Professional Documents

Culture Documents

Title 8 - Premium: in Fire, Casualty, and Marine Insurance

Uploaded by

Anonymous lyWnW10 ratings0% found this document useful (0 votes)

22 views3 pagesINSURANCE

Original Title

Title 8 Premium

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentINSURANCE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views3 pagesTitle 8 - Premium: in Fire, Casualty, and Marine Insurance

Uploaded by

Anonymous lyWnW1INSURANCE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

insurance contract is ENTIRE or INDIVISIBLE, not

severable, or divisible, as to the items insured.

TITLE 8 - PREMIUM

It is immaterial that they are shipped or transported

separately.

Sec. 77- An Insurer is entitled to payment of the premium

as soon as the thing insured is exposed to the peril insured

against.

PREMIUM

Notwithstanding any agreement to

he contrary, no policy or contract of

nsurance issued by an insurance

company is valid and binding unless

and until the premium thereof has

been paid, except in the case of life

or an industrial life policy whenever

he grace period provision applies, or

whenever under the broker and

agency agreements with duly

icensed intermediaries, a ninety (90)day credit extension is given.

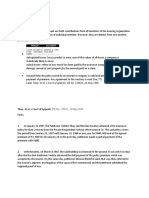

Levied and paid to

meet anticipated

losses

Assessment

ASSESSMENT

Collected to meet

actual losses

A sum specifically levied by mutual

insurance companies or associations,

upon a fixed and definite plan, to pay

losses and expenses.

After first payment

Legally enforceable once

of premium, not

levied, unless agreed Payment of Premium ordinarily

not a debt or obligation

enforceable against otherwise

the insured

1. In fire, casualty, and

marine insurance

Not a debt

A debt, unless other

wise expressly agreed

The premium payable becomes a

debt as soon as the risk attaches

No credit extension to a duly licensed

ntermediary should exceed ninety (90) days from date of

In suretyship as soon as the contract or bond is

ssuance of the policy. (Modified)

perfected and delivered to the obligor.

Sec. 78 Employees of the Republic of the Philippines,

ncluding its political subdivisions and instrumentalities, and

government-owned or controlled-corporations may pay their

nsurance premiums and loan obligations through salary

deduction:

Provided, that the treasurer, cashier, paymaster or official of

he entity employing the government employee is

authorized, notwithstanding the provisions of any existing

aw, rules, and regulations to the contrary, to make

deductions from the salary, wage or income of the latter

pursuant to the agreement between the insurer and the

government employee and to remit such deductions to the

nsurer concerned, and collect such reasonable fee for its

services. (New section)

the thing insured is exposed to the peril

insured against assumes that the contract is

perfected which takes place when the applicants

offer is accepted by the insurer.

2. In Life Insurance

The premium becomes a debt only when in the case

of the:

1.

First premium, the contract has become

binding;

2.

Subsequent premiums, when the insurer has

continued the insurance after maturity of the

premium, in consideration of the insureds

express or implied promise to pay.

Insurance Premium

Effect of nonpayment of premium

General rules of law applicable to the payment of

money obligation are applicable.

The agreed price for assuming and carrying

the risk- that is, the consideration paid an

insurer for undertaking to indemnify the insured

against a specified peril.

NOTE: where only one premium is paid for several

things not separately valued or separately insured, the

General rule:

The time specified for the payment of premiums is of

the essence of the contract.

1.

First Premium

- nonpayment of the first premium unless waived,

prevents that contract from becoming binding

notwithstanding the acceptance of the application nor

the issuance of policy.

* Nonpayment of the balance of premium due does

not produce the cancellation of contract.

2. Subsequent Premiums

- nonpayment of subsequent premiums does not affect

the validity of the contracts unless, by express

stipulation, it is provided that the policy shall in that

event be suspended or shall lapse.

* In individual life or endowment insurance and group

life insurance the policyholder is entitled to a grace

period of either (30) days or one (1) month within

which the payment of any premium after the first may

be made.

* Industrial life insurance the grace period is four

(4) weeks, if payable monthly, either thirty (30) days or

1 month.

Excuses for nonpayment of premiums

1.

Fortuitous Events

rendering the payment of the premium by the

insured wholly impossible will not prevent the

forfeiture of the policy when the premium remains

unpaid.

The insurer must have some efficient means of

enforcing punctuality.

2.

Condition, conduct or default of insurer

-no excuse whatever will avail to prevent forfeiture

except only when the nonpayment has in some

way been induced by the condition, conduct or

default, of the insurer.

Nonpayment is excused:

a. Where the insurer has become insolvent,

suspended business, or has refused

without justification a valid tender of

premiums.

b. Where the failure to pay was due to the

wrongful conduct of the insurer as when

the insurer induced the beneficiary under a

policy to surrender it for cancellation by

falsely representing that the insurance was

illegal and void, and returning the

premiums paid.

c. Where the insurer has in any wise waived

his right to demand payment.

Validity of policy where credit extension

granted to insured

In Makati Tuscany Condominium Corp. vs. Court of

Appeals

SC RULING:

An Insurance policy other than life issued originally or

on renewal is not valid and binding until actual

payment of the premium.

The parties may not agree expressly or impliedly on

the extension of credit or time to pay the premium and

consider the policy before actual payment.

Credit extension agreement is valid:

1. Mere acknowledgement in the policy of

receipt of premium makes the policy

binding

2. The familiar principle is that what the law

prohibits to be done directly cannot be

done indirectly.

3. The new rule is susceptible to the

constitutional objection that it unduly

restricts the freedom of contract

4. Ruling of the SC in UCPB General

Insurance Co. is unduly favorable to the

insurer who may grant an extension to the

insured and easily lull the latter into a false

sense of security and then deny liability

should the event insured against takes

place.

When policy valid and binding notwithstanding

nonpayment of premium

4.

When there is an agreement to grant the

insured credit extension for the payment of the

premium and loss occurs before the expiration of

credit term

5.

When estoppels bars the insurer from

invoking sec 77 to avoid recovery on a policy

providing credit term for the payment of the

premium, as against the insured who relied in

good faith on such extension.

Exceptions to Section 77:

1.

In a life or an industrial policy whenever the

grace period provision applies

2.

When there is an acknowledgement in a

policy or contract of insurance of receipt of

premium

3.

When there is an agreement allowing the

insured to pay the premium in installments and

partial payment has been made at the time of

loss

Sec. 79 An acknowledgement in a policy or contract

of insurance of the receipt of premium is conclusive

evidence of its payment, so far as to make the policy

binding, notwithstanding any stipulation therein that it

shall not be binding until the premium is actually paid.

You might also like

- 7e Ch5 Mini Case AnalyticsDocument6 pages7e Ch5 Mini Case AnalyticsDaniela667100% (9)

- Three Sections Account Provides Financial Settlement SummaryDocument7 pagesThree Sections Account Provides Financial Settlement SummaryDominic HoNo ratings yet

- EBL's Organizational StructureDocument35 pagesEBL's Organizational Structurenasir mamunNo ratings yet

- Insurance Premiums ExplainedDocument43 pagesInsurance Premiums Explainedowen100% (1)

- Insurance Reviewer 5Document7 pagesInsurance Reviewer 5Nikko Franchello SantosNo ratings yet

- Insurance Premium Rules & ExceptionsDocument47 pagesInsurance Premium Rules & ExceptionsKatrina ANo ratings yet

- PREMIUM: An Insurance Premium Is The Consideration Paid An Insurer For Undertaking ToDocument3 pagesPREMIUM: An Insurance Premium Is The Consideration Paid An Insurer For Undertaking ToPrudencio Ruiz AgacitaNo ratings yet

- UCPB General Insurance Co., Inc. vs. Masagana Telamart, IncDocument9 pagesUCPB General Insurance Co., Inc. vs. Masagana Telamart, IncRadel LlagasNo ratings yet

- Life Insurance in India - 3Document7 pagesLife Insurance in India - 3Himansu S MNo ratings yet

- Insurance - Construction and PerfectionDocument3 pagesInsurance - Construction and Perfectionkenken320100% (2)

- CHAPTER 4 - INSURANCE CONTRACTPERFECTION AND PREMIUM PAYMENTDocument4 pagesCHAPTER 4 - INSURANCE CONTRACTPERFECTION AND PREMIUM PAYMENTylessinNo ratings yet

- Insurance Premium Payment RequirementsDocument4 pagesInsurance Premium Payment RequirementsAyleen RamosNo ratings yet

- Insurance VI IXDocument16 pagesInsurance VI IXMa Jean Baluyo CastanedaNo ratings yet

- 2023 Aspects of Long-Term Insurance FinalDocument22 pages2023 Aspects of Long-Term Insurance Final96bcvmxwydNo ratings yet

- Chapter 4 Premiums GuideDocument15 pagesChapter 4 Premiums GuideAmanda LoveNo ratings yet

- 44 Manufacturers Life Insurance V MeerDocument7 pages44 Manufacturers Life Insurance V Meerkarl doceoNo ratings yet

- Insurance Exam Key PointsDocument14 pagesInsurance Exam Key PointsVanessa Evans CruzNo ratings yet

- Life Insurance Claims & COPRA 1986Document34 pagesLife Insurance Claims & COPRA 1986Samhitha KandlakuntaNo ratings yet

- Variable Contracts and Claims SettlementDocument3 pagesVariable Contracts and Claims SettlementAlvin PateresNo ratings yet

- Insurance Final Exam NotesDocument5 pagesInsurance Final Exam NotesJaymee Andomang Os-agNo ratings yet

- Insurance Policy Forms, Offers, and PremiumsDocument5 pagesInsurance Policy Forms, Offers, and PremiumsEric TamayoNo ratings yet

- The Offer Except From The Time It Came To His Knowledge". (Enriquez vs. Sun LifeDocument13 pagesThe Offer Except From The Time It Came To His Knowledge". (Enriquez vs. Sun LifePing ArtVillNo ratings yet

- Topics On Past ExamsDocument6 pagesTopics On Past ExamsKatrina Angeli MurilloNo ratings yet

- w3 - Contract Provisions in Life InsuranceDocument31 pagesw3 - Contract Provisions in Life InsuranceNur AliaNo ratings yet

- Law On InsuranceDocument31 pagesLaw On InsuranceThea DagunaNo ratings yet

- INSURANCE NotesDocument6 pagesINSURANCE NotesWinna Yu OroncilloNo ratings yet

- insurance-law_compressDocument4 pagesinsurance-law_compressrieann leonNo ratings yet

- Insurance Law Claims Settlement and Subrogation NotesDocument5 pagesInsurance Law Claims Settlement and Subrogation NotesTenten ConanNo ratings yet

- Insurance Law (Personal Reviewer)Document7 pagesInsurance Law (Personal Reviewer)Jazz OrtegaNo ratings yet

- LIC's Group Credit Life Insurance Plan DetailsDocument5 pagesLIC's Group Credit Life Insurance Plan DetailsRKNo ratings yet

- Finals - Insurance NotesDocument22 pagesFinals - Insurance NotesBlaise VENo ratings yet

- Insurance Contracts and Parties ExplainedDocument7 pagesInsurance Contracts and Parties ExplainedElmer SarabiaNo ratings yet

- Upload 1.4Document5 pagesUpload 1.4DAVID JEROMENo ratings yet

- Insurance Part VI ProvisionsDocument1 pageInsurance Part VI ProvisionsJCapskyNo ratings yet

- NU CBA - Key Insurance ConceptsDocument11 pagesNU CBA - Key Insurance ConceptsJasmine SollestreNo ratings yet

- Claims Settlement: Title 11Document33 pagesClaims Settlement: Title 11Eunice SerneoNo ratings yet

- Life InsuranceDocument23 pagesLife InsuranceSruthi RavindranNo ratings yet

- Return of PremiumDocument8 pagesReturn of PremiumAdvocate Gayathri JayavelNo ratings yet

- Premium payment requirements for insurance policy validityDocument6 pagesPremium payment requirements for insurance policy validityNathalie QuinonesNo ratings yet

- CORITANA Research 1Document2 pagesCORITANA Research 1Jade CoritanaNo ratings yet

- WarrantiesDocument19 pagesWarrantiesowenNo ratings yet

- PREMIUMDocument9 pagesPREMIUMInais GumbNo ratings yet

- Insurance Reviewer - Key Concepts in 11 PointsDocument9 pagesInsurance Reviewer - Key Concepts in 11 PointsSantoy CartallaNo ratings yet

- Ent 121 - 97-102Document6 pagesEnt 121 - 97-102Joseph OndariNo ratings yet

- Insurance Reviewer Atty GapuzDocument6 pagesInsurance Reviewer Atty GapuzJohn Soap Reznov MacTavishNo ratings yet

- October-19-Lecture-Notes SLUDocument5 pagesOctober-19-Lecture-Notes SLUPrincess ParasNo ratings yet

- Chapter 7Document13 pagesChapter 7Yebegashet AlemayehuNo ratings yet

- Insurance Contract DefinitionsDocument20 pagesInsurance Contract Definitionsraechelle bulosNo ratings yet

- InsuDocument7 pagesInsumisssweet786No ratings yet

- Insurance Notes (Rkuw/Rondez) : What Laws Govern Insurance?Document46 pagesInsurance Notes (Rkuw/Rondez) : What Laws Govern Insurance?anne valbuenaNo ratings yet

- MercRev Insurance Syllabus (My Part)Document8 pagesMercRev Insurance Syllabus (My Part)p95No ratings yet

- Insurance Policy & PremiumDocument33 pagesInsurance Policy & PremiumCarlos Ryan RabangNo ratings yet

- Characteristics of An Insurance ContractDocument5 pagesCharacteristics of An Insurance ContractRamon GutierrezNo ratings yet

- Insurance CodeDocument39 pagesInsurance CodeRaymavy AdvinculaNo ratings yet

- Policy forms minimum requirementsDocument74 pagesPolicy forms minimum requirementsKelvin CulajaráNo ratings yet

- Life Stay Smart Plan BrochureDocument2 pagesLife Stay Smart Plan BrochureBadi SudhakaranNo ratings yet

- Kotak Complete Cover Group PlanDocument7 pagesKotak Complete Cover Group PlanGens GeorgeNo ratings yet

- Personal Accident Insurance Policy WordingDocument15 pagesPersonal Accident Insurance Policy WordingGravindra ReddyNo ratings yet

- 2 - Formation of Insurance ContractDocument21 pages2 - Formation of Insurance Contractchong huisinNo ratings yet

- Electronic Equipment Insurance Policy SummaryDocument6 pagesElectronic Equipment Insurance Policy SummaryArshad BashirNo ratings yet

- Claims Settlement and SubrogationDocument16 pagesClaims Settlement and SubrogationRaymund ArcosNo ratings yet

- Chapter 7Document20 pagesChapter 7Yebegashet Alemayehu100% (1)

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- NPS Form 102 GPDocument6 pagesNPS Form 102 GPVivek KumarNo ratings yet

- Phe Batagram Payroll 01-2021Document97 pagesPhe Batagram Payroll 01-2021Fayaz KhanNo ratings yet

- Accounting 211 Chapter 2Document34 pagesAccounting 211 Chapter 2Musfiqul AzadNo ratings yet

- Middle Market Investment Banking GuideDocument234 pagesMiddle Market Investment Banking GuideAnonymous MZMEHGHB100% (1)

- Banking-Finance Degree at Beirut Arab UniversityDocument5 pagesBanking-Finance Degree at Beirut Arab UniversityAA BB MMNo ratings yet

- Vidhyaashram First Grade College Corporate Accounting III II AssignmentDocument4 pagesVidhyaashram First Grade College Corporate Accounting III II AssignmentveenaNo ratings yet

- Gaisano Cagayan, Inc Vs Insurance Company of North America DigestDocument2 pagesGaisano Cagayan, Inc Vs Insurance Company of North America DigestAbilene Joy Dela Cruz100% (1)

- Bank Alfalah Limited: That Appear in Reliable Third-Party PublicationsDocument15 pagesBank Alfalah Limited: That Appear in Reliable Third-Party PublicationsChanchal KuriNo ratings yet

- Project On MCB GCUFDocument19 pagesProject On MCB GCUFAmna Goher100% (1)

- The North Face Case Audit MaterialityDocument2 pagesThe North Face Case Audit MaterialityAjeng TriyanaNo ratings yet

- Ketan Parekh: The Rise and Fall of the Bombay BullDocument31 pagesKetan Parekh: The Rise and Fall of the Bombay Bullolkp151019920% (1)

- Central Bank Act MCQDocument12 pagesCentral Bank Act MCQJemima LalaweNo ratings yet

- CIR Vs Manila Bankers' Life Insurance CorpDocument9 pagesCIR Vs Manila Bankers' Life Insurance CorpAnonymous vAVKlB1No ratings yet

- Senior Manager Internal Audit in Boston MA Providence RI Resume Edward NolanDocument3 pagesSenior Manager Internal Audit in Boston MA Providence RI Resume Edward NolanEdwardNolanNo ratings yet

- Executive Summary My ReportDocument1 pageExecutive Summary My ReportNirob Hasan VoorNo ratings yet

- ESinghbhum PDFDocument38 pagesESinghbhum PDFTumpa DasNo ratings yet

- AICPADocument5 pagesAICPAMikaela SalvadorNo ratings yet

- Why Hayek Was Wrong On Concurrent CurrenciesDocument12 pagesWhy Hayek Was Wrong On Concurrent CurrenciesKrzysiek RembiaszNo ratings yet

- Bacungan V CaDocument2 pagesBacungan V CaJoy Margaret Maniego RituaNo ratings yet

- Factoring ForfaitingDocument19 pagesFactoring ForfaitingSumesh MirashiNo ratings yet

- Study online at quizlet.com/_1lwdnhDocument3 pagesStudy online at quizlet.com/_1lwdnhPatriciaNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- 1 - BPI V CADocument5 pages1 - BPI V CADanielle Palestroque SantosNo ratings yet

- New Sources of Leverage Loans: Making Use of FHA Loans in A NMTC TransactionDocument4 pagesNew Sources of Leverage Loans: Making Use of FHA Loans in A NMTC TransactionReznick Group NMTC PracticeNo ratings yet

- Acctstmt DDocument4 pagesAcctstmt Dmaakabhawan26No ratings yet

- Audit Group 5 (Investment Audit and Cash Balance)Document12 pagesAudit Group 5 (Investment Audit and Cash Balance)feny febbianiNo ratings yet

- SFI Regional Coordinator ManualDocument38 pagesSFI Regional Coordinator ManualMorgan JohnstoneNo ratings yet