Professional Documents

Culture Documents

Slump Sale and Related Income Tax Provisions

Uploaded by

Mahaveer DhelariyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Slump Sale and Related Income Tax Provisions

Uploaded by

Mahaveer DhelariyaCopyright:

Available Formats

PrintFriendly.

com: Print web pages, create PDFs

1 of 4

https://www.printfriendly.com/print/?source=homepage&url=http://taxguru...

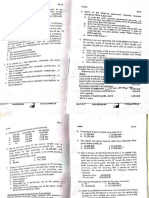

Slump Sale and Related Income Tax Provisions

Admin

Anjali Goyal

Introduction: In the process of integration of the Indian economy with the world economy, a number

of companies are going for restructuring to gain benefits from large scale operations and focus upon

its core competencies. In the restructuring exercise, certain companies sell off their unprofitable

business activities and the business activity as a whole is sold along with assets and liabilities. The

income from restructuring process was used to compute as capital gains and business income in

respect of each asset. In this view, the concept of Slump sale has been introduced to compute income with respect

to such division or undertaking as a whole.

What is Slump Sale?

Slump Sale is a transfer of one or more undertakings for a lumpsum consideration, without values being assigned to

the individual assets & liabilities.

There should necessary be a sale. Sale includes transfer of an asset from one person to another for some

consideration, where consideration can be in kind or cash. Literally, consideration can be even of Rs.1 to

specify such transfer as a sale.

Undertaking shall include any part of an undertaking or a unit or division of an undertaking or a business

activity taken as a whole, but does not include individual assets or liabilities or any combination thereof not

constituting a business activity.

Lumpsum consideration means consideration not being in instalments or any other basis. It should be one

time.

Also, lumpsum amount is not decided on the basis of assigning values to each asset & liability. The overall

idea is taken as to Net Worth of the transferred undertaking.But assignment of values can be done for other

purposes: payment of stamp fees

registration fees

any other taxes, etc

The values of property may be specified in the agreement but it should be proved that such assignment of values

was done for other purposes and not to compute value for transfer of such assets.

Is it necessary that undertaking should be a slump in order to effect a slump sale ?

Slump means dropping or falling heavily of something. It can be related to an undertaking that has suddenly

declined or deteriorated or sinked heavily, being operational or financial loss.

The intention of the law maker was to introduce the concept of slump sale for those undertakings whose assets &

liabilities has lost its value in the market. In these cases, assignment is not done for each asset or liability but as a

whole i.e. raddi ke bhaw mein bechna.

But since there is no such specific condition has been stated in the law for undertaking to be necessarily a slump,

08-Jul-16 3:14 PM

PrintFriendly.com: Print web pages, create PDFs

2 of 4

https://www.printfriendly.com/print/?source=homepage&url=http://taxguru...

the process of slump sale can be used even for transfer of profit-making company.

Therefore, it is not necessary that undertaking should be a slump to effect slump sale.

Transfer of assets without transfer of liabilities:

Slump sale do not apply where assets of an undertaking are transferred without transfer of liabilities. The base of

Slump sale is the transfer of an undertaking as a whole . In a case where liabilities has not been transferred, it

cannot be stated that undertaking has been transferred as a whole and therby provisions of slump sale shall not be

applied.

Unabsorbed losses and depreciation:

The unabsorbed losses and depreciation with respect to transferred undertaking shall be allowed to carry forward in

future years to the transferor.

COMPUTATION OF CAPITAL GAINS:

Net Profit shall be ,

Slump Sale consideration

Less: Net Worth of the undertaking or division

Taxability: The net amount of profit out of transfer with respect to slump sale shall be taxable under the head

Capital Gains. No income shall be taxable under income from business if the transfer has duly complied with the

conditions being a slump sale.

Even stock in trade of such undertaking shall not be taxable under income from business.

Taxable Year: The taxable year shall be the effective year, where effective year is the year in which transfer of

undertaking has been legally made effective. The taxability shall not be dependent upon the date of actual

possession of assets or actual transfer.

Effective date shall be taken as the date of agreement or effective date, if any specified therein.

Nature of Capital Gains: The nature of Capital Gains (whether short term or long term) shall be dependent upon the

period of holding of the undertaking ,where such undertaking shall become long term if it has been held for more than

36 months. The nature or period of holding of assets of such undertaking shall not be considered to determine the

nature of Capital Gains.

Even if all assets are short term in nature and undertaking is long term in nature, the transfer of assets shall be held

as long term only & taxable as Long term Capital Gains.

COMPUTATION OF NET WORTH:

No Cost of acquisition or Cost of improvement:

No actual cost of acquisition or cost of improvement shall be taken for the computation of Net worth. Net worth shall

be taken on the basis of :

Book values of assets & liabilities

as on the date of transfer.

No Indexation:

08-Jul-16 3:14 PM

PrintFriendly.com: Print web pages, create PDFs

3 of 4

https://www.printfriendly.com/print/?source=homepage&url=http://taxguru...

No indexation is required since even cost of acquisition or improvement shall not been considered for the

computation of Net worth.

No Revaluation:

Revaluation of assets shall not be considered while computing the Net Worth.

What if revaluation of assets has been done in current or past years?

There shall not be made any change to the value of such assets. Revaluation is not allowed as on the date of

transfer but earlier revaluation wont make any difference. Simply, existing book values shall be picked for

computation of Net Worth.

Whether revaluation can be done for assignment of value to the assets for other purposes?

Yes, revaluation can be done for other purposes (other than purpose of sale).

But no revaluation shall be done for computing Net Worth.

Value of Depreciable assets:

In case of depreciable assets, the written down value of such assets shall be computed as per Sec 43(6)(c)(i)(C),

which computes the WDV in the following way:

Actual cost of the assets falling within the block transferred by way of slump sale as reduced by

Less: depreciation actually allowed upto AY 1987-88 in respect of the asset transferred

Less: depreciation that would have been allowable for AY 1988-89 and future AYs as if the asset was the only asset

in the block of assets.

( However, the above reduction shall be limited to the written down value of Block of assets)

Note :

The law does not prescribe as to what will be the actual cost of the assets in the hands of the transferee. A logical

view is that the slump consideration should be apportioned on the basis of fair market value of the assets and

depreciation be allowed on such apportioned cost.

Value of Non Depreciable assets:

In case of non depreciable assets, the value of assets shall be taken at their Book Values.

Value of Assets in regard to which deduction has been provided u/s 35AD:

In such cases , the values taken shall be NIL.

This is because, since deduction in respect of such value has already been given earlier. Now adding the value of

such asset for the computation of Net Worth shall give assessee the cascading benefits.

AFTER SLUMP SALE: Successors Position

In the absence of any specific provisions for computation of WDV of assets acquired upon slump sale in the

books of the transferee, a view could be taken that apportionment of slump consideration on the basis of fair

values of various assets is possible.

Where claims for export incentives and cash assistance formed part of assets of the undertaking acquired by

08-Jul-16 3:14 PM

PrintFriendly.com: Print web pages, create PDFs

4 of 4

https://www.printfriendly.com/print/?source=homepage&url=http://taxguru...

way of slump sale, and the amount of the claim was received by the transferee, the amount so received was

held to be capital receipts. This was because the claims for export incentives and cash assistance were

actionable claims purchased by the assessee for a consideration.

Where the transferor is denied deduction u/s.43B on the ground of non-payment of dues, and the dues are

paid by the successor, the benefit of deduction u/s.43B should be available even to the transferee.

(Author is a Licentiate Company Secretary and CA Final student of ICAI and she can be reached For any queries or

suggestions, at anjaligoyal0602@gmail.com)

08-Jul-16 3:14 PM

You might also like

- HSBC0469, D, Priyansh - Group D11Document14 pagesHSBC0469, D, Priyansh - Group D11Priyansh KhatriNo ratings yet

- Summary of Pas 36Document5 pagesSummary of Pas 36Elijah MontefalcoNo ratings yet

- Classification of ExpenditureDocument34 pagesClassification of Expenditurepriya19990No ratings yet

- Slump SaleDocument19 pagesSlump SaleGeetika AnandNo ratings yet

- Capital GainsDocument25 pagesCapital GainsanonymousNo ratings yet

- Intangible AssetDocument1 pageIntangible AssetAyesha IqbalNo ratings yet

- Slump Sale and Slump Exchange ExplainedDocument36 pagesSlump Sale and Slump Exchange ExplainedVicky Murthy0% (1)

- GAURAV Valuation Content Edited RevisedDocument17 pagesGAURAV Valuation Content Edited Revisedgauravbansall567No ratings yet

- As 28Document14 pagesAs 28Harsh PatelNo ratings yet

- Profits and Gains of Business or ProfessionDocument14 pagesProfits and Gains of Business or Professionsadathnoori100% (1)

- Accounting Standard 28Document27 pagesAccounting Standard 28Asif ShaikhNo ratings yet

- Article On Slump SaleDocument3 pagesArticle On Slump SaledafriaNo ratings yet

- CCI - Guidelines For ValuationDocument13 pagesCCI - Guidelines For Valuationsujit0577No ratings yet

- Tax Law RPDocument14 pagesTax Law RPArthi GaddipatiNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting AssignmentSanjeevParajuliNo ratings yet

- Acc470 Ias 36Document33 pagesAcc470 Ias 36Naji EssaNo ratings yet

- IAS16 Defines Property, Plant and Equipment As "Tangible Items ThatDocument35 pagesIAS16 Defines Property, Plant and Equipment As "Tangible Items ThatMo HachimNo ratings yet

- Deferred Revenue Expenditure and The Income-Tax Act, 1961: TaxationDocument5 pagesDeferred Revenue Expenditure and The Income-Tax Act, 1961: Taxationjoseph davidNo ratings yet

- Deductions NotesDocument11 pagesDeductions Notescirenne10No ratings yet

- Sample of Asset-Office Land, Equiptment, Cash, MachinesDocument29 pagesSample of Asset-Office Land, Equiptment, Cash, MachinesMaria Cludet NayveNo ratings yet

- Final SummaryDocument6 pagesFinal SummaryAkanksha singhNo ratings yet

- Ias 36 - Impairment of Assets ObjectiveDocument9 pagesIas 36 - Impairment of Assets ObjectiveAbdullah Al Amin MubinNo ratings yet

- Topic 1Document49 pagesTopic 1TafadzwaNo ratings yet

- Dwnload Full Foundations of Financial Management Canadian 9th Edition Hirt Solutions Manual PDFDocument36 pagesDwnload Full Foundations of Financial Management Canadian 9th Edition Hirt Solutions Manual PDFhenrykr7men100% (11)

- Text F2D63A82F4A4 1Document3 pagesText F2D63A82F4A4 1AVNo ratings yet

- Full Download Advanced Financial Accounting Christensen 10th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Advanced Financial Accounting Christensen 10th Edition Solutions Manual PDF Full Chapterdatiscincnidariak6y549100% (15)

- Impairment of AssetDocument6 pagesImpairment of AssetOLAWALE AFOLABI TIMOTHYNo ratings yet

- Discounted Cash Flow ModelDocument21 pagesDiscounted Cash Flow Modelvaibhavsachdeva0326No ratings yet

- Income Under The Head Capital GainsDocument15 pagesIncome Under The Head Capital GainsHudson ManuelNo ratings yet

- Acquisations 120312044311 Phpapp01Document3 pagesAcquisations 120312044311 Phpapp01Nayaz UddinNo ratings yet

- Chapter 9 ValuationDocument85 pagesChapter 9 ValuationSaravanaaRajendran100% (1)

- Advanced Financial Accounting Christensen 10th Edition Solutions ManualDocument36 pagesAdvanced Financial Accounting Christensen 10th Edition Solutions Manualuraninrichweed.be1arg100% (43)

- Historical Cost of Property, Plant and EquipmentDocument9 pagesHistorical Cost of Property, Plant and EquipmentChinchin Ilagan DatayloNo ratings yet

- Accounting Concepts F5Document7 pagesAccounting Concepts F5Tinevimbo NdlovuNo ratings yet

- DCF PrimerDocument30 pagesDCF PrimerAnkit_modi2000No ratings yet

- Lecture Notes On Revaluation and ImpairmentDocument6 pagesLecture Notes On Revaluation and Impairmentjudel ArielNo ratings yet

- Lecture Notes On Revaluation and Impairment PDFDocument6 pagesLecture Notes On Revaluation and Impairment PDFjudel ArielNo ratings yet

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargNo ratings yet

- Valuing Business EDP SDMDocument104 pagesValuing Business EDP SDMsamrulezzzNo ratings yet

- Financial Accounting 2 SummaryDocument10 pagesFinancial Accounting 2 SummaryChoong Xin WeiNo ratings yet

- Income Under The Head Profits and Gains From Business and ProfessionDocument20 pagesIncome Under The Head Profits and Gains From Business and ProfessionSapna KawatNo ratings yet

- Ch-7 Approaches of Business ValuationDocument46 pagesCh-7 Approaches of Business ValuationManan SuchakNo ratings yet

- READING 11 Private Company ValuationDocument33 pagesREADING 11 Private Company ValuationDandyNo ratings yet

- Revenue Recognition - Installment SalesDocument3 pagesRevenue Recognition - Installment SalesMariah Janey VicenteNo ratings yet

- IAS 36 Impairment of AssetsDocument45 pagesIAS 36 Impairment of AssetsvidiNo ratings yet

- Accounting Standard 28 Impairment 2Document15 pagesAccounting Standard 28 Impairment 2sosteniblebusinessNo ratings yet

- Basic Accounting Terminology: Tangible AssetsDocument4 pagesBasic Accounting Terminology: Tangible Assetskavya guptaNo ratings yet

- Principle of SelectionDocument16 pagesPrinciple of SelectionIsiyaku AdoNo ratings yet

- Asset Intra Company TransferDocument4 pagesAsset Intra Company TransferManoj KumarNo ratings yet

- MODULE 4: Impairment of AssetsDocument3 pagesMODULE 4: Impairment of AssetsPauline Joy GenalagonNo ratings yet

- Chapter 10Document25 pagesChapter 10Danlrh JustDanlrhNo ratings yet

- Revaluation and ImpairmentDocument2 pagesRevaluation and Impairmentriyan_al_fajriNo ratings yet

- Terminology Asset: Share CapitalDocument8 pagesTerminology Asset: Share CapitalHenna HussainNo ratings yet

- Valuation - DCFDocument38 pagesValuation - DCFKumar Prashant100% (1)

- 08 InvestmentquestfinalDocument13 pages08 InvestmentquestfinalAnonymous l13WpzNo ratings yet

- Accounting For Property Plant and EquipmentDocument6 pagesAccounting For Property Plant and EquipmentmostafaNo ratings yet

- LimitationDocument2 pagesLimitationAhmed SroorNo ratings yet

- Assignment of Tax Law: Gitarattan International Business School DELHI-110085Document5 pagesAssignment of Tax Law: Gitarattan International Business School DELHI-110085AbhishekNo ratings yet

- Lecture Notes On Trade and Other Receivables PDFDocument5 pagesLecture Notes On Trade and Other Receivables PDFjudel ArielNo ratings yet

- Notices Us 1421 of Income Tax ActDocument3 pagesNotices Us 1421 of Income Tax ActMahaveer DhelariyaNo ratings yet

- Taxguru - In-Taxation of Charitable and Religious Trusts - 3Document5 pagesTaxguru - In-Taxation of Charitable and Religious Trusts - 3Mahaveer DhelariyaNo ratings yet

- Income Tax Changes For FY 2017-18 (AY 2018-19)Document22 pagesIncome Tax Changes For FY 2017-18 (AY 2018-19)soumyaviyer@gmail.comNo ratings yet

- What Is GST Audit - 2Document6 pagesWhat Is GST Audit - 2Mahaveer DhelariyaNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Top 5 Ways To Break WinRAR Password Easily and EfficientlyDocument11 pagesTop 5 Ways To Break WinRAR Password Easily and EfficientlyMahaveer DhelariyaNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- Amount in WordsDocument7 pagesAmount in WordsMahaveer DhelariyaNo ratings yet

- 43144bos32841 PDFDocument1 page43144bos32841 PDFMahaveer DhelariyaNo ratings yet

- Salary SlipDocument1 pageSalary SlipMahaveer DhelariyaNo ratings yet

- 40 20170808085815 Article gstr3bDocument2 pages40 20170808085815 Article gstr3bMahaveer DhelariyaNo ratings yet

- Case LawsDocument137 pagesCase LawsrubykambojNo ratings yet

- Bos 31624 As CDocument5 pagesBos 31624 As CMahaveer DhelariyaNo ratings yet

- CAclubindia News - You Want To Quit CADocument2 pagesCAclubindia News - You Want To Quit CAMahaveer DhelariyaNo ratings yet

- CAclubindia News - Audit and Auditor As Per Companies Act, 2013Document9 pagesCAclubindia News - Audit and Auditor As Per Companies Act, 2013Mahaveer DhelariyaNo ratings yet

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNo ratings yet

- Interest Paid For Broken Period Not Part of Purchase Price SCDocument3 pagesInterest Paid For Broken Period Not Part of Purchase Price SCMahaveer DhelariyaNo ratings yet

- Brief Insights On Concept of Reverse Mortgage in IndiaDocument3 pagesBrief Insights On Concept of Reverse Mortgage in IndiaMahaveer DhelariyaNo ratings yet

- Resolutions To Be Filed With Registrar of Companies Under Companies Act 2013Document2 pagesResolutions To Be Filed With Registrar of Companies Under Companies Act 2013Mahaveer DhelariyaNo ratings yet

- Intimation About The Quarterly TDSDocument2 pagesIntimation About The Quarterly TDSMahaveer DhelariyaNo ratings yet

- Annual Compliances Under Foreign Exchange Management Act, 1999 - An InsightDocument2 pagesAnnual Compliances Under Foreign Exchange Management Act, 1999 - An InsightMahaveer DhelariyaNo ratings yet

- Matters Which Require Ordinary Resolutions Under Companies Act 2013Document3 pagesMatters Which Require Ordinary Resolutions Under Companies Act 2013Mahaveer DhelariyaNo ratings yet

- Company Law Electoral Trust NotificationDocument1 pageCompany Law Electoral Trust NotificationMahaveer DhelariyaNo ratings yet

- Fdi PolicyDocument12 pagesFdi PolicyMahaveer DhelariyaNo ratings yet

- GST Impact On Distribution Companies and DealersDocument3 pagesGST Impact On Distribution Companies and DealersMahaveer DhelariyaNo ratings yet

- CAclubindia News - Taxability of Government Services Under Reverse Charge MechanismDocument6 pagesCAclubindia News - Taxability of Government Services Under Reverse Charge MechanismMahaveer DhelariyaNo ratings yet

- Insight To Undisclosed Income SchemeDocument4 pagesInsight To Undisclosed Income SchemeMahaveer DhelariyaNo ratings yet

- FAQs On Exchange Earner's Foreign Currency AccountDocument3 pagesFAQs On Exchange Earner's Foreign Currency AccountMahaveer DhelariyaNo ratings yet

- Various Returns Under Model GST LawDocument2 pagesVarious Returns Under Model GST LawMahaveer DhelariyaNo ratings yet

- Sony Ht-ct390 Startup ManualDocument1 pageSony Ht-ct390 Startup Manualalfred kosasihNo ratings yet

- Condo Contract of SaleDocument7 pagesCondo Contract of SaleAngelo MadridNo ratings yet

- Lembar Soal I. Read The Text Carefully and Choose The Best Answer Between A, B, C, D or E!Document5 pagesLembar Soal I. Read The Text Carefully and Choose The Best Answer Between A, B, C, D or E!nyunyunNo ratings yet

- Listen The Song and Order The LyricsDocument6 pagesListen The Song and Order The LyricsE-Eliseo Surum-iNo ratings yet

- Interpretive Dance RubricDocument1 pageInterpretive Dance RubricWarren Sumile67% (3)

- Ijara-Based Financing: Definition of Ijara (Leasing)Document13 pagesIjara-Based Financing: Definition of Ijara (Leasing)Nura HaikuNo ratings yet

- DharmakirtiDocument7 pagesDharmakirtialephfirmino1No ratings yet

- Ingo Plag Et AlDocument7 pagesIngo Plag Et AlDinha GorgisNo ratings yet

- Beginner Guide To Drawing AnimeDocument14 pagesBeginner Guide To Drawing AnimeCharles Lacuna75% (4)

- The Role of The Board of Directors in Corporate GovernanceDocument12 pagesThe Role of The Board of Directors in Corporate GovernancedushyantNo ratings yet

- PRTC Tax Final Preboard May 2018Document13 pagesPRTC Tax Final Preboard May 2018BonDocEldRicNo ratings yet

- Thesis ClarinetDocument8 pagesThesis Clarinetmeganjoneshuntsville100% (2)

- Ozone Therapy - A Clinical Review A. M. Elvis and J. S. EktaDocument5 pagesOzone Therapy - A Clinical Review A. M. Elvis and J. S. Ektatahuti696No ratings yet

- Libro de Social Studies PDFDocument76 pagesLibro de Social Studies PDFNoheNo ratings yet

- The Cornerstones of TestingDocument7 pagesThe Cornerstones of TestingOmar Khalid Shohag100% (3)

- Becg Unit-1Document8 pagesBecg Unit-1Bhaskaran Balamurali0% (1)

- Cotton Fruit Extract As A Degreaser: Marvie OsorioDocument17 pagesCotton Fruit Extract As A Degreaser: Marvie OsorioJamailla MelendrezNo ratings yet

- Eris User ManualDocument8 pagesEris User ManualcasaleiroNo ratings yet

- Skans Schools of Accountancy CAF-8: Product Units RsDocument2 pagesSkans Schools of Accountancy CAF-8: Product Units RsmaryNo ratings yet

- 22 Habits of Unhappy PeopleDocument2 pages22 Habits of Unhappy PeopleKlEər OblimarNo ratings yet

- Measures of Variability For Ungrouped DataDocument16 pagesMeasures of Variability For Ungrouped DataSharonNo ratings yet

- 1 Reviewing Number Concepts: Coursebook Pages 1-21Document2 pages1 Reviewing Number Concepts: Coursebook Pages 1-21effa86No ratings yet

- Sand Cone Method: Measurement in The FieldDocument2 pagesSand Cone Method: Measurement in The FieldAbbas tahmasebi poorNo ratings yet

- The Dallas Post 07-24-2011Document16 pagesThe Dallas Post 07-24-2011The Times LeaderNo ratings yet

- 10.MIL 9. Current and Future Trends in Media and InformationDocument26 pages10.MIL 9. Current and Future Trends in Media and InformationJonar Marie100% (1)

- Chapter 2 System Architecture: HapterDocument34 pagesChapter 2 System Architecture: HapterMohamed AmineNo ratings yet

- Cone Penetration Test (CPT) Interpretation: InputDocument5 pagesCone Penetration Test (CPT) Interpretation: Inputstephanie andriamanalinaNo ratings yet

- English8 q1 Mod5 Emotive Words v1Document21 pagesEnglish8 q1 Mod5 Emotive Words v1Jimson GastaNo ratings yet

- MAraguinot V Viva Films DigestDocument2 pagesMAraguinot V Viva Films DigestcattaczNo ratings yet

- Elevex ENDocument4 pagesElevex ENMirko Mejias SotoNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)