Professional Documents

Culture Documents

Zarai Taraqiati Bank Limited Consolidated Statement of Financial Position As at December 31, 2015 Note 2015 2014 Rupees in '000 Assets

Uploaded by

Faisal AwanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zarai Taraqiati Bank Limited Consolidated Statement of Financial Position As at December 31, 2015 Note 2015 2014 Rupees in '000 Assets

Uploaded by

Faisal AwanCopyright:

Available Formats

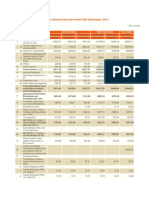

ZARAI TARAQIATI BANK LIMITED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT DECEMBER 31, 2015

Note

2015

2014

Rupees in '000

ASSETS

Cash and balances with treasury banks

Balances with other banks

Lendings to financial institutions

Investments - net

10

Advances - net

11

Operating fixed assets

12

Deferred tax assets - net

Other assets - net

13

14

2,516,338

4,491,391

16,742,698

5,913,555

-

820,190

19,665,649

29,237,315

129,552,744

108,553,958

2,105,429

1,584,150

507,162

1,581,812

11,669,626

16,793,850

187,883,870

163,851,997

346,059

561,964

57,143,100

969,349

35,869,024

26,695,967

LIABILITIES

Bills payable

15

Borrowings

16

Deposits and other accounts

17

Sub-ordinated loan

18

Liabilities against assets subject to finance lease

Deferred tax liabilities - net

Other liabilities

NET ASSETS

REPRESENTED BY

3,204,323

-

19

11,845,150

10,805,319

108,407,656

39,032,599

79,476,214

124,819,398

Share capital

20

Reserves

21

Unappropriated profit

Share deposit money

Surplus on revaluation of assets - net of tax

16.5

22

12,522,441

12,522,441

5,643,290

4,588,766

18,983,064

14,742,303

37,148,795

31,853,510

40,155,992

89,490,985

2,171,427

3,474,903

79,476,214

124,819,398

ZARAI TARAQIATI BANK LIMITED

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED DECEMBER 31, 2015

Note

Mark-up / return / interest earned

24

Mark-up / return / interest expensed

25

Net mark-up / interest income

Provision for diminution in the value of investments net

(Reversal) / provision against non-performing loans

and advances - net

2015

2014

Rupees in '000

18,284,43

6

6,013,77

5

12,270,66

1

15,522,13

0

2,398,27

0

13,123,86

0

(573,11

0)

160,00

9

(413,10

1)

12,683,76

2

1,381,32

4

-

10.3

11.3.4

Impairment in the value of investment

Write offs under relief packages

Bad debts written off directly

Net mark-up / interest income after provisions

113,663

1,494,98

7

11,628,873

NON MARK-UP / INTEREST INCOME

Fee, commission and brokerage income

40,919

Dividend income

81,805

Income from trading in government securities

Income from dealing in foreign currencies

Gain on sale of securities

366,437

Unrealized gain on revaluation of investments

classified as held for trading

Other income

Total non-mark-up / interest income

28,648

26

5,086,00

1

5,575,16

2

18,258,92

4

68,116

118,414

4,269,52

9

4,484,70

7

16,113,580

NON MARK-UP / INTEREST EXPENSES

Administrative expenses

Provision / (reversal) against other assets - net

Other charges

27

14.6

28

Total non mark-up / interest expenses

EXTRA ORDINARY / UNUSUAL ITEMS

PROFIT BEFORE TAXATION

Taxation - Current year

- Prior years

- Deferred

29

PROFIT AFTER TAXATION

Profit available for appropriation

Diluted earnings per share (Rupees)

2,311,747

361,40

8

477,39

1

3,150,54

6

5,343,110

Unappropriated profit brought forward

Basic earnings per share (Rupees)

9,706,35

8

34,93

6

23,97

4

9,765,26

8

8,493,65

6

8,493,65

6

30

31

14,742,30

3

20,085,41

3

4.26

7

4.26

7

7,730,76

5

(10,66

6)

11,099

7,731,19

8

8,382,38

2

8,382,38

2

3,003,99

0

4,26

3

(82,15

3)

2,926,10

0

5,456,28

2

13,758,92

9

19,215,211

4.35

7

4.35

7

ZARAI TARAQIATI BANK LIMITED

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED DECEMBER 31, 2015

2015

2014

Rupees in '000

Profit after taxation for the year

5,343,110

5,456,282

(74,020)

26,195

(47,825)

5,295,285

(5,214,509)

1,825,078

(3,389,431)

2,066,851

(680,022)

(623,454)

(1,303,476)

3,991,809

847,130

(228,419)

618,711

2,685,562

Other comprehensive income - net of tax

Items that will not be reclassified subsequently to profit and

loss account

Remeasurement of defined benefit plans

Deferred tax

Items that may be reclassified to profit and loss account

Comprehensive income transferred to equity

Components of comprehensive income not reflected in equity

Items that may be subsequently reclassified to profit and loss

Net change in fair value of available for sale securities

Deferred tax

Total comprehensive income for the year

Surplus arising on revaluation of assets has been reported in accordance with the directives of the State

Bank of Pakistan in a separate account below equity.

The annexed notes from 1 to 46 and annexure I form an integral part of these consolidated financial

statements.

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consolidated Annual Fin State31Dec14Document88 pagesConsolidated Annual Fin State31Dec14aqeel shoukatNo ratings yet

- Assets: Balance Sheet 2009 2010Document21 pagesAssets: Balance Sheet 2009 2010raohasanNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisLiza KhanNo ratings yet

- Unconsolidated Condensed Interim Financial Information As On 31 MARCH 2015 Zarai Taraqiati Bank LimitedDocument17 pagesUnconsolidated Condensed Interim Financial Information As On 31 MARCH 2015 Zarai Taraqiati Bank Limitedaqeel shoukatNo ratings yet

- Years Assets: Analysis Ratios of Allied BankDocument8 pagesYears Assets: Analysis Ratios of Allied BanksaniaasfaqNo ratings yet

- Rupees in '000 Rupees in '000: Balance Sheet 2008 2009Document22 pagesRupees in '000 Rupees in '000: Balance Sheet 2008 2009Ch Altaf HussainNo ratings yet

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Document36 pagesNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNo ratings yet

- United Bank Limited: Consolidated Condensed Interim Financial StatementsDocument19 pagesUnited Bank Limited: Consolidated Condensed Interim Financial StatementsMuhammad HassanNo ratings yet

- Valuasi TLKM Aditya Anjasmara Helmi DhanuDocument64 pagesValuasi TLKM Aditya Anjasmara Helmi DhanuSanda Patrisia KomalasariNo ratings yet

- Financial Due Diligence ReportDocument18 pagesFinancial Due Diligence ReportbiswajeetNo ratings yet

- BankingDocument113 pagesBankingKiran MaheenNo ratings yet

- B. LiabilitiesDocument1 pageB. LiabilitiesSamuel OnyumaNo ratings yet

- Balance Sheet: Lending To Financial InstitutionsDocument10 pagesBalance Sheet: Lending To Financial InstitutionsAlonewith BrokenheartNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- NBP Unconsolidated Financial Statements 2015Document105 pagesNBP Unconsolidated Financial Statements 2015Asif RafiNo ratings yet

- Financial Statements For The Year Ended 31 December 2009Document64 pagesFinancial Statements For The Year Ended 31 December 2009AyeshaJangdaNo ratings yet

- MCB Annual Report 2008Document93 pagesMCB Annual Report 2008Umair NasirNo ratings yet

- Ittehad ChemicalsDocument50 pagesIttehad ChemicalsAlizey AhmadNo ratings yet

- Bestway Cement Annual 15 AccountsDocument49 pagesBestway Cement Annual 15 AccountsM Umar FarooqNo ratings yet

- Accounts September 2010Document1 pageAccounts September 2010Fawad AkhtarNo ratings yet

- Value in Lacs Sme-Service InputDocument27 pagesValue in Lacs Sme-Service InputSugandha MadhokNo ratings yet

- Annual Report 2014 RevisedDocument224 pagesAnnual Report 2014 RevisedDivya AhujaNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Tugas 6 PerhitunganDocument21 pagesTugas 6 PerhitunganDiah KrismawatiNo ratings yet

- MCB Financial AnalysisDocument28 pagesMCB Financial AnalysisSana KazmiNo ratings yet

- ZTBL 2008Document62 pagesZTBL 2008Mahmood KhanNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Airbus Annual ReportDocument201 pagesAirbus Annual ReportfsdfsdfsNo ratings yet

- BDO Unibank: H1 Statement of ConditionDocument1 pageBDO Unibank: H1 Statement of ConditionBusinessWorldNo ratings yet

- HEXA TP FinancialsDocument60 pagesHEXA TP FinancialsKanmani FX21015100% (1)

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- Al-Habib Bank LTDDocument44 pagesAl-Habib Bank LTD2friendNo ratings yet

- San Miguel CorporationDocument1 pageSan Miguel CorporationHUPGUIDAN, GAUDENCIANo ratings yet

- Dont Del My Folder Its ImportantDocument15 pagesDont Del My Folder Its ImportantMinha irshadNo ratings yet

- Jabil Circuit Vertical Analysis (6050)Document12 pagesJabil Circuit Vertical Analysis (6050)Roy OmabuwaNo ratings yet

- LB 2013-2014 Standardized Statements MinervaDocument9 pagesLB 2013-2014 Standardized Statements MinervaArmand HajdarajNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Consolidated Financial Statements Dec 312012Document60 pagesConsolidated Financial Statements Dec 312012Inamullah KhanNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- 2010Document51 pages2010Mahmood KhanNo ratings yet

- Balance Sheet2006Document50 pagesBalance Sheet2006malikzai777No ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- ConsolidatedReport08 (BAHL)Document87 pagesConsolidatedReport08 (BAHL)Muhammad UsmanNo ratings yet

- Fame Export 1Document42 pagesFame Export 1sharedcaveNo ratings yet

- Final Accounts 2005Document44 pagesFinal Accounts 2005Mahmood KhanNo ratings yet

- Dandot CementDocument154 pagesDandot CementKamran ShabbirNo ratings yet

- Luckycement Annual Report 2Document4 pagesLuckycement Annual Report 2jointariqaslamNo ratings yet

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNo ratings yet

- SGVFS015182 : Manila Electric Company and Subsidiaries Consolidated Statements of Financial PositionDocument8 pagesSGVFS015182 : Manila Electric Company and Subsidiaries Consolidated Statements of Financial Positionjosie belazaNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Unaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Document4 pagesUnaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Dhruba DebnathNo ratings yet

- A Comparative Study On ITC PVT LTD and HUL PVT LTDDocument18 pagesA Comparative Study On ITC PVT LTD and HUL PVT LTDVishal RoyNo ratings yet

- SKYBEEDocument52 pagesSKYBEEMuhammad Ihsan SaputraNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- Financial Statement PertaminaDocument10 pagesFinancial Statement PertaminaAgnes Grace Florence SimanjuntakNo ratings yet

- PHYSiologyDocument7 pagesPHYSiologyFaisal AwanNo ratings yet

- PHYsiolgyDocument15 pagesPHYsiolgyFaisal AwanNo ratings yet

- Physiology McqsDocument5 pagesPhysiology McqsFaisal AwanNo ratings yet

- Performance Evaluation Form 2020-21Document4 pagesPerformance Evaluation Form 2020-21Faisal AwanNo ratings yet

- AntonymDocument6 pagesAntonymzahurNo ratings yet

- Adjectives: What Is An Adjective?Document6 pagesAdjectives: What Is An Adjective?leah rualesNo ratings yet

- Performance Evaluation Form 2020-21 (Managers)Document5 pagesPerformance Evaluation Form 2020-21 (Managers)Faisal AwanNo ratings yet

- Jalees Khan11Document2 pagesJalees Khan11Faisal AwanNo ratings yet

- Internship Report On National Bank of Pakistan L Branch Abbottabad (1907)Document71 pagesInternship Report On National Bank of Pakistan L Branch Abbottabad (1907)Faisal AwanNo ratings yet

- Paper: Human Anatomy (1 Hour) BSC (Hons) Medical Imaging Technology Name: - Date: - (Section-A) Encircle The Correct One. (30 Marks)Document3 pagesPaper: Human Anatomy (1 Hour) BSC (Hons) Medical Imaging Technology Name: - Date: - (Section-A) Encircle The Correct One. (30 Marks)Faisal AwanNo ratings yet

- Faiz ShahDocument7 pagesFaiz ShahFaisal AwanNo ratings yet

- D) Maintaining Balance of BodyDocument11 pagesD) Maintaining Balance of BodyFaisal AwanNo ratings yet

- AnatomyDocument4 pagesAnatomyFaisal AwanNo ratings yet

- AamirDocument7 pagesAamirFaisal AwanNo ratings yet

- Arbaz Khan: ObjectiveDocument1 pageArbaz Khan: ObjectiveFaisal AwanNo ratings yet

- Anatomy Internal Assessment Proforma1122Document2 pagesAnatomy Internal Assessment Proforma1122Faisal AwanNo ratings yet

- 30 June FuelDocument1 page30 June FuelFaisal AwanNo ratings yet

- Days of The Week: Monday Tuesday Wednesday Thursday Friday Saturday SundayDocument3 pagesDays of The Week: Monday Tuesday Wednesday Thursday Friday Saturday SundayFaisal AwanNo ratings yet

- Class 8th Syllabus MiseDocument2 pagesClass 8th Syllabus MiseFaisal Awan100% (1)

- Usman MCBTDocument88 pagesUsman MCBTFaisal AwanNo ratings yet

- Internship Report On Askari Bank Pma Kakul Branch Abbottabad (0030)Document70 pagesInternship Report On Askari Bank Pma Kakul Branch Abbottabad (0030)Faisal AwanNo ratings yet

- English BDocument2 pagesEnglish BFaisal AwanNo ratings yet

- Government College of Management Sciences Abbottabad: Internship Report ON District Comptroller of Accounts AbbottabadDocument78 pagesGovernment College of Management Sciences Abbottabad: Internship Report ON District Comptroller of Accounts AbbottabadFaisal AwanNo ratings yet

- Internship Report On Askari Bank Limited Mansehra: Government College of Management Sciences MansehraDocument75 pagesInternship Report On Askari Bank Limited Mansehra: Government College of Management Sciences MansehraFaisal AwanNo ratings yet

- Azizullah NBP nbp2Document72 pagesAzizullah NBP nbp2Faisal AwanNo ratings yet

- Umer IbraheeeeeeeeemDocument77 pagesUmer IbraheeeeeeeeemFaisal AwanNo ratings yet

- Umer IbrahimDocument61 pagesUmer IbrahimFaisal AwanNo ratings yet

- Amir Majid NBP nbp2Document72 pagesAmir Majid NBP nbp2Faisal AwanNo ratings yet

- Internship Report On Askari Bank Limited Mansehra: Government College of Management Sciences MansehraDocument71 pagesInternship Report On Askari Bank Limited Mansehra: Government College of Management Sciences MansehraFaisal AwanNo ratings yet

- Asfand nbp2Document77 pagesAsfand nbp2Faisal AwanNo ratings yet

- Credit Report Clean PDFDocument2 pagesCredit Report Clean PDFMarioBlanks100% (2)

- Airports in Cities and RegionsDocument192 pagesAirports in Cities and RegionsMarlar Shwe100% (2)

- General AwarenessDocument137 pagesGeneral AwarenessswamyNo ratings yet

- Klyde Warren Park, Dallas, TX: Urban Design Literature Study by Suren Mahant 10008Document24 pagesKlyde Warren Park, Dallas, TX: Urban Design Literature Study by Suren Mahant 10008coolNo ratings yet

- 1 Introduction To Agro-Industrial Waste ManagementDocument45 pages1 Introduction To Agro-Industrial Waste ManagementKarizze NarcisoNo ratings yet

- Status of Solid Waste Management in The Philippines: Alicia L. Castillo " Suehiro Otoma University of Kitakyushu, JapanDocument3 pagesStatus of Solid Waste Management in The Philippines: Alicia L. Castillo " Suehiro Otoma University of Kitakyushu, JapanPrietos KyleNo ratings yet

- Ky HT KHTVN Toan Cau Lan 2 (08.9.2023)Document263 pagesKy HT KHTVN Toan Cau Lan 2 (08.9.2023)Tuấn Anh NguyễnNo ratings yet

- Factors Affecting Balance of PaymentsDocument3 pagesFactors Affecting Balance of Paymentsashu khetan100% (5)

- Chenglong Motor Dongfeng Liuzhou Co LTD User ManualDocument280 pagesChenglong Motor Dongfeng Liuzhou Co LTD User ManualalindNo ratings yet

- DatabaseDocument3 pagesDatabaseJesicaNo ratings yet

- Executive Shirt CompanyDocument9 pagesExecutive Shirt CompanyAshish Adike0% (1)

- Garden Reach Shipbuilders & Engineers LimitedDocument63 pagesGarden Reach Shipbuilders & Engineers LimitedSRARNo ratings yet

- Labour Unrest at Honda MotorcyclesDocument7 pagesLabour Unrest at Honda MotorcyclesMayuri Das0% (1)

- 25 Important Model IBPS Banking Awareness QuestionsDocument5 pages25 Important Model IBPS Banking Awareness Questionsjaved alamNo ratings yet

- RFBT Chapter2 OutlineDocument20 pagesRFBT Chapter2 OutlineCheriferDahangCoNo ratings yet

- Final Draft of Toledo City LSPDocument21 pagesFinal Draft of Toledo City LSPapi-194560166No ratings yet

- Coca Cola Company PresentationDocument29 pagesCoca Cola Company PresentationVibhuti GoelNo ratings yet

- Letter - Offer of Earnest MoneyDocument2 pagesLetter - Offer of Earnest MoneyIpe Closa100% (1)

- PLB - EnglishDocument16 pagesPLB - Englishsetyabudi bowolaksonoNo ratings yet

- Philips 3580Document4 pagesPhilips 3580gabymourNo ratings yet

- BHIM ABPB FAQsDocument6 pagesBHIM ABPB FAQsLenovo Zuk z2plusNo ratings yet

- The Guidebook For R and D ProcurementDocument41 pagesThe Guidebook For R and D Procurementcharlsandroid01No ratings yet

- 1 Croucher S. L.. Globalization and Belonging: The Politics of Identity in A Changing World. Rowman & Littlefield. (2004) - p.10 1Document10 pages1 Croucher S. L.. Globalization and Belonging: The Politics of Identity in A Changing World. Rowman & Littlefield. (2004) - p.10 1Alina-Elena AstalusNo ratings yet

- RoadsDocument23 pagesRoadsNikhil SharmaNo ratings yet

- BR100 Accounts Receivable ReferenceDocument127 pagesBR100 Accounts Receivable ReferenceVenkat Subramanian RNo ratings yet

- List of PublicationDocument3 pagesList of PublicationBiswajit JenaNo ratings yet

- Chapter 1 Eco561Document32 pagesChapter 1 Eco561norshaheeraNo ratings yet

- RVU Distribution - New ChangesDocument5 pagesRVU Distribution - New Changesmy indiaNo ratings yet

- 4 Local EconomyDocument31 pages4 Local EconomyCj CaoNo ratings yet

- Expectations-At The End of This UnitDocument23 pagesExpectations-At The End of This Unitxx101xx100% (1)