Professional Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

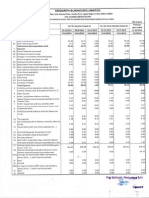

INDO COTSPIN LIMITED

REGD. OFFICE : DELHI MILE STONE 78 K M, G.T.ROAD ,NH-1, VILLAGE: JHATTIPUR, POST BOX NO. 3 ,POST.OFFICE.SAMALKHA , PANIPAT-132103

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 31.12.2014

PART - I

CIN: L17111HR1995PLC032541

ISIN- 407P01017

3 MONTHS

ENDED

31.12.2014

PARTICULARS

Un-audited

S.No.

Description

INCOME FROM OPERATIONS

(a) Net Sales/Income from operations

(b) Other Operating Income

TOTAL INCOME FROM OPERATIONS

EXPENSES

(a) COST OF MATERIAL CONSUMED

(b) PURCHASES OF STOCK-IN-TRADE

(c) CHANGES IN INVENTORIES OF FINISHED

GOODS, WIP AND STOCK-IN-TRADE

(d) EMPLOYEE BENEFITS EXPENSE

(e) DEPRECIATION AND AMORTISATION EXPENSE

(f) OTHER EXPENSES

TOTAL EXPENSES

PROFIT/(LOSS) FROM OPERATIONS BEFORE OTHER

INCOME , FINANCE COSTS AND EXCEPTIONAL

ITEMS (1-2)

OTHER INCOME

13

14

SHARE OF PROFIT / (LOSS) OF ASSOCIATES

15

MINORITY INTEREST

6

7

8

9

10

11

12

Un-audited

Un-audited

9 MONTHS

ENDED

31.12.2014

9 MONTHS

ENDED

31.12.2013

TWELVE

MONTHS ENDED

31.03.2014

Un-audited

Un-audited

Audited

-----------------------------------------------------------------------------------Amount (Rs. Lacs)------------------------------------------------------------------------------------

PROFIT / (LOSS) FROM ORDINARY ACTIVITIES

BEFORE FINANCE COSTS AND EXCEPTIONAL ITEMS

(3+4)

FINANCE COSTS

PROFIT / (LOSS) FROM ORDINARY ACTIVITIES

AFTER FINANCE COSTS AND BUT BEFORE

EXCEPTIONAL ITEMS (5-6)

EXCEPTIONAL ITEMS

PROFIT / (LOSS) FROM ORDINARY ACTIVITIES

BEFORE TAX (7+8)

TAX EXPENSE

NET PROFIT/(LOSS) FROM ORDINARY ACTIVITIES

AFTER TAX (9-10)

EXTRAORDINARY ITEMS (NET OF TAX EXPENSE

Rs.____ LAKHS)

NET PROFIT/(LOSS) FOR THE PERIOD (11+12)

BSE Scrip Code 538838 -ICL

CORRESPONDING 3

PRECEDING 3

MONTHS ENDED

MONTHS ENDED

31.12.2013

30.09.2014

IN THE PREVIOUS

YEAR

259.93

0.00

259.93

97.25

0.00

97.25

309.19

0.00

309.19

463.90

0.00

463.90

532.31

0.00

532.31

742.97

0.00

742.97

106.72

59.24

45.25

47.46

160.81

0.00

241.30

185.20

404.20

1.21

479.11

261.12

63.00

5.13

3.79

19.91

257.80

(19.48)

5.93

4.70

13.67

97.53

(17.55)

5.48

3.80

10.05

162.60

(34.65)

16.38

11.33

43.81

463.37

(62.78)

14.51

11.50

24.25

392.89

(62.25)

20.92

15.20

34.45

748.55

2.13

0.25

(0.28)

0.90

146.60

4.51

0.53

3.15

139.42

15.03

(5.58)

162.23

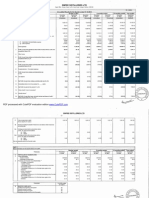

2.38

0.02

0.62

0.03

151.11

0.00

3.68

0.07

154.45

0.04

156.65

0.06

2.36

0.00

0.59

0.00

151.11

0.00

3.61

0.00

154.41

0.00

156.59

0.00

2.36

0.00

0.59

0.00

151.11

50.10

3.61

0.00

154.41

50.10

156.59

31.7

2.36

0.59

101.01

3.61

104.31

124.89

0.00

0.00

0.00

0.00

2.36

0.59

101.01

3.61

0.00

104.31

0.00

124.89

-

16

NET PROFIT / (LOSS) AFTER TAXES , MINORITY

INTEREST AND SHARE OF PROFIT / (LOSS) OF

ASSOCIATES (13+14+15)

17 PAID-UP EQUITY SHARE CAPITAL ( FACE VALUE OF

THE SHARE Rs.10 EACH)

18 RESERVE EXCLUDING REVALUATION RESERVES AS

PER BALANCE SHEET OF PREVIOUS ACCONTING

YEAR

19.i EARNINGS PER SHARE (BEFORE EXTRAORDINARY

ITEMS )

(OF RS.10/- EACH)

(NOT ANNUALISED):

(a) BASIC

(b) DILUTED

19.ii EARNINGS PER SHARE (AFTER EXTRAORDINARY

ITEMS)

(OF RS. 10/- EACH)

(NOT ANNUALISED):

(a) BASIC

(b) DILUTED

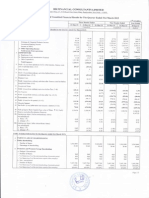

PART - II

A

PARTICULARS OF SHAREHOLDING

1

PUBLIC SHAREHOLDING

-NUMBER OF SHARES

-PERCENTAGE OF SHAREHOLDING

2

2.36

0.59

101.01

3.61

420.05

420.05

420.05

420.05

420.05

0.06

0.06

0.01

0.01

2.40

2.40

0.09

0.09

2.48

2.48

2.97

2.97

0.06

0.06

0.01

0.01

2.40

2.40

2.48

2.48

2.97

2.97

1194500

1194500

1334500

1194500

28.44

28.44

31.77

28.44

1334500

31.77

1334500

31.77

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

3006000

3006000

2866000

3006000

2866000

2866000

100.00

100.00

100.00

100.00

100.00

100.00

71.56

71.56

68.23

71.56

68.23

68.23

0.09

0.09

104.31

124.89

420.05

157.52

PROMOTERS AND PROMOTER GROUP

SHAREHOLDING

a) PLEDGED/ENCUMBERED

- NUMBER OF SHARES

- PERCENTAGE OF SHARES (as a % of the total

shareholding of promoter and promoter group)

- PERCENTAGE OF SHARES (as a % of the total

share capital of the company)

b) NON- ENCUMBERED

- NUMBER OF SHARES

- PERCENTAGE OF SHARES (as a % of the total

shareholding of promoter and promoter group)

- PERCENTAGE OF SHARES (as a % of the total

share capital of the company)

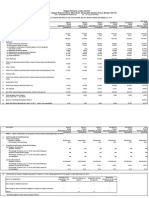

INVESTORS COMPLAINTS

Pending at the beginning of the quarter

Nil

Disposed off during the quarter

Nil

Nil

Received during the quarter

Remaining unresolved at the end of the quarter

Nil

NOTES:

The above unaudited financial results of the company for the quarter ended on 31st December, 2014 have been approved by the Board of Directors at its

1. meeting held on 31st January, 2015 after being approved and recommended by the Audit Committee of the Board.

2.

The statutory Auditors of the company have carried out the Limited Review of the above financial results of the company for the quarter ended 31st December,

2014 in accordance with the clause 41 of the Listing Agreement.

3. The above unaudited results are in accordance with the standard accounting practicies followed by the company in preperation of its statutory accounts.

4. Previous Year Figures have been regroup/rearranged whereever necessary.

5. There is no segmental results, As the company deals in only one segement that is textile material.

6. EPS/Cash EPS is Worked out on total number paid up equity shares.

E.MAIL:-rajpalaggarwal2000@yahoo.com

PAN:-AAACI4596A

For Indo Cotspin Limited

www:-Indocotspin.com

Place: Panipat

Date: 31/01/2015

Bal Kishan Aggarwal

Managing Director

You might also like

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Financial Statement Analysis of BG Group Plc.Document34 pagesFinancial Statement Analysis of BG Group Plc.Saurabh MalikNo ratings yet

- Multiple Choice - ProblemsDocument2 pagesMultiple Choice - ProblemsAnthony Koko Carlobos0% (1)

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- June 2015Document2 pagesJune 2015Aarush VermaNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document4 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document1 pageStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument6 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Result)Document5 pagesFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Mco-7 emDocument8 pagesMco-7 emKhundrakpam Satyabarta100% (3)

- NFJPIA - Mockboard 2011 - P2 PDFDocument6 pagesNFJPIA - Mockboard 2011 - P2 PDFSteven Mark MananguNo ratings yet

- Osmena V SSSDocument2 pagesOsmena V SSSErrica Marie De GuzmanNo ratings yet

- How The Sensex Is CalculatedDocument2 pagesHow The Sensex Is CalculatedsumantrabagchiNo ratings yet

- Corporate Governance in India EvolutionDocument10 pagesCorporate Governance in India EvolutionAnkitaNo ratings yet

- Assignment Corporate FinanceDocument3 pagesAssignment Corporate FinanceRose Abd Rahim50% (2)

- Chapter 14 SolutionDocument9 pagesChapter 14 Solutionbellohales0% (1)

- MWR-TWR White PaperDocument4 pagesMWR-TWR White PaperAmol ChavanNo ratings yet

- Resume Swap Markets 15-1 Background: 15-1a Use of Swaps For HedgingDocument9 pagesResume Swap Markets 15-1 Background: 15-1a Use of Swaps For HedgingAbdul Aziz FaqihNo ratings yet

- Mutual Fund Review: Equity MarketDocument15 pagesMutual Fund Review: Equity MarketHariprasad ManchiNo ratings yet

- The Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007Document13 pagesThe Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007alexjones365No ratings yet

- Chapter 10 - HW SolutionsDocument8 pagesChapter 10 - HW Solutionsa882906No ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- Investors' Protection in India: Regulatory Framework and Investors' Rights, Obligations & GrievancesDocument33 pagesInvestors' Protection in India: Regulatory Framework and Investors' Rights, Obligations & GrievancesHarshSuryavanshiNo ratings yet

- Questions On Mariott Case StudyDocument1 pageQuestions On Mariott Case StudyKaran BaruaNo ratings yet

- Termpapermgt517Document3 pagesTermpapermgt517Addydutt SharmaNo ratings yet

- Abhilash SynopsisDocument7 pagesAbhilash SynopsisMoin KhanNo ratings yet

- HDFC Mid-Cap Opportunities Fund - Presentation (Apr 2023)Document28 pagesHDFC Mid-Cap Opportunities Fund - Presentation (Apr 2023)RajNo ratings yet

- Finman2 Material1 MidtermsDocument8 pagesFinman2 Material1 MidtermsKimberly Laggui PonayoNo ratings yet

- IFRS Red Book - IAS 7 Statement of Cash FlowsDocument37 pagesIFRS Red Book - IAS 7 Statement of Cash FlowsAjmal HusseinNo ratings yet

- Ifsa Chapter2Document31 pagesIfsa Chapter2bingoNo ratings yet

- ADR/GDRDocument10 pagesADR/GDRKopal TandonNo ratings yet

- Tutorial AnswerDocument14 pagesTutorial AnswerJia Mun LewNo ratings yet

- Diagnostic Exam 2017Document8 pagesDiagnostic Exam 2017Rommel RoyceNo ratings yet

- B2B Assignment Section C Group 3Document8 pagesB2B Assignment Section C Group 3PON VINOTHANNo ratings yet

- Synopsis CIMOC IFCDocument5 pagesSynopsis CIMOC IFCthemak76No ratings yet

- Harley-Davidson Financial ValuationDocument51 pagesHarley-Davidson Financial Valuationfebrythiodor100% (1)