Professional Documents

Culture Documents

James Stephen Fennel v. Commissioner of IRS, 11th Cir. (2014)

Uploaded by

Scribd Government DocsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

James Stephen Fennel v. Commissioner of IRS, 11th Cir. (2014)

Uploaded by

Scribd Government DocsCopyright:

Available Formats

Case: 14-10060

Date Filed: 09/02/2014

Page: 1 of 5

[DO NOT PUBLISH]

IN THE UNITED STATES COURT OF APPEALS

FOR THE ELEVENTH CIRCUIT

________________________

No. 14-10060

Non-Argument Calendar

________________________

Agency No. 4697-11 L

JAMES STEPHEN FENNEL,

Petitioner,

versus

COMMISSIONER OF IRS,

Respondent.

________________________

Petition for Review of a Decision of the

U.S.Tax Court

________________________

(September 2, 2014)

Before MARCUS, PRYOR and ANDERSON, Circuit Judges.

PER CURIAM:

James Fennel appeals the U.S. Tax Courts denial of his pro se petition for

review of a lien or levy action imposing penalties under 26 U.S.C. 6702(a) for

Case: 14-10060

Date Filed: 09/02/2014

Page: 2 of 5

filing frivolous tax returns. The Internal Revenue Service (IRS) imposed seven

penalties for filing frivolous tax returns based on returns Fennel filed for tax years

1999 and 2001 through 2006 that claimed zero income and zero tax liability and

also claimed a refund for the full amount of money withheld from his pay. At trial,

Fennel acknowledged that he worked and received pay during tax years 1999 and

2001 through 2006. On appeal, he argues that: (1) the IRS presented insufficient

evidence to impose penalties under 6702(a); (2) he is not a person for purposes

of 6702; and (3) the IRS failed to prove that the penalty assessments against him

received written supervisory approval. After thorough review, we affirm.

We review the Tax Courts conclusions of law de novo and findings of fact

for clear error. Creel v. Commr of Internal Revenue, 419 F.3d 1135, 1139 (11th

Cir. 2005). The IRS has the burden of proving the applicability of penalties for

frivolous returns. 26 U.S.C. 6703(a).

The Internal Revenue Code imposes a $5,000 penalty on a taxpayer who

files a tax return that meets two criteria. 26 U.S.C. 6702(a). The first criterion is

satisfied if the return (A) does not contain information on which the substantial

correctness of the self-assessment may be judged, or (B) contains information that

on its face indicates that the self-assessment is substantially incorrect. Id.

6702(a)(1). The second criterion is satisfied if the filing of the return either (A) is

based on a position which the Secretary has identified as frivolous under

2

Case: 14-10060

Date Filed: 09/02/2014

Page: 3 of 5

subsection (c), or (B) reflects a desire to delay or impede the administration of

Federal tax laws. Id. 6702(a)(2). Subsection (c) provides that the Secretary

shall prescribe, and periodically revise, a list of positions that have been identified

as frivolous for purposes of this subsection. Id. 6702(c). The Code further

provides that [n]o penalty under this title shall be assessed unless the initial

determination of such assessment is personally approved (in writing) by the

immediate supervisor of the individual making such determination or such higher

level official as the Secretary may designate. 26 U.S.C. 6751(b).

IRS Notice 2007-30, released on March 16, 2007, and published on April 2,

2007, provided a list of positions identified as frivolous for purposes of 6702(c).

IRS Notice 2007-30, 2007-1 C.B. 883. Among the positions identified as frivolous

was the position that a taxpayer has the option to elect to file a tax return

reporting zero taxable income and zero tax liability even if the taxpayer received

taxable income during the taxable period for which the return is filed. Id.

Subtitle A of the Code sets forth the statutes governing the federal income

tax. See generally 26 U.S.C. 1-1563. Section 1 provides for the imposition of

an income tax on all taxable income. Id. 1. Section 63 defines taxable

income as gross income minus the deductions that the chapter allows. Id.

63(a). In turn, 61(a) defines gross income as all income from whatever

source derived, including (but not limited to) . . . [c]ompensation for services. Id.

3

Case: 14-10060

Date Filed: 09/02/2014

Page: 4 of 5

61(a)(1). Under 3402(a)(1), every employer making payment of wages shall

deduct and withhold upon such wages a tax determined in accordance with tables

or computational procedures prescribed by the Secretary.

Id. 3402(a)(1).

Wages are defined in reference to that section as all remuneration . . . for

services performed by an employee for his employer. Id. 3401(a). The Code

defines employer as the person for whom an individual performs or performed

any service, of whatever nature, as the employee of such person. Id. 3401(d).

Finally, the Code defines a person as, among other things, an individual, and

this definition applies throughout the Code where not otherwise distinctly

expressed or manifestly incompatible. Id. 7701(a). Section 6671 provides that,

for purposes of applying assessable tax penalties, the term person . . . includes an

officer or employee of a corporation, or a member or employee of a partnership,

who as such officer, employee, or member is under a duty to perform the act in

respect of which the violation occurs. Id. 6671(b).

We have said that arguments that wages are not taxable income have been

rejected by courts at all levels of the judiciary and are patently frivolous. Stubbs

v. Commr of Internal Revenue Serv., 797 F.2d 936, 938 (11th Cir. 1986); see also

Hyslep v. United States, 765 F.2d 1083, 1084 (11th Cir. 1985); Madison v. United

States, 758 F.2d 573, 574 (11th Cir. 1985).

Case: 14-10060

Date Filed: 09/02/2014

Page: 5 of 5

Here, Fennel fails to show that the Tax Court erred in upholding the IRSs

penalty assessments under 6702(a) or clearly erred in any of its underlying fact

findings. To begin with, the record shows that the Tax Court did not err in

determining that Fennels returns, which listed zero income and zero tax liability in

spite of the fact that he also stated that he worked a job and received pay that was

withheld, contained information that on its face indicated that Fennels selfassessment was substantially incorrect. See 26 U.S.C. 6702(a)(1)(B). Moreover,

Fennels position that he had zero taxable income and zero tax liability even

though he received taxable income during each of the relevant tax years was a

position identified as frivolous for the purposes of 6702(a) at the time Fennel

filed his returns from June to November of 2007. See id. 6702(a)(2)(A), (c); IRS

Notice 2007-30, 2007-1 C.B. 883; see also, e.g., Stubbs, 797 F.2d at 938. Finally,

Fennels argument that the penalty assessments did not receive written supervisory

approval is belied by the record, and he clearly qualifies as a person for purposes

of 6702. See 26 U.S.C. 6671(b), 7701(a).

AFFIRMED.

You might also like

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Parker Excavating v. LaFarge West, 10th Cir. (2017)Document24 pagesParker Excavating v. LaFarge West, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Noli Me TangereDocument18 pagesNoli Me TangereDeseryl Hermenegildo100% (2)

- Final Appeal MemorandumDocument21 pagesFinal Appeal MemorandumSHANMUKH BACHUNo ratings yet

- HIS 100 Topic Exploration WorksheetDocument3 pagesHIS 100 Topic Exploration WorksheetRachael BrownNo ratings yet

- Why Cripps Mission Was Sent:: Main ProposalsDocument4 pagesWhy Cripps Mission Was Sent:: Main ProposalsAnand RajNo ratings yet

- Rothbard's Wall Street Banks and American Foreign PolicyDocument5 pagesRothbard's Wall Street Banks and American Foreign PolicyGold Silver WorldsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 79. Docket 23183Document4 pagesUnited States Court of Appeals, Second Circuit.: No. 79. Docket 23183Scribd Government DocsNo ratings yet

- Criminal Law I Program Module No. 4 AteneoDocument4 pagesCriminal Law I Program Module No. 4 AteneoBABY LOVE UMPANo ratings yet

- Leadership Style of Raul RocoDocument25 pagesLeadership Style of Raul RocoRadee King CorpuzNo ratings yet

- Moorish Science of Salvation TrueDocument217 pagesMoorish Science of Salvation Truekimmy2012100% (22)

- Pip (Program Implementation Plan)Document2 pagesPip (Program Implementation Plan)sureesicNo ratings yet

- Charles County Code Home Rule ReportDocument32 pagesCharles County Code Home Rule ReportMarc Nelson Jr.No ratings yet

- Ulster County Industrial Development Agency - March 14, 2012 MinutesDocument8 pagesUlster County Industrial Development Agency - March 14, 2012 MinutesNewPaltzCurrentNo ratings yet

- NRA LetterDocument2 pagesNRA LetterBreitbart UnmaskedNo ratings yet

- Home Department Govt. of Bihar: Seniority List of Ips Officers of The Rank of Deputy Inspector General (D.I.G.)Document2 pagesHome Department Govt. of Bihar: Seniority List of Ips Officers of The Rank of Deputy Inspector General (D.I.G.)sanjeet kumarNo ratings yet

- Judicial Precedent As A Source of LawDocument8 pagesJudicial Precedent As A Source of LawBilawal MughalNo ratings yet

- Duncano Vs SandiganbayanDocument3 pagesDuncano Vs SandiganbayanGretch PanoNo ratings yet

- Wildland-Urban InterfaceDocument10 pagesWildland-Urban InterfacePiney MartinNo ratings yet

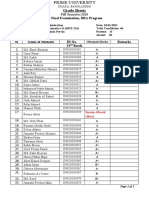

- Grade Sheet S: Final Examination, BBA ProgramDocument2 pagesGrade Sheet S: Final Examination, BBA ProgramRakib Hasan NirobNo ratings yet

- Simulasi Cat HitungDocument2 pagesSimulasi Cat HitungSir cokieNo ratings yet

- (American History in Depth) M. J. Heale (Auth.) - McCarthy's Americans - Red Scare Politics in State and Nation, 1935-1965 (1998, Macmillan Education UK) PDFDocument387 pages(American History in Depth) M. J. Heale (Auth.) - McCarthy's Americans - Red Scare Politics in State and Nation, 1935-1965 (1998, Macmillan Education UK) PDFМомчило МанојловићNo ratings yet

- 14.3 England and France DevelopDocument5 pages14.3 England and France DevelopMónica Vásquez CaicedoNo ratings yet

- Washington's Newburgh AddressDocument3 pagesWashington's Newburgh AddressPhDJNo ratings yet

- Famanila vs. Court of AppealsDocument11 pagesFamanila vs. Court of AppealsAngel Amar100% (1)

- Ras PDFDocument3 pagesRas PDFPadgro Consultants Pvt Ltd - EngineeringNo ratings yet

- Consti II Case ListDocument44 pagesConsti II Case ListGeron Gabriell SisonNo ratings yet

- Urban Transition in Bangladesh Issues and Challenges: Urban Knowledge Platform Country TeamDocument16 pagesUrban Transition in Bangladesh Issues and Challenges: Urban Knowledge Platform Country TeamUrbanKnowledgeNo ratings yet

- Sime Darby Philippines v. Goodyear PhilippinesDocument13 pagesSime Darby Philippines v. Goodyear PhilippinesHannahLaneGarciaNo ratings yet

- Joel Jude Cross Stanislaus Austin CrossDocument1 pageJoel Jude Cross Stanislaus Austin Crossjoel crossNo ratings yet

- A Study Viet Cong Use of TerrorDocument85 pagesA Study Viet Cong Use of TerrorCu Tèo100% (1)

- Khyber Pakhtunkhwa Public Service CommissionDocument2 pagesKhyber Pakhtunkhwa Public Service CommissionazmatNo ratings yet