Professional Documents

Culture Documents

Credit Risk

Uploaded by

mmkattaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Risk

Uploaded by

mmkattaCopyright:

Available Formats

Chapter-5 Basics of Credit Risk

Certificate in Risk Management

Page 1 of 25

Confidentiality statement

This document should not be carried outside the physical and virtual boundaries of TCS and

its client work locations. The sharing of this document with any person other than TCSer

would tantamount to violation of confidentiality agreement signed by you while joining

TCS.

Notice

The information given in this course material is merely for reference. Certain third party

terminologies or matter that may be appearing in the course are used only for contextual

identification and explanation, without an intention to infringe.

Certificate in Risk Management

TCS Business Domain Academy

Contents

Chapter 5 Basics of Credit Risk ...........................................................................................4

5.1 CREDIT RISK ................................................................................................................ 5

5.2 Credit Risk Management ........................................................................................... 10

5.3 Credit Derivatives ......................................................................................................20

Summary ........................................................................................................................24

Page 3 of 25

Certificate in Risk Management

TCS Business Domain Academy

Chapter 5 Basics of Credit Risk

Introduction

This chapter helps in understanding the basics of credit risk. This chapter provides

framework for credit risk management with examples. It also discusses the measurement

methodologies of credit risk.

Learning Objective

After reading this chapter you will:

To understand the basics of major financial risks i.e. credit risk

To explain the various management process for risk management

To understand the risk management framework

Page 4 of 25

Certificate in Risk Management

TCS Business Domain Academy

5.1 CREDIT RISK

It is the risk of loss of capital or any benefits from a borrowers failure to repay a loan. Credit

risk represents the major risk faced by the banks and it arises from their lending activities.

As defined by RBI, credit risk is defined as the possibility of losses associated with

diminution in the credit quality of borrowers or counter parties. It arises when a borrower

doesnt pay interest or/and installments as and when it falls due or in case where a loan is

repayable on demand, the borrower fails to make the payment as and when demanded.

In addition banks also face risks caused by the concentration of their credit portfolio in

certain type of loan facilities like- overdrafts, cash credit, term loans, lease/hire purchase

and their heavy non-fund exposures related to letter of credit etc. For overcoming such risks

banks may have to diversify their credit portfolio by fixing exposure limits and effective

systems to monitor exposures periodically for initiating timely corrective actions.

The management of credit risk process should broadly cover the following:

(a) Designing a comprehensive system of risk scoring and rating of individual borrowers.

(b) Evolving procedure for measuring portfolio risk by making use of scoring/rating

systems. Also measuring credit concentration under various segments of credit

portfolio.

(c) Having systems of pre-sanction appraisal and post-sanction monitoring of loan

accounts.

(d) Evaluating and managing credit policies and procedures which are well-defined,

sensitive and responsive to changes.

Board and Senior Managements Oversight

Board Oversight

The Board of directors has a critical role to play in overseeing the credit-granting and credit

risk management functions of a banking institution. It is the overall responsibility of a

banking institutions Board to approve credit risk strategy and significant policies relating to

credit risk and its management which should be based on the overall business strategy. To

keep it current, the overall strategy as well as significant policies has to be reviewed by the

Board, preferably annually. The responsibilities of the Board with regard to credit risk

management shall include to:

Page 5 of 25

Certificate in Risk Management

TCS Business Domain Academy

Delineate banking institutions overall risk tolerance in relation to credit risk;

Ensure that banking institutions significant credit risk exposure is maintained at

prudent levels and consistent with the available capital;

Ensure that top management as well as individuals responsible for credit risk

management possess sound expertise and knowledge to accomplish the risk

management function;

Ensure that the banking institution implements sound fundamental policies that

facilitate the identification, measurement, monitoring and control of credit risk;

Ensure that appropriate plans and procedures for credit risk management are in place;

Ensure that internal audit reviews the credit operations to assess whether or not the

Institutions policies and procedures are adequate and being adhered to;

Review exposures to insiders and their related parties, including policies related thereto;

Ratify exposures exceeding the level of the management authority delegated to

management and be aware of exposures that, while worthy of consideration, are not

within the ambits of existing credit policies of the institution;

Review trends in portfolio quality and the adequacy of institutions provision for credit

losses; and

Outline the content and frequency of management report to the Board on credit risk

management.

Delegation of Authority

Institutions are required to establish responsibility for credit sanctions and delegate

authority to approve credits or changes in credit terms. It is the responsibility of institutions

Board to approve the overall lending authority structure, and explicitly delegate credit

sanctioning authority to senior management and the credit committee. Lending authority

assigned to officers should be commensurate with the experience, ability and personal

character. It would be better if institutions develop risk-based authority structure where

lending power is tied to the risk ratings of the borrower. Large institutions may adopt

multiple credit approvers for sanctioning such as credit ratings, risk approvals etc. to

institute a more effective system of check and balance. The credit policy should spell out

the escalation process to ensure appropriate reporting and approval of credit extension

beyond prescribed limits. The policy should also spell out authorities for unsecured credit

(while remaining within Reserve Bank of Malawi limits), approvals of disbursements of

excess over limits, and other exceptions to credit policy.

Page 6 of 25

Certificate in Risk Management

TCS Business Domain Academy

In cases where lending authority is assigned to the loan originating function, there should

be compensating processes and measures to ensure adherence to lending standards. There

should also be periodic review of lending authority assigned to officers.

Senior Management Oversight

Senior Management is responsible for implementing the institutions credit risk

management strategies and policies and ensuring that procedures are put in place to

manage and control credit risk and the quality of credit portfolio in accordance with these

policies. The responsibilities of Senior Management with regard to credit risk management

shall include:

developing and establishing credit policies and credit administration procedures as a

part of overall credit risk management framework for approval by the Board;

implementing credit risk management policies;

ensuring the development and implementation of appropriate reporting system with

respect to the content, format, and frequency of information concerning the credit

portfolio and the credit risk to permit effective analysis and sound and prudent

management and control of existing and potential credit risk exposure;

monitoring and controlling the nature and composition of the institutions portfolio;

monitoring the quality of credit portfolio and ensuring that the portfolio is soundly and

conservatively valued, uncollectible exposure is written off and probable losses are

adequately provided for;

establishing internal controls including putting in place clear lines of accountability and

authority to ensure effective credit risk management process; and

developing lines of communication to ensure timely dissemination of credit risk

management policies, procedures and other credit risk.

Credit Strategy, Policies, Procedures and Limits

Credit Strategy

The primary purpose of banking institutions credit strategy is to determine the risk

appetite. Once it is determined, the banking institution could develop a plan to optimize

return while keeping credit risk within predetermined limits. The credit risk strategy thus

should spell out:

Page 7 of 25

Certificate in Risk Management

TCS Business Domain Academy

The institutions plan to grant credit based on various client segments and products,

economic sectors, geographical location, currency and maturity;

Target market within each lending segment and level of diversification/concentration;

Pricing strategy.

It is essential that institutions give due consideration to their target market while devising

credit risk strategy. The credit procedures should aim to obtain an in depth understanding

of the banking institutions clients, their credentials and their businesses in order to fully

know their customers.

The strategy should provide continuity in approach and take into account cyclic aspect of

countrys economy and the resulting shifts in composition and quality of overall credit

portfolio. While the strategy would be reviewed periodically and amended, as deemed

necessary, it should be viable in long term and through various economic cycles.

Policies

Credit policies establish framework for making investment and lending decisions and reflect

an institutions tolerance for credit risk. To be effective, policies should be communicated in

a timely fashion, and should be implemented through all levels of the institution by

appropriate procedures. Any significant deviation/exception to these policies must be

communicated to the Senior Management/Board and corrective measures should be taken.

At a minimum, credit policies should include:

General areas of credit in which the institution is prepared to engage or is restricted

from engaging such as type of credit facilities, type of collateral security, types of

borrowers, or geographic sectors on which the institution may focus;

Detailed and formalized credit evaluation/ appraisal process, administration and

documentation;

Credit approval authority at various hierarchy levels including authority for approving

exceptions;

Clear guidelines for each of the various types of credits, such as loans, overdrafts,

mortgages, leases, etc4.

Concentration limits on single counterparties and groups of connected counterparties,

particular industries or economic sectors, geographic regions and specific products.

Page 8 of 25

Certificate in Risk Management

TCS Business Domain Academy

Banking institutions should ensure that their own internal exposure limits comply with

any prudential limits or restrictions set by the Reserve Bank of Malawi;

o

Authority for approval of allowance for probable losses and write-offs;

Credit pricing;

Roles and responsibilities of units/staff involved in origination and management of

credit;

Guidelines on management of problem loans; and

In order to be effective, credit policies must be communicated throughout the institution,

implemented through appropriate procedures, and periodically revised to take into account

changing internal and external circumstances.

Limits

An important element of credit risk management is to establish exposure limits covering

on-balance sheet and off-balance sheet credit exposures for single counterparties and

group of connected counterparties. The objective being to prevent institutions from relying

excessively on a large borrower or group of borrowers. The size of the limits should be

based on the credit strength of the counterparty, genuine requirement of credit, economic

conditions and the institutions risk appetite. Limits should also be set for respective

products, activities, specific industry, economic sectors and/or geographic regions to avoid

concentration risk.

Credit limits should be reviewed regularly at least annually or more frequently if

counterpartys credit quality deteriorates. All requests of increase in credit limits should be

substantiated.

Implementation challenges in credit risk

Cost of implementation - Even though a cost-benefit assessment of the frameworks

implementation will vary by country, the operational requirements (especially for the IRB

Approach) will likely be prohibitively expensive for many smaller developing countries.

Large international banks are already closer to the adoption of Basel II - compatible risk

management systems and can spread the costs over a larger asset base.

Inadequate supervisory capacity- The greater burden and wide discretion placed on them

by Pillars 1 (e.g. model validation) and 2 (e.g. treatment of other risks) will stretch scarce

Page 9 of 25

Certificate in Risk Management

TCS Business Domain Academy

supervisory resources and will require a step-up improvement in available skills and

information technology. Even when supervisors build up required skills, it is likely that many

of them will be poached by domestic banks that are eager to adopt these new risk

management tools and able to provide them with higher salariesan unfortunate

consequence of the fact that regulators often drive (rather than respond to) change in many

developing countries.

Impact on domestic banking systems is not fully understood - Firstly, there will likely be a

redistribution of capital requirements within and across banks depending on their individual

customer, product, and portfolio mixes; the dislocation in bank behavior that may result

from this redistribution has not generally been sufficiently studied or considered. Secondly,

smaller domestic banks will likely be at a competitive disadvantage since they will only

afford to adopt less sophisticated (and more capital-onerous) approaches to credit risk and

will probably be subject to moral hazard (attracting riskier assets) because of their inability

to properly differentiate and price for risk. Thirdly, to the extent that they are not already

operating under an economic capital framework, a few less sophisticated foreign banks may

cut back/refocus their exposures to some developing countries in response to the revised

capital requirements

Home-host supervisory coordination - Given the significant presence of G-10 banks in

developing countries and the considerable discretion given to national supervisory

authorities, a significant degree of home host cooperation is essential to ensure

consistency across jurisdictions. Alternatively, a concerted approach could be established

whereby the two regulators agree on a single set of supervisory adopt the IRB Advanced

Approach.

5.2 Credit Risk Management

a) As in case of market risk management, credit risk management also involves finding

answers to four key questions:

b) What are the risks?

c) Which, when and how much risk to accept that will result in improving the bottomline?

d) How can we monitor and control credit risk?

Page 10 of 25

Certificate in Risk Management

TCS Business Domain Academy

e) Can we reduce risk? If so, how?

Accordingly, credit risk management processes are sub-divided into following four parts:

i.

Credit Risk Identification

Credit risk arises from potential changes in the credit quality of a borrower. It has two

Components:

Default Risk: Default risk is driven by the potential failure of a borrower to make promised

payments, either partly or wholly. In the event of default, a fraction of the obligations will

normally be paid. This is known as recovery rate.

Credit Spread Risk/ Downgrade Risk: If a borrower does not default, there is still risk due

to worsening in credit quality. This results in the possible widening of the credit-spread. This

is credit-spread risk. These may arise from a rating change (upgrade or degrade). It will

usually be firm specific.

Default risk and credit-spread risk are transaction level risks. Risks associated with credit

portfolio as a whole is termed as Portfolio Risk. Portfolio risk has two components:

o

Systematic or Intrinsic Risk

Concentration Risk

ii. Credit Risk Measurement

Measurement of Credit risk consists of:

o

Measurement of risk through credit rating/scoring;

Quantifying the risk through estimating expected losses i.e. the amount of loan

losses that a bank would experience over a chosen time horizon and unexpected

loan losses i.e. the amount by which actual losses exceed the expected losses.

Page 11 of 25

Certificate in Risk Management

TCS Business Domain Academy

Credit Rating

Credit rating of an account is done with primary objective to determine whether the

account, after the expiry of a given period, would remain a performing asset i.e. it will

continue to meet its obligation to its creditors, including Bank and would not be in default.

There is no mathematical/economic/empirical model, which can predict the future

capability of a borrower to meet its financial obligations accurately. Regulatory authority

i.e. RBI has also issued necessary instructions and guidance notes emphasizing upon banks

to apply credit rating to their borrowers and classify them category wise. The banks are also

advised to maintain necessary data on defaults of borrowers rating category wise. This

would help to manage credit portfolio in a proactive manner.

To enable the banks to manage credit portfolio, they must have a Credit Rating Model. A

firm where there is a reasonable level of security, as being classified with a credit rating of

triple B (BBB) or above is defined as Investment grade. The best rated credit are defines as

Triple A (AAA). Firm credit below triple B that is double B (BB) or below is defined as

Speculative grade.

Credit Rating Model: Credit rating model essentially differentiates the borrowers based on

degree of stability in terms of top line (e.g. sales) and bottom-line (net profit) revenue

generation. There are various credit rating models in the market. Some of them are

explained in brief here under:

a) Credit Metrics: J P Morgan developed this tool in 1997. They proposed a rating system

where the ratings of the various firms (investment options) are expected to change in

the specified time period. It is the tool for assessing portfolio risk due to changes in debt

value caused by changes in obligor credit quality. The probability that they will change

is also given, for each rating transition (i.e., if a firm is now rated A, the probabilities of it

changing to AA, AAA, BBB, BB, B and lower are all given). Credit Risk is then calculated

based on these probabilities and the total exposure. Credit Metrics will be useful to all

companies worldwide that carry credit risk in the course of their business. It provides a

methodology to quantify credit risk across a broad range of instruments, including

traditional loans, commitments and letters of credit; fixed income instruments;

commercial contracts such as trade credits and receivables; and market-driven

instruments such as swaps, forwards and other derivatives.

Page 12 of 25

Certificate in Risk Management

TCS Business Domain Academy

It evaluates credit risk by predicting movements in the credit ratings of the individual

investments in a portfolio. Credit Metrics consists of three main components:

i.

Historical data sets

ii. A methodology for measuring portfolio Value at Risk (VAR)

iii. A software package known as Credit Manager.

Credit Metrics measures changes in portfolio value by predicting movements in a debtor's

credit ratings and accordingly the values of individual portfolio investments. After the

values of the individual portfolio investments have been determined, Credit Metrics can

then calculate the credit risk.

b) Credit Risk+: First Boston Credit Suisse developed it in 1997. In this approach, the only

states considered are default and no default. In this methodology the distribution of

possible credit losses from a portfolio is calculated. The format of the methodology is a

spreadsheet that is fast and easy to use. Data requirements for the calculation are: loss

given default for each asset, estimated default probabilities and the volatilities of the

asset values. The portfolio is divided into sectors, and the correlation between the

sectors is found. The volatility of the default rate is calculated based on the correlation

between these sectors.

When estimating credit risk, Credit Risk+ considers:

o

credit quality and systematic risk of the debtor

size and maturity of each exposure

concentrations of exposures within a portfolio

Credit Risk+ accounts for the correlation between different default events by analyzing

default volatilities across different sectors, such as different industries or countries. This

method works because default is often related to the same background factors, such as

economic downturn.

The severity of losses is modeled by sorting assets by severity bands. For example, loans

around USD 2,000 would be the first band; loans around USD 40,000 would be the second

Page 13 of 25

Certificate in Risk Management

TCS Business Domain Academy

band. A distribution of losses would be obtained for each band. Both Risk Metrics and Credit

Risk + assume that there is no market risk faced by the investment.

c) KMV: Moodys KMV developed the Expected Default Frequencies (EDF), which is based

on Mertons option pricing model. The firm defaults when the value of assets falls below

a certain level. But as an end product, it comes up with the expected default frequency

(EDF) (i.e. the probability of default). Much of the workings of the KMV approach are

proprietary and available only to KMV customers. This model generates an estimated

default frequency based on the distance between the current value of assets and the

default point. This distance represents the deviation from the mean. The model

assumes that the corporation is financed through single zero-coupon debt maturing at

time t and single equity paying no dividends. This model has been extensively used by

financial institutions and institutional investors for modeling and estimating credit risk.

Default happens when the value of assets falls below a certain value, called the default

point. (The default point under KMV is not the same as the point where the value of

the assets falls below the value of the total debt.) Over time, the assets of the firm will

earn a certain return and trend with a given mean and volatility. Under KMV, the value

of the firms assets is assumed to be log-normally distributed, i.e. the returns on the

assets are normally distributed

View: McKinsey developed credit Portfolio View in 1997. It considers the state of the

economy as a part of the assessment model; the assumption is that the default rates

increase during recessions. The recovery rates for each borrower are calculated based

on the factors like country, industry and rating. Then the portfolio loss distribution is

constructed (the frequency table of the possible losses), from which the exposure of the

firm is estimated.

There are essentially three steps to the credit risk assessment process under the KMV

approach

o

Determine the value of assets (V) and their volatility ().

Calculate the distance to default (DD)

Determination of the EDFs

Page 14 of 25

Certificate in Risk Management

TCS Business Domain Academy

Rating Migration: Rating migration is the change in the rating of a borrower over a period

of time when rated on the same standard or model. For example, say a borrower X is rated

as B+ based on its position as on 31-3-07. the same company is again rated as on 31-3-08

based on its position as on that date, its rating say comes to B. then we say that the rating

of the account has migrated from B+ to B over one year period.

iv. Credit Risk Monitoring and Control

Risk taking through lending activities needs to be supported by a very effective control and

monitoring mechanism, firstly because this activity is widespread, and secondly, because of

very high share of credit risk in the total risk taking activity of a bank. This is also important

to achieve the desired portfolio. Consequently, credit risk controlling and monitoring is

directed both at transaction level and portfolio level.

v. Credit Risk Mitigates

Credit risk mitigation means reduction of credit risk in an exposure by a safety net of

tangible and reliable securities including third-party approved guarantees/insurance. Banks

use a number of techniques to mitigate the credit risks to which they are exposed.

Exposures may be collaterized by first priority claims, in whole or in part with cash or

securities, a loan exposure may be guaranteed by a third-party, or a bank may buy a credit

derivative to offset various forms of credit risk.

The various credit risks mitigates laid down by Basel Committee are as follows:

1) Collateral (tangible, marketable) securities

2) Guarantees

3) Credit derivatives

4) On-balance-sheet netting

The extent to which a particular credit risk mitigant helps depends on the quantum of

exposure, or the strength of the mitigant. There are certain conditions to be met for the use

of credit risk mitigants, which are as follows:

Page 15 of 25

Certificate in Risk Management

TCS Business Domain Academy

All documentation used in collateralized transactions and for documenting on-balancesheet netting, guarantees, and credit derivative must be binding on all parties and must

be legally enforceable in all relevant jurisdictions.

Banks must have properly reviewed all the documents and should have appropriate

legal opinions to verify such, and ensure its enforceability.

Credit Risk Framework under Basel II

In contrast to Basel I that applies a one size fits all approach to all bank, Basel II offers a

menu of options under Pillar 1 for calculating the credit capital requirements of banking

book exposures.

In particular, two main methodologies can be used for most exposures: the Standardized

Approach and the Internal Ratings Based (IRB) Approach; securitization exposures are

subject to a separate (but similar) capital treatment. Each approach has different

characteristics and requirements that are briefly described below.

1) Standardized Approach

This approach measures credit risk similar to Basel I, but has greater risk sensitivity because

it uses the credit ratings of external credit assessment institutions (ECAIs) to define the

weights used when calculating RWAs. National supervisors are responsible for recognizing

ECAIs in accordance with specific eligibility criteria (e.g. objectivity, independence,

disclosure of methodologies etc.) mentioned in the document, as well as for mapping their

assessments to the risk weights available.

The minimum capital requirements for credit risk in Basel I and Basel II are set according to

the following formulas:

n

RW (i) A (i) = RWA

(1)

RWA 0.08 = RC

(2)

Where

RW (I) =

risk-weight attached to asset i A

Page 16 of 25

Certificate in Risk Management

A (i)

RWA =

RC

TCS Business Domain Academy

asset I (i= 1, 2,)

Risk weighted Assets

Regulatory capital

As shown in formula (2), the minimum amount of regulatory capital that a bank must hold

for credit risk is equal to 8% of its risk-weighted assets. The key difference between Basel I

and the standardized approach to credit risk in Basel II is the choice of the risk-weights (RW)

in formula (1). While Basel I only recognizes a simple.

Credit exposures to be categorized based on observable characteristics of the exposures

(e.g. whether the exposure is a corporate loan or a residential mortgage loan).

Fixed risk weights corresponding to each supervisory category

Differentiated risk weights for supervisory categories - sovereign, interbank, and

corporate exposures - based on external credit assessments.

For sovereign exposures, these credit assessments may include those developed by

OECD export credit agencies, as well as those published by private rating agencies.

National supervisors to determine eligibility of a particular source of external ratings

Where no external rating is applied, mostly a risk weighting of 100% be used, implying a

capital requirement of 8%

Past-due Loans not specifically provided to be risk weighted at 150%

Banks may recognize the expanded range of credit risk mitigates (collateral,

guarantees, and credit derivatives)

Specific treatment for retail exposures. Lower risk weights for residential mortgage and

other retail exposures than for unrated corporate exposures. Subject to meeting various

criteria some loans to small and medium sized enterprises (SMEs) to be included within

the retail treatment.

Distinctions between exposures and transactions in an effort to improve the risk

sensitivity of the resulting capital ratios.

2) IRB Approach

The IRB Approach is a more sophisticated methodology, since it is primarily based upon the

credit risk building blocks described in the previous section. Subject to certain minimum

conditions and disclosure requirements, this approach relies on banks own internal

estimates of certain risk parameters to determine credit capital requirements. However, the

Page 17 of 25

Certificate in Risk Management

TCS Business Domain Academy

capital figure itself is still derived from a supervisory formula provided by the Basel

Committee that has been calibrated to reflect the risk of specific asset types and to ensure

that overall capital levels in G-10 countries remain broadly unchanged.

Risk components estimates of risk parameters (PD, LGD, EAD, effective maturity)

that can be calculated by banks themselves or provided by supervisors.

Risk-weight functions the formulas by which risk components are transformed into

risk-weighted assets and therefore capital requirements

Minimum requirements minimum standards for a bank to use the IRB approach for a

given asset class.

Banks internal assessments of key risk drivers serve as primary inputs to the capital

calculation. Four quantitative inputs are:

I.

Probability of default (PD), which measures the likelihood that the borrower will default

over a given time horizon

II.

Loss given default (LGD), which measures the proportion of the exposure that will be

lost if a default occurs

III.

Exposure at default (EAD), which for loan commitments measures the amount of the

facility that is likely to be drawn if a default occurs

IV.

Maturity (M), which measures the remaining economic maturity of the exposure.

Securitization

Securitization refers to a transaction where financial securities are issued against the cash

flow generated from a pool of assets. Cash flow arising out of payment of interest and

repayment of principal are used to service the interest and repayment of financial securities.

Usually a SPV- Special Purpose Vehicle is created for the purpose. Originating bank i.e. the

bank which has originated the assets transfers the ownership of such assets to the SPV. SPV

issues financial securities and has the responsibility to service interest and repayments on

such financial instruments.

The framework includes a Standardized and an IRB Approach for securitization exposures,

depending on the method by which the underlying exposures are treated. The former

Page 18 of 25

Certificate in Risk Management

TCS Business Domain Academy

approach applies ECAI assessments that are generally mapped to risk weights, with specific

treatment applied to unrated securitization exposures, credit risk mitigates and early

amortization features. The latter approach utilizes three different methods to derive

regulatory capital requirements:

Ratings-Based Approach (RBA) for rated exposures, or where a rating can be inferred

(subject to specific operational requirements); the risk weights depend on the

external/inferred rating, whether the rating is long-or short -term, the granularity of the

underlying pool and the seniority of the position

Internal Assessment Approach for asset - backed commercial paper related

exposures such as liquidity facilities and credit enhancements; banks can use (subject to

specific operational requirements) their internal credit assessments of such exposures,

which must be mapped to equivalent external credit rating agency ratings in order to

determine the appropriate RBA risk weights to use.

Supervisory Formula in all other instances; this is based on five bank supplied inputs

(IRB capital charge had the underlying exposures not been securitized, the tranches

credit enhancement level and thickness, and the pools effective number of exposures

and weighted average LGD).

For a bank using the IRB Approach, the maximum capital requirement for its securitization

exposures is equal to the IRB capital requirement that would have been assessed against

the underlying exposures had they not been securitized. In the process the originating bank

transfers credit risk to the investors. A bank may also become an investor in a securitization

transaction and may acquire credit risk.

Securitization exposures include Asset-backed securities, Mortgage-backed securities,

credit enhancements, liquidity facilities, interest rate or currency swaps, credit derivatives

and trenched cover.

Page 19 of 25

Certificate in Risk Management

TCS Business Domain Academy

5.3 Credit Derivatives

Credit derivatives are financial derivatives designed to transfer the credit risk of one counter

party to another. Credit risk arises mainly due to the default of the debtor or due to the

deterioration of the credit quality of the debtor. During the incidence of such risk the

creditor only receives the amount that can be recovered from the debtor. Therefore it

becomes essential for the investors to assess and mitigate credit risk through hedging

strategies. Credit derivatives are the outcome of such efforts intended to dilute the effects

of credit risk. The objective behind many credit derivatives is to separate market risk from

credit risk. This effectively reduces a bank's exposure and its risk of loss. These are over-thecounter derivatives.

The mechanism of credit derivative (CD) can be explained as follow:

Under a CD transaction, Protection Buyer (PB, generally the Originator of credit assets)

enters into an agreement with the Protection seller (PS), whereby the PB transfers the Credit

Risks with reference to a Notional Value of the Reference Obligation (credit asset) to the

PS, by agreeing to pay regular Premiums to the PS. In the instance of a Credit Event

(delinquencies, default, foreclosure, prepayments, etc. as agreed upon in the contract)

taking place with respect to the reference obligation, there is a Settlement between them,

whereby the PS compensates the PB for the losses incurred as a result of the event.

The settlement can be Physical Settlement or Cash Settlement. Under a physical

settlement, the PB delivers the reference asset to the PS and in return the PS pays the par

value plus accrued interest of the reference asset. In a Cash settlement the PS pays the PB

the loss suffered (i.e. the difference between the par value plus accrued interest and the

market value of the defaulted reference obligation or the estimated recoveries).

There are many credit risk mitigation derivatives but the three main structures which are

mostly used are:

i.

Credit Default Swap

It is the swap used to transfer the credit of fixed income products between parties. CDS is

the simplest and the most popular form of credit derivative under which the protection

Page 20 of 25

Certificate in Risk Management

TCS Business Domain Academy

buyer (PB) agrees to pay regular premium to the protection seller (PS) for buying protection

against the reference obligation. The premium is based on certain basis points of the

notional value for which the protection is bought the instance of the credit event. The

reference obligation may be a single reference obligation or a portfolio of obligations. The

portfolio can again be static or dynamic. In case of portfolio of obligations the swap is called

as Portfolio swap. If the premiums under the CDS are paid in advance at the time of entering

into the contract, the transaction takes the form of an option contract and is termed as

Credit Default Options.

ii.

Total Rate of Return Swap

These are the agreements where two parties exchange periodic payments based on some

notional principal amount over the life of the agreement. One party of the agreement

makes payments based upon the total return of a specified asset (which can be anything

including indexed instruments) and the other makes fixed or floating payments.

In a TRS, the PB swaps with the PS, total actual return (coupon capital

appreciation/depreciation) on an asset in return for a premium. The premium is arrived at by

adding a spread to a reference rate like LIBOR. This in a TRS, protection seller is able to

synthetically create an exposure to the reference asset without actually lending to it.

iii.

Credit Linked Notes (CLN)

CDS are generally off balance sheet items and are unfounded. CLNs on the other hand are

on balance sheet equivalents of a CDS which combines credit derivative to normal bond

instruments. It thus converts credit derivatives (generally an OTC instrument) into a capital

market instrument. Under it, the protection buyer is an SPV. These SPV raises money

issuing CLNs in the market. The SPV also enters into a credit derivative with the protection

buyer. If the credit event takes place, the proceeds from CLNs are used to make payments

to the PB for the losses and the balance is paid back to the investors. In case, no credit

event takes place then the yield that an investor gets is equal to the sum of the returns on

collateral plus premium received by the PB.

Page 21 of 25

Certificate in Risk Management

TCS Business Domain Academy

Major exposures

o

Corporate, interbank and sovereign exposures

Retail Exposures

Specialized lending

Equity Exposures

1) Corporate, interbank and sovereign exposures - Relies on four quantitative inputsPD

Provided by bank based on own estimates

LGD Supervisory values set by the Committee

EAD Supervisory values set by the Committee

M

Supervisory values set by the Committee or at national discretion, provided

by bank based on own estimates (with an allowance to exclude certain exposures).

2) Retail Exposures- The key inputs PD, LGD and EAD are all to be provided by the bank

based on its internal estimates. Estimates for pools of similar exposures than for

individual exposures. Retail exposures are divided into three primary categories:

I.

Exposures secured by residential mortgages

II.

Qualifying revolving retail exposures (QRRE) - unsecured revolving credits that

exhibit appropriate loss characteristics, including credit card relationships

III.

Other retail - other non-mortgage consumer lending including exposures to small

businesses. A separate risk-weight formula for each of the three categories is

provided.

3) Specialised lending - It Refers to financing of individual projects where the repayment

is highly dependent on the performance of the underlying pool or collateral as

distinguished from other forms of corporate lending High volatility commercial real

estate (HVCRE), banks to use a more conservative risk weight formula Banks that

cannot estimate the required inputs will classify their HVCRE exposures into five grades,

for which the accord provides specific risk weights.

4) Equity Exposures - There are two distinct approaches. One approach builds on the

PD/LGD approach for corporate exposures and requires banks to provide own PD

estimates for the associated equity exposures. This approach, however, mandates the

use of a 90% LGD value and also imposes various other limitations, including a

Page 22 of 25

Certificate in Risk Management

TCS Business Domain Academy

minimum risk weight of 100% in many circumstances. The other approach is intended

to provide banks with the opportunity to model the potential decrease in the market

value of their equity holdings over a quarterly holding period.

Treatment of Credit Risk Mitigates

Specific treatment of Securitisation

Page 23 of 25

Certificate in Risk Management

TCS Business Domain Academy

Summary

Credit risk is defined as the possibility of losses associated with diminution in the

credit quality of borrowers or counter parties.

Credit has two components: Default risk and Credit Spread risk

Default risk is driven by the potential failure of a borrower to make promised

payments, either partly or wholly.

Default risk and credit-spread risk are transaction level risks

Risks associated with credit portfolio as a whole is termed as Portfolio Risk.

Rating migration is the change in the rating of a borrower over a period of time

when rated on the same standard or model.

Credit risk mitigation refers to the process through which credit risk is reduced or it

is transferred to a counter party.

Securitization refers to a transaction where financial securities are issued against

the cash flow generated from a pool of assets.

Credit derivatives are financial derivatives designed to transfer the credit risk of one

counter party to another.

There are many credit risk mitigation derivatives but the three main structures

which are mostly used are CDS, TRS and CLN.

Page 24 of 25

Page 25 of 25

You might also like

- Rating Credit Risks - OCC HandbookDocument69 pagesRating Credit Risks - OCC HandbookKent WhiteNo ratings yet

- CRM 1Document41 pagesCRM 1Arjun PadmanabhanNo ratings yet

- Credit Risk Management-ReportDocument11 pagesCredit Risk Management-ReportNazuk DilNo ratings yet

- Bsp-Credit Risk ManagementDocument69 pagesBsp-Credit Risk Managementjhomar jadulanNo ratings yet

- Basel IV & CRR II: Revised Standardised Approach For Market RiskDocument52 pagesBasel IV & CRR II: Revised Standardised Approach For Market RiskNasim AkhtarNo ratings yet

- Regulatory ToolboxDocument40 pagesRegulatory ToolboxAtul KapurNo ratings yet

- Basel III Capital RegulationDocument326 pagesBasel III Capital RegulationucoNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Enterprise Risk Management A Complete Guide - 2019 EditionFrom EverandEnterprise Risk Management A Complete Guide - 2019 EditionNo ratings yet

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskFrom EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskRating: 3.5 out of 5 stars3.5/5 (1)

- Credit Risk Mgmt. at ICICIDocument60 pagesCredit Risk Mgmt. at ICICIRikesh Daliya100% (1)

- Booklet Toolbox Basel4Document74 pagesBooklet Toolbox Basel4Rahajeng PramestiNo ratings yet

- Credit Risk ModelingDocument4 pagesCredit Risk ModelingmohamedciaNo ratings yet

- BASEL Norms Concept & Implication: Awadhesh Kumar Patel & Manish Kumar SoniDocument17 pagesBASEL Norms Concept & Implication: Awadhesh Kumar Patel & Manish Kumar SoniAnjalinishantNo ratings yet

- Model Risk Management: Building Supervisory ConfidenceDocument24 pagesModel Risk Management: Building Supervisory ConfidenceJune JuneNo ratings yet

- CredRiskMod PDFDocument65 pagesCredRiskMod PDFPriya RanjanNo ratings yet

- Credit Risk Estimation TechniquesDocument31 pagesCredit Risk Estimation TechniquesHanumantha Rao Turlapati0% (1)

- FRTB Ey ReviewDocument8 pagesFRTB Ey Review4GetM100% (1)

- Guidelines On Risk Appetite Practices For BanksDocument34 pagesGuidelines On Risk Appetite Practices For BanksPRIME ConsultoresNo ratings yet

- Basel II-III Credit Risk Modelling and Validation Training BrochureDocument7 pagesBasel II-III Credit Risk Modelling and Validation Training BrochuremakorecNo ratings yet

- BASEL I, II, III-uDocument43 pagesBASEL I, II, III-uMomil FatimaNo ratings yet

- Credit Risk ModelsDocument32 pagesCredit Risk ModelsGiorgio191919No ratings yet

- Basel IIIDocument31 pagesBasel IIIRahul WaniNo ratings yet

- Credit Risk Grading PDFDocument14 pagesCredit Risk Grading PDFaziz100% (1)

- Loan PricingDocument39 pagesLoan PricingBhagath GottipatiNo ratings yet

- ICRRS Guidelines - BB - Version 2.0Document25 pagesICRRS Guidelines - BB - Version 2.0Optimistic EyeNo ratings yet

- Credit Risk: Monetary Authority of SingaporeDocument29 pagesCredit Risk: Monetary Authority of SingaporeNikhil ChandeNo ratings yet

- Credit Risk Grading-Apex TanneryDocument21 pagesCredit Risk Grading-Apex TanneryAbdullahAlNomunNo ratings yet

- Credit ManagementDocument46 pagesCredit ManagementMohammed ShaffanNo ratings yet

- Credit Risk Modelling - A PrimerDocument42 pagesCredit Risk Modelling - A PrimersatishdwnldNo ratings yet

- Capital Adequacy and PlanningDocument6 pagesCapital Adequacy and Planningdeepak kumarNo ratings yet

- Marketing Aspect of Wealth ManagementDocument28 pagesMarketing Aspect of Wealth ManagementParin ShahNo ratings yet

- Pragya: The Best FRM Revision Course!Document26 pagesPragya: The Best FRM Revision Course!mohamedNo ratings yet

- Standardized Approach For Counterparty Credit RiskDocument2 pagesStandardized Approach For Counterparty Credit RiskjalutukNo ratings yet

- Op Risks in BanksDocument22 pagesOp Risks in Banksshubhkarman_sin2056100% (1)

- Modelin NG Banks' ' Probabil Lity of de EfaultDocument23 pagesModelin NG Banks' ' Probabil Lity of de Efaulthoangminhson0602No ratings yet

- An Actuarialmodel For Credit RiskDocument17 pagesAn Actuarialmodel For Credit RiskMiguel RevillaNo ratings yet

- Credit Risk: Categories ofDocument17 pagesCredit Risk: Categories ofaroojchNo ratings yet

- ICAAP Overview Core Concepts TocDocument3 pagesICAAP Overview Core Concepts TocJawwad FaridNo ratings yet

- Credit Risk Management (Credit Management)Document106 pagesCredit Risk Management (Credit Management)Farhia NaveedNo ratings yet

- Minimum Capital Requirements For Market Risk BIS 2019Document136 pagesMinimum Capital Requirements For Market Risk BIS 2019Atul KapurNo ratings yet

- C Hap Ter 1 3 Overviewof Internal ControlDocument53 pagesC Hap Ter 1 3 Overviewof Internal ControlMariel Rasco100% (1)

- Risk Model Presentation For Risk and DDDocument15 pagesRisk Model Presentation For Risk and DDjohn9727100% (1)

- BASEL 3 - Interest Rate Risk in The Banking BookDocument51 pagesBASEL 3 - Interest Rate Risk in The Banking BookJenny DangNo ratings yet

- bcbs292 PDFDocument61 pagesbcbs292 PDFguindaniNo ratings yet

- DICO-IfRS 9 Modelling and ImplementationDocument28 pagesDICO-IfRS 9 Modelling and ImplementationRadian Adhi100% (1)

- Risk Management: Sample Board Risk Policy Document and Risk Policy Table of ContentDocument7 pagesRisk Management: Sample Board Risk Policy Document and Risk Policy Table of Contentmanishmalik1981No ratings yet

- Liquidity Risk Management Manual 8.23.22Document12 pagesLiquidity Risk Management Manual 8.23.22Angelica B. PatagNo ratings yet

- 15 Numerical RAROCDocument1 page15 Numerical RAROCVenkatsubramanian R IyerNo ratings yet

- Stress Testing GuidelinesDocument10 pagesStress Testing GuidelinesDeep KrishnaNo ratings yet

- RSKMGT NIBM Module Operational Risk Under Basel IIIDocument6 pagesRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaNo ratings yet

- Deloitte Approach On IRRBBDocument4 pagesDeloitte Approach On IRRBBraiden9413No ratings yet

- Basel II Operational RiskDocument5 pagesBasel II Operational RiskLyn SpoonerNo ratings yet

- Interest Rate Risk AuditDocument4 pagesInterest Rate Risk AuditpascaruionNo ratings yet

- ERM Audit QuestionnaireDocument3 pagesERM Audit QuestionnaireRodney Labay100% (1)

- TopeDocument22 pagesTopemmkattaNo ratings yet

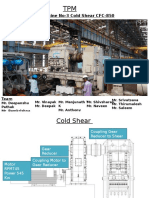

- TMP - 17875-Lifting Table826369497Document1 pageTMP - 17875-Lifting Table826369497mmkattaNo ratings yet

- OPL Bolt TighteningDocument2 pagesOPL Bolt TighteningmmkattaNo ratings yet

- M451-110 - Falk Lifelign Gear CouplingsDocument62 pagesM451-110 - Falk Lifelign Gear CouplingsLee LaiHaaNo ratings yet

- OPL-usage of Torch LightDocument1 pageOPL-usage of Torch LightmmkattaNo ratings yet

- Plain Bearings and Rod EndsDocument50 pagesPlain Bearings and Rod EndsmmkattaNo ratings yet

- Deblin Rotary JointDocument56 pagesDeblin Rotary JointmmkattaNo ratings yet

- Kaman CatalogDocument275 pagesKaman CatalogmmkattaNo ratings yet

- Circlip Sizes IS 3075 PDFDocument5 pagesCirclip Sizes IS 3075 PDFmmkattaNo ratings yet

- SPIROLDocument8 pagesSPIROLmmkattaNo ratings yet

- Engineering Economics: William Loendorf, P.EDocument30 pagesEngineering Economics: William Loendorf, P.EmmkattaNo ratings yet

- Pressure Relief ValveDocument64 pagesPressure Relief Valveedhy_03No ratings yet

- HaweDocument262 pagesHawemmkattaNo ratings yet

- Coupling PDFDocument68 pagesCoupling PDFmmkattaNo ratings yet

- V Ringe PDFDocument18 pagesV Ringe PDFmmkattaNo ratings yet

- Deblin Rotary JointDocument56 pagesDeblin Rotary JointmmkattaNo ratings yet

- DRPDocument152 pagesDRPmmkattaNo ratings yet

- Control of Voltage Source Inverters Using PWMDocument48 pagesControl of Voltage Source Inverters Using PWMManohar DakaNo ratings yet

- Performa PDFDocument43 pagesPerforma PDFmmkattaNo ratings yet

- Deublin 155 000 001Document3 pagesDeublin 155 000 001mmkattaNo ratings yet

- Cor 1078 CRM o BrochureDocument21 pagesCor 1078 CRM o BrochuremmkattaNo ratings yet

- Ank Seals Catalog Compressed 1Document28 pagesAnk Seals Catalog Compressed 1mmkattaNo ratings yet

- WINCC StorageDocument150 pagesWINCC StorageAyoub AyayNo ratings yet

- Plummer BlockDocument66 pagesPlummer BlockmmkattaNo ratings yet

- Clamp CatalogueDocument33 pagesClamp CatalogueRaja Guru100% (2)

- SocketDocument88 pagesSocketmmkattaNo ratings yet

- SocketDocument88 pagesSocketmmkattaNo ratings yet

- Complete Guide To ChainDocument230 pagesComplete Guide To ChainVijay GohilNo ratings yet

- FORDAWASH FinalPriting 123Document103 pagesFORDAWASH FinalPriting 123John Paul FornesteNo ratings yet

- Michigan Property Assessment FormDocument2 pagesMichigan Property Assessment FormIsabelle PasciollaNo ratings yet

- Check List For Various Noc's: ../affidavit For Consent To Establish ../affidavit For Consent To Operate PDFDocument23 pagesCheck List For Various Noc's: ../affidavit For Consent To Establish ../affidavit For Consent To Operate PDFshubham kumarNo ratings yet

- Solutions Test Bank For Principles of Managerial Finance 15th Edition by ZutterDocument30 pagesSolutions Test Bank For Principles of Managerial Finance 15th Edition by Zuttergood goodNo ratings yet

- Jeoparty Fraud Week 2022 EditableDocument65 pagesJeoparty Fraud Week 2022 EditableRhea SimoneNo ratings yet

- Mcdonal's Finanical RatiosDocument11 pagesMcdonal's Finanical RatiosFahad Khan TareenNo ratings yet

- RE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotDocument1 pageRE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotAndre SenabNo ratings yet

- Customer Persona and Value PropositionDocument24 pagesCustomer Persona and Value PropositionVishnu KompellaNo ratings yet

- Module 1Document113 pagesModule 1Anirudh SNo ratings yet

- Biogas Production in The Anaerobic Treatment of Cattle ManureDocument8 pagesBiogas Production in The Anaerobic Treatment of Cattle Manuretera novaNo ratings yet

- Curriculum Vitae of Hafiz Sikander 1Document7 pagesCurriculum Vitae of Hafiz Sikander 1hafiz2422No ratings yet

- Classification of Businesses: Revision AnswersDocument2 pagesClassification of Businesses: Revision AnswersJane Lea100% (6)

- Price Adjustment in Construction ContractDocument7 pagesPrice Adjustment in Construction ContractRam Prasad Awasthi100% (1)

- Acc Account Name Trial Balance Debit CreditDocument6 pagesAcc Account Name Trial Balance Debit CreditNofi NurlailaNo ratings yet

- Mba STR 2020-21Document124 pagesMba STR 2020-21MÄÑÚ GÖWDÀNo ratings yet

- Building Permit ChecklistDocument1 pageBuilding Permit Checklistar desNo ratings yet

- Jakki Mohr, Sanjit Sengupta, Stanley Slater Marketing of High-Technology Products and InnovationsDocument569 pagesJakki Mohr, Sanjit Sengupta, Stanley Slater Marketing of High-Technology Products and InnovationsArshed Rosales100% (3)

- Instructions For Form 8973: (Rev. December 2018)Document4 pagesInstructions For Form 8973: (Rev. December 2018)malik turkiNo ratings yet

- The Toilet Paper Entrepreneur PDFDocument198 pagesThe Toilet Paper Entrepreneur PDFMarco Gómez Caballero83% (6)

- SS - 9 - Forfeiture of SharesDocument3 pagesSS - 9 - Forfeiture of SharesMihir MehtaNo ratings yet

- Business Insights & Analytics ManagerDocument1 pageBusiness Insights & Analytics ManagerAndrew ZinkinNo ratings yet

- ALARP - Demonstration STD - AUSDocument24 pagesALARP - Demonstration STD - AUSMahfoodh Al AsiNo ratings yet

- Traditional Correspondence: Memos and LettersDocument9 pagesTraditional Correspondence: Memos and LettersHala Tawfik MakladNo ratings yet

- 1.1. PNC PRE FO 66 Proposed Student Research Topics 2.1Document9 pages1.1. PNC PRE FO 66 Proposed Student Research Topics 2.1ALWINA CATINDOYNo ratings yet

- Budgeting: Accounting: A Malaysian Perspective, 5e (Adapted From Accounting 26e: Warren, Reeve & Duchac)Document58 pagesBudgeting: Accounting: A Malaysian Perspective, 5e (Adapted From Accounting 26e: Warren, Reeve & Duchac)Asyikin OsmanNo ratings yet

- MST Installation of WEHOLITE Pipe - Stormwater - FinalDocument13 pagesMST Installation of WEHOLITE Pipe - Stormwater - FinalShahzaib ShahidNo ratings yet

- Sale 238 26-06-2023Document2 pagesSale 238 26-06-2023Creeper TechnologiesNo ratings yet

- Commissioner Vs Manning Case DigestDocument2 pagesCommissioner Vs Manning Case DigestEKANGNo ratings yet

- (FIX) FOH Budget and COGS BudgetDocument26 pages(FIX) FOH Budget and COGS BudgetAlifia Zulfa SalsabilaNo ratings yet

- Scientia L 2023Document244 pagesScientia L 2023john umaru rikkaNo ratings yet