Professional Documents

Culture Documents

Portfolio Review - Shobha Bhagwan Tewani PDF

Uploaded by

Anand ChineyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Review - Shobha Bhagwan Tewani PDF

Uploaded by

Anand ChineyCopyright:

Available Formats

Portfolio Review - Shobha Bhagwan Tewani

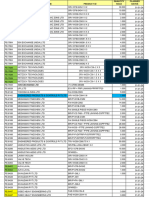

Portfolio Synopsis

Sr.No.

Top 10 Stocks

Allocation

Current Portfolio Value (Rs. Crs)

2.48

IndusInd Bank Ltd.

10.69%

Total No. of Stocks

264

The Federal Bank Ltd.

7.7%

Top 10 stocks %

45

Reliance Industries Ltd.

5.10%

61.2

Eicher Motors Ltd.

4.5%

Largest Single Stocks %

10.70%

Suven Life Sciences Ltd.

4.35%

Concentration in Single Sector %

26.1%

Amara Raja Batteries Ltd.

3.4%

Stocks with less then 1% holdings

240

HDFC Bank Ltd.

2.94%

52.8%

Voltas Ltd.

2.5%

Top 5 Sector %

Large Cap Exposure %

Gujarat Ambuja Exports

Mid Cap Exposure %

Small Cap Exposure %

38.60%

Ltd.

8.5%

10

United Breweries Ltd.

1.9%

Top 5 Sectors

Allocation

2.26%

Bank

26.1%

Healthcare

12.4%

Automobile & Ancillaries

10.7%

FMCG

6.4%

Crude Oil

5.5%

Your Portfolio Performance Comparison with Benchmark Indices, Anand Rathi PMS Portfolio Plus and 3 Stock Basket

(Aggressive, Moderate & Conservative). Data as on 31st May 2016.

As on 31st May 2016.

NIFTY 50

1M

6M

1 Yr

2 Yr

3 Yr

4.0%

16.8%

-3.2%

12.9%

36.3%

NIFTY MIDCAP 100

0.7%

15.0%

0.8%

31.1%

69.9%

PMS Portfolio Plus

5.5%

22.1%

-1.1%

22.5%

53.5%

Your Portfolio

1.9%

19.5%

1.3%

33.6%

79.3%

Since

6Month

As on 31st May 2016.

Inception

1 Month (%)

3Month (%)

(%)

1 Year (%)

18th Feb

Basket

2.4%

26.2%

-2.0%

6.1%

7.8%

Anand Rathi Moderate Stock Basket

3.3%

23.6%

2.0%

2.8%

2.7%

2.8%

22.1%

2.3%

2.3%

1.1%

Anand Rathi Aggressive Stock

Anand Rathi Conservative Stock

Basket

Portfolio Review - Feedback

Total Number of stocks held by you is 264 with portfolio value of Rs 248.84 Lakhs.The number of stocks held by you is too

high as times it gets difficult for even a Fund Manage with all his research team to manage such high number of stocks in

portfolio. We would suggest to bring down the number of stocks to 30 which would be within the manageble limit

Your Large Cap is 52.8%, Mid Cap is 38.6%, Small Cap is 8.5% of the portfolio. We appreciate that the majority of the stocks

held by you is Large Cap which are less volatile. If you are ready to take little risk on portfolio, we would suggest to have

60:40 Large Cap and Mid Cap allocation which will help to create alpha in this secular Bull run

The portfolio seems to be very well diversified across sectors.

The protfolio is well diversified among stocks.

There are 240 Stocks with less than 1% holding. Holding these stocks would not have any material impact in the overall

portfolio. Hence we would suggest to exit them or increase allocation in the same.

The Portfolio has performed well against the bechmark indices both in shorterm as well as longterm. Major part of this

performance is attributed to few stocks like IndusInd Bank Ltd. etc. Hence we would suggest to re-evaluate the portfolio,

had this stock not been there in portfolio how would the performance look like. We are running a PMS Portfolio Plus for last

4 and Half years the portfolio has been consistent performer over this period. One can consider this option to invest in more

managed approach.

We also have three model recommended stock basket for investments, which are design according to the risk profile of the

investor. The same has been consitently outperforming the broader market indices.

Please speak to our Equity Advisor for any further portfolio related discussion and review.

Market Cap Allocation

Portfolio Details - Sector Wise

Company Name

Sector

QTY

Hindustan Dorr-Oliver Ltd.

CMP

Amount

% Held

Reco.

100

9.26

926

0%

EXIT

300

680.65

204195

1%

HOLD

CCL Products (India) Ltd.

200

234.85

46970

0%

HOLD

Dhampur Sugar Mills Ltd.

100

91.45

9145

0%

EXIT

E.I.D. Parry (India) Ltd.

100

234.45

23445

0%

EXIT

KS Oils Ltd.

300

0.97

291

0%

EXIT

184

79.55

14637.2

0%

EXIT

Rajshree Sugars & Chemicals Ltd.

416

47.7

19843.2

0%

EXIT

Rana Sugars Ltd.

700

7.05

4935

0%

EXIT

Shree Renuka Sugars Ltd.

200

14.16

2832

0%

EXIT

Tata Global Beverages Ltd.

250

117.9

29475

0%

EXIT

240

19.7

4728

0%

EXIT

657

727.85

478197.45

2%

EXIT

Amara Raja Batteries Ltd.

1000

840.75

840750

3%

HOLD

Apollo Tyres Ltd.

100

156.25

15625

0%

INCREASE EXPO

Automotive Axles Ltd.

181

636.05

115125.05

0%

EXIT

Bajaj Auto Ltd.

10

2618.9

26189

0%

INCREASE EXPO

Bharat Forge Ltd.

60

756.35

45381

0%

INCREASE EXPO

Ceat Ltd.

75

924.85

69363.75

0%

INCREASE EXPO

Eicher Motors Ltd.

60

18524.2

1111452

4%

HOLD

600

17.5

10500

0%

EXIT

Grindwell Norton Ltd.

Oudh Sugar Mills Ltd.

United Breweries (Holdings) Ltd.

United Breweries Ltd.

Abrasives

Agri

Alcohol

Electrosteel Castings Ltd.

Automobile &

Hero MotoCorp Ltd.

Ancillaries

30

3099.15

92974.5

0%

hold

Metalyst Forgings Ltd.

78

43.15

3365.7

0%

EXIT

Rico Auto Industries Ltd.

400

34.35

13740

0%

EXIT

Shanthi Gears Ltd.

200

100

20000

0%

EXIT

SKF India Ltd.

100

1237.2

123720

0%

HOLD

SML Isuzu Ltd.

100

987

98700

0%

HOLD

Tata Motors - DVR Ordinary

100

311.65

31165

0%

HOLD

Timken India Ltd.

25

544.4

13610

0%

EXIT

70

285.75

20002.5

0%

HOLD

300

54.7

16410

0%

EXIT

50

53.2

2660

0%

EXIT

Central Bank Of India

1344

82.1

110342.4

0%

EXIT

DCB Bank Ltd.

100

94.25

9425

0%

HOLD

Dhanlaxmi Bank Ltd.

200

19.3

3860

0%

EXIT

The Federal Bank Ltd.

TVS Motor Company Ltd.

Taneja Aerospace & Aviation Ltd.

Aviation

Allahabad Bank

36500

52.35

1910775

8%

HOLD

HDFC Bank Ltd.

620

1181.35

732437

3%

HOLD

ICICI Bank Ltd.

125

245.2

30650

0%

HOLD

IDBI Bank Ltd.

150

67.95

10192.5

0%

EXIT

IDFC Bank Ltd.

700

48.2

33740

0%

EXIT

1500

26.95

40425

0%

EXIT

IndusInd Bank Ltd.

2410

1103.6

2659676

11%

REDUCE EXPO

The Karnataka Bank Ltd.

1437

128.6

184798.2

1%

HOLD

State Bank Of India

1200

204.85

245820

1%

HOLD

The South Indian Bank Ltd.

700

19.05

13335

0%

HOLD

State Bank Of Travancore

150

381.75

57262.5

0%

EXIT

Syndicate Bank

1225

67.1

82197.5

0%

EXIT

Union Bank Of India

2050

118.05

242002.5

1%

EXIT

Yes Bank Ltd.

125

1031.95

128993.75

1%

EXIT

Indian Overseas Bank

Bank

Action Construction Equipment Ltd.

900

40

36000

0%

HOLD

25

386.9

9672.5

0%

EXIT

1450

120.7

175015

1%

EXIT

200

66.3

13260

0%

EXIT

200

132.2

26440

0%

EXIT

400

58.05

23220

0%

EXIT

250

73.55

18387.5

0%

EXIT

36.8

220.8

0%

EXIT

Mangal Credit and Fincorp Ltd.

1500

59.7

89550

0%

EXIT

MPF Systems Ltd.

293

5.72

1675.96

0%

EXIT

Alfred Herbert (India) Ltd.

Bharat Heavy Electricals Ltd.

Crompton Greaves Ltd.

Crompton Greaves Consumer

Electricals Ltd.

Elecon Engineering Company Ltd.

Graphite India Ltd.

Kirloskar Electric Company Ltd.

Capital Goods

Capital Goods

Permanent Magnets Ltd.

150

13.15

1972.5

0%

EXIT

Premier Ltd.

50

33.6

1680

0%

EXIT

Roto Pumps Ltd.

125

49.95

6243.75

0%

EXIT

Siemens Ltd.

30

1207.3

36219

0%

HOLD

Suzlon Energy Ltd.

650

15.95

10367.5

0%

EXIT

Terruzzi Fercalx India Ltd.

100

8.18

818

0%

EXIT

Voltamp Transformers Ltd.

20

798.9

15978

0%

EXIT

Berger Paints India Ltd.

100

283.1

28310

0%

HOLD

Bhansali Engineering Polymers Ltd.

300

19.8

5940

0%

EXIT

Ganesh Benzoplast Ltd.

100

23.85

2385

0%

EXIT

Godrej Industries Ltd.

100

345.7

34570

0%

HOLD

80

71.85

5748

0%

EXIT

214

214

0%

EXIT

Chemicals Ltd.

75

138.6

10395

0%

EXIT

Meghmani Organics Ltd.

600

34.95

20970

0%

EXIT

Phillips Carbon Black Ltd.

100

118.05

11805

0%

EXIT

Rashtriya Chemicals & Fertilizers Ltd.

300

43.25

12975

0%

EXIT

UPL Ltd.

275

596.3

163982.5

1%

HOLD

ACC Ltd.

50

1531.8

76590

0%

HOLD

Ambuja Cements Ltd.

10

228.7

2287

0%

EXIT

Borosil Glass Works Ltd.

20

4175.7

83514

0%

EXIT

Century Textiles & Industries Ltd.

20

622.2

12444

0%

EXIT

Empire Industries Ltd.

25

1579.75

39493.75

0%

EXIT

50

280.35

14017.5

0%

HOLD

Gujarat State Fertilizers & Chemicals

Ltd.

Gujarat Alkalies & Chemicals Ltd.

Chemicals

Gujarat Narmada Valley Fertilizers &

HSIL Ltd.

Construction

The India Cements Ltd.

Materials

550

94.25

51837.5

0%

HOLD

Jai Mata Glass Ltd.

9400

0.2

1880

0%

EXIT

Jaiprakash Associates Ltd.

4050

5.54

22437

0%

EXIT

JK Lakshmi Cement Ltd.

112

339.55

38029.6

0%

HOLD

Orient Cement Ltd.

1630

160.8

262104

1%

HOLD

Shiva Cement Ltd.

6160

0%

HOLD

1100

5.6

Ultratech Cement Ltd.

20

3229.35

64587

0%

HOLD

Blue Star Ltd.

325

416.05

135216.25

1%

EXIT

200

1293.95

258790

1%

EXIT

1850

335.9

621415

2%

HOLD

Bharat Petroleum Corporation Ltd.

25

981.35

24533.75

0%

HOLD

Cairn India Ltd.

100

145.2

14520

0%

EXIT

Hitachi Home & Life Solutions (India)

Ltd.

Consumer

Durables

Voltas Ltd.

Hindustan Oil Exploration Company

Ltd.

160

33.75

5400

0%

EXIT

Ltd.

25

907.05

22676.25

0%

EXIT

Indian Oil Corporation Ltd.

50

415.75

20787.5

0%

HOLD

Hindustan Petroleum Corporation

Crude Oil

Oil & Natural Gas Corporation Ltd.

Reliance Industries Ltd.

Classic Diamonds (India) Ltd.

Diamond &

60

211.15

12669

0%

EXIT

1324

958.95

1269649.8

5%

HOLD

2600

0.48

1248

0%

EXIT

Jewellery

Shrenuj & Company Ltd.

900

2.46

2214

0%

EXIT

Aditya Birla Nuvo Ltd.

1048.35

7338.45

0%

HOLD

Birla Corporation Ltd.

50

416.9

20845

0%

HOLD

DCM Shriram Ltd.

100

192

19200

0%

EXIT

Orient Paper & Industries Ltd.

1630

47.25

77017.5

0%

EXIT

Oswal Agro Mills Ltd.

840

11.63

9769.2

0%

EXIT

Diamond Power Infrastructure Ltd.

974

43.95

42807.3

0%

EXIT

400

7.4

2960

0%

HOLD

100

92.3

9230

0%

EXIT

ETF

70

258.1

18067

0%

NO VIEW

Ferro

5966

18.95

113055.7

0%

EXIT

Indian Metals & Ferro Alloys Ltd.

48

122.05

5858.4

0%

EXIT

Bajaj Finserv Ltd.

1823.8

12766.6

0%

HOLD

Indosolar Ltd.

Diversified

Electricals

Sterlite Technologies Ltd.

Kotak Mutual Fund - Gold Exchange

Traded Fund

Balasore Alloys Ltd.

Manganese

Finance

Can Fin Homes Ltd.

50

1207.7

60385

0%

HOLD

Ltd.

200

198.7

39740

0%

HOLD

GIC Housing Finance Ltd.

150

277.2

41580

0%

HOLD

IDFC Ltd.

700

51.55

36085

0%

EXIT

IFCI Ltd.

700

24.15

16905

0%

EXIT

6.75

20.25

0%

EXIT

Kalyani Investment Company Ltd.

10

1608.35

16083.5

0%

EXIT

L&T Finance Holdings Ltd.

100

78.55

7855

0%

HOLD

LIC Housing Finance Ltd.

150

469.45

70417.5

0%

HOLD

Max Financial Services Ltd.

925

356.45

329716.25

1%

HOLD

957.65

5745.9

0%

HOLD

1970

0.25

492.5

0%

EXIT

Reliance Capital Ltd.

73

410.9

29995.7

0%

EXIT

Avanti Feeds Ltd.

870

463.95

403636.5

2%

EXIT

Bilcare Ltd.

55

41.3

2271.5

0%

EXIT

Dabur India Ltd.

600

290

174000

1%

HOLD

10452

53.7

561272.4

2%

EXIT

100

1032.6

103260

0%

EXIT

50

281.2

14060

0%

EXIT

Mirza International Ltd.

3250

97

315250

1%

EXIT

NB Footwear Ltd.

200

4.77

954

0%

EXIT

Dewan Housing Finance Corporation

Innovassynth Investments Ltd.

Finance

Multi Commodity Exchange Of India

Ltd.

Pan India Corporation Ltd.

Gujarat Ambuja Exports Ltd.

Jubilant FoodWorks Ltd.

FMCG

KRBL Ltd.

VenkyS (India) Ltd.

75

391.4

29355

0%

EXIT

Aurobindo Pharma Ltd.

420

785.55

329931

1%

HOLD

Dishman Pharmaceuticals &

Chemicals Ltd.

1000

151.6

151600

1%

EXIT

Divis Laboratories Ltd.

40

1102.9

44116

0%

EXIT

Fortis Healthcare Ltd.

1300

161.85

210405

1%

EXIT

Glaxosmithkline Pharmaceuticals Ltd.

71

3547.2

251851.2

1%

HOLD

Hikal Ltd.

850

145.3

123505

0%

EXIT

JB Chemicals & Pharmaceuticals Ltd.

50

254.55

12727.5

0%

EXIT

Lupin Ltd.

50

1474.4

73720

0%

HOLD

Piramal Enterprises Ltd.

Healthcare

296

1442

426832

2%

HOLD

Piramal Phytocare Ltd.

576

78

44928

0%

EXIT

Sterling Biotech Ltd.

500

3.22

1610

0%

EXIT

Strides Shasun Ltd.

131

1112.9

145789.9

1%

EXIT

Sun Pharmaceutical Industries Ltd.

220

762.7

167794

1%

HOLD

Suven Life Sciences Ltd.

5000

216.65

1083250

4%

HOLD

27

918.2

24791.4

0%

HOLD

1500

17.2

25800

0%

EXIT

50

117.6

5880

0%

EXIT

100

32.75

3275

0%

EXIT

150

177.8

26670

0%

EXIT

Wockhardt Ltd.

Hotel Leela Venture Ltd.

The Indian Hotels Company Ltd.

Kamat Hotels (India) Ltd.

Hospitality

Thomas Cook (India) Ltd.

Petronet LNG Ltd.

950

274.2

260490

1%

EXIT

Rain Industries Ltd.

1725

32.8

56580

0%

EXIT

Gammon India Ltd.

40

10.86

434.4

0%

EXIT

Gammon Infrastructure Projects Ltd.

412

4.04

1664.48

0%

EXIT

GMR Infrastructure Ltd.

700

11.26

7882

0%

EXIT

Ltd.

500

18.75

9375

0%

EXIT

IVRCL Ltd.

550

4.07

2238.5

0%

EXIT

Jyoti Structures Ltd.

550

9.34

5137

0%

EXIT

Inds. Gases &

Fuels

Hindustan Construction Company

Kalpataru Power Transmission Ltd.

Infrastructure

200

238.1

47620

0%

EXIT

KEC International Ltd.

1000

138.35

138350

1%

HOLD

Larsen & Toubro Ltd.

321

1474.3

473250.3

2%

HOLD

Lanco Infratech Ltd.

1400

4.28

5992

0%

EXIT

Noida Toll Bridge Company Ltd.

200

23.05

4610

0%

EXIT

Patel Engineering Ltd.

450

51.3

23085

0%

EXIT

Punj Lloyd Ltd.

800

20.15

16120

0%

EXIT

Sadbhav Engineering Ltd.

185

278.35

51494.75

0%

HOLD

Valecha Engineering Ltd.

487

26

12662

0%

EXIT

Bhushan Steel Ltd.

56

36.2

2027.2

0%

EXIT

Gandhi Special Tubes Ltd.

279

226

63054

0%

EXIT

ISMT Ltd.

2147

10.74

23058.78

0%

EXIT

Jayaswal Neco Industries Ltd.

1210

7.28

8808.8

0%

EXIT

JSW Steel Ltd.

258

1391.2

358929.6

1%

EXIT

Kalyani Steels Ltd.

600

183.9

110340

0%

HOLD

Maharashtra Seamless Ltd.

50

235.45

11772.5

0%

EXIT

Monnet Ispat & Energy Ltd.

100

22.1

2210

0%

EXIT

Mukand Ltd.

300

36.8

11040

0%

EXIT

National Steel & Agro Industries Ltd.

4600

11.28

51888

0%

EXIT

24

5.9

141.6

0%

EXIT

30

28.5

855

0%

EXIT

Prakash Industries Ltd.

50

36.05

1802.5

0%

EXIT

PSL Ltd.

400

6.18

2472

0%

EXIT

SAL Steel Ltd.

2500

2.6

6500

0%

EXIT

Nova Iron & Steel Ltd.

Oil Country Tubular Ltd.

Iron & Steel

Iron & Steel

Steel Authority Of India Ltd.

680

42.7

29036

0%

EXIT

Shah Alloys Ltd.

200

8.75

1750

0%

EXIT

Sunflag Iron & Steel Company Ltd.

100

24.15

2415

0%

EXIT

Usha Martin Ltd.

1500

12.37

18555

0%

EXIT

Uttam Galva Steels Ltd.

1850

27.2

50320

0%

EXIT

Vedanta Ltd.

700

108.3

75810

0%

EXIT

Welspun Corp Ltd.

1630

78.25

127547.5

1%

EXIT

Zenith Birla (India) Ltd.

220

0.74

162.8

0%

EXIT

FCS Software Solutions Ltd.

24800

0.3

7440

0%

EXIT

Hexaware Technologies Ltd.

300

216.9

65070

0%

EXIT

KPIT Technologies Ltd.

100

180.75

18075

0%

EXIT

Onmobile Global Ltd.

500

110.8

55400

0%

EXIT

11140

0.61

6795.4

0%

EXIT

Rolta India Ltd.

5539

71.8

397700.2

2%

EXIT

Subex Ltd.

300

9.32

2796

0%

EXIT

Tanla Solutions Ltd.

1400

34.25

47950

0%

EXIT

Tech Mahindra Ltd.

304

538.4

163673.6

1%

HOLD

Essar Shipping Ltd.

66

25.65

1692.9

0%

EXIT

26

40.95

1064.7

0%

EXIT

1850

27.55

50967.5

0%

EXIT

450

88.3

39735

0%

EXIT

Pentamedia Graphics Ltd.

GOL Offshore Ltd.

IT

Logistics

Mercator Ltd.

Dish TV India Ltd.

Media &

Inox Leisure Ltd.

Entertainment

100

201.5

20150

0%

EXIT

7000

0.21

1470

0%

EXIT

75

291.65

21873.75

0%

HOLD

380

2.53

961.4

0%

EXIT

MOIL Ltd.

17

226.3

3847.1

0%

HOLD

Delta Corp Ltd.

900

82.8

74520

0%

HOLD

Future Enterprises Ltd.-B-DVR

206

16.7

3440.2

0%

EXIT

Future Market Networks Ltd.

20

23.2

464

0%

EXIT

28

1.92

53.76

0%

EXIT

Jain Irrigation Systems Ltd. (DVR)

900

42.05

37845

0%

EXIT

RattanIndia Infrastructure Ltd.

1885

3.72

7012.2

0%

EXIT

950

105.15

99892.5

0%

EXIT

KSS Ltd.

Coal India Ltd.

Gujarat NRE Coke Ltd.

Gujarat NRE Coke Ltd. (DVR)

Hindalco Industries Ltd.

Mining

Miscellaneous

Non - Ferrous

Metals

PALCO Ltd.

Kuantum Papers Ltd.

Paper

Essel Propack Ltd.

Finolex Industries Ltd.

Jai Corp Ltd.

Plastic Products

Jain Irrigation Systems Ltd.

500

0.38

190

0%

EXIT

50

147.75

7387.5

0%

EXIT

200

189.35

37870

0%

EXIT

450

388.5

174825

1%

EXIT

1100

69.05

75955

0%

EXIT

75

64.55

4841.25

0%

EXIT

3800

80.95

307610

1%

HOLD

Ltd.

100

84.95

8495

0%

EXIT

GVK Power & Infrastructure Ltd.

100

4.71

471

0%

EXIT

Jaiprakash Power Ventures Ltd.

400

3.86

1544

0%

EXIT

JSW Energy Ltd.

100

71.25

7125

0%

EXIT

NEPC India Ltd.

1000

1.34

1340

0%

EXIT

100

68.85

6885

0%

EXIT

400

23.25

9300

0%

EXIT

Sintex Industries Ltd.

Gujarat Industries Power Company

Neyveli Lignite Corporation Ltd.

NHPC Ltd.

Power

Power Grid Corporation Of India Ltd.

100

15000

0%

HOLD

PTC India Ltd.

700

68.5

47950

0%

EXIT

Reliance Infrastructure Ltd.

397

538.05

213605.85

1%

EXIT

Reliance Power Ltd.

353

52

18356

0%

EXIT

Tata Power Company Ltd.

1550

73.85

114467.5

0%

EXIT

DLF Ltd.

200

129.85

25970

0%

EXIT

Infrastructure Ltd.

2200

97.15

213730

1%

EXIT

Indiabulls Real Estate Ltd.

500

102.1

51050

0%

EXIT

125

189.01

23626.25

0%

HOLD

Omaxe Ltd.

188

155.8

29290.4

0%

EXIT

Sobha Ltd.

50

304.9

15245

0%

EXIT

Unitech Ltd.

100

3.9

390

0%

EXIT

Welspun Enterprises Ltd.

1272

58.95

74984.4

0%

EXIT

257

131.55

33808.35

0%

HOLD

Future Enterprises Ltd.

900

26.6

23940

0%

EXIT

Bharti Airtel Ltd.

50

351.65

17582.5

0%

HOLD

Hathway Cable & Datacom Ltd.

500

34.8

17400

0%

EXIT

767

47.05

36087.35

0%

EXIT

Tata Teleservices (Maharashtra) Ltd.

1472

6.41

9435.52

0%

EXIT

Alka India Ltd.

10000

0.19

1900

0%

EXIT

Arvind Ltd.

1000

318.95

318950

1%

HOLD

35

86.95

3043.25

0%

EXIT

150

Housing Development &

NBCC (India) Ltd.

Aditya Birla Fashion and Retail Ltd.

Reliance Communications Ltd.

Realty

Retailing

Telecom

DCM Ltd.

Textile

Future Lifestyle Fashions Ltd.

368

105

38640

0%

EXIT

JBF Industries Ltd.

100

204.4

20440

0%

EXIT

500

92.35

46175

0%

EXIT

MPIL Corporation Ltd.

55

55.8

3069

0%

EXIT

Nahar Poly Films Ltd.

70

44.15

3090.5

0%

EXIT

8980

0.22

1975.6

0%

EXIT

Suryalata Spinning Mills Ltd.

50

116.15

5807.5

0%

EXIT

Welspun India Ltd.

200

104.1

20820

0%

EXIT

1M

6M

1 Yr

2 Yr

3 Yr

Mkt Cap (Cr)

28845

KG Denim Ltd.

Textile

Paras Petrofils Ltd.

Individual Stock Returns in Portfolio

Company Name

ACC Ltd.

6%

28%

1%

14%

26%

-1%

13%

0%

34%

209%

-11%

2%

-28%

7%

Aditya Birla Nuvo Ltd.

23%

47%

-42%

-20%

-1%

13654

Alfred Herbert (India) Ltd.

2%

9%

2%

61%

52%

29

Alka India Ltd.

0%

0%

111%

19%

90%

10

Allahabad Bank

-9%

23%

-50%

-58%

-56%

3662

Amara Raja Batteries Ltd.

Action Construction Equipment Ltd.

Aditya Birla Fashion and Retail Ltd.

399

10018

-12%

-1%

-5%

106%

215%

14285

Ambuja Cements Ltd.

3%

22%

-4%

5%

25%

35414

Apollo Tyres Ltd.

-2%

-1%

-18%

-12%

75%

7684

Arvind Ltd.

15%

34%

34%

74%

289%

7902

Aurobindo Pharma Ltd.

3%

20%

14%

135%

821%

46190

Automotive Axles Ltd.

2%

15%

-15%

33%

166%

Avanti Feeds Ltd.

5%

28%

46%

281%

1724%

2191

Bajaj Auto Ltd.

5%

19%

13%

34%

44%

76248

Bajaj Finserv Ltd.

-3%

13%

19%

114%

175%

29555

Balasore Alloys Ltd.

4%

25%

15%

-25%

113%

147

Berger Paints India Ltd.

10%

26%

33%

129%

152%

19743

Bhansali Engineering Polymers Ltd.

5%

24%

4%

7%

-1%

334

Bharat Forge Ltd.

-5%

1%

-39%

51%

223%

17486

Bharat Heavy Electricals Ltd.

-4%

32%

-52%

-50%

-40%

28869

Bharti Airtel Ltd.

-3%

11%

-17%

2%

16%

143187

Bhushan Steel Ltd.

-9%

10%

-36%

-91%

-92%

800

Bilcare Ltd.

-2%

0%

-16%

-36%

-37%

102

Birla Corporation Ltd.

6%

27%

2%

14%

66%

3180

Blue Star Ltd.

-3%

33%

16%

54%

149%

3746

Borosil Glass Works Ltd.

31%

70%

162%

348%

476%

1249

Bharat Petroleum Corporation Ltd.

0%

27%

15%

88%

160%

73238

Cairn India Ltd.

0%

23%

-25%

-57%

-49%

26604

Can Fin Homes Ltd.

0%

28%

77%

280%

799%

3234

CCL Products (India) Ltd.

21%

39%

30%

285%

762%

3139

Ceat Ltd.

-16%

-2%

19%

118%

758%

3643

Central Bank Of India

0%

40%

-22%

9%

25%

14697

Century Textiles & Industries Ltd.

-3%

48%

-8%

30%

122%

6898

-8%

-66%

-81%

-80%

Classic Diamonds (India) Ltd.

925

Coal India Ltd.

1%

-6%

-25%

-21%

-10%

195144

Crompton Greaves

Greaves Consumer

Ltd.

Crompton

15%

-49%

-61%

-64%

-30%

4491

5%

22%

7%

54%

85%

53787

2655

Electricals Ltd.

Dabur India Ltd.

DCB Bank Ltd.

8414

0%

32%

-29%

36%

114%

DCM Ltd.

-15%

28%

-10%

4%

28%

151

DCM Shriram Ltd.

22%

66%

69%

49%

231%

3187

Delta

Corp

Ltd. Finance Corporation

Dewan

Housing

1%

67%

7%

-12%

36%

1958

Ltd.

0%

29%

-10%

31%

144%

5744

Dhampur Sugar Mills Ltd.

3%

63%

181%

75%

123%

585

Dhanlaxmi Bank Ltd.

-2%

5%

-45%

-57%

-52%

358

Diamond Power Infrastructure Ltd.

-3%

76%

-12%

-56%

-16%

254

Dish TV India

Ltd.

Dishman

Pharmaceuticals

&

-2%

30%

-13%

71%

36%

9246

Chemicals Ltd.

-11%

2%

108%

241%

324%

2469

Divis Laboratories Ltd.

5%

16%

21%

73%

126%

30263

DLF Ltd.

0%

46%

10%

-38%

-33%

23554

E.I.D. Parry (India) Ltd.

2%

39%

45%

18%

66%

4258

Eicher Motors Ltd.

-8%

-2%

-2%

177%

398%

51016

-7%

35%

-13%

-13%

81%

631

Electrosteel Castings Ltd.

-7%

1%

-4%

-44%

10%

623

Empire Industries Ltd.

-8%

5%

0%

138%

170%

933

Essar Shipping Ltd.

3%

8%

24%

14%

34%

523

Essel Propack Ltd.

4%

40%

46%

120%

355%

2914

FCS Software Solutions Ltd.

-17%

-17%

0%

-35%

36%

51

The Federal Bank Ltd.

14%

13%

-27%

-10%

16%

8785

Finolex Industries Ltd.

7%

27%

41%

53%

193%

4943

Fortis Healthcare Ltd.

-8%

-3%

-7%

53%

83%

7404

Future Enterprises Ltd.-B-DVR

-87%

-83%

-82%

-73%

-85%

66

Future Enterprises Ltd.

-82%

-78%

-78%

-78%

-80%

1104

Future Lifestyle Fashions Ltd.

16%

48%

25%

11%

Future Market Networks Ltd.

-11%

5%

80%

54%

Elecon Engineering Company Ltd.

2039

121%

120

Gammon India Ltd.

-10%

Gammon Infrastructure Projects Ltd.

-21%

-43%

-61%

-45%

390

-16%

-16%

-67%

-68%

-62%

379

Gandhi Special Tubes Ltd.

7%

9%

-10%

50%

45%

326

Ganesh Benzoplast Ltd.

10%

38%

141%

301%

192%

117

GIC Housing Finance Ltd.

5%

42%

22%

79%

147%

1485

Glaxosmithkline Pharmaceuticals Ltd.

-5%

12%

10%

46%

41%

29865

GMR Infrastructure Ltd.

-11%

3%

-21%

-66%

-45%

6700

Godrej Industries Ltd.

-1%

18%

-9%

17%

17%

11948

GOL Offshore Ltd.

-14%

19%

-24%

-59%

-32%

150

Graphite India Ltd.

-8%

11%

-8%

-11%

-4%

1428

Grindwell

Norton

Ltd. & Chemicals

Gujarat

State

Fertilizers

5%

13%

-5%

81%

170%

3802

Ltd.

-3%

14%

1%

-4%

26%

2929

Gujarat Alkalies & Chemicals Ltd.

18%

46%

25%

5%

18%

1559

Gujarat Industries

Ambuja Exports

Gujarat

PowerLtd.

Company

0%

47%

46%

45%

128%

716

Ltd.

Gujarat

Narmada Valley Fertilizers &

4%

9%

3%

1%

16%

1293

Chemicals Ltd.

39%

100%

114%

48%

78%

2137

Gujarat NRE Coke Ltd.

-24%

-13%

-39%

-83%

-84%

324

Gujarat NRE Coke Ltd. (DVR)

-11%

-9%

-35%

-71%

-77%

20

GVK Power & Infrastructure Ltd.

-30%

-27%

-42%

-71%

-42%

671

Hathway Cable & Datacom Ltd.

-6%

16%

-36%

-47%

-38%

2803

HDFC Bank

Ltd.

Housing

Development

&

4%

21%

12%

49%

69%

296745

Infrastructure Ltd.

13%

58%

-11%

7%

132%

3930

Hero MotoCorp Ltd.

7%

24%

15%

32%

78%

62838

Hexaware Technologies Ltd.

-10%

-8%

-23%

51%

169%

6462

Hikal Ltd.

2%

16%

13%

62%

79%

1260

Hindustan

Ltd.Company

Hindustan Dorr-Oliver

Oil Exploration

-9%

-2%

-39%

-33%

-32%

71

Ltd.

-8%

25%

-12%

-43%

-37%

435

Hindalco

Ltd. Company

HindustanIndustries

Construction

9%

53%

-19%

-29%

3%

21775

Ltd.

Hitachi

Home & Life Solutions (India)

-10%

6%

-35%

-45%

41%

1449

Ltd.

-5%

31%

-19%

446%

809%

3464

Hotel LeelaPetroleum

Venture Ltd.

Hindustan

Corporation

-3%

4%

-5%

-27%

-9%

800

Ltd.

9%

32%

34%

126%

222%

31577

HSIL Ltd.

-6%

17%

-21%

32%

171%

1951

ICICI Bank Ltd.

3%

29%

-23%

-14%

6%

141689

IDBI Bank Ltd.

-2%

16%

-5%

-27%

-15%

13207

IDFC Bank Ltd.

1%

6%

IDFC Ltd.

16%

37%

-29%

-13%

-24%

7932

IFCI Ltd.

-5%

15%

-22%

-33%

-5%

3931

The India Cements Ltd.

6%

42%

3%

-6%

41%

2934

Indiabulls Real Estate Ltd.

51%

124%

74%

19%

46%

4905

The Indian Hotels Company Ltd.

12%

20%

15%

31%

129%

12069

Indian Metals & Ferro Alloys Ltd.

-10%

12%

-33%

-70%

-42%

318

Indian Oil Corporation Ltd.

-4%

13%

17%

15%

45%

102800

Indian Overseas Bank

-14%

10%

-38%

-65%

-54%

4909

Indosolar Ltd.

-8%

-3%

-50%

161%

243%

265

IndusInd Bank Ltd.

5%

33%

26%

107%

113%

66919

Innovassynth Investments Ltd.

0%

-14%

-9%

79%

190%

15

Inox Leisure Ltd.

-2%

9%

28%

45%

218%

1915

167

16092

ISMT Ltd.

32%

64%

17%

-30%

-9%

IVRCL Ltd.

-18%

-42%

-70%

-84%

-77%

311

JB Chemicals & Pharmaceuticals Ltd.

4%

5%

6%

76%

208%

2111

Jai Corp Ltd.

1%

24%

22%

-24%

25%

1258

Jai Mata Glass Ltd.

5%

-13%

82%

-23%

-46%

Jain Irrigation Systems Ltd. (DVR)

6%

8%

8%

-13%

24%

80

Jain Irrigation Systems Ltd.

6%

18%

-4%

-42%

-7%

2958

Jaiprakash Power Ventures Ltd.

-16%

-12%

-48%

-83%

-83%

1111

Jaiprakash Associates Ltd.

-26%

-22%

-69%

-92%

-92%

1365

Jayaswal Neco Industries Ltd.

-12%

7%

-13%

-48%

-16%

458

JBF Industries Ltd.

-3%

33%

-4%

81%

91%

1680

JK Lakshmi Cement Ltd.

-3%

26%

-1%

78%

214%

3983

JSW Energy Ltd.

5%

15%

-36%

-3%

28%

11333

JSW Steel Ltd.

1%

24%

52%

15%

103%

33126

Jubilant FoodWorks Ltd.

-11%

4%

-42%

-11%

-6%

6581

Jyoti Structures Ltd.

-11%

-22%

-64%

-85%

-66%

96

8%

97%

330%

525%

593%

225

KG Denim Ltd.

KS Oils Ltd.

-10%

0%

54%

-58%

-50%

48

Kalpataru Power Transmission Ltd.

13%

44%

3%

36%

230%

3803

Kalyani Investment Company Ltd.

-1%

9%

-40%

131%

439%

712

Kalyani Steels Ltd.

8%

37%

52%

103%

376%

805

Kamat Hotels (India) Ltd.

-9%

2%

-49%

-46%

-53%

75

The Karnataka Bank Ltd.

15%

50%

-9%

-5%

-6%

2367

KEC International Ltd.

10%

37%

14%

17%

231%

3485

Kirloskar

Electric

Company

Ltd.

Kotak Mutual

Fund

- Gold Exchange

-4%

48%

47%

11%

73%

224

Traded Fund

-4%

-1%

5%

3%

1%

KPIT Technologies Ltd.

13%

35%

74%

13%

67%

3466

6316

KRBL Ltd.

KSS Ltd.

24%

57%

54%

313%

1041%

-16%

-16%

-40%

-88%

-81%

41

Kuantum Papers Ltd.

0%

34%

49%

113%

409%

120

L&T Finance Holdings Ltd.

10%

54%

22%

8%

2%

13653

Larsen & Toubro Ltd.

18%

37%

-11%

-5%

58%

136166

Lanco Infratech Ltd.

-13%

-18%

-14%

-61%

-54%

1141

LIC Housing Finance Ltd.

2%

11%

12%

47%

83%

23984

Lupin Ltd.

-8%

-16%

-20%

58%

99%

65317

Maharashtra Seamless Ltd.

16%

78%

16%

-22%

2%

1545

Mangal Credit and Fincorp Ltd.

-6%

19%

86%

43%

73%

93

MPF Systems Ltd.

0%

-7%

-37%

-51%

-55%

Max Financial Services Ltd.

-2%

6%

-24%

35%

67%

10162

Meghmani Organics Ltd.

9%

82%

104%

175%

503%

1002

Mercator Ltd.

-3%

40%

70%

-19%

114%

714

Metalyst Forgings Ltd.

-25%

-17%

-76%

-87%

-58%

156

Mirza International Ltd.

-7%

8%

13%

245%

304%

1157

MOIL Ltd.

-5%

19%

-7%

-27%

14%

3919

Monnet Ispat & Energy Ltd.

-20%

13%

-38%

-83%

-85%

434

MPIL Corporation Ltd.

-2%

3%

9%

-20%

Mukand

Ltd.

Multi

Commodity

Exchange Of India

4%

25%

-9%

18%

51%

497

Ltd.

9%

18%

-13%

78%

12%

4953

Nahar Poly Films Ltd.

3%

56%

77%

190%

194%

108

NBCC (India) Ltd.

-6%

9%

23%

214%

601%

11697

National Steel & Agro Industries Ltd.

-18%

-6%

-25%

-56%

-24%

52

NB Footwear Ltd.

-14%

83%

53%

NEPC India Ltd.

-11%

-14%

-36%

-73%

-37%

Neyveli Lignite Corporation Ltd.

-2%

6%

-6%

-27%

3%

11425

NHPC Ltd.

13%

15%

15%

-6%

21%

27289

Noida Toll Bridge Company Ltd.

2%

3%

-32%

-27%

6%

432

-21%

-27%

-28%

-69%

-86%

22

0%

22%

-12%

-46%

-21%

128

Omaxe Ltd.

6%

14%

14%

8%

30%

2851

Oil & Natural Gas Corporation Ltd.

-3%

9%

-36%

-44%

-36%

181291

Onmobile Global Ltd.

-5%

5%

44%

287%

220%

1158

Orient Cement Ltd.

9%

17%

-17%

109%

Orient Paper & Industries Ltd.

23%

48%

84%

77%

574%

913

Oswal Agro Mills Ltd.

-1%

-8%

-3%

-17%

9%

154

Oudh Sugar Mills Ltd.

9%

113%

331%

219%

330%

240

Pan India Corporation Ltd.

-17%

-29%

-14%

-17%

0%

Paras Petrofils Ltd.

10%

5%

-12%

-27%

-15%

Patel Engineering Ltd.

-9%

5%

-35%

-46%

10%

394

PALCO Ltd.

6%

-5%

3%

31%

12%

Pentamedia Graphics Ltd.

-6%

-9%

-26%

-40%

22%

24

Permanent Magnets Ltd.

-16%

-28%

0%

18%

4%

17%

51%

77%

92%

20213

Phillips Carbon Black Ltd.

-1%

43%

9%

67%

78%

401

Piramal Enterprises Ltd.

21%

59%

51%

113%

169%

24957

Piramal Phytocare Ltd.

-9%

59%

109%

176%

228%

191

Power Grid Corporation Of India Ltd.

5%

15%

4%

23%

32%

78657

Prakash Industries Ltd.

-14%

41%

-1%

-66%

4%

480

Premier Ltd.

-9%

11%

-17%

-44%

-49%

99

PSL Ltd.

-15%

-21%

-38%

-75%

-78%

75

PTC India Ltd.

6%

15%

-1%

-20%

23%

2022

Punj Lloyd Ltd.

-14%

-8%

-19%

-51%

-53%

608

Rain Industries Ltd.

-12%

9%

-15%

-33%

-15%

1048

Rajshree Sugars & Chemicals Ltd.

3%

103%

174%

44%

26%

142

Rana Sugars Ltd.

12%

83%

160%

107%

149%

107

RattanIndia Infrastructure Ltd.

5%

16%

73%

-42%

24%

510

Rashtriya Chemicals & Fertilizers Ltd.

-5%

12%

-23%

-18%

12%

2416

10142

Nova Iron & Steel Ltd.

Oil Country Tubular Ltd.

Petronet LNG Ltd.

Reliance Capital Ltd.

3411

12

2%

28%

4%

-22%

26%

Reliance Communications Ltd.

-16%

-9%

-31%

-66%

-56%

12184

Reliance Industries Ltd.

-2%

-1%

9%

-10%

19%

310610

Reliance Infrastructure Ltd.

0%

31%

31%

-22%

49%

13757

Reliance Power Ltd.

2%

17%

-2%

-45%

-24%

14250

Rico Auto Industries Ltd.

-12%

21%

-21%

114%

433%

474

Rolta India Ltd.

-8%

4%

-38%

-33%

21%

1069

Roto Pumps Ltd.

-16%

14%

-48%

4%

150%

77

SAL Steel Ltd.

-12%

-10%

41%

-17%

27%

22

5%

33%

-3%

62%

152%

4797

-10%

22%

-35%

-51%

-24%

17204

8%

29%

-26%

-19%

0%

152539

Sadbhav Engineering Ltd.

Steel Authority Of India Ltd.

State Bank Of India

Shah Alloys Ltd.

-9%

7%

57%

28%

67%

17

Shanthi Gears Ltd.

10%

24%

-2%

22%

86%

854

Shiva Cement Ltd.

1%

21%

48%

43%

89%

101

Shree Renuka Sugars Ltd.

6%

22%

25%

-43%

-34%

1303

Shrenuj & Company Ltd.

-51%

-79%

-93%

-96%

-96%

55

Siemens Ltd.

6%

22%

-12%

39%

103%

43237

Sintex Industries Ltd.

-2%

24%

-27%

-12%

71%

3441

SKF India Ltd.

-4%

5%

-13%

32%

118%

6514

SML Isuzu Ltd.

2%

48%

-18%

132%

228%

1520

Sobha Ltd.

4%

27%

-29%

-32%

-22%

2987

The South Indian Bank Ltd.

4%

14%

-23%

-33%

-24%

2566

State Bank Of Travancore

1%

3%

-14%

-20%

-23%

2704

-20%

-24%

-55%

-76%

-46%

86

Sterlite Technologies Ltd.

4%

26%

26%

110%

337%

3574

Strides Shasun Ltd.

3%

27%

-12%

121%

27%

9888

Subex Ltd.

5%

10%

-24%

-10%

32%

465

Sterling Biotech Ltd.

Sun Pharmaceutical Industries Ltd.

-6%

-11%

-21%

25%

46%

177679

Sunflag Iron & Steel Company Ltd.

5%

27%

13%

9%

16%

433

Suryalata Spinning Mills Ltd.

8%

31%

-6%

84%

100%

52

Suven Life Sciences Ltd.

1%

42%

-23%

154%

838%

2721

Suzlon Energy Ltd.

6%

18%

-37%

-28%

36%

7706

Syndicate Bank

-4%

31%

-43%

-52%

-48%

5078

Taneja Aerospace & Aviation Ltd.

1%

5%

-29%

74%

152%

132

Tanla Solutions Ltd.

-9%

29%

95%

501%

862%

332

Tata Global Beverages Ltd.

-2%

14%

-19%

-21%

-19%

7586

Tata Motors - DVR Ordinary

5%

33%

4%

23%

82%

16070

Tata Power Company Ltd.

5%

29%

-1%

-29%

-14%

19974

Tata Teleservices (Maharashtra) Ltd.

-6%

8%

-10%

-42%

-15%

1241

Tech Mahindra Ltd.

11%

30%

-3%

12%

123%

53345

Terruzzi Fercalx India Ltd.

-9%

-29%

-75%

-47%

-54%

Thomas Cook (India) Ltd.

-2%

-7%

-29%

78%

215%

6670

Timken India Ltd.

5%

31%

-13%

143%

243%

3848

-11%

7%

20%

120%

695%

14115

Ultratech Cement Ltd.

2%

17%

8%

35%

71%

87518

Union Bank Of India

-7%

10%

-32%

-43%

-46%

7785

Unitech Ltd.

-18%

0%

-73%

-86%

-84%

1018

United Breweries (Holdings) Ltd.

-2%

-6%

-1%

-46%

-47%

134

United Breweries Ltd.

-5%

-10%

-24%

-4%

-5%

19216

UPL Ltd.

11%

56%

8%

97%

285%

25963

Usha Martin Ltd.

-15%

81%

-35%

-68%

-46%

376

Uttam Galva Steels Ltd.

-16%

10%

-43%

-66%

-60%

373

Valecha Engineering Ltd.

-13%

-7%

-65%

-65%

-37%

57

-34%

31011

540

TVS Motor Company Ltd.

Vedanta Ltd.

4%

53%

-45%

-61%

VenkyS (India) Ltd.

2%

50%

103%

23%

16%

Voltamp Transformers Ltd.

-2%

16%

16%

25%

100%

802

Voltas Ltd.

14%

50%

1%

80%

301%

11058

Welspun Corp Ltd.

-29%

-2%

-6%

-2%

71%

1872

Welspun Enterprises Ltd.

-6%

33%

31%

110%

345%

1077

Welspun India Ltd.

4%

28%

84%

730%

1739%

10796

Wockhardt Ltd.

-8%

21%

-37%

54%

-25%

10214

Yes Bank Ltd.

9%

50%

17%

81%

112%

44173

Zenith Birla (India) Ltd.

10%

23%

-8%

-56%

-26%

You might also like

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- DSPBRMF Monthly FactsheetDocument1 pageDSPBRMF Monthly FactsheetlamineesNo ratings yet

- Potential Exports and Nontariff Barriers to Trade: Sri Lanka National StudyFrom EverandPotential Exports and Nontariff Barriers to Trade: Sri Lanka National StudyNo ratings yet

- Market Outlook 18th August 2011Document3 pagesMarket Outlook 18th August 2011Angel BrokingNo ratings yet

- Pension Super 12Document2 pagesPension Super 12RabekanadarNo ratings yet

- Fin Analysis - Tvs Motor CompanyDocument16 pagesFin Analysis - Tvs Motor Companygarconfrancais06No ratings yet

- Market Outlook 2nd May 2012Document19 pagesMarket Outlook 2nd May 2012Angel BrokingNo ratings yet

- Daily Equity Report 9 January 2015Document4 pagesDaily Equity Report 9 January 2015NehaSharmaNo ratings yet

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingNo ratings yet

- Jamna AutoDocument5 pagesJamna AutoSumit SinghNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- Mutual Fund Portfolio and ReturnsDocument3 pagesMutual Fund Portfolio and ReturnsVishwa Prasanna KumarNo ratings yet

- Market Outlook 4th August 2011Document4 pagesMarket Outlook 4th August 2011Angel BrokingNo ratings yet

- Equity Derivatives - Research: IndiaDocument2 pagesEquity Derivatives - Research: IndiahdfcblgoaNo ratings yet

- Kotak BankDocument28 pagesKotak BankGyanendra SharmaNo ratings yet

- Annual Report 2005Document68 pagesAnnual Report 2005Aady RizviNo ratings yet

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Document4 pagesCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedNo ratings yet

- TRIVENI140509 Wwwmon3yworldblogspotcomDocument3 pagesTRIVENI140509 Wwwmon3yworldblogspotcomAbhishek Kr. MishraNo ratings yet

- Ashok Leyland Profit & Loss Account, Ashok Leyland Financial Statement & AccountsDocument3 pagesAshok Leyland Profit & Loss Account, Ashok Leyland Financial Statement & AccountsRaghaw MundhraNo ratings yet

- Ipru Balanced Advantage FundDocument4 pagesIpru Balanced Advantage FundJ.K. GarnayakNo ratings yet

- Market Outlook 5th August 2011Document4 pagesMarket Outlook 5th August 2011Angel BrokingNo ratings yet

- Certificate by SIP OrganizationDocument98 pagesCertificate by SIP OrganizationSakshi BehlNo ratings yet

- Analysis of Automobile IndustryDocument100 pagesAnalysis of Automobile IndustryHarshil SanghaviNo ratings yet

- PTCLDocument169 pagesPTCLSumaiya Muzaffar100% (1)

- 53 Consumer Post Conf 19 Mar 2014Document10 pages53 Consumer Post Conf 19 Mar 2014girishrajsNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Accounts AssignmentDocument15 pagesAccounts AssignmentGagandeep SinghNo ratings yet

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- To: Kiritbhai Ramniklal ShahDocument11 pagesTo: Kiritbhai Ramniklal ShahPratik ShahNo ratings yet

- TVS Motor - Company UpdateDocument5 pagesTVS Motor - Company UpdateVineet GalaNo ratings yet

- Financial Analysis On Scooters India LimitedDocument9 pagesFinancial Analysis On Scooters India LimitedMohit KanjwaniNo ratings yet

- Bajaj Finance LTD PresentationDocument31 pagesBajaj Finance LTD Presentationanon_395825960100% (2)

- Bajaj Finserv LimitedDocument31 pagesBajaj Finserv LimitedDinesh Gehi DGNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Financial Analysis Honda Atlas Cars Pakistan 1Document6 pagesFinancial Analysis Honda Atlas Cars Pakistan 126342634No ratings yet

- Working Capital ManagementDocument49 pagesWorking Capital ManagementAshok Kumar KNo ratings yet

- Maruti Suzuki Batch 79Document29 pagesMaruti Suzuki Batch 79Ritika SinghNo ratings yet

- Opening Bell: Key Points Index Movement (Past 5 Days)Document14 pagesOpening Bell: Key Points Index Movement (Past 5 Days)Sandeep AnandNo ratings yet

- NCL Industries (NCLIND: Poised For GrowthDocument5 pagesNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNo ratings yet

- Fundamental Analysis of Sun PharmaDocument13 pagesFundamental Analysis of Sun PharmaManvi JainNo ratings yet

- Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- Hero Honda Demerger Case StudyDocument4 pagesHero Honda Demerger Case StudyAmit JainNo ratings yet

- SBI Securities Morning Update - 03-05-2023Document7 pagesSBI Securities Morning Update - 03-05-2023Ujwal KumarNo ratings yet

- 2010 Annual ReportDocument84 pages2010 Annual ReportnaveenNo ratings yet

- Sectorwise Distribution in The PortfolioDocument15 pagesSectorwise Distribution in The PortfolioAnkush GuptaNo ratings yet

- Millat Capital Securities LTD (Sp09-MBA-158)Document6 pagesMillat Capital Securities LTD (Sp09-MBA-158)Shoaib AliNo ratings yet

- Accounts Project: Maruti-Suzuki DepreciationDocument8 pagesAccounts Project: Maruti-Suzuki Depreciationprasalr100% (3)

- Top Pick SMFDocument5 pagesTop Pick SMFDebjit DasNo ratings yet

- Assignment: School of Management Studies Punjabi University PatialaDocument10 pagesAssignment: School of Management Studies Punjabi University PatialaJitin BhutaniNo ratings yet

- Assignment 1.2: Financial ReportDocument10 pagesAssignment 1.2: Financial ReportRahul GuptaNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Bhuyan Associates Private Limited-01172013Document4 pagesBhuyan Associates Private Limited-01172013dsethiaimtnNo ratings yet

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Document15 pagesLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNo ratings yet

- Equity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Document28 pagesEquity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Ahmed HusainNo ratings yet

- Franklin India Taxshield FIT: PortfolioDocument1 pageFranklin India Taxshield FIT: PortfolioShekhar KapoorNo ratings yet

- Unabridged Annual Report 2013-14-0Document180 pagesUnabridged Annual Report 2013-14-0Shekhar ShekharNo ratings yet

- KSE 100FFloatMigPresentationDocument23 pagesKSE 100FFloatMigPresentationJamal GillNo ratings yet

- JupiterDocument17 pagesJupiterAnand ChineyNo ratings yet

- Jack and Jill English Primary School I Term Exam (2017-18) STD VI Sub-History and CivicsDocument2 pagesJack and Jill English Primary School I Term Exam (2017-18) STD VI Sub-History and CivicsAnand ChineyNo ratings yet

- Numberology License AgreementDocument1 pageNumberology License AgreementAnand ChineyNo ratings yet

- Open High Low LTP CHNG TradeDocument33 pagesOpen High Low LTP CHNG TradeAnand ChineyNo ratings yet

- Solar Fire Interpretations Report Standard Natal InterpretationsDocument17 pagesSolar Fire Interpretations Report Standard Natal InterpretationsAnand Chiney100% (1)

- 20 Years of Studying GannDocument27 pages20 Years of Studying GannNo Name100% (15)

- Square Root TheoryDocument11 pagesSquare Root TheoryRachit Arora100% (3)

- Elogic Solution: 08055591153 E-MailDocument1 pageElogic Solution: 08055591153 E-MailAnand ChineyNo ratings yet

- (C) 2008, Esoteric Technologies Pty Ltdsome Interpretations Are From:Roderick Kidston, Aquarius Communications, 2003-10Document3 pages(C) 2008, Esoteric Technologies Pty Ltdsome Interpretations Are From:Roderick Kidston, Aquarius Communications, 2003-10Anand ChineyNo ratings yet

- Quadrivium The FourDocument1 pageQuadrivium The FourAnand Chiney0% (14)

- Proposed Syllabus of Information Technology Fifth and Sixth Semester RTM Nagpur University, Nagpur ACADEMIC SESSION: 2014-2015Document28 pagesProposed Syllabus of Information Technology Fifth and Sixth Semester RTM Nagpur University, Nagpur ACADEMIC SESSION: 2014-2015Anand ChineyNo ratings yet

- Applied Mathematics 12062 Object Oriented Programming 12063 Digital Techniques 12064 Relational Data Base Management Systems 12065 Visual Basic 12066 Professional Practices-III 12067Document1 pageApplied Mathematics 12062 Object Oriented Programming 12063 Digital Techniques 12064 Relational Data Base Management Systems 12065 Visual Basic 12066 Professional Practices-III 12067Anand ChineyNo ratings yet

- CE 7and8 Sem 2015Document49 pagesCE 7and8 Sem 2015Anand ChineyNo ratings yet

- 5and6 ElectronicsDocument36 pages5and6 ElectronicsAnand ChineyNo ratings yet

- Panch Pakshi2Document1 pagePanch Pakshi2Anand Chiney0% (1)

- Form F Tule DOWNSDocument2 pagesForm F Tule DOWNSAnand ChineyNo ratings yet

- Panch Pakshi1Document1 pagePanch Pakshi1Anand ChineyNo ratings yet

- Form F Tule DOWNSDocument2 pagesForm F Tule DOWNSAnand ChineyNo ratings yet

- Form F Reduction Follow UpDocument2 pagesForm F Reduction Follow UpAnand ChineyNo ratings yet

- Form F Tule Trisomy 13Document2 pagesForm F Tule Trisomy 13Anand ChineyNo ratings yet

- Form FDocument2 pagesForm FAnand Chiney100% (2)

- Form F Fetal ReduDocument2 pagesForm F Fetal ReduAnand ChineyNo ratings yet

- Form For Maintenance of Record in Respect of Pregnant Woman by Genetic Clinic/Ultrasound Clinic/Imaging CentreDocument2 pagesForm For Maintenance of Record in Respect of Pregnant Woman by Genetic Clinic/Ultrasound Clinic/Imaging CentreAnand ChineyNo ratings yet

- Banned DrugsDocument316 pagesBanned Drugspriya selvarajNo ratings yet

- Economics and Business EnvironmentDocument70 pagesEconomics and Business Environmentm agarwalNo ratings yet

- Current Affairs and 800 Important General Awareness QuestionsDocument55 pagesCurrent Affairs and 800 Important General Awareness QuestionsDivya KhanNo ratings yet

- Aadi Industries LTDDocument36 pagesAadi Industries LTDNARENDRANo ratings yet

- Evolution of Banking in IndiaDocument7 pagesEvolution of Banking in IndiaShobhit ShuklaNo ratings yet

- List of Empanelled Banks With Their Nodal Branches: State Bank of IndiaDocument1 pageList of Empanelled Banks With Their Nodal Branches: State Bank of IndiaJatin SuriNo ratings yet

- Acct Statement - XX5598 - 09112023Document21 pagesAcct Statement - XX5598 - 09112023jyotigunu817No ratings yet

- Group AI2 - Berger Paints India Ltd.Document10 pagesGroup AI2 - Berger Paints India Ltd.Oishik BanerjiNo ratings yet

- PTS-2024 English BrochureDocument17 pagesPTS-2024 English BrochureAbhishek KirveNo ratings yet

- Fuzzy Lookup ScripDocument65 pagesFuzzy Lookup ScripNeha MalhotraNo ratings yet

- 85 Current Affairs WAT TopicsDocument4 pages85 Current Affairs WAT TopicsTanay KumarNo ratings yet

- Notes On Growth of Services Sector in IndiaDocument4 pagesNotes On Growth of Services Sector in IndiaProf. SharadaNo ratings yet

- Ceo of Indian CompanyDocument9 pagesCeo of Indian CompanyanudonNo ratings yet

- TNPSC Group 4 Syllabus 2016 Download Group 4 Exam Syllabus PDF Online PDFDocument5 pagesTNPSC Group 4 Syllabus 2016 Download Group 4 Exam Syllabus PDF Online PDFannamalaiNo ratings yet

- Impact of Globalization On Indian EconomyDocument11 pagesImpact of Globalization On Indian EconomyShanthan NellutlaNo ratings yet

- jeHR7q - HMW - 1486899278 - WORKSHEET GRADE 3 MONEY PDFDocument4 pagesjeHR7q - HMW - 1486899278 - WORKSHEET GRADE 3 MONEY PDFveenadivyakish100% (2)

- Fiitjee Two Year Classroom Program For IIT-JEE 2013 Phase Ii Paper 1 Paper 2 S. NO. Batch Name Enrol. NoDocument74 pagesFiitjee Two Year Classroom Program For IIT-JEE 2013 Phase Ii Paper 1 Paper 2 S. NO. Batch Name Enrol. Noi_khandelwalNo ratings yet

- State and Center HPDocument1,274 pagesState and Center HPPreeti JaiswalNo ratings yet

- BA-LLB - IX SEM (2017-22) : S. NO. Name of Student Enrollment No. Mentor Dissertation TopicDocument13 pagesBA-LLB - IX SEM (2017-22) : S. NO. Name of Student Enrollment No. Mentor Dissertation Topicvishal0% (1)

- Economic Survey Volume II Complete PDFDocument468 pagesEconomic Survey Volume II Complete PDFAmit JaiswalNo ratings yet

- Why Agro - in Make in IndiaDocument14 pagesWhy Agro - in Make in IndiaastuteNo ratings yet

- List of Registered Pharma FirmsDocument10 pagesList of Registered Pharma Firmsparag bharoteNo ratings yet

- A Comparative Study On The Consumer....Document33 pagesA Comparative Study On The Consumer....pandeyjdeepakNo ratings yet

- Aka It Industry MajorDocument77 pagesAka It Industry MajorAkarshika PandeyNo ratings yet

- Vikram Sarabhai Space CentreDocument2 pagesVikram Sarabhai Space CentreJyoti KushwahaNo ratings yet

- Broad Status 07Document116 pagesBroad Status 07Aneesh VermaNo ratings yet

- Companies Database - PDF - Mumbai - Service CompaniesDocument91 pagesCompanies Database - PDF - Mumbai - Service CompaniesManav GodhaniNo ratings yet

- II III II: Unit Unit UnitDocument21 pagesII III II: Unit Unit Unitriya singhNo ratings yet

- Jan-24 Pending PlanDocument5 pagesJan-24 Pending PlanoperationsNo ratings yet

- Data BaseDocument3 pagesData Basetuhion12No ratings yet