Professional Documents

Culture Documents

Psms - View Problem Bank1

Uploaded by

AbynMathewScariaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Psms - View Problem Bank1

Uploaded by

AbynMathewScariaCopyright:

Available Formats

26/03/2016

PSMSVIEWPROBLEMBANK

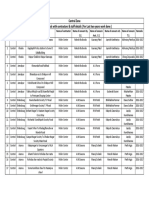

VIEW PROJECT DETAILS

PS TYPE PS-II(Semester-I)

Station

Name :

Website :

Current Batch 2015-2016

Credit Suisse ,Mumbai

www.credit-suisse

Project No.1/1

Titleoftheproject

Credit Suisse Business Analytics (India) Private Limited, Powai, Mumbai

Descriptionofthe

Total Requirement: 21 students split across 4 types of roles as detailed

project

below. 1) Market Risk Management: 12 Job description: Overview of Market

Risk Management (MRM) MRM is responsible to provide best in class

management of market risk through deep level of engagement with and

understanding of the firms business and use of a wide range of risk

management tools. SRM acts as the guardians of the banks risk appetite,

shares responsibility for unexpected or out of strategy losses incurred in

the business. To ensure that risk limits are established; and to approve risk

limits, enforce limits, own escalation process and address excesses. To

promote risk awareness across all levels of the organization and risk

adjusted returns. To function as an advisor to front office management on

risk related matter & ensure ownership of risk limits and to hold front

office accountable for risk decisions. Projects/Assignment Offered: Intern

working in Strategic Risk Management, on market risk related areas like

Value at Risk (VaR), Sensitivity Analysis (Delta, gamma etc), Scenario

Analysis and Basel 3 work Testing/analyzing time series & market risk

feeds/systems for Basel 3, supporting teams on analyzing portfolio

consisting of vanilla/exotic products (rates/fx/credit) Student

Requirement/Qualifications: Bachelors program or integrated Masters

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

1/8

26/03/2016

PSMSVIEWPROBLEMBANK

program (only in Mathematics/Finance/Computer Science/Economics), we

are not looking at pure Masters students i.e. who have not done their

Bachelors at BITS, CGPA 7.5 & above Familiarity with technology (Excel /

MS Access / SQL) Team player Good communicator Proactive approach

to work Problem Solver Ability to multi-task with competing deadlines

Market Risk Management Equities: Market Risk Management Equities

manages market risk for Credit Suisse Equities portfolio which includes

Derivatives, Convertibles, Prime Brokerage, Cash and Systematic Market

Making divisions across US, Europe and Asia Pacific. Risk Management

framework primarily comprises of sensitivity (greeks), VaR & Scenarios

(stress testing). The role of a risk analyst to ensure that correct sensitivity,

VaR and scenarios numbers are reflected in the risk reports and senior

management understands which trading positions are the drivers of risk

numbers and periodic changes in these numbers. In order to perform

his/her task the analyst is required to develop a strong knowledge of

equities products (including structured derivatives) desk and business

strategy (what are the primary trades and hedges, source of PnL), the IT

infrastructure & flow of data (from pricing models to reporting

infrastructure & databases), macro-economic drivers of risk, etc. Through

the role you will develop subject matter expertise in Equities products,

especially the behavior of various Greeks and proactively engage various

stakeholders in identifying the issues relating to market data & systems as

well as help in developing and enhancing risk reports. You will also develop

an understanding of market risk management process, systems and

associated roles in investment banks. Specific Role Description: Cluster:

Understanding desk strategy, developing a knowledge of structured

derivatives, development and validation of reports for senior risk

managers; review & remediation of risk presentation by liaising with

various stakeholders in Risk IT, Risk feeds and Risk reporting & Quant

teams Scenario: The role is expected to cover numerous aspects,

candidates will be expected to learn the business and the environment by

starting with scenario analysis tasks, as their knowledge and experience

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

2/8

26/03/2016

PSMSVIEWPROBLEMBANK

increase they will take over more complex portfolio analysis, sign-off IT

implementation and scenario calibration roles, specifically the following

tasks will be performed: Analysis and review of scenario results,

understanding behavior of allocated portfolio and products under various

scenario and market conditions Liaising with Cluster Managers (US, EMEA

or APAC) to understand their business requirements and provide them

with adhoc analysis and build reports as per specifications Thorough

analysis of periodic Risk Reports (Monthly, Quarterly) resulting in

meaningful, actionable commentary for use by cluster managers Projects:

Working on regulatory and internal projects to analyze risks across the

business by building automated reporting and analysis tools; working with

diverse senior stakeholders across the bank to understand requirements

and methodologies Cash, SMG, Prime: Candidates will get firsthand

experience of Risk sign-off, understanding business, working on high stake

projects, performing daily risk and VaR analysis, interact with Front Office,

drive from Cluster perspective 2) Credit Analytics: 2 Job Description: Credit

Risk Management (CRM) is part of the Risk Division. The CRM mission is to

manage overall credit risk for Credit Suisse consistent with the

bank's appetite, policies and business objectives. Products covered

include loans, derivatives, trading, inventory positions, mortgages and

asset backed lending. CRM responsibilities include developing and

administering credit policies and procedures, working in partnership with

the business divisions to facilitate and approve transactions, rating

countries and counterparties, approving credit limits appropriate to the

strength and standing of the counterparty, monitoring counterparty

exposures and performance and mitigating unacceptable risks, working

out distressed credits and dynamically monitoring exposures, including

country exposure and impaired assets, and setting and managing portfolio

limits. Credit Analytics is the credit risk methodology team within CRM. The

teams main responsibilities include: Development, calibration,

implementation, maintenance, back testing and documentation of credit

risk models and methodologies Provide quantitative credit risk analysis

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

3/8

26/03/2016

PSMSVIEWPROBLEMBANK

and assessment on a transaction and portfolio level Key Responsibilities

Intern would have an opportunity to work across various teams within

CRM - Credit Analytics area in Mumbai. The candidate would be involved in

one or more projects in the following areas: Develop and maintain models

required for estimation of obligors: Probability of default (PD), Loss given

default (LGD) and Exposure to default (EAD). Provide credit exposure

analysis on pre-and live-trades across all markets (FX, Rates, Equities,

Credit) and financial products (Loans, Derivatives) to Trader and credit

officers. The exposure is used to determine Credit charges and to assess

the impact of new trades on regulatory capital. Back-test IMM credit

exposure models, works on the enhancement and maintenance of these

models and tactical tools; Credit scenarios stress testing including stress

testing methodology, new scenario definitions and regulatory reporting.

Assess issuer risk on the trading book, develop, implement and maintain

IRC models. Develop and calibrate Risk Factor Estimation (RFE) models in

Monte Carlo Engine (a statistical technique to calculate exposure) for all

asset classes. Develop and improve inputs, models and controls for

collateralized exposure (EPE, PE) calculations (in INSIGHT) Collaborate with

global teams in delivering Strategic projects in meeting our regulatory

Powered by ELEMENT94 | Centre for Operational Excellence (http://www.element94.com)

commitments Qualifications / Competencies Work performed within the

CRM - Credit Analytics team is technical and the candidate is required to

have a sound mathematical background with interest in Quantitative

finance. Candidates must be able to demonstrate the following

qualifications and competencies: Good MS Access/SQL and VBA

knowledge; knowledge of basic programming (C/C++, R, Matlab) Analytical

and confident personality with excellent relationship skills in order to

interact with senior stakeholders. Ability to multi-task and prioritize work

load on a daily basis, adapting to changing workloads. Excellent written

and interpersonal communication skills Knowledge of Financial products

and risk methodologies would be preferred. 3) Prime Services: 2 Job

Description: Prime Services is a business unit within the Securities Division

within the Investment Banking umbrella. Credit Suisse is a market leading

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

4/8

26/03/2016

PSMSVIEWPROBLEMBANK

provider (globally 2nd) within this space & is a partner of choice for more

than 400 leading hedge funds & other marquee institutional clients. We

provide traditional prime brokerage cover & financing offerings across

multiple asset-classes with value added services for our partner Hedge

Fund Clients including; business consultancy, capital services

(raising/structuring), securities lending, clearance, custody, asset servicing.

Our aim is to support the growth of our clients and deliver the full suite of

products available across Credit Suisse. We emerged as the best Prime

broker according to the statistics drawn by the Global Custodian magazine

soon after the crisis in 2009 and since been reigning in the league of the

big banks globally. Reputed as the safest Prime Service provider we

currently manage a assets in excess of $350bn and we continue to witness

robust growth in terms of revenues, clients in recent times. Our Mumbai

office is a front office hub which blends experience and informed insight to

create practical solutions that are grounded in an understanding of the

unique needs and challenges faced by our clients & the business. This

team supports all three regions US/ Europe/ APAC and is quickly moving up

the value chain in terms of quality and content of services offered. The

team in Mumbai is an integral part of the business with bottom-line

contribution and possesses expertise spanning key functions such as index

management, trade-idea generation, risk & margin assessment, analytics,

pricing & balance sheet management, client onboarding, order

management, controls, etc. Employee Profile: The responsibilities offered

range from quantitative analytics, risk analysis, collateral management,

stock borrowing/ lending, trade idea generation, structuring of index

related products for Hedge fund clients, pricing / financing, client servicing

to actual trade booking depending on the team chosen. Strong analytical

capabilities with attention to detail will be elementary for all candidates.

Prior knowledge of financial products, market structure and financial

services in addition to some technical skills relating to MS Excel, VBA will

help but is not a pre-requisite. 4) IB Controls COO: 5 Job Description: IB

Controls COO Team is a senior specialist team operating within the central

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

5/8

26/03/2016

PSMSVIEWPROBLEMBANK

executive COO function. The team is closely aligned with the businesses,

providing central guidance for all FO (Front Office) Operational Risk and

Control Framework activities, including design, implementation and ongoing monitoring (oversight and QA) of FO Supervision and key FO

Controls. This is a rapidly evolving area of our business, a dynamic

changing environment, which will be both challenging and demanding. The

Candidature should be in similar lines: Preferably M.Sc (Finance), M.Sc

Economics, Computer Science Strong Microsoft skills (Excel, PowerPoint,

Word), with ability to develop Macro using VBA codes Preferred project

should on Financial Market (E.g Equities Pricing, Internal Finance, etc.)

Acute analytical and quantitative skills, with strong attention to detail

Excellent communications skills and ability to coordinate and liaise at all

levels; strong drive for performance, positive can do attitude and solid

work ethic

Requiredskillsets

Ability to learn fast , Adequate Knowledge in Finance , Basic Knowledge of

Accouting , Fluent in English , Good Analytical , problem solving skills ,

Good Communication Skills , Good Programming skills , MS OFFICE ,

Presentation skills , Strong analytical skills , Strong Interpersonal Skills ,

Writing skills

BroadAreaof

PreferredCourse

Preferred

project

Requirement

Disciplines

Any

Remarks

Note: It may be noted preferred discipline does not mean that organization is not open for other

disciplines. If any student is having sufficient skills to undertake a particular project, he/she may give

options accordingly. The final allotment need not necessarily follow the pattern of preferred discipline.

Facilities Extended By the Organization

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

6/8

26/03/2016

PSMSVIEWPROBLEMBANK

Address of the work place

City Park, Central Business Avenue Mumbai

Monthly Stipend:

25000

Weekly Holidays:

Saturday , Saturday , Sunday , Sunday

Accommodation:

Students to make their own arrangements

Remark for

Accommodation:

Accommodation Address

For Boys:

Accommodation Address

For Girls:

Contact Person Details

(Accommodation for Boys ):

Contact Person Details

(Accommodation for Girls) :

To & Fro from Home to PS

station:

Local transportation from

stay to office:

Whether work space will be

provided to students:

Computer Terminal:

Subsidized food:

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

7/8

26/03/2016

PSMSVIEWPROBLEMBANK

http://psd.bitspilani.ac.in/RegistrationReport/ViewStationPBDetails1.aspx?CompanyId=350&StationId=392

8/8

You might also like

- Bicycle Parking Facilities MapDocument1 pageBicycle Parking Facilities MapAbynMathewScariaNo ratings yet

- Internship or Volunteering FormDocument3 pagesInternship or Volunteering FormAbynMathewScariaNo ratings yet

- Example of MLE Computations, Using RDocument9 pagesExample of MLE Computations, Using Rnida pervaizNo ratings yet

- WQU+Catalog+4 10 19 PDFDocument52 pagesWQU+Catalog+4 10 19 PDFAbynMathewScariaNo ratings yet

- Best Subset, Forward Stepwise, or Lasso?: Analysis and Recommendations Based On Extensive ComparisonsDocument19 pagesBest Subset, Forward Stepwise, or Lasso?: Analysis and Recommendations Based On Extensive ComparisonsAbynMathewScariaNo ratings yet

- WQU+Catalog+4 10 19 PDFDocument52 pagesWQU+Catalog+4 10 19 PDFAbynMathewScariaNo ratings yet

- India's Relations With China - The Good, The Bad and The (Potentially) Ugly - Brookings InstitutionDocument8 pagesIndia's Relations With China - The Good, The Bad and The (Potentially) Ugly - Brookings InstitutionAbynMathewScariaNo ratings yet

- BooksDocument2 pagesBooksAbynMathewScariaNo ratings yet

- Bicycle Parking Facilities MapDocument1 pageBicycle Parking Facilities MapAbynMathewScariaNo ratings yet

- VarDocument6 pagesVarAbynMathewScariaNo ratings yet

- BooksDocument2 pagesBooksAbynMathewScariaNo ratings yet

- ITC Corporate PresentationDocument67 pagesITC Corporate PresentationAbynMathewScariaNo ratings yet

- BooksDocument4 pagesBooksAbynMathewScariaNo ratings yet

- These Are The 16 Best TV Shows in The World Right Now (2017) - Killer FeaturesDocument14 pagesThese Are The 16 Best TV Shows in The World Right Now (2017) - Killer FeaturesAbynMathewScariaNo ratings yet

- Equity Valuation Case StudyDocument112 pagesEquity Valuation Case StudyAbynMathewScariaNo ratings yet

- PNL Explained - WikipediaDocument2 pagesPNL Explained - WikipediaAbynMathewScariaNo ratings yet

- 01D07040 2006 Electrical Engineering Dual Degree (B.Tech+M.Tech.) Ravi Sonkar Male 25/03/81 Indian Communication & Signal ProcessingDocument2 pages01D07040 2006 Electrical Engineering Dual Degree (B.Tech+M.Tech.) Ravi Sonkar Male 25/03/81 Indian Communication & Signal ProcessingAbynMathewScariaNo ratings yet

- Financial Ratio AnalysisDocument14 pagesFinancial Ratio AnalysisPrasanga WdzNo ratings yet

- Hirekit FormDocument6 pagesHirekit FormAbynMathewScariaNo ratings yet

- How Should I Plan My Preparation For GRE - Quora PDFDocument6 pagesHow Should I Plan My Preparation For GRE - Quora PDFAbynMathewScariaNo ratings yet

- Spanning Tree Auctions: A Complete CharacterizationDocument17 pagesSpanning Tree Auctions: A Complete CharacterizationAbynMathewScariaNo ratings yet

- Chirag Sapra: ExperienceDocument5 pagesChirag Sapra: ExperienceAbynMathewScariaNo ratings yet

- Guideline For Preparation of Project ReportDocument26 pagesGuideline For Preparation of Project ReportsuryaNo ratings yet

- 2014 ACT Congress - MC12 Neale Blackwood Paper PDFDocument42 pages2014 ACT Congress - MC12 Neale Blackwood Paper PDFAbynMathewScariaNo ratings yet

- Chirag Sapra: ExperienceDocument5 pagesChirag Sapra: ExperienceAbynMathewScariaNo ratings yet

- Admissions Criteria, MFE Program, Berkeley-HaasDocument1 pageAdmissions Criteria, MFE Program, Berkeley-HaasAbynMathewScariaNo ratings yet

- What Is The Best Way To Study For The GMAT - Quora PDFDocument4 pagesWhat Is The Best Way To Study For The GMAT - Quora PDFAbynMathewScariaNo ratings yet

- I'm Actively Looking For A Topic For My Master's Thesis (Final Dissertation) Related To Behavioral Finance But I Have No Clue Where To Start or How To Make A CaseDocument2 pagesI'm Actively Looking For A Topic For My Master's Thesis (Final Dissertation) Related To Behavioral Finance But I Have No Clue Where To Start or How To Make A CaseAbynMathewScariaNo ratings yet

- Test 2Document2 pagesTest 2AbynMathewScariaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Animal Welfare in Bangladesh and The Role of Obhoyaronno CaseDocument11 pagesAnimal Welfare in Bangladesh and The Role of Obhoyaronno CaseZarin Tanjim WoyshorjoNo ratings yet

- Grave MattersDocument19 pagesGrave MattersKeith Armstrong100% (2)

- Entrenamiento 3412HTDocument1,092 pagesEntrenamiento 3412HTWuagner Montoya100% (5)

- Faiths of Eberron PDFDocument2 pagesFaiths of Eberron PDFCarrieNo ratings yet

- Marriage Families Separation Information PackDocument6 pagesMarriage Families Separation Information PackFatima JabeenNo ratings yet

- Rele A Gas BuchholtsDocument18 pagesRele A Gas BuchholtsMarco GiraldoNo ratings yet

- Economies of Scale in European Manufacturing Revisited: July 2001Document31 pagesEconomies of Scale in European Manufacturing Revisited: July 2001vladut_stan_5No ratings yet

- Immediate Life Support PDFDocument128 pagesImmediate Life Support PDFShilin-Kamalei Llewelyn100% (2)

- Gastric Emptying PresentationDocument8 pagesGastric Emptying Presentationrahul2kNo ratings yet

- Espn NFL 2k5Document41 pagesEspn NFL 2k5jojojojo231No ratings yet

- Alice (Alice's Adventures in Wonderland)Document11 pagesAlice (Alice's Adventures in Wonderland)Oğuz KarayemişNo ratings yet

- Torah Hebreo PaleoDocument306 pagesTorah Hebreo PaleocamiloNo ratings yet

- All Zone Road ListDocument46 pagesAll Zone Road ListMegha ZalaNo ratings yet

- Oral Communication in ContextDocument31 pagesOral Communication in ContextPrecious Anne Prudenciano100% (1)

- Sample A: For Exchange Students: Student's NameDocument1 pageSample A: For Exchange Students: Student's NameSarah AuliaNo ratings yet

- ListeningDocument2 pagesListeningAndresharo23No ratings yet

- (Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)Document233 pages(Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)monomonkisidaNo ratings yet

- 40+ Cool Good Vibes MessagesDocument10 pages40+ Cool Good Vibes MessagesRomeo Dela CruzNo ratings yet

- GE 110HP DC Trolley MotorDocument10 pagesGE 110HP DC Trolley MotorAnthony PetersNo ratings yet

- Atelierul Digital Pentru Programatori: Java (30 H)Document5 pagesAtelierul Digital Pentru Programatori: Java (30 H)Cristian DiblaruNo ratings yet

- Irregular Verbs-1Document1 pageIrregular Verbs-1timas2No ratings yet

- Crime Scene Drawing January Incident 10501-10600Document100 pagesCrime Scene Drawing January Incident 10501-10600columbinefamilyrequest100% (2)

- Visual Images of America in The Sixteenth Century: Elaine BrennanDocument24 pagesVisual Images of America in The Sixteenth Century: Elaine Brennanjoerg_spickerNo ratings yet

- Syllabus Biomekanika Kerja 2012 1Document2 pagesSyllabus Biomekanika Kerja 2012 1Lukman HakimNo ratings yet

- Morocco Top ScientistsDocument358 pagesMorocco Top Scientistsa.drioicheNo ratings yet

- Echeverria Motion For Proof of AuthorityDocument13 pagesEcheverria Motion For Proof of AuthorityIsabel SantamariaNo ratings yet

- Grossman 1972 Health CapitalDocument33 pagesGrossman 1972 Health CapitalLeonardo SimonciniNo ratings yet

- Trenching Shoring SafetyDocument29 pagesTrenching Shoring SafetyMullapudi Satish KumarNo ratings yet

- Nikulin D. - Imagination and Mathematics in ProclusDocument20 pagesNikulin D. - Imagination and Mathematics in ProclusannipNo ratings yet

- Performance MeasurementDocument13 pagesPerformance MeasurementAmara PrabasariNo ratings yet