Professional Documents

Culture Documents

M 040

Uploaded by

GilbertGalopeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M 040

Uploaded by

GilbertGalopeCopyright:

Available Formats

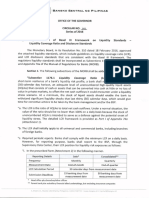

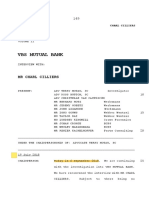

BANoKo SexrRlL No PtulPlxas

OFFICE OF THE DEPUTY GOVERNOR

SUPERVISION AND EXAMINATION SECTOR

MEMORANDUM NO. M-2011- O4O

To

AILBANKS

Subiea

Effective Interest Rate Calculation Models for All Types of Loans

Relative to the implementation of Circular No. 730 dated 20 July 2011 on updated

rules in implementing the Truth in Lending Act to enhance loan transaction transparency,

Effective Interest Rate (ElR) calculation models illustrative of common loan features are

presented herewith (Annexes A-E) for guidance. lt is understood, however, that an EIR

calculation model, founded on established principles of discounted cash flow analysis, for

a loan should be based on the actual features thereof. A bank shall be solely responsible

for the propriety and accuracy of its EIR calculation model. However, for purposes of

determining compliance with Circular No. 730, the BSP's determination of the

reasonableness and accuracy of an EIR calculation model prevails.

,ffi{

!{uty zott

Att.: A/S

A. Mabini St., Malate 1004 Manila, Philippines o Trunkline 1632152417O-Ll

a URl:www.bsp.gov.ph o e-mail: bspmail@bsp.gov.ph

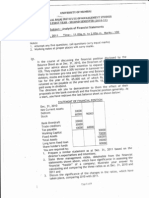

ANNEXA

lllustration 1

EFFECTIVE ITTTEREST CALCULANON MODEL

FIXED EQUAT AMORNZANON CASE

AB

Loan Amount

Monthly Installment

Contractual Rate (Monthly)

Other Charges

3.OO%

No. of Monthly tnstallment

12

4

5

120,000.00

11,001.50

tSWa

Installment

Gross

Period

Loan

Prlncioal

Intercst

O$er

Charges

ols

Cash

f,ows

Balance

120,000.00

10

11

L2

120,000.00

3,600.00

116,400.00

(11,001.50)

120,000.00

(11,001.60)

101,458.79

(11,001.60)

91,979.06

{11,001.60)

(11,001.60)

72,590.9L

(11,001.60)

62,679.77

(11,m1.50)

52,676.74

15

t7

9,201.60 1,900.00

9,339.62 1,561.99

9,479.72 1,521.99

9,521.91 7,379.69

9,765.24 1,235.35

9,972.74 1,089.95

10,051.43 940-77

18

74,212.35

789.25

(11,001.60)

42,404.39

19

10,365.53

536.O7

(11,001.501

32,038.86

13

t4

t5

4

5

L7O,798.4O

82,357.!5

z0

10

tt

to,521.O2

2t

480.58

(11,001.60)

27,517.85

10,678.83

322.77

22

23

t2

10,839.01

(1L,001.60)

10,839.01

162.59

(11,001.60)

TOTAL

120,000.00 72,oL9.79

Monthly Installment

3,500.00

PMT(C3,C5,-Cl)'r-1

11,001.60

(using Excel PMT FunAion)

Effective Annual lnterest Rate (ElR) =

(using

(1+lRR(F10:F22!,!.,, - L

r@

IRR(FIO:F2Z)

l-Erml

Excel lRR Functlon)

Effective Monthly Interest Rate (MlR)

{using Excel

tRR

Funaion)

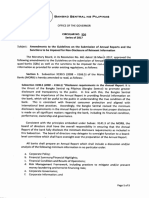

ANNEX B

lllustration 2

EFFECTIVE INTEREST CATCUTATION MODET

FIXED PRINCIPAL AMORTIZANON CASE

AB

1

2

3

4

5

Loan Amount

120,000.00

Monthly Installment

ContractualRate(Monthly)

OtherCharges

No. of Monthly lnstallment

10,ooo.oo

7.5W6

3.0096

72

7

8

lnstallment

Gross

Perlod

loan

(}ther

Prlncloal

Interst

Charses

o/s

Cash

florrs

120,000.00

120,000.00

10

11

10,000.00

1,800.00

t2

10,000.00

1,650.00

3,500.00 116,400.00

120,000.00

(11,800.00)

(11,550.00)

110,000.00

90,000.00

13

10,000.00

1,500.00

t4

10,000.00

1,350.00

15

10,000.00

1,200.00

16

10,000.00

1,050.00

t7

10,000.m

900.00

18

7

8

10,000.00

750.00

19

10,000.00

600.00

20

21

22

10

10,000.00

450.00

11

10,000.00

300.00

{11,500.00)

(11,350.00)

(11,200.00)

{11,050.00}

(10,900.00)

(10,750.00)

(10,600.00)

(10,450.00)

(10,300.00)

L2

10,000.00

150.00

(10,150.00)

120,000.00

11,700.00

z3

TOTAT

Balance

Effective Annual Interest Rate (ElR) =

100,000.00

80,000.00

70,00o.0o

60,000.00

50,000.m

40,0o0.m

30,000.00

20,000.00

10,000.00

3,600.00

(1+lRR(F10:F22ll" - 7

l_Er%l

IRR(F10:F221

r----rrfi

(using Excel IRR Funcrriol

Effective Monthly lnterest Rate (MlR)

(using Excel

IRR

Fundion)

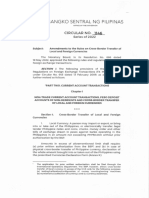

ANNEX C

lllustration 3

EFFECTIVE INTEREST CALCUTATION MODET

FrxED EQUALAMORmZATTON CASE WITH GRACE PERTOD

c

1

Loan Amount

120,000.00

Monthly Installment

Contractual Rate (Monthly)

Other Charges

No. of Monthly Installment

t2

(2 months grace period on principal and interest payments)

Installment

Period

11,001.60

I.50o/o

3.00%

Gross

Loan

ols

Other

Princioal

lnterest

Charges

Cash flows

120,000.00

Balance

120,000.00

10

11

L2

13

9,201.60

1,800.00

(11,001.50)

110,798.40

14

9,339.62

1,661.99

(11,001.60)

15

9,479.72

1,521.88

(11,001.60)

lot,458.79

9t,979.06

16

9,62L.9I

1,379.59

(11,001.60)

82,357.L5

T7

9,766.24

1,235.35

(11,001.60)

72,59O.9L

18

9,9L2.74

1,088.95

(11,001.60)

19

10,061.43

94c.L7

(11,001.60)

52,678.t7

52,6t6.74

1o,2L2.35

789.25

(11,001.60)

42,Q94.39

32,039.96

3,600.00

116,400.00

120,000.00

120,000.00

120,000.00

20

10

2l

11

10,365.53

636.07

(11,001.60)

22

L2

70,521.02

0.58

(11,001.60)

21,517.85

23

13

10,678.83

322,77

(11,001.60)

10,839.01

24

t4

25

TOTAL

10,839.01

162.59

98,482.15

11,533.84

Monthly Installment

(11,001.60)

(o.oo)

3,600.00

PMT(C3,C5,-Cl)*-1

11,001.60

(using Excel PMT Function)

Effective Annual Interest Rate (ElR) =

(1+lRR(F10:F221112 - L

19.

(using Excel IRR Fundion)

Effective Monthly Interest Rate (MlR)=

(using Excel

IRR

Function)

IRR(F10:F24)

1.5

ANNEX D

lllustratlon 4

EFFECTIVE INTEREST CATCUTATION MODET

CASE: PERIODIC INTEREST PAYM Et{T, BAU.OON PAYMENT AT

1

2

3

4

5

AB

MATRIW

CD

Loan Amount

120,000.00

Monthly Installment

Contractual Rate (Monthly)

OtherCharges

1,800.00 (lnterest Only)

t-50%

3.0095

No. of Monthly Installment

12

7

8

Installment

Gross

Perlod

Loan

Otlrer

Prlncioal

lnterest

Charees

o/s

Cashflows

Balance

120,000.00

120,000.00

l0

t1

t2

1,800.00

13

3,600.00

1,800.00

116,400.00 120,000.00

(1,800.00) 120,000.00

(1,800.00) 120 000.00

(1,800.00) 120,000.00

t4

1,800.00

1,800.00

15

1,800.00

16

1,800.00

t7

1,800.00

18

1,80O.00

19

(1,800.00) 120,000.00

(1,800.00) 120,000.00

(1,800.00) 120,0m.00

t1,8{D.00} 120,m0.00

1,800.00

(1,80O.0O) 120,000.00

20

10

2l

1,800.00

11

1,800.00

(1,800.00)

(1,800.00)

22

23

t2

TOTAL

120,000.00

1,800.00

120,000.00

21,500.00

Effective Annual Interest Rate (ElR) =

(using

Etrcel IRR

IRR

Funaion)

120,000.00

120,000.00

(121,800.00)

3,600.00

(1+lRR(F10:F22ll', - 7

l-IgsEml

|RR(F10:F22)

Funaion)

Effective Monthly Interest Rate (MtR)

(uslng Excel

(1,80O.O0) 120,000.00

1.1816l

ANNEX E

lllustration 5

EFFECNVE I|IEREST

CAtCt'tANOil MODET

FIXED EQUAI. AMORTIZATION CASE

(wEEKry |NSTATIMENTS qUOTED tN MOt{THry EFFECTTVE RATE}

I

2

3

4

5

5

7

E

9

Loan Amount

10,000.00

Weekly Installment

Contractual Rate (Monthly)

788.00

l.sWo

Weekly Compounding Rate

OtherCharges

0.3s%

3-OWa

Term (Week)

13

Period/Year

52

Installment

Gross

Period

Loan

t0

11

0

L2

1

132

143

154

165

t76

187

198

209

21 10

22 tt

2t

t2

24 13

25

Princloal

Interest

Other

Char es

o/s

Cash flows

Balance

10,000.00

10,000.00

300.00

TOTAL

753.38

34.62

755.99

32.01

9,700,00

(788.00)

10,000.00

8,490.63

9,246.62

758.61

29.39

{788.00)

(788.o0)

767-2?

26.76

(788.00)

5,97A.78

763.87

24.73

(788.O0)

766.51

2t-49

(788.o0)

6,206.91

5,444.40

7,732.02

769.17

18.83

(788.oo)

4,671.24

771,a3

16.17

774.50

13.50

{788.00}

(788.00)

3,124.91

777.18

10.82

(788.00)

2,347.72

779.87

8.13

(788.00)

1,557.85

782.57

s.43

(788.00)

78s.28

2.72

243.98

(788.00)

10,000.00

Weekly Installment

3,899.41

785.28

(0.00)

300.00

PMT(Contractual Rate,Term,-Loan Amount)*-1

(using Excel PMt Function)

Effective Annual Interest Rate (ElR) =

(1+lRR(F10:F24))t'- 1

f'--o4G%l

(using Excel nR Function)

Effective Monthly lnterest Rate (MlR) =

(using

Excel lRR FunctionJ

(1+|RR(F10;F24))r3f -

l--TItE

You might also like

- Finance Past PaperDocument6 pagesFinance Past PaperNikki ZhuNo ratings yet

- Updates On Financial Results For June 30, 2015 (Result)Document7 pagesUpdates On Financial Results For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Mohan MuthusamyNo ratings yet

- MB0041 - Summer 2014Document3 pagesMB0041 - Summer 2014Rajesh SinghNo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- Financial Management-Coursework 2Document11 pagesFinancial Management-Coursework 2Tariq KhanNo ratings yet

- BSP Circular 730Document5 pagesBSP Circular 730gmcgarcia2973No ratings yet

- TVM-Time Value of Money ApplicationsDocument13 pagesTVM-Time Value of Money ApplicationsSourav Sharma100% (2)

- Problem No. 1: ST STDocument2 pagesProblem No. 1: ST STaditic000No ratings yet

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- Circular No 905Document55 pagesCircular No 905chrisNo ratings yet

- Central Bank Circular No. 905Document55 pagesCentral Bank Circular No. 905Marjorie KayeNo ratings yet

- Chapter 9 IAS-8 Accounting Policies, Change in Estimates and ErrorsDocument30 pagesChapter 9 IAS-8 Accounting Policies, Change in Estimates and Errorszarnab azeemNo ratings yet

- Task:1 Theoretically, A Financial Model Is A Set of Assumptions About Future Business ConditionsDocument7 pagesTask:1 Theoretically, A Financial Model Is A Set of Assumptions About Future Business ConditionsDILIP KUMARNo ratings yet

- Banking Services To The Government and Banks: 2.1 OverviewDocument10 pagesBanking Services To The Government and Banks: 2.1 OverviewAwais ShahzadNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- DCF Problems PGDM Tri 4Document3 pagesDCF Problems PGDM Tri 4pratik waliwandekarNo ratings yet

- Ch16 Tool KitDocument18 pagesCh16 Tool Kitjst4funNo ratings yet

- BSP Circular 730 PDFDocument5 pagesBSP Circular 730 PDFDante Bauson JulianNo ratings yet

- Reference Form (Free Translation of Formulário de Referência)Document197 pagesReference Form (Free Translation of Formulário de Referência)MillsRINo ratings yet

- The Reserve Bank'S ACCOUNTS FOR 2010-11: IncomeDocument14 pagesThe Reserve Bank'S ACCOUNTS FOR 2010-11: IncomeNeha RaiNo ratings yet

- Interest-free Loan and Bond Valuation Case StudiesDocument31 pagesInterest-free Loan and Bond Valuation Case StudiesDedy SiburianNo ratings yet

- Buy-to-Let Index Q1 2014: What A Difference A Year Makes!Document4 pagesBuy-to-Let Index Q1 2014: What A Difference A Year Makes!TheHallPartnershipNo ratings yet

- UntitledDocument197 pagesUntitledMillsRINo ratings yet

- Problems On Cash FlowsDocument14 pagesProblems On Cash FlowsAbin Jose100% (2)

- Mortgage MathDocument40 pagesMortgage MathAmit KumarNo ratings yet

- Unit 7 Cash and Funds Flow StatementsDocument85 pagesUnit 7 Cash and Funds Flow StatementsASIFNo ratings yet

- Analysis of Financial StatementsDocument5 pagesAnalysis of Financial StatementsNikhil KasatNo ratings yet

- Impact of Basel Accord On Banking Sector of Pakistan Shumaila Samad, Waqar Sadiq, Junaid Iqbal, Amna Saeed, Jazba Gohar ArshadDocument7 pagesImpact of Basel Accord On Banking Sector of Pakistan Shumaila Samad, Waqar Sadiq, Junaid Iqbal, Amna Saeed, Jazba Gohar ArshadShumailaNo ratings yet

- Image 1646906033506Document4 pagesImage 1646906033506Sanaullah M SultanpurNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- BSP Amends Disclosure GuidelinesDocument23 pagesBSP Amends Disclosure GuidelinesMaribel VillaverdeNo ratings yet

- Rbi/2007-2008/327 Dbod - Aml.Bc. No. 85/ 14.01.001 / 2007-08 May 22, 2008 All Scheduled Commercial Banks/Fis (Excluding RRBS)Document17 pagesRbi/2007-2008/327 Dbod - Aml.Bc. No. 85/ 14.01.001 / 2007-08 May 22, 2008 All Scheduled Commercial Banks/Fis (Excluding RRBS)Kunwarbir Singh lohatNo ratings yet

- FM09-CH 10.... Im PandeyDocument19 pagesFM09-CH 10.... Im Pandeywarlock83% (6)

- Project Titels: Study On Overall Financial Performance of Central Bank of IndiaDocument24 pagesProject Titels: Study On Overall Financial Performance of Central Bank of IndiaVishwas NayakNo ratings yet

- Mayfield PlazaDocument9 pagesMayfield PlazaPuran SarnaNo ratings yet

- 4.1 Emergence of Retail Banking BusinessDocument18 pages4.1 Emergence of Retail Banking BusinessSteffy AntonyNo ratings yet

- Paper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingAyushNo ratings yet

- Question Papers Supplementary Exam 2007Document24 pagesQuestion Papers Supplementary Exam 2007ce1978No ratings yet

- QFR RTDocument3 pagesQFR RTkishorvedpathakNo ratings yet

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- Measuring Commercial Bank Profitability: Proceed With CautionDocument18 pagesMeasuring Commercial Bank Profitability: Proceed With CautionShubham GuptaNo ratings yet

- Financial Reporting and Statement Analysis ºa Stategy perspective¿ÎºóÌâ а Chapter2Document14 pagesFinancial Reporting and Statement Analysis ºa Stategy perspective¿ÎºóÌâ а Chapter2Udit AgrawalNo ratings yet

- Liabilities 2010 2011 Assets 2010 2011Document2 pagesLiabilities 2010 2011 Assets 2010 2011Revathy NairNo ratings yet

- Management Accounting BankDocument23 pagesManagement Accounting BankVaishnavi ChoudharyNo ratings yet

- Masters of Business Administration Semester 2 MB0045 - Financial ManagementDocument9 pagesMasters of Business Administration Semester 2 MB0045 - Financial ManagementKumar GauravNo ratings yet

- The Examiner's Answers – F2 - Financial ManagementDocument11 pagesThe Examiner's Answers – F2 - Financial ManagementMyat Zar GyiNo ratings yet

- Corporate Finance Session-3Document3 pagesCorporate Finance Session-3Pandy PeriasamyNo ratings yet

- Ias 8 Accounting PoliciesDocument6 pagesIas 8 Accounting Policiesibrahim AhmedNo ratings yet

- FORM L 3 Balance Sheet - Mar11Document1 pageFORM L 3 Balance Sheet - Mar11Mukesh Kumar MukulNo ratings yet

- Toronto Shelter, Support and Housing Admin Capital Budget Analyst Notes Budget 2012Document23 pagesToronto Shelter, Support and Housing Admin Capital Budget Analyst Notes Budget 2012arthurmathieuNo ratings yet

- CapStrTheo&Policy Assignment PiyushDocument28 pagesCapStrTheo&Policy Assignment PiyushPiyush ChandakNo ratings yet

- MidtermDocument2 pagesMidtermSumanth MuvvalaNo ratings yet

- Chap 18 WileyDocument13 pagesChap 18 WileyPratik Patel100% (1)

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- BHM307 Financial Management ExamDocument4 pagesBHM307 Financial Management ExamAmit Mondal0% (1)

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Banking and Beyond: The Evolution of Financing along Traditional and Alternative AvenuesFrom EverandBanking and Beyond: The Evolution of Financing along Traditional and Alternative AvenuesCaterina CrucianiNo ratings yet

- Bangko NG: Sentral NODocument5 pagesBangko NG: Sentral NOGilbertGalopeNo ratings yet

- CL 041Document1 pageCL 041GilbertGalopeNo ratings yet

- Bangko NG: Sentral PilipinasDocument10 pagesBangko NG: Sentral PilipinasGilbertGalopeNo ratings yet

- Barueko Serurnal Pn-Tptnas: of ofDocument1 pageBarueko Serurnal Pn-Tptnas: of ofGilbertGalopeNo ratings yet

- AMLC Reminds DNFBPs to Present Registration Certificates for CDDDocument3 pagesAMLC Reminds DNFBPs to Present Registration Certificates for CDDGilbertGalopeNo ratings yet

- Bangko NG: Sentral Pilipinas Circular Series 2O2Document3 pagesBangko NG: Sentral Pilipinas Circular Series 2O2GilbertGalopeNo ratings yet

- M 016Document1 pageM 016GilbertGalopeNo ratings yet

- In Its: Bangko PilipinasDocument3 pagesIn Its: Bangko PilipinasGilbertGalopeNo ratings yet

- Legal Counseling-Final GiboDocument29 pagesLegal Counseling-Final GiboGilbertGalopeNo ratings yet

- IFRS 9 Financial Instruments ImplementationDocument15 pagesIFRS 9 Financial Instruments ImplementationGilbertGalopeNo ratings yet

- CL 033Document1 pageCL 033GilbertGalopeNo ratings yet

- CL 019Document1 pageCL 019GilbertGalopeNo ratings yet

- Survivorship Agreement PDFDocument1 pageSurvivorship Agreement PDFGilbertGalopeNo ratings yet

- CL 031Document3 pagesCL 031GilbertGalopeNo ratings yet

- C 1011Document32 pagesC 1011GilbertGalopeNo ratings yet

- Sentral Pilipinas: LLL TiquidityDocument10 pagesSentral Pilipinas: LLL TiquidityGilbertGalopeNo ratings yet

- BSP amends TOFA reserve regulationsDocument1 pageBSP amends TOFA reserve regulationsGilbertGalopeNo ratings yet

- CL 058Document1 pageCL 058GilbertGalopeNo ratings yet

- To Of: SenrnalDocument17 pagesTo Of: SenrnalGilbertGalopeNo ratings yet

- Bexero: Serurnal No PlulptnnsDocument6 pagesBexero: Serurnal No PlulptnnsGilbertGalopeNo ratings yet

- Soc LAWDocument1 pageSoc LAWGilbertGalopeNo ratings yet

- cl058 PDFDocument1 pagecl058 PDFGilbertGalopeNo ratings yet

- Senrnal: P!L!PinasDocument4 pagesSenrnal: P!L!PinasGilbertGalopeNo ratings yet

- BSP Prohibits Rural Bank of Sta. Elena from OperationsDocument1 pageBSP Prohibits Rural Bank of Sta. Elena from OperationsGilbertGalopeNo ratings yet

- CL 058Document1 pageCL 058GilbertGalopeNo ratings yet

- Senrnnl: BeruoxoDocument3 pagesSenrnnl: BeruoxoGilbertGalopeNo ratings yet

- Soc LAWDocument1 pageSoc LAWGilbertGalopeNo ratings yet

- Remedial Law ReviewDocument1 pageRemedial Law ReviewGilbertGalopeNo ratings yet

- NRPS FAQ AML ConcernsDocument8 pagesNRPS FAQ AML ConcernsMaya Julieta Catacutan-EstabilloNo ratings yet

- Chap 013Document53 pagesChap 013Amry IrawanNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- 12 Month Real Estate MillionaireDocument27 pages12 Month Real Estate Millionairetestnation0% (1)

- Prec. Wires (I)Document9 pagesPrec. Wires (I)AnilKumarNo ratings yet

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- Gis Intrest RatesDocument9 pagesGis Intrest RatesdayakarNo ratings yet

- Types of Investors and Investment AlternativesDocument13 pagesTypes of Investors and Investment AlternativesAnjali ShuklaNo ratings yet

- Hyperinflation in ZimbabweDocument16 pagesHyperinflation in ZimbabweAmber HamzaNo ratings yet

- PDF Budget Control PDFDocument18 pagesPDF Budget Control PDFjoana seixasNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- 45 NBFCDocument109 pages45 NBFCViji RangaNo ratings yet

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet

- Level II Alt Summary SlidesDocument25 pagesLevel II Alt Summary SlidesRaabiyaal IshaqNo ratings yet

- Camparative Study of Tata, Icici and HDFC Mutual FundsDocument86 pagesCamparative Study of Tata, Icici and HDFC Mutual FundsravikumarreddytNo ratings yet

- Chapter 16 Payout Policy Multiple Choice QuestionsDocument11 pagesChapter 16 Payout Policy Multiple Choice Questionscasey222100% (2)

- Freedom of Redemption ProcessDocument161 pagesFreedom of Redemption ProcessRedfieldHasArrived100% (8)

- Assignment Chapter 12Document17 pagesAssignment Chapter 12Nicolas ErnestoNo ratings yet

- Answers To Questions Chapter 06.part IIDocument19 pagesAnswers To Questions Chapter 06.part IIDaniel TadejaNo ratings yet

- AccountingDocument118 pagesAccountingReshmi R Nair100% (1)

- Tax-Free Savings Account: Investment SolutionsDocument3 pagesTax-Free Savings Account: Investment Solutionsapi-97071804No ratings yet

- Commercial and Central Bank FunctionsDocument8 pagesCommercial and Central Bank Functionsanon_792919970No ratings yet

- Proforma Financial Statements of Walt DisneyDocument44 pagesProforma Financial Statements of Walt DisneyArif.hossen 30No ratings yet

- Module Far1 Unit-1 Part-1c.1Document6 pagesModule Far1 Unit-1 Part-1c.1Hazel Jane EsclamadaNo ratings yet

- Trustline Summer Training Report PresentationDocument27 pagesTrustline Summer Training Report Presentationatul kumar100% (1)

- Internship Saudi Pak Investment CompanyDocument39 pagesInternship Saudi Pak Investment Companyikhan5100% (2)

- Aligning Corporate and Financial StrategyDocument46 pagesAligning Corporate and Financial StrategyDr-Mohammed FaridNo ratings yet

- Transcription - Charl Cilliers (06.09.18)Document86 pagesTranscription - Charl Cilliers (06.09.18)Leila DouganNo ratings yet

- Statement All Transactions 20230401 20230422Document3 pagesStatement All Transactions 20230401 20230422Jyc KunduNo ratings yet

- Surviving The Final Bubble by Charles HayekDocument29 pagesSurviving The Final Bubble by Charles HayekMichael RosesthereNo ratings yet

- Chapter 4 - Interest RatesDocument16 pagesChapter 4 - Interest Ratesuyenbp.a2.1720No ratings yet