arthicNo ratings yet

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDocument53 pagesGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700No ratings yet

- Question and Answer - 16Document31 pagesQuestion and Answer - 16acc-expert0% (1)

- Assignment 4Document14 pagesAssignment 4Nur KarimaNo ratings yet

- PNP Loan Application Form February 2021 16Document6 pagesPNP Loan Application Form February 2021 16Wilhelm RegaladoNo ratings yet

- Chapter 10 ForecastingDocument2 pagesChapter 10 ForecastingElizabethNo ratings yet

- Moore MedicalDocument16 pagesMoore MedicalNiyati GargNo ratings yet

- Homework Demand and SupplyDocument4 pagesHomework Demand and SupplyLilia IstratiNo ratings yet

- Chap III Off Balance Sheet ActivitiesDocument20 pagesChap III Off Balance Sheet ActivitiesGing freexNo ratings yet

- Summary of Accounting Standards From Cfas Book CompressDocument34 pagesSummary of Accounting Standards From Cfas Book Compressofficial.kwentoniagimatNo ratings yet

- Npo QuestionDocument8 pagesNpo QuestionKritika MahalwalNo ratings yet

- Financial Accounting An Introduction To Concepts Methods and Uses 14th Edition by Weil ISBN Solution ManualDocument18 pagesFinancial Accounting An Introduction To Concepts Methods and Uses 14th Edition by Weil ISBN Solution Manualellen100% (27)

- Dr. D. S. ChaubeyDocument18 pagesDr. D. S. ChaubeyAnonymous y3E7iaNo ratings yet

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- The New Elite: Inside the Minds of the Truly WealthyFrom EverandThe New Elite: Inside the Minds of the Truly WealthyRating: 4 out of 5 stars4/5 (10)

- Economics 101: How the World WorksFrom EverandEconomics 101: How the World WorksRating: 4.5 out of 5 stars4.5/5 (34)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- The Meth Lunches: Food and Longing in an American CityFrom EverandThe Meth Lunches: Food and Longing in an American CityRating: 5 out of 5 stars5/5 (5)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistFrom EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistRating: 4.5 out of 5 stars4.5/5 (37)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- This Changes Everything: Capitalism vs. The ClimateFrom EverandThis Changes Everything: Capitalism vs. The ClimateRating: 4 out of 5 stars4/5 (349)

- Nickel and Dimed: On (Not) Getting By in AmericaFrom EverandNickel and Dimed: On (Not) Getting By in AmericaRating: 3.5 out of 5 stars3.5/5 (197)