Professional Documents

Culture Documents

The Costs of Harmonizing Romanian Accounting With International Regulations

Uploaded by

Luciana StanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Costs of Harmonizing Romanian Accounting With International Regulations

Uploaded by

Luciana StanCopyright:

Available Formats

The Costs of Harmonizing Romanian Accounting with

International Regulations

Romanian Accounting has known several major waves of reform:

adopting the Accounting Law in 1991 and implementing a French-inspired

accounting chart and guidelines in 1993 or harmonizing the large entities

accounting with EU accounting directives and International Accounting

Standards/ International Financial Reporting Standards (IAS/IFRS) in 1999

and 2001.

Ion Ionascu, Mihaela Ionascu, Lavinia Olimid and Daniela Calu have

conducted a research among listed Romanian companies following three

main objectives: identifying the extent to which Romanian companies feel

the need for IAS/IFRS, identifying and evaluating the costs involved in the

harmonization of Romanian accounting with international regulations and

capturing the perception of finance directors regarding the costs and

benefits linked to the harmonization process.

They identified four main types of harmonization costs: personnel

training costs, adjustment of information systems, consultants fees and

double reporting.

Almost all the listed companies surveyed (94.7%) incurred personnel

training costs and 71.1% of them have encountered adjustments of

information systems (as seen in Table 1). Consequently, we might believe

that these companies intended to assimilate and apply international

regulations with their own staff, rather than externalize the accounting

function. Even though companies intended to implement IAS/IFRS with

their own staff, the actual procedures were supervised by a professional

accounting firm, as 65.8% of companies indicated significant consultants

fees.

Table 1: Types of harmonization costs

Type of costs

Percentages

Training of personnel

94,7%

Adjustments of information systems

71,1%

Consultants fees

65,8%

Double reporting

23,7%

The companies surveyed mentioned other IAS/IFRS implementation

costs, such as: audit costs, documentation costs and remuneration costs.

Since the financial statements prepared in accordance to the

Harmonization Regulation had to be audited, all companies actually

incurred audit costs.

Table 2: Main harmonization costs

Most important costs

Percentages

Training of personnel

36,8%

Consultants fees

28,9%

Audit

18,4%

Adjustment of information systems

10,5%

Other costs

5,4%

Total

100,00%

It seems that wherever accounting firms gave their assistance in

areas related to the implementation of the Harmonization Regulation,

companies had difficulties in distinguishing between audit costs and other

implementation costs. Therefore it is possible that some of them

overlapped and were reported in a less precise way.

Regarding the values of the costs, it has been noticed, during the

study, that the average implementation cost was of approximately 30,000

euros, 78.26% of the analyzed companies indicating costs lower than

50,000 euros. Compared to the results of other studies regarding this

subject in the European Union, the costs of Romanian enterprises that

have implemented IAS/IFRS are much lower, due to the highly qualified

professional services delivered at much lower costs than in Western

Europe and to a possible minimal application of the Harmonization

Regulation.

Cost intervals

Below 50,000

50,000 100,000

Over 100,000

Total

Table 3: Size of costs

Percentages

78.26%

17.39%

4.35%

100.00%

In conclusion, only a few companies were ready to prepare IAS/IFRS

conforming financial statements out of the need to obtain foreign financing

and the benefits of the harmonization were perceived as not being

significant by the majority of finance directors of listed companies, even

though implementation costs were rather low. The data analysis involved

had shown that the lack of necessary expertise of the finance directors

involved is strongly correlated with a disconsideration for the

implementation of the IAS/IFRS with the Romanian accounting. Therefore,

in 2005, the regulator decided to withdraw the Harmonization Regulations

and limit the application of full IAS/IFRS to the consolidated accounts of

public interest entities. of the finance directors surveyed were of the

opinion that the benefits of adopting IAS/IFRS do not cover related

costs at

present.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Design of Combinational Circuit For Code ConversionDocument5 pagesDesign of Combinational Circuit For Code ConversionMani BharathiNo ratings yet

- 2014 - A - Levels Actual Grade A Essay by Harvey LeeDocument3 pages2014 - A - Levels Actual Grade A Essay by Harvey Leecherylhzy100% (1)

- Sociology As A Form of Consciousness - 20231206 - 013840 - 0000Document4 pagesSociology As A Form of Consciousness - 20231206 - 013840 - 0000Gargi sharmaNo ratings yet

- How To Configure PowerMACS 4000 As A PROFINET IO Slave With Siemens S7Document20 pagesHow To Configure PowerMACS 4000 As A PROFINET IO Slave With Siemens S7kukaNo ratings yet

- Gas Dynamics and Jet Propulsion 2marksDocument15 pagesGas Dynamics and Jet Propulsion 2marksAbdul rahumanNo ratings yet

- IEC TC 56 Dependability PDFDocument8 pagesIEC TC 56 Dependability PDFsaospieNo ratings yet

- English Homework 10 Grammar Focus 2: Lecturer: Mr. Dr. H. Abdul Hamid, M.SiDocument4 pagesEnglish Homework 10 Grammar Focus 2: Lecturer: Mr. Dr. H. Abdul Hamid, M.SiMutiara siwa UtamiNo ratings yet

- Advanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsDocument74 pagesAdvanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsetayhailuNo ratings yet

- Chapter 13 (Automatic Transmission)Document26 pagesChapter 13 (Automatic Transmission)ZIBA KHADIBINo ratings yet

- Cisco UCS Adapter TroubleshootingDocument90 pagesCisco UCS Adapter TroubleshootingShahulNo ratings yet

- Sept Dec 2018 Darjeeling CoDocument6 pagesSept Dec 2018 Darjeeling Conajihah zakariaNo ratings yet

- Food ResourcesDocument20 pagesFood ResourceshiranNo ratings yet

- PDF Chapter 5 The Expenditure Cycle Part I Summary - CompressDocument5 pagesPDF Chapter 5 The Expenditure Cycle Part I Summary - CompressCassiopeia Cashmere GodheidNo ratings yet

- DBMS Lab ManualDocument57 pagesDBMS Lab ManualNarendh SubramanianNo ratings yet

- Executive Summary-P-5 181.450 To 222Document14 pagesExecutive Summary-P-5 181.450 To 222sat palNo ratings yet

- Kiritsis SolutionsDocument200 pagesKiritsis SolutionsSagnik MisraNo ratings yet

- 1 - 2020-CAP Surveys CatalogDocument356 pages1 - 2020-CAP Surveys CatalogCristiane AokiNo ratings yet

- Catify To Satisfy - Simple Solutions For Creating A Cat-Friendly Home (PDFDrive)Document315 pagesCatify To Satisfy - Simple Solutions For Creating A Cat-Friendly Home (PDFDrive)Paz Libros100% (2)

- Recitation Math 001 - Term 221 (26166)Document36 pagesRecitation Math 001 - Term 221 (26166)Ma NaNo ratings yet

- Building Services Planning Manual-2007Document122 pagesBuilding Services Planning Manual-2007razanmrm90% (10)

- Lecture 2 Effects of Operating Conditions in VCCDocument9 pagesLecture 2 Effects of Operating Conditions in VCCDeniell Joyce MarquezNo ratings yet

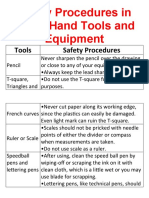

- Safety Procedures in Using Hand Tools and EquipmentDocument12 pagesSafety Procedures in Using Hand Tools and EquipmentJan IcejimenezNo ratings yet

- Music CG 2016Document95 pagesMusic CG 2016chesterkevinNo ratings yet

- The cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayDocument7 pagesThe cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayMennatallah AliNo ratings yet

- Case CapsuleDocument8 pagesCase CapsuleLiza BulsaraNo ratings yet

- Cloud Comp PPT 1Document12 pagesCloud Comp PPT 1Kanishk MehtaNo ratings yet

- RFID Seminar AbstractDocument2 pagesRFID Seminar Abstractanushabhagawath80% (5)

- Lecture2 GranulopoiesisDocument9 pagesLecture2 GranulopoiesisAfifa Prima GittaNo ratings yet

- Bom Details FormatDocument6 pagesBom Details FormatPrince MittalNo ratings yet

- Measurement Assignment EssayDocument31 pagesMeasurement Assignment EssayBihanChathuranga100% (2)