Professional Documents

Culture Documents

TiStory d020220160519 Jorgensen

Uploaded by

Shamir GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TiStory d020220160519 Jorgensen

Uploaded by

Shamir GuptaCopyright:

Available Formats

PROPERTY

DEVELOPMENT:

PRACTICAL INCOME TAX,

CGT AND GST ISSUES

Property development: Practical income tax,

CGT and GST issues

Written by:

Ron Jorgensen, CTA

Partner

Rigby Cooke Lawyers

VIC Division

19 / 20 May 2016

Leonda By The Yarra, Melbourne / Mercure, Geelong

Ron Jorgensen 2016

Disclaimer: The material and opinions in this paper are those of the author and not those of The Tax Institute.

The Tax Institute did not review the contents of this paper and does not have any view as to its accuracy. The

material and opinions in the paper should not be used or treated as professional advice and readers should

rely on their own enquiries in making any decisions concerning their own interests.

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

CONTENTS

1

Introduction .................................................................................................................................... 3

1.1

Overview ................................................................................................................................... 3

Introduction to Taxation ................................................................................................................ 4

2.1

Overview ................................................................................................................................... 4

2.2

Trading stock ............................................................................................................................ 5

2.3

Profit making schemes.............................................................................................................. 7

2.4

Capital gains tax ....................................................................................................................... 9

2.5

Differences in expense treatment ........................................................................................... 10

2.6

Mere realisation ...................................................................................................................... 10

Introduction to structuring .......................................................................................................... 11

3.1

Tax planning ........................................................................................................................... 11

3.2

Landowner entities .................................................................................................................. 12

3.3

Restructuring ........................................................................................................................... 13

3.4

Development entity ................................................................................................................. 13

3.5

Builder entity ........................................................................................................................... 14

Practical Examples ...................................................................................................................... 17

4.1

Main residence projects .......................................................................................................... 17

4.2

Mixed investment and sale projects ........................................................................................ 18

4.3

Private property syndicate projects ......................................................................................... 19

4.4

Partition and exchange and in-specie distribution projects .................................................... 20

4.5

GST residential development classifications .......................................................................... 21

4.6

GST going concern project disposals ..................................................................................... 22

Glossary ........................................................................................................................................ 24

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

1 Introduction

1.1 Overview

The distinction between property development and property investment is often difficult to divine in

practice.

Property development is used to mean the development of property for the purpose of sale (including

subdividing the familys acre block, broad acre subdivision and high-density strata developments).

Property investment is used to mean the development of property for the purpose of retention and

use to derive assessable income (including as premises of a trading business and to derive rental).

The diversity of a property project makes it impossible to deal comprehensively with the topic in a

paper of this nature.

This paper uses examples to illustrate and explain the income tax, CGT and GST treatment of

common property development transactions including:

distinguishing between and the taxation of trading stock, profit making schemes and capital

gains property development;

the selection of ownership and development structures to undertake property development;

main residence projects;

mixed investment and sale projects;

private property syndicate projects;

partition and exchange and in-specie distribution investment projects

GST residential development classifications

GST going concern project disposals

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

2 Introduction to Taxation

2.1 Overview

The income taxation of a property project is complex as up to three taxation regimes may apply to

levy tax. The transfer of land may be taxable:

1.

as a disposal of trading stock of a property development business;

2.

as a profit making scheme; or

3.

as a taxable gain on the disposal of a CGT asset.

The application of these regimes leaves little scope for the transaction to be considered a non-taxable

4

mere realisation of a capital asset. It is usually only simple developments of pre-CGT Assets that

will qualify for this treatment.

Accordingly, most analysis by practitioners concerns whether:

1.

the taxpayer is carrying on a business of property development (i.e. whether the trading stock

2.

rules apply);

the taxpayer had a profit making motive at the time of acquisition (i.e. whether there is a profit

3.

making scheme); or

5

a specific statutory provision (e.g. profit making undertaking or plan) applies.

The trading stock regime provides an exclusive regime for the taxation of land that constitutes trading

6

stock. The CGT regime expressly exempts trading stock (i.e. land) from being a CGT Asset. The

trading stock regime only operates on stock held in the ordinary course of business. Accordingly, the

trading stock regime and the profit making scheme regime (which has a residual operation for

7

revenue assets that are not trading stock) or the CGT regime (which operates for capital assets)

cannot operate concurrently.

Where the acquisition of land is for a profit making purpose, the land is considered a revenue asset

8

and its realisation a revenue profit. However, the fact that the land is a revenue asset does not

9

preclude it from being a CGT Asset. Land is a concurrent CGT Asset. Accordingly, the profit making

scheme regime and the CGT regime apply concurrently. The ordinary income regime has legislative

priority over the CGT regime, because, where a receipt is taxable as ordinary income and a capital

10

gain, the capital gain is reduced by the amount of the revenue profit. Where the net profit under the

profit making scheme regime is calculated differently to the CGT regime, concurrent taxation

operation is arguable possible.

Div. 70 ITAA 1997.

Sec. 6-5 ITAA 1997.

3 Pt 3.1 and 3.3 ITAA 1997.

4 i.e. land acquired before 20 September 1985.

5 Sec. 15-15 ITAA 1997; previously sec. 25A ITAA 1936.

6 Sec 118-25 ITAA 1997.

7 R. Parsons, Income Taxation in Australia, Law Book Company Ltd, 1985, para 12.3.

8 R. Parsons, Income Taxation in Australia, Law Book Company Ltd, 1985, e.g. para 12.8; FCT v Myer Emporium Ltd [1987] HCA 18.

9 Sec. 108-5(1) ITAA 1997 defines a CGT Asset as any kind of property and does not exclude revenue assets that are not trading stock.

10 Sec. 118-20 ITAA 1997.

1

2

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

If these provisions do not apply, the adviser must determine whether:

1.

2.

the CGT provisions apply; or

the realisation will be a non-taxable mere realisation.

2.2 Trading stock

Trading stock includes articles acquired for the purpose of manufacture, sale or exchange in the

ordinary course of business. Land may be trading stock for tax purposes.

A taxpayer will account for trading stock on the following basis:

1.

11

12

acquisition and ancillary costs (e.g. development costs) of purchased trading stock are an

allowable general deduction13 in the year the trading stock is held for use in a business;

14

and

2.

disposal consideration of trading stock is assessable income in the year of disposal of the

15

trading stock; and

3.

where the opening trading stock value (e.g. the previous year 30 June closing trading stock

16

value) exceeds closing trading stock value (e.g. the current year 30 June closing trading stock

17

4.

value), an allowable general deduction is incurred; or

where the closing trading stock value (e.g. the current year 30 June closing trading stock

value)

18

exceeds opening trading stock value (e.g. the previous year 30 June closing trading

stock value), assessable income is derived.

19

Vacant land will constitute trading stock in globo even before it is converted into a subdivided and

improved condition for sale.

20

trading stock upon subdivision.

In globo trading stock will become converted to individual articles of

21

The key factors to weigh in determining whether the particular property project was part of a business

of property development are:

1.

the taxpayers purpose in acquiring and carrying out the project;

2.

3.

the taxpayers history of property development or investment;

24

the extent of personal involvement of the taxpayer;

4.

the reasons for developing the land;

22

23

25

FCT v St Huberts Island P/L 78 ATC 4104; (1978) 8 ATR 452.

Sec. 70-5 ITAA 1997.

13 Sec. 8-1 ITAA 1997.

14 Sec. 8-1 & 70-15 ITAA 1997.

15 Sec. 6-5 ITAA 1997.

16 Sec. 70-40 ITAA 1997.

17 Sec. 70-35 ITAA 1997.

18 Sec. 70-45 ITAA 1997.

19 Sec. 70-35 ITAA 1997.

20 FCT v St Huberts Island P/L 78 ATC 4104; (1978) 8 ATR 452.

21 Barina Corporation Ltd v FCT (1985) 4 NSWLR 96.

22 FCT v Whitfords Beach P/L [1982] HCA 8 (new shareholders intent to develop) & Stevenson v FCT 91 ATC 4476; (1991) 22 ATR 56 (change in

development purpose).

23 FCT v Whitfords Beach P/L [1982] HCA 8 (new shareholders had a history of developments) & Crow v FCT 88 ATC 4620; (1988) 19 ATR 1565 (multiple

successive history of development).

24 Stevenson v FCT 91 ATC 4476; (1991) 22 ATR 56 (significant involvement of landowner); cf Casimaty v FCT 97 ATC 5135; (1997) 37 ATR 358 (most

aspects delegated to contractors and agents).

25 FCT v Whitfords Beach P/L [1982] HCA 8 (systematic for a profit); cf Casimaty v FCT 97 ATC 5135; (1997) 37 ATR 358 (piecemeal as increasing debt

and deteriorating heath dictated).

11

12

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

26

5.

the duration of ownership;

6.

7.

the scale of the sub-division; and

28

the extent of any construction work undertaken.

27

Reasonable practitioners may differ on whether a particular property project was a property

development business when weighing these factors resulting in potential dispute with the ATO.

Reasonable practitioners may differ on ddetermining the cost of land and improvements during a tax

period and allocating costs to individual articles of trading stock upon subdivision resulting in potential

dispute with the ATO.

The concept of cost is directed at ascertaining the costs incurred in the course of a taxpayers

materials purchasing and manufacturing activities to bring the article to the state in which it became

29

trading stock held. It arguably excludes expenses and overheads that do not have a relationship

with production (e.g. marketing, distribution and selling expenses and general administration

30

31

expenses).

Although many of these costs will be otherwise deductible, there are a number of

expenses that may neither be included in the cost of trading stock nor deductible as a general

business outgoing.

Generally, the following costs of subdivision should be characterised as part of the cost price of the

broad acres before subdivision and, therefore, upon subdivision part of the cost price of the

32

subdivided lots:

1.

the cost of infrastructure land (i.e. that part of the broad acres land on which services and

utilities were to be build and transferred to the Council);

2.

the costs of infrastructure works (e.g. the cost of establishing services and utilities

infrastructure land); and

3.

the external costs (e.g. the costs of headworks including the provision of services and

utilities

34

33

on the

to the land, but on land not owned by the taxpayer).

It is unclear whether reinstatement costs may be used to reduce the market selling value of broad

35

acres. The cost of, for example, reinstating excavation works and rectifying site contamination may

markedly reduce the market value of land (at least for a period).

From year to year, the taxpayer may determine to value each article of trading stock at cost, market

36

selling value or replacement price. Replacement price is generally not an appropriate method of

Scottish Australian Mining Co Ltd v FCT (1950) 81 CLR 188 & Casimaty v FCT 97 ATC 5135; (1997) 37 ATR 358; cf Stevenson v FCT 91 ATC 4476;

(1991) 22 ATR 56.

27 FCT v Whitfords Beach P/L [1982] HCA 8 (magnitude of development does not convert it into a business); cf Stevenson v FCT 91 ATC 4476; (1991) 22

ATR 56 (magnitude of development is highly persuasive).

28 Stevenson v FCT 91 ATC 4476; (1991) 22 ATR 56 (extensive services and utilities provided); cf Casimaty v FCT 97 ATC 5135; (1997) 37 ATR 358

(minimal works to obtain council approval).

29 e.g. Philip Morris Ltd v FCT 79 ATC 4352; (1979) 10 ATR 44 (regarding costing generally and not specifically land).

30 Rulings IT 2350 & IT 2402.

31 Determination TD 92/132.

32 FCT v Kurts Development Ltd 98 ATC 4877; (1998) 39 ATR 493.

33 e.g. internal access roads, internal street lighting, internal sewage and drainage and parklands.

34 e.g. external road works to the broad acres, downstream sewage and drainage to the broad acres and external parklands and contributions to civil

services such as school improvements and expansions.

35 Refer to Case A42 69 ATC 235 where new Council requirements on developing land arguably reduced the lands market value. The taxpayer was

unsuccessful because the change occurred after the close of the income year the subject of the assessment.

36 Sec. 70-45 ITAA 1997.

26

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

valuing land that is trading stock.

37

For an appreciating article of trading stock such as land where

there will be an increase in value between the start of an income year and the end of the income year,

the change from:

1.

cost to market selling value, will likely derive assessable income; and

2.

market selling value to cost, will likely incur a general deduction.

It may be possible to recognise a general deduction for the loss in value in a particular year (e.g. by

reinstatement costs) by changing from cost to the market selling value method. The change back

from market selling value to cost will reverse this general deduction and derive assessable income.

Although relatively short term, this may create a cash flow benefit in the appropriate circumstances.

2.3 Profit making schemes

The ordinary income of a business operation or commercial transaction includes the profit on certain

isolated transactions entered into with the purpose of making a profit.

Westfield Ltd v FCT

39

38

emphasised the distinction between a transaction occurring as part of

business operations (Business Limb) and as part of a commercial transaction outside the ordinary

business operations (Commercial Limb).

Arguably, the main difference between the Business Limb and Commercial Limb is that:

1.

it will automatically be inferred at all times that the taxpayer had a profit-making intent under the

Business Limb; but

2.

it will need to be positively establish at the time of entering into the transaction that the taxpayer

intended to make a profit in relation to the particular transaction by which the profit was in fact

made and not simply in a temporal sense under the Commercial Limb.

40

The Commissioner considers that the sale of property will be a profit making scheme under both limbs

if the taxpayer had a profit making intent at the time the sale transaction is entered into and it need

not be established that the profit arose in the manner initially intended.

41

The Commissioners position would significantly expand the operation of the profit making scheme

regime.

The Commissioner considers the following factors to determine whether an isolated transaction

constitutes a profit making scheme:

1.

2.

the nature of the entity undertaking the operation or transaction;

the nature and scale of other activities undertaken by the taxpayer;

3.

the amount of money involved in the operation or transaction and the magnitude of the profit

sought or obtained;

e.g. Parfew Nominees P/L v FCT 86 ATC 4673 (1986) 17 ATR 1017.

FCT v Myer Emporium Ltd [1987] HCA 18; Westfield Ltd v FCT 91 ATC 4234; (1991) 21 ATR 1398; Ruling TR 92/3.

39 Westfield Ltd v FCT 91 ATC 4234; (1991) 21 ATR 1398.

40 FCT v Myer Emporium Ltd [1987] HCA 18; Westfield Ltd v FCT 91 ATC 4234; (1991) 21 ATR 1398; & FCT v Hyteco Hiring P/L 92 ATC 4694; (1992) 24

ATR 218.

41 Ruling TR 92/3.

37

38

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

4.

the nature, scale and complexity of the operation or transaction;

5.

6.

the manner in which the operation or transaction was entered into or carried out;

the nature of any connection between the relevant taxpayer and any other party to the

7.

operation or transaction;

if the transaction involves the acquisition and disposal of property, the nature of that property;

8.

and

the timing of the transaction or the various steps in the transaction.

Profit is calculated according to profit and loss accounting methodology and not receipts and

outgoings tax accounting. The profit calculation assumes the profit arises from one transaction and

not from a continuing business. The methodology of calculating the profit has not received much

42

judicial comment. The profit is the difference between the price realised on disposal, less the costs

43

of acquisition and the costs of selling.

44

45

It is unclear whether historical cost or market value at the time the property becomes subject to a

profit making scheme is used. The historical cost basis would significantly increase the profit on the

transaction and might lead to double taxation.

46

The concept of cost is arguably includes a wider variety of costs in the profit calculation. The fact

that a cost has not yet been paid or a liability is contingent at the time of calculating the profit does not

47

preclude such costs being subtracted from the profit. The calculation may therefore result in costs

not otherwise allowable as a cost of trading stock being subtracted/deducted under the profit making

scheme regime

Where land is sold, the costs applicable to the development must be apportioned to each parcel of

48

land sold. This is done under the method of tax accounting. The calculation method will need

modification if the project is restructured before development is completed. These issues are

variously discussed in the following Taxation Determinations (which in several respects can be

criticized):

1.

TD 92/126 Income tax: property development: if in an isolated commercial transaction land is

acquired for the purpose of development, subdivision and sale, but the development and

subdivision do not proceed, how is a profit on a sale of the land treated for income tax

purposes?

2.

TD 92/127 Income tax: property development: if land is acquired for development, subdivision

and sale but the development is abandoned and the land sold in a partly developed state, how

is a profit on a sale of the land treated for income tax purposes?

3.

TD 92/128 Income tax: property development: if land is acquired for development, subdivision

and sale, but after some initial development the project ceases and is recommenced in a later

income year, how is a profit on a sale of the land treated for income tax purposes?

FCT v Whitfords Beach P/L [1982] HCA 8 (the decision when remitted to the Federal Court to determine the profit of the transaction).

FCT v McClelland (1969) 118 CLR 353, 358.

44 FCT v Myer Emporium Ltd [1987] HCA 18.

45 FCT v Whitfords Beach P/L [1982] HCA 8.

46 FCT v Whitfords Beach P/L [1982] HCA 8; R. Parsons, Income Taxation in Australia, Law Book Company Ltd, 1985, para 12.40

47 R. Parsons, Income Taxation in Australia, Law Book Company Ltd, 1985, para 12.42 & 12.43.

48 FCT v Thorogood (1927) 40 CLR 454

42

43

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

2.4 Capital gains tax

A capital gain or loss may arise upon the occurrence of a CGT event (e.g. a transfer)

49

in respect of a

50

CGT asset (e.g. land), unless an exemption applies, rollover relief defers the capital gain or a

provision denies the loss.

A capital gain arises where the proceeds from the CGT event exceed the adjusted acquisition costs of

51

the CGT asset. A capital loss arises where the proceeds from the CGT event are less than the

52

adjusted acquisition costs of the CGT event.

Capital gains on assets acquired before 20 September 1985 are disregarded.

A net capital gain is included in the assessable income of the taxpayer.

53

54

An individual or trust that has held a CGT asset for at least 12 months may reduce the capital gain by

50% and a superannuation fund may reduce the capital gain by 33% under the CGT general

discount.

55

56

A number of exemptions (e.g. the main residence exemption ) and concessions (e.g.

57

small business concessions ) may also apply in particular circumstances.

Acquiring and retaining land as a capital asset to access these discounts, exemptions and

concessions is central to tax planning property projects.

The cost base of acquiring an assets consists of 5 elements:

1.

The 1st element of cost base represents amounts of money or property paid or given, or

2.

required to be paid or given, to acquire the asset.

The 2nd element of cost base includes incidental costs of acquisition (e.g. advice costs,

transfer costs, stamp duty, advertising costs and valuation fees).

3.

The 3rd element of cost base includes non-capital costs of ownership (e.g. interest not

otherwise deductible, repairs and insurance costs and rates and land tax).

4.

5.

The 4th element of cost base includes capital expenditure increasing the asset's value.

The 5th element of cost base includes capital expenditure to preserve title.

Some project expenses may not be included in the cost base. For example, it is unclear whether the

st

58

th

1 element of cost base includes remote third party tender payments and whether the 4 element of

cost base include compensation payments to obtain Council approvals.

Sec. 104-10 ITAA 1997 - Disposal of a CGT Asset: CGT event A1.

Sec. 108-5 ITAA 1997.

51 Sec. 102-5 ITAA 1997.

52 Sec. 102-10 ITAA 1997.

53 Sec. 104-10(5) ITAA 1997 - Disposal of a CGT Asset: CGT event A1; Determination TD 7.

54 Sec. 102-5 ITAA 1997.

55 Sec. 115-25 ITAA 1997; Determination TD 2002/10.

56 Div. 118-B ITAA 1997.

57 Div. 152 ITAA 1997.

58 The provision would appear to be sufficiently widely worded.

49

50

Ron Jorgensen 2016

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

2.5 Differences in expense treatment

It is unclear whether development costs such as:

1.

informal compensation payments to residents objecting to the development;

2.

3.

the notional value of personal services in managing the development;

59

60

opportunity payments,

tender administration payments

and transferable floor area

payments

61

will be a cost of trading stock, subtracted in calculating profit under the profit making scheme regime

or an element of cost base under the CGT regime or whether such costs will be wasted (i.e. black

hole expenditure).

The entitlement to these expenses can be inconsistent across the regimes, so tax planning may

require structuring so a particular regime applies which will include the particular expenses.

2.6 Mere realisation

Where the trading stock, profit making scheme or capital gains tax regimes do not apply (e.g. preCGT assets), the proceeds of the project are not taxed.

Post-CGT buildings and intangible improvements to pre-CGT Assets are separate post-CGT Assets.

These improvements are subject to the CGT regime, requiring capital proceeds to be apportioned.

A post-CGT building or structure is a separate asset to the pre-CGT land.

62

Accordingly, the building

component of a property development on pre-CGT land, is taxable. The Commissioner considers that

the increase in land value attributable to Council approval for rezoning and development will be a

separate post- CGT Asset and separately taxable under the CGT regime.

63

Tax planning to retain the pre-CGT status of land usually involves appointing a separate development

entity to undertake any development so that the landowner remains very passive so that the property

project does not become a profit making scheme.

A payment to a person to assume that persons right to tender for land in a restricted tender arrangement.

A payment to a tender offeror to permit the taxpayer to tender or to defray administration costs of the offeror in considering the tender.

61 The ability for the owner of a conservation site to transfer developer floor area to another site to increase the maximum permissible floor area for

development purposes of the other site; see the Naval Military & Airforce Club of South Australia Case (1994) 28 ATR 161.

62 Section 108-55(2) of the 1997 Act.

63 CGT Determination No. 5; sec. 108-70(2) ITAA 1997.

59

60

Ron Jorgensen 2016

10

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

3 Introduction to structuring

3.1 Tax planning

Tax planning is the professional art of balancing different legal and tax entities relative tax and nontax characteristics including:

64

1.

tax treatments (degree of transparency, working capital

splitting/streaming, entitlement to CGT discounts and concessions);

retention,

distribution

2.

progressive marginal and corporate tax rates;

3.

4.

investment flexibility (capitalisation and financing);

asset protection robustness (personal, corporate and intra-entity insolvency);

5.

6.

business succession flexibility (third party or intergenerational transmissions);

governance regulation (degree of contractual, statutory and governmental and professional

7.

supervision); and

administrative and compliance complexity and cost.

Legitimate tax planning uses tax policy distinctions/disconformities to reduce the overall effective tax

rate.

Tax planning opportunities are dictated principally by whether the landowner intends to sell the

subdivided land to produce a profit or retain the land for income producing purposes (e.g. to use in a

business or for leasing). This will determine whether the profit is potentially taxable on revenue

account (e.g. as ordinary income) or on capital account (e.g. as a taxable capital gain) respectively.

Choosing the correct business structure is an art rather than a scientific application of principles. The

choice of structure will vary depending upon (amongst other matters) the insolvency protection,

liquidity and financing requirements and priorities of each participant.

There is a significant benefit of classifying a transaction on capital account on the odd occasion where

the mere realisation principle will apply. Also, there is arguably a bias towards classifying a

transaction on capital account where the taxpayer has carried forward capital losses or there is the

opportunity to use the CGT general discount

65

or the small business concessions.

66

This paper does not discuss the State taxes consequences of structuring including stamp duty and

land tax.

B. Freudenberg, Tax on my mind: Advisors recommendations for choice of business form, (2013) AT Rev 33.

Div. 115 ITAA 1997.

66 Div. 152 ITAA 1997.

64

65

Ron Jorgensen 2016

11

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

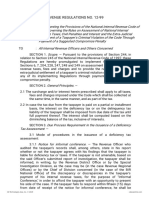

3.2 Landowner entities

Selecting the landowner structure for a property project is not always possible.

67

A comparison of some of the relevant attributes of the above structures are summarised below:

Individual

Partnship

Family

Trust

Unit Trust

Company

Joint

Venture

Low

Medium

Medium

Medium

High

High

Partnership

Acts

Trustee Acts

Trustee Acts

Corporations

Act

Insolvency risk to participants

High

High

Low

Low

Low

Medium

Family dispute risk to

participants

High

High

Low

High

High

High

Access to development losses

Yes

Yes

No68

No

No

Yes

Access to negative gearing at

participant level

Yes

Yes

No

Yes69

Yes70

Yes

Access to 50% CGT Discount

Yes

Yes

Yes

Yes

No

Yes

Access to equity

Yes

Yes71

Yes

possible

CGT Event

E4

Dividend

Division 7A

Yes

Distribution flexibility

Low

Low

High

Low

Low

Low

Administrative complexity

External regulation

A company provides a high degree of insolvency protection and has a well-defined corporate

governance process, which is ideal for unrelated business parties. A company may be suitable for a

trading stock or profit making scheme project landowner. However, legislative restrictions on dividend

72

73

74

policies; the inability to distribute current year losses, and ineligibility for the CGT discount;

means that a company is not the most appropriate tax structure for a capital gains project landholder.

A trust (particularly a discretionary trust or a hybrid unit trust) provides a high degree of flexibility in

profit distribution policy. Again, the inability to distribute current year losses and restrictions on

transferring losses without making a family trust election

75

means that a trust is not the most

appropriate structure for landownership between unrelated parties. Negative gearing discretionary

76

and hybrid trusts is also problematic.

e.g. the land was acquired under a will or by a particular entity for commercial and other reasons without regard to the taxation and commercial issues for

future development.

68 The trust loss rules in Schedule 2F of the 1936 Act may permit injection activities in limited circumstances.

69 If borrowed at participant level and used to capitalise the unit trust.

70 If borrowed at participant level and used to capitalise the company.

71 FCT v Roberts & Smith 92 ATC 4380; (1992) 23 ATR 494; Ruling TR 95/25.

72 Div. 7A ITAA 1936 (deemed dividends); sec. 109 ITAA 1936 (excessive remuneration); Div. 202 - 207 ITAA 1997 (imputation credits); sec. 160APHC160APHU ITAA 1936 (45-day holding period rules); Division 197 ITAA 1997 (share tainting rules)

73 Div. 36 ITAA 1936 (prior year losses); Div. 165 ITAA 1997 (current year losses and bad debt deductions); Div. 175 (current year deductions); Div. 170

ITAA 1997 (intercompany loss transfers)

74 Sec. 115-10 ITAA 1997.

75 Sch. 2F ITAA 1936.

76 Income Tax Ruling IT 2385 & ATOID 2003/546.

67

Ron Jorgensen 2016

12

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

A partnership permits the distribution of current year losses and has a reasonably well-defined

governance process. However, the agency and fiduciary relationships of the partners and the joint

and several liabilities of the partners generally outweigh the advantage of using current year losses,

making a partnership an unattractive structure.

An unincorporated joint venture or a non-entity joint venture provides separate taxation treatment of

77

landowners.

The Commissioner limits a joint venture operation to circumstances where the

78

participants are compensated by a share of the output rather than joint or collective profits.

An

improperly established joint venture structure may not achieve the desired business,

taxation

81

requirements, because it is in fact a general law partnership

82

79

financing

80

and

83

or a taxation partnership .

Various forms of unincorporated joint ventures of companies and trusts are frequently used to achieve

a satisfactory mix of the above requirements.

3.3 Restructuring

Care needs to be exercised when the structuring of a property development is intended to be on

capital account, because changes to the taxpayer structure (e.g. a change of shareholding or a

change of purposes in a Constitution) may transform a capital account development into a property

development business. The admission of new equity parties to fund the property development may

be the catalyst that transforms a capital account development into a property development business.

84

Such changes were considered critical in FCT v Whitfords Beach Co P/L where beach front land

held in a company and used as a right of way to fishing shacks on the beach was acquired and

restructured to permit subdivision and development.

85

The practice of establishing separate development entities to argue that each entity does not have a

history of property development may be of little effect. The members extensive history of property

86

development was a significant factor in FCT v Whitfords Beach Co P/L in concluding that the

87

company was carrying on a property development business.

This reasoning suggests that the

Courts may look beyond the separate legal entity to the history of members and possibly other key

associates such as directors and managers.

88

3.4 Development entity

Ruling GSTR 2004/2.

Ruling GSTR 2004/2.

79 The Laws of Australia, The Law Book Company Limited, Part 4.8, Chapter 4.

80 The Laws of Australia, The Law Book Company Limited, Part 4.8, Chapter 4.

81 Discussed in M. Walsh, Partnerships joint ventures and taxation (1978-79) 13 Taxation in Australia, 478; G. Ryan, Joint venture agreements, (1982) 4

AMPLJ, 101; H. Speath, Joint ventures & GST, (2001) 4(3) Tax Specialist, 162.

82 A general law partnership is defined as the relationship that subsists between persons carrying on a business in common with a view to profit (Section

5(1) of the Partnership Act).

83 A partnership for tax purposes includes a general law partnership and an association of persons in receipt of income jointly (Section 995-1 of the 1997

Act). For the purpose of this paper, general law partnership will refer to a partnership satisfying the Partnership Acts, a taxation partnership will be used

to refer to persons in receipt of income jointly and partnership will refer to both types.

84 FCT v Whitfords Beach P/L [1982] HCA 8.

85 FCT v Whitfords Beach P/L [1982] HCA 8, Gibbs CJ; Wilson J; cf Mason J.

86 FCT v Whitfords Beach P/L [1982] HCA 8.

87 FCT v Whitfords Beach P/L [1982] HCA 8 Gibbs CJ; Mason J cf Wilson J.

88 compare Determination TD 92/124 where the Commissioner takes a broad view of when land will be trading stock.

77

78

Ron Jorgensen 2016

13

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

Since the indicia of carrying on a property development business includes the extent of involvement of

the landowner, the appointment of a development entity to manage the development and contract

with service providers may permit the landowners to remain very passive to assist in establishing that

the landowner is not carrying on a business.

The developer entity can be a company or trust. Depending on how the development contract is

structured, derivation of income and incurring of expenses can be managed so avoid liquidity

problems.

3.5 Builder entity

The Proposed Structure

The obligation to incur and carry building costs may be transferred by the building contract to Builder

P/L.

A turn-key or modified turn-key building contract may require Builder P/L to incur and carry

development costs and to render an account only upon achieving a milestone (e.g. at lock up or

practical completion stages) or upon sale of the development (respectively).

Builder P/L deducts all these outgoings on a current year basis and returns income in the later years

when the milestones are met or the development is sold (as applicable). The landowner only brings

into account the increase in value of the land resulting from the building at the later years when the

milestones are met or the development is sold. As a group, the group has effectively accelerated the

deduction for the building costs.

Ron Jorgensen 2016

14

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

Tax Effect for the Builder

Builder P/L will derive income when entitled to bill for the work (being the time Builder P/L has a

89

present and non-contingent right to receive payment). This will be when Builder P/L achieves the

milestone or the development is sold (as applicable). The Commissioner appears to have accepted

this proposition in respect of arms length contracts.

90

The Commissioner requires Builder P/L to apply normal accounting methods.

91

The basic method and estimated profit basis are alternate accounting methods available to Builder

P/L to return income in respect of a long term construction contract. A long-term construction

92

contract is a building contract that extends over two income years.

The basic method returns

income (e.g. all progress and final payments) derived in an income year less all outgoing deductions

93

incurred in carrying on the building business in an income year. The estimated profit basis returns

the ultimate profit or loss over the duration of the contract on a reasonable basis in accordance with

accepted accounting standards.

The Commissioner has attempted unsuccessfully to require Builder P/L to use the estimated profit

basis where derivation of income for Builder P/L is deferred under the building contract.

94

Tax Effect for the Landowner

The landowner is obliged to include in the cost of trading stock expenditure incurred in the course of

the landowners material purchasing and manufacturing activities to bring the article to the state in

which it became trading stock held. The building expenditure under the turn-key and modified turnkey building contracts are not incurred until Builder P/L achieves the milestone or the development is

sold. This is because the landowner does not have a non-contingent liability to pay those amounts

until that time. Accordingly, the landowner does not have an obligation to increase the cost value of

trading stock by the value of the building improvements.

Henderson v FCT 70 ATC 4016; (1970) 1 ATR 596; Barratt v FCT 92 ATC 42745; (1992) 23 ATR 339.

Determination TD 94/39.

91 Ruling IT 2450.

92 Ruling IT 2450.

93 This represents the simple application of the statutory provisions; Grollo Nominees P/L v FCT 97 ATC 4585; (1997) 36 ATR 424.

94 Grollo Nominees P/L v FCT 97 ATC 4585; (1997) 36 ATR 424.

89

90

Ron Jorgensen 2016

15

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

Reduced Building Margin

There is no requirement for a captive builder to charge a captive landowner full margins on services.

Where the landowners development is on capital account Builder P/L might forgo the builders margin,

which would otherwise be taxable to Builder P/L as ordinary income. As the value of the building vest

in the landowner, Builder P/Ls notional profit may be shifted to the landowner and converted to

capital.

95

This value shift may have value shifting consequences where Builder P/L is incorporated.

96

Part IVA

The general anti-avoidance provisions in Part IVA ITAA 1936 need to be carefully considered.

95

96

Grollo Nominees P/L v FCT 97 ATC 4585; (1997) 36 ATR 424

Div. 727 ITAA 1997.

Ron Jorgensen 2016

16

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

4 Practical Examples

4.1 Main residence projects

The purpose of this example is to demonstrate the technical considerations that must be considered

in selling a 2 lot main residence subdivision.

Jack purchased 2 hectares (5 acres) in July 1997 on the outskirts of St Helens township. Jack completed

building a main residence on the property by December 2008. The property has tripled in value. Jack

wants to subdivide into 2 x 2.5 acres blocks, to retain one block as a main residence and to sell the other

block.

The property was acquired to be used as a main residence and is on capital account. The property is

97

within the 2 hectare main residence limitation.

The main residence exemption will apply to the block and subsequent dwelling from date of

acquisition, if the dwelling is built within 4 years from the date the land was acquired. The main

residence must be moved into as soon as practicable after the work is finished and cannot be sold

98

within 3 months of completion.

The subdivision of the property is not a CGT event and the cost base is apportioned between the new

99

split blocks. The Commissioner will accept an apportionment between the new split blocks on an

area basis or a relative market value basis.

100

The main residence exemption attaches to the land with the dwelling. Accordingly, the main

101

residence exemption will not apply to the sale of the vacant land.

Therefore, to preserve the main

residence exemption, the current dwelling and land should be sold and the taxpayer should retain and

build upon the vacant land.

Sec. 118-120 ITAA 1997; Determination TD 1999/67.

Sec. 118-150 ITAA 1997.

99 Sec. 112-25 ITAA 1997; Determination TD 7.

100 Determination TD 97/3.

101 Sec. 118-165 ITAA 1997.

97

98

Ron Jorgensen 2016

17

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

The taxpayer can build on the vacant block, assume occupation of the new main residence and sell

102

the old main residence, provided the concurrent ownership periods do not exceed 6 months.

A

103

modified method of calculating the ownership period would then apply.

The taxpayers ownership

104

interest in the old main residence only ends at settlement of the sale.

Care is required to ensure

the 6 months period is not exceeded. Long settlement dates can, therefore, be hazardous.

Alternatively, the taxpayer can sell the old main residence and then build a new main residence on

the vacant land. The main residence exemption may be retained in the new main residence for up to

4 years from the date the land is acquired (not applicable in this example). Otherwise the 4 year

period applied for the period immediately before the land became the new main residence. The new

main residence must be moved into as soon as practicable after the work is finished and cannot be

sold within 3 months of completion.

105

The ownership period of the new main residence does not include the period of the old main

residence (if more than 4 years from the date of acquisition of the land). Accordingly, tax will be

payable on the subsequent disposal of the new main residence on a proportionate basis. The

alternate scenarios need to be compared for tax efficiency.

The subdivision and sale of a main residence is unlikely to be an enterprise for GST purposes.

107

subdivision and issue of new titles will, therefore, have no GST consequences.

106

The

4.2 Mixed investment and sale projects

The purpose of this example is to demonstrate the effect of mixed investment & development purpose

projects.

Jack acquired a property for the purpose of subdivision, building 1 shop, 3 terrace houses and

48 townhouses for lease. To repay the bank, it is estimated that the shop, terrace houses and

15 townhouses would be sold (i.e. 36% of the project). In fact only the shop, 3 terrace houses and

13 townhouses were sold (32% of the project).

Sec. 118-140 ITAA 1997.

Sec. 118-130 ITAA 1997; Determination TD 2000/13.

104 Gasparin v FCT 94 ATC 4280, 4288; (1994 ) 28 ATR 130.

105 Sec 118-150 ITAA 1997.

106 Determination GSTD 2000/8; Miscellaneous Taxation Ruling MT 2000/1, example 11.

107 Ruling GSTR 2003/3.

102

103

Ron Jorgensen 2016

18

Ron Jorgensen

ARM Construction P/L v FCT has stated that:

Property Development - Practical Income Tax, CGT and GST Issues

108

The decisive factor in determining whether or not the unitsbecame trading stock at any timewas the primary or substantial intent or purpose of the

parties, which intention or purpose was carried into execution. The fact that they may have had a secondary or subsidiary purpose in selling the units if that

became necessary in order to discharge their subsequent borrowingdid not stamp upon the units the character of trading stock

[So] far as the unsold town houses are concerned, the situation is the sameI am of the opinion that the town houses in fact retained as well as the 13

sold, could not be characterised a trading stock, a conclusion which extends to the shop and the terrace houses. But I consider that the profits arising on

the sale of theproperties in fact sold is assessable under the provisions of sec. 26(a). So far as the shop and the two terrace houses are concerned, I

find that it wa the intention of the appellants from the outset o sell them in order to assist funding the development, an intention which related with greater

certainty to the ship than to the terrace houses.

Accordingly, the properties intended to be sold and in fact sold would be a profit making scheme. The

balance would retain their capital status. Although the taxpayer thought he would have to sell an

additional 2 townhouses, that expectation does not appear to make those 2 townhouses part of the

profit making scheme.

4.3 Private property syndicate projects

The purpose of this example is to demonstrate that a unit trust property syndicate is generally tax

inefficient, unless a specially modified unit trust is used.

Jack and seven unrelated people acquired a property in a unit trust for the purpose of subdivision,

building a house on each block and distributing the block in specie (in kind) to each unitholder.

The mixed purpose of the participants creates a problem identifying the purpose of the project. To

reconcile the mixed purposes, the property should be subdivided and each block distributed in kind to

109

the relevant unit holder.

This will ensure the property is not trading stock and is not a profit making

scheme. This will permit the various unit holders to have different intentions.

The terms of the unit trust will also be vital. The unit holders of a traditional unit trust hold a tenants110

in-common interest in all of the property (not any identifiable part of the property).

After subdivision,

each unit holder owns a proportionate interest in each block. The partition and exchange of interests

so that each unit holder owns one block absolutely represents a proportionate disposal of an interest

ARM Construction P/L v FCT 87 ATC 4790, 4806; (1987) 19 ATR 337.

ARM Construction P/L v FCT 87 ATC 4790, 4806; (1987) 19 ATR 337.

110 CSR (Vic) v Karingal 2 Holdings P/L [2003] VSCA 214.

108

109

Ron Jorgensen 2016

19

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

in all other blocks.

consequences.

The disposal of the various interests will, therefore, have income tax

111

If a special purpose unit trust is used where each unit in the trust grants a beneficial interest in the

particular block of land, then the unitholder will have an absolute entitlement to the land and there is

112

no partition and exchange.

The unit holder exemption exempts an in-kind transfer of land by the principal unit trust to a unit

holder who was a unit holder at the time the land was acquired.

In respect of the exemption:

1.

only unit holders at the time the land was acquired can obtain an exempt transfer and other unit

holders are subject to duty;

2.

the exemption is only applicable in the same proportion as the unit holders proportionate unit

holding; and

3.

the value of the unit holder in the unit trust must decrease by a redemption of unit or by the

overall value.

The transfer must be a transfer in the capacity of beneficiary and not on sale. There must not be any

collateral consideration.

The beneficiary must receive the property in its capacity that it owned the units. Where the unit holder

was a company there must be no change in ownership control or as a trustee there must be no

change in the relevant beneficiary from the date the land was acquired by the principal unit trust.

The unit trust is treated as a separate entity for GST purposes.

of property will have GST consequences.

113

Accordingly, the in kind distribution

114

4.4 Partition and exchange and in-specie distribution projects

The purpose of this example is to demonstrate how a partition and exchange occurs.

Jack and Jill inherited a property at tenants-in-common. Jack and Jill wish to subdivide the land so each

owns their own block.

Determination TD 92/148.

Sec. 116-30 ITAA 1997; cf TR 2004/D25; CSR (Vic) v Victoria Gardens Developments P/L [2000] VSCA 233.

113 Sec 23-5 & 184-1 GSTA 1999.

114 By analogy with partnerships see Rulings GSTR 2003/13 & GSTR 2003/D5.

111

112

Ron Jorgensen 2016

20

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

A partition of land occurs when W and B as co-owners of both white acre and black acre exchange

115

their interests so that W solely owns white acre and B solely owns black acre.

116

In Maybelina Investments P/L v CSR (Vic), M, A and I acquired property as co-owners to develop

and partition 6 lots. Prior to partition 2 lots were sold to third parties. The partition of the balance land

was effected by sale contracts for a specified monetary amount. The SRO argued that since the

transaction was effected as a sale, it was not a partition and it was subject to transfer duty. Further,

since some land was removed from the pool of land, a partition could not occur in respect of any of the

property because there was not a community of ownership of the original acquired property.

VCAT held that a partition occurred in respect of the land interests exchanged despite being effected

by a sale. However, no partition occurred in respect of the lots sold to third parties accordingly, duty

was payable on the value of that land.

Ruling DA.017 provides the following worked example:

Example

X and Y own land in Victoria valued at $100,000 with a respective 30% and 70% interests in the land. The land is partitioned under an agreement such that

after the partition, each has an interest of $50,000 in the land.

No duty would be charged on the transfer of Y's interest in the land because the value of Ys interest in the land prior to the partition (ie $70,000) exceeds

the value after the partition (ie $50,000). Duty would be charged on the transfer of X's interest in the land because the value after the partition (ie $50,000) is

greater than that before the partition (ie $30,000). Duty would therefore be charged on the transfer of the interest in land to X and calculated on a value of

$20,000.

Provided each block is of equivalent value to the value of the tenants-in-common interest, no duty

should be paid.

4.5 GST residential development classifications

This example discusses the differences between different types of residential premises for GST

purposes.

Jack owned a terrace and significantly renovated the interior, including moving walls, altering the

location of the bathroom, refurbishing the kitchen and building a second story on the rear of the terrace.

Jack used the terrace as a dental surgery. Jack listed the property for sale and the purchaser wanted to

use the property as medical treatment rooms.

115

116

Sec. 27 DAV 2000; CSR (Vic) v Christian [1991] 2 VR 129.

Maybelina Investments P/L v CSR (Vic) [2004] VCAT 549.

Ron Jorgensen 2016

21

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

10% GST is levied on the value (or deemed value) of taxable supplies of goods, services, rights and

things connected with Australia made in the course or furtherance of an enterprise that is registered or

117

required to be registered but does not include GST-free, financial or input taxed supplies.

Such an enterprise is entitled to an input tax credit or reduced input tax credit in respect of creditable

acquisitions of goods, services, rights and things obtained in the course or furtherance of the

118

enterprise that are not referable to GST-free, financial or input taxed supplies.

The supply of new residential premises is a taxable supply. The supply of residential premises is an

119

input taxed supply. The supply of commercial residential premises is a taxable supply.

Residential premises means land or a building that is occupied or is intended to be occupied and is

capable of being occupied as a residence or for residential accommodation (regardless of the term of

120

the occupation or intended occupation).

121

The character of the premises is determined by the physical characteristics of the premises test

122

without reference to the suppliers use of the premises

or the recipients intend use of the

123

premises.

Jacks terrace demonstrates all the objective characteristics of residential premises. Jacks use of the

premises and the recipients intended use of the premises is irrelevant and does not convert the

premises into commercial premises.

The premises will be new residential premises where the premises are substantially renovated.

124

The Commissioner considers substantial renovation includes:

1.

the renovation needs to affect the building as a whole and result in the removal or replacement

125

of all or substantially all of the building;

2.

substantial renovations can be the structural or non-structural components of the building;

3.

the removal and replacement of a kitchen and bathroom will not of itself be substantial

127

renovation;

4.

the additional story to the building was not substantial renovations;

126

128

Reasonable practitioners can differ on what constitutes substantial renovation and whether substantial

renovations has occurred to Jacks terrace.

Reasonable practitioners can differ on whether the sale is the input taxed supply of residential

premises or the taxable supply of new residential premises.

4.6 GST going concern project disposals

Sec. 9-5 GSTA 1999.

Sec. 11-20 GSTA 1999.

119 Sec. 40-65 GSTA 1999

120 Section 195-5 GSTA 1999.

121 Sunchen P/L v FCT [2010] FCAFC 138

122 Ruling GSTR 2000/20 at [19] and [22] does not apply.

123 Toyama P/L v Landmark Building Developments P/L 2006 ATC 4160; Decision Impact Statement (4541/02).

124 Sec. 40-75 GSTA 1999; GSTR 2003/3.

125 GSTR 2003/3 at [61].

126 GSTR 2003/3 at [69].

127 GSTR 2003/3 at [76].

128 GSTA TPP 068.

117

118

Ron Jorgensen 2016

22

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

This example discusses whether the supply of an incomplete property development can constitute a

GST free supply of a going concern.

Jack owned 50 hectares of land and carried on a property development business of subdividing the land

into residential blocks over 3 stages. At the end of stage 1, Jack sells the land to a new developer and

agrees to continue construction of stages 2 and 3. Up until settlement Jack continued to the

development in accordance with the development timetable.

The supply of a going concern is GST-free if for consideration, the recipient is GST registered or

required to be GST registered, all things necessary for the continued operation of the enterprise are

supplied and the supplier and recipient agree in writing that the supply is of a going concern.

In Aurora Developments P/L v FCT

130

129

the supply was not a going concern because the supplier had

abandoned the development activities before settlement. Theoretically it should be possible to

continue the development activities up until the date of settlement. There are some practical

difficulties in how to contractually manage this - e.g. adjustments for the materials and expenses up

until settlement since it is not defrayed from trading income.

Any hiatus between the completion of stage 1 and the continuation of work on stage 2 by Jack may

result in the property development enterprise not being carried on up to the date of the supply.

This paper was previously presented to the Tax Institute on 29 October 2015.

29 October 2015

Ron Jorgensen

Partner

Rigby Cooke Lawyers

Chartered Tax Adviser

Accredited Specialist in Tax Law

T

03 9321 7824

0414 967 411

03 9321 7900

Level 11, 360 Elizabeth Street, Melbourne, Victoria, 3000

rjorgensen@rigbycooke.com.au

www.rigbycooke.com.au

www.taxlore.biz

@TaxLore

129

130

Sec. 38-325 GSTA 1999.

Aurora Developments P/L v FCT [2011] FCA 232.

Ron Jorgensen 2016

23

Ron Jorgensen

Property Development - Practical Income Tax, CGT and GST Issues

5 Glossary

DAV 2000

Duties Act 2000 (Vic) (DAV 2000)

GSTA 1999

A New Tax System (Goods and Services Tax) Act 1999

ITAA 1936

Income Tax Assessment Act 1936 (Cth)

ITAA 1997

Income Tax Assessment Act 1997 (Cth)

Ron Jorgensen 2016

24

You might also like

- Property Rental PDFDocument25 pagesProperty Rental PDFlewisweiss363No ratings yet

- Hong Kong Taxation Reform: From An Offshore Financial Center PerspectiveDocument10 pagesHong Kong Taxation Reform: From An Offshore Financial Center Perspectivegp8hohohoNo ratings yet

- Taxation of Income Earned From Selling SharesDocument5 pagesTaxation of Income Earned From Selling Sharesphani raja kumarNo ratings yet

- Calasanz V. Commissioner of Internal Revenue G.R. No. L-26284, October 9, 1986 FactsDocument13 pagesCalasanz V. Commissioner of Internal Revenue G.R. No. L-26284, October 9, 1986 FactsAngelie Fei CuirNo ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Cheat Sheet Ac2301Document3 pagesCheat Sheet Ac2301Christopher OngNo ratings yet

- CREBA vs. RomuloDocument1 pageCREBA vs. RomuloFlorence UdaNo ratings yet

- City Sky Co: Laws Related To The CaseDocument12 pagesCity Sky Co: Laws Related To The Casesv03No ratings yet

- FRB 5 Acctg For SG Property Tax Rebate Covid 19Document11 pagesFRB 5 Acctg For SG Property Tax Rebate Covid 19cheezhen5047No ratings yet

- Profits and Gains of Business or ProfessionDocument5 pagesProfits and Gains of Business or ProfessionAngna DewanNo ratings yet

- Managerial Economics Assignment No: 1 Name: Sharada Raut PRN: 09020446006Document6 pagesManagerial Economics Assignment No: 1 Name: Sharada Raut PRN: 09020446006sharadararautNo ratings yet

- Property Rental Toolkit: 2019-20 Self Assessment Tax Returns Published April 2020Document28 pagesProperty Rental Toolkit: 2019-20 Self Assessment Tax Returns Published April 2020jonofsNo ratings yet

- Self Employed: TRN Requirements For Sole ProprietorsDocument14 pagesSelf Employed: TRN Requirements For Sole ProprietorsAnonymous imWQ1y63No ratings yet

- Taxation of Cross-Border Mergers and Acquisitions: February 2022Document14 pagesTaxation of Cross-Border Mergers and Acquisitions: February 2022Đinh Ngọc BiếtNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains Taxlheamaecayabyab4No ratings yet

- Chamber of Real Estate and Builder'S Associations, Inc. Exec Sec. Romulo, Et AlDocument28 pagesChamber of Real Estate and Builder'S Associations, Inc. Exec Sec. Romulo, Et AlJohanaflor MiraflorNo ratings yet

- CREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Document4 pagesCREBA vs. Romulo, GR No. 160756 Dated March 9, 2010daybarbaNo ratings yet

- KPMG Flash News Hitesh Satishchandra DoshiDocument7 pagesKPMG Flash News Hitesh Satishchandra DoshiHimanshuNo ratings yet

- Tax On Corporate Transactions in Portugal Overview - 1 - 1Document27 pagesTax On Corporate Transactions in Portugal Overview - 1 - 1doegoodNo ratings yet

- 2023B HKTF - L7 - ProfitsDocument16 pages2023B HKTF - L7 - Profitseliu8866No ratings yet

- Solution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungDocument35 pagesSolution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungCourtneyCollinsntwex100% (40)

- Taxation in A Nutshell (Sec. 24D, Nirc) : RulesDocument2 pagesTaxation in A Nutshell (Sec. 24D, Nirc) : Rulesjelo_456No ratings yet

- NUTS (Sale of Realty)Document2 pagesNUTS (Sale of Realty)jelo_456No ratings yet

- Accounting Standard Applicable To Construction IndustryDocument17 pagesAccounting Standard Applicable To Construction IndustrymartincastillopNo ratings yet

- Securities Transaction Tax (STT)Document9 pagesSecurities Transaction Tax (STT)koushiki mishraNo ratings yet

- Direct Tax Code: Kunal Vora Bhavik BhanderiDocument11 pagesDirect Tax Code: Kunal Vora Bhavik BhanderiBhavik BhanderiNo ratings yet

- CRS Chapter 9 RIT Inclusions To Gross IncomeDocument60 pagesCRS Chapter 9 RIT Inclusions To Gross Incomesheryl ann dizonNo ratings yet

- Taxation Direct and IndirectDocument9 pagesTaxation Direct and IndirectFlora ChauhanNo ratings yet

- CGT Lecture Slides - IndividualsDocument27 pagesCGT Lecture Slides - IndividualsMusa NgobeniNo ratings yet

- Getting Started With TradingDocument24 pagesGetting Started With TradingmoumonaNo ratings yet

- Income Tax&GSTDocument7 pagesIncome Tax&GSTTania SharmaNo ratings yet

- Chapter 1Document39 pagesChapter 1Momentum PressNo ratings yet

- PSE Reit Listing RulesDocument2 pagesPSE Reit Listing RulesE ENo ratings yet

- Tax Implications On Cross Border Mergers and Acquisitions-Indian PerspectiveDocument5 pagesTax Implications On Cross Border Mergers and Acquisitions-Indian Perspectivesiddharth pandeyNo ratings yet

- Purple Wings Tax DigestsDocument36 pagesPurple Wings Tax DigestsJf LarongNo ratings yet

- ACCTAX HW 3Document4 pagesACCTAX HW 3JasperNo ratings yet

- The Recent Qualified Opportunity Zone Guidance: What We Know, What We Don't and What It All MeansDocument4 pagesThe Recent Qualified Opportunity Zone Guidance: What We Know, What We Don't and What It All Meansstephjohnson15No ratings yet

- Properties Exempted From CGTDocument5 pagesProperties Exempted From CGTD GNo ratings yet

- Lesson 1 Tax Administration Tutorial NotesDocument8 pagesLesson 1 Tax Administration Tutorial Notes4mggxj68cyNo ratings yet

- Author Ayan Ahmed Blog Capital Gain in FranceDocument5 pagesAuthor Ayan Ahmed Blog Capital Gain in FranceAYAN AHMEDNo ratings yet

- Income From Salary (Section 12) : This Includes Income Received by An Individual AsDocument4 pagesIncome From Salary (Section 12) : This Includes Income Received by An Individual AsShoaib MemonNo ratings yet

- The Property Handbook Web PDFDocument31 pagesThe Property Handbook Web PDFPaulo BorgesNo ratings yet

- Cma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsDocument358 pagesCma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsSarath KumarNo ratings yet

- Long Periods of Account 1Document10 pagesLong Periods of Account 1Alellie Khay JordanNo ratings yet

- Sổ tay thuế 2023 PWCDocument45 pagesSổ tay thuế 2023 PWCDuc PhamNo ratings yet

- Pwc-Vietnam-Pocket Tax Book 2023Document45 pagesPwc-Vietnam-Pocket Tax Book 2023giang.lhhNo ratings yet

- PWC VN-Tax Book-2023-EnDocument45 pagesPWC VN-Tax Book-2023-Enbryanmark2512No ratings yet

- Singapore Income TaxDocument15 pagesSingapore Income TaxSophia LimNo ratings yet

- Capital Gains TaxDocument7 pagesCapital Gains TaxMark Rainer Yongis LozaresNo ratings yet

- Taxation ManagementDocument11 pagesTaxation Managementshreya chhajerNo ratings yet

- Global Minimum TaxDocument3 pagesGlobal Minimum TaxMehar Verma0% (1)

- Deductions To Gross IncomeDocument45 pagesDeductions To Gross IncomeKenzel lawasNo ratings yet

- Tax CIA Bryna 2011346Document14 pagesTax CIA Bryna 2011346BRYNA BHAVESH 2011346No ratings yet

- Elective Paper GST CPTDocument169 pagesElective Paper GST CPTVani BalajiNo ratings yet

- Article - Shefali Goradia - Jul 121341305754Document9 pagesArticle - Shefali Goradia - Jul 121341305754Alok Kumar ShuklaNo ratings yet

- VatDocument274 pagesVatzaneNo ratings yet

- Book: The Twilight Zone: Complete StoriesDocument488 pagesBook: The Twilight Zone: Complete StoriesShamir Gupta100% (1)

- Gbs Thesis 2002 53 PDFDocument110 pagesGbs Thesis 2002 53 PDFShamir GuptaNo ratings yet

- TIA Tax Effective Restructuring For SMEsDocument9 pagesTIA Tax Effective Restructuring For SMEsShamir GuptaNo ratings yet

- Bba 104Document418 pagesBba 104Alma Landero100% (1)

- NTAA's 2016 Budget SummaryDocument6 pagesNTAA's 2016 Budget SummaryShamir GuptaNo ratings yet

- APES 310 Audit ProgramDocument13 pagesAPES 310 Audit ProgramShamir Gupta100% (1)

- 2011 Sydney Law School Postgraduate GuideDocument144 pages2011 Sydney Law School Postgraduate GuideShamir GuptaNo ratings yet

- BKM 9e Commonly Used NotationDocument1 pageBKM 9e Commonly Used Notationfossils1001No ratings yet

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsDocument90 pagesLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiNo ratings yet

- TXVNM - Lecturer Notes 2023Document257 pagesTXVNM - Lecturer Notes 2023huyen9bbbbbNo ratings yet

- Income Tax Calculation 2019 20Document760 pagesIncome Tax Calculation 2019 20Dsp VarmaNo ratings yet

- Morales Taxation Topic 4 Fringe BenefitsDocument14 pagesMorales Taxation Topic 4 Fringe BenefitsMary Joice Delos santosNo ratings yet

- 2009 Taxation Law Bar QuestionsDocument4 pages2009 Taxation Law Bar QuestionsMowanNo ratings yet

- 4.e. INCOME TAXATION - PARTNERSHIPSDocument13 pages4.e. INCOME TAXATION - PARTNERSHIPSTine TungpalanNo ratings yet

- Taxation in IndiaDocument437 pagesTaxation in IndiaVishal Mandhare100% (1)

- Form - Texas Revocable Living Trust - Q-Tip Trust FormDocument11 pagesForm - Texas Revocable Living Trust - Q-Tip Trust Formtroyjoyner09100% (4)

- Cases: General Principles of TaxationDocument272 pagesCases: General Principles of TaxationRio BarrotNo ratings yet

- ITP Exam SuggetionDocument252 pagesITP Exam SuggetionNurul AminNo ratings yet

- IT Income From Other Sources Pt-2Document7 pagesIT Income From Other Sources Pt-2syedfareed596No ratings yet

- CGT Slides 2018 - 4th YearDocument58 pagesCGT Slides 2018 - 4th YearLemon SherbertNo ratings yet

- Tax Sample ComputationDocument10 pagesTax Sample ComputationEryka Jo MonatoNo ratings yet

- Tax Finals Summative s02Document13 pagesTax Finals Summative s02Von Andrei MedinaNo ratings yet

- Kap 1 6th Workbook Te CH 11Document38 pagesKap 1 6th Workbook Te CH 11Gurpreet KaurNo ratings yet

- Corp Tax OutlineDocument81 pagesCorp Tax OutlinesashimimanNo ratings yet

- 2020 W-4 FormDocument4 pages2020 W-4 FormFOX Business100% (8)

- Case 1Document130 pagesCase 1Mert KaygusuzNo ratings yet

- ENTREP HO 2 4th QuarterDocument27 pagesENTREP HO 2 4th QuarterJohann PajaritoNo ratings yet

- What's Under The Bonnet?: Car ExpensesDocument2 pagesWhat's Under The Bonnet?: Car Expensesliehuan wangNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Introduction and Basic Concept of Income Tax Final 5.12Document53 pagesIntroduction and Basic Concept of Income Tax Final 5.12Sai prasad100% (1)

- TDS Rate With Section FY 2019-2020Document22 pagesTDS Rate With Section FY 2019-2020Iftekhar SaikatNo ratings yet

- Relevant BIR UpdatesDocument49 pagesRelevant BIR UpdatesElsha dela penaNo ratings yet

- Partnership Tax NotesDocument35 pagesPartnership Tax NotesAleksandr Kharshan100% (1)

- Example 4 - Memo Re Character of Crypto Income (Final)Document70 pagesExample 4 - Memo Re Character of Crypto Income (Final)arindam duttaNo ratings yet

- Allowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.Document2 pagesAllowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.kavita.m.yadavNo ratings yet

- RR 12-99Document16 pagesRR 12-99doraemoanNo ratings yet

- Accounting For Joint and By-ProductsDocument16 pagesAccounting For Joint and By-ProductsElla DavisNo ratings yet

- Employment QuestionDocument14 pagesEmployment QuestionAnusha carkeyNo ratings yet