Professional Documents

Culture Documents

Cherat Cement

Uploaded by

lordraiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cherat Cement

Uploaded by

lordraiCopyright:

Available Formats

Foundation Research|

Equities

REK-192

Cherat Cement

PAKISTAN

18 February 2016

CHCC PA

Outperform

Stock price as of 17 Feb

Jun 2016 target

Upside/downside

Valuation

Rs

Rs

%

Rs

93.0

107.5

15.6

107.5

Rs bn

US$m

US$m

m

16.4

0.4

157

177

- DCF based

Cement Sector

Market cap

30-day avg turnover

Market cap

Number shares on issue

Investment fundamentals

Year end 30 Jun

2015A

2016E

m

m

%

m

%

6,565

1,969

29.99

1,288

(2.1)

6,643

2,328

35.04

1,507

17.0

10,265

4,042

39.37

2,582

71.3

14,473

5,508

38.06

3,444

33.4

EP S

PE

Rs

x

7.3

12.7

8.5

10.9

14.6

6.4

19.5

4.8

To tal DP S

To tal div yield

Rs

%

3.00

3.2

3.00

3.2

4.00

4.3

6.50

7.0

%

%

x

x

13.6

16.0

8.1

2.0

8.5

17.1

8.8

1.9

10.8

22.6

5.2

1.4

13.1

25.1

3.3

1.2

To tal revenue

EB ITDA

EB IT M argins

Net P ro fit

P ro fit growth

ROA

ROE

EV/EB ITDA

P rice/bo o k

2017E

2018E

New cement line to bump up earnings

Initiate with Outperform, TP set at PKR107.5/sh, 16% upside

We initiate coverage of Cherat Cement (CHCC) with a near term favorable outlook given first

mover advantage in upcoming expansion cycle. However, we highlight a robust profitability

growth in FY17/18 would immediately be followed by a period of underperformance as

other capacities come online. Hence, despite trading at a FY17/18 discounted PE of 6.4/4.8

(FSLs cement universe PE of 9.8/9.1), our Jun-16 TP of Rs107.5 provides a relatively limited

upside of 16%.

Impact of new line to be diluted when others catch up

Commissioning of new 1.3mn ton cement line by January 2017 would significantly improve

companys market share, particularly in FY17/18. We estimate sequential increase in the

companys market share to 3.8%/5.1% in FY17/FY18 from 2.4% currently. As a result,

earnings would shoot up to Rs14.6/19.5 in FY17E/18E versus Rs8.5 in FY16E. Nonetheless,

volumes are allocated on capacity basis and we expect market share will eventually be

normalized to 4.5% beyond FY18 when other players (LUCK, DGKC and ACPL) bring their new

capacities online. Subsequently, we see earnings to stabilize (Rs 13/sh) beyond FY18. Our

valuations reflect a conservative cement price assumption accompanying capacity addition

as suggested by historical precedence (see Fig 3)

Section 65B warrants early commissioning than January 2017

Though the company has highlighted commissioning of a new line by January 2017 (our

valuations reflect the same), odds are higher of early commissioning, in our view. We believe

the company would strive to complete the project by Jun-16 to avail the advantage offered

in Section 65B of Income Tax Ordinance. The section provides tax credit of 10% of

investment, provided the plant is purchased and installed by Jun-16. Early commissioning

can provide a one-time earnings gain of ~Rs6.8/sh. Furthermore, being set-up in KPK the

expansion also entitles the company to 5-yr tax holiday as announced in Federal Budget

FY16.

Lower FO prices have a meaningful earnings impact

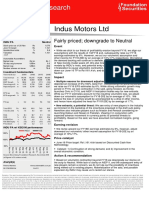

CHCC PA rel KSE100 performance

CHCC have in-house power generation of 32MW (7MW Waste Heat Recovery Plant, 21MW

HFO based captive and 4MW diesel based captive) against the requirement of 16MW (on

current capacity). Hence, lower Furnace oil prices make the case for switching to HFO based

captive power plant from the expensive grid. Going forward, power cost would further come

down when new 6MW WHR plant comes online along with the new clinker plant.

1.4

CHCC

1.3

KSE100

1.2

1.1

1.0

Earnings

0.9

Feb-16

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

Apr-15

May-15

Mar-15

Feb-15

0.8

So urce: B lo omberg, Foundatio n Research, Feb 2016

(all figures in Rs unless noted)

Based on the aforementioned, we see earnings to bump up to Rs 14.6/19.5 in FY17/18 but

then normalize to Rs 13/sh beyond FY18.

Valuations

We have valued CHCC at Rs107.5/sh on DCF based methodology.

Key upside and downside risks

Analyst

Khurram M. Arif

Khurram.arif@fs.c om.pk

M. Arsalan Siddiqui

Arsalan.siddiqui@fs.c om.pk

92 21 35612290- 94

Ext 335

Price Catalyst (1) early commissioning of new plant, (2) cement prices to remain firm post

expansion, and (3) commissioning of WHRP.

Key downside risks (1) Technical faults in new plant and (2) lower than expected market

share.

Please Refer to last page for important disclosures and analyst certifications

Cherat Cement

February 18, 2016

Key Graphs

Capacity (RHS, mn tons)

Market share (LHS)

5.5%

80%

52.0

5.0%

CHCC

Industry

FY17

Fig 2: FY17/18 sales OP to be followed by FY19 UP

FY16

Fig 1: Mkt share to shuffle as new capacities come online

70%

60%

4.5%

50.0

4.0%

48.0

3.5%

46.0

3.0%

50%

40%

30%

20%

Source: APCMA, Foundation Research, February 2016

Source: APCMA, Foundation Research, February 2016

Fig 3: Expansion cycles exert pressure on prices

Fig 4: Implied PE converging to industry average

Local dispatches

Capacity

Price (Rs/bag, RHS)

50.0

45.0

40.0

400

14.0

350

12.0

300

35.0

30.0

250

25.0

200

20.0

150

CHCC

Industry

10.0

8.0

6.0

Source: APCMA, PBS, Foundation Research, February 2016

Foundation Securities (Pvt) Limited

0.0

Source: Foundation Research, February 2016

FY20

2.0

FY19

FY14

FY12

FY10

FY08

FY06

FY04

FY02

FY00

FY98

FY96

FY94

FY92

50

FY18

5.0

4.0

FY17

100

10.0

FY16

15.0

FY20

-10%

FY19

0%

FY18

FY20

FY19

FY18

FY17

FY16

FY15

42.0

FY14

2.0%

10%

FY15

2.5%

FY14

44.0

Cherat Cement

February 18, 2016

About the company

Cherat Cement Company Limited (the Company) was incorporated in Pakistan as a public company limited by shares under the

Companies Act, 1913 (now the Companies Ordinance, 1984) in the year 1981. Its main business activity is manufacturing, marketing and

sale of cement. The Company is listed on Karachi, Lahore and Islamabad Stock Exchanges. The registered office of the Company is

situated at Village Lakrai, District Nowshera, Khyber Pakhtunkhwa province.

Important disclosures:

Disclaimer: This report has been prepared by FSL. The information and opinions contained herein have been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified and no guaranty,

representation or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to

change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are

not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or

other financial instruments. FSL may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis

before such material is disseminated to its customers. Not all customers will receive the material at the same time. FSL, their respective directors, officers,

representatives, employees, related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers

described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial

instruments from time to time in the open market or otherwise, either as principal or agent. FSL may make markets in securities or other financial

instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. FSL may have

recently underwritten the securities of an issuer mentioned herein. This document may not be reproduced, distributed or published for any purposes.

Research Dissemination Policy: Foundation Securities (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible

clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the

material at the same time.

Target price risk disclosures: Any inability to compete successfully in their markets may harm the business. This could be a result of many factors

which may include geographic mix and introduction of improved products or service offerings by competitors. The results of operations may be materially

affected by global economic conditions generally, including conditions in financial markets. The company is exposed to market risks, such as changes in

interest rates, foreign exchange rates and input prices. From time to time, the company will enter into transactions, including transactions in derivative

instruments, to manage certain of these exposures.

Analyst certification: The views expressed in this research accurately reflect the personal views of the analyst(s) about the subject securities or issuers

and no part of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this

research. The analyst principally responsible for the preparation of this research receives compensation based on overall revenues of Foundation

Securities and has taken reasonable care to achieve and maintain independence and objectivity in making any recommendations.

Recommendations definitions

If

Expected return >+10%

Expected return from -10% to +10%

Expected return <-10%

Outperform.

Neutral.

Underperform.

Foundation Securities (Pvt) Limited

You might also like

- Risk Assessment For Trial Pit Excavation-RevDocument15 pagesRisk Assessment For Trial Pit Excavation-RevRawoofuddin ChandNo ratings yet

- Accenture Credit Risk Model Monitoring PDFDocument16 pagesAccenture Credit Risk Model Monitoring PDFdeeptiNo ratings yet

- Corporate FinanceDocument398 pagesCorporate FinanceLongeni Hendjala100% (1)

- Greenwald Earnings Power Value EPV Lecture SlidesDocument43 pagesGreenwald Earnings Power Value EPV Lecture SlidesOld School Value100% (12)

- RCM PDFDocument46 pagesRCM PDFanwarhas05No ratings yet

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocument62 pages2010 May - Morning Pack (DBS Group) For Asian StocksShipforNo ratings yet

- Code of Practice On: Workplace Safety and Health (WSH) Risk ManagementDocument51 pagesCode of Practice On: Workplace Safety and Health (WSH) Risk Managementaminul islamNo ratings yet

- Amc Concourse Bridge Project: Activity: Flushing of Chilled Water PipelineDocument8 pagesAmc Concourse Bridge Project: Activity: Flushing of Chilled Water PipelineEm Niax100% (1)

- Fundamental Analysis of PETROLEUM SectorDocument31 pagesFundamental Analysis of PETROLEUM SectorAbhay Kapkoti0% (1)

- Basics of Commercial Banking Group 6 Handout 2Document12 pagesBasics of Commercial Banking Group 6 Handout 2Daniela Kian AyalaNo ratings yet

- ISO 27001 2022 Gap Analysis ToolDocument16 pagesISO 27001 2022 Gap Analysis ToolMuhammed Ali Ahmad100% (5)

- Hazard and Operability (HAZOP)Document11 pagesHazard and Operability (HAZOP)Supian Jannatul FirdausNo ratings yet

- Fundamental AnalysisDocument46 pagesFundamental AnalysisGeeta Kaur BhatiaNo ratings yet

- Chapter 12 @riskDocument42 pagesChapter 12 @riskcrystalspring100% (1)

- Workplace Exposure Standards 2016 PDFDocument72 pagesWorkplace Exposure Standards 2016 PDFMarco CorrengiaNo ratings yet

- Indus Motors LTD: EquitiesDocument2 pagesIndus Motors LTD: EquitiesShazeb NaseemNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Hindustan Construction CompanyDocument18 pagesHindustan Construction CompanySudipta BoseNo ratings yet

- JK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97Document4 pagesJK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97ajd.nanthakumarNo ratings yet

- Greatview Aseptic Packaging (468.HK) : IPO PreviewDocument3 pagesGreatview Aseptic Packaging (468.HK) : IPO Previewtkgoon6349No ratings yet

- CardinalStone Research - Seplat Petroleum Development Corporation - Trading UpdateDocument5 pagesCardinalStone Research - Seplat Petroleum Development Corporation - Trading UpdateDhameloolah LawalNo ratings yet

- Auto 03jun16 MoslDocument4 pagesAuto 03jun16 Moslravi285No ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- Consolidation Time: Punter's CallDocument4 pagesConsolidation Time: Punter's CallNaleep GuptaNo ratings yet

- Pakistan State Oil: SecuritiesDocument16 pagesPakistan State Oil: SecuritiesAmmad SheikhNo ratings yet

- Lafarge Malaysia: A Plunging QuarterDocument3 pagesLafarge Malaysia: A Plunging QuarterRachel LauNo ratings yet

- Premarket MarketOutlook Motilal 19.12.16Document4 pagesPremarket MarketOutlook Motilal 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Corp LTD: (GMDV)Document3 pagesCorp LTD: (GMDV)api-234474152No ratings yet

- Market Notes May 16 MondayDocument1 pageMarket Notes May 16 MondayJC CalaycayNo ratings yet

- TopPicks 020820141Document7 pagesTopPicks 020820141Anonymous W7lVR9qs25No ratings yet

- Amara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Document8 pagesAmara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Harshal ShahNo ratings yet

- Cash Flow-Latest ViewsDocument44 pagesCash Flow-Latest ViewsSyed Sheraz AliNo ratings yet

- Rico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To BuyDocument2 pagesRico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To Buyajd.nanthakumarNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- AMBSCTFDocument2 pagesAMBSCTFckzeoNo ratings yet

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Ester Report 1Document18 pagesEster Report 1api-555390406No ratings yet

- National Thermal Power Corporation LimitedDocument15 pagesNational Thermal Power Corporation Limitedprathamesh tawareNo ratings yet

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Document2 pagesBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecNo ratings yet

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Initiating Coverage Ruchi Soya Industries LTDDocument20 pagesInitiating Coverage Ruchi Soya Industries LTDShruti SharmaNo ratings yet

- State Bank of India: Play On Economic Recovery Buy MaintainedDocument4 pagesState Bank of India: Play On Economic Recovery Buy MaintainedPaul GeorgeNo ratings yet

- Shriram Transport Finance: Recommendation: Buy CMP: Inr 1376 Allocation: 10%Document2 pagesShriram Transport Finance: Recommendation: Buy CMP: Inr 1376 Allocation: 10%genid.ssNo ratings yet

- Real Estate Overweight: Set To Recover in 2H13Document4 pagesReal Estate Overweight: Set To Recover in 2H13bodaiNo ratings yet

- Fin 639 Project - Square PharmaDocument25 pagesFin 639 Project - Square PharmaPushpa BaruaNo ratings yet

- MB - Afnan Iqbal - 04 May 2020Document21 pagesMB - Afnan Iqbal - 04 May 2020afnaniqbalNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Engineering Civilised Numbers: Yongnam HoldingsDocument5 pagesEngineering Civilised Numbers: Yongnam HoldingsTerence Seah Pei ChuanNo ratings yet

- HCL Tech - Event Update - Axis Direct - 05042016 - 05!04!2016 - 13Document5 pagesHCL Tech - Event Update - Axis Direct - 05042016 - 05!04!2016 - 13gowtam_raviNo ratings yet

- Fundamental Aanalysis On ICICI Bank by Ashwin KulkarniDocument55 pagesFundamental Aanalysis On ICICI Bank by Ashwin KulkarniSujit KunalNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Q2 FY17 Results Update: Power Grid: Company Details: Quarterly HighlightsDocument4 pagesQ2 FY17 Results Update: Power Grid: Company Details: Quarterly Highlightsnabamita pyneNo ratings yet

- Crisil HeroDocument28 pagesCrisil HeroSachin GuptaNo ratings yet

- Short Term Call: Company Name: Tata Chemicals LTDDocument4 pagesShort Term Call: Company Name: Tata Chemicals LTDharsh gNo ratings yet

- NCL Industries (NCLIND: Poised For GrowthDocument5 pagesNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNo ratings yet

- Module: Corporate Finance: Module Leader: S A PalanDocument13 pagesModule: Corporate Finance: Module Leader: S A PalanSõúmëñ AdhikaryNo ratings yet

- Dividend Month Premium in The Korean Stock MarketDocument34 pagesDividend Month Premium in The Korean Stock Market찰리 가라사대No ratings yet

- J STREET Volume 317Document10 pagesJ STREET Volume 317JhaveritradeNo ratings yet

- 110516-OSK-1QFY11 Results Review - Affected by External FactorsDocument4 pages110516-OSK-1QFY11 Results Review - Affected by External FactorsTodd BenuNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Pakistan Insight - 20200727 - Power Previews - Twofold Earnings, Dividends Expected.Document3 pagesPakistan Insight - 20200727 - Power Previews - Twofold Earnings, Dividends Expected.SHAHZAIB -No ratings yet

- Morning Briefing: Futures HigherDocument8 pagesMorning Briefing: Futures HigherAbdullah18No ratings yet

- J Street Vol 310Document10 pagesJ Street Vol 310JhaveritradeNo ratings yet

- Technical Report 16th January 2012Document5 pagesTechnical Report 16th January 2012Angel BrokingNo ratings yet

- Pakistan Oil and Gas - The Undiscovered Value (Detailed Report)Document79 pagesPakistan Oil and Gas - The Undiscovered Value (Detailed Report)Faiz MehmoodNo ratings yet

- Fundamental and Technical Analysis of The Stock Price: International Scientific Journal Monte April 2019Document10 pagesFundamental and Technical Analysis of The Stock Price: International Scientific Journal Monte April 2019Rahul ChandranNo ratings yet

- Pioneer Invest Corp - Harshit TaunkDocument40 pagesPioneer Invest Corp - Harshit Taunkrjain_112No ratings yet

- The Power of Charts: Using Technical Analysis to Predict Stock Price MovementsFrom EverandThe Power of Charts: Using Technical Analysis to Predict Stock Price MovementsNo ratings yet

- Crescent Star Insurance LimitedDocument5 pagesCrescent Star Insurance LimitedlordraiNo ratings yet

- KSE Valuation Matrix-May2014Document28 pagesKSE Valuation Matrix-May2014lordraiNo ratings yet

- SCM G Students Handout Solutions - SP5 - 2013Document25 pagesSCM G Students Handout Solutions - SP5 - 2013lordraiNo ratings yet

- Financial ShenanigansDocument24 pagesFinancial ShenaniganslordraiNo ratings yet

- MCB-AH Corp Presentation Sept 12 PDFDocument30 pagesMCB-AH Corp Presentation Sept 12 PDFlordraiNo ratings yet

- Overseas Skilled OptionsDocument2 pagesOverseas Skilled OptionslordraiNo ratings yet

- PROJECT MGMT MTECH SyllabusDocument66 pagesPROJECT MGMT MTECH SyllabuswayzodeneerajNo ratings yet

- Kchambers Entrepreneur InterviewDocument8 pagesKchambers Entrepreneur Interviewapi-310748370No ratings yet

- QS MH - Pt. Gading Lautan Perkasa (6 Kapal)Document4 pagesQS MH - Pt. Gading Lautan Perkasa (6 Kapal)AKHMAD SHOQI ALBINo ratings yet

- Manajemen RisikoDocument9 pagesManajemen RisikoAnonymous FLInViNo ratings yet

- Final Project All Chapter Phase1&2Document75 pagesFinal Project All Chapter Phase1&2derejetamiruloleNo ratings yet

- Daftar Isi I. Pendahuluan... 1 Ii. Rencana Pengamanan (Security Plan) ... 2 PDFDocument46 pagesDaftar Isi I. Pendahuluan... 1 Ii. Rencana Pengamanan (Security Plan) ... 2 PDFIndra Jaya100% (1)

- Chapter 12Document31 pagesChapter 12Jerrica Rama0% (1)

- Hazard Map PresentationDocument35 pagesHazard Map PresentationDwitikrushna RoutNo ratings yet

- BRI Sustainability Framework Second Party OpinionDocument24 pagesBRI Sustainability Framework Second Party OpinionJaya IrawanNo ratings yet

- Religiosity As A Moderating Variable For Generation X and Generation Baby BoomerDocument15 pagesReligiosity As A Moderating Variable For Generation X and Generation Baby BoomerArun KumarNo ratings yet

- FP Last SemDocument173 pagesFP Last SemAthira RaveendranNo ratings yet

- 2021 Registered Insurance Agents As at 15th February 2021 CompressedDocument164 pages2021 Registered Insurance Agents As at 15th February 2021 CompressedericmNo ratings yet

- BSBFIM501 - Assessment Task 3Document7 pagesBSBFIM501 - Assessment Task 3babluanandNo ratings yet

- Case ListDocument2 pagesCase ListMuhammad Fuad AlhudaNo ratings yet

- Cosmetics Production: ManagerDocument13 pagesCosmetics Production: Managershuba shnyNo ratings yet

- Safety Management For CpE-1Document13 pagesSafety Management For CpE-1Jayvee ColiaoNo ratings yet

- Study On Financing The Deep Tech Revolution enDocument160 pagesStudy On Financing The Deep Tech Revolution enKelmaisteis CorreaNo ratings yet

- PE 4 DISCUSSION HandoutsDocument3 pagesPE 4 DISCUSSION Handoutsjmo32309No ratings yet