Professional Documents

Culture Documents

GST Impact On Distribution Companies and Dealers

Uploaded by

Mahaveer DhelariyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Impact On Distribution Companies and Dealers

Uploaded by

Mahaveer DhelariyaCopyright:

Available Formats

Shree Guru Kripas Institute of Management

27, Akbarabad Second Street, Kodambakkam, Chennai 600 024

Ph.No.: 044 2483 7667 / 044 2484 7667

Web: www.shrigurukripa.com

Date: 17.01.2015

BRIEF ANALYSIS OF THE PROPOSED GST REGIME ON DISTRIBUTORS / TRADERS

Authors Note: With the onset of Goods and Service Tax Regime, it is pertinent for all the companies to

revisit their supply chain mechanism to make their operations more effective and efficient. It is high time for

the Chartered Accountants to have a look at their clients delivery channels to make them in consonance with

the proposed regime, as such reorientation normally takes a substantial period to become operational.

This article aims to pass on a brief profile of the GST regime and its impact on distributors / dealers.

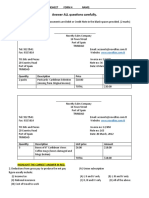

1. Duties and Taxes which are replaced:

Central Excise Duty, Additional EDs,

Service Tax, CVD and Special Additional

Duty on imports, Surcharge and Cesses

Central GST

(CGST)

1. CGST + SGST are pegged at 18% to 22%.

2. No distinction between services and goods

3. CGST paid on inputs / input services can

be set off CGST payable on output / output

services.

4. Similar, SGST on inputs / input services

VAT, Entry Tax (not in lieu of Octroi),

Entertainment Tax, Luxury Tax, Taxes on

lottery / gambling, states cesses / surcharge

can be set off against SGST on outputs /

State GST

output services.

(SGST)

5. Cross

utilization

between

goods

and

between

SGST and

services is allowed.

6. Cross

utilization

CGST is not possible.

1. IGST is also expected around 18% to 22%.

CST

InterState

GST

2. It can be claimed as credit when the goods

are sold in another state.

3. Earlier, CST used to be cost. Post GST

regime, it becomes eligible for credit.

In case of imports, Basic Customs Duty on imports be levied in addition to CGST + SGST

Impact of GST on Distributors / Dealers

SGK Update, Chennai

2. Impact of GST on the purchases:

State of Supplier

Rate

Creditable

CST 2%

No

IGST 18 to 22%

Yes

VAT 5% / 14.5%

Yes

SGST + CGST 18-22%

Yes

BCD No

BCD (present rate) + SGST +

BCD No

CVD+SAD Yes

CGST 18-22%

Others

Outside Tamil Nadu

Inside Tamil Nadu

Outside India

Imports

Proposed GST Rate Creditable

Yes

Inferences:

(a) Based on the above table, it could be referred that in all purchases, the Company had to pay tax of around

18% to 22%. For Imports, there will be an additional levy of Basic Customs Duty.

(b) However, there will be cost reduction to the extent of 2% CST due to IGST eligible for CENVAT credit.

(c) All services and inputs are eligible for credit (except certain items to be listed by the government)

(d) Hence, the company may have to shell out an additional 16% to 20% on its interstate purchases, but it

shall not affect the cash flows of the company because it is also going to collect the additional % from its

suppliers. There could be a minor impact on cash flow during the initial months of implementation of

the GST (depending upon the Companys debtors credit period) till the existing stocks are cleared.

(e) There is a press release in December 2014 which indicates the Governments intention to continue CST at

1% for further 2 years (whereas powers are given in the Constitution Amendment Bill to levy CST for

maximum 5 years). This could be a cost to the company.

3. Impact of GST on the Sales:

Supplier Name

Proposed GST Rate

Creditable for buyers

Sales within the State

SGST + CGST 18% to 22%

Yes

Sales outside the State

IGST 18% to 22%

Yes

Zero rated

N.A.

Exports

Inferences:

(a) From buyers perspective, they can claim credit of all GSTs (whether it is SGST / CGST / IGST).

(b) Reversal of credit in relation to Stock transfers may be phased out in the new regime. But, given that the

direct sale to the customers is better, there may not be much need for stock transfers, except for

operational convenience.

2

Impact of GST on Distributors / Dealers

SGK Update, Chennai

4. Location of Warehouses and GST regime:

(a) There is no need to have State-wise warehouses to avoid CST and to facilitate buyers to

claim credit.

(b) Warehouses can be decided based on operational efficiency instead of tax savings.

(c) Warehouses can be minimized based on the operational convenience of the company. This serves two

purposes (a) Reduction of establishment costs (b) Reduction of documentation and registration.

5. Registration: In case of warehouses/marketing units in multiple states, each of them has to be registered

under the respective state and returns have to be filed separately for each state (both CGST & IGST).

6. Documentation requirements:

(a) C Form and other forms may be phased out, reduction of multiple returns filed and documentation

(b) Single Invoice for both CGST and SGST together.

(c) Separate returns to be filed in common format for CGST and SGST for every place of registration.

The above information are based on the discussion paper on the Goods and Services Tax and existing

practices in other countries.

In case of further information / clarity, please contact the undersigned.

Shree Guru Kripas Institute of Managment

CA T.R.Srinivasan

Faculty

Ph.No.: 97899 76079

Mail ID: trsrinivasan@shrigurukripa.com

You might also like

- SFDFGDocument3 pagesSFDFGBaiju DevNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Task 8Document23 pagesTask 8Anooja SajeevNo ratings yet

- Compostion SchemeDocument6 pagesCompostion SchemeK S RNo ratings yet

- Basic Understanding of Composition Scheme Under GST Law - Taxguru - in PDFDocument2 pagesBasic Understanding of Composition Scheme Under GST Law - Taxguru - in PDFSanthanakrishnan VenkatNo ratings yet

- GST in India: A Comprehensive Guide BookDocument77 pagesGST in India: A Comprehensive Guide Bookgaurav dhallNo ratings yet

- Simplified Goods & Services Tax (GST) For Hotels & RestaurantsDocument14 pagesSimplified Goods & Services Tax (GST) For Hotels & Restaurantsvishaljain_caNo ratings yet

- GST NotesDocument39 pagesGST NotesCrick CompactNo ratings yet

- Composition Scheme Sec. 10: Ques-1 What Is Composition Levy Under GST?Document12 pagesComposition Scheme Sec. 10: Ques-1 What Is Composition Levy Under GST?Tapan BarikNo ratings yet

- GST Supply Chain Management PDFDocument31 pagesGST Supply Chain Management PDFKrishna Sashank JujaruNo ratings yet

- Impact of GST On Warehousing and Supply ChainDocument39 pagesImpact of GST On Warehousing and Supply ChainSundaravaradhan Iyengar100% (6)

- GST & Msmes: Presentation Before The Hon'ble Members of Lok Sabha and Rajya SabhaDocument17 pagesGST & Msmes: Presentation Before The Hon'ble Members of Lok Sabha and Rajya SabhaPragya Singh BaghelNo ratings yet

- GST - Answer 2Document9 pagesGST - Answer 2Tarun SolankiNo ratings yet

- Faq Composition Levy RevisedDocument8 pagesFaq Composition Levy Revisedbharigopan8360No ratings yet

- Chapter 1 - Introduction To GST: Applicability of Utgst ActDocument7 pagesChapter 1 - Introduction To GST: Applicability of Utgst ActSoul of honeyNo ratings yet

- Analysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFDocument4 pagesAnalysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFPawan AswaniNo ratings yet

- GST 49th Council Meeting 200223Document3 pagesGST 49th Council Meeting 200223Divay PranavNo ratings yet

- Department of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Document7 pagesDepartment of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Amit SharmaNo ratings yet

- Taxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTDocument5 pagesTaxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTTheEnigmatic AccountantNo ratings yet

- GST Assign.Document23 pagesGST Assign.Saif Ali KhanNo ratings yet

- Taking Advantage of GST - Critical Impact Areas and ImplicationsDocument7 pagesTaking Advantage of GST - Critical Impact Areas and ImplicationsSachinNo ratings yet

- Do You Know GST - July 2022Document17 pagesDo You Know GST - July 2022CA Ranjan MehtaNo ratings yet

- GST & Custom Law AssignmentDocument13 pagesGST & Custom Law AssignmentNikita -0251 ENo ratings yet

- Article On Reverse Charge 28jul2017Document6 pagesArticle On Reverse Charge 28jul2017Venkataramana NippaniNo ratings yet

- Cma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsDocument358 pagesCma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsSarath KumarNo ratings yet

- Goods and Service Tax (GST)Document19 pagesGoods and Service Tax (GST)Saurabh Kumar SharmaNo ratings yet

- Topic:: Law of TaxationDocument8 pagesTopic:: Law of TaxationNeelam KejriwalNo ratings yet

- Press Release Part A. Law and Procedure Related Changes: Form Gstr-9 Form Gstr-9C Form Gstr-1 Form GSTR-1 Form Gstr-1Document3 pagesPress Release Part A. Law and Procedure Related Changes: Form Gstr-9 Form Gstr-9C Form Gstr-1 Form GSTR-1 Form Gstr-1CA Ishu BansalNo ratings yet

- Chapter 1: Introduction To GST 1.1 Basics of GST 1.1.1 What Is GST?Document13 pagesChapter 1: Introduction To GST 1.1 Basics of GST 1.1.1 What Is GST?Ashutosh papelNo ratings yet

- Goods & Service TaxDocument4 pagesGoods & Service TaxAkshay ModakNo ratings yet

- Impact of GST On Indian SCMDocument9 pagesImpact of GST On Indian SCMVinodh Kumar Perumal100% (2)

- FOURTH SEMESTER GSTDocument6 pagesFOURTH SEMESTER GSTKenny PhilipsNo ratings yet

- The First Level of Differentiation Will Come in Depending On Whether The Industry Deals With Manufacturing, Distributing and Retailing or Is Providing A ServiceDocument13 pagesThe First Level of Differentiation Will Come in Depending On Whether The Industry Deals With Manufacturing, Distributing and Retailing or Is Providing A ServiceMansi jainNo ratings yet

- 12th Accounts by CA, Cma Santosh Kumar SirDocument329 pages12th Accounts by CA, Cma Santosh Kumar SirMillat AfridiNo ratings yet

- GST - PUBLIC FINANCE GE by Pratham SinghDocument7 pagesGST - PUBLIC FINANCE GE by Pratham Singhsejalsahni3108No ratings yet

- New GST Returns Made Simple - 2020Document33 pagesNew GST Returns Made Simple - 2020Qamran moin khanNo ratings yet

- Sem 4 Project (Impact of GST On Restaurants) 1Document46 pagesSem 4 Project (Impact of GST On Restaurants) 1Priyanka Satam100% (1)

- GST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Document20 pagesGST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Atul VermaNo ratings yet

- GST IndiaDocument12 pagesGST Indiakirchand0% (1)

- Indian GST Reference ManualDocument594 pagesIndian GST Reference ManualY M Shah & Co100% (5)

- 48th GST Council Meeting RecommendationsDocument17 pages48th GST Council Meeting RecommendationsRaviteja SirivelaNo ratings yet

- 47th GST Council Meeting ReportDocument5 pages47th GST Council Meeting ReportAnubhav BeriNo ratings yet

- GST TradersDocument11 pagesGST TradersSHAIK AHMEDNo ratings yet

- LogiQuest EastCoastExpress NMIMSDocument12 pagesLogiQuest EastCoastExpress NMIMSAyush KumarNo ratings yet

- Impact of GST On Stock MarketDocument14 pagesImpact of GST On Stock MarketSiddhartha0% (1)

- Composition Scheme Under GST ExplainedDocument3 pagesComposition Scheme Under GST ExplainedrgurvareddyNo ratings yet

- All About GST in India: Parvesh AghiDocument115 pagesAll About GST in India: Parvesh AghiParvesh AghiNo ratings yet

- Audit Under Fiscal Laws GST AuditDocument4 pagesAudit Under Fiscal Laws GST AuditRanjit BhogesaraNo ratings yet

- "Impact of GST On The Fast Moving Consumer Goods Sector": March 22ndDocument10 pages"Impact of GST On The Fast Moving Consumer Goods Sector": March 22ndRahul Tom JosephNo ratings yet

- GST Audit ElegibilityDocument1 pageGST Audit ElegibilityRavindra BagateNo ratings yet

- Document 4Document2 pagesDocument 4STAR PRINTINGNo ratings yet

- CA Final GST and Customs Flow Charts Nov 2018Document173 pagesCA Final GST and Customs Flow Charts Nov 2018Amar ShahNo ratings yet

- TaxesDocument2 pagesTaxesRameshNadarNo ratings yet

- Group Project - Impact of GST On Supply Chain ManagementDocument20 pagesGroup Project - Impact of GST On Supply Chain ManagementArpit Shah83% (6)

- How GST Would Impact Startups & Small and Medium Size BusinessesDocument12 pagesHow GST Would Impact Startups & Small and Medium Size BusinessesSouravNo ratings yet

- GST Weekly Update - 36-2022-23Document5 pagesGST Weekly Update - 36-2022-232480054No ratings yet

- Income Tax Provisions For FY 2019-20Document26 pagesIncome Tax Provisions For FY 2019-20Mohit SharmaNo ratings yet

- GST Revision of Mcqs 1Document21 pagesGST Revision of Mcqs 1forharshever9936No ratings yet

- Top 5 Ways To Break WinRAR Password Easily and EfficientlyDocument11 pagesTop 5 Ways To Break WinRAR Password Easily and EfficientlyMahaveer DhelariyaNo ratings yet

- Income Tax Changes For FY 2017-18 (AY 2018-19)Document22 pagesIncome Tax Changes For FY 2017-18 (AY 2018-19)soumyaviyer@gmail.comNo ratings yet

- Notices Us 1421 of Income Tax ActDocument3 pagesNotices Us 1421 of Income Tax ActMahaveer DhelariyaNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- What Is GST Audit - 2Document6 pagesWhat Is GST Audit - 2Mahaveer DhelariyaNo ratings yet

- Taxguru - In-Taxation of Charitable and Religious Trusts - 3Document5 pagesTaxguru - In-Taxation of Charitable and Religious Trusts - 3Mahaveer DhelariyaNo ratings yet

- Amount in WordsDocument7 pagesAmount in WordsMahaveer DhelariyaNo ratings yet

- Case LawsDocument137 pagesCase LawsrubykambojNo ratings yet

- 43144bos32841 PDFDocument1 page43144bos32841 PDFMahaveer DhelariyaNo ratings yet

- Bos 31624 As CDocument5 pagesBos 31624 As CMahaveer DhelariyaNo ratings yet

- 40 20170808085815 Article gstr3bDocument2 pages40 20170808085815 Article gstr3bMahaveer DhelariyaNo ratings yet

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNo ratings yet

- Salary SlipDocument1 pageSalary SlipMahaveer DhelariyaNo ratings yet

- Interest Paid For Broken Period Not Part of Purchase Price SCDocument3 pagesInterest Paid For Broken Period Not Part of Purchase Price SCMahaveer DhelariyaNo ratings yet

- Annual Compliances Under Foreign Exchange Management Act, 1999 - An InsightDocument2 pagesAnnual Compliances Under Foreign Exchange Management Act, 1999 - An InsightMahaveer DhelariyaNo ratings yet

- Slump Sale and Related Income Tax ProvisionsDocument4 pagesSlump Sale and Related Income Tax ProvisionsMahaveer DhelariyaNo ratings yet

- CAclubindia News - You Want To Quit CADocument2 pagesCAclubindia News - You Want To Quit CAMahaveer DhelariyaNo ratings yet

- Intimation About The Quarterly TDSDocument2 pagesIntimation About The Quarterly TDSMahaveer DhelariyaNo ratings yet

- Brief Insights On Concept of Reverse Mortgage in IndiaDocument3 pagesBrief Insights On Concept of Reverse Mortgage in IndiaMahaveer DhelariyaNo ratings yet

- Matters Which Require Ordinary Resolutions Under Companies Act 2013Document3 pagesMatters Which Require Ordinary Resolutions Under Companies Act 2013Mahaveer DhelariyaNo ratings yet

- Company Law Electoral Trust NotificationDocument1 pageCompany Law Electoral Trust NotificationMahaveer DhelariyaNo ratings yet

- CAclubindia News - Audit and Auditor As Per Companies Act, 2013Document9 pagesCAclubindia News - Audit and Auditor As Per Companies Act, 2013Mahaveer DhelariyaNo ratings yet

- Resolutions To Be Filed With Registrar of Companies Under Companies Act 2013Document2 pagesResolutions To Be Filed With Registrar of Companies Under Companies Act 2013Mahaveer DhelariyaNo ratings yet

- Insight To Undisclosed Income SchemeDocument4 pagesInsight To Undisclosed Income SchemeMahaveer DhelariyaNo ratings yet

- Fdi PolicyDocument12 pagesFdi PolicyMahaveer DhelariyaNo ratings yet

- FAQs On Exchange Earner's Foreign Currency AccountDocument3 pagesFAQs On Exchange Earner's Foreign Currency AccountMahaveer DhelariyaNo ratings yet

- CAclubindia News - Taxability of Government Services Under Reverse Charge MechanismDocument6 pagesCAclubindia News - Taxability of Government Services Under Reverse Charge MechanismMahaveer DhelariyaNo ratings yet

- Various Returns Under Model GST LawDocument2 pagesVarious Returns Under Model GST LawMahaveer DhelariyaNo ratings yet

- CPM Guidant Corporation Shaping Culture Through Systems ChristoperDocument19 pagesCPM Guidant Corporation Shaping Culture Through Systems ChristoperfreteerNo ratings yet

- Midterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsDocument3 pagesMidterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsJinky ValdezNo ratings yet

- Course OutlineDocument217 pagesCourse OutlineAðnan YasinNo ratings yet

- Indian Accounting StandardsDocument9 pagesIndian Accounting StandardsAman Singh0% (1)

- 'Expert Advisor Based On The - New Trading Dimensions - by Bill Williams - MQL5 ArticlesDocument12 pages'Expert Advisor Based On The - New Trading Dimensions - by Bill Williams - MQL5 Articlesradityaananta2000100% (2)

- CRD of Michael Yehuda RiceDocument23 pagesCRD of Michael Yehuda RicebuyersstrikewpNo ratings yet

- Life Insurance Advertising in India Analysis of Recen 337186587Document12 pagesLife Insurance Advertising in India Analysis of Recen 337186587Raghav DudejaNo ratings yet

- Quiz 2Document9 pagesQuiz 2yuvita prasadNo ratings yet

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDocument2 pagesAccount Statement: Date Value Date Description Cheque Deposit Withdrawal BalancesadhanaNo ratings yet

- 1 Villaroel v. EstradaDocument2 pages1 Villaroel v. EstradaNinaNo ratings yet

- Tqs Finals Operations-AuditDocument46 pagesTqs Finals Operations-AuditCristel TannaganNo ratings yet

- DP HCM (MATHS) Printable PDFDocument81 pagesDP HCM (MATHS) Printable PDFAarzoo RatheeNo ratings yet

- Berkshire PartnersDocument2 pagesBerkshire PartnersAlex TovNo ratings yet

- Wikborg Global Offshore Projects DEC15Document13 pagesWikborg Global Offshore Projects DEC15sam ignarskiNo ratings yet

- Coworking Space: Shared Workspaces in Metro ManilaDocument23 pagesCoworking Space: Shared Workspaces in Metro ManilaKenneth VirtudesNo ratings yet

- Past Paper - BFDDocument73 pagesPast Paper - BFDarifgillcaNo ratings yet

- Chapter 10Document8 pagesChapter 10Nguyên NguyễnNo ratings yet

- Partnership Agreement - Sample - Taxguru - inDocument7 pagesPartnership Agreement - Sample - Taxguru - inAbhinav BharadwajNo ratings yet

- HSBC ProjectDocument48 pagesHSBC ProjectPooja MishraNo ratings yet

- ID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanDocument8 pagesID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanLinda UtariNo ratings yet

- My Affidavit For LawyerDocument4 pagesMy Affidavit For LawyerJohn GuillermoNo ratings yet

- Personal Trading BehaviourDocument5 pagesPersonal Trading Behaviourapi-3739065No ratings yet

- Module 4 PDFDocument19 pagesModule 4 PDFRAJASAHEB DUTTANo ratings yet

- Real Estate Principles Legal Equitable "Exclusive Equity"Document92 pagesReal Estate Principles Legal Equitable "Exclusive Equity"Ven Geancia100% (1)

- Accounting I Assignment CH 3 and 4 - 2Document8 pagesAccounting I Assignment CH 3 and 4 - 2Mahmoud AminNo ratings yet

- Building Business Credit - CreditXDocument14 pagesBuilding Business Credit - CreditXsonwuu469100% (1)

- Marketing ManagementDocument146 pagesMarketing ManagementMannu Bhardwaj100% (2)

- Mid AFA-II 2020Document2 pagesMid AFA-II 2020CRAZY SportsNo ratings yet

- Profit and Loss Projection 1yr 0Document1 pageProfit and Loss Projection 1yr 0Suraj RathiNo ratings yet

- Lesson 4 Investment ClubDocument26 pagesLesson 4 Investment ClubVictor VandekerckhoveNo ratings yet

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessFrom EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessNo ratings yet

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet