Professional Documents

Culture Documents

Unfair Trade Practices by Real Estate Firms: Consumer Protection

Uploaded by

Abhinav Gupta0 ratings0% found this document useful (0 votes)

14 views1 pageNaren and Sudha Sheth booked a flat from Sri Sainath Enterprises, but faced unfair practices from the builder. The builder did not execute the sale agreement and demanded additional payment for parking without basis. They threatened to cancel the flat allotment if the Seths did not sign an interim agreement with arbitrary terms. The National Commission found the builder's actions illegal and arbitrary. It ordered the builder to refund the entire ~1.02 crore paid by the Seths, along with 18% annual interest, and pay ~1 lakh compensation for the unfair treatment.

Original Description:

ok

Original Title

20160516a_012101002

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNaren and Sudha Sheth booked a flat from Sri Sainath Enterprises, but faced unfair practices from the builder. The builder did not execute the sale agreement and demanded additional payment for parking without basis. They threatened to cancel the flat allotment if the Seths did not sign an interim agreement with arbitrary terms. The National Commission found the builder's actions illegal and arbitrary. It ordered the builder to refund the entire ~1.02 crore paid by the Seths, along with 18% annual interest, and pay ~1 lakh compensation for the unfair treatment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageUnfair Trade Practices by Real Estate Firms: Consumer Protection

Uploaded by

Abhinav GuptaNaren and Sudha Sheth booked a flat from Sri Sainath Enterprises, but faced unfair practices from the builder. The builder did not execute the sale agreement and demanded additional payment for parking without basis. They threatened to cancel the flat allotment if the Seths did not sign an interim agreement with arbitrary terms. The National Commission found the builder's actions illegal and arbitrary. It ordered the builder to refund the entire ~1.02 crore paid by the Seths, along with 18% annual interest, and pay ~1 lakh compensation for the unfair treatment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Unfair trade practices by real estate firms

CONSUMER PROTECTION

JEHANGIR B GAI

Naren and Sudha Sheth booked a

residential flat in a housing-cumcommercial project known as Lodha

Luzuria at Thane, being constructed

by Sri Sainath Enterprises, belonging to the Lodha Group. The price of

the flat, measuring 1,118 square feet

carpet area on the second floor,

was ~1.04 crore.

Out of the agreed consideration,

Seths paid ~1.02 crore in instalments

from September 27, 2010, to

November 2, 2010. The remaining

amount of ~2.6 lakh was to be paid at

the time of possession. To pay for the

purchase of this flat, Seths had to

break their fixed deposits, losing

~3 lakh towards interest and

other charges.

The builder avoided executing

the agreement for sale. No heed was

paid to the correspondence made by

the Seths in this regard. On

December 22, 2010, the builder

demanded an additional sum of

~3.96 lakh for car parking. The Seths

questioned this demand. Since no

heed was paid to their e-mail, they

had a legal notice issued. In response,

the builders representative informed

them that they would have to pay for

parking, else execute an indemnity

bond that they did not want the facility and would not park their vehicle

in the premises. Seths e-mail protest

was ignored.

In January 2011, the builder

sent a letter for executing an interim agreement, and telephonically

threatened the Seths that the flat

allotted to them would be can-

celled if they failed to sign on the

dotted line. The Seths finally filed

a complaint before the National

Commission.

The builder contested the complaint. According to the builder, the

complaint was not maintainable as

the Seths had several properties and

they were investors, not consumers.

The Seths were blamed for noncompliance with the terms and conditions set out in the application

form for allotment of the flat, due to

which the allotment was cancelled

and an amount of ~91.66 lakh had

been refunded. The flat was later sold

to another buyer, Monish Jain,

through a registered agreement.

The Commission considered

Seths clarification that they owned

only two small flats, which were

inadequate for their family that comprised themselves and their three

daughters. The Commission accepted this explanation, and held the

complaint to be maintainable.

The Commission observed the

concept of an interim agreement

was completely illegal, arbitrary and

unacceptable. It also observed that

the allotment letter set out the

schedule of payment for the flat,

along with two parking places.

There was no reference to any additional amount payable towards car

parking. Yet, the builder attempted

to deprive the Seths of the car parking through execution of an interim

agreement, where parking space

was stated as nil. Besides this, the

Commission observed that most of

the clauses of the interim agreement were arbitrary and against the

interests of the flat purchasers.

The interim agreement was

silent in respect of completion of

the project and execution of conveyance deed. It also provided for

payment of advance maintenance

charges for two years, which was in

contravention of MOFA which mandates that a society must be formed

within four months.

The Commission indicted the

builder for his arbitrary, high-handed and capricious character.

However, the subsequent buyer,

Monesh Jain, could not be ousted

as he was a bonafide purchaser and

could not be made to suffer.

The Commission noted that even

though Seths had paid ~1.02 crore,

the builder had issued refund

cheques for ~91.66 lakh, and no interest was paid even though the money

was lying with them for five years.

The Commission condemned

the builder for pulling a fast one

over the Seths and making havoc

with the hard-earned money.

Accordingly, by its order of May 5,

2016, delivered by Justice J M Malik

for the bench with S M Kantikar,

the Commission ordered Shree

Sainath Enterprises to refund the

entire amount of ~1.02 crore, along

with annual interest at 18 per cent

from the date of its deposit.

Additionally, ~1 lakh was awarded

as compensation to be paid within

90 days and pay nine per cent interest if delayed.

The author is a consumer activist

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Judgment On Possession Delay (From The Deposit Date)Document3 pagesJudgment On Possession Delay (From The Deposit Date)Vineet RathiNo ratings yet

- Birender Singh Vs M3M India LTDDocument13 pagesBirender Singh Vs M3M India LTDAssignment PointNo ratings yet

- Avnish Kumar Sare GurugramDocument5 pagesAvnish Kumar Sare GurugramSai VijitendraNo ratings yet

- Krani Swarup 1994Document6 pagesKrani Swarup 1994Pulkit AggarwalNo ratings yet

- Equivalent Citation: AIR2010SC3534, 2010 (6) ALD29 (SC), 2010Document21 pagesEquivalent Citation: AIR2010SC3534, 2010 (6) ALD29 (SC), 2010Pradeep YadavNo ratings yet

- Recovery of LoanDocument19 pagesRecovery of LoanSudeep SharmaNo ratings yet

- Unit 26 and 36 Case Laws SummaryDocument4 pagesUnit 26 and 36 Case Laws SummaryVipra VashishthaNo ratings yet

- B'vinedale Distilleries Ltd. Vs Union of India (Uoi) and Ors. On 23 April, 2008'Document15 pagesB'vinedale Distilleries Ltd. Vs Union of India (Uoi) and Ors. On 23 April, 2008'Bruce AlmightyNo ratings yet

- Comment On JudgmentDocument3 pagesComment On JudgmentSoumiki GhoshNo ratings yet

- Vinal RITESH JAIN Affidavit of Evidence FinalDocument29 pagesVinal RITESH JAIN Affidavit of Evidence FinalSailee RaneNo ratings yet

- GTM Builders & Promoters PVT Ltd. v. Sneh Developers PVT LTDDocument4 pagesGTM Builders & Promoters PVT Ltd. v. Sneh Developers PVT LTDchitraNo ratings yet

- Maharera 439414Document16 pagesMaharera 439414Legal ClawsNo ratings yet

- Judgment On Possession DelayDocument3 pagesJudgment On Possession DelayVineet RathiNo ratings yet

- MahaRera Order 26apr2021Document16 pagesMahaRera Order 26apr2021Aarav Verma100% (1)

- CPC ProjectDocument11 pagesCPC ProjectanshulNo ratings yet

- Rera JudgementDocument12 pagesRera JudgementAvinash SrivastavaNo ratings yet

- 825 State of Maharashtra V Aspi Chinoy 30 Sep 2022 438024Document4 pages825 State of Maharashtra V Aspi Chinoy 30 Sep 2022 438024jailaxmiconstructionsNo ratings yet

- Taxguru - In-Joint Development Agreement With Land Owners To Construct Residential Complex Attracts Service TaxDocument13 pagesTaxguru - In-Joint Development Agreement With Land Owners To Construct Residential Complex Attracts Service TaxnivasshaanNo ratings yet

- Deemed ConveyanceDocument2 pagesDeemed ConveyanceJnanamNo ratings yet

- Hindustan Times (Mumbai) (2012!10!29) Page7Document1 pageHindustan Times (Mumbai) (2012!10!29) Page7Pra SuryaNo ratings yet

- Preeti Santosh Dwivedi and Santosh Dwivedi Versus Raymond Limited Judgement by MahaRERADocument20 pagesPreeti Santosh Dwivedi and Santosh Dwivedi Versus Raymond Limited Judgement by MahaRERAAdv KewalramanisNo ratings yet

- Chief Administrator HUDA and Ors Vs Shakuntla DeviSC20160912161701274COM263903Document5 pagesChief Administrator HUDA and Ors Vs Shakuntla DeviSC20160912161701274COM263903A.SinghNo ratings yet

- The RGNUL Freshers' Intra Moot Court Competition Proposition, 2021Document6 pagesThe RGNUL Freshers' Intra Moot Court Competition Proposition, 2021Shivangi SinghNo ratings yet

- New Directive From Apex Court On GREATER NOIDA WEST PDFDocument3 pagesNew Directive From Apex Court On GREATER NOIDA WEST PDFAbhijit HazarikaNo ratings yet

- Important Judgments Arising Out of RERA Act, 2016 - Taxguru - inDocument3 pagesImportant Judgments Arising Out of RERA Act, 2016 - Taxguru - inmarketingandsalesconsultantNo ratings yet

- Judgement cc858 2016Document14 pagesJudgement cc858 2016udamsinglaNo ratings yet

- Rohit Chawla and Ors. vs. Bombay Dyeing and Mfg. Co. Ltd. (31.12.2019 - REAT Maharashtra)Document35 pagesRohit Chawla and Ors. vs. Bombay Dyeing and Mfg. Co. Ltd. (31.12.2019 - REAT Maharashtra)Humanyu KabeerNo ratings yet

- MR Dilip Anant Joshi Vs M-S Vardhaman Homes On 21 February, 2012 PDFDocument23 pagesMR Dilip Anant Joshi Vs M-S Vardhaman Homes On 21 February, 2012 PDFranpande100% (1)

- Atma Krishna Vs Orris Infrastructure Ltd. & Anr. On 21 December, 2018Document9 pagesAtma Krishna Vs Orris Infrastructure Ltd. & Anr. On 21 December, 2018Monica ChandrashekharNo ratings yet

- Manasi Narasimhan and Ors Vs Larsen and Toubro LimRR202117092114085987COM178532Document6 pagesManasi Narasimhan and Ors Vs Larsen and Toubro LimRR202117092114085987COM178532Visalakshy Gupta100% (1)

- Awas Vikas WritDocument25 pagesAwas Vikas WritrohitashvachakrabortyNo ratings yet

- Order of Subodh AhireDocument4 pagesOrder of Subodh AhiresanjayNo ratings yet

- Judgment: in The Supreme Court of India Civil Appellate JurisdictionDocument14 pagesJudgment: in The Supreme Court of India Civil Appellate JurisdictionLee leeNo ratings yet

- Jawahar Lal Wadhwa and Ors Vs Haripada Chakrobertys880208COM931372Document6 pagesJawahar Lal Wadhwa and Ors Vs Haripada Chakrobertys880208COM931372Prasoon ShekharNo ratings yet

- JUDGMENTSDocument3 pagesJUDGMENTSTejasvi ChaudhryNo ratings yet

- Chand Rani Vs Kamal RaniDocument9 pagesChand Rani Vs Kamal RaniMihir GargNo ratings yet

- Sachin Patil Vs Manish KhandelwalDocument2 pagesSachin Patil Vs Manish KhandelwalLahuNo ratings yet

- Leave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDocument5 pagesLeave and License Agreement: Particulars Amount Paid GRN/Transaction Id Datemohammed kutarwadliNo ratings yet

- Supreme Court of India Page 1 of 15Document15 pagesSupreme Court of India Page 1 of 15Sankar Nath ChakrabortyNo ratings yet

- Ramachandran Karuppiah and Jayanti Rani Versus Shree Sadguru JV, Order Dated 01/07/2022Document11 pagesRamachandran Karuppiah and Jayanti Rani Versus Shree Sadguru JV, Order Dated 01/07/2022Adv KewalramanisNo ratings yet

- Batliboi Environmental Engineers Limited Vs HindusSC20232209231807572COM682424Document22 pagesBatliboi Environmental Engineers Limited Vs HindusSC20232209231807572COM682424Shreya KumarNo ratings yet

- Before The Maharashtra Real Estate Regulatory Authority MumbaiDocument8 pagesBefore The Maharashtra Real Estate Regulatory Authority MumbaiMoneylife FoundationNo ratings yet

- 70 Percent Concent.Document4 pages70 Percent Concent.Pravin KharatNo ratings yet

- Jurisdiction of Civil Court - Under Section 50 of HUDA Act - Not Barred Against The Orders of Appellate Authorities of HUDA PDFDocument24 pagesJurisdiction of Civil Court - Under Section 50 of HUDA Act - Not Barred Against The Orders of Appellate Authorities of HUDA PDFAnuj GoyalNo ratings yet

- D5 ParkwoodsDocument3 pagesD5 Parkwoodsgharmilgaya.sunilNo ratings yet

- Odisha State Consumer Dispute Redressal CommissionDocument3 pagesOdisha State Consumer Dispute Redressal CommissionAnany UpadhyayNo ratings yet

- Car Parking Maha Rera Case LawDocument2 pagesCar Parking Maha Rera Case Lawseshadrimn seshadrimnNo ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2Ram MahatoNo ratings yet

- Arnavaz Rustom Printer Mumbai VS N D ThadaniDocument8 pagesArnavaz Rustom Printer Mumbai VS N D ThadaniM. NAGA SHYAM KIRANNo ratings yet

- AMBIKA LAND DEVELOPERs V Shri Rajpal Laxman RautDocument4 pagesAMBIKA LAND DEVELOPERs V Shri Rajpal Laxman RautsehgalribhuNo ratings yet

- High Court Judgement Venus Chs On Equal Service ChargesDocument16 pagesHigh Court Judgement Venus Chs On Equal Service ChargesSUNDEEP SHELUKARNo ratings yet

- Mahar Era OrderDocument8 pagesMahar Era OrderMoneylife FoundationNo ratings yet

- Display PDFDocument3 pagesDisplay PDFShan 059 [R]No ratings yet

- Nihit/Kaustab: 1) Case Name (Details) :: Satyanarayana Vs Narayan Rao 1999 (Quasi Contract)Document9 pagesNihit/Kaustab: 1) Case Name (Details) :: Satyanarayana Vs Narayan Rao 1999 (Quasi Contract)Puneet SinghNo ratings yet

- Tarun Kumar Ghai Vs Malibu Estate Pvt. Ltd. and Ors. On 20 December, 2007Document8 pagesTarun Kumar Ghai Vs Malibu Estate Pvt. Ltd. and Ors. On 20 December, 2007Monica ChandrashekharNo ratings yet

- 2019 2 1501 34781 Judgement 07-Apr-2022Document24 pages2019 2 1501 34781 Judgement 07-Apr-2022Aryan SrivastavaNo ratings yet

- Date of Arguments: 07.05.2019 Date of Decision: 20.05.2019Document3 pagesDate of Arguments: 07.05.2019 Date of Decision: 20.05.2019Prakhar SinghNo ratings yet

- Application To Appoint A Supervisor in Omkar (FINAL)Document2 pagesApplication To Appoint A Supervisor in Omkar (FINAL)Sailee RaneNo ratings yet

- Clininal Course 3 AssignmentDocument4 pagesClininal Course 3 AssignmentanijasNo ratings yet

- Driving Trade and Export Growth: Time Zone: India Standard Time (IST)Document6 pagesDriving Trade and Export Growth: Time Zone: India Standard Time (IST)Abhinav GuptaNo ratings yet

- Business StandardDocument11 pagesBusiness StandardAbhinav GuptaNo ratings yet

- Annexure 13Document2 pagesAnnexure 13Abhinav GuptaNo ratings yet

- Factoring NotesDocument1 pageFactoring NotesAbhinav GuptaNo ratings yet

- Statement - 4 Net Loss (-) of Loss Making Cpses (Cognate Group Wise)Document4 pagesStatement - 4 Net Loss (-) of Loss Making Cpses (Cognate Group Wise)Abhinav GuptaNo ratings yet

- CDCS Question BankDocument5 pagesCDCS Question BankAbhinav GuptaNo ratings yet

- Weekly Progress & Evaluation Test 26: D. 2 & 3 OnlyDocument3 pagesWeekly Progress & Evaluation Test 26: D. 2 & 3 OnlyAbhinav GuptaNo ratings yet

- LIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Document10 pagesLIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Abhinav GuptaNo ratings yet

- Weekly Progress & Evaluation Test 19: Cdcs Exam 2019 (April Intake) Preparation ProgramDocument1 pageWeekly Progress & Evaluation Test 19: Cdcs Exam 2019 (April Intake) Preparation ProgramAbhinav GuptaNo ratings yet

- ANSWERS To CDCS Question BankDocument5 pagesANSWERS To CDCS Question BankAbhinav GuptaNo ratings yet

- An 011101002Document1 pageAn 011101002Abhinav GuptaNo ratings yet

- Can Ajay Singh Turn Spicejet Around?: Spicejet'S Shrinking NumbersDocument1 pageCan Ajay Singh Turn Spicejet Around?: Spicejet'S Shrinking NumbersAbhinav GuptaNo ratings yet

- Weekly Progress & Evaluation Test 22: D. None of The AboveDocument2 pagesWeekly Progress & Evaluation Test 22: D. None of The AboveAbhinav GuptaNo ratings yet

- JD Kotak Banking and Financial Group Capital MarketDocument1 pageJD Kotak Banking and Financial Group Capital MarketAbhinav GuptaNo ratings yet

- MR - Abhinav Gupta: Page 1 of 2 M-8113103Document2 pagesMR - Abhinav Gupta: Page 1 of 2 M-8113103Abhinav Gupta100% (1)

- Bankers Admit Cost of Funds Has Come Down by 50-60 Bps But Transmission Hasn't Been More Than 20-30 BpsDocument1 pageBankers Admit Cost of Funds Has Come Down by 50-60 Bps But Transmission Hasn't Been More Than 20-30 BpsAbhinav GuptaNo ratings yet

- Tomorrow Is WaitingDocument8 pagesTomorrow Is WaitingsrplsmskNo ratings yet

- ICMA2011 DigestDocument160 pagesICMA2011 DigestPREEDAIENGINEERINGNo ratings yet

- LKPD Bahasa Inggris Kelas VII - Descriptive TextDocument1 pageLKPD Bahasa Inggris Kelas VII - Descriptive TextAhmad Farel HusainNo ratings yet

- Csm-Form SchoolDocument2 pagesCsm-Form SchoolGERLY REYESNo ratings yet

- Enron Case StudyDocument23 pagesEnron Case StudyJayesh Dubey100% (1)

- Unit 8 Technical Analysis: ObjectivesDocument13 pagesUnit 8 Technical Analysis: Objectivesveggi expressNo ratings yet

- Lecture-8: Identification of The Suspect: Attributing Cyber Conduct To A PersonDocument22 pagesLecture-8: Identification of The Suspect: Attributing Cyber Conduct To A Personreputation.com.ngNo ratings yet

- Lec04 - Types of RegistersDocument17 pagesLec04 - Types of RegistersBilal ImranNo ratings yet

- Remotivation Therapy (Sammm)Document4 pagesRemotivation Therapy (Sammm)Sam Venezuelȧ100% (3)

- 3 - Cellular Respiration NotesDocument22 pages3 - Cellular Respiration Notesapi-375285021No ratings yet

- Biodiversity-2: Ramsar Convention On WetlandsDocument9 pagesBiodiversity-2: Ramsar Convention On WetlandsAhmad NawazNo ratings yet

- BOQ New Store Plumbing MDocument10 pagesBOQ New Store Plumbing MMd. Mominul IslamNo ratings yet

- The Rise of Robot Friendship: Ethical Dilemmas in Science and TechnologyDocument10 pagesThe Rise of Robot Friendship: Ethical Dilemmas in Science and TechnologyStephen VillegasNo ratings yet

- Baking Enzymes PDFDocument2 pagesBaking Enzymes PDFOrhan Avur0% (1)

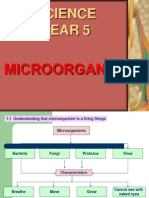

- Science Year 5: MicroorganismsDocument8 pagesScience Year 5: MicroorganismscthanifahNo ratings yet

- 10.21307 - Immunohematology 2022 048 PDFDocument6 pages10.21307 - Immunohematology 2022 048 PDFTanupreetNo ratings yet

- Research Paper On Employee BenefitsDocument7 pagesResearch Paper On Employee Benefitskrqovxbnd100% (1)

- Single and Multistage Steam Jet Ejectors: TorinoDocument12 pagesSingle and Multistage Steam Jet Ejectors: TorinoSuman SenapatiNo ratings yet

- VPSC7c ManualDocument114 pagesVPSC7c ManualChandra ClarkNo ratings yet

- Tugas 2.grammar Translation Exercises 03Document2 pagesTugas 2.grammar Translation Exercises 03Daffa SyahraniNo ratings yet

- Classroom of The Elite Volume 12Document276 pagesClassroom of The Elite Volume 12Kaung Khant100% (1)

- Hot Mix Asphalt Overlay Splice: (Pavement Termination Detail)Document1 pageHot Mix Asphalt Overlay Splice: (Pavement Termination Detail)JUAN RULFONo ratings yet

- 3 ReviewsDocument14 pages3 ReviewsGabriela ZambranoNo ratings yet

- 2021 Test3 Part5Document9 pages2021 Test3 Part5Sicut DilexiNo ratings yet

- Implementing (7, 4) Hamming Code Using CPLD On VHDLDocument6 pagesImplementing (7, 4) Hamming Code Using CPLD On VHDLmohanNo ratings yet

- Lanco Antifloat D-14, TDSDocument2 pagesLanco Antifloat D-14, TDSZein HayekNo ratings yet

- Original PDFDocument37 pagesOriginal PDFAhmadS.Alosta50% (2)

- Lecture 9Document26 pagesLecture 9Tesfaye ejetaNo ratings yet

- BOSS GLOBAL CONCEPTS LTD - AML Policy-UpdatedDocument46 pagesBOSS GLOBAL CONCEPTS LTD - AML Policy-UpdatedtwaseemdttNo ratings yet

- Machine Elements in Mechanical Design Solution PDFDocument309 pagesMachine Elements in Mechanical Design Solution PDFazkonaNo ratings yet