Professional Documents

Culture Documents

Resolutions To Be Filed With Registrar of Companies Under Companies Act 2013

Uploaded by

Mahaveer DhelariyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Resolutions To Be Filed With Registrar of Companies Under Companies Act 2013

Uploaded by

Mahaveer DhelariyaCopyright:

Available Formats

24/5/2014

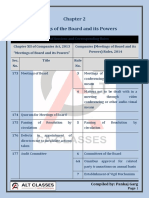

Resolutions to be filed with Registrar of Companies under Companies Act 2013

By P C Agrawal

B.Com., LL.B., CAIIB, FCS

cs.pcagrawal@gmail.com

Aurangabad (Maharashtra)

Section

94(1)

196(4),

Sch.V Part

III Para 2

117(3)

Rule

(Chapter

XII)

Particulars

Proposed resolution for keeping registers & returns at a place other than registered

office of the company

Resolution of Board for appointment, reappointment and variation in terms of

appointment of MD.

a. Special resolutions

b. Resolutions which have been agreed to by all members of a co., but which, if

not so agreed to, would not have been effective for their purpose unless

they had been passed .as special resolution

c. any resolution of the Board of Directors of a company or agreement

executed by a co., relating to the appointment, reappointment or renewal of

the appointment, or variation of the terms of appointment, of a managing

director

d. resolutions or agreements which have been agreed to by any class of

members but which, if not so agreed to, would not have been effective for

their purpose unless they had been passed by a specified majority or

otherwise in some particular manner; and all resolutions or agreements

which effectively bind such class of members though not agreed to by all

those members

e. resolutions passed by a company according consent to the exercise by its

Board of Directors of any of the powers under clause (a) and clause (c ) of

Sec.180

f. resolutions requiring a company to be wound up voluntarily passed in

pursuance of sec.304

g. resolutions passed in pursuance of sub-section (3) of section 179

h. any other resolution or agreement as may be prescribed and placed in the

public domain

Page 1 of 2

www.taxguru.in

Section

Rule

(Chapter

XII)

179(3)(a)

179(3)(b)

179(3)(c)

179(3)(d)

179(3)(e)

179(3)(f)

179(3)(g)

Particulars

To make calls on shareholders in respect of money unpaid on their shares

To authorize buy-back of securities under section 68

8(9)

179(3)(h)

179(3)(i)

179(3)(j)

182

203

203

204

184

8(1)

8(2)

8(3)

8(4)

8(5)

8(6)

76

76

8(7)

8(8)

To issue securities, including debentures, whether in or outside India

To borrow monies

To invest the funds of the company

To grant loans or give guarantee or provide security in respect of loans

To approve annual financial statements, the Boards report and quarterly/half-yearly

financial statements or results

To diversify the business of the company

To approve amalgamation, merger or reconstruction

To take over a company or acquire a controlling or substantial stake in another

company

To make political contributions

To appoint or remove key managerial personnel or to fill casual vacancy

To take note of appointment(s0 or removal(s) of one level below the KMP

To appoint secretarial auditor

To take note of the disclosure of directors interest and shareholding

To buy, sell investments held by the company (other than trade investments),

constituting 5% or more of the paid up share capital and free reserves of the

investee company

To invite or accept or renew public deposits and related matters

To review or change the terms & conditions of public deposits

***

Page 2 of 2

www.taxguru.in

You might also like

- Form MGT-14Document11 pagesForm MGT-14Yuvan SharmaNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Matters Requiring Special ResolutionDocument5 pagesMatters Requiring Special ResolutionShital Darak MandhanaNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- (As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Document3 pages(As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Pranzali GuptaNo ratings yet

- Filing of Form MGT-14 For Special Resolutions - Companies Act 2013Document7 pagesFiling of Form MGT-14 For Special Resolutions - Companies Act 2013Krishnendu BhattacharyyaNo ratings yet

- Companies Act, 1956 in A Nutshell: Section MatterDocument10 pagesCompanies Act, 1956 in A Nutshell: Section MatterMeghna SuryakumarNo ratings yet

- Companies Applicability Chart by Darshan KhareDocument6 pagesCompanies Applicability Chart by Darshan KharePavan KumarNo ratings yet

- Form No. Mgt-14: Filing of Resolutions and Agreements To The RegistrarDocument3 pagesForm No. Mgt-14: Filing of Resolutions and Agreements To The RegistrarANKIT TIWARINo ratings yet

- BOD PART 2 SEC. 173 To 195 - BM RPT Etc-PagesDocument35 pagesBOD PART 2 SEC. 173 To 195 - BM RPT Etc-Pagespriyankaar2003No ratings yet

- 9367 62530 Matters Requiring Special Resolutions Under Companies Act 2013 PcaDocument4 pages9367 62530 Matters Requiring Special Resolutions Under Companies Act 2013 PcaSathyanarayana ReddyNo ratings yet

- Board Resolutions That Cannot Be Passed by CirculationDocument6 pagesBoard Resolutions That Cannot Be Passed by CirculationaachantaNo ratings yet

- Types of Resolutions Under Companies ActDocument9 pagesTypes of Resolutions Under Companies ActAnil SonarNo ratings yet

- KaizenDocument10 pagesKaizenCaramakr ManthaNo ratings yet

- Appointment and Remuneration of Managerial PersonnelDocument20 pagesAppointment and Remuneration of Managerial PersonnelMuhammed ShabeebNo ratings yet

- Companies Act 1967Document532 pagesCompanies Act 1967orangetdm568No ratings yet

- Types of Resolutions Under Companies Act, 1956Document6 pagesTypes of Resolutions Under Companies Act, 1956Soumitra Chawathe0% (1)

- COMPANY LAW (Guideline Answers) : Intermediate ExaminationDocument14 pagesCOMPANY LAW (Guideline Answers) : Intermediate Examinationjeevan_v_mNo ratings yet

- 78 Law TestDocument2 pages78 Law TestKrushna MateNo ratings yet

- Voting, Poll and ResolutionsDocument23 pagesVoting, Poll and Resolutionspriyanka_balanNo ratings yet

- Part A Corporate Law ChartsDocument62 pagesPart A Corporate Law Chartsphanindra gaddeNo ratings yet

- Arrangements and AmalgamationDocument60 pagesArrangements and AmalgamationPrabhat ShuklaNo ratings yet

- Powers and Fiunctions of NCLTDocument8 pagesPowers and Fiunctions of NCLTBhola PrasadNo ratings yet

- Chapter 2 Meetings of The Board and Its PowersDocument125 pagesChapter 2 Meetings of The Board and Its PowersDeepsikha maitiNo ratings yet

- Form No. Mgt-14: Filing of Resolutions and Agreements To The RegistrarDocument3 pagesForm No. Mgt-14: Filing of Resolutions and Agreements To The Registrartiger SNo ratings yet

- Companies Act 1967Document602 pagesCompanies Act 1967Rian AlvinNo ratings yet

- Board - Its PowersDocument4 pagesBoard - Its PowersVishnu Teja AnnamrajuNo ratings yet

- Companies Act 1967Document593 pagesCompanies Act 1967Yna Beatriz BocayaNo ratings yet

- Notice: Ordinary BusinessDocument15 pagesNotice: Ordinary BusinessArun BatraNo ratings yet

- Meetings of Board and Its Powers (Chapter-XII) : A Refresher Course On Companies Act, 2013Document25 pagesMeetings of Board and Its Powers (Chapter-XII) : A Refresher Course On Companies Act, 2013Priyanka BhattacharyyaNo ratings yet

- Insurance Act 1938Document123 pagesInsurance Act 1938abhinav_surveyor1355No ratings yet

- Siyaram S AR 18-19 With Notice CompressedDocument128 pagesSiyaram S AR 18-19 With Notice Compressedkhushboo rajputNo ratings yet

- Topic 4Document14 pagesTopic 4Sophia AilyzaNo ratings yet

- Overall Bird Eye View ChartDocument24 pagesOverall Bird Eye View Chartsri valliNo ratings yet

- Filing of Resolutions and Agreements To The RegistrarDocument6 pagesFiling of Resolutions and Agreements To The RegistrarAshutosh RawatNo ratings yet

- Companies (General Provisions and Forms) Regulations 2018Document99 pagesCompanies (General Provisions and Forms) Regulations 2018YousafNo ratings yet

- MGT-14 - Due Date & Filing ProcDocument8 pagesMGT-14 - Due Date & Filing ProcDivyaNo ratings yet

- Pfizer Limited - Annual Report 2019-20Document89 pagesPfizer Limited - Annual Report 2019-20aditya saiNo ratings yet

- Ca Final Corporate and Allied Notes - Ca Punarvas Jayakumar: Section SubjectDocument11 pagesCa Final Corporate and Allied Notes - Ca Punarvas Jayakumar: Section SubjectKushalNo ratings yet

- Companies Act 1965Document450 pagesCompanies Act 1965Meister PrabaNo ratings yet

- Liability of DirectorsDocument12 pagesLiability of DirectorsVijayanta PawaseNo ratings yet

- Change in Name of The Company: Stepwise Procedure To Be Followed: Step 1Document2 pagesChange in Name of The Company: Stepwise Procedure To Be Followed: Step 1manak siyalNo ratings yet

- Companies Act 1965Document512 pagesCompanies Act 1965Yus Shahril FeezrieNo ratings yet

- Joint Joint Venture Agreement Venture Agreement: DefinitionsDocument4 pagesJoint Joint Venture Agreement Venture Agreement: DefinitionsKaran UpadhyayNo ratings yet

- Chapter 5 Compormises and ArrangementDocument41 pagesChapter 5 Compormises and ArrangementDeepsikha maitiNo ratings yet

- NOTICE IS HEREBY GIVEN That The Annual General Meeting of Emperor InternationalDocument7 pagesNOTICE IS HEREBY GIVEN That The Annual General Meeting of Emperor Internationalwilliam zengNo ratings yet

- 2020MCNo22 PDFDocument5 pages2020MCNo22 PDFAsdfghjkl qwertyuiopNo ratings yet

- AGM Notice TataElxsiDocument12 pagesAGM Notice TataElxsiArun KumarNo ratings yet

- Notice: Ordinary Business Special BusinessDocument16 pagesNotice: Ordinary Business Special BusinessmohitbabuNo ratings yet

- Shareholder MeetingDocument4 pagesShareholder MeetingyusehaiNo ratings yet

- Notice Tata Elxsi 34th AGMDocument15 pagesNotice Tata Elxsi 34th AGMNaresh JainNo ratings yet

- Form MGT-14Document4 pagesForm MGT-14Narayan choudharyNo ratings yet

- Key Compliances of The Producer CompanyDocument4 pagesKey Compliances of The Producer CompanyDHRUV BARUANo ratings yet

- Sona BLW Precision Forgings Limited: Notice of Annual General MeetingDocument17 pagesSona BLW Precision Forgings Limited: Notice of Annual General MeetingmohitbabuNo ratings yet

- Company Law 2007 Sri LankaDocument21 pagesCompany Law 2007 Sri LankaShafras NazeerNo ratings yet

- Form No. Mgt-14: Filing of Resolutions and Agreements To The RegistrarDocument3 pagesForm No. Mgt-14: Filing of Resolutions and Agreements To The Registrartiger SNo ratings yet

- Notices Us 1421 of Income Tax ActDocument3 pagesNotices Us 1421 of Income Tax ActMahaveer DhelariyaNo ratings yet

- Taxguru - In-Taxation of Charitable and Religious Trusts - 3Document5 pagesTaxguru - In-Taxation of Charitable and Religious Trusts - 3Mahaveer DhelariyaNo ratings yet

- Income Tax Changes For FY 2017-18 (AY 2018-19)Document22 pagesIncome Tax Changes For FY 2017-18 (AY 2018-19)soumyaviyer@gmail.comNo ratings yet

- What Is GST Audit - 2Document6 pagesWhat Is GST Audit - 2Mahaveer DhelariyaNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Top 5 Ways To Break WinRAR Password Easily and EfficientlyDocument11 pagesTop 5 Ways To Break WinRAR Password Easily and EfficientlyMahaveer DhelariyaNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- Amount in WordsDocument7 pagesAmount in WordsMahaveer DhelariyaNo ratings yet

- 43144bos32841 PDFDocument1 page43144bos32841 PDFMahaveer DhelariyaNo ratings yet

- Salary SlipDocument1 pageSalary SlipMahaveer DhelariyaNo ratings yet

- 40 20170808085815 Article gstr3bDocument2 pages40 20170808085815 Article gstr3bMahaveer DhelariyaNo ratings yet

- Case LawsDocument137 pagesCase LawsrubykambojNo ratings yet

- Bos 31624 As CDocument5 pagesBos 31624 As CMahaveer DhelariyaNo ratings yet

- CAclubindia News - You Want To Quit CADocument2 pagesCAclubindia News - You Want To Quit CAMahaveer DhelariyaNo ratings yet

- Company Law Electoral Trust NotificationDocument1 pageCompany Law Electoral Trust NotificationMahaveer DhelariyaNo ratings yet

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNo ratings yet

- Slump Sale and Related Income Tax ProvisionsDocument4 pagesSlump Sale and Related Income Tax ProvisionsMahaveer DhelariyaNo ratings yet

- Interest Paid For Broken Period Not Part of Purchase Price SCDocument3 pagesInterest Paid For Broken Period Not Part of Purchase Price SCMahaveer DhelariyaNo ratings yet

- Fdi PolicyDocument12 pagesFdi PolicyMahaveer DhelariyaNo ratings yet

- Intimation About The Quarterly TDSDocument2 pagesIntimation About The Quarterly TDSMahaveer DhelariyaNo ratings yet

- Brief Insights On Concept of Reverse Mortgage in IndiaDocument3 pagesBrief Insights On Concept of Reverse Mortgage in IndiaMahaveer DhelariyaNo ratings yet

- CAclubindia News - Audit and Auditor As Per Companies Act, 2013Document9 pagesCAclubindia News - Audit and Auditor As Per Companies Act, 2013Mahaveer DhelariyaNo ratings yet

- Annual Compliances Under Foreign Exchange Management Act, 1999 - An InsightDocument2 pagesAnnual Compliances Under Foreign Exchange Management Act, 1999 - An InsightMahaveer DhelariyaNo ratings yet

- Matters Which Require Ordinary Resolutions Under Companies Act 2013Document3 pagesMatters Which Require Ordinary Resolutions Under Companies Act 2013Mahaveer DhelariyaNo ratings yet

- GST Impact On Distribution Companies and DealersDocument3 pagesGST Impact On Distribution Companies and DealersMahaveer DhelariyaNo ratings yet

- CAclubindia News - Taxability of Government Services Under Reverse Charge MechanismDocument6 pagesCAclubindia News - Taxability of Government Services Under Reverse Charge MechanismMahaveer DhelariyaNo ratings yet

- Insight To Undisclosed Income SchemeDocument4 pagesInsight To Undisclosed Income SchemeMahaveer DhelariyaNo ratings yet

- FAQs On Exchange Earner's Foreign Currency AccountDocument3 pagesFAQs On Exchange Earner's Foreign Currency AccountMahaveer DhelariyaNo ratings yet

- Various Returns Under Model GST LawDocument2 pagesVarious Returns Under Model GST LawMahaveer DhelariyaNo ratings yet

- 101pdf Money and BankingDocument4 pages101pdf Money and BankingalienNo ratings yet

- Free Stock Market Tips Via MArket ExpertsDocument9 pagesFree Stock Market Tips Via MArket ExpertsRahul SolankiNo ratings yet

- A Study On Investor's Perception Towards Mutual Funds With Reference To Birla Sunlife AmcDocument11 pagesA Study On Investor's Perception Towards Mutual Funds With Reference To Birla Sunlife AmcKanika AgarwalNo ratings yet

- Nov. 4 Saline City Council Meeting AgendaDocument45 pagesNov. 4 Saline City Council Meeting Agendaabell35No ratings yet

- Chapter 3 FMDocument23 pagesChapter 3 FMeferemNo ratings yet

- Auditing The Expenditure CycleDocument4 pagesAuditing The Expenditure CycleIndri IswardhaniNo ratings yet

- Price ForcastDocument38 pagesPrice ForcastLalit GoyalNo ratings yet

- IFRS9 Final Handout CFAPv2Document69 pagesIFRS9 Final Handout CFAPv2rafid aliNo ratings yet

- Checklist of Documentary Requirements - Issuance by BIR of CARDocument1 pageChecklist of Documentary Requirements - Issuance by BIR of CARLRMNo ratings yet

- Dhaka Stock Exchange LTD.: Over-The-Counter (OTC) Market Bulletin Quotation at The Close of BusinessDocument3 pagesDhaka Stock Exchange LTD.: Over-The-Counter (OTC) Market Bulletin Quotation at The Close of BusinessSujoy dattaNo ratings yet

- Read This First - High ProbabilityDocument5 pagesRead This First - High ProbabilitySanthosh InigoeNo ratings yet

- CrowdStrike Holdings, Inc. Class ADocument132 pagesCrowdStrike Holdings, Inc. Class AJose AntonioNo ratings yet

- Free Float Market Capitalization of Nifty 50 StocksDocument2 pagesFree Float Market Capitalization of Nifty 50 StocksagadandiNo ratings yet

- Arbitrage Pricing TheoryDocument5 pagesArbitrage Pricing TheoryShivani RathiNo ratings yet

- Tareck El Aissami and Samark Lopez Bello NetworkDocument1 pageTareck El Aissami and Samark Lopez Bello NetworkEl Informador WebNo ratings yet

- Sec Memo Circular No 14-2000Document2 pagesSec Memo Circular No 14-2000Gen GrajoNo ratings yet

- A Heuristic Framework For The Bi Objective Enhanced Index Tracking Problem 2016 OmegaDocument16 pagesA Heuristic Framework For The Bi Objective Enhanced Index Tracking Problem 2016 OmegaUmang SoniNo ratings yet

- Milestones Cfa CeDocument1 pageMilestones Cfa CeSanjay JagatsinghNo ratings yet

- ForecastForecasting With Term StructureDocument44 pagesForecastForecasting With Term StructureCésar Chávez La RosaNo ratings yet

- JPMorgan Chase London Whale GDocument15 pagesJPMorgan Chase London Whale GMaksym ShodaNo ratings yet

- EntropyDocument81 pagesEntropyManish SharmaNo ratings yet

- Security Valuation: Soumendra RoyDocument38 pagesSecurity Valuation: Soumendra RoySoumendra Roy0% (1)

- MPERS - Section 35 - MFRS 1 - First Time AdoptionDocument7 pagesMPERS - Section 35 - MFRS 1 - First Time Adoptionckin1609No ratings yet

- Merchant BankingDocument539 pagesMerchant BankingGyanendra Padhi100% (1)

- Mining Stocks Investor GuideDocument9 pagesMining Stocks Investor Guidecvac01100% (1)

- Investment AssignmentDocument3 pagesInvestment AssignmentRomikaNo ratings yet

- Amazon Stock RSU Global Agreement PDFDocument27 pagesAmazon Stock RSU Global Agreement PDFlindytindylindtNo ratings yet

- Idx Monthly Apr 2018Document111 pagesIdx Monthly Apr 2018nadiladlaNo ratings yet

- NTPC PPT UpdateDocument52 pagesNTPC PPT UpdateSanjay SatyajitNo ratings yet

- Open Interest, MaxPain & Put Call Ratio (PCR) Z-Connect by ZerodhaDocument43 pagesOpen Interest, MaxPain & Put Call Ratio (PCR) Z-Connect by ZerodhaSingh SudipNo ratings yet