Professional Documents

Culture Documents

Verville

Uploaded by

Shah Maqsumul Masrur TanviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Verville

Uploaded by

Shah Maqsumul Masrur TanviCopyright:

Available Formats

EVALUATING ERP SOFTWARE IN THE ACQUISITION PROCESS: A

THREE PHASE ACTIVITY

Dr. Jacques Verville, Texas A&M International University, jverville@tamiu.edu

ABSTRACT

Based on an extensive study that involved the cases of four different organizations, this paper

presents a discussion of the evaluation process for ERP software.

Keywords: evaluation, ERP, vendor, functionality, technical, and implementation

INTRODUCTION

Enterprise Resource Planning (ERP) is a suite of application modules that can link back-office

operations to front-office operations as well as internal and external supply chains, ERP software

conjoins functional areas and business processes in an integrated environment that provides a

broad scope of applicability for organizations. While considered a viable alternative to in-house

development (Verville & Halingten, 2001; Verville, 2000; Eckhouse, 1999; McNurlin &

Sprague, 1998), the acquisition of ERP software is not without its challenges. At a cost of

several hundreds of thousands or even millions of dollars, the acquisition of ERP software is a

high-expenditure activity that consumes a significant portion of their capital budgets. It is also

an activity that is fraught with a high level of risk and uncertainty. Why? Because, first of all, if

a wrong purchase is made, it can adversely affect the organization as a whole, in several different

areas and on several different levels, even to the point of jeopardizing the very existence of the

organization (Verville & Halingten, 2001; Verville, 2000). This highlights the obvious need for

making the right choice of software. It also brings to light the need for finding the best means

for acquiring this type of software so that the right choice can be made. Second, because of the

implementatio n and the risk of it going awry. ERP implementations are said to be the single

business initiative most likely to go wrong (Verville & Halingten, 2001; Verville, 2000; Hill,

1999).

In light of these concerns, a research project was undertaken to determine the best way to acquire

ERP software. However, with little research found on the topic of ERP acquisitions, it became

necessary, in the first order, to find out what indeed the process is that organizations go through

to buy ERP software (Esteves & Pastor, 2001; Verville 2000). As such, the research questions

for the study were: How do organizations acquire ERP software? What are the processes that

are involved for ERP software acquisitions? How do organizations evaluate ERP packaged

solutions?

The focus of this paper, then, is on the evaluation process. It will begin with a brief description

of the cases. Subsequent to that, a presentation of the three types of evaluation activities

(vendor, functionality and technical) that the organizations went through to purchase ERP

software.

625

IACIS 2002

EVALUATING ERP SOFTWARE IN THE ACQUISITION PROCESS: A

DESCRIPTION OF THE CASES

The four organizations (pseudonymously named, with the exception of Keller) that participated

in the study were:

OMEGA, a large international carrier, provides air transportation services for passengers and

cargo both to domestic and international arenas. OMEGA purchased PeopleSofts ERP

solution (finance, human resources, and payroll applications) for the sum of US$86 million.

The ERP acquisition process that OMEGA went through took approximately 9 months and

was completed by the summer of 1996. Its subsequent implementation was completed in the

scheduled timeframe and was regarded a success.

GAMMA is a holding company for a gas and electric utility and non-utility energy business.

GAMMA completed the purchase of Oracles ERP solution (finance and related

applications) at a cost of US$6.5 million in March of 1997. Its ERP acquisition process took

approximately 6 months from start to finish. This case is especially significant because it

highlights the need to verify sources of information.

LIMA LIMA Inc. is a North American based overseas carrier which maintains commercial

relations and operates facilities that allow domestic network operators and other service

providers to exchange telecommunication traffic with 240 countries and territories. LIMA

started but did not complete the purchase of a proposed US$10 million packaged ERP

solution (international billing system). Owing to the strategic nature of the intended

purchase, an impasse on the issues of code ownership and cost brought the business

negotiations to a halt.

Keller Manufacturing Company is a manufacturer of household furniture. Today, this

organization has over 700 employees in three manufacturing plants in the Keller

Manufacturing purchased an ERP solution (manufacturing execution system) from Effective

Management Systems (EMS) Inc. for approximately US$1 million. Kellers ERP acquisition

process took approximately 11 months and was completed in August of 1996. Regarded as a

great success, the implementation of EMS software was completed within the scheduled

timeframe with only a few minor problems.

ERP SOFTWARE EVALUATION PROCESS:

VENDOR, FUNCTIONAL AND TECHNICAL

Within this study we have identified three types of evaluation that were carried out in acquisition

process for ERP software: (1) vendor evaluation (conducted primarily by the purchasing

department), (2) functional evaluation of the software (functionalities determined primarily by

the users), and (3) technical evaluation (conducted primarily by the systems department).

The rigor with which the definition of evaluation criteria (vendor, functional and technical) and,

subsequent to that, the Evaluation process were carried out appeared, in all of the cases, to have

been proportionate to the size or type of purchase and its potential effect on the organization in

626

EVALUATING ERP SOFTWARE IN THE ACQUISITION PROCESS: A

IACIS 2002

terms of strategic benefits. In each case, the evaluations took on slightly different twists

depending on the internal customers, the culture of the organization, sometimes even the

approval process that needed to be followed to get funding.

Each of the acquisition teams developed tools (questionnaires and matrices/grids) that they used

to assist them with the three different areas of the Evaluation process. These evaluation tools

had both quantitative and qualitative attributes.

As we see in the following sections of this paper, the Evaluation process was also an iterative

process. The Vendor Evaluation occurred in part with the Marketplace Analysis. As more

information was obtained from client referrals and other sources, the Vendor Evaluation process

was re-visited. Similarly, the processes for evaluating the functional and technical aspects of the

technology were reiterated. Preliminary eva luations for both areas were carried out during the

Selection process with the review of the RFP (RFI for Keller) responses; then, during the formal

evaluation, more in-depth investigations were conducted.

ERP Software Evaluation: Vendor Evaluation

In the early stage of the selection process, each of the teams conducted a cursory evaluation of

potential vendors during which an initial screening was carried out, using pre-established highlevel or general criteria, to arrive at a long-list of vendors. Some of the basic screening criteria

that were used in three of the cases (OMEGA, LIMA and GAMMA) to evaluate potential

vendors were the size of the vendor, and the vendors reputation, market share and global

presence. An exception to this was done by LIMA. As with OMEGA and GAMMA, the size of

the vendor was a criterion that LIMAs team had used to weed out vendors. It was only when

the team presented their short- list of three vendors to the Steering Committee at the end of the

Selection process that the exception came about, however, more precisely, the Steering

Committee asked the team to add two more vendors to their list for consideration, one of which

was a small vendor. The reason for this was that they did not want the team to discount any new

technology that might come from a smaller vendor simply because of their size.

As the teams received more information, their long- lists were further reduced to an acceptable

number of vendors. As previously noted, one of OMEGAs strategies to evaluate the vendors on

their long-list was to bring all of their potential vendor candidates together, which they did, in a

vendor awareness session. Though uncertain of the results of this unorthodox strategy

(normally, the vendors are kept in the dark about whom they are competing against), it proved

to be useful in that (1) it served as a natural weeding mechanism to reduce the number of

potential candidatesone of the vendors bowed out once they saw who they were competing

against and realized that they would not be able to meet OMEGAs criteria for an integrated

solution; (2) it allowed OMEGA to get a feel for who could do the work for them; and (3) it gave

vendors the opportunity to team or partner together in order to provide the full scope of

applications that OMEGA ultimately wanted.

Another criterion that was evaluated was whether the solution was single-sourced, that is, was

the proposed technology developed in-house by the vendor candidate or would they (the vendor

candidate) have to outsource part of the application to another vendor? This was an important

627

IACIS 2002

EVALUATING ERP SOFTWARE IN THE ACQUISITION PROCESS: A

factor for all of the cases. A single vendor solution would reduce or eliminate the risk of a

potential fallout between partners, or of one of the vendors no longer being in business which

could result in problems regarding the long-term responsibility for the overall solution. A single

vendor solution would also avoid any shifting of responsibility for the technology.

Vendors were also evaluated according to their ability to assist the organizations with the

implementation of their ERP software solutions, their association with or the availability of thirdparty vendors/partners to assist with local support, as well as other criteria such as their vision

(future plans and trends regarding the directio n of the components of the proposed solution [both

technical and functional]) and strategic position.

ERP Software Evaluation: Functional Evaluation

The Functional Evaluation of the ERP software was also an important facet of the acquisition

process. In the case of GAMMA, the functional requirements accounted for 42% of the overall

weighting, and in the case of LIMA, functionality accounted for 60% of the overall weighting.

For OMEGA as well as the functionality of the ERP software was the prime consideration and

received the most weighting.

Two different methods were used to evaluate the functionality of the software: (1) scripted

demonstrations, and (2) canned demonstrations. Two of the cases, OMEGA and GAMMA, used

the strategy of a scripted demonstration. At the completion of their Selection process, OMEGA

and GAMMA developed demonstration scripts that would be used to verify the contents of the

RFP responses (Can the software do what they claimed it can do?), to simulate tasks (from

simple to very complex), and to clarify issues and areas that were unclear or were not addressed

in the RFP responses. These scripts were then sent to each of the vendors on their short- lists a

couple of weeks prior to the demonstrations and were the basis for the functional demonstrations

of the vendors proposed solutions. Keller, on the other hand, opted for canned demonstrations

from the vendors they had invited in-house. Subsequently, they then asked their top vendor

candidate to return for an intensive 2-day in- house scripted demonstration where they (Keller)

had them perform a multitude of simulations (tasks) with the software. For all three of these

cases (OMEGA, GAMMA and Keller), user participation at these demonstrations was

considered very important . On the other hand, LIMAs strategy was quite different from the

others on this point. They decided to visit the vendors on their short- list.

In each of the four cases, feedback was obtained from all demonstration participants to determine

their impressions about the proposed software solutions. Both the users and the acquisition team

members completed matrices/grids and/or questionnaires to report their impressions and score

the appropriate categories for the demonstrations.

ERP Software Evaluation: Technical Evaluation

In conjunction with the Functional Evaluation, all of the cases, with the exception of Keller,

conducted a Technical Evaluation of their proposed ERP solutions. The technical evaluation

itself consists of a series of tests to assess the rigor, capacity, and performance of the ERP

software and all aspects of the technology supporting the applications, including the platforms,

628

EVALUATING ERP SOFTWARE IN THE ACQUISITION PROCESS: A

IACIS 2002

the operating systems, the database management systems, and all of the systems management

aspects (availability, security, etc.). While these issues were addressed in the RFP (with the

defined technical pre- and co-requisites) and reviewed during the paper Technical Evaluation,

the live Technical Evaluation provided physical evidence of the ERP softwares ability to

actually do what the vendor claimed. Hence, the Technical Evaluation provided answers to such

questions/issues as (a few examples): Is the platform that the proposed solution should ideally

operate on ideal for optimum performance?; Is the organizations compatible DBMS (Database

Management Systems) with the proposed solution?; Can the proposed solution integrate into the

organizations existing environment? In addition, the Technical Evaluation included tests to

assess the rigor, capacity and performance of the software and all aspects of the technology

supporting the applications, including the platforms, the operating systems, the database

management systems, and all of the systems management aspects.

It was noted within this study that the Technical Evaluation was carried out in a two-tier process

(much the same as the Functional Evaluation was carried out), the first of which happened

subsequent to the return of the RFP responses from the vendors (i.e., evaluation of the paper

responses), and the second of which took place either before or following the in- house vendor

demonstrations and/or at the vendors sites and/or at referral sites. This also was an iterative

process. As the acquisition teams learned more about the vendors solutions from the RFP

responses, they were able to adjust, add, or remove criteria, benchmarks, etc., in their Technical

Evaluation processes.

OMEGA, LIMA, and GAMMA used the information they had gathered earlier about their

organizations current functional and data/information needs, their existing systems architecture

and their existing (or future) technological infrastructure, as the basis by which to evaluate the

vendors proposed ERP solutions. From an evaluation of the information they gathered on their

current functional and data/information needs, they gained a high- level understanding of their

organizations business processes and needs, the key functions that were supplied by their

existing application(s) (and that would necessarily be required of the new application[s]); the

data (the minimum data) that they needed to keep track of; and the types of interfaces that were

used (and would be required of the new software solution). From both a business perspective

and a technical perspective, this was important because of the existing relationships and interdependence of the applications that were to be replaced by the proposed ERP software solution

and those that would remain in place. Integration of the new applications might necessitate

modifications to their organizations existing processes (business and technical) and data models

in order to conform with the new software. Modifications to the business processes were an

issue of BPR (which was a factor) and were of concern to the organizations? OMEGA,

GAMMA, and Keller viewed the replacement of their current systems as an opportunity to

reengineer the way they do business in those areas. However, from a technical perspective, each

of the organizations voiced tha t a conscious decision was made on their parts to be as flexible as

possible with regard to changes that might have to be made in order to accommodate the ERP

solution of their choice into their technological environment. So, although it was important for

them (OMEGA, LIMA and GAMMA) to understand the internal workings of their current

applications as well as the proposed ERP solutions, they found it more important that the new

software meet their base requirements regarding business processes, key functio nalities,

minimum data, and visual (front-end) interfaces.

629

IACIS 2002

EVALUATING ERP SOFTWARE IN THE ACQUISITION PROCESS: A

From a support and implementation standpoint, OMEGA, LIMA, and GAMMA each did a highlevel analysis of the proposed ERP software architecture during their initial technical evaluation.

Here, once again, they began by referring back to information that they had gathered during the

initial stages of the process when they were defining their system requirements and gathering

information on their infrastructure for inclusion in the RFP, information such as who the users

were, what processes and data the systems would be handling, what the availabilities were, the

service- level requirements, the platforms they were on, the type and number of hardware

systems, network, DBMS, and so on. They compared their requirements with the information

that was supplied by the vendors on the major components of their solution, its architecture,

process and data models, integratability with the organizations systems, infrastructural

requirements, and their implementation services and strategies. During this initial evaluation,

they were able to assess the appropriateness of each vendors solution for their organization, that

is, how it would fit with their organizations current technological environment, the ability of the

organization to support it (what the processing requirements wereon- line, batch, synchronized,

central, distributed; in-house technical expertise, etc.) and, its scalability and openness. It also

gave the teams an indication of what type of performance they could expect, what the loads

would be on their networks based on their volume of data, the volume of processing that would

be required, whether the traffic would be significant, what the impact would be, and what the

response times would be on a LAN (local area network) versus a WAN (wide area network).

Further, they looked at what systems management tools would have to be procured (if any); and

what systems management processes would have to be executed if they needed to have software

data distribution across the network, etc. They also looked at the ability of their whole

infrastructure, end-to-end, to support the availability feature of the software.

For the second phase of the Technical Evaluation, which consisted of evaluating working

versions of the software solutions, OMEGA and GAMMA used benchmarks that they had

established. They had benchmarks to evaluate the server capacity, the capacity of the network

components, and the size of the workstations that would be needed. The Technical Evaluation

teams also validated benchmarks that were supplied to them by the vendors as well as those

coming from external sources to assist them in evaluating the capacity of the software.

CONCLUSION

The evaluation process for ERP software comprised of three distinct areas of evaluation: Vendor,

Functionality, and Technical. All three types of evaluation were conducted by the three of the

four cases and of the three, the Functional Evaluation carried the most weight, primarily due to

the participation of the end-users in the process and three of the four the organizations (OMEGA,

GAMMA and Keller) which weight heavily because of user-buying (acceptance of the system)

which was a factor in the decision process.

In addition, the area of technical evaluation, during this study, was found to differ somewhat

from what has been described in the systems development. While the technical evaluation and

testing of each step or module of software as it is developed, the technical evaluation that was

done of the ERP software took a significantly different approach. In fact, the technical

evaluation that was described in three of the four cases appeared to have been an outside- in

630

EVALUATING ERP SOFTWARE IN THE ACQUISITION PROCESS: A

IACIS 2002

approach (not be confused with reverse engineering), where they began with the finished

product and examined its architecture, design characteristics, and how the proposed solution

integrated with existing systems; tested load capacity and speed on their networks, response

time, availability, security and so forth.

REFERENCES

Eckhouse, J. (1999). ERP Vendors Plot a Comeback. Information Week, (718), 126-128.

Esteves, J., and Pastor, J. (2001). Enterprise Resource Planning Systems Research: An Annotated

Bibliography. Communication of AIS, 7 (8), 1-52.

Hill, S., Jr. (1999). It Just Takes Work. Manufacturing Systems, Selecting and Implementing

Enterprise Solutions Supplement, A2-A10.

McNurlin, B.C., and Sprague, R.H., Jr. (1998). Information Systems Management in Practice

(4th ed.). Prentice Hall, NJ.

Verville, J., and Halingten, A. (2001). Acquiring Enterprise Software: Beating the Vendors at Their

Own Game. Prentice-Hall (PTR), NJ.

Verville, J.C. (2000). An Empirical Study of Organizational Buying Behavior: A Critical

Investigation of the Acquisition of ERP Software. Dissertation, Universit Laval, Qubec.

631

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- CRACK TOUGH CISSP EXAMDocument6 pagesCRACK TOUGH CISSP EXAMrahuls256No ratings yet

- CFSA Study GuideDocument312 pagesCFSA Study Guidehossainmz88% (8)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Internal AuditDocument43 pagesInternal AuditNicoleta ConstantinescuNo ratings yet

- Asian Paints Case StudyDocument18 pagesAsian Paints Case StudyMahbubul Islam Koushick100% (2)

- Choosing Your ERP System in 2022 - v1.1Document19 pagesChoosing Your ERP System in 2022 - v1.1Pankaj Singh100% (2)

- Infosys Solution For Claims Leakage ReductionDocument8 pagesInfosys Solution For Claims Leakage ReductionSailendran MenattamaiNo ratings yet

- VARIABLE & ABSORPTION COSTING COMPARISONDocument6 pagesVARIABLE & ABSORPTION COSTING COMPARISONManwol JangNo ratings yet

- The Race Towards Industry 4.0 PDFDocument38 pagesThe Race Towards Industry 4.0 PDFFikri ZdinNo ratings yet

- Iso 27001Document84 pagesIso 27001sboukhal100% (2)

- Project Plant Pals SMART GoalsDocument2 pagesProject Plant Pals SMART Goalsabhilash74% (19)

- Local Coffee Shop Business PlanDocument12 pagesLocal Coffee Shop Business PlanMary SuganyaNo ratings yet

- Five Ws Internal Audit36700Document13 pagesFive Ws Internal Audit36700Shah Maqsumul Masrur TanviNo ratings yet

- Five Ws Internal Audit36700Document13 pagesFive Ws Internal Audit36700Shah Maqsumul Masrur TanviNo ratings yet

- INST 275 Lecture14Document51 pagesINST 275 Lecture14bayern munchenNo ratings yet

- Project Scheduling with OpenProjDocument16 pagesProject Scheduling with OpenProjShah Maqsumul Masrur TanviNo ratings yet

- Audit Checklist: RequirementDocument4 pagesAudit Checklist: RequirementShah Maqsumul Masrur TanviNo ratings yet

- INST 275 Lecture14Document51 pagesINST 275 Lecture14bayern munchenNo ratings yet

- Assement AuditDocument35 pagesAssement AuditPeter GeorgeNo ratings yet

- Chapt 1Document22 pagesChapt 1Sidra SwatiNo ratings yet

- Pharma Compliance Auditing Best PracticesDocument35 pagesPharma Compliance Auditing Best PracticesShah Maqsumul Masrur TanviNo ratings yet

- Role of Internal Audit DepartmentDocument19 pagesRole of Internal Audit DepartmentGuadalupe PenningtonNo ratings yet

- Project Scheduling with OpenProjDocument16 pagesProject Scheduling with OpenProjShah Maqsumul Masrur TanviNo ratings yet

- A Model For Assessing COBIT 5 and ISO 27001 Simultaneously: July 2018Document11 pagesA Model For Assessing COBIT 5 and ISO 27001 Simultaneously: July 2018Shah Maqsumul Masrur TanviNo ratings yet

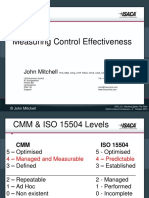

- Measuring Control Effectiveness - John MitchellDocument19 pagesMeasuring Control Effectiveness - John MitchellShah Maqsumul Masrur TanviNo ratings yet

- Car Loan Application FormDocument56 pagesCar Loan Application FormShah Maqsumul Masrur TanviNo ratings yet

- Pharma Compliance Auditing Best PracticesDocument35 pagesPharma Compliance Auditing Best PracticesShah Maqsumul Masrur TanviNo ratings yet

- MD - Mushfiqur RahmanCISA, CLPTP, CCISOProfileDocument10 pagesMD - Mushfiqur RahmanCISA, CLPTP, CCISOProfileShah Maqsumul Masrur TanviNo ratings yet

- Coreworx Interface Management Implementation Webinar October2013Document21 pagesCoreworx Interface Management Implementation Webinar October2013Shah Maqsumul Masrur TanviNo ratings yet

- Coreworx Interface Management Basics Webinar October2013Document21 pagesCoreworx Interface Management Basics Webinar October2013Shah Maqsumul Masrur TanviNo ratings yet

- 3 Big Problems For Social Network Analysis FinalDocument2 pages3 Big Problems For Social Network Analysis FinalShah Maqsumul Masrur TanviNo ratings yet

- Flourish Your Career With ACME: Executive/ Senior Executive - Corporate LegalDocument1 pageFlourish Your Career With ACME: Executive/ Senior Executive - Corporate LegalShah Maqsumul Masrur TanviNo ratings yet

- Function HierarchyDocument22 pagesFunction HierarchyShah Maqsumul Masrur TanviNo ratings yet

- Unit 03Document37 pagesUnit 03Shah Maqsumul Masrur TanviNo ratings yet

- ISO27001 - 2013 Implementation RoadmapDocument1 pageISO27001 - 2013 Implementation RoadmapShah Maqsumul Masrur TanviNo ratings yet

- Accenture Management Consulting: Advancing The Science of High PerformanceDocument24 pagesAccenture Management Consulting: Advancing The Science of High PerformanceShah Maqsumul Masrur TanviNo ratings yet

- Accounting MathDocument1 pageAccounting MathShah Maqsumul Masrur TanviNo ratings yet

- CH 11Document21 pagesCH 11Shah Maqsumul Masrur TanviNo ratings yet

- International Journal of Quality & Reliability ManagementDocument16 pagesInternational Journal of Quality & Reliability ManagementGilmer ERNo ratings yet

- Unit 1: Introduction To Service Marketing: Chapter OutlineDocument18 pagesUnit 1: Introduction To Service Marketing: Chapter OutlineIshita GosaliaNo ratings yet

- IKEA Case Study PresentationDocument19 pagesIKEA Case Study PresentationSHREYASI JAISWALNo ratings yet

- Makalah TKMPN XX - 2016 REGARDING 1 PDFDocument15 pagesMakalah TKMPN XX - 2016 REGARDING 1 PDFheru SetiawanNo ratings yet

- Kindle Company EnglishDocument65 pagesKindle Company EnglishNauman QureshiNo ratings yet

- Halal Logistic Services Trust and Satisfaction Amongst Malaysian 3PL Service ProvidersDocument19 pagesHalal Logistic Services Trust and Satisfaction Amongst Malaysian 3PL Service ProvidersAliz AzizNo ratings yet

- NDE Summery Sample ReportDocument2 pagesNDE Summery Sample Reportdada khalandarNo ratings yet

- Princess CruiseDocument55 pagesPrincess CruiseRaja Talib HussainNo ratings yet

- Civica EDM Overview BrochureDocument8 pagesCivica EDM Overview BrochureCivicaGroupNo ratings yet

- Elements of SteelDocument1 pageElements of Steelashish.mathur1No ratings yet

- Module 5Document33 pagesModule 5arun prabhakaranNo ratings yet

- FBE Coating Plant Limitation-May 2021, Rev - 03Document14 pagesFBE Coating Plant Limitation-May 2021, Rev - 03NavasNo ratings yet

- En AC350 470 Col33Document126 pagesEn AC350 470 Col33Guido Pagliotti50% (2)

- PB Orvar Supreme EnglishDocument12 pagesPB Orvar Supreme EnglishTrexa GyreueNo ratings yet

- Applied Entrep (q3w7Document6 pagesApplied Entrep (q3w7Eunel PeñarandaNo ratings yet

- Balance Scorecard SummaryDocument4 pagesBalance Scorecard Summarywasi_aliNo ratings yet

- EU System Maintenance 2023R1Document106 pagesEU System Maintenance 2023R1ALHNo ratings yet

- K04420030120154040K0442 - MetKuan-Inventory ModelsDocument53 pagesK04420030120154040K0442 - MetKuan-Inventory ModelsAdrian TanuwijayaNo ratings yet

- 440C Martensitic Stainless Steel: Gloria Material Technology CorpDocument1 page440C Martensitic Stainless Steel: Gloria Material Technology CorppvdangNo ratings yet

- Blanking & Piercing - Forming Questions and Answers - SanfoundryDocument4 pagesBlanking & Piercing - Forming Questions and Answers - SanfoundryrahmaNo ratings yet

- Sample Problems - Inventories Problem 1Document4 pagesSample Problems - Inventories Problem 1krizzmaaaayNo ratings yet

- Operation Management GuideDocument7 pagesOperation Management Guidemarlon stylesNo ratings yet

- Strategic CostDocument12 pagesStrategic CostTessie Mae Onongen PagtamaNo ratings yet