Professional Documents

Culture Documents

Assign Guidelines Section 2 Mar 2016 v3

Uploaded by

toaniltiwariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assign Guidelines Section 2 Mar 2016 v3

Uploaded by

toaniltiwariCopyright:

Available Formats

Section 2: 60% (1,600 words)

Crosswell International, a U.S.-based manufacturer and distributor of health care

products has been approached by Material Hospitalar, a distributor of health care

products throughout Brazil who are interested in distributing Crosswells diaper

products. Considerable competition already exists in the Brazilian Market, so pricing

and therefore cost control will be critical for the success of this collaboration.

Case study of the core text book by Moffett, Stonehill and Eiteman (2014, p. 529)

Making use of extensive academic justifications and an in-depth analysis of the

Crosswell International and Brazil case answer the following questions:

Question A Mandatory (35 marks)

Discuss the exposure to currency risk that Crosswell International faces in its dealing

with Material Hospitalar and examine the methods of hedging it could engage with to

protect itself from this.

Question B (25 marks)

Discuss how the various stages and their costs impact the ability of Crosswell as an

exporter in being competitive on the pricing of its products in penetrating the Brazilian

market.

OR

Using an example of Croswell in Brazil, you are to discuss and apply management

guidelines to minimize the costs of funding working capital requirements in trading with

countries of different payment terms practices.

1. Section 2 Question A (Mandatory): 35% 950 words

Discuss the exposure to currency risk that Crosswell International faces in its dealing with

Material Hospitalar and examine the methods of hedging it could engage with to protect

itself from this.

Guidelines

a)

b)

c)

d)

e)

Define what constitutes currency transaction exposure

Explain the purpose of currency hedging

Relate to Crosswell Intl where they are selling health care products to Material Hospitalar

with payments to Crosswell Intl supposedly in Brazilian Real.

Risk to Crosswell Intl: Payment in Brazilian Real (worst case) since USD payment is not

guaranteed. Thus Crosswell Intl faced the potential weakening of Brazilian Real against USD

when they receive them in 60-day time per payment agreement.

Discuss on the types of factors impacting on FX rate changes like:

i) high inflation in USA higher USD interest rate -> higher USD currency value against

Brazilian Real unfavourable to Crosswell Intl should receivables in Brazilian Real .

ii) high trade deficit for USA US Govt needs to borrow more USD to meet foreign payments

-> USD decline against Brazilian Real -> favourable to Crosswell Intl

iii) Political instability in USA result in weaker USD -> favourable to Crosswell Intl should

their receivables in Brazilian Real .

Provide in-depth analysis on the outcome in terms of Profit/Loss of the FX hedging (more

details on next slide)

Action: Sell Brazilian Real against USD FX Forward 60-day per contract agreement. Use

numerical examples (next slide as example)

Conclusion

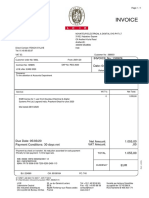

Section 2 Question A : 35% 950 words Mandatory Example of FX

hedging for Crosswell Intl

Analysis:

On June 7 the spot rate of BR is BR6.00 vs BR4.5 on Apr 08 , as a result BR ended

weaker worth lesser by US$100,000 (US$400,000 less US$300,000), Crosswell had

eliminated the FX risk by selling the Brazilian FX forward contract. Crosswell will benefit

when Brazilian Real appreciates and thus increase their sales revenue from the sale of

health care products. However, if the FX forward contract is not created, Crosswell would

have converted BR at the spot rate of BR6.00 to 1 US$ resulting in receiving lesser USD

when BR depreciates. However, the sale of FX forward contract on Brazilian real helped

Crosswell to lock the exchange rate and reduce their Brazilian real foreign exchange rate

fluctuation against them.

1. Section 2 Question B (i): 25% 550 words (Choose 1 out of 2)

Discuss how the various stages and their costs impact the ability of Crosswell as an

exporter in being competitive on the pricing of its products in penetrating the Brazilian

market.

Guidelines

a) Brief introduce the challenges/risks faced by exporter having to enter foreign

markets.

b) Identify the types of risks faced by Crosswell entering Brazilian market

resulting in an impact on their competitiveness in pricing their products.

i)

Political Risks (include Global-specific Risk; Country-specific Risk)

ii) Creditworthiness of Importer

iii) Riskiness of sale; Timing of sale

iv) Types of financing available

c) Provide in-depth analysis on the pros and cons on each of the risks impacting their

pricing competitiveness of their products with suggestion to overcome them.

d) Conclusion - There will always be challenges to success and education is for longterm investment with heavy capital outlay at initial stages.

1. Section 2 Question B (ii): 25% 550 words (Choose 1 out of 2)

Using an example of Croswell in Brazil, you are to discuss and apply management

guidelines to minimize the costs of funding working capital requirements in

trading with countries of different payment terms practices.

Guidelines

a)

b)

Briefly introduce what comprised of working capital requirements

Discuss the importance of minimising the cost of funding working capital

requirements to a typical company.

c) Relate to Crosswells challenges to minimise the cost of funding working

capital requirements like delay in receipts from customer or delay from

supplier

d) Provide in-depth analysis on the pros and cons on each of the risks with

strategy/suggestion to overcome them

i) factoring on a/c receivables, loans on a/c receivables, JIT for inventory

management, better credit terms from suppliers

e)

Conclusion suggest how to manage it or best practice.

You might also like

- Summer 2021 FIN 6055 New Test 2Document2 pagesSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Chapter 16 - Accessible - Case - PPTDocument20 pagesChapter 16 - Accessible - Case - PPTKamran MemmedovNo ratings yet

- Learning OutcomesDocument48 pagesLearning OutcomesPom Jung0% (1)

- Chapter 11 Testbank: StudentDocument71 pagesChapter 11 Testbank: StudentHoan Vu Dao KhacNo ratings yet

- Cross Currency SwapDocument23 pagesCross Currency SwapcathmichanNo ratings yet

- Exam Banking Financial Services Draft Jan 2020 With SolutionsDocument10 pagesExam Banking Financial Services Draft Jan 2020 With SolutionsBD04No ratings yet

- CFI5214201411 Multinational Business Finance and TradeDocument6 pagesCFI5214201411 Multinational Business Finance and TradeNelson MrewaNo ratings yet

- Sample FRM Part 1Document6 pagesSample FRM Part 1Silviu TrebuianNo ratings yet

- Midterm Exam MBA-12 MacroeconomicsDocument3 pagesMidterm Exam MBA-12 MacroeconomicsROHNIT PANNUNo ratings yet

- Liquidity Provision in The Convertible Bond Market: Analysis of Convertible Arbitrage Hedge FundsDocument51 pagesLiquidity Provision in The Convertible Bond Market: Analysis of Convertible Arbitrage Hedge FundsChris MasonNo ratings yet

- Basel 3 Literature ReviewDocument7 pagesBasel 3 Literature Reviewaflskkcez100% (1)

- Term Final Friday Spring 2020 Inffin OnlineDocument2 pagesTerm Final Friday Spring 2020 Inffin OnlineMd. Abdul HaiNo ratings yet

- 4 MacroeconomicsDocument3 pages4 MacroeconomicsgmustafaijtNo ratings yet

- Beta at DamodaranDocument39 pagesBeta at DamodaranAbhishek JaiswalNo ratings yet

- Assignment 7Document3 pagesAssignment 7Arunim YadavNo ratings yet

- Final Exam PracticeDocument8 pagesFinal Exam PracticebobtanlaNo ratings yet

- Crosswell International and BrazilDocument3 pagesCrosswell International and Brazilhariprasadj89No ratings yet

- 2016 - 01Document9 pages2016 - 01Bích ChâuNo ratings yet

- Question Paper Financial Risk Management - II (232) : October 2004Document12 pagesQuestion Paper Financial Risk Management - II (232) : October 2004api-27548664100% (2)

- Sem 2 Papers 2021 PDFDocument17 pagesSem 2 Papers 2021 PDFsahil sharmaNo ratings yet

- Certified Business Economist (CBE) Practice Exam: Answers, Content Areas and ExplanationsDocument14 pagesCertified Business Economist (CBE) Practice Exam: Answers, Content Areas and ExplanationsBelay BayuNo ratings yet

- QT CasesDocument18 pagesQT CasesHimanshu Rajesh Patnekar0% (1)

- Accounting Textbook Solutions - 60Document19 pagesAccounting Textbook Solutions - 60acc-expertNo ratings yet

- Nick Stavrou Tutorial Questions 2015Document2 pagesNick Stavrou Tutorial Questions 2015Trang PhanNo ratings yet

- Toy World - Group 14Document3 pagesToy World - Group 14Gowthami Shaik0% (1)

- McKinsey Global Institute - Define Contributions MarketDocument37 pagesMcKinsey Global Institute - Define Contributions MarketHugh NguyenNo ratings yet

- Topic 57 To 60 AnswerDocument12 pagesTopic 57 To 60 AnswerNaveen SaiNo ratings yet

- Exam AFBI 23 October 2018 PDFDocument2 pagesExam AFBI 23 October 2018 PDFMelanie VanNo ratings yet

- Assignment IIIDocument5 pagesAssignment IIItobias stubkjærNo ratings yet

- SET - A (For Odd Class ID)Document2 pagesSET - A (For Odd Class ID)farhanNo ratings yet

- Risk Management - Sample QuestionsDocument11 pagesRisk Management - Sample QuestionsSandeep Spartacus100% (1)

- The Optimization of Everything: OTC Derivatives, Counterparty Credit Risk and FundingDocument8 pagesThe Optimization of Everything: OTC Derivatives, Counterparty Credit Risk and FundingsinghhavefunNo ratings yet

- Arm - MF - Final - Sample (From 2016)Document27 pagesArm - MF - Final - Sample (From 2016)甜瓜No ratings yet

- Practice Questions 8 SolutionsDocument3 pagesPractice Questions 8 SolutionsNevaeh LeeNo ratings yet

- Bloomberg Sample QuestionsDocument7 pagesBloomberg Sample QuestionsAditya Verma100% (1)

- LM3 Overview of Asset AllocationDocument2 pagesLM3 Overview of Asset AllocationshkauntlaNo ratings yet

- Jun18l1equ-C03 QaDocument7 pagesJun18l1equ-C03 Qarafav10No ratings yet

- Seminar Set I 2022-23Document2 pagesSeminar Set I 2022-23MARIAM BAGGONo ratings yet

- FRM Part I - VAR & Risk ModelsDocument17 pagesFRM Part I - VAR & Risk Modelspradeep johnNo ratings yet

- CSC I - Fina 739 - Ch6-7 Q&ADocument14 pagesCSC I - Fina 739 - Ch6-7 Q&ANiranjan PaudelNo ratings yet

- FINC3012 - Interest Rate Futures and OptionsDocument5 pagesFINC3012 - Interest Rate Futures and OptionsLucas TingNo ratings yet

- International Financial Management 8Th Edition Eun Test Bank Full Chapter PDFDocument66 pagesInternational Financial Management 8Th Edition Eun Test Bank Full Chapter PDFDeniseWadeoecb100% (11)

- International Financial Management 8th Edition Eun Test BankDocument45 pagesInternational Financial Management 8th Edition Eun Test Bankjethrodavide6qi100% (30)

- Indian Economic EnvironmentDocument14 pagesIndian Economic Environmentrenu13205No ratings yet

- Assignment 5 2020Document5 pagesAssignment 5 2020林昀妤No ratings yet

- State Whether The Following Statements Are True or False. Give Reason For Your Answer. (Max Word LimitDocument2 pagesState Whether The Following Statements Are True or False. Give Reason For Your Answer. (Max Word LimitAkshay GuptaNo ratings yet

- Rajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100Document3 pagesRajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100SachinNo ratings yet

- Multinational Business Finance 15th Edition Eiteman Test BankDocument14 pagesMultinational Business Finance 15th Edition Eiteman Test Bankmisavizebrigadeuieix100% (26)

- Assignment BM014 3.5 3 DMKGDocument7 pagesAssignment BM014 3.5 3 DMKGDavid CarolNo ratings yet

- 15 Dec 2020Document2 pages15 Dec 2020KostNo ratings yet

- Financial Institutin ManagementDocument7 pagesFinancial Institutin ManagementAbu SufianNo ratings yet

- Parctise Worksheet 2024Document3 pagesParctise Worksheet 2024Thembelani ChiliNo ratings yet

- 2016 - Global Economics - Group Exercise 2Document2 pages2016 - Global Economics - Group Exercise 2Fer Garcia De RojasNo ratings yet

- Lab 2Document9 pagesLab 2Ahmad AlNo ratings yet

- Additional QuestionsDocument3 pagesAdditional QuestionsHotel Bảo LongNo ratings yet

- FRM Test 17Document19 pagesFRM Test 17Kamal BhatiaNo ratings yet

- Credit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsFrom EverandCredit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsRating: 1 out of 5 stars1/5 (1)

- Cash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityFrom EverandCash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityNo ratings yet

- Credit Guarantees: Challenging Their Role in Improving Access to Finance in the Pacific RegionFrom EverandCredit Guarantees: Challenging Their Role in Improving Access to Finance in the Pacific RegionNo ratings yet

- The Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesFrom EverandThe Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesNo ratings yet

- i did until now: let t = (1-α) m + α M t= m - α *m+ α*M = m - α * (M-m) then we show t ∈ (m,M) when α ∈ (0,1) t=m when α=0 t=M when α=1Document1 pagei did until now: let t = (1-α) m + α M t= m - α *m+ α*M = m - α * (M-m) then we show t ∈ (m,M) when α ∈ (0,1) t=m when α=0 t=M when α=1toaniltiwariNo ratings yet

- Sample Maths ExamDocument11 pagesSample Maths ExamtoaniltiwariNo ratings yet

- Me 262 Lecture 8Document25 pagesMe 262 Lecture 8toaniltiwariNo ratings yet

- ME 340 - Sp16 - HW1Document1 pageME 340 - Sp16 - HW1toaniltiwariNo ratings yet

- SylMARK304PrincMarkFall2015 2Document10 pagesSylMARK304PrincMarkFall2015 2toaniltiwariNo ratings yet

- Week5 SolutionsDocument7 pagesWeek5 SolutionstoaniltiwariNo ratings yet

- AdmDocument2 pagesAdmtoaniltiwariNo ratings yet

- Formal Report TalkDocument22 pagesFormal Report TalktoaniltiwariNo ratings yet

- Maths StatsDocument5 pagesMaths StatstoaniltiwariNo ratings yet

- 2110010Document8 pages2110010toaniltiwari100% (1)

- Senior Project CivilDocument12 pagesSenior Project CiviltoaniltiwariNo ratings yet

- Sample Solutions Manual ChapterDocument47 pagesSample Solutions Manual ChaptertoaniltiwariNo ratings yet

- AUCS 340 Business and Medical Ethics Individual Case AnalysisDocument1 pageAUCS 340 Business and Medical Ethics Individual Case AnalysistoaniltiwariNo ratings yet

- 1st Yr. Enggineering Mechanics IDocument2 pages1st Yr. Enggineering Mechanics ItoaniltiwariNo ratings yet

- Project SelectionDocument8 pagesProject SelectiontoaniltiwariNo ratings yet

- 01 LowforComm - pdf.PdfCompressor 1071199Document7 pages01 LowforComm - pdf.PdfCompressor 1071199toaniltiwariNo ratings yet

- 182 Exam 2 ReviewDocument2 pages182 Exam 2 ReviewtoaniltiwariNo ratings yet

- PhysicsDocument5 pagesPhysicstoaniltiwariNo ratings yet

- Solution Physics QuizDocument3 pagesSolution Physics QuiztoaniltiwariNo ratings yet

- P184 Practice Final AnswersDocument9 pagesP184 Practice Final AnswerstoaniltiwariNo ratings yet

- S.No Cust ID Name of Customer PO DateDocument3 pagesS.No Cust ID Name of Customer PO DatetoaniltiwariNo ratings yet

- Mirrors and Thin Lens Sign ConventionDocument1 pageMirrors and Thin Lens Sign ConventionSepamoNo ratings yet

- Physics Question SetDocument4 pagesPhysics Question SettoaniltiwariNo ratings yet

- 01 Math - assignment2.PDF - Pdfcompressor 1071200Document22 pages01 Math - assignment2.PDF - Pdfcompressor 1071200toaniltiwariNo ratings yet

- CH15Document75 pagesCH15Darren Scott Casey100% (1)

- Mastering PhysicsDocument40 pagesMastering Physicsandreea_ward0% (1)

- 21 Day Plateau Crusher Edited VersionDocument33 pages21 Day Plateau Crusher Edited Versiontoaniltiwari100% (1)

- Reading-Applications of Regular ExpressionsDocument6 pagesReading-Applications of Regular ExpressionstoaniltiwariNo ratings yet

- Southbayodnkouzes09 10 12 v1 120912022403 Phpapp02Document80 pagesSouthbayodnkouzes09 10 12 v1 120912022403 Phpapp02toaniltiwariNo ratings yet

- Class Notes: Class: XI Topic: Financial StatementDocument3 pagesClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaNo ratings yet

- Project Report of Bank of KathmanduDocument30 pagesProject Report of Bank of Kathmandushyamranger85% (27)

- What Is Credit AnalysisDocument7 pagesWhat Is Credit AnalysisAbyotBeyechaNo ratings yet

- Lesson 7 - Financial ForecastingDocument24 pagesLesson 7 - Financial Forecastingkylasaragosa04No ratings yet

- 2023 Tax Rates and Other DataDocument9 pages2023 Tax Rates and Other DataNonietandelNo ratings yet

- Ladrillo Investor PresentationDocument16 pagesLadrillo Investor PresentationMOVIES SHOPNo ratings yet

- FDRM - Answers Numericals - Assignment Questions - Dec2021Document4 pagesFDRM - Answers Numericals - Assignment Questions - Dec2021Chandramohan SNo ratings yet

- Summer Internship Project ReportDocument77 pagesSummer Internship Project ReportSagar GohelNo ratings yet

- RBI Branch and ATM Expansion LiberalizedDocument9 pagesRBI Branch and ATM Expansion LiberalizedbistamasterNo ratings yet

- 1 T1TOL - Overview - R10.1Document55 pages1 T1TOL - Overview - R10.1Tanaka Machana100% (1)

- Summer Internship Project Report On HDFC Bank LTDDocument72 pagesSummer Internship Project Report On HDFC Bank LTDGAURAV HindustaniNo ratings yet

- Total Return Swaps On Corp CDOsDocument11 pagesTotal Return Swaps On Corp CDOszdfgbsfdzcgbvdfcNo ratings yet

- Assignment 2Document2 pagesAssignment 2Sidharth ChughNo ratings yet

- Concepts in Financial ManagementDocument3 pagesConcepts in Financial ManagementfeilohNo ratings yet

- Credit ReportDocument34 pagesCredit ReportsophiaNo ratings yet

- Braden River High School BandsDocument2 pagesBraden River High School BandsAlex MoralesNo ratings yet

- International Asset PricingDocument37 pagesInternational Asset Pricingarif0194No ratings yet

- Cash Flow Statement Format: Add: Non-Cash Charges / Non-Business Expesnes Less: Non-Business IncomeDocument5 pagesCash Flow Statement Format: Add: Non-Cash Charges / Non-Business Expesnes Less: Non-Business IncomeTharani NagarajanNo ratings yet

- CH 6 - Cost of Capital PDFDocument49 pagesCH 6 - Cost of Capital PDFJanta RajaNo ratings yet

- CHEQUEmaster ClassDocument10 pagesCHEQUEmaster ClassMohanarajNo ratings yet

- Hsslive-Chapter 5 BRS 1 PDFDocument2 pagesHsslive-Chapter 5 BRS 1 PDFRam IyerNo ratings yet

- Hesham AldandashiDocument11 pagesHesham Aldandashihisham aldandashiNo ratings yet

- Type RI Contract NB 165895 INVOICE NB 132829 Client NB 388603 PDFDocument3 pagesType RI Contract NB 165895 INVOICE NB 132829 Client NB 388603 PDFPushpendra NamdeoNo ratings yet

- Corporate FinanceDocument18 pagesCorporate FinanceNishakdasNo ratings yet

- The Pony Express: Read The Article Below Then Answer The Questions That FollowDocument12 pagesThe Pony Express: Read The Article Below Then Answer The Questions That FollowHower XuNo ratings yet

- Dispute Claim Form: Personal InformationDocument1 pageDispute Claim Form: Personal InformationOptimiNo ratings yet

- Sbi Account Jan 2021Document2 pagesSbi Account Jan 2021Manoj GaurNo ratings yet

- Cmals 2010 Retired QuestionsDocument130 pagesCmals 2010 Retired QuestionsShahid Musthafa50% (2)

- Tybaf Black Book TopicDocument7 pagesTybaf Black Book Topicmahekpurohit1800No ratings yet

- Amfi Advisors Module NotesDocument57 pagesAmfi Advisors Module NotesMahekNo ratings yet