Professional Documents

Culture Documents

Overseas Projects Nigeria

Uploaded by

Prateek VyasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Overseas Projects Nigeria

Uploaded by

Prateek VyasCopyright:

Available Formats

L&T OVERSEAS PROJECTS NIGERIA LIMITED

DIRECTORS REPORT

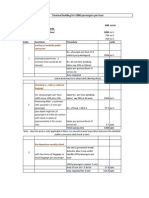

The Directors present their report and audited accounts for the year ended December 31, 2012.

FINANCIAL RESULTS

During the year under review, the Company did not carry on any business activities and accordingly a statement of Income and Expenditure during

Pre-Operational period is prepared.

In Lakhs

Particulars

Loss before tax

2012

V

Naira

(8.67)

(2.96)

(9.04)

(2.77)

(8.67)

(2.96)

(9.04)

(2.77)

Provision for taxes

Loss after tax

2011

Naira

Preliminary Expenses charged to P&L

Balance brought forward from Previous Year

(72.77)

(24.12)

(63.73)

(21.35)

Balance carried to Balance Sheet

(81.44)

(27.08)

(72.77)

(24.12)

DIVIDEND

During the period under review, no dividend has been proposed or paid.

PERFORMANCE OF THE COMPANY

During the period under review, the Company did not carry out any commercial activities.

CAPITAL EXPENDITURE

During the period under review, the Company did not incur any capital expenditure.

AUDITORS REPORT

The Auditors Report to the shareholders does not contain any qualifications.

DISCLOSURE OF PARTICULARS

The Company being registered outside India, the disclosures required to be made in accordance with Companies (Disclosure of Particulars in the

Report of Board of Directors) Rules, 1988, are not relevant. Hence the same has not been furnished.

PARTICULARS OF EMPLOYEES U/S 217(2A)

The Company being registered outside India, the disclosures required to be made in accordance with the provisions of Section 217(2A) of the

Companies Act, 1956, read with the Companies (Particulars of Employees) Rules, 1975 are not applicable.

SUBSIDIARY COMPANIES

The Company has no subsidiary companies.

DIRECTORS

Mr. Dileep Shevde submitted his resignation from the Board with effect from March 27, 2012. Mr. K. Ravindranath has been appointed as a Director

of the Company in place of Mr. Dileep Shevde with effect from the said date. The Board of Directors places on record their appreciation for the

contribution made by Mr. Dileep Shevde during his tenure as Director and welcomes Mr. K. Ravindranath to the Board.

The current Directors of the Company are:

Mr. U. Dasgupta

Mr. K. Ravindranath

DIRECTORS RESPONSIBILITY STATEMENT

The Board of Directors of the Company confirms:

I.

that in the preparation of the annual accounts, the accounting standards have been followed to the extent applicable and there has been no

material departure;

II.

that the selected accounting policies were applied consistently and the directors made judgements and estimates that are reasonable and

prudent so as to give a true and fair view of the state of affairs of the Company as at December 31, 2012;

III.

that proper and sufficient care has been taken for the maintenance of adequate accounting records in accordance with the provisions of the

Companies Act, 1956 for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities;

S-142

L&T OVERSEAS PROJECTS NIGERIA LIMITED

L&T OVERSEAS PROJECTS NIGERIA LIMITED

IV.

that the annual accounts have been prepared on a going concern basis;

V.

that proper systems are in place to ensure compliance of all laws applicable to the Company; and

VI.

that the details of all the related party transactions form part of the accounts as required under AS 18 (refer to Point 6 in Note G of the Annual

Report).

AUDITORS

M/s. Adedolapo Fayomi & Co., the Auditors of the Company has indicated their willingness and is eligible for re-appointment.

ACKNOWLEDGEMENT

The Directors acknowledge the invaluable support extended to the Company by the bankers, staff and management of the parent Company.

For and on behalf of the Board

Place : Mumbai

Date : April 25, 2013

U. DASGUPTA

Director

K. RAVINDRANATH

Director

S-143

L&T OVERSEAS PROJECTS NIGERIA LIMITED

L&T OVERSEAS PROJECTS NIGERIA LIMITED

AUDITORS REPORT

TO THE MEMBERS OF L&T OVERSEAS PROJECTS NIGERIA LIMITED

The financial statements of L&T OVERSEAS PROJECTS NIGERIA LIMITED for the year ended 31 December 2012, being a Company registered

in Nigeria, are audited by Adedolapo Fayomi & Co. and we have been furnished with their audit report dated February 14, 2013.

We are presented with the accounts in Indian Rupees prepared on the basis of the aforesaid accounts to comply with the requirements of Section

212 of the Companies Act, 1956. We give our report as under:

We have audited the attached Balance Sheet, statement of income and expenditure during pre-operational period and Cash Flow Statement of

L&T Overseas Projects Nigeria Limited as at 31 December 2012. These financial statements are the responsibility of the Companys management.

Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in India. Those standards require that we plan and perform the

audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a

test basis, evidence supporting the amounts and disclosures in financial statements. An audit also includes assessing the accounting principles

used and significant estimates made by management, as well as evaluating the overall financial statements presentation. We believe that our audit

provides a reasonable basis for our opinion.

In accordance with the provisions of Section 227 of the Companies Act, 1956, we report that:

(1)

As required by the Companies (Auditors Report) Order, 2003, issued by the Central Government of India under sub-section (4A) of Section

227 of the Companies Act, 1956, and on the basis of such checks of the books and records of the Company as we considered appropriate

and according to the information and explanations given to us, we enclose in the Annexure a statement on the matters specified in paragraphs

4 and 5 of the said Order.

(2)

Further to our comments in the Annexure referred to above, we report that:

(a)

we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes

of our audit;

(b) in our opinion, proper books of account as required by law have been kept by the Company so far as appears from our examination of

those books;

(c)

the Balance Sheet, statement of income and expenditure during pre-operational period and Cash Flow Statement dealt with by this report

are in agreement with the books of account;

(d) in our opinion, the Balance Sheet, statement of income and expenditure during pre-operational period and Cash Flow Statement dealt

with by this report comply with the accounting standards referred to in sub-section (3C) of Section 211 of the Companies Act, 1956; and

(e)

as regards reporting on the disqualification of directors under Section 274(1)(g) of the Indian Companies Act, 1956, since the Company

is registered in Nigeria, no reporting is required to be made under the above Section.

In our opinion and to the best of our information and according to the explanations given to us, the said accounts, read together with the notes

thereon, give the information required by the Companies Act, 1956 in the manner so required and give a true and fair view in conformity with

the accounting principles generally accepted in India:

(i)

in the case of the Balance Sheet, of the state of affairs of the Company as at 31 December 2012;

(ii)

in the case of the statement of income and expenditure during pre-operational period, of the excess of expenditure over income for the

year ended on that date; and

(iii) in the case of the Cash Flow Statement, of the cash flows for the year ended on that date.

SHARP & TANNAN

Chartered Accountants

Firms registration no. 109982W

by the hand of

FIRDOSH D. BUCHIA

Partner

Membership no. 38332

Place : Mumbai

Date : April 25, 2013

S-144

L&T OVERSEAS PROJECTS NIGERIA LIMITED

L&T OVERSEAS PROJECTS NIGERIA LIMITED

ANNEXURE TO THE AUDITORS REPORT

(Referred to paragraph (1) of our report of even date)

1

The Company has no fixed assets and hence reporting under paragraphs 4(i)(a), (b) and (c) is not applicable.

The Company has no inventories and hence reporting under paragraphs 4(ii)(a), (b) and (c) is not applicable.

We are informed by management that there are no companies, firms and other parties that are required to be listed in the register maintained

under section 301 of the Companies Act, 1956. Accordingly, paragraphs 4(iii)(b) to (g) of the Order are not applicable.

The Company has not commenced commercial operations and accordingly we are unable to comment on the adequacy of the internal control

procedures.

We are informed by management that there are no companies, firms and other parties that are required to be listed in the register maintained

under section 301 of the Companies Act, 1956. Accordingly, paragraphs 4(v)(a) and (b) of the Order are not applicable.

The Company has not accepted deposits from the public.

The Company has no internal audit system at present.

The Company is not required to maintain cost records under section 209(1)(d) of the Companies Act, 1956.

(a)

According to the information and explanations given to us, the Company is regular in depositing undisputed statutory dues with appropriate

authorities and there are no undisputed statutory dues outstanding for a period exceeding six months as at 31 December 2012.

(b) According to the information and explanations given to us, there are no dues towards income tax, sales tax, service tax, customs duty,

excise duty and wealth tax that were under dispute as at 31 December 2012.

10

The Companys accumulated losses are more than fifty percent of its net worth as at 31 December 2012 and it has incurred cash losses in

the financial year ended on that date and in the immediately preceding financial year.

11

According to the information and explanations given by management, the Company has neither borrowed from a bank nor a financial institution

and neither has it issued any debentures.

12

The Company has not granted any loans or advances on the basis of security by way of pledge of shares, debentures or other securities.

13

The provisions of any special statute applicable to chit fund/ nidhi /mutual benefit fund/societies are not applicable to the Company.

14

In our opinion and according to the information and explanations given to us, the Company is not a dealer or trader in securities.

15

According to the information and explanations given to us, the Company has not given any guarantee for loans taken by others from banks

or financial institutions.

16

The Company has not availed any term loans during the year.

17

According to the information and explanations given to us, the Company has not raised any loans during the year.

18

The Company has not made any preferential allotment of shares to any party during the year.

19

The Company has not issued debentures during the year and accordingly, no security is required to be provided.

20

The Company has not raised any money by public issues during the year.

21

During the course of our examination of the books and records of the Company, carried out in accordance with the generally accepted auditing

practices in India, and according to the information and explanations given to us, we have neither come across any instances of fraud on or

by the Company, noticed or reported during the year, nor have we been informed of such case by management.

SHARP & TANNAN

Chartered Accountants

Firms registration no. 109982W

by the hand of

FIRDOSH D. BUCHIA

Partner

Membership no. 38332

Place : Mumbai

Date : April 25, 2013

S-145

L&T OVERSEAS PROJECTS NIGERIA LIMITED

L&T OVERSEAS PROJECTS NIGERIA LIMITED

BALANCE SHEET AS AT DECEMBER 31, 2012

Note No.

As at 31.12.2012

V

As at 31.12.2011

V

EQUITY AND LIABILITIES

Shareholders funds

Share capital

3,344,783

3,344,783

Reserve & Surplus

(2,691,137)

(2,413,943)

328,507

414,731

982,153

1,345,571

Non-Current Liabilities

Current Liabilities

Other current liabilities

TOTAL

ASSETS

Non-Current Assets

Fixed assets

Current assets

Cash and bank balances

D(I)

956,870

1,322,611

Short term loans and advances

D(II)

25,283

22,960

OTHER NOTES FORMING PART OF THE ACCOUNTS

SIGNIFICANT ACCOUNTING POLICIES

982,153

1,345,571

982,153

1,345,571

The notes referred to above form an integral part of financial statements.

As per our report attached

For and on behalf of the Board

SHARP & TANNAN

Chartered Accountants

Firms registration no. 109982W

by the hand of

FIRDOSH D. BUCHIA

Partner

Membership No. 38332

U. DASGUPTA

Director

Place : Mumbai

Date : April 25, 2013

Place : Mumbai

Date : April 25, 2013

S-146

L&T OVERSEAS PROJECTS NIGERIA LIMITED

K. RAVINDRANATH

Director

L&T OVERSEAS PROJECTS NIGERIA LIMITED

STATEMENT OF INCOME AND EXPENDITURE DURING PRE-OPERATIONAL

PERIOD FOR THE YEAR ENDED DECEMBER 31, 2012

2012

V

Note no.

2011

V

INCOME

Revenue from operations

Other Income

15,767

17,476

15,767

17,476

312,190

294,853

312,190

294,853

(296,423)

(277,377)

(296,423)

(277,377)

(0.03)

(0.03)

TOTAL

EXPENDITURE

Sales, administration and other expenses

TOTAL

Excess of expenditure over income during pre-operational period before tax

Tax expenses

Excess of expenditure over income during pre-operational period after tax

Earnings per Share

- Basic & Diluted (V)

Face value per equity share (Naira)

OTHER NOTES FORMING PART OF THE ACCOUNTS

SIGNIFICANT ACCOUNTING POLICIES

The notes referred to above form an integral part of financial statements.

As per our report attached

For and on behalf of the Board

SHARP & TANNAN

Chartered Accountants

Firms registration no. 109982W

by the hand of

FIRDOSH D. BUCHIA

Partner

Membership No. 38332

U. DASGUPTA

Director

Place : Mumbai

Date : April 25, 2013

Place : Mumbai

Date : April 25, 2013

K. RAVINDRANATH

Director

S-147

L&T OVERSEAS PROJECTS NIGERIA LIMITED

L&T OVERSEAS PROJECTS NIGERIA LIMITED

CASH FLOW STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2012

A.

2012

V

2011

V

(296,423)

(277,377)

(15,767)

(17,476)

19,229

119,829

(292,961)

(175,024)

Cash flow from operating activities

Excess of expenditure over income during pre-operational period before tax (after

extraordinary items)

Adjustment for :

Interest Income

Increase/(Decrease) in translation reserve

Operating profit before working capital changes

Adjustments for :

(Increase)/ decrease in short term loans and advances

(2,323)

(4,514)

(86,224)

212,535

(381,508)

32,997

(381,508)

32,997

Interest Income

15,767

17,476

Net cash (used in)/from Investing Activities (B)

15,767

17,476

Net (decrease) / increase in cash and cash equivalents (A+B+C)

(365,741)

50,473

Cash and cash equivalents at beginning of the year

1,322,611

1,272,138

956,870

1,322,611

Increase/ (decrease) in other current liabilities

Cash (used in)/generated from operations

Direct taxes refund / (paid) - net

Net cash (used in)/from operating activities (A)

B

Cash flow from investing activities

Cash flow from financing activities

Cash and cash equivalents at end of the year

Notes:

1

Cash Flow Statement has been prepared under the indirect method as set out in the Accounting Standard (AS) 3 Cash Flow Statements as

specified in the Companies (Accounting Standards) Rules, 2006.

Cash and cash equivalents at the end of the year represent cash and bank balances and include unrealised gain of V Nil (previous year V Nil)

on account of translation of foreign currency bank balances.

Previous years figures have been regrouped/reclassified wherever applicable.

As per our report attached

For and on behalf of the Board

SHARP & TANNAN

Chartered Accountants

Firms registration no. 109982W

by the hand of

FIRDOSH D. BUCHIA

Partner

Membership No. 38332

U. DASGUPTA

Director

Place : Mumbai

Date : April 25, 2013

Place : Mumbai

Date : April 25, 2013

S-148

L&T OVERSEAS PROJECTS NIGERIA LIMITED

K. RAVINDRANATH

Director

L&T OVERSEAS PROJECTS NIGERIA LIMITED

NOTES FORMING PART OF ACCOUNTS

As at 31.12.2012

A.

As at 31.12.2011

Number of

shares

Amount in V

Number of

shares

Amount in

V

10,000,000

3,344,783

10,000,000

3,344,783

10,000,000

3,344,783

10,000,000

3,344,783

10,000,000

3,344,783

10,000,000

10,000,000

SHARE CAPITAL

A(I) Share capital authorised, issued, subscribed and paid up:

Authorised:

Equity shares of Naira 1/- each

Issued, subscribed and fully paid up:

Equity shares of Naira 1/- each

A(II) Reconciliation of the number of equity shares and share

capital:

Issued, subscribed and fully paid up equity shares outstanding

at beginning of the year

Add: Shares issued during the year

Issued, subscribed and fully paid up equity shares

outstanding at the end of the year

10,000,000

3,344,783

10,000,000

10,000,000

Number of

Shares

Shareholding

%

Number of

Shares

Shareholding

%

9,999,998

99.99

9,999,998

99.99

A(II) Holding Company

99,99,998 equity shares of Face Value Naira 1/- each amounting

to V 33.44 lakhs are held by Larsen & Toubro International FZE,

Sharjah which is the holding Company.

A(IV) Shareholders holding more than 5% of equity shares

as at the end of the year

Larsen & Toubro International FZE

As at 31.12.2012

V

B.

As at 31.12.2011

V

RESERVES & SURPLUS

Translation Reserve

As per last Balance Sheet

(1,651)

(121,480)

Addition/(deduction) during the year (net)

19,229

119,829

17,578

(1,651)

Surplus / (Deficit) Statement of Income & Expenditure

during pre-operational period

As per last Balance Sheet

Excess of expenditure over income during pre-operational

period after tax

TOTAL

C.

(2,412,292)

(2,134,915)

(296,423)

(277,377)

(2,708,715)

(2,412,292)

(2,691,137)

(2,413,943)

OTHER CURRENT LIABILITIES

Due to related parties

131,986

130,858

Other payables

196,521

283,873

TOTAL

328,507

414,731

S-149

L&T OVERSEAS PROJECTS NIGERIA LIMITED

L&T OVERSEAS PROJECTS NIGERIA LIMITED

NOTES FORMING PART OF ACCOUNTS (Contd.)

As at 31.12.2012

V

D.

As at 31.12.2011

V

CURRENT ASSETS

D(I) CASH AND BANK BALANCES

Cash and cash equivalent

Balance with banks

956,870

423,272

899,339

Fixed deposits with banks (maturity less than 3 months)

TOTAL

956,870

1,322,611

D(II) SHORT TERM LOANS AND ADVANCES

Others

Considered good:

Income tax receivable

25,283

25,283

22,960

982,153

1,345,571

Interest on Fixed Deposit

15,767

17,476

TOTAL

15,767

17,476

TOTAL

E.

F.

22,960

OTHER INCOME

SALES, ADMINISTRATION AND OTHER EXPENSES

Audit fees

34,182

30,685

264,545

237,560

Miscellaneous expenses

17,129

22,661

Exchange (gain)/loss (net)

(3,666)

3,947

312,190

294,853

Professional Fees

TOTAL

G.

1.

OTHER NOTES FORMING PART OF THE ACCOUNTS

The Balance Sheet as on December 31, 2012 and Statement of Income and Expenditure during Pre-Operational period for the year ended

December 31, 2012 are drawn and presented as per the revised format prescribed under Schedule VI to the Companies Act, 1956 applicable

for the financial year commencing from April 1, 2011. The amounts pertaining to the previous year have been recast to conform with the revised

format.

2.

During the year under review, the Company did not carry on any business activities and accordingly a Statement of Income and Expenditure

during Pre-Operational period is prepared.

3.

Preliminary and pre-operative expenses incurred prior to commencement of commercial business operations has been charged to the statement

of income and expenditure during pre-operational period.

4.

There are no amounts due to micro and small enterprises as defined in Micro, Small and Medium Enterprises Development Act, 2006 as at

December 31, 2012.

5.

Disclosures regarding derivative instruments:

6.

a.

Derivatives outstanding as on 31.12.2012 - V Nil (previous year V Nil)

b.

The Company does not have any material foreign currency exposure as at 31.12.2012 that are hedged by a derivative instrument or

otherwise.

c.

Unhedged foreign currency exposure as on 31.12.2012

Currency

Recognised liability (V)

Previous year (V)

USD

131,986

130,858

Disclosure of related party transactions:

(V)

Particulars

2012

2011

131,986

130,858

Accounts payable to related parties

Due to Larsen & Toubro Limited [Ultimate holding Company]

S-150

L&T OVERSEAS PROJECTS NIGERIA LIMITED

L&T OVERSEAS PROJECTS NIGERIA LIMITED

NOTES FORMING PART OF ACCOUNTS (Contd.)

7.

Basic and Diluted Earnings per share [EPS] computed in accordance with Accounting Standard (AS) 20 Earnings per Share

(V)

Particulars

2012

2011

Basic

Loss after tax as per Accounts

Number of Shares

(296,423)

(277,377)

10,000,000

10,000,000

(0.03)

(0.03)

Basic EPS (V)

8.

There are no obligation, past or present, which have arisen from past events which have not been provided for in the books at the Balance

Sheet date.

9.

Auditors remuneration and expenses charged to the accounts:

(V)

Particulars

Audit fees

2012

2011

34,182

30,685

H.

SIGNIFICANT ACCOUNTING POLICIES

1.

Basis of Accounting

The accounts have been prepared using historical cost convention and on going concern basis, in accordance with generally accepted

accounting principles in India and in compliance with Accounting Standards referred to in Section 211(3C) and other requirements of the

Companies Act, 1956.

2.

Translation of accounts

The accounts of the Company are maintained in Nigerian Naira. The accounts are translated in Indian Rupees as follows :a.

Share capital is retained at the initial contribution amount

b.

Current assets and Liabilities are translated at year end rates

c.

Revenue transactions are translated at average rates

The resultant difference is accounted as Translation Reserve in the Balance Sheet.

As per our report attached

For and on behalf of the Board

SHARP & TANNAN

Chartered Accountants

Firms registration no. 109982W

by the hand of

FIRDOSH D. BUCHIA

Partner

Membership No. 38332

U. DASGUPTA

Director

Place : Mumbai

Date : April 25, 2013

Place : Mumbai

Date : April 25, 2013

K. RAVINDRANATH

Director

S-151

L&T OVERSEAS PROJECTS NIGERIA LIMITED

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Business Analytics Case Study - NetflixDocument2 pagesBusiness Analytics Case Study - NetflixPurav PatelNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Walsh January Arrest Sherrif Records Pgs 10601-10700Document99 pagesWalsh January Arrest Sherrif Records Pgs 10601-10700columbinefamilyrequest100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Anthony D. Slonim, Murray M. Pollack Pediatric Critical Care Medicine PDFDocument950 pagesAnthony D. Slonim, Murray M. Pollack Pediatric Critical Care Medicine PDFAnca DumitruNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- JBL Tune 115TWS HeadphoneDocument2 pagesJBL Tune 115TWS HeadphoneTimiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- H.P. Elementary Education Code Chapter - 4 - 2012 SMC by Vijay Kumar HeerDocument7 pagesH.P. Elementary Education Code Chapter - 4 - 2012 SMC by Vijay Kumar HeerVIJAY KUMAR HEERNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- (NewResultBD - Com) Mymensingh Board JSC Scholarship Result 2019Document80 pages(NewResultBD - Com) Mymensingh Board JSC Scholarship Result 2019rthedthbdeth100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Bus Terminal Building AreasDocument3 pagesBus Terminal Building AreasRohit Kashyap100% (1)

- Investment ChecklistDocument3 pagesInvestment ChecklistArpan chakrabortyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- People in OrganisationsDocument8 pagesPeople in OrganisationsBritney valladares100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Docu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsDocument11 pagesDocu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsAmir Majzoub GhadiriNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Way of St. LouiseDocument18 pagesWay of St. LouiseMaryann GuevaradcNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Quantum PauseDocument5 pagesQuantum Pausesoulsearch67641100% (2)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Preparatory Surface Cleaning of Architectural Sandstone: Standard Practice ForDocument2 pagesPreparatory Surface Cleaning of Architectural Sandstone: Standard Practice Fors.swamyNo ratings yet

- Siy Cong Bien Vs HSBCDocument2 pagesSiy Cong Bien Vs HSBCMJ Decolongon100% (1)

- Indian Board of Alternative Medicine: Partner-Pub-1166 ISO-8859-1Document14 pagesIndian Board of Alternative Medicine: Partner-Pub-1166 ISO-8859-1vipinNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Downloaded From Manuals Search EngineDocument29 pagesDownloaded From Manuals Search EnginehaivermelosantanderNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bill Vaskis ObitDocument1 pageBill Vaskis ObitSarah TorribioNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Design Engineering JourneyDocument159 pagesDesign Engineering JourneyKarenNo ratings yet

- Anna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Document7 pagesAnna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Case Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022Document4 pagesCase Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022ShravanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- National Highways Authority of IndiaDocument3 pagesNational Highways Authority of IndiaRohitNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Infor LN Baan - Debugging The BshellDocument26 pagesInfor LN Baan - Debugging The BshellShiva KumarNo ratings yet

- FINAL Parent Handbook AitchisonDocument68 pagesFINAL Parent Handbook AitchisonSaeed AhmedNo ratings yet

- 7 Types of English Adjectives That Every ESL Student Must KnowDocument3 pages7 Types of English Adjectives That Every ESL Student Must KnowBenny James CloresNo ratings yet

- Medical and Health Care DocumentDocument6 pagesMedical and Health Care Document786waqar786No ratings yet

- Surimi Technology: Submitted To: Dr.A.K.Singh (Sr. Scientist) Submitted By: Rahul Kumar (M.Tech, DT, 1 Year)Document13 pagesSurimi Technology: Submitted To: Dr.A.K.Singh (Sr. Scientist) Submitted By: Rahul Kumar (M.Tech, DT, 1 Year)rahuldtc100% (2)

- Youthful PopulationsDocument18 pagesYouthful PopulationsJamesy66No ratings yet

- Huawei Videoconferencing MCU VP9600 Series Data SheetDocument2 pagesHuawei Videoconferencing MCU VP9600 Series Data SheetIsaac PiresNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- FAR MpsDocument2 pagesFAR MpsJENNIFER YBAÑEZNo ratings yet

- PRE-TEST (World Religion)Document3 pagesPRE-TEST (World Religion)Marc Sealtiel ZunigaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)